- PMI: Economy is stabilizing; new export orders up for fourth consecutive month. (Speed Round)

- Trade deficit down 50% in the first half of the year on falling imports, modest rise in exports. (Speed Round)

- Bus fares in Cairo went up as much as 50% over the weekend. (What We’re Tracking Today)

- IPO WATCH- El Garhy Steel, Misr Italia confirm plans for offerings. (Speed Round)

- Centamin will not invest in Egyptian exploration under current terms. (Speed Round)

- Welcome, officially, to state fiscal year 2017-18. (Speed Round)

- An Egyptian restaurant only Hannibal Lecter could love. (Image of the Day)

- The Markets Yesterday

Sunday, 6 August 2017

Egypt’s economy is stabilizing, the July PMI suggests

TL;DR

What We’re Tracking Today

Expect grumbling in the streets this morning after Cairo public bus fares rose 50%: The Transport Authority raised the price of public bus tickets by EGP 0.50 on Friday, according to Al Mal. The decision comes following cuts in fuel subsidies last month, but drivers are claiming that the move came without warning. Bus tickets will now cost EGP 1.50 for shorter distances (up from EGP 1.00) and EGP 2.50 for longer rides. The new fares went into effect on Friday. The story is making headlines in the international press thanks to a pickup from the Associated Press.

What better way to start a new week than to note that it’s officially 2017-18 for statecoffers — and soon, too, for schools. The state budget for this fiscal year came into effect yesterday after President Abdel Fattah El Sisi signed off on it (more in Speed Round, below). On the school front, the first students head back a week from Wednesday, though most institutions — public and private alike — won’t go back until after the upcoming Eid Al Adha holiday at month’s end.

The executive regulations of the Investment Act should be in final form by todayand will make their way back to the Cabinet economic group in time for its Wednesday meeting, Investment Minister Sahar had said last week. She had also said that the regs should be out early this month. The Ismail government’s investment map should go to the House Economics Committee this week, according to committee chair Amr Ghallab.

The Electricity Ministry will be signing an agreement today with the European Bank for Reconstruction and Development, according to an announcement by the Investment Ministry. No word on what the agreement covers.

The National Weather Office is warning about hot weather to start the week in the capitalcity, with highs of 36°C. (Does that really qualify as hot in August? It was hotter yesterday in Belgrade than Cairo on the back of this “Lucifer” heatwave). Both of our favourite weather apps agree it will be sub-40°C temps all week, but watch out for humidity today, particularly in the morning.

The New York Times Magazine has a moving (and gripping) profile of the oldsters whohave been guiding the Voyager probes across our universe for some 40 years now. The continued evolution of humanity’s understanding of space hinges on how long these folks are willing to continue working past retirement age — and some of them have been on duty since 1972.

Finally: Our favourite viral video in ages is a hoax, according to IB Times. The website quotes a Singapore Airlines spokesman as saying a 1,000 ft AirDrop of photos made between jetliners at 35,000 ft never happened. AppleInsider appears to have broken the story of the video, which has since been taken down from Youtube, but which is still available on the IB Times site.

What We’re Tracking This Week

Brace yourselves for price bumps in phone services: Vodafone Egypt will kick off today a series of meetings the National Telecommunications Regulatory Authority (NTRA) will be holding with mobile network operators this week to discuss fee hikes, reports Youm7. MNOs want the NTRA to allow them to raise prices for both phone and internet services, claiming their operational costs have gone up after recent fuel and energy price increases, and that costs will only climb as the 14% value-added tax is imposed on the telecoms sector.

On The Horizon

The House is expected to pass the long-awaited Bankruptcy Act at the start of its fall legislative term, House Legislative Committee MP Samy Ramadan tells Youm7. The committee is expected to begin its review of the bill — which would effectively decriminalize bankruptcy and could make it possible for companies to request time to re-structure under US “chapter 11” style bankruptcy protection — as soon as it reconvenes and is waiting for the Investment Act’s executive regulations to use as guidelines for their discussion.

Enterprise+: Last Night’s Talk Shows

With Lamees Al Hadidi off for the month and Amr Adib off for the week, we expect the airwaves will continue to serve us mixed platters of random topics.

