- It’s official: Markets close for three days starting on Sunday for Eid El-Fitr. (What We’re Tracking Today)

- The Electricity Ministry will be announcing new electricity prices after the Eid Al Fitr break. (What We’re Tracking Today)

- House signs off on income tax cuts, boosts minimum pension payment. (Speed Round)

- Controlling inflation is now Egypt’s top priority –El Garhy. (Speed Round)

- Agriculture companies holding back on capex amid high interest rates. (Speed Round)

- ENR to get EUR 290 mn facility from EBRD to finance fleet upgrade. (Speed Round)

- Trade Ministry downplays supposed Saudi strawberry ban as “procedural” matter. (Speed Round)

- A government blueprint to begin transforming Egypt into a regional energy hub will be completed in November. (Speed Round)

- By the Numbers — Pharos FCI – A Temporary Decline in May as the Policy Rate Hike Feeds into the System

Tuesday, 20 June 2017

Income tax cuts pass the House.

Plus: Eid El Fitr starts on Sunday, electricity price hikes to be announced right after the break

TL;DR

What We’re Tracking Today

IT’S OFFICIAL: Eid Al-Fitr in Egypt will be a three-day break from Sunday, 25 June until Tuesday, 27 June, Prime Minister Sherif Ismail announced yesterday, according to AMAY. All public institutions will be closed on those days. The Central Bank of Egypt subsequently announced (pdf) banks will also be closed Sunday-Tuesday.

The Electricity Ministry will be announcing new electricity prices after the Eid Al Fitr break, minister Mohamed Shaker said yesterday, explaining that only those customers in the highest consumption tier will be paying more than it actually costs to generate electricity, according to Youm7. Those consuming over 1,000 KW a month will be paying a price higher than the actual cost of production at EGP 0.97 per KW. Profit generated on the highest-volume consumers will be used to defray in part the subsidy earmarked for users in the lowest-consumption tier, Shaker added.

Budget talks postponed to today: The House of Representatives’ general assembly will kick off its debate of the Ismail government’s FY2017-18 budget today. The discussion was originally due to get underway yesterday, but was postponed to allow MPs time to wrap up other agenda items including amendments to the income tax code and raises for state bureaucrats, Al Borsa reports. We have more on what they got up to yesterday in the Speed Round.

Keep your ears to the ground: Last night was the deadline imposed by Investment Minister Sahar Nasr for a government committee to finish drafting the first cut of the executive regulations that will govern the new Investment Act.

PSA- Enterprise will be taking the full week off next week, as we suspect many of you kind people will. We’ll be back to our normal publication schedule on Sunday, 2 July.

So, when do we eat? Maghrib prayers are at 6:59pm CLT in Cairo, and the cutoff time for sohour is 3:08am.

What We’re Tracking This Week

President Abdel Fattah El Sisi will attend the Nile Basin Initiative’s presidential summit in Uganda on Thursday, 22 June, where discussions on Egypt rejoining can be expected. Foreign Minister Sameh Shoukry is there ahead of the ministerial preparatory meeting on Wednesday.

Enterprise+: Last Night’s Talk Shows

Rising electricity prices and bumps in pension payouts were in the limelight on CBC Extra with Lamees Al Hadidi last night.

Lamees first spoke to Social Solidarity Minister Ghada Wali, who explained that the increase in the minimum monthly pension payment to EGP 150 from EGP 130 came at the request of the House majority bloc, the pro-government Support Egypt Coalition (watch, runtime 5:49).

Lamees then suggested that rising electricity prices should come as no surprise, as the Electricity Ministry is the only government body to have adopted and communicated a clear and progressive pricing scheme since 2014. The host said consumers should also brace themselves for a hike in fuel prices, which will come “sooner or later” (watch, runtime 1:56).

Over on Kol Youm, Lamees’ lesser half focused on the attack on the Finsbury Park mosque in London, which left one person dead. Adib is once again badgering the UK for being “soft” on terror groups and expects members of the Ikhwan in London to pop up soon and position themselves as a moderate Islamic group (watch, runtime: 4:42).

Speed Round

Controlling inflation is now Egypt’s top priority, Finance Minister Amr El Garhy told Bloomberg TV (runtime 03:25). The priority is to bring inflation down into the ‘teens, El Garhy said. Concerns about “reform fatigue” will have no impact on the government’s economic growth target, he says, explaining that “next year’s 4.6% [GDP growth target] is manageable… we’re coming from a period of time where economic activity was very slow … now the economy is kicking back.”

