- Beltone setting up USD 1 bn fixed income fund, looks to expand in frontier markets. (Speed Round)

- Diplomatic standoff with Italy cooling as Rome says it will send a new ambassador to Cairo. (What We’re Tracking Today)

- Cabinet is studying raising the minimum wage, but signals it won’t be targeting the private sector. (Speed Round)

- Tourist arrivals up 52.3% y-o-y in 1H2017. (Speed Round)

- MENA startups increasingly turn to offshore havens to avoid regulatory hurdles. (Speed Round)

- President should shut down proposals to extend presidential terms. –columnist. (On Deadline)

- Egyptian swimmer medals at international meet. He’s 86. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 15 August 2017

In praise of slow, late-summer news days

TL;DR

What We’re Tracking Today

On a blessedly slow late-summer news day in Egypt and around the world — American pundits seem more obsessed with whether their president would call racists “racists” than the prospect of nuclear Armageddon — the return of an ambassador qualifies as big news.

After more than a year of estrangement, Italy is sending its ambassador back to Cairo. One of our top trade and investment partners, Italy pulled its envoy to Omm El Donia in protest of the brutal murder of Italian grad student Giulio Regeni. The labor researcher went missing on 25 January; his body was found on the outskirts of the capital city days later with multiple signs of brutal torture. “The Italian government’s commitment remains to clarify the tragic disappearance of Giulio,” the Italian foreign ministry said in a statement. “Sending an authoritative liaison (ambassador) will help, through contacts with the Egyptian authorities, reinforce judicial cooperation and as a consequence the search for the truth.” This comes as sources tell ANSAmed that Egyptian prosecutors took “a step forward” on Monday and sent Rome new transcripts from the questioning of police officers who investigated Regeni’s death. The Associated Press, Reuters and Ahram Online also have the story.

Stephen Fakan, the US consul general in Alexandria, announced his departure last week. Fakan wrote on Facebook he and his wife “wanted to take the opportunity to thank everyone who made our tour so special and memorable. This city and lower Egypt is undeniably a remarkable place with remarkable people, and although we leave with heavy hearts, we are grateful that so many of you have shared this wonderful city and its vibrant culture with us.”

Will the government announce across-the-board cuts in port fees today? From what we’re hearing via Al Mal, Transport Minister Hisham Arafat will be announcing discounts as high as 40% on port fees in East Port Said at a presser today. The discounts, which will be based on cargo volume, are meant to win back shipping lines that left the port in March to protest a 150% hike in fees. Additional fees imposed on ships longer than 350 meters will also be scrapped, sources said. This comes as we await the announcement of unified fees for ports across the country on Thursday, sources also tell the newspaper.

Pimco sees “handsome” rewards in emerging market bonds, including Egypt’s, Bloomberg reports. The fixed-income giant said yesterday that EM local government debt will become “much larger, deeper and more liquid as countries including China and Egypt are likely added to benchmark indexes.” This is expected to increase the attractiveness of assets that are already being boosted by a slumping USD. And Pimco isn’t only one singing the praises of EM bonds: BNP Paribas Asset Management, Schroders Plc and Ashmore are all bullish, with the latter calling them “the best bet in the world.”

The Financial Times released a 17-book long list for the FT / McKinsey annual Business Book of the Year for 2017. The FT says this year’s titles “give a new twist to the old maxim about certainty” and “include analyses of the implications of world-changing innovations, from the iPhone to drones; a lively account of the rise of Uber; and a sobering history of the role war, plague and catastrophe have played in shaping our economies.”

One of the standouts on the list is Sheelah Kolhatkar’s Black Edge, which, besides sounding very familiar to fans of the HBO series bns, “describes how Steven Cohen’s former hedge fund, SAC Capital, built its Wall Street dominance before facing insider trading charges.” The economics nerds here were happy to see Nobel Laureate Jean Tirole’s Economics for the Common Good get a nod, despite him consistently being the main source of nightmares for postgraduate microeconomics students since the 1980s. And the Apple Sheep among us are really enjoying Brian Merchant’s critical look at the development and manufacturing of the iPhone in The One Device. More mainstream authors on the list include the Middle-East-taxi-driver-whisperer Thomas Friedman and Microsoft CEO Satya Nadella, Stephen King, and journalist Amy Goldstein.

