- The Ismail government signs off on EGP 46 bn social security package that includes increased welfare spending and tax breaks for individuals. (Speed Round)

- A busy legislative and regulatory agenda: The capital markets tax has passed, high school cheaters are going to jail, EFSA must approve brokerage stake sales, and the NGO law is drawing flak in the western press. (Speed Round)

- Trade deficit down nearly 50% in 4M17, Armani and Massimo Dutti contract manufacturer Arafa Holding is eyeing US export opportunities. (Speed Round)

- India’s TCI Sanmar considers USD 300 mn investment. (Speed Round)

- Supreme Media Council to discuss news website ban today. (Speed Round)

- EFG Hermes’ Khalpey sees a USD 500 mn headache as Pakistan is upgraded to emerging market status at month’s end

- The 50-year-old management book we may be forced to read. (Worth Reading)

- The ultimate Ramadan business story is about coffee, donuts and private equity. (What We’re Tracking Today)

Tuesday, 30 May 2017

Gov’t push EGP 46 bn social security package, including more welfare spending and tax cuts for individuals

TL;DR

What We’re Tracking Today

The successful eurobond issuance continues to make the rounds in the international media, with the Financial Times quoting Finance Minister Amr El Garhy as saying it is “a vote of confidence in the economic story of Egypt and the economic reform programme that Egypt is adopting.” El Garhy says there is no chance Egypt is going to scrap the IMF reform program, saying it is “a programme by the Egyptian government that we are going to deliver.” El Garhy also reiterated that trading in the nation’s eurobonds shows that “the market is basically perceiving” that Egypt deserves a credit ratings upgrade.

The government is getting busy on the legislative front: The House of Representatives approved a 0.125% stamp tax on capital market transactions during a plenary session yesterday. The measure won’t come into effect until signed off by President Abdel Fattah El Sisi and being published in the Official Gazette. Meanwhile, cabinet is working on draft legislation that would see state coffers benefit from ministerial slush funds, the new (and controversial) NGO law went into effect yesterday, the House has made cheating on exams a criminal offense, and EFSA’s new regulations on ownership of brokerage houses have gone into effect. Details on all of this in Speed Round, below.

More strikes on Derna? Warplanes launched three airstrikes on Derna in Libya yesterday, a witness told Reuters. “There was no immediate confirmation of Monday’s strikes from officials in Libya or neighboring Egypt, nor any claim of responsibility for the raid on the city at the eastern end of Libya’s Mediterranean coast.” The Libyan National Army said it was coordinating with Egypt on the strikes, while an Egyptian military spokesman said, “Anyone sponsoring terrorism will be punished no matter where they are. We have not announced the cessation of military operations against terrorist training camps.”

The state’s Supreme Media Council will discuss today a ban imposed on nearly two dozen news websites, according to media reports. The news comes as rumors circulate that the ban has been lifted, apparently prompted by some of the sites becoming intermittently available within Egypt. All the sites are accused of spreading false news or of being pro-terror. We have more in Speed Round, below.

Headed to the UK today? Breathe easy. “British Airways said its IT systems are back up and a full flight schedule is planned Tuesday at London’s airports, where thousands of passengers were stranded because of the breakdown,” CNN reports.

“U.A.E. Minister Says Gulf States in Crisis Amid Qatar Spat,” Bloomberg declares, reporting that Gulf monarchies are suffering a “severe” crisis as a result of “a spat between a Saudi-led alliance and Qatar over ties with Iran.” Bloomberg’s Alaa Shahine and Ladane Nasseri pick up on Saudi newspapers savaging Qatar in the wake of a call from The Statelet’s ruler to Iranian President Hassan Rouhani.

Another looming credit crisis in America? Worries that student loans would trigger another US credit crisis haven’t come to pass, so the Cassandras at the Financial Times are turning their attention to the car loan market. “Big banks are throttling back” from the USD 1.2 tn market for automotive financing “fearing that consumers have taken on more debt than they can handle. … The consequences of an car sector meltdown are unlikely to be as severe as in mortgages, a market about eight times bigger, but ‘there will be fallout,’” the FT suggests.

I want my corner office back. And no “open door policy,” either. A week-old piece from the Wall Street Journal on CEOs fleeing open-plan workspaces for the corner office is getting wide notice. “Mr. Hamad has joined a cadre of bosses chucking the egalitarianism of working alongside their employees for the old-fashioned private office. Their open-office revolt, they say, is less about reclaiming the corner office than about needing a quiet place to think.” Read CEOs Want Their Offices Back (paywall).

