- Supply Ministry ends subsidies on flour mills producing subsidized bread (Speed Round)

- Energy cuts demonstrate commitment to fiscal and economic reforms, says Fitch (Speed Round)

- Egyptian Propylene and Polypropylene Company to list in 1Q18 (Speed Round)

- Hisham Tawfiq acquires 45% of NBK Capital (Speed Round)

- Turkish glassware producer Paşabahçe acquires Egypt’s Pearl Glass for USD 50 mn (Speed Round)

- Egyptian Competition Authority rules beIN Sports agreements with CNE void (Speed Round)

- Eastern Company raises low-cost Cleopatra cigarettes prices by 4.2%-17.6% (Basic Materials + Commodities)

- Shell repays USD 2 bn Idku loan ahead of schedule (Energy)

- By the Numbers — The Exchange Rate Questions — The Impact of Sterilization, Reasons for Appreciation, and Outlook

Thursday, 13 July 2017

Gov’t ends flour subsidies

TL;DR

What We’re Tracking Today

IMF to decide on USD 1.25 bn disbursement today: The Executive Board of the International Monetary Fund will be meeting today to review progress on Egypt’s economic reforms ahead of voting to release the second USD 1.25 bn disbursement of the IMF’s USD 12 bn Extended Fund Facility. After some tough measures in the last few weeks — namely, the fuel and electricity subsidy cuts and the central bank’s 200 bps interest hikes — we anticipate the IMF will vote to approve the disbursement.

We have yet to hear any confirmation that the laptop ban on EgyptAir flights had indeed been lifted yesterday. While both EgyptAir and the Civil Aviation Ministry stated on Tuesday that the ban on electronics onboard cabins of flights destined to New York had been lifted as of yesterday, the US Department of Homeland Security said it would need to make further assessments before confirming. We’ll be keeping our ears to the ground. But in the meantime, If any of our readers happened to have traveled there yesterday or today, we would kindly appreciate sending us a heads up.

Speaking of the 200 bps interest rate hikes, UAE-based Arqaam Capital sees the hike as the last of the central bank’s tightening measures, and expects the CBE to cut interest rates in 3Q18, Al Mal reports. This is a tacit projection by Arqaam that the CBE should be able to meet its target of bringing inflation down to 13% by then.

Meanwhile, Banque Misr became the second of the big three state-owned banks to move interest rates yesterday. The bank raised interest rates on variable interest certificates 25-100 bps, while maintaining rates on high-yield deposit certificates, Youm7 reports. The National Bank of Egypt will hold its Alco (assets and liabilities committees meetings) today, according to Arab Finance.

Canada joins the global interest rate hike party: The Bank of Canada raised interest rates for the first time in nearly seven years, joining the US Federal Reserve in leading a monetary policy shift across major industrialised countries in response to better global economic growth, writes Roger Blitz for the Financial Times. Analysts say the move was done to curb inflation. The CAD hit a 12-month high against the USD as a result. Meanwhile, US markets interpreted US Fed Chairman Janet Yellen’s remarks yesterday that the US’s persistently subdued inflation could raise questions about the Federal Reserve’s current path of gradually raising interest rates as “dovish” and signalling that the next interest rate hike this year is some ways down the road.

Inflation-adjusted emerging market bond yields have risen to their highest level since at least 2004, despite an increasingly desperate “hunt for yield” on the part of global investors, the salmon-colored paper reported. The gap between real yields in emerging and developed markets also hit its highest level for at least 13 years. This is no thanks to Latin America, whose frequent corruption scandals have subdued returns on their debts, and have seen EM funds such as Pictet Asset Management, Neuberger Berman Group LLC and RBC Global Asset Management end 1H17 as the worst performers in their class, according to Bloomberg.

On The Horizon

We are so very eagerly awaiting the three day weekend to commemorate Revolution Day on Sunday 23 July, as climate change kicks our [redacted] here in Cairo. Please plan on something more interesting than Sahel.

Enterprise+: Last Night’s Talk Shows

The state’s decision to lift flour subsidies and Eastern Tobacco hiking cigarette prices, topped discussions on the airwaves last night.

Yahduth fi Misr’s Sherif Amer was on the Supply Ministry’s decision to halt flour subsidies to bakeries starting next month (we’ve got that covered in this morning’s Speed Round). Ministry spokesperson Mohamed Sewed explained to Amer that subsidized bread will continue to be sold for EGP 0.05 and that the decision means primarily to end the corruption plaguing the subsidized bread industry.