Looking to add to your TBR pile from past winners? We highly recommend Esther Duflo’s and Abhijit Banerjee’s magnum opus Poor Economics — in our opinion, the single most influential book on the list. It looks at the social and economic dimensions of poverty globally and won the award in 2011.

86 year-old Egyptian wins bronze medal for swimming: 86-year old Egyptian Essam Nasser snagged the bronze medal at an international 800-meter freestyle swim race this week, according to the Facebook page Sports News Egypt. You can ponder that the next time you need some motivation to get you to lace up your running shoes / head to the gym / pack your swim bag.

What We’re Tracking This Week

Will the central bank drop interest rates this week? Stay tuned for the Monetary Policy Committee meeting on Thursday to find out. The general expectation is that the committee will leave rates on hold, especially in light of the spike in inflation in July.

The Ismail cabinet will look at the Investment Act’s executive regulations and at the Factoring and Leasing Act at its weekly meeting, which should take place on Wednesday. We’re expecting on approval on the former.

On The Horizon

The Ismail cabinet is expected to review the “final draft” of the Universal Healthcare Act by the end of the month, with an eye towards introducing it to the House of Representatives when MPs reconvene in September.

Enterprise+: Last Night’s Talk Shows

The airwaves gave us a mixed bag of nuts last night, with minimum wage, rail upgrades, the return of Italy’s ambassador, and future investment opportunities being the main points of discussion.

The proposal to set a monthly minimum wage of EGP 2,000 for the private sector will not be mandatory, Manpower Minister Mohamed Saafan told Hona Al Asema’s Dina Zahra (sitting in for Lamees). He said that the proposal was still under review and being discussed by a “very receptive” business community (watch, runtime 7:23).

Separately, Yahduth fi Misr’s Sherif Amer said that sources told him the finance and planning ministries are studying an across-the-board hike in the minimum wage, which would apply to both the public- and private-sectors. (We have more in this morning’s Speed Round).

Over on Masaa DMC, Investment Minister Sahar Nasr told host Eman El Hosary that she was working on luring new funds into the country. Nasr met with investors from London and will be meeting with the European Bank for Reconstruction and Development today to talk about potential investments in energy and transport. Suez Canal Authority Chief Mohab Mamish is reportedly preparing a comprehensive investment strategy for the Canal’s economic zone, which Nasr and the admiral will market during an upcoming roadshow to Vietnam and Singapore (watch, runtime: 5:44).

The railway was still a hot topic of debate last night. Transport Minister Hisham Arafat told Amer that upgrades to the sector will take about four years to complete. Plans are already in place, but funding is where the well runs dry and the ministry is on the prowl for financing.

Amer also spoke to Foreign Ministry spokesperson Ahmed Abu Zeid about the imminent return of Italy’s ambassador to Cairo. Abu Zeid confirmed that Italy has asked Egypt to sign off on its new envoy and that investigations into the death of murdered PHD student Giulio Regeni were still ongoing. He said the case will not hinder diplomatic relations and that Italian prosecutors “have faith” in their Egyptian counterparts.

Speed Round

INVESTMENT WATCH- Beltone Financial will launch in September a USD 1 bn fund to invest in fixed-income instruments, CEO Bassem Azab said in an interview with Ihab Farouk from Reuters’ Arabic service. The fund targets foreign investors from the GCC, Europe, and the US, Azab says, adding that its roadshow will begin after the Eid break in September and will hit the US by October. Beltone is looking to raise AUM of about USD 150-200 mn in its initial phase. Azab also added that Beltone is targeting growth in frontier markets and is looking to acquire brokerage houses there through its US subsidiary Auerbach Grayson & Co, of which Beltone owns a 60% stake. Azab says Beltone is in the lookout for brokerage houses to acquire in Egypt as well, with an aim to become one of the top two brokerages in the country in 2018. The number one slots are currently held by EFG Hermes and CI Capital.

It would appear that the ministries of planning and finance are in fact working to amend the national minimum wage and increase it from its current EGP 1,200 a month, sources with knowledge of the matter tell Al Masry Al Youm. The ministries are currently conducting studies to determine the extent of the raise and assess its impact on the state budget. It’s unclear when studies will conclude, but any decision on the matter will affect both the public and private sectors. This news comes one day after Manpower Minister Mohamed Saafan said his ministry was considering imposing a monthly minimum wage of EGP 2,000 on the private sector. House Manpower Committee Chair Maraghy El Gebaly said, however, questioned the legality of imposing separate private- and public-sector minimum wages. Maraghy said he had pushed for a revision of the current minimum wage but has yet to hear back from the government.

