- Central bank to remove caps on USD deposit “soon” –IMF’s Jarvis. (Speed Round)

- Kabil postpones talks with EU officials on automotive directive. (Speed Round)

- House to start its annual budget debate today, vote could take place as early as Tuesday. (Speed Round)

- DEVELOPING- Van crashes into crowd of Muslim worshippers leaving London mosque after taraweeh prayers. (What We’re Tracking Today)

- Egypt in dash to resolve pesticides “crisis” before November export season. (Speed Round)

- Remittances from Egyptian expatriates have risen 11.1% y-o-y since the EGP float. (Speed Round)

- Meet the Egyptian CIA spy who allegedly conspired with the Russians on a coup in Montenegro. International enough for you? (Worth Reading)

- Private equity has no ‘responsibility’ to create jobs in Africa. (On Your Way Out)

- The Markets Yesterday

Monday, 19 June 2017

The central bank will lift USD deposit caps “soon,” says IMF’s Jarvis

Plus: Kabil postpones talks with EU officials on automotive directive

TL;DR

What We’re Tracking Today

MPs will kick off today plenary session discussion of the Ismail government’s 2017-18 budget, according to local media reports. We have the latest in Speed Round, below.

The country’s three incumbent mobile network operators will be receiving their 4G frequencies today and the service should be fully active across the country in two months’ time, CIT Minister Yasser El Kadi said on Sunday, Al Ahram reports. It’s unclear when the service will roll out to customers, an executive from the one of the MNOs tells the newspaper, explaining that the National Telecommunications Regulatory Authority still needs to finish mapping out the frequencies before they can be used. Orange sent out text messages last night inviting customers in Dokki to try out 4G service. Meanwhile, Telecom Egypt is getting ready to roll out 4G services by September, according to Al Borsa. The company has floated an RFP seeking an advertising agency to design and brand its new business, the newspaper reports.

Drafting of the executive regulations to the Investment Act to wrap by tonight? Investment Cooperation Minister Sahar Nasr set tonight as the deadline for the committee drafting the regs to wrap their first cut, according to a ministry statement. Nasr said the document will be circulated to all ministries for feedback before being discussed at cabinet.

DEVELOPING- Several people were injured when a van drove into a crowd ofworshippers leaving a mosque in London’s Finsbury Park neighborhood in the early hours of this morning. The victims are believed to have been in the street after taraweeh prayers. Reports at dispatch time today noted “multiple casualties” but no word on the split of injuries versus deaths. The Independent noted, “Footage showed injured people motionless on the pavement as angry crowds surrounded a white man believed to be the driver.” One report claims two other men in the van escaped on foot. Counter-terrorism police are investigating, reports the Guardian, which was live-blogging from the scene as we hit “Send” this morning, while the Telegraph was posting regular updates.

It’s a great business — just check your conscience at the door when you start reading about it. “One mn Syrian customers,” Western Union CEO Hikmet Ersek says. “Do you think they will ever forget Western Union?” Nope. Not when they recall the exorbitant fees they were charged to make transfers in their moments of desperation. Get beyond that breathless tone — and the utterly uncritical angle the piece takes — and Bloomberg Businessweek nevertheless tells a fascinating tale of how a company founded in 1851 is grappling with fintech and regulation as it profits from serving migrant workers and refugees around the world. It’s a bit much even for cold-hearted business lizards such as us, but you should still read “For Western Union, Refugees and Immigrants Are the Ultimate Market.”

Sleep-in this weekend — it’s good for your waistline. “Catching up on lost sleep over weekends may help people keep their weight down, according to a study in South Korea” Reuters reports, quoting the lead author of the study as explaining, “Short sleep, usually causing sleep debt, is common and inevitable in many cases, and is a risk factor for obesity, hypertension, coronary heart disease, as well as mortality.” A lie-in on the weekend is part of the solution: “Sleeping in may be better than napping, as the sleep may be deeper and follows the body’s sleep-wake rhythms more closely, Yun said.”

When do we eat? Maghrib prayers are at 6:59pm CLT in Cairo, and the cutoff time for sohour is 3:08am.

REMINDERS- Egypt observes the Eid Al-Fitr holiday next week. It’s a three-day break starting Sunday or Monday — we’ll know when, exactly, on Saturday night. Neither the Central Bank of Egypt nor the EGX have made clear their holiday schedules as yet. We have, though: Enterprise is going to be taking a break for the full week to catch up on our sleep. We’ll be back to our normal publication schedule on Sunday, 2 July.

What We’re Tracking This Week

Argentina will find out tomorrow whether it’s being upgraded to emerging market status, the Financial Times reminds us. Bloomberg, meanwhile, suggests that any post-upgrade sell-off of Argentine shares could be milder than was the case in the UAE, Pakistan and Qatar following their respective upgrades.