El Garhy also notes that tightening of monetary policy would not have a large impact on growth prospects because it “should be there temporarily” and would come down to a more manageable level. This will not be something we will live with for long, he stressed, saying people looking for long-term investments should not worry about the high interest rates.

Until rates do come down, some business owners are feeling the pinch and are thinking twice about new investment, say players in the agriculture sector speaking with Al Bora. They say the most recent rate hike (which sent rates up 200 bps) drove up their production costs by as much as 4%. Hesham El Naggar, Vice Chairman at Daltex, says his projected 15% annual rate of return on investment isn’t high enough to justify new CAPEX. Given the interest rates, El Naggar says, businesses need to be returning “at least” 25% each year — rates unheard of in the sector. He says the expected cost increases from the pending hike in fuel prices will put the agriculture sector under even more pressure. Rival producer Belco expects investors in the sector to refrain from borrowing at the current rates for the time being. Belco Chairman Sherif El Beltagui says the added costs are eating away any export advantages the sector might have had following the EGP float. Their concerns mirror those of manufacturers, as we noted earlier this month.

Parliament approves income tax cuts: Manufacturers and others with lower cost labor can take heart, though: Interest rates may speak against CAPEX right now, but the cost of running their businesses just got a bit lighter with income tax cuts passed by the House of Representatives yesterday. MPs voted on Monday to increase the minimum income tax threshold to an annual EGP 7,200 from EGP 6,500 previously, Reuters reports. That means self-employed people or those working in trade or industry making EGP 7,200 a year or less (that’s below the minimum wage, for those of you keeping track at home) would not pay income tax, according to Youm7. Public and private sector employees making up to EGP 14,200 would be exempt (up from EGP 13,500). Other features of the law includes:

- Salary amounts between EGP 7,200 and EGP 30,000 per year, currently taxed at 10%, will receive an 80% break, bringing the effective tax rate on that bracket to 2%;

- Amounts between EGP 30,001-45,000 a year, currently taxed at 15%, get a 40% break, making the new rate for the bracket 9%;

- Sums in the EGP 45,001-200k bracket, currently taxed at 20%, will get a 5% break, for a new effective tax rate of 19%;

- Amounts above EGP 200k will still be taxed at the full 22.5% rate.

The tax cuts will not come into effect until they are signed-off by President Abdel Fattah El Sisi and published in the Official Gazette.

The House also passed a proposal to increase the minimum threshold for annual raises under the Civil Service Act by at least EGP 65 a month and at most EGP 130 a month, according to AMAY. The proposal also includes a 7% hardship raise for state bureaucrats covered by the act. For those not covered by the Civil Service Act, MPs approved a 10% hardship raise that will be paid retroactive to 1 July 2016,Al Shorouk says.

Pensions will also be rising by an annual 15% starting 1 July 2017,rising by a minimum of EGP 150 and a maximum of EGP 551, after representatives approved a government proposal yesterday, AMAY reports. This increase, which is primarily geared towards low-income pensioners, will cost the state around EGP 21.3 bn and benefit around 9.4 mn families, according to Social Solidarity Minister Ghada Wali. Finance Minister Amr El Garhy had okayed an increase in the minimum rate for pensions to EGP 150 from EGP 130 during discussion earlier in the day.

It’s a good week for the Egyptian National Railway, which is getting EUR 290 mn from the EBRD to finance its fleet upgrade. In the latest sign the Ismail government is taking rail transport seriously, ENR is getting EUR 290 mn in financing from the European Bank for Reconstruction and Development to help finance the purchase of 100 locomotives from General Electric. Investment and International Cooperation Minister Sahar Nasr signed the agreement for the facility with the EBRD on Monday and this follows the USD 575 mn supply-and-maintenance contract with General Electric signed on Saturday. The bank will also provide ENR with the technical assistance and support necessary to “implement a comprehensive freight reform program” and launch a safety-focused awareness campaign to promote safe rail travel for women, according to an EBRD press release. “This is a key step in supporting the development and reform of the transport sector in line with the EBRD’s Green Economy Transition approach,” EBRD Managing Director for the Southern and Eastern Mediterranean Janet Heckman said.

