- No gas imports from Israel until Israel Electric’s nearly USD 2 bn dispute is settled, oil ministry says. (Speed Round)

- Egypt signs USD 3.2 bn expansion of repo financing agreement with global banks. (Speed Round)

- Talks on water security with Ethiopia and Sudan are on the brink of failure. (Last Night’s Talk Shows)

- Signals that foreign appetite for EGP T-bill might have peaked? Go enjoy your negative interest rates elsewhere. (Speed Round)

- EgyptAir expected to announce orders for Bombardier C-Series and Boeing 787 Dreamliner jets. (Speed Round)

- German tourists’ bookings in Hurghada, Marsa Alam surge again in October. (Speed Round)

- Cook’s shareholder appoints Arqaam to advise on sale. (Speed Round)

- Domty denies entering into a partnership to produce and package olive oil. (Speed Round)

- The Market Yesterday

Tuesday, 14 November 2017

Water talks with Ethiopia and Sudan are failing, passed on to “higher authority”

TL;DR

What We’re Tracking Today

Listing regulations that impose a one month deadline for companies to IPO after receiving regulatory approval will come into effect today, after being published in the Official Gazette last night. Under the new regulations, the Financial Regulatory Authority (FRA) had also made it mandatory for companies wishing to list new shares to first apply for FRA approval FRA and submit fair value reports and details of the IPO. The amendments include an internal deadline for FRA to process listing requests within 15 days of receiving the application.

Expect lots of news from EBRD’s second SEMED Business Forum, which kicks off today: The European Bank for Reconstruction and Development’s second Business Forum for the southern and eastern Mediterranean (SEMED) region will be held at the Conrad Hotel in Cairo today (you can register for the event here). The forum, which is being held under the theme of investing for sustainable growth, will see discussions on the region’s business outlook and obstacles to increasing investments. EBRD President Suma Chakrabarti and Investment and International Cooperation Minister Sahar Nasr will lead the forum.

We expect EBRD to announce it has signed partnership or financing agreements with at least two Egyptian banks, and the institution said in an emailed statement that Egypt and Tunisia will sign a number of MoUs at the forum today, without providing further details. EBRD has also said that it is supporting the Women and Foetal Imaging (WAFI) clinic in Cairo by putting its founder in contact with a strategic advisor.

Elsewhere this morning:

The Donald may be roiling politics, but he’s had a soporific effect on the US market, the Financial Times reports, noting that “the year after Donald Trump’s surprise victory in the US presidential election have been the quietest months for the US stock market in more than half a century. … The quietest 12 months on record also followed a political shock, starting a week after the assassination of John F. Kennedy in 1963.”

Lebanon fears being given the Qatar treatment: “Lebanese politicians and bankers believe Saudi Arabia intends to do to their country what it did to Qatar — corral Arab allies into enforcing an economic blockade unless its demands are met,” Reuters notes this morning.

More than 15,000 scientists from 184 countries have issued a “warning to humanity” on the 25th anniversary of a previous warning that human-induced climate change is destroying our planet, Canada’s CBC reports.

What We’re Tracking This Week

It’s interest rate week: The Central Bank of Egypt’s Monetary Policy Committee will meet on Thursday to review rates. The meeting comes as inflation inched down fractionally in October, but before the central bank has a full year of inflation data on which to declare victory in its post-float ‘war on inflation.’

The US embassy in Cairo and its consulate in Alexandria will host an array of activities aimed at engaging young Egyptians with an interest in Entrepreneurship from 13 to 19 November as part of Global Entrepreneurship Week, according to an embassy statement. “Prominent business figures, entrepreneurs, trainers, and embassy exchange program alumni are set to lead the sessions. Topics to be covered include: lean entrepreneurship, skills for career success, marketing for entrepreneurs, maker technologies, and entrepreneurship simulation.”

Talks on Libya: Foreign Minister Sameh Shoukry will meet with his Tunisian and Algerian counterparts in Cairo on Wednesday for tripartite talks on Libya, according to Youm7.

On The Horizon

Bringing visual and performing arts together in Cairo: Arts-Mart Gallery is holding its first “Orchestra in Art” event, A Night of Musicals, on 24 November. A Night of Musicals is being held under the patronage of our friends at SODIC Art and promises to be a captivating artistic and cultural experience. The event will have a full orchestra performing selections from popular musicals including Phantom of the Opera, West Side Story, Cats, and Les Miserables, led by conductor Nader Abbassi and the international award-winning soloists Fatma Said and Gala El Hadidi. Along with the music, there will be a specially curated exhibition of Egyptian contemporary art. The event will be held at the Arts-Mart Gallery and more information can be found here.