President Abdel Fattah El Sisi is set to attend the Nile Basin Initiative’s presidentialsummit in Uganda on Thursday, 22 June, Ahram Online reports. Foreign Minister Sameh Shoukry is heading there tonight to participate in ministerial meetings in the run-up, according to a ministry statement. On the agenda for the summit, which was rescheduled from mid-May, is Egypt’s rejoining the group, which sets a framework for water distribution rights along the Nile. Egypt pulled out of the Entebbe agreement in 2010 and has recently been pushing to re-engage with other Nile Basin countries.

On The Horizon

Look for news soon on petrol price hikes: The Supreme Energy Council will be deciding the rate of fuel price hikes during its next meeting, an unnamed government official tells Al Shorouk, without specifying when. Sources had said last week that the government was planning to raise the price of 92 octane petrol to EGP 4.50 per liter (an EGP 1.00 hike) starting July. Some in government and parliament have been pushing to postpone the hike until political tension — primarily over the Tiran and Sanafir agreement — eases and to avoid coinciding with the increase in electricity prices starting July, the newspaper reports. Delayed or not, the official says, the price hikes are coming and have already been factored into the state budget for the new fiscal year. AMAY cites sources in government as saying that the authorities have not yet agreed on a timeline for the price hike.

Enterprise+: Last Night’s Talk Shows

The airwaves offered us up a bag of somewhat mixed nuts for a change last night, with the biggest news being the Egyptian National Railway (ENR)’s USD 575 mn purchase of 100 locomotives from General Electric.

Lamees Al Hadidi spoke to Transport Minister Hisham Arafat during her weekly spot on CBC Extra. Arafat said that he hopes the new locomotives, the first shipment of which will arrive in April 2018, will see ENR make better use of its capacity and generate revenues to help cover the cost of upgrades over the coming seven or eight years.

Fifty of the 100 locomotives will be built in Egypt in partnership with the military’s Arab Organization for Industry, GE’s President and CEO for North East Africa Ayman Khattab told Lamees (more on that in the Speed Round). The agreement is the largest commercial transaction between Egypt and a US company since President Abdel Fattah El Sisi’s visit to DC earlier this year, he added, explaining that the 15-year maintenance package is possibly the first of its kind in Egypt (watch, runtime 8:42).

Lamees then moved on to a quick review of major philanthropic activities this Ramadan (well-timed since we are in the last week of the holy month), starting with the 500500 Cancer Hospital, which reportedly receives around 1,000 patients a day. The hospital is establishing a new facility in the Cairo suburb of Sheikh Zayed (watch, runtime 4:35). Meanwhile, Misr Al Kheir charity group is planning to expand its presence to 17 new areas in Upper Egypt, in partnership with the National Bank of Egypt (watch, runtime: 5:40).

Over on Kol Youm, Amr Adib played clips from El Sisi’s Ramadan iftar with 28 citizens on Sunday while defending the president against critical comments on social and mainstream media. “He’ll get attacked whether he does the iftar or not,” Adib said (watch, runtime: 6:03).

Adib also took some time to cover the fire in West London, describing 2017 as a “dark year” {for the UK, just as 2016 was for France (watch, runtime: 4:22).

Speed Round

The central bank will remove caps on USD deposits entirely in “the coming months,” IMF Egypt mission chief Chris Jarvis told Al Borsa. Importers of non-essential goods still face a USD 10k per day limit on deposits and can deposit no more than USD 50k per month. The IMF also welcomed the central bank’s removal of restrictions on USD transfers, which scrapped the cap of a USD 100k transfer per client per year, Jarvis said, adding that removing all restrictions on the flow of funds is part of the agreement with the IMF.

Kabil postpones talks with EU officials on automotive directive: Trade and Industry Minister Tarek Kabil has postponed a planned visit to Brussels during which he was expected to discuss the EU’s concerns about the proposed automotive directive, EU Mission Chief to Egypt Ivan Surkoš tells Al Mal. The local press had picked up an announcement by Surkoš last week that a meeting to discuss the automotive industry with EU officials was in the cards. Surkoš had said last month that the bill, which gives incentives to Egyptian car assemblers who go further up the value chain into manufacturing, would violate the terms of Egypt’s trade agreements with the EU. European car makers and local importers of their goods had complained to the European Commission and have spearheaded an effort to derail the bill in the House of Representatives. The Trade and Industry Ministry has been trying to push the legislation along by recently forming a committee to look into a compromise that would leave both parties happy.

Other topics we expect would have been on the agenda include the Exporters Registry, which the EU had said it would pressure Egypt to abandon. The registry places additional quality control measures for companies looking to export to Egypt. Kabil’s meeting with the EU has yet to be rescheduled.