Egypt is also in talks for debt-for development swap agreements with the French and US governments, Nasr said at the signing ceremony on Monday, according to Al Borsa. Debt-for development swap agreements usually see a foreign entity or government purchase debts from the original creditor at a substantial discount then reselling it to the debtor country in the local currency equivalent; the proceeds are then used to finance development projects.

Meanwhile, We should also be expecting the African Development Bank (AfDB) to sign off on the third and final USD 500 mn tranche of its USD 1.5 bn loan this year, the bank’s Egypt representative Leila Mokadem said on Monday, according to an Investment and International Cooperation Ministry statement. An AfDB delegation had met with Minister Sahar Nasr, Electricity Minister Mohamed Shaker, and Trade and Industry Minister Tarek Kabil to discuss the timeline for the tranche.

Trade Ministry downplays supposed Saudi strawberry ban as “procedural” matter: Saudi Arabia’s Agriculture Ministry has only imposed new regulatory procedures for imports of Egyptian strawberries and guavas and has not banned the imports altogether, the Trade and Industry Ministry said, according to Al Ahram. Under the new procedures, Egyptian exporters must present documentation proving their fruit shipments have been tested for pesticide levels, and only non-compliant shipments will be barred from entering the kingdom. The new procedures will come into effect on 14 September for guava imports and 14 November for strawberry imports. The Trade Ministry’s statement comes at odds with earlier reports that KSA had slapped a temporary ban on imports of Egyptian strawberries over concerns of high pesticide levels, effective from 11 July.

In any case, we’re not taking any chances with future fruit exports: The agriculture and trade ministries are planning to impose Global Good Agricultural Practices, an internationally recognized standard for farm production, on upcoming strawberry and pepper harvests, Al Mal reports. The grape harvest that is currently in export season was held to the same standard. The Agriculture Ministry had also said it is investigating labs responsible for testing exports and is blacklisting the unnamed company whose strawberries triggered the latest issue with Saudi.

Former Investment Minister Ashraf Salman says his new private equity outfit, Aur Capital, will invest as much as EGP 22 bn in the next five years, Daily News Egypt reports (that about USD 1.2 bn if you, like us, are still struggling with the FX conversion math). The consumer-focused GP will launch in December and will focus on opportunities in real estate, health, education and food, said Salman. It’s first major investment since Salman went public with the fund last November was in real estate developer ARCO. Next on the list for execution are investments in the non-banking financial sector in partnership with Egyptian Gulf Bank (EGBank) and healthcare. Notable investors at the GP level are CityStars’ Abdul Rahman Al Sharbatly and the EGBank.

A government blueprint to begin transforming Egypt into a regional energy hub will be completed in November, Al Borsa reports. The strategy, which is being put together by a group of consultants hired by the Oil Ministry, aims to boost Egypt’s role in trading and storing crude oil, petroleum products, and natural gas, in addition to providing bunkering services. The strategy will factor in Egypt’s competitive advantages including existing infrastructure in the Suez Canal, the SUMED pipeline, ports on the Red Sea and Mediterranean, as well as LNG liquefaction plants. And, we hope, the sticky matter of the Arish-Ashkelon pipeline, which if reversed would allow us to process natural gas from Israel…

France’s Engie will acquire a 40% stake in Dubai’s National Central Cooling Company (Tabreed) to help drive the company’s expansion in Egypt, Turkey, and India, Reuters reports. Engie will pay USD 762 mn for the stake in the UAE-based cooling and building infrastructure company. “Tabreed will become one of Engie’s main regional development platforms and the company is expected to lead rapid growth for Tabreed in new emerging markets such as India, Egypt and Turkey,” read a statement from Abu Dhabi state investor Mubadala Investment which sold the shares to Engie. Engie is currently operating a number of projects in Egypt, including the a 250 MW wind farm, in addition to E&P assets.

Egypt is ranked 88th globally and third from the bottom in MENA region on the Talent Competitiveness Index by INSEAD Business School, Google, and the Center for Economic Growth. The index ranks countries based on their ability to attract, grow, and retain talent. “While the UAE ranked first among the MENA countries and made to the top 25 globally, Egypt, Morocco and Algeria appeared at the bottom of the list,” Wamda’s Tala El Issa notes. The report notes that “Egypt is among the low performers in the pillars Enable, Attract and Grow. The country has a large pool of workers, some with adequate skills, but employment opportunities are still lacking… Its relative ranking position is significantly better in its income group … than within its regional group… The largest ‘gap’ of Egypt with respect to the top countries and to its best competitors is in the pillar Attract … The country does not compare well either in any other pillar at the global level, although the score gap for the pillars Grow and Global Knowledge skills is somewhat smaller when compared to the regional leaders.”