Tourist arrivals increased by 52.3% y-o-y in 1H2017, according to data received by the Tourism Ministry and cited by Al Shorouk. 3.5 mn tourists visited Egypt in the first half of the year, with tourist nights increasing to 37 mn from the 13 mn recorded in 1H2016.

Tax revenues for FY2016-17 exceeded targets for the first time ever, Vice Minister of Finance Amr El Monayer said, according to AMAY. El Monayer stopped short of specifying a figure, saying an announcement on that will come sometime this week. The last fiscal year was the first for Egypt’s value-added tax at a baseline rate of 13%. Finance Minister Amr El Garhy had estimated last month that tax revenues increased during FY2016-17 to EGP 450 bn from EGP 350 bn a year before. On inflation, El Monayer said the government’s forecast is for a 10% rate by the fiscal year starting July 2018. The CBE is sees the figure at 13% by the end of 2018.

The second of BP’s Egypt upstream projects is coming online before the end of 2017, reports World Oil. The first phase of West Nile Delta project started production earlier this year and the company has seven major global upstream projects it expects to come before the year is up.

Logic Management Consulting has been tapped to advise on the set up of Egypt’s new natural gas market regulator, CEO Mohamed El Sherif told Al Borsa on Monday. Under the newly-issued Natural Gas Act, which liberalized the industry, the state plans to establish a new market regulator that would have a say in pricing gas, set up the rules of the system, encourage investment, and ensure equal access to all private-sector players. The World Bank, the project’s financial consultant, chose Logic from a list of four bidders that included PricewaterhouseCoopers. Logic expects to conclude its work by early 2018 and will hold its first meeting with state officials next week.

The Transportation Ministry is plans to spend EGP 45 mn on railway projects in the coming years, Minister Hisham Arafat says, according to Ahram Online. This includes EGP 3 bn to install emergency brake systems on trains, EGP 2 bn on work at some 560 crossings, and EGP 2.4 bn on new signalling systems. Arafat made clear that the government is counting on new private-sector interest in the system at the same time.

EARNINGS WATCH- Talaat Mostafa Group’s 1H2017 consolidated net profit after tax stood at EGP 696.5 mn, up from EGP 432.1 mn in the same period last year, according to an EGX filing. The company reported revenues of EGP 3.26 bn in 1H2017, up from EGP 2.92 bn a year ago.

M&A WATCH- WPP subsidiary Grey Group has acquired a majority stake in regional digital marketing agency Hug Digital. Hug is headquartered in Dubai and has offices in Egypt and India, employing 145 full-time staff. “We are eager to take our digital expertise and knowledge of the MENA region and scale this with WPP and Grey Group. This acquisition will enable us to access resources that will expand our capabilities and accelerate our growth,” Hug Chairman Oussama Jamal says. The size and value of the stake were not disclosed.

IPO WATCH- Emaar is planning to offload 30% of its UAE real estate business in an IPO, according to the Associated Press. Gulf retail investors love a payout and local favourite Emaar isn’t going to disappoint — proceeds from the IPO will go to fund a dividend.

IPO WATCH- Angry birds is set for potential USD 2 bn IPO — will it fly? Rovio Entertainment, makers of Angry Birds, is looking to IPO soon and could see a valuation of USD 2 bn, Bloomberg reports. The Finnish firm could raise roughly USD 400 mn from a local market listing, but details so far are scarce. While tech and software firms have been the toast of markets, mobile gaming is a different animal: Most find success difficult to replicate, and the sector averages 18% off IPO prices for those who have ventured there. Rovio could prove different as they have had success with the Angry Birds movie and could use proceeds for a sequel. We aren’t excited about this one — a firm with an IPO of that size needs many more cards in its deck if it has legs to go.

Some good news on the economy out of Japan for a change: The Asian giant has posted its longest unbroken growth streak in over a decade, according to the Financial Times. Japan’s GDP grew an annualised 4% in 2Q2017 — the sixth consecutive quarter of growth — prompting analysts to see this a possible lifeline for the “Abenomics” revival program.

CORRECTION- A senior official at the Investment and International Cooperation Ministry contacted us yesterday to confirm that Prince Alwaleed bin Talal has not discussed plans to invest in the Egypt Ventures fund with Minister Sahar Nasr, as mentioned by Al Borsa. The Ministry also says it is “still in talks regarding Egypt Venture’s campaign and no company has been confirmed yet.” The story has been corrected on our website.

