- Cabinet denies Ismail is in poor health. (What We’re Tracking Today)

- M&A WATCH- EK Holding subsidiary sells 26% stake in Egyptian Hydrocarbon Company to Carbon Holdings. (Speed Round)

- Online transactions in Egypt up 22% last year, accounting for 20% of all regional online payment activity –Payfort. (Speed Round)

- In DC, Amer says El Sisi supports amendments to Banking Act, defends interest rate policy. (Speed Round)

- Tax revenues up sharply in first quarter of the current fiscal year. (Speed Round)

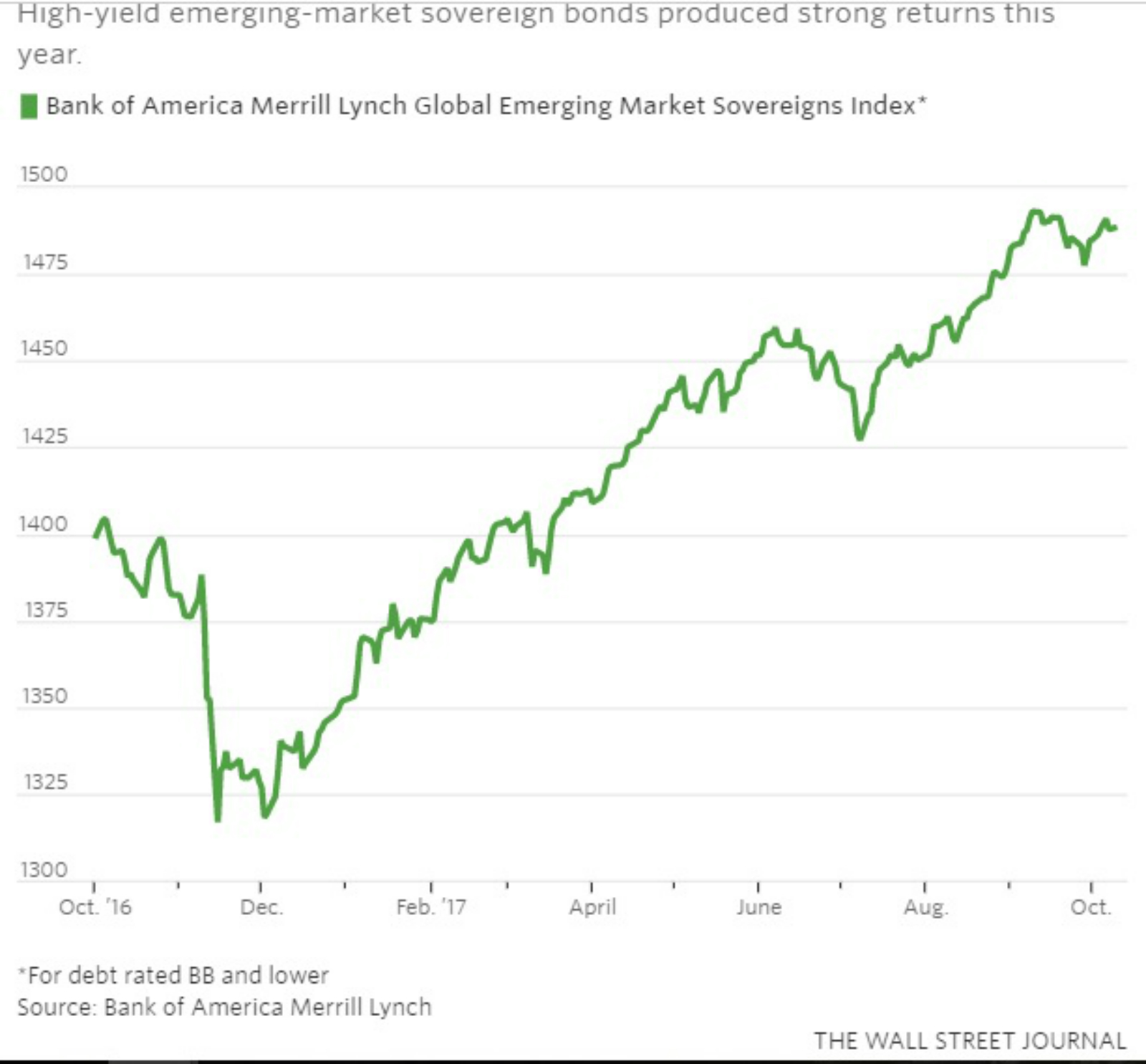

- The best-performing sovereign bonds are from EM that have had difficulties in the past. (The Macro Picture)