Egypt’s Aly El Shafei is among the top 10 nominees who will be competing for The African Innovation Foundation (AIF)’s 2017 Innovation Prize for Africa, which will be awarded in Ghana on 18 July. El Shafei presented the Smart Electro-Mechanical Actuator Journal Integrated Bearing (SEMAJIB), a patented innovation that is designed to be used to support energy generating turbines and can be used to improve efficiency and reduce costs of generating energy in Africa. SEMAJIB is “a smart bearing which is versatile and can change its characteristics as it operates. It consists of a magnetic bearing imbedded in an oil-filled journal bearing, thus forming the smart controllable bearing. The flooding of the bearing with oil is a game changer as the purpose of bearings has traditionally been to expel oil. There is a significant improvement in turbine performance using the SEMAJIB particularly in single line combined cycle plants, as well as conventional generator technology.” The winner of the award’s grand prize receives USD 100k.

A 17 year-old Muslim girl of Egyptian origin was assaulted and killed in the early hours of Sunday as she walked home after taraweeh prayers at a mosque near Washington, The Guardian reports. The dead child, Nabra Hassanen was of Egyptian origin. A potential hate crime is one of the possible motives under investigation, according to The Washington Post. Her mother, Sawsan Gazzar says “I think it had to do with the way she was dressed and the fact that she’s Muslim. Why would you kill a kid? What did my daughter do to deserve this?” Darwin Martinez Torres, 22, has been arrested and charged with murder in relation to the case, according to BuzzFeed News.