Egypt plans to launch its first electronic visa in December at the Cairo ICT expo running from 3-6 December.

Enterprise+: Last Night’s Talk Shows

Talks on water security with Ethiopia and Sudan are on the brink of failure, and after writing tens of thousands of words on the subject in the past three years, we now feel we may (for this morning, at least) not be the only people in Egypt who give a rat’s [redacted] about our nation’s water security.

The background: The nation’s talking heads scrambled to master the Grand Ethiopian Renaissance Dam (GERD) last night after a spokesman for Egypt’s Irrigation Ministry said yesterday that talks had effectively deadlocked. Irrigation Minister Mohamed Abdel Aati has sent a report to Cabinet on the latest round of negotiations with his Ethiopian and Sudanese counterparts, which broke down after the three sides were unable to find common ground, Al Ahram reports. The three have not set a date for the next round of negotiations. As we noted yesterday, Sudan and Ethiopia are refusing to ratify the environmental impact studies French consultancy firms conducted on the dam. According to Abdel Aati, the two countries requested to amend “critical areas” of the report.

Irrigation Ministry Spokesperson Hossam Al Imam phoned in to Al Hayah Al Youm to explain that ministry decided to hand over negotiations to ‘higher authorities’ — our take is that this means the presidency, the MoD and intelligence agencies — after Ethiopia and Sudan said they want to amend the report on the dam’s impact studies. Al Imam stressed that Egypt has been pushing negotiations along, telling host Tamer Amin that the ministry is well aware that the issue is time-sensitive. The three countries’ prime ministers and presidents are now required to take political steps to reach a final solution on the technical agreement, without which further talks are impossible, Al Imam said (watch, runtime: 4:59).

Imam also told Yahduth fi Masr’ Sherif Amer that Ethiopia and Sudan both objected to standards the international consultants used to evaluate the dam’s potential impact on downstream nations.

Kol Youm’s Amr Adib, meanwhile, focused on Egypt’s plans to fulfill its water needs without relying on the Nile. Housing Ministry facilities advisor Sayed Ismail told Adib that the government is currently building three desalination plants, each with a production capacity of 150k cubic meters per day. The country’s overall capacity for water desalination has increased tenfold in two years to reach 700k cubic meters per day as new desalination plants have been built (watch, runtime: 6:25).

Desalination appears to be at the center of the Armed Forces Engineering Authority’s water resources development plan, according to the authority’s boss, Gen. Kamel El Wazir, who phoned in to chat with Adib. The authority plans on establishing desalination plants along its Red Sea and Mediterranean coasts, El Wazir said. Among the plants currently under construction is one in Ain Sokhna that will provide 164k cf/d of water to projects in the Suez Canal Economic Zone (watch, runtime: 10:48).

Metro prices will change, just not now: Over on Masaa DMC, Cairo Metro Company Spokesperson Ahmed Abdel Hady told Eman El Hosary that metro tickets will eventually be priced according to the distance traveled, rather than have a unified price. Abdel Hady said that ticket prices will remain as they are for the foreseeable future, but an increase is inevitable (watch, runtime: 4:40).

El Hosary also talked to House Education Committee member Magda Nasr about the bill to establish an Egyptian space agency, which the committee approved yesterday. Nasr noted that the agency will be funded through state coffers and donations (watch, runtime: 4:38).

Hona Al Asema’s Lamees Al Hadidi was still focused on developments in Lebanon, speaking to journalist Paula Yacoubian, who interviewed former Lebanese Prime Minister Saad Al Hariri. Yacoubian maintained that Al Hariri is not under arrest, and that Saudi Arabia did not interfere in the direction of the interview or the questions she was permitted to ask (watch, runtime: 9:51).

Speed Round

The government will not issue permits to companies to import natural gas from Israel until the arbitration cases between Egypt and Israel are resolved, Oil Minister Tarek El Molla said, according to Reuters. The government will sign off on agreements to import from our eastern neighbor only once the disputes are resolved and under the condition that the agreements “add value,” El Molla say. “Delegations [from Israel] are healthy as it means there are discussions and negotiations, but they have to meet the conditions put by the government as that is only fair,” he says. “In 2015, the International Chamber of Commerce ordered Egypt to pay USD 2 bn in compensation after [an agreement] to export gas to Israel via pipeline collapsed in 2012 due to attacks by insurgents in Egypt’s Sinai peninsula,” the newswire notes.

Dolphinus Holdings, a company owned in part by industrialist Alaa Arafa, has long been interested in importing natural gas from Israel’s Tamar gas field, as we have previously noted on multiple occasions. Israel said last year that it could settle for less than half the total fine imposed in the case brought by Israel Electric, which Egypt has sought to overturn since December 2015.

