- Read a leaked copy of looks to be the executive regulations of the Investment Act. (Speed Round)

- Our roundup of Last Night’s Talk Shows is back in time for an econ-heavy night. (Last Night’s Talk Shows)

- Egypt seals USD 635 mn funding agreement with IFC for Benban solar power complex. (Speed Round0

- Egypt lands EUR 600 mn in funding for EU, but no “Turkey-style” refugee agreement. (Speed Round)

- Banks should support new SMEs that do not have extensive credit or operational history –Amer. (Speed Round)

- Good news for tourism: EgyptAir resumes Tokyo service, RyanAir now flies to Marsa Alam from Ukraine, and both China Southern and Kuwait’s Wataniya will add Cairo routes. (Speed Round)

- Exercise to beat cancer, carbs (not fat) could kill you, and D&D is back. (What We’re Tracking Today)

- The Market Yesterday

Monday, 30 October 2017

First, caffeinate. Then, read a leaked copy of the exec regs to the Investment Act.

TL;DR

What We’re Tracking Today

We don’t know whether it’s a function of this being budget season, the run-up to earnings season and the fact that the House of Reps is in recess, but it feels like the slowest news day ever. In our three years of doing this, it’s quite possibly the slowest news day ever, to the delight of our night staff. (Don’t get complacent, though: It won’t last. It never does.)

IMF delegation’s reform review continues: The IMF delegation in town to review progress on the Sisi administration’s economic reform program met with Vice Minister of Finance Amr El Monayer yesterday, unnamed senior officials tell Al Masry Al Youm. On the agenda: tax policy reforms, which allowed the government to exceed its target revenues for the first time in FY2016-17. Talks are going well, they add, and the visit is expected to unlock another tranche of Egypt’s USD 12 bn extended fund facility. Finance Minister Amr El Garhy had said that structural reforms to support manufacturing and exports are among the key topics during the delegation’s visit, which he expects to wrap up around 8 or 9 November. Also on the agenda: more meetings with Finance Ministry and central bank officials and sit-downs with staff at the ministries of social solidarity and planning.

Random stuff from around the interwebs that’s worth a read this morning if your inner geek, like ours, demands to be satiated:

Exercise isn’t just more powerful than most anti-depressants in treating depression, it’s a protective against cancer, too. In former lives, two of us were molecular biologists, so we can’t help but geek out over Cell’s “Molecular Mechanisms Linking Exercise to Cancer Prevention and Treatment,” which provides an overview of the mechanisms behind how “physical exercise has been shown to reduce cancer incidence and inhibit tumor growth. … Exercise has a role in controlling cancer progression through a direct effect on tumor-intrinsic factors, interplay with whole-body exercise effects, alleviation of cancer-related adverse events, and improvement of anti-cancer treatment efficacy.” It’s by the same researcher who found that running helps your body make and redistribute more of the awesomely named NK or ‘natural killer’ cells, thereby “reducing the risk of cancer and disease recurrence.”

It’s not fat, but sugar and other carbs — including “healthy whole grains” — that are gonna kill you. So says the Economist in its favourable review of Nina Teicholz’s Big Fat Surprise. The book is about three years old now (as is the review), but both are making the rounds of social media of late. Teicholz’s book, along with Gary Taubes’ groundbreaking Why We Get Fat, are at the cutting edge of the post-Atkins anti-carb movement.

D&D is back in fashion, and what better way to prompt us to read about the geeky ‘80s board game some of us loved as kids than a New Yorker piece that opens with the story of a corporate drone who quit his day job to open a board game business that centered on his school-aged daughter? Read The Uncanny Resurgence of Dungeons and Dragons.

What We’re Tracking This Week

Our friends at Trend Micro will hold a press briefing on The State of the Ransomware Threat in Egypt and insights into the Middle East cyber underground on Tuesday at the Nile Ritz Carlton, Cairo.

On The Horizon

EFG Hermes will hold its 7th Annual London Conference on 6-9 November. The conference will see C-suite execs from top listed companies in MENA as well as frontier markets (among them Pakistan, Kenya, Nigeria, Bangladesh, and Sri Lanka) meet face-to-face with top global investors with mandates to invest in emerging and frontier markets. The event will take place at Emirates Arsenal Stadium in London.

US Vice President Mike Pence will be visiting Egypt and Israel in late December, and you can look for the region’s Christian minority to be squarely in the spotlight. “The United States will work hand-in-hand with faith-based groups and private organizations to help those who are persecuted for their faith… From this day forward, America will provide support directly to persecuted communities through USAID,” he said according to the Associated Press.