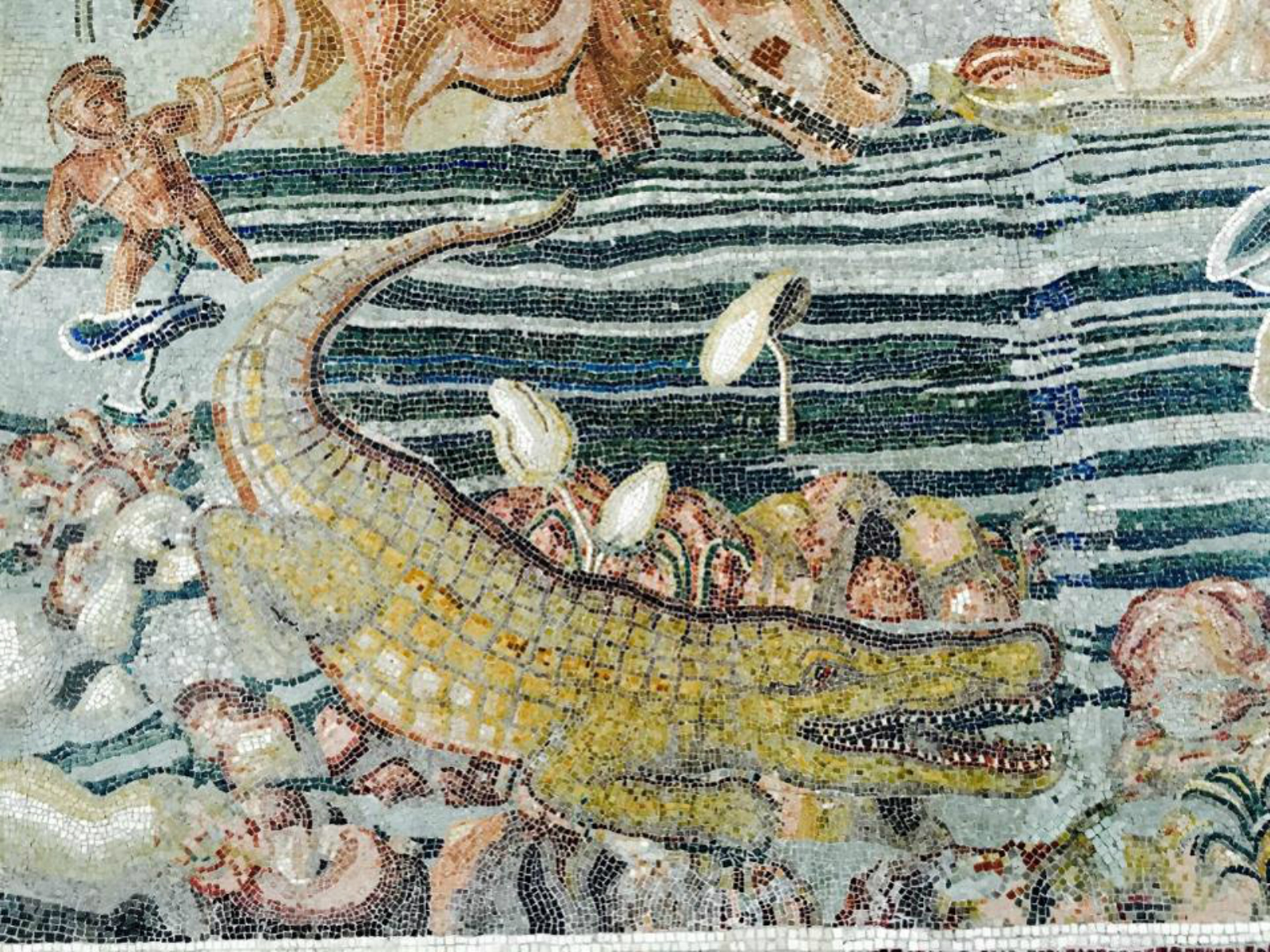

Image of the Day

Ancient Rome apparently had a thing for Nile-born Egyptian crocodiles: The expansion and wealth of the Roman republic saw magistrates and officials begin using its vast arenas “to impress the masses and promote their own personal brand through the display of exotic animals in a kind of fatal zoo-aquarium,” writes an assistant professor of classics at the University of Iowa in a piece for Forbes’ contributor network. The crocs and their dauntless hunters, the Tentyritæ, featured strongly in the art of the era, writes Sarah Bond. “Those who put on Roman games and paid Egyptian crocodile hunters along the Nile for capturing them fed on the hunger of a Roman audience to see the fantastical beasts at the edges of the newly-acquired bounds of the Roman empire.” These croc hunters were paid top denarii for their skills. Eat your heart out Steve Irwin (too soon?)

Egypt in the News

We have Egypt to blame for our collective obsession with cats: In case you needed further proof of the internet’s obsession with cats, the leading story on Egypt in the foreign press this morning happens to be a genetic study in the journal Nature Ecology & Evolution that found that most modern domestic felines trace their genetic origins to the cats of ancient Egypt. While felines were domesticated well before their arrival to Egypt, it is there that the success of the human-cat symbiotic relationship took form and spread throughout the Mediterranean cultures and eventually the world, writes Ian Johnston for the Independent.

Parliament’s approval of a pact handing Tiran and Sanafir islands to Saudi willpit the Presidency and the legislative branch against the judiciary, which finds itself on the same side as opposition politicians and activists, writes the Associated Press’ Hamza Hendawi. “In Egypt’s sometimes murky power structure, it is not clear where such a battle of wills could go,” he adds. Hendawi then speculates into possible Saudi motives for acquiring the islands, stating that the move might preface closer ties with Israel in the interest of thwarting the influence of common enemy Iran.

US President Donald Trump’s Arab alliance is a “mirage,” Antony J Blinken writes in The New York Times. The decision by Saudi Arabia, Egypt, and the United Arab Emirates to sever relations with Qatar is not necessarily “an alliance united against extremism,” but could be a Sunni coalition that will roll back Iran. Blinken also says “our Arab partners could use the anti-Islamic State coalition to go on the offensive, dragging the United States into new misadventures in the Middle East.”

Other coverage worth noting in brief:

- Former President Mohamed Morsi has received visits from his family andlawyers only twice since his 2013 detention, which is unlawful and may have led to deteriorating his health, according to Human Rights Watch.

- An Egyptian national was among those who escaped unharmed following the terrorist attack on a luxury resort just outside Mali’s capital that left two people dead, Reuters reports.

- Forward explores how Spain under Franco helped over 1,500 Egyptian Jews flee Egypt following a clampdown as a result of the Six Days War.

- The Indian Embassy in Cairo is celebrating the UN International Day ofYoga tomorrow (June 21) in Egypt, The Statesman reports.