The Macro Picture

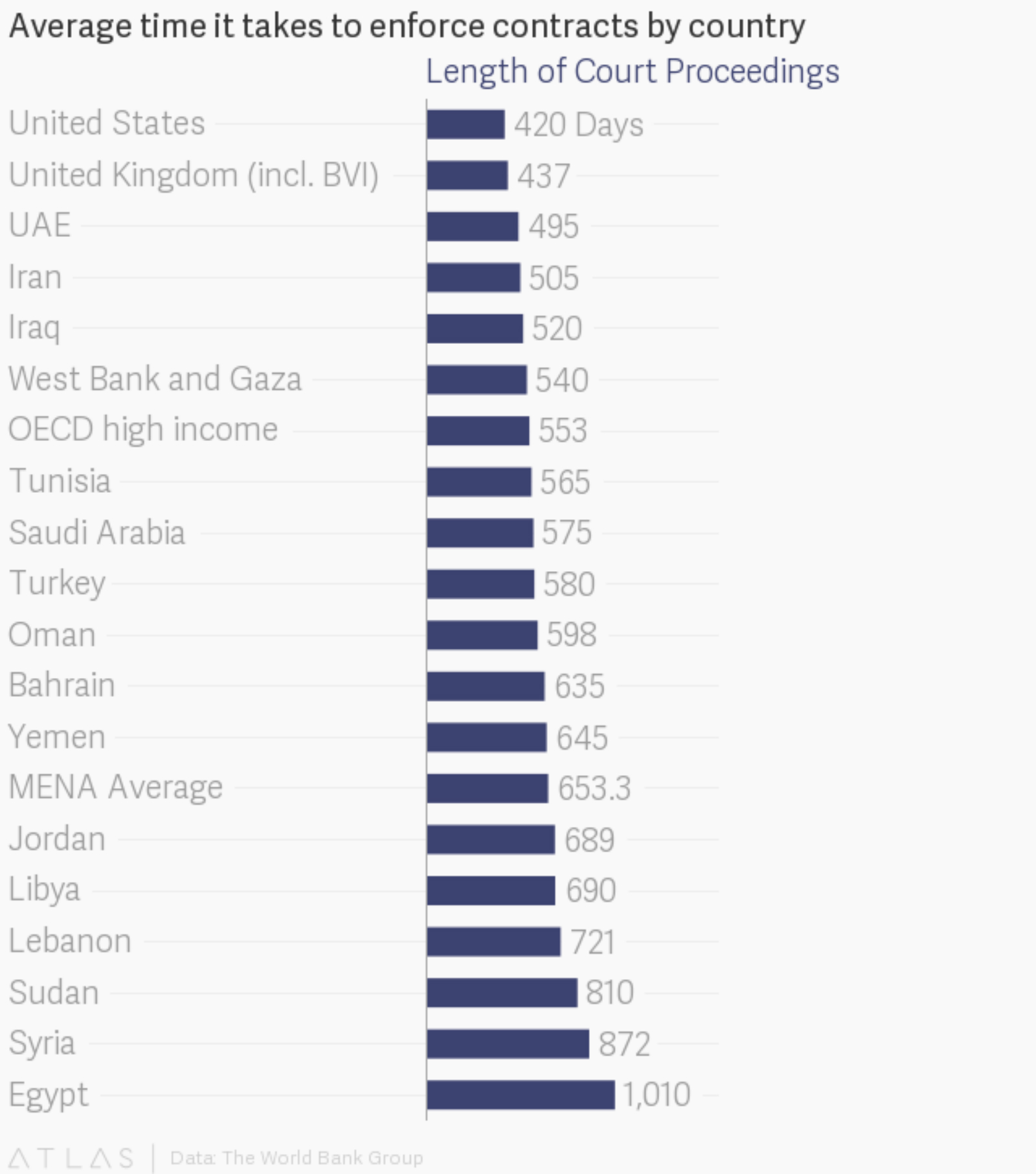

MENA startups increasingly turn to offshore havens to avoid regulatory hurdles: The first order of business for new startups in the Middle East appears to be registering in an offshore haven, writes Dennis Quinn in a piece for Quartz. Taxation is far from the only reason why companies are looking offshore: Regulatory hurdles are the prime motivator, the story claims. Investors in Careem, for example, were not concerned when Jordan clamped down on drivers when the service launched there because the company was registered in the BVI. On the whole, MENA countries have failed to advance their regulations to meet with the demands of entrepreneurship: from a lack of bankruptcy laws that protect individuals from liability of companies to outdated shareholder laws that make it difficult for investors to exit. While there has been efforts to reform legislation in the region, these have largely been addressing the symptoms and not the systems as a whole, with the results at times being detrimental for the investing climate, says Quinn.