The Investment Ministry’s investment map of some 600 projects will reportedly be ready by December and be out for bid by January.

Enterprise+: Last Night’s Talk Shows

Our daily roundup of Last Night’s Talk Shows returns just in time for Lamees Al Hadidi’s busy night interviewing a number of high-profile industry executives in an econ-heavy episode of Hona Al Asema.

AmCham President Tarek Tawfik had a chat with Lamees about the economic reform agenda, which he said is imperative to continue attracting investment. Tawfik explained that reforms have been pushing Egypt’s industrial framework to change, with companies increasingly turning their backs on imports in favor of manufacturing, assembly, and exports. Tourism, food production, and agriculture have so far reaped the greatest benefits of reforms (watch, runtime 9:53).

Domty Vice Chairman Mohamed El Damaty, however, says reforms have hurt the food industry. While the sector is showing very early signs of recovery, there remains the issue of consumer purchasing power, which is still suffering as a result of the float and the removal of energy subsidies. High interest rates are unsustainable for the sector, according to Damaty (watch, runtime 4:04).

Lamees also spoke to EGX Chairman Mohamed Farid about the rebound in foreign portfolio investment. Farid said foreign appetite for Egyptian equities is up more than 13x YTD (watch, runtime 5:39).

Banque Misr Chairman Mohamed El Etreby said the EGP float breathed new life into the nation’s banks, which now have stronger FCY positions and can easily cover the demands of importers. He noted that the current FX rate is largely stable across banks, all of which are buying and selling USD without restraint. On a broader scale, El Etreby pointed to improvements in remittances and the CBE’s FX reserves, rising exports, and the gradual return of tourism as the fruits of economic reform. As for concerns about hot money, El Etreby said that the carry trade shows no sign of going away even though T-bills are yielding 15% today, down from 18% previously.

El Etreby also took a moment to discuss his bank’s newly minted office in Moscow, which he said will offer consultative services to Russian investors eyeing the Egyptian market (watch, runtime 7:34).

Over on Kol Youm, controversial TV host Islam El Behery told Amr Adib about his most trouble with the law, after several news outlets reported yesterday that a court ruling had suspended his show Maa Islam on Al Qahera Wel Nas and barred him from appearing on satellite TV. The host, who had been accused by Al Azhar of attacking Islamic law, said the show has been defunct since 2015 and said a court order can’t keep him from appearing on TV since it would be unconstitutional. El Behery told Adib that he is already back on his feet after a year-long stint in prison, as he is currently hosting one show and is gearing up for another three (watch, runtime 16:00).

Adib spoke to Samih Sawiris about the technicalities of naming the Zewail Science and Technology City, which Sawiris reassured Adib will still be known as Zewail City despite it officially being named The Renaissance Project (watch, runtime 13:13).

Adib also showcased a report about Trade and Industry Minister Tarek Kabil’s inauguration of an SME industrial complex in Suez, which will offer technical training for vocational education students (watch, runtime 3:00).

Electricity Ministry spokesperson Ayman Hamza told Masaa’ DMC’s Eman El Hosary that the ministry has received some 2.34 mn complaints via its hotline over the past two months, the majority of which were about technical issues or consumers’ power bills (watch, runtime: 7:35).

Supply Ministry spokesperson Mohamed Sewed also phoned in to explain that a recent decision forcing subsidized good retailers to pay 25% of the value of their goods as a security deposit means to curb black market sales. Sewed told El Hosary that this system replaces previous punitive measures where grocers would pay a nominal fine if found guilty of graft. However, Grocers’ Syndicate head Maged Nady said the system is harmful and unnecessary since the distribution of subsidized goods is closely monitored now (watch, runtime 11:49).

Over on Yahduth fi Masr, Sherif Amer spoke to Supreme Media Council head Makram Mohamed Ahmed, who said the Arab Quartet’s information ministers agreed during a meeting that more countries need to join the boycott of the Statelet.