The use of smart cards will allow bakers to keep track of how many loaves of subsidized bread they sell so the General Authority for Supply Commodities can later reimburse them, Sewed told Amer.

Amer then moved on to the increases in cigarette prices by Eastern Company (look for more coverage in Basic Materials + Commodities). The new prices had nothing to do with the value-added tax (VAT) but are a welcome source of revenues, Finance Ministry VAT commissioner Abdel Moneim Mattar told Amer.

Dina Zahra (who filled for Lamees Al Hadidi) on Hona Al Asema kept her show about the perennial issue of Qatar. She spoke with political analyst Abdel Moneim Said about the meeting between Egyptian Foreign Minister Sameh Shoukry, his Saudi, Bahraini, Emirati, and Kuwaiti counterparts, and US Secretary of State Rex Tillerson to discuss updates on Qatar (watch, runtime 10:30). There were no updates.

On Kol Youm, Amr Adib was still sore from the night before about Qatar and the US signing an anti-terror agreement. The anger he feigned, though, severely impaired his ability to deliver his message last night, because it certainly wasn’t coming through. We think, but can’t be sure, that he might have been trying to tell the Arab quartet not to concede on any of their demands (watch, runtime 7:33). Slow your roll, Mr. Adib.

Meanwhile on Masaa DMC, Osama Kamal spoke to Egyptian Competition Authority boss Mona El Garf about the termination of Cable Network Egypt’s (CNE) contracts with Qatar’s beIN Sports (more on that in the Speed round). El Garf said that charges had been leveled against beIN in January for monopolistic practices and CNE must repay customers subscription fees collected after that. Any new subscriptions might force the authority to take legal action against CNE (watch, runtime 6:35).

Speed Round

Supply Ministry ends subsidies of flour: The Supply Ministry announcing yesterday it will stop subsidizing the flour it provides to bakeries that produce subsidized bread as of next month, and will limit its subsidy provisions to the actual bread produced, Al Masry Al Youm reports. The move is aimed at curbing wheat subsidies fraud that has cost state coffers mns each year, and will drive down wheat imports — which reached 6.2 mn tonnes this year— by around 10%, according to ministry spokesman Mohamed Sewed. The new system will “remove the incentive for smuggling flour, cutting down on waste and helping to save the state up to [EGP 8 bn] from its 2017-18 food subsidy bill,” Sewed said, according to Reuters.

The decision comes days after the ministry moved to raise the cost of bread production to EGP 180 per sack of flour, up from EGP 160 (each sack of flour yields 1,250 loaves). Under the new system, the ministry will use the electronic bread point system to disburse the subsidy based on the final tally of loaves sold at each bakery, taking into account the new price of production.

The ministry was quick to reassure citizens that the move would not affect the selling price of bread, which is currently sold at EGP 0.05 per loaf, according to Youm7. Citizens receive each loaf of bread at less than 10% of its production cost.

Clerics helping out with the reform agenda? Dar Al Ifta is also doing its part to help the state’s efforts to stop black market trading of subsidized goods, issuing a statement yesterday saying that doing so “constitutes harm to and aggression on those who deserve them and public funds,” Gulf News reports. The edict comes as the government is also working to overhaul the subsidy card system and purge it of moochers as part of economic reforms currently being implemented, the website notes.

Energy subsidies cuts demonstrate commitment to fiscal and economic reforms, says Fitch: Egypt’s new budget and lower electricity and fuel subsidies demonstrate a continued commitment to fiscal consolidation and economic reform, backed by the country’s IMF program, Fitch Ratings said on Wednesday. “Cutting energy subsidies at the beginning of the fiscal year gives us greater confidence in the authorities’ willingness to control expenditure and hence in the credibility of fiscal targets,” said the agency. Fitch upheld Egypt’s ‘B’ Stable sovereign rating from 22 June.

Fitch noted that headline inflation is set to rise back above 30% following the energy price hikes. The CBE is moving to curb it through last Thursday’s 200 bps interest rate hike.

The ratings agency forecasts that the budget deficit will reach 9.3% of GDP (and a primary deficit of 0.3%), higher than the 9.1% of GDP projected in the FY2017-18 budget. increasing social spending on food subsidies and pensions. Nevertheless, the wage bill is still only budgeted to increase by around 8% in the fiscal year, “which even with attrition from retirements would be significantly below the rate of inflation.” Fitch does expect that raising the value-added tax (VAT) to 14% should be a significant source of revenue.