Image of the Day

Alexandria-based Egyptian artist Abdelrahman Al Habrouk uses fire and ash for his artwork. “Cigarettes fuel his art; he breaks them in half, painstakingly traces out monochrome images of celebrities or animals with the fine flakes of tobacco, then sprinkles his creations with gunpowder and sets them on fire,” says Reuters. “The resulting scorch-marks on the white paper form the portrait.” The 23 year-old experimented first with salt, sand, and coffee before finally settling on tobacco. He calls it “[making] something good out of something bad.”

Egypt in the News

Bright Star, Rabaa anniversary dominate international coverage of Egypt on a very slow news day: US tabloid Foreign Policy has caught onto the comeback of Bright Star in a piece headlined “With Obama Gone, Trump Pentagon Resumes Major Egyptian War Game” on a morning in which no single story dominates the narrative on Egypt.

Yesterday’s anniversary of the dispersal of Rabaa passed with little attention in the international press. The usual suspects joined the party (Turkey’s Anadolu, TRT World and Al Jazeera, with the latter focusing on the extension of the detention of one of its journalist in Egypt). Human Rights Watch also picked up the case of the Jazeera journalist, and Amnesty International noted that “not a single person has been held to account for the events on 14 August 2013.”

The Egyptian economy is getting some hate from the Nigerian press (of all places) this morning. Egypt’s macro picture and public finances are currently worse than Nigeria, according to Nigeria’s Proshare, the retail investor ‘platform.’ On reserves and the bond market, “[Nigeria] can claim the same achievements without borrowing from the IMF.” The piece says that Egypt’s reform program cannot be judged until a foreign direct investment inflows improve, and the impact of the social safety net are revealed. This from a country in denial about the benefits of devaluation despite almost unanimous advice (even from the writers of the second season of Showtime’s Bns).

Also worth a brief note:

- Researcher Giuseppe Acconcia talked to Mona Abaza about his experience in Egypt with journalism in times of uprisings for Open Democracy.

- Chinese news agency Xinhua reports that trade volume between Egypt and China reached USD 5.178 bn in 1H2017. Chinese imports from Egypt increased 298.37% y-o-y to USD 660 mn.

- Reuters takes an interest in an Alexandria-native who irons clothes with her feet to make a living. There are no words.

On Deadline

President Abdel Fattah El Sisi should issue a public statement denouncing proposals by MPs to extend his presidential term to six years, writes Amr Rabei for Al Masry Al Youm. The justification for the proposal — which apparently was that since Egypt is now more stable, there is no need to strictly abide the current prescription of the constitution — makes no sense. He cites article 226 of the constitution which clearly bars any amendments to articles that restrict presidential terms. He spares no punches in deriding the proposal, calling on the president, who has sworn to defend the constitution, to shoot it down.

Worth Watching

Egyptian cartoonist Doaa El Adl is taking a stand on women’s rights through her art. “At the beginning of my career, I was not aware of what my role should be. But by the time I realized that, I knew I had to make a difference as a female cartoonist … That’s why the women’s causes depicted in my cartoons are an integral part of me, as I faced many of these situations myself,” she tells Channel 4 news in a video interview. El Adl says cartoon is the channel through which she can deliver her message and concerns about women’s rights issues (watch; runtime 02:20).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi arrived in Tanzania yesterday in the first leg of his Africa tour, which will also include stops in Rwanda, Gabon, and Chad, Al Masry Al Youm reports. The local press is hailing the trip as a grand re-engagement with Africa. El Sisi stressed the need for joint cooperation and seeing eye-to-eye on developing projects along the Nile basin in a joint press conference with Tanzania’s president John Magufuli. Trade featured heavily in their talks: El Sisi called for expanding trading relations, but nothing was mentioned on Egypt’s push to form an African Trade Zone through the merger of COMESA, EAC and SADC trade blocs. El Sisi will be in Rwanda today, according to All Africa.