Speed Round

A copy of what appear to be the executive regulations to the Investment Act has leaked. The regs — on which the Ismail Cabinet signed off last week — list industries and projects eligible for incentives including tax and customs breaks under the government’s investment-promotion framework. Among the highlights include:

- An investment must export 50% of its output to qualify to certain incentives;

- A company’s corporate social responsibility agenda will be a component of whether it qualifies for incentives;

- Foreign labor cannot exceed 10% of the total workforce unless an assessment committee deems a situation exceptional enough to require raising the cap to 20%;

- Foreign workers and investors are guaranteed the rights to repatriate profits and earnings;

- Special incentive areas, such as the Suez Canal Axis and Golden Triangle area, will be outlined in the government’s upcoming investment map of 600 or so projects, which should be issued in December and updated on a regular basis.

The regs also outline the rules for the development and management of private freezones, as well as investment and tech zones. Under the new regs, the General Authority for Freezones and Investment (GAFI) will form a technical committee to oversee the establishment and administration of private freezones and projects they house. To remind you all, companies operating in private freezones must have a capital no less than USD 10 mn, employ at least 500 workers, export at least 80% of output, and source at least 30% of production inputs locally.

The regulations will come into effect once published in the Official Gazette. Click or tap here for a refresher on the regs, or view the full leaked copy here courtesy of Al Masry Al Youm.

Egypt seals USD 635 mn funding agreement with IFC for Benban solar power complex: Investment Minister Sahar Nasr signed a USD 653 mn debt package agreement with the International Finance Corporation (IFC) to fund the development of 13 solar power plants at the Benban complex, according to an official statement. The plants will add a combined 590 MW to the 1.8 GW complex, which is set to become the world’s largest grid-connected solar power park. Constructed under phase two of the feed-in tariff program, the projects are the IFC’s biggest investment in Egypt to date, according to IFC’s Vice President of New Business Dimitris Tsitsiragos. We had noted yesterday that the IFC’s package is the latest in c. USD 1.8 bn in financing Egypt has received for the Benban complex, mainly through the IFC and the European Bank for Reconstruction and Development (EBRD).

Zulficar & Partners advised the Egyptian Electricity Transmission Company on the project agreements under the two rounds of the feed-in tariff program. Sharkawy & Sarhan law firm advised the IFC, EBRD, and Proparco on financing 30 solar power plant projects in Benban.

Egypt signed three MoUs with the European Commission yesterday worth a combined EUR 600 mn, an Investment Ministry statement says. Under a EUR 432-528 mn agreement running from 2017-2022, Egypt will receive support for its economic reform agenda, for renewable energy and for social development projects. (This includes a EUR 38 mn grant from the EU and EUR 360 mn from the EBRD and EIB for sanitation projects in rural areas). Under the second MoU, Egypt will receive EUR 8 mn from the Commission, as well as EUR 237.7 mn from the EIB, to develop the Alexandria tramway.

Still no ‘Turkey-style’ migration agreement: The third and final MoU covered the stemming of illegal migration to Europe, for which Egypt will receive a EUR 60 mn grant. Although a step forward, the agreement lacks the depth and structure of the EU’s pact with Turkey on refugee management and assistance, despite calls from European Officials, including German Chancellor Angela Merkel, who had said that a Turkey-style agreement with Egypt could help Europe “deal with the root causes of migration.” Egypt had also signed an MoU with Germany back in August on handling refugee flow.

The agreements were inked during EU Regional Policy Commissioner Johannes Hahn’s stop in Cairo yesterday.

INVESTMENT WATCH- The Khamis family’s Orientals Urban Development plans to invest at least EGP 3 bn in projects based in new cities next year, Oriental Weavers founder Mohamed Farid Khamis tells Al Mal. Orientals Urban is also planning to begin working on the EGP 450 mn Side Walk Mall in New Cairo alongside real estate marketing firm B2B. Khamis also says the company has completed the first phase of its 5.5 mn sqm Oriental Coast project in Marsa Alam, and has begun work on its second phase.

Banks should support new SMEs that do not have extensive credit or operational history, central bank Governor Tarek Amer said yesterday, according to Al Masry Al Youm. Amer also criticized the concentration in some of the banks’ lending portfolios, calling on them to diversify more. He added that he would like to see banks create more investment funds and introduce new products.

EgyptAir flew to Tokyo from Cairo yesterday for the first time following a four-year suspension, Ahram Gate reports. The flight was originally intended to depart on Saturday but was postponed to Sunday due to bad weather conditions at Tokyo’s Narita International Airport. EgyptAir will run direct flights to Tokyo every Saturday and will consider additional trips if there is demand. This came as Marsa Alam received the first RyanAir flight out of Ukraine on Sunday, with 171 passengers on board. The flight will operate three times a week.