The Transport Ministry’s decision to raise public bus fares in Cairo by EGP 0.50 was the topic of the night on Hona Al Asema, where host Dina Zahra is taking the reins until Lamees returns from summer hiatus. The decision is meant to help decrease the Public Transport Authority’s losses and will also allow it to improve the quality of its service, MP Mamdouh Al Husseini, who serves on the House’s Local Development Committee, said (watch, runtime 47:25).

Other topics last night ranged from the Administrative Prosecution Authority seeking charges against 18 pharmacists accused of negligence by improperly storing vaccines (watch, runtime 5:59) to an interview with Sohag Governor Ayman Abdel Moneim and the impact of the float on hajj season demand.

Speed Round

New export orders increased for the fourth consecutive month in July and new orders overall have stabilised, ending a 21-month straight decline, according the Markit / Emirates NBD Egypt PMI. Overall, with the PMI reading registering 48.6 in July, the downturn in the health of the economy eased in July and output declined at the slowest pace in 12 months, thereby leading to only a marginal fall in input buying. “Egypt’s economy appears to be stabilizing, with new orders unchanged in July following nearly 2 years of contraction. However, firms saw input costs rise sharply on the back of higher fuel costs as subsidies were cut further at the end of June. Inflationary pressure is likely to remain elevated as higher electricity tariffs came into effect this month,” commented Khatija Haque, Emirates NBD’s head of MENA research. The report also notes that “firms remained optimistic with regards to output growth over the next 12 months. Some companies mentioned hopes of stability in currency markets and economic conditions.”

The Trade and Industry Ministry announced on Thursday that the trade deficit for 1H2017 was nearly halved thanks to falling imports and a modest bump in exports. The ministry says the trade deficit dropped 46% y-o-y to USD 13 bn. This came as imports fell 30% to USD 24 bn compared to the same period last year, Exports, meanwhile, rose 8% to USD 11 bn, Reuters notes. Trade Minister Tarek Kabil says the improvement came after the government’s crackdown on lower-quality imports, replacing imported manufacturing inputs with local ones whenever feasible, and expanding exports. The largest increases in exports came in chemicals and fertilizers, construction materials, and ready-made garments, according to Ahram Gate. The news adds context to a Reuters piece we noted on Thursday that surveyed six importers who said the tonnage they have brought into the country was down 25% compared to last year.

Egypt stands out in this week’s On the Frontiers column in the Wall Street Journal, which features a mini-interview with Birch Reynardson, PM at London-based Somerset Capital. On Omm El Donia, which he says has been “a great contributor” to his portfolio: “They’re executing most of the target structural reforms that they instigated a year ago so they’ve managed to reduce the current account deficit and inflation looks like it’s peaking. So the fundamentals are improving, but it’s still a very vulnerable environment in terms of the lack of positive sentiment on the ground. Growth in the near term is more likely to be driven by industrial-led projects and funded through FDI rather than domestic consumption.”

IPO WATCH- El Garhy Steel Group plans to offer 25% of its shares on the EGX during 1Q2018, Chairman Gamal El Garhy said on Saturday, according to Al Masry Al Youm. The company hopes to raise around EGP 3.6 bn in capital needed for its USD 200 mn pelletizing plant and USD 250 smelting and rolling plants, according to El Garhy. The chairman confirmed that a local investment bank is managing the transaction, but declined to share further details.

IPO WATCH- Misr Italia is moving forward with previously communicated plans to list its shares on the EGX, the company said, according to Al Masry Al Youm, denying reports it plans to postpone the move. Misr Italia had said in April that it is looking to list 20-25% of its shares “sometime in May,” but no news about the listing has emerged since. Beltone Financial has been tapped to manage the IPO.

INVESTMENT WATCH- “Mohamed Alabbar is interested in making a large investment in Al Alamein,” Emaar Properties CEO Mohamed El Dahan told Investment Minister Sahar Nasr and Housing Minister Moustafa Madbouly in a meeting on Saturday. The three explored some of the possible projects available there for Emaar, including development on New Al Alamein. The move is part of a wider push by Alabbar into Egypt, which will include projects in the New Administrative Capital, Cairo, and South Sinai, El Dahan said at the meeting. The Emaar founder had expressed interest in investing in Egypt at a meeting with Nasr last week. Reuters also has the story.