On Deadline

Newton wants the government to revise lifting subsidies some more: The Al Masry Al Youm columnist writing under the pseudonym Newton thinks the government should rework its schedule for lifting subsidies in light of the inflationary impact of its economic reforms that has not been offset by an increase in wages. The columnist, who may have slept through the many announcement of wage, pension and other benefit increases, points in particular to subsidies on things that affect low-income citizens, such as diesel, which he believes should not be lifted at the same time as electricity. Newton gets more than his fair dose of Nasseritis, suggesting that the state should look at other sources of financial drain, such as unnecessary luxuries given to certain officials, to curb its expenditures.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met with Abu Dhabi Crown Prince Mohamed Bin Zayed AlNahyan in Cairo yesterday to discuss efforts to combat terrorism and those who provide terrorist groups with funding and media and political coverage (a not so subtle reference to Qatar and Al Jazeera), according to an Ittihadiya statement. Reuters notes that these two were not referenced by name, though clearly alluded to. El Sisi and Al Nahyan’s meeting is their first since Egypt, the UAE, Saudi Arabia, and Bahrain collectively severed their diplomatic ties with Qatar two weeks ago.

Meanwhile, Qatar’s Foreign Minister Sheikh Mohammed Al-Thani said negotiations to resolve the spat are contingent on the lifting of trade and travel blockades Egypt and the GCC countries imposed on Qatar, according to Reuters. Al-Thani said that Doha is prepared to engage in “a proper dialogue” to address the Arab states’ concerns and that a solution is possible. The UAE’s Foreign Affairs Minister Anwar Gargash said the four countries have no intention of backing down from these punitive measures until Qatar responds to their demands, a list of which he said will be sent to Doha in a few days’ time.

Nigeria can potentially take in 35% of Egypt’s furniture exports to African countries, said First for Office Furniture company chairman Mahmoud El Shaarawy, according to Al Borsa. This comes after Nigeria lifted a 2005 ban on furniture imports into the country. Egypt’s furniture exports increased by 6% y-o-y in 2016 to USD 369 mn, only 2% of which go to Africa.

Egyptian members of the House of Representatives want the UK to extradite Ikhwan members back to Egypt, Ahmed Fouad writes for Al-Monitor. The MPs are using the latest London attacks to try to warn the UK from supporting the Ikhwan. "It is time for the British government to be aware that embracing extremists will not ward off threats of terrorism,” read a statement of the parliament’s Arab affairs committee on the day of the Manchester bombing.

Egypt welcomes the Syrian government’s two-day ceasefire in southern city Daraa, says the Foreign Ministry.

Energy

Egypt, Iraq to establish joint oil, natural gas companies -Iraqi VP

Iraqi Vice President Ayad Allawi reached an agreement with Egyptian officials to establish joint oil and natural gas companies during a visit to Cairo, Al Masry Al Youm reports. No further details on the agreement were provided. The two countries had signed a one-year agreement in April under which Iraq will sell 12 mn bbl of oil to Egypt.

Siemens to connect 400 MW from Burullus plant within days

Siemens will connect 400 MW of power produced at the Burullus power plant to the national grid within days, Deputy Electricity Minister Sabah Mashali tells Al Mal. It brings the total output from Siemens’ three plants to 5.2 GW, from the operation of 12 units. Separately, the Electricity Holding Company is set to pay EUR 25 mn in dues to Siemens for the work it completed at the plants, a source says.

Qalaa, Edison postpone gov’t negotiations to build EUR 100 mn power plant

Qalaa Holding and Italy’s Edison postponed negotiations with the Electricity Ministry to build a EUR 100 mn power plant in Abu Qir, until the ministry announces new electricity prices in July, Al Borsa reports. The plant, which is expected to produce 180 MW, is co-financed by both companies. Electricity from the project would be sold directly to consumers.

Production unit from Kuraymat station down, GE fixing it

General Electric is looking for solutions to fix a production unit at the Kuraymat power station that stopped working a few days ago, sources told Al Borsa. A source told Al Borsa the unit is still under warranty and is being sent to the US to be checked. The Egyptian Electricity Holding Company had signed a twelve-year maintenance agreement with Siemens for eight gas units with a capacity as well as two units in the combined cycle plant in Kuraymat in 2015.