News that Kabil was postponing his trip came as word emerged that the European Union will raise its ceiling on aid to Egypt to EUR 600 mn from EUR 450 mn. The decision came during negotiations for a new three-year EU-Egypt Partnership framework agreement, the head of the Investment and International Cooperation Ministry’s Egyptian-EU partnership unit, Gamal Bayoumi, tells Al Masry Al Youm. He added that it was likely that the aid be increased to EUR 660 mn “in the near future.” We could actually expect the aid to be disbursed as one lump sum payment, according to Bayoumi. We noted back in March that the government was making headway in setting a strategic partnership framework after the prior agreement expired last year. That agreement had set poverty alleviation and improving the business environment as priorities for aid with Egypt.

House budget debate to begin today, vote could take place as early as Tuesday: The House of Representatives’ general assembly will begin discussing the state’s 2017-18 budget today — and an up-or-down vote on the bill could take place as early as tomorrow, Al Borsa reports. The Budgeting Committee has reportedly agreed with the government to allocate an additional EGP 20 bn to education, but disbursement of the funds would be contingent on the Education Ministry meeting its September deadline for a sector development plan, committee member MP Yasser Omar tells the newspaper. MPs have also earmarked a few extra piasters for the ministries of supply and youth and the Central Authority for Organization and Administration (details in the Borsa story).

More on the House’s plate: In the latest of its traditional pre-holiday mad dashes to the finish, the House as a whole is also due to discuss before Thursday a draft bill to direct a percentage of ministerial slush funds into the state budget process; the 10% hardship raise for state bureaucrats not covered by the Civil Service Act; the minimum annual raise and a hardship raise for the Civil Service Act; as well as the government’s proposal to raise pensions, Al Ahram says. The House is also expected to vote on legislation regulating organ transplant procedures.

One thing the House can cross of its list is signing off on increases to the prices of 27 different government services starting FY2017-18, AMAY reports. The increases will apply to services that include vehicle registration, passport issuance, and expat residence visas, in addition to a one-time EGP 50 fee for every mobile phone line purchased and EGP 10 on every monthly mobile phone bill. The move is expected to earn the state around EGP 7 bn.

GE will use 50% domestic content in the 100 locomotives it is selling Egypt under a USD 575 mn contract announced this past weekend. That’s up from 35% under similar previous contracts, Investment and International Cooperation Minister Sahar Nasr said in a statement pdf). Judging from chatter on last night’s talk shows (above) the local content requirement will be met in part by having as many as 50 of the locos assembled in Egypt. GE will also supply spare parts and technical support for the new locomotives and 81 existing trains under a 15-year maintenance contract. The Boston-headquartered company is also set to provide training for 275 engineers and technicians from the Egyptian Railway Authority.

Egypt in dash to resolve pesticides “crisis” before November export season: Faced with a fresh ban on agricultural exports on concerns Egyptian growers use too much pesticide — this time targeting strawberry sales to Saudi Arabia — the Agriculture Ministry is investigating labs responsible for testing exports and is blacklisting the unnamed company whose strawberries triggered the ban in Saudi, Al Shorouk reports. The latest ban, which comes into effect on 11 July, is unlikely to result in large losses for Egyptian strawberry exporters as the season ended in April, Agriculture Export Council head Abdel Hamid El Demerdash tells Reuters. “I expect the crisis of Egyptian agricultural exports to Arab countries to be resolved before the beginning of the new export season which begins mid-November,” El Demerdash said. Several countries have banned Egyptian produce due to high pesticide levels, with Saudi Arabia, the UAE, and Kuwait all saying no to Egyptian peppers.

Remittances from Egyptian expatriates have risen 11.1% y-o-y since the EGP float in the period from November 2016 to the end of April 2017, Reuters reports, citing a CBE report. In total, remittances during the period reached USD 9.3 bn. According to the balance of payments report, remittance inflows in the first three quarters of FY 2016-17 registered USD 12.63 bn. “The float is encouraging transfers through official channels, now that the parallel market no longer offers a premium above the official rate," CI Capital Senior economist Hany Farahat told Reuters.

Robust foreign direct investment inflows into Egypt drove a hike in inflows in North Africa, according to the UNCTAD’s World Investment Report 2017 (pdf). FDI in Egypt rose 17% in 2016 to USD 8.1 bn, topping inflows in the region. This influx of FDI was on the back of major hydrocarbon discoveries and investments in the oil and gas sectors, including Shell’s Western Desert concession. In contrast, FDI in Morocco, the second most attractive destination for investors in 2016, fell 29% to USD 2.3 bn. Egypt was one of the few nations that beat the downslide in FDI continent-wide in 2016, with investments falling 3% to USD 59 bn. On the regulatory side, the report took note of the passing of the Investment Act in 2017, which should incentivize investments, and the formation of the Supreme Investment Council. As we noted last week, Egypt saw a net FDI inflow of USD 6.6 bn in the first three quarters of FY2016-17, mostly going to the oil sector.