Egyptian and US officials announced on Monday the completion of the Effective Planning and Services project, which is meant to improve the efficiency and responsiveness of Egypt’s public services. The project, implemented by USAID, supported “Egyptian-led efforts to make public services more accessible, transparent, and accountable through the process of decentralization, as mandated by Egypt’s 2014 constitution…nearly 5,000 government employees received training in areas like information technology, customer relations, media outreach, and ethics. The project provided technical assistance and logistical support for Egypt’s Sustainable Development Strategy, the Civil Service Law, and Citizen Capital Budget Guides…[and] improved ten “one-stop-shop” Citizen Service Centers in Aswan and Beheira governorates.”

Military Production Mohamed Al Assar discussed cooperation with the Chairman of Jordan’s military Joint Chiefs of Staff, Mahmoud Freihat, in Cairo on Monday, Al Shorouk reports. Discussions centered on potential partnerships in military industry and tech production.

Egyptian authorities opened the Rafah Border crossing yesterday to allow Palestinian hajj pilgrims through until 17 August, Al Masry Al Youm reports. Citizens will only be allowed to cross through the one way.

Energy

Electricity Holding Company signs agreements with five firms to purchase 250k smart meters

The Electricity Holding Company signed agreements with five companies who will be providing it with 250k smart meters, a company official tells Al Borsa. The companies are China’s ZTE, Huawei, El Sewedy Electrometer Group, Sigmacom, and Iskra. The Electricity Ministry plans to install 20 mn smart meters over the next decade.

Production at BP’s Atoll gas field targeted for end of 2017

BP will launch production at the USD 3.8 bn Atoll field by the end of this year, the Oil Ministry said in a statement. 70% of the field has been developed so far with three wells having been completed, said Hassan Abbady, chairman of the BP JV Pharaonic Oil Company.

EGAS exports 200 mcf/d through Shell’s Idku plant

EGAS exports a daily 200 mcf of gas through Royal Dutch Shell’s Idku liquefaction plant, sources told Al Borsa on Monday. The plant should be increasing its export capacity in the winter to pump around 300 mcf/d.

Infrastructure

Dubai Ports-Suez Canal Authority JV to be split 49%-51%

Dubai Ports will own 49% of its joint venture with the Suez Canal Authority, with the state holding the majority at 51%, according to Al Ahram. The 92 sq km project was presented and discussed by head of the Suez Canal Authority Mohab Mamish to Minister of Investment Sahar Nasr. The two also discussed a joint foreign tour to Singapore and Vietnam to drum up more investment in ports. More in the Investment Ministry statement here.

State Grid set to complete work next month

Chinese firm State Grid is set to complete the construction of 800 km of electric lines next month,Daily News Egypt reports. The construction is part of efforts to expand as well as fortify the country’s power grid to transfer electricity more efficiently and avoid outages. Some of the lines are taking longer to complete than others due to security controls being put in place by the army.

Real Estate + Housing

Trading halted on Reacap pending Wadi Degla shareholder approval of merger

The bourse halted trading on Reacap Financial Investments’ shares yesterday pending shareholder’s approval of the company’s merger with Wadi Degla Co., a market release said. News of the merger was out earlier this month and it should be completed by year-end if approvals go through.

Tourism

EgyptAir to increases flights

EgyptAir is increasing flights to several destinations with the addition of new planes to its fleet,according to Al Borsa. Additional daily flights to Amsterdam, New York, Manama, Casablanca, and Madrid should start by 29 October. New aircrafts have allowed maintenance and operating costs to drop, the newspaper notes.

Romania wants Cairo-Bucharest direct flights back

Senior Romanian embassy officials are calling for a return to direct flights between Cairo and Bucharest, if demand for them is high enough, according to Al Mal. If demand doesn’t warrant direct flights, then the line could be used as a connection to other European cities.

Banking + Finance

USD 47bn in transactions since the float

The banking sector has made USD 47 bn available for import-export activities since the EGP was floated in November, central bank Deputy Governor for Control and Risk Tarek Fayed tells Al Borsa. USD 34 bn of the total financed LCs, with the balance used for new applications.