INVESTMENT WATCH- Gold miner Centamin will not invest further in exploration in Egypt if the tender terms offered by the Egyptian Mineral Resources Authority are not changed, CEO Andrew Pardey told Reuters’ Eric Knecht. “If the new bid round they keep talking about comes out with the same terms as the previous one, we will not be participating in it … Under the right terms we would definitely be keen to do more exploration in Egypt given we are established in Egypt and know how it operate,” Pardey says. Knecht notes that it is not clear if the commercial terms for the Golden Triangle area will be similar to the previous tender or would incorporate “a more common royalty and tax arrangement favoured by miners.” Centamin reported lower 2Q2017 profits and output but expects a stronger 2H2017.

INVESTMENT WATCH- A Saudi investor is looking to set up an EGP 2 bn fish farm in Marsa Matrouh’s Al Nageela, a local government official . The project is part of a local development plan, Matrouh Governor Alaa Abou Zaid tells the newspaper. Among the investments he expects in the first phase of the program are a new port and real estate developments.

And speaking of Saudis and fish: Saudi Arabia has temporarily banned imports of certain fish products from Egypt, Al Masry Al Youm reports. Saudi Arabia says its ban is for fears of the tilapia lake virus, following a warning from the UN FAO. Industry professionals say the virus is only harmful to other fish species and that Saudi Arabia is protecting maritime life there, but is not harmful to humans. These statements were echoed by the Agriculture Ministry on Saturday, which also urged UN FAO to conduct further tests to verify their results, according to Al Mal.

MOVES- Cleopatra Hospital Group CEO Ahmed Ezz El Din has been appointed a co-chair of the American Chamber of Commerce in Egypt’s Health and Pharma Committee.

MOVES- Charles Hooper has a third star. The former chief of the Office of Military Cooperation at the US embassy in Cairo was confirmed by the US Senate as a lieutenant general and named director of the Defense Security Cooperation Agency, according to Defense News. DSCA is the Pentagon’s point office on foreign weapon sales. Hooper is expected to take up his new duties on Monday, a spokesman for the Pentagon confirmed.

We officially welcome you to fiscal year 2017-18: President Abdel Fattah El Sisi approved on Thursday the budget for the new fiscal year. Utility prices including water and electricity have already risen since the House of Representatives put its seal of approval on the document about a month ago, and we’ve also seen changes to the food and bread subsidy systems. The hike in water prices should save state coffers some EGP 1 bn, according to the spokesperson for the Water Holding Company. Your VAT counters are now officially set to a 14% baseline rate. You can check the full FY2017-18 budget as published on the Official Gazette here or you can catch a quick refresher on the highlights of the budget here.

Infrastructure development weighs heavily in the budget, with around 60% of all government investments directed towards improving basic infrastructure, Planning Minister Hala El Said said, according to Al Masry Al Youm. The plan includes improving the transportation network nationwide and have the transport sector grow by about 5.8% y-o-y to contribute 5% of GDP, El Said added.

The state budget is going digital: The government is making the switch to a digital budget and linking that electronically to state coffers as of today, Finance Minister Amr El Garhy told the press on Saturday, Ahram reports. The move marks the first step in the government’s plan to make a full switch to electronic transactions by early 2018, which is expected to help the state keep better track of its spending and reduce overall expenditures by as much as 10%.

Budget confirms timeline for 2018 presidential elections: What’s otherwise a throw-away story from Al Masry Al Youm explains that the budget will finance the government’s preparations for mid-2018 presidential elections.