The government’s budget GDP growth projection of 4.6% is broadly in line with Fitch’s forecast. “However, public finances are a key weakness in Egypt’s sovereign credit profile. We estimate that the general government debt-GDP ratio exceeded 100% at end-FY2016-17 following the flotation of the EGP.” The agency forecast a decline to 87.9% in FY2018-19, but this is highly dependent on securing a small primary surplus and increasing economic growth.

Egypt’s key risk factor? It’s politics, especially considering presidential elections in May 2018. Political sensitivity to the social impact of spending cuts and high inflation still presents implementation risk.

“Fitch’s note represents a major testament by international institutions to the progress of the economic reforms and a vote of confidence in them,” Finance Minister Amr El Garhy said on Wednesday. Deputy Finance Minister Ahmed Kouchouk noted the similarities between Fitch’s forecast and those outlined in the budget, according to a Finance Ministry statement.

A number of pharma companies plan on petitioning the Health Ministry to increase the prices of a group of meds starting August, especially after recent fuel prices hikes, sources at the Federation of Egyptian Industries’ (FEI) pharma divison tell Al Borsa. The ministry had promised in January to consider a second increase to med prices in August, the sources add, although Health Minister Ahmed Rady had said earlier this month that med prices will not be rising again this year.

“Me too,” say MNOs who want to raise prices as a result of subsidy cuts as well: The country’s private mobile network operators want the National Telecommunications Regulatory Authority (NTRA) to approve a 15% increase to their service prices to offset cost increases from the government’s decision to hike fuel and energy prices last week, sources tell Al Mal. The telecom sector’s prices remained unchanged in the last few years, despite challenging economic conditions, the sources said, explaining that MNOs have been making severe losses recently.

Good news contractors, the Contractors’ Compensation Act was signed into law: President Abdel Fattah El Sisi signed the Contractors’ Compensation Act into law yesterday, AMAY reports. The bill’s executive regulations should be ready within a month, will compensate contractors for losses incurred as a result of the EGP float and last year’s fuel price hikes. It also mandates the Housing Ministry to form a committee that would set the rules and regulations on how to calculate and issue the compensations. The Federation of Egyptian Contractors expects the ministry to set up the committee within a few days and begin issuing compensations in three weeks’ time, members tell Al Borsa, noting that the amount will vary from one contractor to the other. Some contractors reportedly want to ask the government to factor in recent hikes in fuel and energy prices when repricing their contracts, as we noted yesterday.

The CBE expanded its SME finance initiative to include agricultural, livestock, poultry and fishery ventures on Wednesday. According to an email statement, businesses in those fields making annual revenues of between EGP 250K and EGP 50 mn are to receive loans at 5% interest in accordance with the CBE initiative.

IPO Watch – MENA private equity firm Amwal Al Khaleej is looking to list shares of Egyptian Propylene and Polypropylene Company (EPPC) in 1Q18, regional head Karim Saada told Amwal Al Ghad on Tuesday. The planned IPO aims to finance EPPC’s expansions in its petrochemicals plant, where Amwal Al Khaleej is seeking to increase the production capacity of its petrochemicals plant to 600K tonnes annually from 290K tonnes between three and four years, he added. As we noted back in May, EPPC is hoping to invest USD 1 bn in these expansions. EFG Hermes was tapped as the lead manager for the listing, Saada confirmed. EPPC counts Mohamed Farid Khamis, the EGPC, DISA, Arab Investment Company, and Oriental Petrochemical Company as lead shareholders alongside Amwal Al Khaleej.

M&A WATCH- The former chairman of Arabeya Online for Securities Brokerage Hisham Tawfiq acquired a majority stake of 45% of brokerage firm NBK Capital from a consortium of investors that originally bought the firm in April from the National Bank of Kuwait, Al Mal says. The transaction should be final within a week or two at most, but Tawfiq — who will be the company’s CEO and Chairman — has already started procedures to change the company’s name and redistribute stakeholders’ shares, the newspaper says. A group of investors led by businessman Ramses Attiya had bought an 80% stake in the firm, while businessmen Mohamed Keshk and Ali Allouba each acquired a 10% stake, for a total EGP 27.5 mn. Attiya will hold on to a 35% stake in the firm.