More air traffic with Egypt: China Southern Airlines said it would launch daily direct flights to Cairo out of Guangzhou early next year, without specifying a date, and Kuwait’s newly revived Wataniya airways will be also be flying daily to Cairo as of next summer.

MOVES- Till Klauss was appointed hotel manager of the Four Seasons Hotel Alexandria at San Stefano, according to Trade Arabia. Klauss “will assist in uplifting the Alexandrian culinary scene in addition to elevating the guest experience, the hotel said in a statement.”

EARNINGS WATCH- Cheesemaker Domty (Arabian Food Industries Company) reported a net profit of EGP 22 mn in 3Q2017, up from EGP 10 mn in 3Q2016. Revenues for the quarter recorded EGP 680 mn, up from EGP 453 mn in the same period last year, the company said in an earnings release (pdf).

Sheikh Tamim bin Hamad Al Thani would really like it if the Arab Quartet were to refrain from bombing, invading or otherwise doing anything that might interrupt his lunch plans. “Qatar’s emir has warned against any military confrontation over the ongoing diplomatic dispute between his country and four other Arab nations, saying it would only plunge the region into chaos,” the Associated Press quotes Al Thani as saying. He says US President Donald Trump has offered to host a meeting between Qatar and Bahrain, Egypt, Saudi Arabia, and the UAE to resolve the dispute. Bahrain’s Foreign Minister Khalid bin Ahmed Al Khalifa called for Qatar’s GCC membership to be frozen in a tweet on Sunday adding that Bahrain would not sit in or attend any summits where Qatar participates.

Thousands gathered yesterday in Barcelona, Catalonia’s capital, in support of Spanish unity, Bloomberg reports. The demonstrations came as the Catalan government “dismissed Madrid’s direct administrative control” of Catalonia to reaffirm the region’s independence despite Spanish Prime Minister Mariano Rajoy dissolving the Catalan government 48 hours earlier. “The real test of strength for the two sides will come when schools and government offices open Monday, and teachers and civil servants decide whether to follow the ousted Catalan leaders’ call to resist their Spanish masters or acquiesce to the new reality,” the news service says.

Another small win for Saudi women: Nearly a month after the kingdom said it would grant (one day) women the right to drive, the Saudi crown has decided to lift a ban that had prohibited women from entering stadiums and attending public sporting events,Al Arabiya reports. Three stadiums — one each in Riyadh, Jeddah, and Dammam — will open to women in early 2018.

The Macro Picture

Allocation to EM debt rises above long-term average for first time in three years: In another new milestone for emerging markets, the proportion of EM bonds in global fixed income portfolios has risen above the long-term average for the first time since 2014, writes Steve Johnson for the Financial Times. Global bond funds’ allocation to emerging markets reached 11.5% this year, inching above the long term average of 11.1% and closing in on the 13.5% peak in 2013, according to data from EPFR Global, the Institute of International Finance and Morgan Stanley. “As a percentage of global fixed income allocations, EM has only this year returned to its 10-year average of around 11%,” said Gordian Kemen, global head of emerging market fixed income strategy at Morgan Stanley. This follows the taper tantrum of 2013 and the commodity super-cycle in 2014-15. The buying spree has been focused on hard currency EM debt, with Argentina now vying with Brazil as the country where foreign investors are most overweight, followed by Egypt.

Image of the Day

Nilometers: the old-school way of worrying people about water scarcity. Before grand dams and sensors were a thing, the ancients used nilometers to read and predict water levels. Only rulers and priests were allowed to visit the then-secret structures and use their knowledge of water levels to “predict” floods and impress the citizenry. The three once-prevalent types of nilometers can still be found in Egypt on Cairo’s Rhoda Island, Aswan’s Fiyala Island, and another at the main temple in Kom Ombo, according to Atlas Obscura.

Egypt in the News

Topping coverage of Egypt in the international press on an extremely slow newsday is President Abdel Fattah El Sisi’s shakeup of the military and security apparatus leadership on Saturday. Most news outlets, including Bloomberg, are saying the move comes following the El Wahat attack which saw 16 policemen and conscripts killed. El Sisi had appointed Gen. Mohamed Farid Hegazy as chief-of-staff of the Armed Forces replacing Gen. Mahmoud Hegazy. The head of the country’s national security agency was also replaced, along with 10 others senior commanders from the Interior Ministry. The New York Times and The National also have coverage.