Electricity Ministry decides on winning offer to set up sea cables in Saudi-Egypt electricity connection project

The Electricity Ministry has decided on the winner of a tender to set up a sea cable between Egypt and Saudi Arabia for the two countries’ electricity interconnection project, an unnamed ministry source tells Al Shorouk, without disclosing the winning offer. Alstom, ABB, and Siemens have all applied for the tender.

Basic Materials + Commodities

Trade Ministry wants to boost Egypt’s date exports

The Trade and Industry Ministry is looking to prioritize bolstering date exports in the coming season, Minister Tarek Kabil said, according to Ahram Gate. Kabil talked strategy at a meeting with representatives from UNIDO, FAO, Italian and German agencies, the Association of Egypt’s dates and Agriculture Ministry official. Egyptian date exports increased by 8% y-o-y in 2016, and imports of manufactured dates went down by 55% y-o-y.

Real Estate + Housing

El Shams considering EGP 1 bn partnership with NUCA

El Shams Housing And Urbanization Company is considering a EGP 1 bn partnership with the New Urban Communities Authority (NUCA), the company said in an EGX filing. No further details were provided on the potential project.

Telecoms + ICT

TE studies amending infrastructure usage fees after scathing report from CAA

Telecom Egypt (TE) is looking into amending a pricing scheme for MNOs and internet service providers using its infrastructure, an unnamed company official tells Youm7. The move comes after the Central Accounting Agency (CAA) issued a report criticizing TE for unilaterally setting prices and making additional profits off of infrastructure usage fees without prior agreement with MNOs. TE earned EGP 320 mn during 2015 and 2016 from higher infrastructure rental fees, the CAA’s report states, demanding additional details for the revenues earned from the service after finding an EGP 8 mn imbalance, according to Arab Finance.

MNOs say have not yet received 4G frequencies

CIT Minister Yasser El Kadi might have jumped the gun when he said that mobile network operators would be receiving their 4G frequencies on Monday, according to Al Mal. MNOs have not received any official notice about frequency being handed over before Eid Al Fitr, an executive from the one of three operators tells the newspaper. The National Telecommunications Regulatory will be reworking the geographic distribution of frequencies around the country for the next two months, the same timeframe the minister gave on Sunday for 4G service rollout.

Automotive + Transportation

Geyushi Motors becomes official distributor for FAW Group

Geyushi Motors announced yesterday that is the exclusive distributor of China’s FAW Group in Egypt, Al Borsa reports. Under the agreement, Geyushi will also establish a new factory in Egypt to assemble FAW’s cars locally and export them to Africa and the Middle East, according to Geyushi’s chairman.

Banking + Finance

Banks attract USD 30 bn since EGP float -source

The Egyptian banking system attracted USD 30 bn since the start of the EGP float as of the end of last week, a central bank source told Al Borsa. The source said the growth rate of transfers to the banking system, whether from remittances or locally with people exchanging USD, have not changed.

Other Business News of Note

Hassan Allam to pay USD 1.1 mn settlement in dispute with US companies

Construction firm Hassan Allam has agreed to pay a USD 1.1 mn settlement to the US government after being accused of allegedly violating the US False Claims and Foreign Assistance acts, Federal Times reports. The settlement comes after the US government pursued legal action against Washington Group International, Contrack International and Hassan Allam related to a joint venture they had formed in the 1990s to pursue USAID-funded water and wastewater projects in Egypt. Hassan Allam was allegedly “ineligible to participate in the joint venture but its participation was concealed, allowing the partnership to receive contracts to which they were not entitled,” the website claims. Contrack and Washington Group have already settled in the case, which was brought by “the Civil Division’s Commercial Litigation Branch, the U.S. Attorney’s Office for the District of Idaho and the USAID Office of Inspector General.”

Egypt Politics + Economics

Supply Ministry extends deadline for Kramers to update their subsidy card data

The Supply Ministry has extended the deadline for subsidy card holders to update their data to 15 July, from the previous 30 June deadline, ministry spokesman Mamdouh Ramadan said in a phone-in to DMC News (runtime 3:17). Approximately 11.5 mn of the 19 mn beneficiaries have already updated their data, Ramadan said. The government had previously warned it would suspend the cards of holders fail to update or complete their data by the deadline.