- Public sector labor force shrank 13% in FY2016-17, CAPMAS says, offering no explanation as to why. (Egypt Politics + Economics)

- “Draft El Sisi” movement continues as House majority bloc prepares campaign to urge the president to run in 2018. (Egypt Politics + Economics)

- It’s “Christmas” on October 27: iPhone 8 in Egypt, Stranger Things on Netflix and Assassin’s Creed: Origins on the console. (On the Horizon)

- The Market Yesterday

Monday, 16 October 2017

Cabinet denies prime minister is in poor health

TL;DR

What We’re Tracking Today

Prime Minister Sherif Ismail is in good health and is maintaining a normal schedule, the Cabinet Information Decision Support Center said yesterday in a statement. Prompted by photos that showed the PM with a shaved head and appearing to have lost weight, rumors had emerged that Ismail was in poor health, an issue that the statement denied unequivocally. The statement added that Ismail is moving forward with his schedule as planned, including a number of field visits nationwide.

AmCham and EFG Hermes will host a special lunch in New York for Finance Minister Amr El Garhy and Investment Minister Sahar Nasr today. The gathering will feature keynotes from both ministers, according to a statement (pdf). In addition to EFG Hermes boss Karim Awad, you can expect to see execs from BNY Mellon, PepsiCo and Citi on stage. Garhy will also attend this week a workshop with funds organized by CI Capital, according to a statement from the ministry. El Garhy had attended a similar gathering on Thursday.

Foreign Minister Sameh Shoukry is heading to Slovenia today for a two-day trip aimed at increasing economic cooperation between the two countries, according to a Foreign Ministry statement. Shoukry is expected to pitch the Slovenian president, prime minister, and foreign minister on investment in Egypt, particularly in the Suez Canal Economic Zone, in addition to talks on other topics.

The Donald is mulling candidates to chair the US Federal Reserve, and Treasury Secretary Steven Mnuchin tells the Financial Times the process could take at least a month. The next Fed chief will take office in February, and there’s still a chance that incumbent Janet Yellen will be re-appointed. The FT’s backgrounder this morning notes that Trump “must choose between embracing continuity or propelling the world’s most important central bank into a potentially market-jarring change of direction.”

For the oldsters this morning: “Sleep gets more difficult the older you get,” the Wall Street Journal tells us. “Older adults are less able, on average, to obtain as much sleep, or as restorative a sleep, as young adults. … As you enter your 30s and 40s, your deep-sleep brain waves become smaller, less powerful and fewer in number. Reductions in deep-sleep quality increase your risk of heart attacks, obesity and stroke, as well as the buildup of a toxic brain protein—called beta amyloid—that is linkedto Alzheimer’s disease.”

For the middle-aged: Read this Reddit discussion, featuring guys aged 30-60 from r/fitness reassuring twee twenty-somethings that their joints won’t magically explode nor their muscles atrophy overnight on the day they turn 30 / 40 / 50 / 60. A great source of ideas if you’re looking for reassurance, stretches or tweaks for your routines. While you’re there, go read any of the weekly Rant Wednesday threads if you, like us, are driven bonkers by the bad behaviour of your fellow adherents of the Way of Brodin. Re-rack the [redacted] weights and stay on your side of the pool if we agree to let you share a lane with us.

For the youngsters: Fairytales can come true in nightclubs: The literal prince of Ethiopia met his now-wife a dozen years ago at a night spot in DC, according to this weekend’s big feature in the New York Times’ Weddings section.

What We’re Tracking This Week

The House of Representatives’ Transport Committee is planning to review on Tuesday the Egyptian National Railway’s USD 575 mn agreement with GE for the purchase of 100 new locomotives, according to statements by committee member Mohamed Badawi. The committee is also waiting on the cabinet to send over legislative amendments that would allow the private sector to participate in the development, management, and operation of state rail assets. Transport Minister Hisham Arafat said over the weekend that the private sector will only be allowed to operate logistics facilities and warehouses. The actual operation of railway lines will be set aside until the overhaul of the state network is completed.

On a related note, GE has begun maintenance work on some 81 locomotives as part of the locomotives agreement, acting Egyptian National Railways chief Reda Abou Harja tells Al Mal. The locomotives, which were allegedly faulty when they were purchased in 2008, should be overhauled and be ready for service in four months, he added.