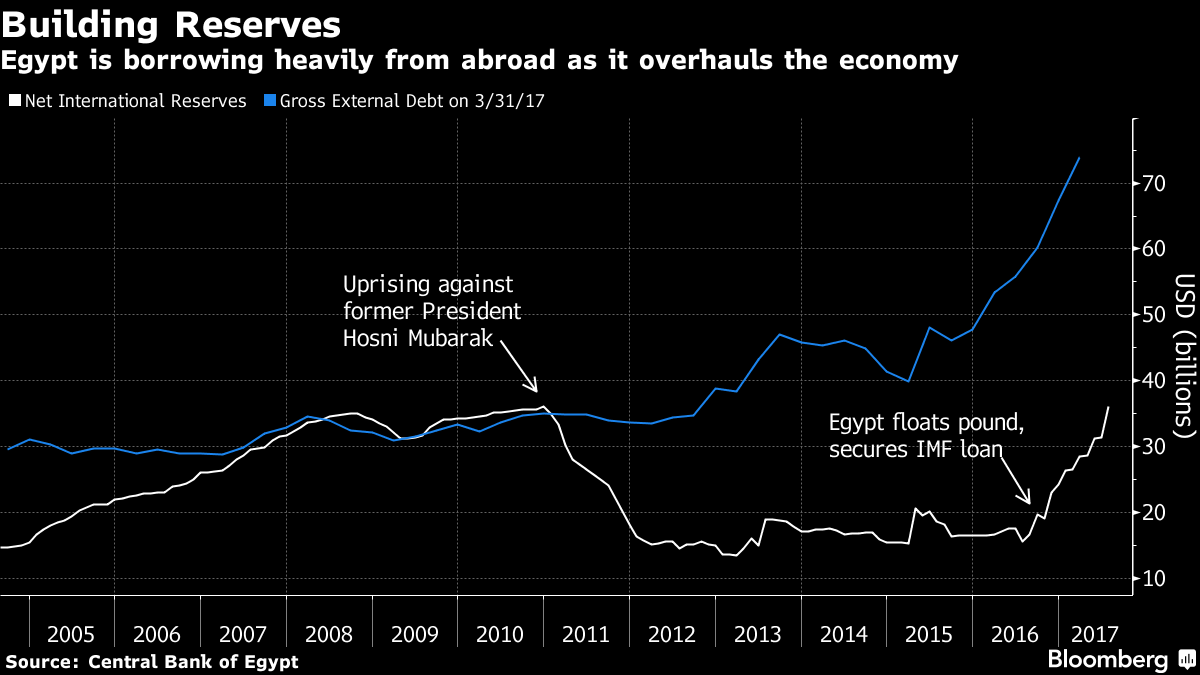

The increase in the central bank’s reserves has been driven by “heavy external borrowing as investors pour money into Egyptian assets,” Bloomberg’s Ahmed Feteha suggests. Praising the increase in the reserve build up, The National’s editorial board suggests that a number of challenges remain for the Egyptian economy. The Abu Dhabi-based publication believes that the EGP is “not yet fully convertible” and is not “freely traded against the [USD]” as other currencies. Egypt also faces other economic challenges, including increasingly high rates of poverty and unemployment. They suggest that Egypt needs to increase investments in education and healthcare to “produce more fit graduates” capable of leading the country.

Foreign direct investment in FY2016-17 is expected to ring at around USD 8.7 bn, climbing 26% y-o-y over the previous fiscal year, said Investment and International Cooperation Minister Sahar Nasr (pdf) on Friday. Total investments for FY2016-17 came in at EGP 502 bn, up 28% y-o-y. Nasr reiterated last week’s statements that FDI for FY2017-18 could exceed USD 10 bn.

World Bank, AfDB tranches coming before the end of the year: The World Bank’s board of governors has approved disbursing the third and final USD 1 bn tranche of the its USD 3 bn loan to Egypt, Nasr tells Al Masry Al Youm. The funds should be in by December, Nasr said, adding that Egypt will also be receiving the USD 500 mn tranche of the African Development Bank’s loan before the end of the year.

The foreign press is calling Neymar Jr’s record EUR 222 mn transfer to ParisSaint-Germain a PR coup for embattled Qatar. The transfer of a player of Neymar’s stature from Barcelona — at such a record price — to the Qatari royal family-owned French club signals that business is usual, the Associated Press writes.