Speaking on upcoming local projects, El Molla said that the EGPC plans to open a new bid round for onshore oil blocks, according to The National. “EGPC’s onshore bid round will be before year end, nine to ten blocks will be offered from the Western desert and Eastern blocks,” he said.

Separately, El Molla also said that the government aims to finalize contracts with local and foreign companies that were awarded five gold mining concessions by year’s end. Four firms, including two foreign companies, were awarded the five blocks in the Eastern Desert and the Sinai peninsula in the first tender for new gold exploration since 2009 last January. There are no plans for offering new concessions until the contracts for this year’s tender are finalized, El Molla says. Egypt’s largest gold producers, including Centamin, Aton Resources, and Thani Stratex, had all refused to participate in the bid round citing concerns over the Egyptian Mineral Resources Authority (EMRA)’s insistence that production sharing agreements were the way to go. Former head of EMRA Omar Taima had challenged them saying the bid round was “successful,” despite no participations from major companies.

Egypt signs USD 3.2 bn expansion of financing agreement with global banks: Egypt has signed an expanded financing agreement with global banks, secured as part of a repurchase (repo) transaction in 2016, CBE Governor Tarek Amer said on Monday, according to Bloomberg. The agreement expands the one-year repo to USD 3.2 bn from USD 2 bn, said Amer, who did not state whether the duration has changed. The USD 2 bn in repo funding was secured last November against USD-denominated sovereign bonds issued in a private placement and are listed on the Irish Stock Exchange. Finance Minister Amr El Garhy had hinted last month that an expansion in the agreement would be contingent on the haircut, or discount, anticipating the latter might drop to 25% this year from 30% last year. Those terms have yet to be announced by the CBE. The move comes as Egypt looks set to make USD 14 bn in foreign debt payments this year.

Foreign holdings of Egyptian T-bills fell for the first time since the EGP was floated in November 2016 as maturing notes exceeded new purchases, Ahmed Feteha writes for Bloomberg. He says the drop in holding could suggest that demand for Egyptian debt is peaking. “The flow of new money and the appetite to renew maturing notes may be waning due to seasonal factors,” Samy Khallaf, head of the Finance Ministry’s public debt division, said noting that overseas investors held EGP 330.0 bn worth of T-bills, down from EGP 333.6 bn a week earlier. “We’re still seeing purchases from foreign investors, but maturities this quarter are larger than the previous one … We’re also entering the holiday season so it is normal to see lower activity from foreign funds,” Khallaf explained. This comes as the CBE sold EUR 692.9 mn in one-year T-bills yesterday, Reuters reported. The EUR-denominated T-bills carried an average yield of 1.499%. The average yield on Egypt’s three- and seven-year treasury bonds rose in yesterday’s auctions.

Some foreign money managers who have been bullish on Egypt’s debt see the play waning given the potential that the CBE may cut interest rates this coming Thursday. High rates today have made Egypt’s bonds one of the most attractive emerging market debts, and political concerns loom in their minds, writes Ira Iosebashvili for the Wall Street Journal. “The [carry] trade is a little bit exhausted,” said Jan Dehn, head of research at Ashmore Group, which owned Egypt’s local currency bonds earlier this year. “I think it’s on its last legs,” he added. Jim Barrineau, co-head of emerging-market debt at Schroders, said concerns over high inflation pushed him recently to sell Egyptian local currency bonds his firm had invested in earlier this year. “It was a very good trade,” Barrineau said. “Better to sell now than … when everyone is trying to get out at once.” Y’all go enjoy your negative rates in Europe, okay?

One factor which may keep the bonds at play for investors are guarantees of repatriation, argues Iosebashvili. “One of the things we wanted to know was whether we can get our [greenbacks] back,” said Colm McDonagh, head of emerging-markets fixed income at U.K.-based Insight Investment. He said his firm holds Egyptian bonds, which it purchased in February.

EgyptAir is expected to announce today a USD 1.1 bn order for Bombardier C-Seriesjets, Boeing 787s: EgyptAir has reportedly been in advanced talks with Bombardier to buy 12 CS300 jets in a transaction worth c. USD 1.1 bn, people familiar with the matter tell Bloomberg. The order is expected to be announced today at the Dubai Air Show. The airline is also reportedly mulling other options to buy another dozen of the single-aisle planes, and EgyptAir is also expected to unveil an order for at least six of Boeing’s 787 carbon fiber Dreamliners, said people familiar with the discussions. Airbus SE has also been in talks to secure a commitment for its A320neo single-aisle jetliners, the people said. The purchases come as part of an expansion of EgyptAir’s fleet as tourism shows signs of recovery and the airline weathering the crash of EgyptAir flight MS 804 from Paris to Cairo. Civil Aviation Minister Sherif Fathy said last month that the government expected to pay about USD 3.3 bn of the costs the national flag carrier will incur in acquiring some 45 planes.