Cultural events in Egypt are “faced with increasing curbs,” according to a report by AFP. Artists were being subjected to increasing limitations, says Hossam Fazulla of the Association for Freedom of Thought and Expression. “The curbs have wiped out some art forms, especially street events, which were starting to flourish after the 2011 uprising that toppled longtime ruler Hosni Mubarak, he said.” The report mentions bans on screening films including The Nile Hilton Incident and In The Last Days of the City as well as on censorship bans for music and concerts.

Australian journalist Peter Greste, who was released from prison in Egypt more than two-and-a-half years ago, still “grapples with freedom and airports,” Stephen Brook writes for The Australian. Greste now finds his “fame” getting in the way of his reporting and says traveling continues to be an obstacle. “There’s another problem quite beyond the fame and that is that I’m a convicted terrorist … I have an outstanding prison sentence to serve. And so any country that still has an extradition treaty with Egypt is technically a problem for me and that’s not an insignificant number of countries.” While Greste, Mohamed Fahmy, and Baher Mohamed were released following the case that was known as the Marriott cell, they were never cleared formally.

Worth Watching

American Thrones: where lines between reality and dark fantasy are blurred: Lately it seems that international politics is just stranger than fiction. What if you woke up and found that the craziness has just been one of the worst scripted political thrillers ever? Well, Game of Thones creators and showrunners David Benioff and D. B. Weiss gave a taste of that alternate reality with their sneak preview of an episode of American Thrones. In it, they analyze their choice of making the villain Donald Trump the main character. They look at some of the choices he has made vis-a-vis his support of the White Walkers (the KKK) and trouble he might face with the Wall. But most intriguing plot device of all is having him meet his match in the equally maniacal Kim Jung Un. Reality or fiction, you can count on the US President tweeting about the great ratings this show will have (watch, runtime: 2:11).

Diplomacy + Foreign Trade

A delegation from the Palestinian Authority (PA) is in Cairo to discuss with Egyptian officials the procedures that will see the PA take charge of the Gaza border crossing at the start of November, sources tell Ahram Gate. The visit follows the first round of Egypt-brokered reconciliation talks earlier this month between rival Palestinian factions Fatah and Hamas, whose 10 year rift appears to be finally on the mend.

The Egyptian Businessmen’s Association met with 54 Polish companies in Katowice last week interested in investing in Egypt, according to Al Ahram. Among the industries they expressed interest in were energy, food production, auto parts, and petrochemicals.

Energy

First phase wells in Zohr drilled, production schedule on track

The first phase of drilling operations in wells at the supergiant Zohr gas field have concluded, Oil Minister Tarek El Molla announced, according to Ahram Gate. The project remains on track to begin production before year-end.

Telecoms + ICT

Vodafone and TE renew international gateway agreement

Vodafone Egypt and Telecom Egypt recently renewed their international gateway license agreement, government sources tell Youm7. The new contract will be valid for five years and allows Vodafone to use TE’s network infrastructure for its international voice call services. The sources are punting the signing as proof that there is no discord between the Vodafone and TE, who have seen repeated delays in the signing of a domestic roaming agreement, under which TE would use Vodafone’s infrastructure to offer its newly launched mobile service. Recently, Vodafone Egypt CEO Stephen Gastaut said it was important to find a quick solution for the conflict of interest between both companies with TE owning a 45% stake in Vodafone, which it now openly competes with in the mobile market. This comes as TE announced yesterday that its mobile network WE netted one mn subscribers during its first month in operation — a feat no MNO has accomplished before, CEO Ahmed El Behery said.

Banking + Finance

Did the CBE deny HDBK’s request to spin off its real estate holdings?

The CBE reportedly denied the Housing and Development Bank’s (HDBK) request to spin off its real estate holdings into a separate company, sources close to the matter supposedly told Al Mal. HDBK’s board had voted in favor of a demerger back in February and had been receiving pitches from investment banks vying to advise on the transaction. HDBK said it had yet to receive word from the CBE on the matter in a regulatory filing on Sunday (pdf).

NBE approves EGP 800 mn in loans as part of the CBE’s tourism rescue initiative

The National Bank of Egypt (NBE) has approved EGP 800 mn in funding to refurbish seven hotels in South Sinai as part of the CBE’s tourism rescue initiative, NBE Vice Chairman Yehia Aboul Fotouh tells Al Mal on Sunday. The bank has also approved restructuring the debts of the three unnamed tourism companies which operate the hotels, with loan repayments pushed back by as much as seven years, he added. The CBE had set a target of EGP 5 bn in loans to the sector to help upgrade facilities. The initiative was launched in 2013 during some of the worst years of the tourism sector.