Meanwhile, GCC and some Egyptian banks are ratcheting up the pressure on Qatar and are refusing to extend deposits in Qatari banks, Bloomberg reports. Lenders are also struggling to repatriate funds because their counterparts in Qatar aren’t swapping QAR into USD. Banks can either roll over their QAR deposits or convert them into USD in the global market, where they get less favourable exchange rates than Qatar’s pegged official rate.

General Khalifa Haftar, the Libyan military commander backed by Egypt, ordered his air and naval forces to confront any unauthorized vessels in Libyan waters, according to the Washington Post. This comes after the Italian government sent ships to help stem migrant movement to Europe at the request of a rival government faction led by Fayez Serraj, who later denied making the request. Haftar’s faction sees Italy’s presence as a violation of sovereignty and as a push to export the European migrant crisis into Libya. The UN-backed Serraj government met with Haftar’s faction in Paris last week to discuss cooperation.

A little further from home, US President Donald Trump has begun the process to formally withdraw the US from the Paris climate change accord, Bloomberg reports.

Speaking of The Donald: He’s on a 17-day vacation (longer than Barack Obama took in his first year, CNN notes). The US president’s break began as the UN passed sanctions on North Korea advanced by his administration. The measures will cost Pyongyang about USD 1 bn in foreign revenues annually, the Wall Street Journal reports.

The Macro Picture

African nations ordered EUR 550 mn worth of military equipment from France in 2016, according to a report to the French Parliament by the French Armed Forces. African nations received EUR 326 mn worth of equipment last year. North Africa ordered EUR 170.4 mn in military hardware, while Sub-Saharan Africa ordered EUR 379.9 mn in 2016, Defense Web reports. The report excludes EUR 1.3 bn worth of deliveries to Egypt including four Gowind corvettes, two Mistral class LHDs, a FREMM frigate and 24 Rafale fighters. Egypt is classified under the Middle East.

Image of the Day

Surgery-themed kebda restaurant tries and fails at marketing ploy: Reuters is profiling the latest gimmick in kebda restaurants: staff dressed as operating room surgeons. Founded by former doctors, the D. Kebda restaurant hopes to dispel fears of food poisoning generally associated with street kebda, but projecting an image of hospital-grade sanitary cleanliness. We found the opposite emanates from the creepiness of it all. We certainly haven’t been able to shake the image of a Hannibal Lecter backroom to an organ trafficking organization.

Egypt in the News

On a blessedly slow news day for Egypt this morning, we note that Israel is set to build a 3-km-long underground barrier along its border with Egypt and Gaza, Ynet reports. The barrier will take about a year and a half to complete at a cost of USD 940 mn. Meanwhile, Al Monitor is still discussing what President Abdel Fattah El Sisi’s appointment of judges and heads of judicial bodies means for judicial independence.

On Deadline

Media regulators caught in a quagmire of overlapping jurisdictions: Regulation of the Egyptian media is essentially a minefield of overlapping jurisdictions, writes Salah Eissa for Al Masry Al Youm. Eissa cites the dual penalties incurred by some TV shows of late (including Rehaam Saeed) by both the Supreme Media Council and the Press Syndicate. While the state did put in place legislation granting authorities to three media councils, other elements of the Media Act remain with the House of Representatives. Delays in passing them will only make the operating climate for the media much more difficult.

Diplomacy + Foreign Trade

We’re hearing nothing but empty platitudes of “brotherly love” after Foreign Minister Sameh Shoukry’s visit to Sudan over the weekend. Nothing new has emerged on developments in resolving the ban on Egyptian agriculture goods or the deportation of Sudanese nationals from the disputed areas of Halayeb and Shalatin. Shoukry requested Sudan’s support in coordinating policy on the Nile Basin Initiative talks, according to Daily News Egypt.

Trade Ministry exempts ammonium nitrates from export duties: The Trade and Industry Ministry exempted exports of ammonium nitrate whose nitrogen concentration exceeds 34.2% from export duties on Saturday, according to Al Shorouk.

We are importing 1,000 cows from Romania for Eid, Egyptian-Romanian Business Council member Yasser Al Ahwal tells Al Ahram. The agreement is one of several inked in Bucharest recently.