M&A WATCH – Turkish glassware producer Paşabahçe acquired Egyptian glass manufacturer Pearl Glass Group in a transaction worth USD 50 mn, Trade and Industry Minister Tarek Kabil announced yesterday. Paşabahçe is also planning to invest USD 100 mn in Egypt. The company is currently upgrading the factory, which is expected to employ up to 1200 workers, ahead of launching production next year, Kabil said. The company plans on exporting its products to the United States, Latin America, Europe, Africa, and the Arab world.

Polish automotive plastics manufacturer Boryszew is looking to establish its first factory in Egypt soon, International Cooperation Minister Sahar Nasr said yesterday at a meeting with a Polish business delegation visiting Cairo. No details were offered as to the size and scope of the investment. The delegation told her that several other Polish companies are interested in expanding their investments in Egypt. Separately, the delegation also met with Suez Canal Economic Zone (SCZone) head Mohab Mamish to continue discussions on the Polish industrial zone that will be established in the SCZone, Al Shorouk reports.

Saudi Arabia’s tourism investments in Egypt are on the rise, with Tourism Minister Yehia Rashid reportedly stating that they are on track to rise 30% by 2020, writes Nada Al Rifai for Thomson Reuters’ Zawya. There are currently 17 Saudi-funded projects worth USD 270 mn underway — six projects in the Red Sea, two at the Gulf of Aqaba, five in Ras Sedr , three in Ain Sokhna, and one at the North Coast, Rashid said. He estimates that there are over 50 hotels and restaurants and malls are jointly owned by Saudi and Egyptian businessmen.

The Ismail government approved yesterday a project to establish a new city in Mansoura spanning 5,100 feddans, according to a Cabinet statement. The new city, which will be equipped with a technology and industrial zone, is expected to accommodate 500,000 citizens. The Housing Ministry will offer the units in the new city to Dakahliya residents once President Abdel Fattah El Sisi signs off on the project.

The Egyptian Competition Authority (ECA) declared the agreements between Cable Network Egypt (CNE) and Qatar’s beIN Sports void on Wednesday, according to AMAY. The contracts leave wiggle room for anti-competitive practices, ECA boss Mona El Garf said. The contracts are to be immediately terminated without a court ruling, she added, explaining that the ECA had taken legal action against beIN Sports last January for forcing subscribers to switch to a different satellite frequency. Terminating the agreement with beIN Sports would force CNE to refund customers’ subscription fees. CNE reportedly told the ECA that it was still reviewing the contracts to decide if it would go for termination or nonrenewal, a source tells Al Mal.

Egypt and Hamas have agreed to increase Egypt’s fuel supplies to Gaza and “commercial exchanges” to alleviate the blockade on Gaza, Hamas’ chief of financial affairs Yousif Al-Kayyali said, according to Maan News Agency. The measures include new policies being implemented at the Rafah border crossing with regards to the passage of both people and goods. Al-Kayyali also said that delegations from the group will be visiting Egypt over the coming period to follow up on the agreements. A Fatah leader had claimed that Egypt agreed to open the Rafah crossing only in the presence of Palestinian Authority (PA) forces, while Hamas maintains Egypt said it would open the crossing normally come September. Egypt and Hamas have been warming up to each other as of late, with Egypt sending fuel shipments to Gaza and agreeing to supply Hamas with security equipment. However, Cairo is also trying to maintain a balance in its relations with Hamas and its rival, the PA, which is headed by Palestinian President Mahmoud Abbas.

Image of the Day

This artefact was among those found the complex of ancient building recently unearthed by Greek archaeologist Kalliopi Papakostas in the Shallalat Gardens area in Alexandria, where excavations began 21 years ago. “The new discovery is a carved tunnel at a depth of 10 meters,” Philip Chrysopoulos writes for GreekReporter.com. The site reportedly was part of the Royal Quarter of the Ptolemaic Kingdom. This is just the latest in a spate of new archeological discoveries this year. Keep em coming folks.

Egypt in the News

No topic in particular kept the international press busy on Egypt this morning. Here are some of the stuff that caught our eye:

Egypt’s economic reform “will matter long after any future political transition:” Whether or not people support President Abdel Fattah El Sisi, there’s no doubt that he “has expended great political capital to undertake reforms, which, frankly, are more than a half-century overdue,” Michael Rubin writes in Commentary Magazine. Diplomats and politicians in Washington can debate all they want the questions of security and human rights surrounding Sisi and the state of Egypt, but it’s his success or failure at navigating the country through this period of economic reform that “will matter long after any future political transition in Egypt.” The journey to reform is perilous, Rubin says, and focus should be primarily devoted to a “more holistic Egypt policy as Sisi works to transform the economy,” which simply can’t handle another “full-blown” crisis or populist movement.