The EgyptAir contract would be a big win for Bombardier, which is locked in trade dispute with Boeing in the United States that saw the temporary imposition of a 220% duty on C-series jets sold into Amreeka.

And speaking of the tourism upswing, German tourists continued to book more holidays in Hurghada and Marsa Alam in October, German tourism portal FVW says, citing figures from reservations provider Traveltainment. Bookings to Hurghada rose 83% y-o-y, while Marsa Alam bookings surged 90% y-o-y during October. This is the third consecutive month to see a boom in bookings from German tourists; Marsa Alam enjoyed a particularly healthy y-o-y leap of 121% during September, albeit from a low base.

M&A WATCH- The main shareholders in food products producer Cook’s Industries have appointed Arqaam Capital to advise on the sale of their stake in the company, sources told Al Mal. Cook’s, founded in Cairo in 1954, is owned by the heirs of founder Agamemnon Paraskevas. Al Mal says Arqaam is shopping Cook’s to GCC investors, with current shareholders looking to cash in on increased interest in the sector and export potential following the EGP devaluation.

INVESTMENT WATCH- Domty denied that it is planning to invest USD 25-30 mn in an olive packaging and processing operation with a company owned by Abdel Salam Alwadi, chairman of the Tunisian Olive Oil Association. Domty made the announcement in a regulatory filing on Monday (pdf) after a report in Al Mal surfaced yesterday quoting Alwadi as saying that his company signed an agreement to get 10k feddans for the proposed plant and Domty is expected to get another 3k feddans. The land was supposed to be allocated as part of the 1.5 mn feddan desert reclamation project, according to statements attributed to Alwadi.

MOVES- Elsayed Mohamed Aly has been appointed chairman and managing director of Abu Dhabi Islamic Bank (ADIB)-Egypt. Aly was formerly the chairman and managing director of Mashreq Bank-Egypt.

The Transport Ministry began implementing unified port fees nationwide last month on a trial basis, Transport Minister Hisham Arafat announced yesterday, Al Masry Al Youm reports. Arafat and Suez Canal Economic Zone head Mohab Mamish had agreed on the unification of fees back in June and follows a series of announced exits by major shipping firms who complained about Egypt’s port fees. The two had said the new fees would come into effect in October. Arafat and Mamish had also announced in August that the government will provide shipping companies with breaks on Suez Canal port fees as high as 50%. The breaks on fees will be proportionate to the volume of cargo shipped by the lines.

Separately, Prime Minister Sherif Ismail issued a decree yesterday appointing himself as the new head of the Supreme Ports Council, Al Borsa reports. The council was previously headed by the transport minister, who will now become its deputy head. The decree also stipulated the inclusion of maritime experts, nominated by the transport minister, in the council. Other members include the heads of the Suez Canal Authority and Suez Canal Economic Zone, as well as representatives from the defense, interior, investment, and tourism ministries.

In other port news, the Suez Canal Authority is working on developing the port of Al Arish in North Sinai, Mamish told Al Ahram. He added that an unnamed French company is constructing a container terminal in East Port Said.

IPO WATCH- Abu Dhabi’s ADNOC took a step toward its previously hinted sale of least 10% of its fuel stations unit in a December IPO in the Abu Dhabi Stock Exchange, ADNOC CEO Sultan Ahmed Al Jaber said on Monday in an interview with Bloomberg. The move would make it among the first major state-owned energy IPOs in the region, beating out the planned listing of Saudi Aramco which may take place next year. ADNOC is seeking a valuation of between USD 10-14 bn. EFG Hermes reportedly joins Goldman Sachs and Morgan Stanley as joint bookrunners for the offering, while Citigroup, First Abu Dhabi Bank, HSBC and Merrill Lynch International will be coordinating the IPO.

Image of the Day

A year later, we look back at NASA’s images of Mars taken by the Mars Reconnaissance Orbiter, reports Science Alert. The high tech camera on board the orbiter takes incredibly detailed images and the good people at Science Alert combed through the 2,054 shots released by NASA to pick the best ones. We went with a close-to-home duney number for our pick.