Egypt Politics + Economics

Warraq residents refuse settlement

Inhabitants of the Warraq island in South Cairo refused on Monday a government-proposed settlement offering them new properties in social housing projects if they leave the contested land, Al Shorouk reports. The islanders defended their legal right to the land, claiming they have been paying their bills for years and that authorities are trying to unlawfully evict them from their homes. Warraq had been the sight of clashes that killed at least one person last month when security forces attempted to clear the area from what they claimed were illegal settlements and squatters.

Yields on five- and 10-year T-bonds continuing to fall

Average yields on Egypt’s five- and 10-year treasury bonds continued to fall at yesterday’s auction, Reuters reports. The average yield on the five-year bonds fell to 17.001% from 17.800% on July 31. The yield on the 10-year bonds fell to 17.130% from 17.798%.

On Your Way Out

Egypt has the world’s sixth-harshest blasphemy law, stricter than Saudi Arabia, according to a list by the US Commission on International Religious Freedom cited by The Economist (paywall). Iran and Pakistan have the strictest laws against blasphemy globally. “The countries were assessed on the basis of the harshness of their penalties, the vagueness or precision of the offence, and the degree to which the blasphemy laws underpinned discrimination against some religious groups.” The Economist adds that “Pakistan and Egypt were among the countries found to be using blasphemy laws as a form of anti-minority oppression.” Overall, 71 countries punish blasphemy in some form. A surprise entry on the list is Canada with the ninth mildest, although Canadian law explicitly upholds the right to robust religious debate, as long as it is conducted in “good faith and decent language.”

Approximately 35,884 Syrian refugee students in Egypt have finished national exams for basic and secondary education under the UNHCR’s joint capacity building program with the Education Ministry as of June 2017, according to a Relief Web report (pdf). Around one third of Syrian refugees of school age in Jordan, Lebanon, Turkey, Egypt and Iraq are not enrolled in schools, UN officials tell the Associated Press. This comes as a result of pledge shortfalls by donors who have only met 25% of the USD 8 bn target set by the UN for education in overburdened host countries.

An Egyptian “superhero” has cars run him over and would apparently like to pull a plane. Skeptical? Think again. The man looks like he needed some smelling salts at the end of this video (runtime 1:12). So legit.

The Market Yesterday

EGP / USD CBE market average: Buy 17.71 | Sell 17.81

EGP / USD at CIB: Buy 17.71 | Sell 17.81

EGP / USD at NBE: Buy 17.73 | Sell 17.83

EGX30 (MONDAY): 13,135 (-1.1%)

Turnover: EGP 620 mn (33% below the 90-day average)

EGX 30 year-to-date: +6.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.1%. CIB, the index’s heaviest constituent, closed down 1.3%. EGX30’s top performing constituents were: Sidi Kerir Petrochemicals up 0.7%; Telecom Egypt up 0.5%; and AMOC up 0.4%. Today’s worst performing stocks were: Heliopolis Housing down 3.1%; Amer Group down 3.0%; and Pioneers Holding down 2.8%. Market turnover was EGP 620 mn; regional investors were the sole net buyers.

Foreigners: Net Short | EGP -14.8mn

Regional: Net Long | EGP +17.6 mn

Domestic: Net Short | EGP -2.8 mn

Retail: 71.1% of total trades | 71.9% of buyers | 70.3% of sellers

Institutions: 28.9% of total trades | 28.1% of buyers | 29.7% of sellers

Foreign: 14.4% of total | 13.2% of buyers | 15.6% of sellers

Regional: 8.7% of total | 10.1% of buyers | 7.3% of sellers

Domestic: 76.9% of total | 76.7% of buyers | 77.1% of sellers

WTI: USD 47.57 (-0.04%)

Brent: USD 50.73 (-2.63%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu, (+0.4%, September 2017 contract)

Gold: USD 1,281.10 / troy ounce (-0.72%)

TASI: 7,125.47 (-0.32%) (YTD: -1.18%)

ADX: 4,480.58 (-0.45%) (YTD: -1.45%)

DFM: 3,585.91 (-0.77%) (YTD: +1.56%)

KSE Weighted Index: 424.77 (+0.53%) (YTD: +11.76%)

QE: 9,191.73 (-0.15%) (YTD: -11.93%)

MSM: 4,977.53 (+0.15%) (YTD: -13.92%)

BB: 1,319.1 (-0.28%) (YTD: +8.08%)

Calendar

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the Eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06 September (Wednesday): The Emirates NBD Egypt PMI report for August released.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-15 September (Wednesday-Friday) Financial Inclusion Conference in Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.