Egypt was ranked as one of the “leading” countries globally in the Global Cybersecurity Index (GCI), which measures states’ commitment to cybersecurity. Egypt ranked 14th out of 193 countries on the index, ranking as the second-highest rated Arab country, behind Oman. The landing page of the report is here.

The CBE denied it is allowing the cryptocurrency bitcoin to be traded within the Egyptian banking system, according to Al Borsa. Deputy central bank governor Lobna Helal denied the central bank made any reference to considering allowing bitcoin being traded. Helal says the Egyptian banking system handles official currencies only.

Image of the Day

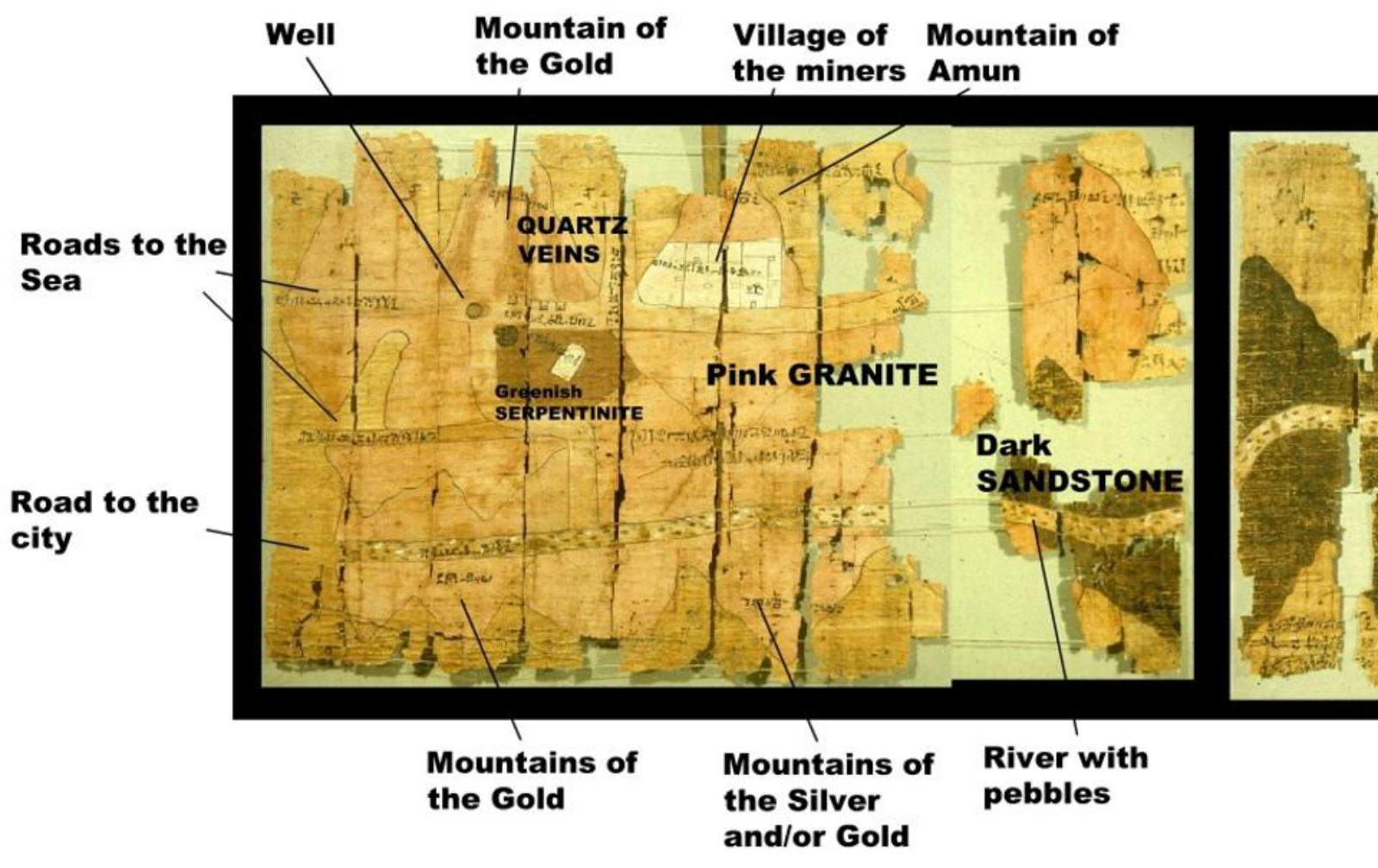

Ancient Egypt’s 3,000-year old geological maps: Before modern geologists had digital maps, Ancient Egyptians created topographic maps on papyrus tracking the locations of gold mines, David Bressan writes for Forbes. This particular map, which dates back to 1,150 BC, was discovered near Luxor in the early 1800s and is now on display at the Egyptian Museum in Turin, Italy. “The Turin-map, of course, is more of a treasure map or topographic map with indications for miners, as it is a true geological map,” Bressan notes, saying that it is nonetheless a “testimony of the keen practical and geological observations of the ancient Egyptians.”