Egypt in the News

The foreign press appears preoccupied this morning with the Lebanon crisis, with Egypt’s regional role as an ally of Saudi Arabia dominating conversation on Omm El Donia as we headed for dispatch. A number of publications including Al Jazeera are interpreting President Abdel Fattah El Sisi’s message urging calm and Foreign Minister Sameh Shoukry’s regional tour as a slight break from the hardline stance of Saudi Arabia.

On that front, Shoukry met with the Crown Prince of Abu Dhabi Mohamed Bin Zayed Al Nahyan and Kuwaiti Emir Sabah Al Sabah on his tour of the Gulf, according to official statements. While the statements from the ministry only pay lip service to the crisis in Lebanon, it made sure to stress Iran’s meddling in regional affairs, paying particular notice of Houthis threatening Riyadh with missiles.

Neither Egypt nor Turkey apply the World Trade Organization’s Plurilateral Agreement on Government Procurement (GPA), according to Econostrum. “The expected benefits for these two countries in becoming signatories to the GPA would be enormous. This agreement would allow both countries to move towards increased competition and to improve governance. For firms, it would be a real opportunity to win new business deals by opening the doors to a large market.”

Also worth a skim this morning:

- El Alamein battle: A man from Henley in the UK followed his father’s footsteps in Egypt, where he fought in the battle of El Alamein, 75 years later, in a report for the Henley Standard.

- National team mainstay Essam El Hadary could be poised to be the oldest player in World Cup history, The Guardian reports.

On Deadline

The Commies are back: Imposing a state-mandated pricing system on private hospitals is a good idea in principle, but would be difficult to implement on the ground, Mamdouh Shaaban writes for Al Ahram. The unified system, which a Health Ministry official announced is in the works earlier this month, would be the first “serious step” to address price gouging in the private healthcare system, Shaaban says. The brilliant columnist goes on to suggest the ministry only oversees two-thirds of private hospitals, leaving the remaining one-third without a proper mechanism for the implementation of a mandatory pricing scheme. Shaaban also says that the pricing system must be accompanied with clear and significant punishments for hospitals and clinics that do not adhere to the state-imposed price list.

Worth Reading

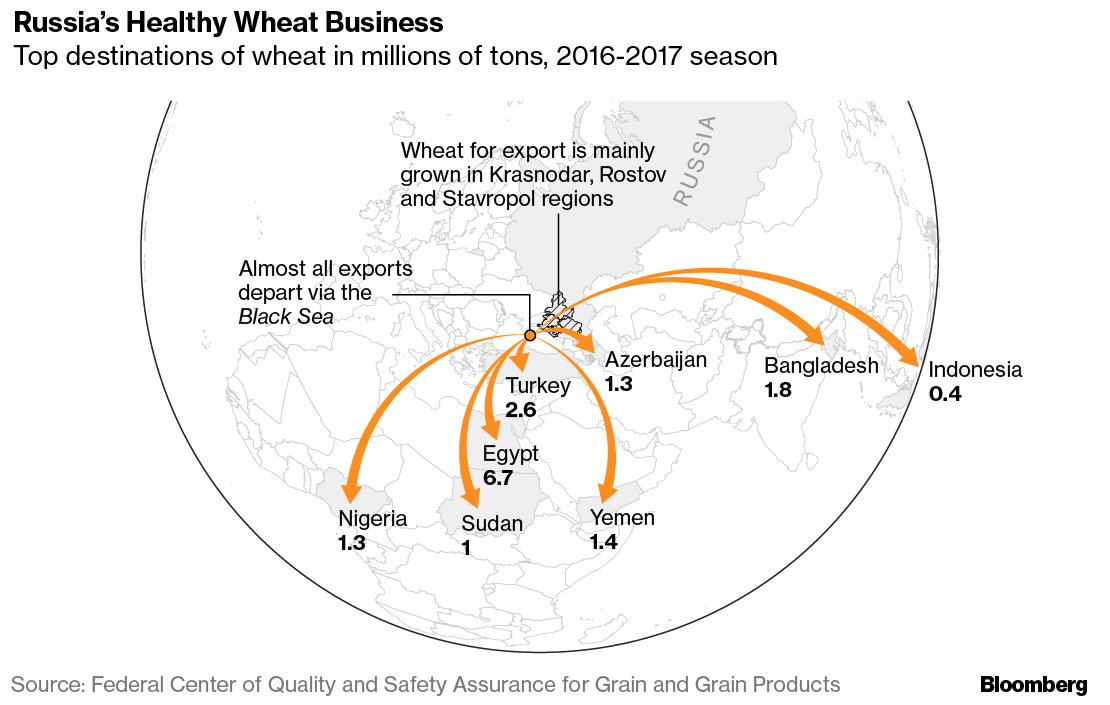

Russia is now the dominant supplier of wheat globally, Bloomberg Businessweek’s explores in a report. Russia’s output of wheat has surged in recent years as good growing conditions boost farmers’ profits, allowing them to reinvest in better seeds and equipment. Now, about half of the countries in the world are buying Russian wheat, with Egypt being its top customer. Their biggest selling point is price and “Russia’s dominance also gives it the power to shake up world markets.”