“It may have been a long time coming, but it looks like Egypt might make it through the bad times,” Simon Constable writes in a piece for Middle East Eye. Despite the setbacks of the years following the Arab Spring, such as soaring unemployment and high inflation levels, the Egyptian economy has much to look forward to in the months and years to come, as the effects of reforms begin to show. The basket of promising eggs includes better growth forecasts for the country’s GDP, credit rating upgrades on the horizon, and higher capital and foreign currency inflows thanks to renewed investor appetite.

Despite being an ode to Cairo, internationally acclaimed film In The Last Days of the City has been banned from screening in Egypt as part of a “crackdown,” The Guardian’s Ruth Michaelson notes. The film, which Michaelson describes as a “cinematic love letter” to Cairo set within the context of the January 2011 uprising, was not granted the necessary permits to be promoted or screened. “Journalists or filmmakers wishing to shoot in the city centre are now forced into a Kafka-esque battle for permits from several different authorities,” Michaelson says.

Other stories on Egypt in the international press worth a skim:

- Officials at Ireland’s Department for Foreign Affairs are advising against taking Egypt to the International Court of Justice over Ibrahim Halawa’s case, and recommended the continued reliance on diplomatic channels, according to Irish Legal News.

- Turkey’s Sultan’s mouthpiece is claiming that former Al Jazeera cameraman Mohamed Fawzi — who is reportedly suing the Doha-based networkfor “endangering the lives of journalists working in Egypt” — has been working for Egypt’s intelligence services.

- MTV will begin airing drama series in Egypt and India centered around issues such as FGM and child marriage in 2018 with the aim of stimulating debate on these taboo topics, Reuters reports.

On Deadline

British Ambassador to Egypt John Casson’s latest remarks on Egypt’s airport security are both infuriating and odd, Youssef Alomi says bluntly in his Al Masry Al Youm column. Past that sentence, it’s nothing to see here folks, as he engages in tripe conspiracy theories.