Egypt in the News

Topping coverage of Egypt in the foreign press this morning are pickups of wire copy on aroadside bomb attack that killed a police officer near Maadi on Sunday morning. The explosion was claimed by the Hasm terrorist organization. Reuters and other newswires are tracing the growth of Hasm and noting that the attack came following Parliament’s approval of the Tiran and Sanafir handover agreement.

The media area also exploring a reported warming of ties between Cairo and Hamas. Leading coverage is wire copy on statement through Hamas’ deputy leader in Gaza Khalil Al Hayya saying that relations with Egypt have been improving. "Securing borders is a joint interest. We are keen and we have the determination and the ability to prevent any harm to reach out for Egypt from Gaza," Hayya said. He also added that war with Israel over the Gaza power crisis was unlikely. Meanwhile, Haaretz’s Zvi Bar’el writes that Cairo has agreed with Hamas and Palestinian President Mahmoud Abbas’ Fatah rival Mohammed Dahlan on a new arrangement on ruling Gaza. A spokesman for Ittihadiya denied the report, according to Daily News Egypt. A delegation from Hamas was in Egypt earlier this month to meet with security officials in Egypt. Bar’el writes that the alleged agreement could lead to the opening of Rafah crossing and increasing Egypt’s electricity supply to Gaza.

Al Azhar Law highlights division of opinions over the institution: The proposed draft Al Azhar Act would curtail its authority significantly, writes Sonia Farid for Al Arabiya. In an analytical piece, Farid looks at the most controversial elements of the law (introduced by MP Mohamed Abu Hamid), which would restrict the Grand Imam’s tenure to two six-year terms, have the position be elected by two councils from Al Azhar, and split its non-religious teachings to be under the jurisdiction of the Higher Education Ministry. Opponents of the act believe the legislation violates statutes that guarantee Al Azhar’s independence, while supporters laud making its non-theological curriculum secular and under government control. The divisions reflect debate over the old institutions, between those who feel it is already moderate, and those that believe it can stand some reform.

64% of men admitted to harassing women on the street in Egypt, according to a study by Promundo and UN Women last month picked up by NPR. The study, considered one of the first to look into the issue by asking men, came up with other disturbing findings. It was more likely for younger, more educated males to engage in harassment than older, less educated ones. The study also showed that many of the perpetrators said they did it out of boredom or for entertainment, with researchers suggesting that their metaphorical impotence (lack of jobs) was driving them to lash out and bully women.

Other international headlines worth noting in brief:

- Dalal Abdel-Qader, a 43-year-old mother from Cairo, is breaking gender taboos by becoming Egypt’s first female mesaharaty, according to the Associated Press.

- Egypt’s sunken antiquities, including the Pharos Lighthouse (one of the seven ancient wonders of the world), are at risk of harm by waste and oil spills from Alexandria’s ships, TRT World reports.

On Deadline

Egypt is missing out on a golden opportunity to become an exporter of renewable energy due to our insistence on using coal despite clear signs this is the wrong choice, Ragia El Gerzawy writes in a column for Al Masry Al Youm. Using coal for energy production simply does not make sense for Egypt: We produce none of the stuff, and the health and environmental repercussions of its use are disastrous. Egypt naturally has access to large amounts of sunlight and wind that should be taken advantage of, particularly as studies indicate that renewable energy will be less costly than other energy sources in the future. El Gerzawy points to India, which is turning its back on coal as an energy source — despite being the world’s third biggest coal producer — in favor of solar energy as it works to produce enough electricity to cover its citizens’ needs.

As expected, the nation’s columnists are still collectively shaking their heads at the handover of Tiran and Sanafir to Saudi Arabia. The entire ordeal was mismanaged and showed a lack of political wisdom on the government’s part as it insisted on passing the contentious agreement during such volatile times, Al Ahram’s Farouk Goweida says, adding that it was, above all else, a loss for democracy. Al Masry Al Youm’s Mohamed Kamal agrees on the democracy bit and says it highlighted the clear lack of political parties to lobby for a certain viewpoint. The only thing that would make the issue worse would be President Abdel Fattah El Sisi ratifying the islands’ handover before holding a public referendum or waiting for the Supreme Constitutional Court’s final verdict on the agreement, Amr Hashem Rabie writes for AMAY.