Worth Watching

Specialist art company Factum Foundation is running a five year project to 3D print a replica of Pharaoh Seti I’s tomb, CNN reports. Part of the replica is already on display in the Antikenmuseum Basel in Switzerland and it is indistinguishable from the original. Three Egyptian specialists have already been trained to use the scanners that transfer the information to the printers. The hope is that the technology will be used for other archaeological sites around the world. Seti’s tomb was discovered by Giovanni Belzoni in 1817 and is considered incredibly rich in its artwork and intricacy (watch, runtime: 2:56).

Diplomacy + Foreign Trade

Israeli Prime Minister Benjamin Netanyahu has been in touch with President Abdel Fattah El Sisi and Russian President Vladimir Putin on matters of Israeli security, according to Haaretz. Netanyahu’s comments, which did not delve into specifics, came during a hearing at the Knesset.

Energy

EEHC sets 26 November deadline to submit offers for USD 8 bn Hamrawein power plant

The Egyptian Electricity Holding Company (EEHC) has set 26 November as the deadline for companies to submit offers for the USD 8 bn Hamrawein “clean coal” power plant, EEHC sources tell Al Borsa. Three consortia — Shanghai Electric-Dong Fang, General Electric-Harbin Electric, and Mitsubishi-Marubeni-Elsewedy — have qualified for the project, the sources say. The EEHC will take as long as 10 months to review the companies’ offers for the plant.

NREA to tender 400 MW solar and wind projects in 2018

The New and Renewable Energy Authority (NREA) is planning to tender solar and wind projects with a combined production capacity of 400 MW, NREA head Mohamed El Khayat tells Al Borsa. Among these projects is a 20 MW solar power plant that will be funded by the Japanese International Cooperation Agency. The Electricity Ministry had said that all future projects after the feed-in tariff (FiT) program would be tendered with rates being set on a project by project basis.

Egyptera renews electricity distribution, production licenses to 10 companies

The Egyptian Electric Utility & Consumer Protection Regulatory Agency (Egyptera) has renewed electricity distribution and production licenses for 10 companies, sources from the agency tell Al Borsa. The companies include TCI Sanmar, Majid Al Futtaim Properties, and Emaar Misr. Egyptera also approved granting FAS Energy and Alef Solar, which are taking part in phase 1 of the feed-in-tariff program in Benban, 25-year licenses to produce solar power.

Negotiations underway for Finance Ministry to guarantee FiT payments

The Electricity Ministry is in negotiations with the Finance Ministry to issue payment guarantees of USD 3 bn for projects that are part of phase 2 of the FiT program,ministry sources told Al Mal. The EETC is expecting to pay EGP 3.3 bn per year for power from the FiT program.

Basic Materials + Commodities

Supply Ministry looking to reduce flour allocations for subsidized bread bakeries

The Supply Ministry is reportedly looking to reduce the amount of flour it provides to bakeries producing subsidized bread, an unidentified ministry source tells Al Mal. According to the source, the new system — which would come into effect today if approved — would cut down flour allocations to bakeries in urban areas to 70% of their current levels, and bakeries in the countryside would have their flour supplies reduced to 50%. The ministry had enacted a new system back in August that requires bakeries to pay the ministry market prices for wheat and flour, and receive compensations based on the number of subsidized bread loaves sold through the smartcard system.

GASC purchases 25,000 tonnes of vegetable oil

The General Authority for Supply Commodities (GASC) has purchased 10,000 tonnes of sunflower oil and 15,000 tonnes of soybean oil, according to UkrAgroConsult. The deadline for the tender was today and the delivery is set for the first half of January 2018.

Real Estate + Housing

Housing Ministry considers fixed interest rates on PPP projects with developers

The Housing Ministry is considering holding interest rates on land purchases by developers steady for public-private partnership developments, Housing Minister Moustafa Madbouly said on Monday. The move would help reduce costs of land purchases by developers, who have been complaining that rising land prices have been a hindrance in expanding development, Madbouly said, according to Al Shorouk. Madbouly also responded to land price complaints by rebuking developers who only focus on projects in and around Cairo at the expense of cheap land in other governorates.