Banque Misr to launch cross-border mortgages

Banque Misr plans to launch a mortgage financing facility soon for Egyptian expats in the UAE interested in owning property back home, according to Al Mal. The fund will offer loans between EGP 200k-5 mn, with payment plans of up to 10 years. Emirates NBD already provides a similar service, which is an alternative for Egyptian banks to shoring up foreign reserves.

Other Business News of Note

OTMT to complete development of Giza plateau by end of 2018

Orascom Telecom Media and Technology Holding (OTMT) is expected to complete development works at the Giza plateau with the Sound and Light Cinema Company (SLCC) by the end of 2018, Holding Company for Tourism, Hotels, & Cinema Chairman Mervat Hataba says, Al Mal reports. OTMT had bought City Stars Properties out of the SLCC development project last week in an agreement that will see it invest USD 10 mn over a 20-year period.

Egypt Politics + Economics

FEP withdraws confidence from party Secretary General Nasr Al Qaffas

Free Egyptians Party (FEP) Chairman Essam Khalil decided yesterday to withdraw confidence from the party’s Secretary General Nasr Al Qaffas, Al Shorouk reports. The move came after Al Qaffas made unsanctioned statements on the party’s behalf, Khalil explained. Naguib Sawiris, who founded the party, was also dismissed from it earlier this year after “giving off the impression he speaks for the party,” among other things. Khalil said elections for a new secretary general would be held soon.

Coptic Church denounces shuttering of churches in Minya

The Minya diocese of the Coptic Church issued statement on Saturday denouncing the repeated closing of churches in Minya after authorities shut down another two churches. “We have kept quiet for two weeks after the closure of one of the churches, but due to our silence the situation has worsened … it is as if prayer is a crime the Copts must be punished for,” the statement read. The diocese alleged that worshipers were harassed at both churches and pelted with rocks. A third church was also shut down following rumors of an impending attack. Reuters also has the story.

Health, transport, and antiquities sectors have highest rates of graft, says Administrative Prosecution

The health, transportation, and antiquities sectors saw the highest rates of graft and corruption incidents in 2016, the Administrative Prosecution said in its annual statistical report, which Al Shorouk picked up. The report also lists significant corruption in the education, supply, agriculture and land reclamation, and local administration sectors.

Two conscripts killed in North Sinai

Two police conscripts were killed in North Sinai when their vehicle hit a roadside bomb and was attacked by militants, according to the Associated Press which is citing security officials who spoke on condition of anonymity.

On Your Way Out

Two French women level harassment charges against Ikhwan founder’s Swiss-born grandson: Two French women have leveled [redacted] harassment charges against the grandson of Ikhwan founder Hassan Al Banna, the New York Times reports. French activist Hend Ayari said she was assaulted in 2012 and a second unnamed woman said the Swiss-born Islamic scholar, Tariq Ramadan, raped her in 2009. Ramadan has so far denied the charges, the latest in a series of explosive allegations that rippled across the internet after Hollywood actresses took accusations against famed producer Harvey Weinstein public, triggering a global anti-harassment campaign.