Worth Reading

Meet Joseph Assad, the Egyptian former CIA agent at the center of East-versus-West spy games in Montenegro: Former CIA agent Joseph Assad’s trip to Montenegro ahead of an alleged coup there is the focus of a congressional inquiry on whether he was part of the plot. Russia has been accused by both the Montenegrin government and US officials of having tried to pull off a coup to unseat the current pro-NATO government, allegations which the Russians have denied, write Julian E. Barnes and Drew Hinshaw for the Wall Street Journal.

Prosecutors in Montenegro are investigating whether Assad — a US citizen born and raised in Egypt — was hired to help the 14 suspects accused of masterminding the alleged coup, in addition to advising on an escape plan for members of the pro-Russia opposition calling for a referendum into the country’s membership into NATO. Assad has denied the accusations, saying he had been there to help advise a friend, a political consultant to the opposition, on security there. Some officials speculate that Russia might have used a former CIA agent to give it deniability.

The plot gets especially juicy considering that Assad and his wife had been celebrated in the US media for helping evacuate and rescue Iraqi Christians from Daesh-held territory there (the Times of Israel has an extensive report on his role in the operation). We smell a Ramadan Mosalsal in the making here.

Diplomacy + Foreign Trade

Nigeria lifted a 2005 ban on furniture imports, creating an export opportunity for Egyptian furniture manufacturers, Trade and Industry Minister Tarek Kabil said, according to Ahram Gate. Kabil says the decision comes following discussions in Geneva between the ministry and Nigerian officials. Kabil says Egypt noted that the ban was in violation with World Trade Organization regulations. He says Egyptian producers should seize the opportunity and increase exports to Nigeria. The Federation of Egyptian Industries’ wood and furniture division is studying setting up a furniture exhibition in Nigeria to take advantage of the ban being lifted, Ahram Gate reports.

Investment Minister to sign agreement with EBRD: The European Bank for Reconstruction and Development’s Managing Director for the SEMED region Janet Heckman is expected to sign an agreement today with Investment and International Cooperation Minister Sahar Nasr, according to a ministry statement. The statement provides no details on the agreement that will be signed, but we speculate it may be a USD 500 mn framework to finance renewable energy projects, which the bank’s board of directors approved earlier this month. Heckman also met with Foreign Minister Sameh Shoukry yesterday to discuss the bank’s current and future projects in Egypt, Ahram Gate reports.

Egypt rejected Italian prosecutors’ request to attend the questioning of the seven police officers who had investigated Italian graduate student Giulio Regeni prior to his death, Italian news website Ansa reports. The Egyptian government said that laws prohibit the presence of foreign officials during such legal proceedings and instead sent Italy a report summarizing the policemen’s testimonies. “Italian magistrates are hoping for a third tranche of documents, starting with questioning of the national security chief who investigated Regeni a few days before his disappearance,” the news agency says.

Energy

OTMT-Lafarge Holcim planning to increase investments in refuse-derived fuel

A consortium formed by OTMT and Lafarge Holcim is planning to increase its investments in refuse-derived fuel (RDF) projects to EGP 600 mn by the end of 2018, Al Borsa reports. The consortium is also looking to expand its RDF production over the next three years and is currently in talks to establish eight factories across different governorates, sources tell the newspaper. The companies have also completed feasibility studies on using alternative fuel sources for energy generation, and will establish two factories near Ain Sokhna before the year’s end, according to the CEO of Lafarge subsidiary Geocycle, Amr El Kady. The consortium had announced late last year it was resuming feasibility studies on a EGP 300 mn project to use RDF to generate energy.

Infrastructure

Armed Forces’ Engineering Authority to build four desalination plants

The Armed Forces’ Engineering Authority is set to establish four water desalination plants in cooperation with a German and a French company, Authority chairman Kamel El Wazir said, according to Al Mal. Three plants in East Port Said, Alamein, and Galala will each have a capacity of 150k cubic feet per day. The fourth in the north west of the Gulf of Suez in Ain Sokhna will produce 164k cubic feet per day. The project, which the authority says is the biggest desalination project in Egypt, is set to be completed in 2018.

Basic Materials + Commodities

Supply Ministry has rice reserves to last for two months

The Supply Ministry says rice supplies in stock are enough to last two months, the ministry’s spokesperson said, according to Al Shorouk. The ministry is set to buy its needs in rice from local farmers soon, with domestic rice purchase prices to be determined soon after Eid Al-Fitr.