On The Horizon

Gadget freaks, Eighties fans and game aficionados, mark Friday, 27 October on your calendar. That’s the day that:

- The iPhone 8 and 8 plus will officially launch in Egypt, an Apple retailer announced;

- The iPhone X becomes available for pre-order in many markets;

- All episodes of season two of Stranger Things drop on Netflix;

- The new Assassin’s Creed: Origins — set in Ancient Egypt — launches.

The second Blue Planet series makes its debut two days later on Sunday, 29 October, and Egypt was among the filming locations. Presenter Sir David Attenborough warns in the run-up that world needs to cut down on the use of plastics by “tomorrow,” The Guardian notes. Attenborough says two things concerned him: the rising temperatures and plastic in the oceans. Click or tap here for the trailer if you missed it when we ran it last (runtime 1:00).

An IMF delegation is expected in Cairo on Wednesday, 25 October to conduct a second review of the state’s reform program. The delegation will be in town through 7 November, according to remarks over the weekend by Jihad Azour, director of the IMF’s Middle East and Central Asia Department.

Egypt’s industrial investment map will be finalized and made available at the end of the month, Industrial Development Authority Chairperson Ahmed Abdel Razek said. The map will include over 4,000 ready investment opportunities, he added, according to Al Masry Al Youm.

EFG Hermes will hold its 7th Annual London Conference on 6-9 November. The conference will see C-suite execs from top listed companies in MENA as well as frontier markets (among them Pakistan, Kenya, Nigeria, Bangladesh, and Sri Lanka) meet face-to-face with top global investors with mandates to invest in emerging and frontier markets. The event will take place at Emirates Arsenal Stadium in London.

The Investment Ministry’s investment map of some 600 projects will be ready by December, a source from the General Authority for Freezones and Investment tells Youm7. Projects under the map will be ready for investors to place bids on them in January, the sources added.

Enterprise+: Last Night’s Talk Shows

A number of topics kept our nation’s talking heads busy last night on the airwaves, including the Egyptian delegation in D.C, the new administrative capital, and the UNESCO elections.

The government’s upcoming eurobond issuance will not be preceded by a roadshow like its predecessor, Finance Minister Amr El Garhy told Hona Al Asema’s Lamees Al Hadidi. The minister phoned in from Washington, DC, to update Lamees on the IMF and World Bank’s Fall Meetings, where he sat down with IMF Managing Director Christine Lagarde and several finance ministers from the MENA region to discuss inclusive growth and each country’s challenges in achieving it.

The minister also recapped some positive economic indicators, including month-on-month declines in inflation, which he said also reflects price stability and a nascent economic recovery. That will eventually lead the CBE to reduce interest rates that have slowed private investment (watch, runtime 10:48).

Lamees also hosted the chairman of the New Administrative Capital Company (NACC), Ahmed Zaki Abdeen, who said that his company reworked the project’s blueprints to cope with the “massive turnout” of eager investors, converting certain areas from residential to investment districts. Land plots are currently going for EGP 3,500 per sqm, and NACC has sold 1,600 feddans to investors so far (watch, runtime 3:12).

Despite the strong demand, rising costs as a result of the float have been a challenge for the NACC, which is 49%-owned by the New Urban Communities Authority, with the military holding the balance (watch, runtime 3:53).

Meanwhile on Kol Youm, Foreign Minister Sameh Shoukry told Amr Adib that the decision to push an Egyptian nominee into the race for UNESCO’s top job was partially due to Qatar’s early announcement of its intention to run (watch, runtime 6:00). The minister said he was surprised when some of Egypt’s backers withdrew their support during the election (watch, runtime 1:24)

Over on Masaa DMC, Eman El Hosary discussed the Palestinian reconciliation with Fatah spokesperson Hazem Abou Shanab, who said that the Rafah border crossing will be under Palestinian Authority control once Egypt is done reconstructing its side (watch, runtime 5:00).

Yahduth fi Masr’s Sherif Amer spoke to US Squash Open champions, Ali Farag and Nour El Tayeb, about their victory last weekend — the first time a married couple win a major championship on the same day.

Speed Round

M&A WATCH- An Egypt Kuwait Holding subsidiary sold a 26% stake in Egyptian Hydrocarbon Company to Carbon Holdings, according to a regulatory filing. Carbon Holdings bought the stake for USD 65.2 mn, the disclosure notes without adding further detail. A source close to the transaction tells us that EKS will record a capital gain of USD 18 mn on the investment, which it will recognize in its 3Q2017 financials. The exit, which we’re told will have no impact on EKH’s recurring revenues or profitability, should help make EK Holding a cleaner investment story going forward.