Is this the ultimate Ramadan business story? Perhaps for Canadians. The National Post’s Financial Post takes a deep, character-filled dive into how iconic coffee and donut brand Tim Hortons is faring now that it is owned by the private equity cultists at Brazil’s 3G Capital, whose “efficiency-driven management style” dictates everything from menu choices to how employees at Tim Hortons’ headquarters should organize their desks. Why should you care if you’re not a Canadian coffee drinker? 3G capital owns iconic brands including Burger King, Anheuser-Busch, Kraft, Heinz and Popeye’s Louisiana Chicken. The catch? Even as it takes the brand global, 3G is driving Tim Hortons’ core franchisees to the point of near-revolt. Whether you have an affinity for the brand or you’re a PE type who wants to learn how not to foment revolt at your portfolio companies, read “At Tim Hortons it’s not business as usual: Profits are up, but so is franchisee discontent.”

A longtime friend of Enterprise has gotten together with a number of his friends to launch an online petition to talk about religious tolerance in Egypt. The organizers are asking you to show “your fellow Egyptians and the international community that we are all united — Muslims and Christians — against all forms of violence and that Islam, like all religions, denounces all forms of violence and extremism.” Not even the deep cynic in us can disagree with that sentiment. Check out the petition here — signing it will take just seconds, unless you also choose to leave a comment.

So, when do we eat? Maghrib prayers are at 18:50 CLT in Cairo, and the cutoff time for sohour is 3:11am.

What We’re Tracking This Week

Sudanese Foreign Minister Ibrahim Ghandour canceled a trip to Egypt that was previously expected this week, Africanews reports. “We told our brothers in Egypt about the postponement of the visit due to internal issues and it would take place later,” Ghandour said in a statement. Sudan’s president had accused Egypt of arming Sudanese rebels (a charge Egypt denies) and is droning on about Shalateen and Halayeb.

We’re still fumbling toward passage of the Finance Ministry’s 2017-18 budget. With MPs having promised to pass the spending bill before the start of the new fiscal year on 1 July (and, coincidentally, just before they go on summer break on 30 June), the House Budget Committee is now looking to probe the budget impact of the surprise 200 bps rate hike. Meanwhile, the House Economics Committee may call Central Bank Governor Tarek Amer to testify about the rate hike “within days,” Al Borsa reports.

Also on the House’s legislative agenda this week: The House Manpower Committee will be discussing amendments to the Labor Act throughout the week, while the Environment Committee will be discussing the establishment of an executive agency to oversee nuclear power projects. The House Agriculture Committee will meet this week with the state’s land reclamation committee as well as officials from the ministries of agriculture and local development to discuss the legal framework for individuals wanting to repossess land they claim has been taken from them illegally.

We’re also keeping our eyes peeled this week for news of the Petroleum Ministry’s gold exploration tender.

On The Horizon

Investment Act exec regs to be approved by Ismail cabinet as early as mid-June? The Investment Ministry is reportedly expecting to deliver the final draft of the executive regulations for the new Investment Act to cabinet for approval by mid-June, now that it’s finished with them and getting input from other ministries, sources tell Youm7. The ministry will launch a promotional campaign to introduce the law to citizens and investors once the regulations are issued. That is expected to kick off with a major investment conference towards the final quarter of the year.

Enterprise+: Last Night’s Talk Shows

Amr Adib — whose talk show Kol Youm is the only one we follow that is sticking to a daily schedule during Ramadan — had two things on his mind last night: the new EGP 46 bn social welfare package announced by the government (which we cover in greater detail in the Speed Round); and Qatar.

On the welfare bump, which includes a 15% raise in pensions, 25-30% rise in Takaful and Karama benefits, bonuses and a slew of tax breaks, Adib hosted a debate between MP Anissa Hassouna and TV host Nahawand Serry. Hassouna praised the move, which she said was necessary for pensioners (watch, runtime 2:03), but Serry criticized it saying that it was an unnecessary waste of EGP 46 bn that will not make that great of an impact for pensioners (watch, runtime 2:10).

Adib also continued to bash Qatar, calling its military capabilities “poor” in a not-so-mature move to engage with Qatari twitter trolls (watch, runtime 19:09). Stay classy, Mr. Adib.

Speed Round

The Ismail government has signed off on an EGP 46 bn social security package for FY2017-18, according to a statement from the Finance Ministry. The package includes a 15% increase in pensions at a cost to the state of EGP 20 bn in a bid to cushion pensioners from the worst of record-high inflation, Social Solidarity Minister Ghada Wali told Al Masry Al Youm. Cash transfers from the Takaful and Karama programs will increase by about EGP 100 per household as the government earmarked an extra EGP 2.25 bn for them, she added. Finance Minister Amr El Garhy says the government will also disburse two bonuses to state employees who are subject to the Civil Service Act, while state employees not regulated by it will get one bonus payment.