Worth Watching

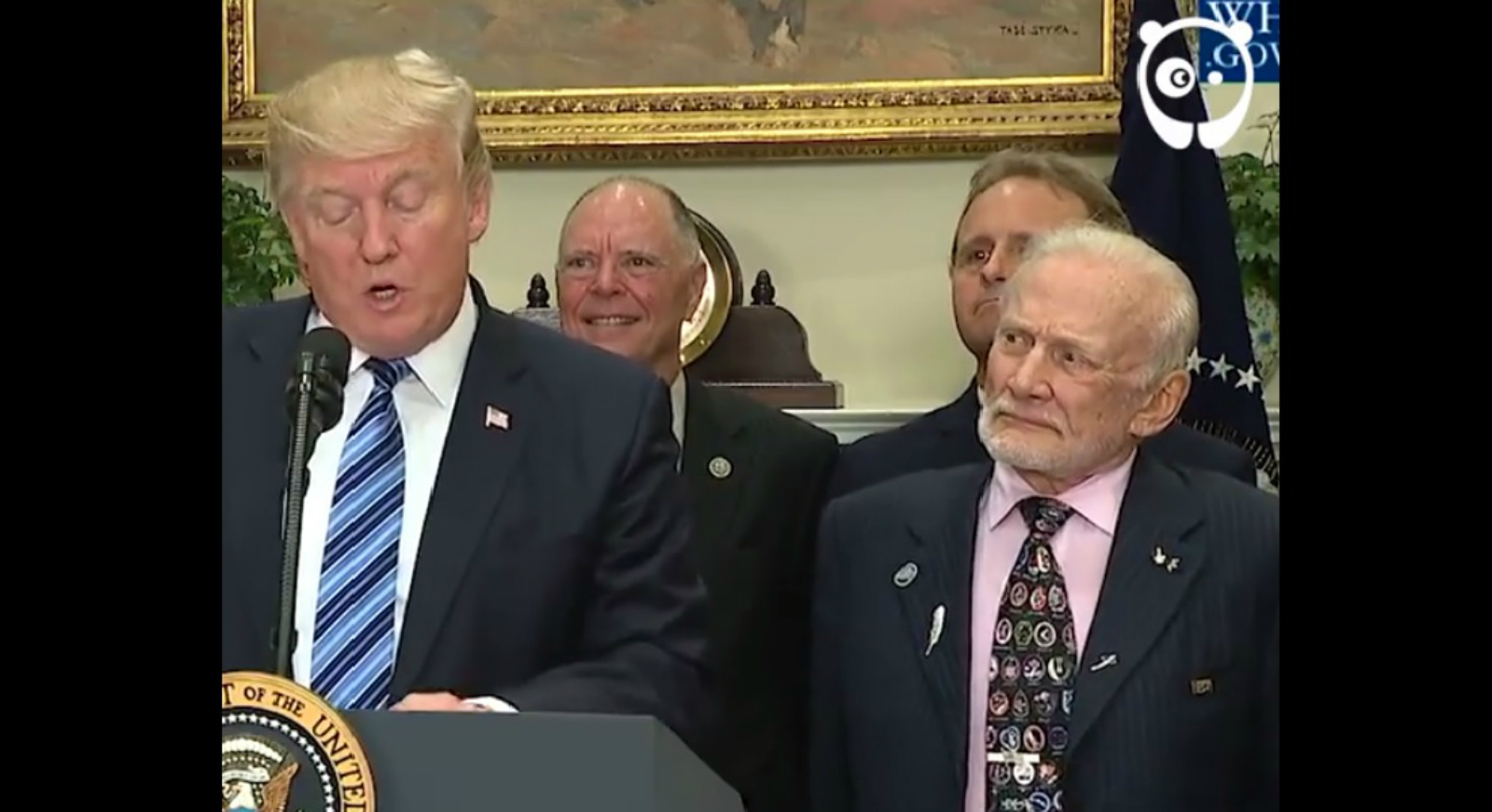

Buzz Aldrin’s facial expressions say everything we can’t about The Donald: Apollo 11 astronaut and space legend Buzz Aldrin stole the spotlight from US President Donald Trump’s speech about space with his facial expressions that basically sum up how people other than bucktoothed mouth-breathers feel about The Donald’s speeches (watch, runtime: 1:35). Aldrin flashes a range of emotions throughout Trump’s speech, including confusion, disdain, and downright despair, cueing a flood of jokes on Twitter about the astronaut wishing he could go back to space.

Diplomacy + Foreign Trade

New youth unemployment program in the works? Investment and International Cooperation Minister Sahar Nasr discussed Egypt’s new youth employment program with representatives from the International Labor Organization, the World Bank, the African Development Bank, USAID, the Japanese International Cooperation Agency, according to a ministry statement (pdf). The program aims to provide 1 mn young citizens with employment opportunities over the next three years. The opportunities will be divided among the major economic sectors, entrepreneurship, and sustainable businesses in low-income areas.

President Abdel Fattah El Sisi spoke on the phone yesterday with his Cypriot counterpart Nicos Anastasiades, according to an Ittihadiya statement. The two presidents discussed “cooperating with Greece,” which to us could only mean natural gas in the east Mediterranean.

Energy

Shell repays Idku loan ahead of schedule

Royal Dutch Shell repaid the final installment in the second tranche of a USD 2 bn loan issued to BG to build the Idku liquefaction plant ahead of schedule, a statement from the Petroleum Ministry picked up by Al Mal says. The company had said in January that it would complete the payments by December 2017. The Egyptian General Petroleum Corporation had agreed to pay USD 480 mn of the first installment due to the Idku plant halting operations in 2012.

Chinese-operated natural gas station to come online in September

The China Petroleum Technology & Development Corporation, a subsidiary of the China National Petroleum Corporation, will begin pumping natural gas in September from the Beni Suef regulator station, Xinhua reports, citing a company representative. It is the first natural gas station to be operated by a Chinese company in Egypt.

Infrastructure

Ships at Damietta Port piers now required to purchase power from port’s authority

Ships docked at the Damietta Port will now have to purchase electricity from the port authority at USD 0.50 per kWh, Al Mal reports. Ships will be allowed to use their generators only while loading and unloading cargo, the Damietta Port Authority decided in a bid to boost its USD revenues. The decision, which was originally made in February 2016 and delayed, was met with severe resistance from shipping companies, an unnamed source from the Damietta Chamber of Shipping tells the newspaper. This comes as we wait for new unified fees for ports next month.