Online transactions in the Middle East rose by 22% y-o-y in 2016, according to a survey conducted by Amazon-owned Payfort. The increase in Egypt was 22% and, overall, events and entertainment was the fastest growing segment at 33% y-o-y. Egyptians carried out USD 6.2 bn in online transactions during the year, or about 20% of the region’s USD 30.4 bn. “The biggest concern of online consumers remained security, with more than 50 per cent of cash-on-delivery customers polled saying that they would switch to online payments if they deemed it secure enough, according to the survey. The highest levels of cash-on-delivery payments were registered in Egypt, accounting for about 70 per cent of all transactions, followed by Lebanon where it was 60 per cent,” The National says. The Saudi Gazette also has the story. Or tap here to go play with the full survey yourself, including a tool that lets you build your own custom report based on your data preferences.

INVESTMENT WATCH- Al Ahly Capital to invest EGP 1.5 bn next year in fields including energy, healthcare, and financial services: National Bank of Egypt subsidiary Al Ahly Capital plans to invest EGP 1.5 bn in healthcare, energy, financial services, building materials, and consumer retail in 2018, Managing Director Khaled Badawi tells AMAY. The holding company presently has investments of EGP 9-10 bn in 12 companies.

President Abdel Fattah El Sisi apparently supports amendments to the Central Bank and Banking Acts, CBE Governor Tarek Amer told Al Shorouk in an interview on the sidelines of the IMF and World Bank Fall Meetings. Amer said the act would enhance the CBE’s role as a regulator of the sector to safeguard depositors. He also said the act, which would set term limits for managing directors, tweak the CBE’s representation on bank boards, and force banks to kick in 5% of their bottom lines annually for an industry development fund, would also make the sector more competitive.

Amer then went on to defend prevailing interest rates, saying that they had played a major role in the increase in foreign inflows, particularly into the debt market. He added that despite the rate hikes this year, returns from direct foreign investments far exceeded returns on Egypt’s treasuries, with foreign companies raking in as much as 60% in returns. He stated that Egypt managed to draw in around USD 80 bn since “the economy pivoted on the correct trajectory,” adding that USD 18 bn came from investments in treasuries, USD 18 bn in investments in equities, USD 35 bn came from Egyptian depositors, and USD 7 bn from the last round of eurobond issuances.

Amer also said that he was unconcerned about Egypt’s foreign debt obligations, which amount to USD 12.9 bn for the upcoming year, especially as the UAE and Saudi Arabia will let their deposits at the CBE rest until after the original 2018 date for their return. China has also approved renewing a USD 2.7 bn currency swap agreement. Amer assured that while foreign debt does appear to be high, it was necessary spur economic growth. He added that the CBE was ready to repay a USD 3.7 bn African Export-Import Bank loan this December.

While in Washington, Amer was named Central Bank Governor of the Year for the MiddleEast and North Africa by GlobalMarkets in a special issue for the IMF and World Bank Fall Meetings.

The Islamic Development Bank (IsDB) is developing a new cooperation strategy with Egypt worth USD 3 bn for 2018-2020, President Bandar Hajjar told Investment Minister Sahar Nasr. Hajjar and Nasr discussed setting up a branch for IsDB in Cairo and to increase its support of projects in Egypt, besides promoting entrepreneurship and innovative projects through investing in Egypt Entrepreneurship Program. On the sidelines of her trip to attend the World Bank’s annual fall meetings, Nasr also met with Abdel Latif Yousif Al Hamad, chairman of the Arab Fund for Economic and Social Development, as well as President of the Kuwait Fund for Arab Economic Development Abdulwahab Al Bader.

…Also in Washington, Finance Minister Amr El Garhy met with representatives from JP Morgan, according to a ministry statement. El Garhy noted that Egypt’s reform program has garnered the support of the international investment community. He added that tourism, manufacturing, and government investments are expected to bolster the Egyptian economy in the upcoming period. He also told investors from BNP Paribas in Washington that Egypt is looking to achieve and sustain a primary budget surplus of 1-2% in the future.

Meanwhile, Nasr discussed the disbursal of USD 150 mn as part of an agreement with the UK Department for International Development (DFID) signed in March, with DFID head Nick Dyer. The funding will go towards supporting the economic reform program. The agreement also included USD 18 mn in provisions for the social safety net, according to a ministry statement.

Nasr also met with HSBC Global Banking & Markets CEO Samir Assaf and HSBC MENA Region head George Elhedery to discuss expanding the bank’s presence in Egypt.