Energy

EGPC crude oil production reaches 57,000 bbl/d for the first time

The EGPC’s production of crude oil reached 57,000 bbl/d for the first time in its history, the company said in a geological report picked up by Al Masry Al Youm on Friday. The boost came on the back of production from new discoveries. The EGPC is expanding crude exploration efforts in a bid to bring that number up to 60,000 bbl/d.

Rosneft delivered 129k tonnes of LNG in 1H17

Rosneft delivered 129k tonnes of LNG to Egypt as part of its contract with EGAS for 1H2017 deliveries, the company said, according to TASS. Rosneft had said it would supply 10 consignments of LNG to Egypt with a total volume of 600k tonnes from May to October 2017.

Basic Materials + Commodities

Rumors resurface that Supply Ministry will amend bread subsidy system

Rumors that the Supply Ministry might amend the bread point system and cut the daily ration down to four loaves from five are once again swirling, according to sources speaking to Al Shorouk. This comes despite the Supply Ministry denying the news last month.

Manufacturing

NCIC taps India’s Nuberg for EUR 15 mn hydrogen peroxide project

El Nasr Co. for Intermediate Chemicals (NCIC) awarded India’s Nuberg a EUR 15 mn turnkey project to manufacture hydrogen peroxide in a Giza facility. The plant will produce at a capacity of 70 tonnes per day. Nuberg says the NCIC project would be its fourth specialty chemical turnkey project in Egypt, having worked on a caustic soda plant for Egyptian Petrochemical Company in Alexandria, a calcium chloride plant for TCI Sanmar Chemical in Port Said, and sulphuric acid plant for Agrochem in Alexandria.

Health + Education

Four private universities to establish branches at new administrative capital for total EGP 5 bn

Four private universities will be building branches at the new administrative capital for a collective investment cost of EGP 5 bn, sources from the Higher Education Ministry tell Al Borsa. The ministry has already agreed with the New Administrative Capital Company to allocate 450k feddans at the new capital to the Japanese and Canadian Universities, as well as Sinai University, they add. The Higher Education Ministry has reportedly received nine other offers from private universities that it intends to begin reviewing in September.

ACDIMA to finalize United Pharma IV acquisition in two weeks

ACDIMA is expected to close the SPA on its acquisition of United Pharma IV within two weeks, United Pharma IV Chairman Abdullah Mahfouz tells Al Borsa. The transaction value will exceed the EGP 320 mn mark that was previously reported earlier this week, Mahfouz said, but refused to disclose by how much.

Real Estate + Housing

Azmeel Real Estate Group developing EGP 600 mn real estate projects

Azmeel Real Estate Group is currently developing projects worth EGP 600 mn, according to board member Ahmed Ibrahim. The company is working on compounds and other varying developments in Sheikh Zayed and 6 October, Al Mal reports.

Capital group to start implementing first phase of new Smart Village

Capital Group for Real Estate will start work on the first phase of the new Smart Village in the Al Borouj project before the year is up, according to Al Masry Al Youm. Contracts for the development of the EGP 1.5 bn phase are currently being prepared for tendering, the company said, and execution should take about three years.

Tourism

Work on Sharm campaign set to start

The Tourism Promotion Authority (TPA) is planning to launch a new EGP 10 mn campaign “within days” to attract tourists from European and Arab countries to Sharm El Sheikh, TPA chief Hisham El Demery tells Al Shorouk. JWT will run the six-month-long campaign under its contracts with the TPA.

Saudi Arabia’s Red Sea project creates competition for Egypt

Saudi Arabia’s plan to develop Red Sea islands for tourism creates direct competition for Egypt, tourism industry representatives tell Al Shorouk. The competition would be less intense if Saudi Arabia strictly targeted ultra-rich visitors or if it focused on diving. Other operators are less worried about competition from the project, saying Saudi Arabia’s visa restrictions and regulations against serving alcohol would limit their growth opportunities.

Ministry of tourism pulls burkini measure

The Ministry of Tourism has reneged on a measure that obliges hotels to allow burkinis on their pools and beaches, Al Ahram reports. The circular that was canceled 24 hours after it was published with the intention of further study to go into the matter.