Manufacturing

Alexandria’s Chamber of Commerce setting up EGP 5 bn industrial complex

Alexandria’s Chamber of Commerce is attempting to set up a new EGP 5 bn industrial complex comprised of a logistics zone and a commodities exchange center, Federation of Egyptian Chambers of Commerce head Ahmed El Wakil said, Al Mal reports. The chamber is currently in talks with representatives from the Alexandria governorate to allocate 150-200 feddans for the project, El Wakil told the press. The chamber had previously reached an agreement with the governorate to allocate 150 feddans for the complex, but part of the land was allocated to other projects.

Health + Education

Education Ministry removes 2011 and 2013 uprisings from high school history

The Ministry of Education removed lessons on the January 2011 and June 2013 uprisings from high school history curriculums, Ahram Online reported on Sunday. The news website notes that the inclusion of such contemporary events in history curriculums had stirred controversy in recent years.

Real Estate + Housing

PHD co-developing 12.6 mn sqm project in Sixth of October with NUCA

Palm Hills Developments (PHD) announced that the New Urban Communities Authority (NUCA) approved an agreement to co-develop a residential project on 12.6 mn sqm in Sixth of October. “The project is an integrated community with complete residential complex offering multi tenants buildings, standalone units complemented by full spectrum of commercial, educational and leisure facilities. The land allocation will be split as 88% for residential and 12% for commercial developments.” The project will be implemented on a revenue sharing basis, with NUCA taking a 26% revenue share as well as an in-kind payment of up to 371k sqm of residential built-up area and 50k sqm of commercial BUA.

Heliopolis Housing says 11-month net profit exceeds full-year target, buys land plot

Heliopolis Housing announced that its profit figures for the first 11 months of FY 2016-17 have exceeded the targets for the entire year, according to an EGX disclosure. Net profit for the first 11 months registered EGP 374 mn from revenues of EGP 730 mn as at 31 May. The company had projected a total net profit figure for the whole year of EGP 300.1 mn. Heliopolis Housing also announced it is buying a 3.1k sqm plot of land in Cairo for EGP 87.2 mn from the General Company for Electrical Projects (ELEJECT).

Telecoms + ICT

Internet prices to go up in September once the full VAT is applied to services, says Abdel Moneim Mattar

Internet prices are likely to go up in September, once the value-added tax (VAT) is fully applied to the service, according to Al Borsa. ADSL services had been exempt from the VAT for its first year in effect, but will be subject to a 14% rate when the VAT rises, Finance Ministry VAT commissioner Abdel Moneim Mattar says. Private internet service providers said last week that they asked the ICT Ministry to help them extend their exemption for a second year, especially since they are already paying TE Data high utilization fees for its infrastructure and incurring losses due chiefly to its monopoly of the market.

Other Business News of Note

Saudi prince withdraws from USD 1 bn steel complex with Suez Canal Authority

Saudi Prince Walid bin Musaed bin Saud bin Abdel Aziz Al Saud’s company withdrew from a USD 1 bn steel complex that was set to be implemented in partnership with the Suez Canal Authority (SCA), sources tell Al Mal. He reportedly had objections concerning key contractual details. SCA is likely to seek a European loan for cover investments. Construction of the project was set to begin in October, after an Italian company finishes drafting the feasibility studies.

Union Capital files paperwork to establish venture capital fund

Union Capital filed paperwork to establish the venture capital fund to restart operations at idle factories to the Egyptian Financial Supervisory Authority (EFSA), Union Capital chairman Hani Tawfik tells Al Borsa. Tawfik said he expects the company to be established after Eid holidays. The outfit will have a capital of EGP 150 mn and is funded by the Industrial Modernization Center, Ayadi, the National Investment Bank, and the Tahya Misr fund.

Legislation + Policy

Egypt signs first international anti-tax evasion agreement

Egypt was among 68 countries to sign the Organization for Economic Cooperation and Development’s (OECD) Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting in Paris on 7 June, Vice Minister of Finance Amr El Monayer said, according to a ministry statement. The treaty modifies tax treaties to eliminate double taxation, and “implements agreed minimum standards to counter treaty abuse and to improve dispute resolution mechanisms,” according to an OECD statement. The agreement will allow Egypt to revise 35 treaties it has signed on double taxation, El Monayer said. Egypt and Kuwait are the only two Arab signatories, according to El Monayer. A delegation from the OECD is set to visit Cairo after Eid Al-Fitr to discuss Egypt’s private sector and taxation development, according to Assistant Vice Finance Minister Mai Abou Ghali said.

El Sisi signs off on amendments to Commercial Registration Act

President Abdel Fattah El Sisi signed off yesterday on amendments to the Commercial Registration Act, Al Shorouk reports. The law will require manufacturers to receive approval from their industry’s division at the Federation of Chambers of Commerce and the Federation of Egyptian Industries before being listed in the Commercial Registry. The House of Representatives had signed off on the amendments in April.