Tax revenues for the first quarter of FY2017-18 increased to EGP 88.6 bn from EGP 57 bnin the same period the year before, Vice Minister of Finance Amr El Monayer announced on Sunday, Al Ahram reports. The proceeds exceeded the ministry’s target by 1%, notes Al Masry Al Youm. Income tax revenues rose by 36% y-o-y to EGP 21.76 bn, while taxes from state institutions such as the CBE, Suez Canal, and EGPC recorded EGP 16 bn, compared to EG 13 bn last year. Real estate taxes rose to EGP 804 mn during the quarter, up from EGP 469 mn (Note to readers: Al Ahram incorrectly puts the figure in bns). The value-added tax reeled in EGP 50.7 bn, up from EGP 28.3 bn in the same period last year, and 3% higher than expected, according to El Monayer.

While some legislative amendments to the tax code will still be necessary, there will beno changes on the income tax front that would impact lower-income citizens, El Monayer said. The introduction of fiscal and legislative reforms, such as the VAT, last year helped the government increase tax proceeds by 31.8% to EGP 464.4 bn in FY2016-17. Proceeds from sales tax and VAT were up by 53% y-o-y to EGP 183 bn in the last fiscal year, El Monayer said, with the petroleum sector largely driving collections. The official attributed the growth of 520% y-o-y in petroleum taxes last year to the resolution of outstanding disputes between the industry and the Tax Authority. Also up in FY2016-17 were income tax proceeds, which increased by 20% y-o-y to EGP 226 bn and real estate taxes.

Trump’s stance on Iran nuclear deal creating “chasm” with allies: US President Donald Trump’s attitude towards the Iran nuclear power agreement is creating “a widening chasm of mutual disdain between the United States and its traditional allies,” Karen DeYoung writes for the Washington Post. The countries that signed the 2015 agreement — France, the UK, China, Russia, and Germany — did not respond well to Trump’s Friday announcement that he would terminate the agreement with Iran “if Congress didn’t come up with a way to rewrite it to his liking,” receiving scorn from EU foreign policy chief Federica Mogherini who saw the move as a power play. Trump accused Iran of failing to honor the agreement and later told the press that “the Europeans were only interested in Iran’s money.” Trump gave Congress 60 days to decide what to do with the agreement. Egypt’s Foreign Ministry issued a statement backing Trump’s decision.

Trump’s “gamble won’t pay off,” Richard Nephew says in the FT (paywall). Not only is the agreement as it stands “very much in the US’ national security interests,” as State Secretary Rex Tillerson also stressed, but the hurdles are just too many, with no guarantees that Iran would even accept.

Uber’s food delivery platform UberEats has been going strong, accounting for c. 10% of the ride-hailing app’s total bookings, or around USD 3 bn in sales, sources close to the matter tell the FT (paywall). The budding food delivery business is a diamond in what has been a rough year for Uber, growing even faster than the company’s core business. The segment is not without its pitfalls, however, with limited margins and growing competition from existing firms, such as GrubHub and Amazon, as well as newcomers, such as Facebook, joining the fray. The firm’s single advantage is its existing network of drivers.

EU leaders are getting together this week to discuss allowing Turkey to join their bloc, according to the FT (paywall). Turkey has been trying and failing to meet the EU’s entry requirements for years. Many EU governments are critical of the country’s human rights record, but Turkey is key to stemming the flow of illegal migrants from the Middle East into the EU. The meeting is a precursor to an official report on Turkey’s status vis-a-vis the EU in April.

The Macro Picture

The top performers in emerging markets appear to be those that have had financial difficulties in the past, Manju Dalal writes for the Wall Street Journal (paywall). Sovereign bonds rated ‘BB’ and lower, tracked by Bank of America Merrill Lynch Global Emerging Market Sovereigns Index, have returned 10.2% this year. US corporate junk bonds have returned 7.3% over the same period. Top performers include Egypt, whose 30-year bonds have returned 18.3% since they were sold in January. Despite defaults in the past, Argentina’s nine- and 29-year old bonds issued in April have returned around 15.4% and 14.8%, respectively. El Salvador’s bonds have returned 17.9%, despite rating agencies assessment that it remains financially weak.

Image of the Day

Climeworks and Reykjavik Energy launched operations at the world’s first negative emissions plant, according to Engadget. The geothermal plant in Hellisheidi actually removes more CO2 than it produces. Using the Climeworks system to capture CO2 out of the air, at a rate of 50 metric tonnes a year, it then binds the CO2 with water before embedding it back into the earth where it remains for billions of years. While the system may not yet be cost effective, the price for the technology is dropping, and aside from the environmental benefit, it could appeal to major cities with smog issues.