Beta Egypt raises its investments to EGP 6 bn

Beta Egypt for Urban Development has raised its real estate investments fourfold to EGP 6 bn, chairman Alaa Fekry said on Monday. The company has managed to grow its land bank to 100 feddans worth EGP 2 bn, he added. The company is expected to spend EGP 5 bn in projects in the Future City development, said Fekry, according to El Wattan. The company is also currently developing three malls in 6 October City.

Inertia achieves sales of EGP 2 bn in Jefaira North Coast project

Real estate developer Inertia already achieved sales of EGP 2 bn from phase 1 of its Jefaira project in the North Coast, according to Al Borsa. The company is targeting sales of EGP 3 bn for the first phase of the EGP 20 bn project, which will be completed over 15 years.

Automotive + Transportation

Transport Ministry to announce winning offer for 1,300 new locomotives next month

The Transport Ministry is planning to announce the winning offer from international companies to supply 1,300 new locomotives for the National Railway Authority’s fleet next month, Minister Hisham Arafat said yesterday, Al Borsa reports. The ministry is currently deliberating between three rival bids from Italy, China, and a Hungarian-Russian consortium. The ministry had initially said it would purchase 800 locomotives from the winning international company, but has since increased that number to 1,300. The ministry has also reached a separate agreement with the Arab Organization for Industrialization to manufacture another 300 locomotives, and expects to receive them within two years.

Arafat meets with Danish ambassador and investor

Transport Minister Hisham Arafat met with the Managing Partner at AP Moller Capital Kim Fejfer to discuss investment opportunities in the transportation sector,according to Al Shorouk. The meeting comes ahead of a Danish investment delegation visit expected before the end of the year.

Other Business News of Note

NIB sues ERTU over EGP 886 mn loan

The National Investment Bank (NIB) filed a lawsuit against the Egyptian Radio and Television Union (ERTU) in a Cairo Economic Court for the latter to repay a EGP 886 mn loan and additional penalties of 16% of the loan, Al Borsa reports. Complications from this dispute may have played a hand in blocking NIB’s acquisition of a 40% stake in the Egyptian Satellite Company (Nilesat).

Mamish reviews investments with delegation

Suez Canal Economic Zone head Mohab Mamish met with a delegation of representatives from industrial developer Polaris and the African Cotton & Textile Industries Federation on Monday to discuss possible investments in the area, according to Al Borsa.

Legislation + Policy

House refers Cyber Crimes Act to committees for discussion

The House of Representatives has referred the Cyber Crimes Act to a joint ICT, defense, national security, and constitutional and legislative committee for discussion, deputy head of the House ICT Committee Ahmed Zedan tells Al Mal. The joint committee reportedly began its review of the legislation yesterday, and plans to hearings on cybercrimes soon. The legislation attempts to regulate crimes related to the internet and social media, but will oblige security forces to seek authorization before tracking any specific individuals to avoiding infringing on citizens’ personal privacy.

House Education Committee approves establishing an Egyptian space agency

The House Education, Higher Education, and Scientific Research Committee approved yesterday the bill to establish an Egyptian space agency, Ahram Gate reports. The 16-article law, which the newspaper has published in its latest form, will now be discussed and voted on in a plenary session.

Egypt Politics + Economics

Labor unions slam Labor Unions Act as unconstitutional

A group of independent labor unions announced their rejection of the Labor Unions Act currently being discussed by parliament, Al Shorouk reports. Speaking at a press conference yesterday, General Coordinator of the Center for Trade Unions Kamal Abbas said the legislation is both unconstitutional and in violation of Egypt’s agreement with the International Labor Organization (ILO) that guarantees the freedom of labor unions in the country. Abbas also pointed out that the bill has drawn criticism from the ILO. Former MP Mohamed Anwar Sadat said that issuing the law in its current form would significantly restrict the activity of labor unions and civil society organizations, and would also have a negative impact on investments. The Egyptian Federation of Independent Trade Unions is expected to meet with an ILO delegation visiting Cairo today to discuss the bill, Al Mal reports. The government had made it clear that it considers independent trade unions to be unconstitutional and it plans to do away with them.