Basic Materials + Commodities

Eastern Company raises low-cost Cleopatra cigarettes prices by 4.2%-17.6%

The Eastern Tobacco Company hiked prices for three of its Cleopatra products by 4.2-17.6% due to increasing production costs, Chairman Mohamed Othman Haroun tells Reuters. The company justified the increases with the 100 bps rise in the value-added tax (VAT) that came into effect with the start of the new fiscal year, in a filing to the bourse picked up by AMAY. The Finance Ministry’s VAT commissioner was quick to quash these claims, explaining that VAT for cigarettes is calculated under a separate system. Vice Minister of Finance Amr El Monayer had previously said that the prices of cigarettes would not rise after the VAT rises. Ahram Gate, however, is reporting that the Finance Ministry did tell the company it wants revenues from the company to increase 50%. The Tax Authority said in a statement, however, that the decision to raise prices came from the company and not under the direction of any state authority. Japan Tobacco International and British American Tobacco will not be hiking prices, company representatives tell Al Borsa.

Supply Ministry to set regulations to keep rice prices from soaring too high in upcoming season

The Supply Ministry will be setting strict regulations to keep the price of rice from soaring too high during the upcoming marketing season, sources with knowledge of the matter tell Al Shorouk. The remarks come in response to a statement on Tuesday saying that rice prices will be liberalized and left up to market forces next season. The Supply Ministry will be calculating the costs of production and agreeing on a fair profit margin range for businesses. The ministry will also be setting an adequate price to purchase rice from farmers that factors in all the costs entailed. Minister Ali El Moselhy had said that Egypt plans to double its rice production this year to 6.5 mn tonnes.

Egypt poultry imports from Brazil up by 40% y-o-y in 1H2017

Egypt’s poultry imports from Brazil rose 40% year-on-year in 1H2017 to 76k tons, according to data from the Brazilian Association of Animal Protein that ran in the Brazilian-Arab News Agency. The increase in imports is partly driven by the “favorable costs of the Brazilian product.” Egypt is the only Arab country to see an increase in Brazilian exports.

Health + Education

Health Ministry advises citizens against buying infant formula from private pharmacies

Citizens should stop purchasing infant formula from private-sector pharmacies, since the government has large quantities of subsidized formula on offer through its retail outlets, Health Ministry spokesperson Khaled Megahed said on Wednesday, according to Al Borsa. Pharmacists were naturally outraged by the remarks, accusing the government of trying to ruin business for them and squeeze them out of the infant formula market. After a severe shortage in the product last year, the Armed Forces had stepped in to begin importing formula that they would sell through pharmacies at reduced prices of EGP 30 instead of EGP 60 per pack.

Manufacturing

Samsung manufactures QLED TV in Beni Suef

Samsung Egypt began to locally manufacture its latest TV model, the QLED, at its USD 270 mn Beni Suef plant, Vice Chairman Sherif Barakat tells Daily News Egypt. The plant will export about 2.8 mn screens to over 36 countries in the MENA region.

Real Estate + Housing

NBE to provide social mid-income housing project Dar Misr with EGP 2 bn

The National Bank of Egypt (NBE) has agreed to provide EGP 2 bn in funding for clients looking to finance residential units in the social mid-income housing project Dar Misr before the end of 2017, Retail Credit Risk division head Karim Sous tells Al Mal. The amount is expected to finance around 5,000 units in Dar Misr developments across the country. Housing and Development Bank Chairman Fathy El Sebai had previously told the newspaper that he expects banks that signed onto the Dar Misr initiative to provide the project with a collective EGP 100 bn in financing during its four years of development.

Tourism

Dutch investors interested in establishing tourism project west of Suez Canal

Dutch investors are in talks with Egyptian officials, in coordination with the Egyptian-Dutch Advisory Council for Water Management, to establish a tourism project to the west of the Suez Canal, Al Mal reports. No information was given on the size of the investment or who these “mysterious” investors were.

!_StoryHed_ UAE’s Etihad Airways to increase number of flights to Cairo this year

Abu Dhabi’s Etihad Airways plans to increase its number of flights to Cairo by October to 35 a week from a current 28 to keep up with the spike in demand, The National says.The carrier will also increasing flights to Nigeria.