Egypt in the News

There is nothing new under the sun for Egypt in the international press, and that’s not a bad thing at all.

On Deadline

The House of Representatives’ decision to extend the state of emergency relied on a constitutional loophole, which makes it in violation of the constitution, Al Masry Al Youm’s Amr Hashem Rabie says. The House has not learned any lessons from the Mubarak era, whose permanent state of emergency did little in the fight against terrorism. Representatives also seem to ignore the impact of a continued state of emergency on the investment climate, Rabie points out.

Worth Watching

Rise and fall of the for-profit college industry in the US: PBS Frontline’s 2010 documentary College Inc. (watch, runtime: 55:13) takes a look at the rise of for-profit universities in the US, how they have changed the higher education landscape and how a series of shady practices may have brought about its downfall. The rise of for-profit colleges has demonstrated that there is a market for those that traditional higher education has failed (or who have rather failed out of higher education). The market had been growing immensely prior to 2010, witnessing even IPOs and M&As, targeting mostly adult-age individuals continuing their education, lower middle-income students, single parents and others who have been unable to meet rising tuitions at traditional universities. These students had been lured with the promise of an effective degree which would help them compete in a post-financial crisis job market, but by 2010, many of them were filing lawsuits.

The Obama administration also began tightening regulations, threatening to upend the industry. Institutions closed down campuses as enrollment levels dropped. Yet while the industry struggles to clean house, many of those whom they have served continue to struggle to get access to higher education.

Diplomacy + Foreign Trade

Egypt’s non-oil exports increased 9.3% y-o-y to USD 15.4 bn during 9M2017, Al Masry Al Youm reports. Chemicals and fertilizers exports grew the most, registering a growth rate of 38% y-o-y to record 3.12 bn. Agricultural exports increased by 13.9% y-o-y in 9M2017 to reach 4.1 mn tonnes compared to 3.6 mn tonnes a year earlier, Agriculture Ministry spokesman Hamid Abdel Dayim said, according to Reuters. The proceeds amounted to USD 1.72 bn, growing 4% y-o-y, as exports of potatoes, grapes and strawberries rose. Reuters also noted that the volume increase “comes after a turbulent year for Egyptian produce, with a Hepatitis A scare in North America linked to Egyptian strawberries and a temporary ban on Egyptian fruits and vegetables in Russia, one of Cairo’s major buyers.”

Supreme Council for Nile Water gives preliminary nod to GERD impact studies: The Supreme Council for Nile Water gave a preliminary nod to the French consultancy firms’ impact studies on the Grand Ethiopian Renaissance Dam (GERD) during a meeting yesterday, Prime Minister Sherif Ismail told reporters, according to Al Ahram. Egypt, Sudan, and Ethiopia had signed agreements with French consultancy firms BRL and Artelia to conduct the studies last year. Ismail also said the three countries’ irrigation ministers are expected to meet on Wednesday in Addis Ababa to discuss the studies, which Ethiopia reportedly has some concerns about.

Energy

Zohr works 91% complete -El Molla

Work on the Zohr field is 91% complete, Oil Minister Tarek El Molla says, according to Al Masry Al Youm. “We are now counting down to the start of production,” El Molla says. The first phase of the project is expected to be brought on stream this year and the second phase to begin straight after.

Government to repay more of its arrears to IOCs before end of 2017

The government is planning to repay a portion of its arrears to international oil companies before the end of 2017, especially as they have been expanding their investments in the country, Prime Minister Sherif Ismail told the press on Sunday, Al Mal reports. IOCs had raised investments in Egypt to USD 10 bn this year, while arrears had dropped to USD 2.3 bn, their lowest levels since 2013, Oil Minister Tarek El Molla said last month.

EETC holds its first general assembly since demerger from Electricity Holding Company

In another step towards deregulating the electricity market, the Egyptian Electricity Transmission Company (EETC) held its first general assembly on Sunday after it split from the Egyptian Electricity Holding Company, Al Masry Al Youm reports. Electricity Minister Mohamed Shaker said that procedures to completely spin off the company are ongoing and once completed would see the EETC transform into a market regulator and transmission system operator as per the executive regulations of the Electricity Act.

Basic Materials + Commodities

Al Mona Misr launched food processing company, to export all output

Louis Dreyfus’s local affiliate Al Mona Misr has set up a EGP 100 mn company with businessman Alaa Moghazy called Al Mona for Food Industries, Al Mal reports. The business will focus on packaging and preparing frozen fruit and vegetables at two production facilities in Borg El Arab. The output will be directed entirely to exports and both facilities are set to begin operations before the end of 1H2018.