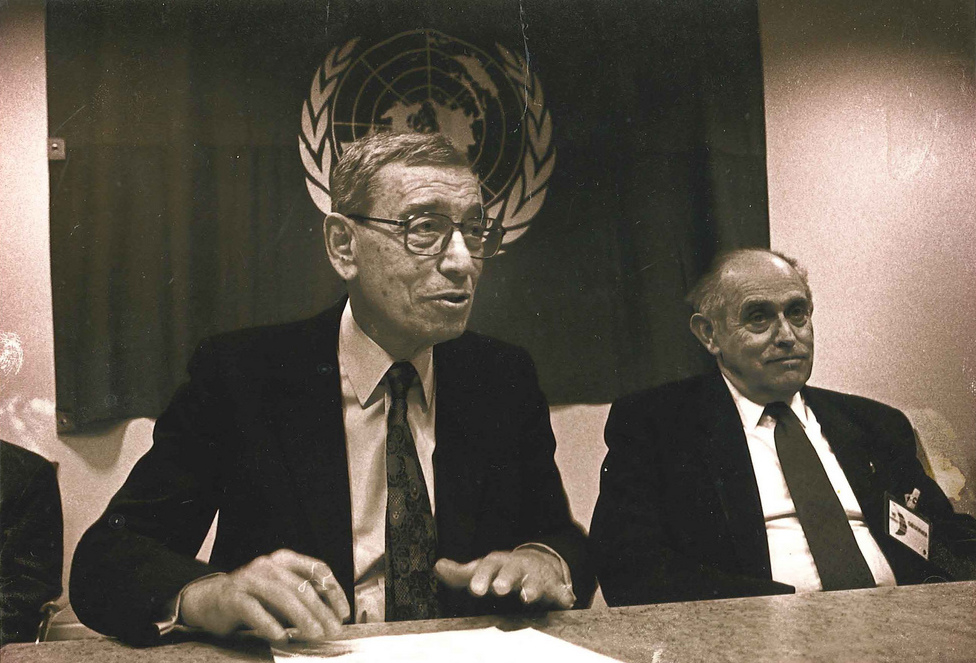

On Your Way Out

ON THIS DAY- On this day in 1954, former President Gamal Abdel Nasser and the Free Officers Movement deposed former President Mohamed Naguib. Former UN Secretary General Boutros Boutros Ghali was born on this day in Cairo, in 1922. Ghali served as UN Secretary General from 1992 to 1996 and was the first Arab and first African to hold the post. He died in 16 February 2016. The US has formally accused two Libyan intelligence officers of masterminding the Lockerbie bombing on this day in 1991. In 1969, the Apollo 12 was launched, landing on the moon five days later. Herman Melville’s magnum opus Moby Dick was published on this day in 1851. Also born on this day are former Indian Prime Minister Jawaharlal Nehru in 1889, French painter Claude Monet in 1840, and former US Secretary of State Condoleezza Rice in 1954. This time last year we were going through the terms of the IMF bailout package.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5904 | Sell 17.6904

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.58 | Sell 17.68

EGX30 (Monday): 14,123 (-1.0%)

Turnover: EGP 783 mn (20% below the 90-day average)

EGX 30 year-to-date: +14.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.0%. CIB, the index heaviest constituent ended down 1.5%. EGX30’s top performing constituents were: Eastern Co up 1.3%; AMOC up 1.3%; and Abu Dhabi Islamic Bank up 0.9%. Yesterday’s worst performing stocks were: Domty down 3.2%; Amer Group down 2.8%; and Qalaa Holdings down 2.7%. The market turnover was EGP 783 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -40.1 mn

Regional: Net Long | EGP +22.6 mn

Domestic: Net Long | EGP +17.5 mn

Retail: 73.5% of total trades | 76.6% of buyers | 70.3% of sellers

Institutions: 26.5% of total trades | 23.4% of buyers | 29.7% of sellers

Foreign: 11.9% of total | 9.3% of buyers | 14.4% of sellers

Regional: 10.9% of total | 12.3% of buyers | 9.4% of sellers

Domestic: 77.2% of total | 78.4% of buyers | 76.2% of sellers

WTI: USD 56.71 (-0.05%)

Brent: USD 63.11 (-0.65%)

Natural Gas (Nymex, futures prices) USD 3.14 MMBtu, (-2.37%, December 2017 contract)

Gold: USD 1,278.7 / troy ounce (+0.35%)

TASI: 6,961.52 (+0.41%) (YTD: -3.45%)

ADX: 4,369.59 (-0.09%) (YTD: -3.89%)

DFM: 3,477.74 (+0.38%) (YTD: -1.51%)

KSE Weighted Index: 395.38 (+0.9%) (YTD: +4.02%)

QE: 7,856.99 (-0.24%) (YTD: -24.72%)

MSM: 5,083.92 (+0.33%) (YTD: -12.08%)

BB: 1,262.86 (-0.11%) (YTD: +3.48%)

Calendar

14 November (Tuesday): SEMED Business Forum: Investing for Sustainable Growth, Conrad Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

05 December (Tuesday): Egypt’s Emirates NBD PMI reading for November to be announced.

03-06 December (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.