Automotive + Transportation

Transport Authority to buy buses from MAN-Kastour for EGP 35 mn, launches new WiFi-equipped buses in Cairo

The Public Transport Authority signed a EGP 35 mn agreement with MAN-Kastour for 13 double-decker buses, authority chief Rizk Ali says, according to Al Borsa. The buses will be operational at the start of 2018 and serve as a replacement to the Heliopolis tram that was retired in 2014. Another tender will be issued soon for new buses in other areas in Cairo. In the meantime, the Public Transport Authority has also launched a new line of buses, equipped with WiFi, air conditioning, and an e-ticketing system, Ahram Online reports. A ride on one of these 26-seaters, which were provided in collaboration with private transport company Mowasalat Misr, will set you back EGP 5, according to AMAY — a far cry from the EGP 1 and EGP 2 charged on regular public buses. 10 vehicles were put into service last week, with 30 more set to hit the streets by 1 August, according to Ali. The Transport Authority plans to “impose a strict system of regular maintenance ”to ensure that service quality remains at its highest.

EgyptAir Holding profits expected to record EGP 2 bn in FY 2017-18

EgyptAir Holding is expecting to record EGP 2 bn in profits in FY 2017-18, Chairman and CEO Safwat Musallam told the press on Wednesday, according to Al Mal. The company has a busy pipeline of new investments and upgrades, which include maintenance for hangars and training rooms. EgyptAir will also be operating direct flights to Shanghai and Tokyo starting October, according to Musallam. Civil Aviation Minister Sherif Fathy also said that EgyptAir will be supplementing its fleet with 40 new planes, but provided no additional details.

On Your Way Out

Egyptian startup Green Pan is planning to expand its operations into Alexandria, according to Thomson Reuters’ MySalaam.com. Green Pan, which collects cooking oil from households and converts it to biodiesel, launched last year under the umbrella of renewable energy and waste management firm Tagaddod. “With a five-litre minimum order, along with an incentive scheme offering one litre of soap for every five litres donated … the collection process became easier and more efficient,” co-founder Ahmed Raafat says. Supported by our good friends at Flat6Labs, Tagaddod now mass produces and exports biodiesel.

The markets yesterday

EGP / USD CBE market average: Buy 17.8493 | Sell 17.9478

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.82 | Sell 17.92

EGX30 (Wednesday): 13,690 (0.0%)

Turnover: EGP 917 mn (33% below the 90-day average)

EGX 30 year-to-date: +10.9%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session almost flat. CIB, the index heaviest constituent ended up 0.2%. EGX30’s top performing constituents were: Amer Group up 6.1%, Porto Group up 5.7%, and Credit Agricole up 2.8%. Yesterday’s worst performing stocks were: Domty down 3.1%, Juhayna down 2.9%, and Oriental Weavers down 1.8%. The market turnover was EGP 917 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +9.1 mn

Regional: Net Long | EGP +39.8 mn

Domestic: Net Short | EGP -48.9 mn

Retail: 69.2% of total trades | 68.7% of buyers | 69.7% of sellers

Institutions: 30.8% of total trades | 31.3% of buyers | 30.3% of sellers

Foreign: 14.5% of total | 15.0% of buyers | 14.1% of sellers

Regional: 11.2% of total | 13.4% of buyers | 9.0% of sellers

Domestic: 74.3% of total | 71.6% of buyers | 76.9% of sellers

***

PHAROS VIEW

The Exchange Rate Questions — The Impact of Sterilization, Reasons for Appreciation, and Outlook: In its latest report, Pharos Holdings studies the classification of the EGP exchange rate regime as flexible by looking at the monthly fluctuations of the exchange rate and the volatility of FX reserves. Pharos notes that the exchange rate shifted from a flexible regime in FY2002-03, then reverted to a de facto managed exchange rate, before turning into a flexible exchange rate in FY2016-17. The report looks at questions on the limit of the EGP depreciation, its recent appreciate, and the CBE’s sterilization of hot monetary inflows, and concludes that Egypt has indeed shifted to a flexible regime since the CBE free floated the EGP on 3 November, 2016. Tap here for the full report (pdf).

***

WTI: USD 45.29 (-0.44%)

Brent: USD 47.56 (-0.38%)

Natural Gas (Nymex, futures prices) USD 3.00 MMBtu, (+0.64%, August 2017 contract)

Gold: USD 1,218.10 / troy ounce (-0.08%)

TASI: 7,306.58 (+0.84%) (YTD: +1.33%)

ADX: 4,409.53 (+0.02%) (YTD: -3.01%)

DFM: 3,494.44 (+1.59%) (YTD: -1.03%)

KSE Weighted Index: 404.96 (+0.01%) (YTD: +6.54%)

QE: 9,280.38 (+2.77%) (YTD: -11.08%)

MSM: 5,170.23 (-0.02%) (YTD: -10.59%)

BB: 1,317.14 (+0.41%) (YTD: +7.92%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.