Telecoms + ICT

First locally produced smartphone to be in November

SICO is set to start producing the first Egyptian-made smartphone in November, reports Al Mal. The company, which partnered with China’s Megane on the venture, should be receiving the equipment it needs to start moving the assembly lines by mid-October and hopes to kick things off with an annual production capacity of 1.8 mn devices a year. The USD 15 mn production facility will operate six assembly lines and is expecting to export roughly 65% of output to Eastern Europe and the Middle East. 4G devices will set consumers back around EGP 2,000.

Automotive + Transportation

Transport Ministry looking to fund local components for electrical train ahead of inking USD 725 loan agreement with China

The Transport Ministry is on the lookout for someone to fund the USD 500 mn venture to manufacture local components for its electric rail line project which will link Salam City with Tenth of Ramadan and the new administrative capital, Minister Hisham Arafat said on Saturday, Al Borsa reports. The ministry will sign a USD 700 mn loan agreement carrying a 2% interest rate with the Export–Import Bank of China once it secures financing for the domestic components needed for the c. USD 1.2 bn rail line, according to Arafat. The Chinese funds will be used for the purchase of new locomotives and control systems, he said. The state will provide the remaining USD 500 mn to finance the project’s’ infrastructure and civil engineering works that are being implemented by a consortium of Egyptian construction firms, including Petrojet, Arab Contractors, and Orascom Construction, alongside Chinese partner AVIC. The project is expected to be completed within 24 months of breaking ground.

Egypt is part of COSCO’s expansion plans in the Mediterranean

Egypt is part of China’s COSCO Shipping’s plans to expand internationally and Hellenic Shipping News suggests that they are taking special interest in the Mediterranean. “New plans include Chinese investment in cruise, logistics and ship-repair zones” in the region. The report notes that COSCO, for example, picked Egypt 12 years ago, focusing on its location, for “the shipping lanes of all the major lines to and from Asia-Europe via the Mediterranean” when it bought a 20% stake in the Suez Canal Container Terminal at Port Said.

CPA files complaint with prosecutor General against Bavarian Auto Group

The Consumer Protection Agency (CPA) filed a case against Bavarian Auto Group with the Prosecutor General, CPA head Atef Yakoub said on Saturday, according to AMAY. The case concerns alleged failure by the company to comply with a CPA order to cover repair costs of two cars whose owners complained to the CPA. In an update by Al Mal, Bavarian Auto denied the allegations, maintaining it did not refuse to repair the cars in question and that the company must comply with BMW’s standards on a case by case basis.

Nissan and Hyundai top the market in sales in 1H2017

Nissan led auto sales in 1H2017 with a 26% market share and 40,000 units moving into the marketplace, reports Al Mal, citing data from the Automotive Information Council (AMIC). The number represents a rise from 14.4% last year, although total number of units sold dipped from 70k last year. Hyundai captured a 17.3% share of the market, and Toyota rounded off the top three with 8.5%.

Legislation + Policy

Investment Act will include clauses supporting national projects -Nasr

The Investment Act’s executive regulations will include specific incentives for national projects including the Suez Canal economic zone and the new administrative capital, Investment Minister Sahar Nasr told Al Mal. The executive regulations will also include maintain incentives for existing investors. Separately, Nasr said that three commercial disputes in the Suez Canal area will be resolved during the week.

Egypt Politics + Economics

Yields on Egypt’s short-term borrowing fall significantly

The average yields on Egypt’s six-month and one-year treasury bills dropped in their weekly auction on Thursday, reports Reuters. Average yield on the six-month bill fell to 19.574% from 21.175% and the yield on the one-year bill fell to 19.348% from 20.952%. The drop “illustrates improvement in liquidity, mainly boosted by the strong recovery in appetite from foreign investors and inflows in Egyptian treasuries … This will ease the cost of funding for the government,” CI Capital senior economist Hany Farahat says. Head of public debt at the Finance Ministry Sami Khallaf says that the total foreign holdings of Egyptian securities reached EGP 250.7 bn as of 1 August.