Supply Ministry reaches agreement with vendors on new system for subsidized commodities

The Supply Ministry reached an agreement with subsidized commodity vendors on a new framework for the distribution of goods under the smartcard system, a ministry source tells Al Shorouk. In addition to ensuring citizens receive their allotted commodities each month, the agreement also requires vendors to pay 50% of products’ value upfront when collecting them from wholesale outlets. It also sets a system in place for the calculation of vendors’ profit margins.

Farmers are refusing to sell their rice harvests to the government due to low prices, says syndicate head

Farmers are selling their rice on the open market because the government is offering them prices that are too low, Farmers’ Syndicate head Hussein Abdel Rahman said, Al Mal reports. Some farmers are also smuggling their harvests to Libya, Sudan, Jordan, or the Gulf to fetch a higher price, despite an ongoing ban on rice exports. The government set the price of rice at EGP 3,500 per tonne, while traders on the open market purchase each tonne at EGP 4,000 in the local market and as much as EGP 7,000 overseas. Abdel Rahman said he expects the government to face a shortage this season due to that.

Manufacturing

Hayat Kimya raises investments to USD 278 mn

Turkey’sHayat Kimya Egypt launched their new Papia and Familia brands locally after an investment of USD 278 mn, Egypt GM Zeki Armagan said, Al Mal reports. The company also spent USD 125 mn on a new paper napkin factory in Ain Sokhna with an annual production capacity of 70k tonnes.

Health + Education

Inaugural semester of Egyptian-Japanese schools postponed

The inaugural semester of Egyptian-Japanese schools, which was supposed to take place this fall, will be postponed until the schools have been fully furnished, said Education Ministry Undersecretary Farida Megahed, according to Al Masry Al Youm.

Real Estate + Housing

ISDF allocated EGP 1.3 bn to compensate Maspero triangle residents

The Informal Settlement Development Fund (ISDF) is allocating EGP 1.3 bn to compensating Maspero Triangle households, Al Mal reports. More than 4,500 families will be relocated as part of development plan for the area. ISDF executive director Khaled Seddik says 435 families received financial compensation so far, 341 opted to get housing in the Asmarat project instead, and 200 households have yet to decide between the two options.

Karma begins implementation of two projects in New Cairo

Karma Real Estate began work on two EGP 160 mn projects in the New Cairo, Chairman Ahmed Mostafa tells AMAY. The company is targeting sales of EGP 60 mn by the end of the year.

Tourism

Egyptian-Czech discovers parts of Ramses II temple

An Egyptian-Czech archaeological mission discovered parts of a temple to King Ramses II during excavation work in Abusir necropolis, Mohamed Megahed, deputy to the mission director, told Ahram Online.

JWT preparing tourism promotional campaign during Egypt’s World Cup matches

JWT is preparing a tourism promotion campaign for Egypt during the FIFA World Cup 2018 in Russia, said Reham El Sawy, CEO of JWT subsidiary Mindshare. She tells Al Borsa that the company is awaiting the group stage draw to launch the campaign during Egypt’s matches at the tournament.

Banking + Finance

SAIB in talks with EBRD for USD 20-30 mn loan

SAIB Bank is currently in talks with the European Bank for Reconstruction and Development for a USD 20-30 mn loan for SME financing, senior bank officials tell Al Borsa. SAIB had recently signed a USD 40 mn agreement with the China Development Bank for SME funding.

Other Business News of Note

Trade Ministry requires manufacturers, importers of 10 goods including furniture, toys and eyeglass lenses to comply with Egyptian quality standards

Trade and Industry Minister Tarek Kabil issued a decision yesterday requiring manufacturers and importers of 10 goods and commodities, including furniture, children’s toys, and eyeglass lenses, to comply with Egyptian quality standards, Al Shorouk reports. Manufacturers and importers have been granted a six-month grace period to comply with the decision.

Egypt Politics + Economics

Public sector labor force shrank 13% y-o-y in FY2016-17 -CAPMAS

The number of employees in the public sector decreased 13% y-o-y in FY2016-17 to reach 5 mn people, down from 5.8 mn during the previous year, according to numbers from state census bureau CAPMAS cited by Al Masry Al Youm. Local administration positions accounted for the lion’s share of the public sector’s labor force at 56%, and male employees outnumbered their women counterparts by nearly threefold. The story gives no explanation for the decline.