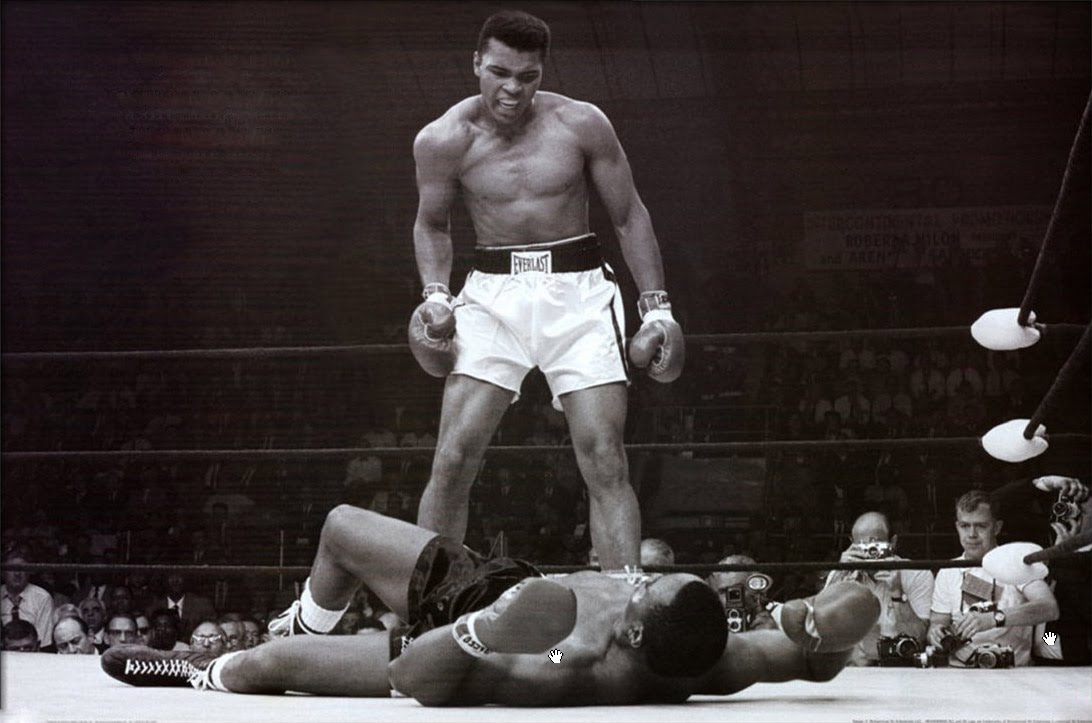

ON THIS DAY- The Madrid peace conference took place on this day in 1991, hosted by Spain and co-sponsored by the US and the Soviet Union. It was the first time in 43 years that Israel has sat down with all its Arab neighbors to discuss peace; the conference was deemed a success and paved the way for more talks, including the 1993 Oslo Accords. In 1957, the British government unveiled plans to reform the House of Lords that included admitting women for the first time. Muhammad Ali knocked out George Foreman on this day in 1974 in the “Rumble in the Jungle,” regaining the world heavyweight boxing title. Footballer Diego Maradona was born on this day in 1960 and the second president of the US, John Adams, in 1793. Two years ago we were supportive of a piece trying to kill corporate speak in our weekend edition. This time last year we were shocked when the EGP broke the EGP 17.00 per USD 1 in trading … little did we know.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6016 | Sell 17.7015

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Sunday): 14,024 (+0.5%)

Turnover: EGP 1.1 bn (17% above the 90-day average)

EGX 30 year-to-date: +13.6%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.5%. CIB, the index heaviest constituent ended down 0.3%. EGX30’s top performing constituents were: Ezz Steel up 4.3%, Palm Hills up 3.0%, and EFG Hermes 3.0%. Yesterday’s worst performing stocks were: Amer Group down 2.7%, Qalaa Holdings down 2.2%, and Egyptian Iron and Steel down 2.0%, and Kima down 0.4%. The market turnover was EGP 1.1 bn, and regional investors were the sole net sellers.

Foreigners: Net Short | EGP -6.4 mn

Regional: Net Long | EGP +24.3 mn

Domestic: Net Short | EGP -17.9 mn

Retail: 78.2% of total trades | 74.6% of buyers | 81.7% of sellers

Institutions: 21.8% of total trades | 25.4% of buyers | 18.3% of sellers

Foreign: 8.2% of total | 8.5% of buyers | 7.9% of sellers

Regional: 10.7% of total | 9.6% of buyers | 11.9% of sellers

Domestic: 81.1% of total | 81.9% of buyers | 80.2% of sellers

WTI: USD 54.07 (+0.32%)

Brent: USD 60.71 (+0.45%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu (-0.13%, December 2017 contract)

Gold: USD 1,273.60 / troy ounce (+0.14%)

ADX: 4,462.76 (-0.11%) (YTD: -1.84%)

DFM: 3,639.67 (-0.31%) (YTD: +3.08%)

KSE Weighted Index: 426.87 (-0.52%) (YTD: +12.31%)

QE: 8,134.46 (+0.08%) (YTD: -22.06%)

MSM: 4,966.65 (+0.16%) (YTD: -14.11%)

BB: 1,276.77 (-0.05%) (YTD: +4.61%)

Calendar

31 October (Tuesday): The State of Ransomware Threat in Egypt & Insights into the Middle East Cyber Underground press briefing by Trend Micro, Nile Ritz Carlton, Cairo.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

14 November (Tuesday): SEMED Business Forum: Investing for Sustainable Growth, Conrad Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.