Water Act resurfaces -Irrigation Ministry

The Irrigation and Water Resources Ministry has completed yet another draft of the Water Act, which had last been heard of in January after months of silence, Al Shorouk reports, citing a ministry statement. We had first heard of this law, which aims to develop and regulate the sector, in 2014, but it has died and been resurrected a handful of times since. The latest 133-article draft tackles a number of issues that the existing 33-year old act fails to address, such as the impact of climate change, dangerously high pollution levels, growing demand and dwindling water resources in light of high industrialization and rapid population growth.

Egypt Politics + Economics

119 MPs ask El Sisi to hold on Smurf Islands agreement until Constitutional Court issues verdict

More than a hundred members of the House of Representatives signed a request that President Abdel Fattah El Sisi wait for a verdict from the Supreme Constitutional Court before signing an agreement that would hand sovereignty over the Red Sea islands of Tiran and Sanafir to Saudi Arabia, AMAY reports.

Sports

Saudi Arabia to launch rival to beIN Sports

Saudi Arabia will launch a regional rival network to Qatar’s beIN Sports soon, Al Arabiya reports. Saudi Media City Chairman Muflih Al Hafatah says the network will be free to air, with one channel launched initially, followed by five channels that will be ready by the new season. Al Hafatah said the network’s channels will be free to air, unlike beIN, “if allowed by international laws.”

On Your Way Out

Reading an op-ed this morning in the Financial Times, it was hard not to ask: Why doacademics insist on making declarations such as, “African PE must rise to the challenge of job creation”? All PE needs to do is turn a profit, and do so responsibly. Someday, an academic will learn to frame his or her argument not in hectoring tones about the “need” for PE to invest in manufacturing, but on two fronts: First, the “need” for government to give incentives to PE to invest in companies that create jobs (and to clear obstacles to investment at the same time). Second, by learning to make an actual investment case to business.

The author takes eight paragraphs — and invokes Malthus — to argue why PE needs to invest in African manufacturing to help solve our continent’s woes. One paragraph to quantifying who bad a job GPs are doing. And all of three paragraphs outlining why this might be the case and what might be done for it. And what is the solution, you ask? “Middle market funds, in particular, have an enormous opportunity to unlock potential in this sector. Doing so will not only create value for investors by creating a robust pipeline with attractive exit opportunities; it will also help to address the critical job-creation challenge facing the continent.” Don’t get us started on those attractive exit opportunities.

Someday, business and the academy will learn to speak each other’s language. And some day, academics and wannabees in business will both stop referring to Africa as if we’re a single country. That day isn’t today.

The markets yesterday

EGP / USD CBE market average: Buy 18.0441 | Sell 18.1435

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Sunday): 13,496 (+0.1%)

Turnover: EGP 576 mn (38% below the 90-day average)

EGX 30 year-to-date: +9.3%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.2%. EGX30’s top performing constituents were: Porto Group up 5.0%, Orascom Construction up 3.6%, and Eastern Co up 3.5%. Yesterday’s worst performing stocks were: Amer Group down 2.5%, Domty down 1.9%, and Sodic down 1.6%. The market turnover was EGP 576 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -11.0 mn

Regional: Net Short | EGP -17.2 mn

Domestic: Net Long | EGP +28.2 mn

Retail: 66.7% of total trades | 66.5% of buyers | 66.9% of sellers

Institutions: 33.3% of total trades | 33.5% of buyers | 33.1% of sellers

Foreign: 20.3% of total | 19.3% of buyers | 12.2% of sellers

Regional: 7.7% of total | 6.2% of buyers | 9.2% of sellers

Domestic: 72.0% of total | 74.5% of buyers | 69.6% of sellers

WTI: USD 44.56 (-0.40%)

Brent: USD 47.18 (-0.40%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (-2.93%, July 2017 contract)

Gold: USD 1,253.90 / troy ounce (-0.21%)

TASI: 6,881.39 (+0.89%) (YTD: -4.56%)

ADX: 4,500.86 (-0.02%) (YTD: -1.00%)

DFM: 3,444.13 (-0.44%) (YTD: -2.46%)

KSE Weighted Index: 405.72 (+1.48%) (YTD: +6.74%)

QE: 9,188.09 (-0.75%) (YTD: -11.96%)

MSM: 5,249.24 (+0.02%) (YTD: -9.23%)

BB: 1,323.12 (-0.29%) (YTD:+8.41%)

Calendar

26 May-23 June (Friday-Friday): Window for firms to submit expressions of interest to the European Bank for Reconstruction and Development for consulting on Egypt’s oil and gas sector reform, London, UK.

22 June (Thursday): Nile Summit scheduled to be held in Uganda.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

06 July (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

13-15 July (Thursday-Saturday): AGRENA’s 19th Annual Poultry, Livestock, and Fish show, Cairo International Convention Center, Cairo.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.