Waste-to-energy feed-in tariff set at EGP 1.45, pending Cabinet approval

The waste-to-energy feed-in tariff has been set at EGP 1.45 per kWh, and is pending Cabinet approval, Assistant Environment Minister Fatma Mohsen tells Al Shorouk. Prime Minister Sherif Ismail and the Finance, Environment, Planning, Electricity, and Local Development Ministers are set to meet this week to discuss the tariff, according to Mohsen.

Police officer who killed activist Shaimaa El Sabbagh sentenced to 10 years

A criminal court sentenced a police officer who killed activist Shaimaa El Sabbagh to 10 years in prison, Reuters reports. El Sabbagh was gunned down during a peaceful protest in 2015, on the fourth anniversary of the 2011 revolution. The sentence may be appealed to the Court of Cassation, Egypt’s highest appeals court. El Sabbagh’s family lawyer says it is the first time an officer in the police service has been held accountable for killing a protester since 2011.

On Your Way Out

Egypt announces 2016 Nile Awards in Arts, Literature, and Social Sciences: The Supreme Council for Culture announced on Monday its 2016, Ahram Online reports. Film director Ali Badrakhan received the Nile Award, the highest honor, in the Arts. Late critic and Andalusian studies specialist El-Taher Makki received the Nile Award in Literature, while AUC management professor Sabry El-Shabrawi received the Nile Award for the Social Sciences. Encouragement, appreciation, and excellence awards were also granted to winners in the three categories.

The markets yesterday

EGP / USD CBE market average: Buy 18.0465 | Sell 18.1459

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Monday): 13,508 (+0.1%)

Turnover: EGP 753 mn (38% below the 90-day average)

EGX 30 year-to-date: +9.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were: Orascom Construction up 2.2%, Ezz Steel up 1.8%, and Global Telecom up 1.8%. Yesterday’s worst performing stocks were: Egyptian Iron and Steel down 9.0%, Porto Group down 2.4%, and GB Auto down 1.4%. The market turnover was EGP 753 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +32.8 mn

Regional: Net Short | EGP -3.3 mn

Domestic: Net Short | EGP -29.5 mn

Retail: 61.2% of total trades | 58.0% of buyers | 64.3% of sellers

Institutions: 38.8% of total trades | 42.0% of buyers | 35.7% of sellers

Foreign: 23.8% of total | 26.0% of buyers | 21.6% of sellers

Regional: 10.1% of total | 9.9% of buyers | 10.4% of sellers

Domestic: 66.1% of total | 64.1% of buyers | 68.0% of sellers

***

PHAROS VIEW

Pharos Financial Conditions Index — A Temporary Decline in May as the Policy Rate Hike Feeds into the System: The Financial Conditions Index (FCI) down in May despite further policy tightening by the CBE on 21 May, due to the time-lag between a policy rate change and its effect on financial market. real M2 annual growth accelerated in May, while the EGX30 Index rose 7.3% month-on-month and the exchange rate stabilized. Meanwhile, the overnight interbank spread sub-index declined in May, which was no surprise since the impact of the CBE’s 200 bps policy rate hike on the average daily overnight interbank rate was not fully felt yet. You can read the full report here (pdf).

***

WTI: USD 44.28 (+0.18%)

Brent: USD 47.02 (+0.23%)

Natural Gas (Nymex, futures prices) USD 2.89 MMBtu, (-0.10%, July 2017 contract)

Gold: USD 1,245.90 / troy ounce (-0.60%)

TASI: 7,046.53 (+2.40%) (YTD: -2.27%)

ADX: 4,491.29 (-0.21%) (YTD: -1.21%)

DFM: 3,458.37 (+0.41%) (YTD: -2.05%)

KSE Weighted Index: 407.90 (+0.54%) (YTD: +7.32%)

QE: 9,069.34 (-1.29%) (YTD: -13.10%)

MSM: 5,220.94 (-0.54%) (YTD: -9.71%)

BB: 1,316.52 (-0.50%) (YTD: +7.87%)

Calendar

26 May-23 June (Friday-Friday): Window for firms to submit expressions of interest to the European Bank for Reconstruction and Development for consulting on Egypt’s oil and gas sector reform, London, UK.

22 June (Thursday): Nile Summit scheduled to be held in Uganda.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

06 July (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

13-15 July (Thursday-Saturday): AGRENA’s 19th Annual Poultry, Livestock, and Fish show, Cairo International Convention Center, Cairo.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.