Labor Minister to sign seven agreements today for 10% hardship raise for private sector employees

Labor Minister Mohamed Saafan will sign seven agreements today that will see privately-run companies from the food, tourism and chemical industries sectors pay out the 10% hardship raise intended for private sector employees, according to Al Ahram. Saafan will also hold a press conference after the signing to outline the details of the raise, which was announced last month under a non-binding initiative between the government and the private sector that will see some employees receive an additional EGP 165-330 a month.

National Security

50 policemen sentenced for going on strike

Fifty policemen were sentenced to three years in prison for going on strike in protest of working conditions, according to Reuters. The policeman were also fined EGP 500 and 40 of them relieved of duty. Their protest was against an increase in work hours and a reduction in vacation time. Charges included striking, inciting violence and intimidating security forces. The Associated Press also has the story.

Attack in Luxor leaves two dead

An attack by two gunmen left a civilian and one police officer dead in Luxor on Thursday, the Interior Ministry announced. The two gunmen opened fire after being stopped by a patrol. One of the perpetrators was arrested, while the other fled.

On Your Way Out

Egypt is the third-largest contributor to UN peacekeeping forces deployed worldwide, the UN Department of Peacekeeping Operations said Saturday. Egypt has 729 officers and personnel task force in different countries, according to a Xinhua pickup of MENA news agency story.

Artwork and a wide range of pieces from the Arab world are set to be displayed at Edinburgh’s Fringe Festival, writes Tim Cornwell of The Scotsman. The coordinator of the Arab Arts Focus, Ahmed Al Attar, director of the D-CAF festival in Egypt, says this festival is the perfect opportunity to “challenge preconceptions” and shed a “completely different light on what life in the Arab world is and what Arabs are today.” Al Attar says “this is the kind of work that people don’t expect to see coming out of the Arab world.”

The markets yesterday

EGP / USD CBE market average: Buy 17.7685 | Sell 17.8679

EGP / USD at CIB: Buy 17.77 | Sell 17.87

EGP / USD at NBE: Buy 17.75 | Sell 17.85

EGX30 (Thursday): 13,413 (+ 0.1%)

Turnover: EGP 886 mn (4% below the 90-day average)

EGX 30 year-to-date: +8.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.1%. Index heavyweight CIB was down 0.7%. Top performing constituents included Sidi Kerir Petrochemicals (+5.1%), Heliopolis Housing (+4.7%), and Cairo Oils and Soap (+4.4%). Among the worst performers: Amer Group (-3.1%), Porto Group (-2.5%), and Palm Hills (-1.3%). Total turnover stood at EGP 886 mn, with regional investors the sole net buyers.

Foreigners: Net short | EGP -4.8 mn

Regional: Net long | EGP + 29.4 mn

Domestic: Net short | EGP – 24.6 mn

Retail: 58.9% of total trades | 54.2% of buyers | 63.6% of sellers

Institutions: 41.1% of total trades | 45.8% of buyers | 36.4% of sellers

Foreign: 24% of total | 23.7% of buyers | 24.2% of sellers

Regional: 6.2% of total | 7.9% of buyers | 4.5% of sellers

Domestic: 69.8% of total | 68.4% of buyers | 71.3% of sellers

WTI: USD 49.58 (+1.12%)

Brent: USD 52.42 (+0.79%)

Natural Gas (Nymex, futures prices) USD 2.77 MMBtu, (-0.93%, Sept 2017 contract)

Gold: USD 1,264.6 / troy ounce (-0.77%)

TASI: 7,085.56 (+0.07%) (YTD: -1.73%)

ADX: 4,596.03 (-0.27%) (YTD: +1.09%)

DFM: 3,675.12 (+0.39%) (YTD: +4.09%)

KSE Weighted Index: 412.7 (-0.1%) (YTD: +8.58%)

QE: 9,398.09 (+0.4%) (YTD: -9.95%)

MSM: 5,057.57 (-0.33%) (YTD: -12.54%)

BB: 1,322.58 (-0.27%) (YTD: +8.37%)

Calendar

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the Eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06 September (Wednesday): The Emirates NBD Egypt PMI report for August released.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.