More voices back El Sisi in upcoming presidential race

The House of Representatives’ majority bloc, the Support Egypt Coalition, plans to launch a campaign urging President Abdel Fattah El Sisi to run in the 2018 elections, Daily News Egypt reports, citing state media. This comes one day after news reports said many House representatives and celebrities had signed another petition backing El Sisi, who has yet to declare his candidacy, in the upcoming race.

Protest-related cases to be tried in civilian courts instead of military courts

The Constitutional Court issued a ruling on Saturday that places protest-related cases under the jurisdiction of civilian courts instead of military courts, Ahram Online reports. The ruling follows a judicial dispute over which court would judge six cases of illegal protests in Beni Suef. It is unclear if this ruling effectively sets aside sentences handed down by military courts in previous protest-related cases.

Ahmed Douma retrial appeal accepted

The Court of Cassation accepted the appeal of activist Ahmed Douma last Thursday, ordering a retrial of his 2011 case on charges of illegal protesting, possession of weapons, assaulting security personnel and attacking government buildings, the AP reports.

National Security

24 terrorists, six soldiers killed in terror attack on military checkpoints in North Sinai

Terror attacks in North Sinai’s Karam El Kawadis area yesterday resulted in the death of 24 terrorists and six soldiers, according to an Armed Forces statement. Daesh has claimed responsibility for the attack, which also left 20 members of the security forces injured. The attack has had the additional consequence of delaying a planned opening of the Rafah crossing for a duration of four days; the crossing was to have opened today.

On Your Way Out

President Abdel Fattah El Sisi increased funding to Ittihadiya’s Tech Entrepreneurs of the Future Initiative to EGP 400 mn on Sunday, Al Borsa reports. The program, which launched in 2015, would see the ICT Ministry provide training and mentorship to around 10,000 potential entrepreneurs over a three year period.

ON THIS DAY- On this day in 1978, cardinals at the Vatican picked Cardinal Karol Wojtyla, the Archbishop of Krakow, who became Pope John Paul II and the first non-Italian Pope for more than 400 years. In 1934, Mao Zedong and Chinese Communists began what was known as the Long March to escape encirclement during the civil war between the Nationalists and Communists. The UK made the sensible move to announce plans to outlaw almost all handguns on this day 1996. Across the Channel, Marie-Antoinette was guillotined in the wake of the French Revolution. In Enterprise last year, readers were hearing about plans by the private sector to attempt to cool off the parallel market by boycotting it for 21 days.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5918 | Sell 17.6918

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Sunday): 13,906 (+0.1%)

Turnover: EGP 1.0 bn (9% above the 90-day average)

EGX 30 year-to-date: +12.6%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were: Egyptian Iron and Steel up 6.1%, Kima up 4.8%, and Arab Cotton Ginning up 3.8%. Yesterday’s worst performing stocks were: Heliopolis Housing down 2.4%, Porto Group down 2.1%, and Sidi Kerir Petrochemicals down 1.7%. The market turnover was EGP 1.0 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -55.1 mn

Regional: Net Long | EGP +3.6 mn

Domestic: Net Long | EGP +51.6 mn

Retail: 78.6% of total trades | 80.3% of buyers | 76.9% of sellers

Institutions: 21.4% of total trades | 19.7% of buyers | 23.1% of sellers

Foreign: 10.5% of total | 7.9% of buyers | 13.1% of sellers

Regional: 7.5% of total | 7.7% of buyers | 7.4% of sellers

Domestic: 82.0% of total | 84.4% of buyers | 79.5% of sellers

WTI: USD 51.87 (+0.82%)

Brent: USD 57.62 (+0.79%)

Natural Gas (Nymex, futures prices) USD 2.97 MMBtu, (-1.10%, November 2017 contract)

Gold: USD 1,304.20 / troy ounce (-0.03%)

TASI: 6,937.94 (-0.71%) (YTD: -3.78%)

ADX: 4,518.38 (-0.17%) (YTD: -0.62%)

DFM: 3,657.54 (-0.07%) (YTD: +3.59%)

KSE Weighted Index: 430.47 (-0.25%) (YTD: +13.25%)

QE: 8,341.11 (-0.01%) (YTD: -20.08%)

MSM: 5,138.90 (+0.20%) (YTD: -11.13%)

BB: 1,274.36 (-0.03%) (YTD: +4.42%)

Calendar

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

21 October (Saturday): The African Leadership Academy will hold its “Beyond Education” seminar on on university readiness and the future of leadership in Africa, at the Dusit Thani, Lakeview, New Cairo and the Hilton Pyramids Golf, 6 October City.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.