The Ismail cabinet also approved raising the minimum income tax threshold to EGP 7,200 a year from EGP 6,500, Vice Minister of Finance Amr El Monayer told a news conference on Monday, according to Reuters and AMAY. That means individuals earning less than 7,200 a year (or half the minimum wage) will not be subject to income tax.

The state will also provide tax breaks to citizens, with the size of break falling the higher up the income ladder you are. Those making between the minimum threshold of EGP 7,200 and EGP 30,000 will see their taxes discounted by 80%. Those making EGP 30,000-45,000 will receive a 40% break, while those making up to EGP 250K will be getting 5% off their tax bills, said El Monayer.

The increased spending was taken into consideration when drafting the FY2017-18 budget, said Vice Minister of Finance Ahmed Kouchouk, who added that the government is still projecting a deficit of 9% of GDP during the year, Bloomberg reports. Some elements of the package will remain outside the budget and will require separate legislation, El Garhy noted, saying these have to do with tax benefits, according to Al Borsa. Bloomberg, meanwhile, says “the package, excluding the cash subsidy raise, requires parliament approval.”

The story is getting widespread pickup outside of Egypt thanks to coverage by Reuters and Bloomberg (above) and a take by the Associated Press.

Uh, how much, exactly, is the package worth? The release from the Finance Ministry puts it at EGP 46 bn. They’re the folks who foot the bill, so we’re going with them. But Bloomberg is reporting EGP 45 bn, Reuters is saying EGP 43 and we’ve seen EGP 43 in some domestic press outlets.

House approves capital markets stamp tax and a law criminalizing cheating: The House of Representatives approved changes to the income tax law in a plenary session vote on Monday that will impose a 0.125% stamp tax on the buy- and sell-sides of capital markets transactions, Al Borsa says. The duty, which replaces the suspended capital gains tax, will rise in steps to 0.175% by its third year in effect. The measure still needs to be ratified by the presidency and published in the Official Gazette before it comes into effect, probably within days, as Vice Minister of Finance Amr El Monayer had previously said that tax would be enforced in late May or early June.

The House also voted to approve a bill that sets strict punishments and high fines for cheating on high school exams,Ahram Gate says. The law will see teachers and administrators found to have leaked exams face from 2-7 years in prison and pay fines of EGP 100-200k, while students caught cheating will face a year in prison and fines of EGP 5-10k.

EFSA’s new regulations for investment in securities brokerages have gone into effect: The Egyptian Financial Supervisory Authority (EFSA)’s new regulations on investments in brokerage firms were published in the Official Gazette on Monday, Al Shorouk reports. The new rules, which were issued in early May, make it mandatory for the EFSA to approve transactions through which any individual or entity would acquire stakes of 10%, 25%, 33%, 50%, 66%, or 100% in a licensed brokerage. EFSA is presenting the change as being part of its drive to tighten capital market regulation and improve overall transparency.

State coffers to get a slice of slush funds: The Ismail cabinet signed off on a new law proposal on Monday that would see the government earmark a percentage of what are known as “special revenue funds” or “special accounts” for state coffers to help narrow the budget deficit, Al Borsa reports. The percentage deducted from the semi-official slush funds would be determined according to the value and size of the accounts managed by each ministry, which would be categorized into three tiers. The law will exclude research funds, funds from international donors (including both loans and grants), university hospital accounts, as well as social welfare, housing, and healthcare funds, the newspaper adds.

House Representatives have been pressing the government to draft legislation to govern slush funds — which are financed with revenues that are separate from the normal budget process and can reportedly be spent on a minister’s authority with little oversight — and potentially allocate around 80% of them to state coffers. The government’s decision comes a little over a week after the Finance Ministry said it would be working with the prime minister’s office to have ministries and government agencies compile reports on the funds under their control to present to the House for review.

President Abdel Fattah El Sisi signed the new NGO bill into law yesterday, Al Shorouk reports. The bill, which was approved by the House of Representatives back in November, is already out on the Official Gazette. The law will regulate the work of some 46k non-governmental organizations, which have one year to comply or face jail terms of up to five years. As before, the law gives the state the power to decide who can set up an NGO and for what purpose. It also stipulates that donations of more than EGP 10k “must be preapproved. If no approval is granted within 60 days the request is automatically denied,” Reuters reports. The law would also give a new regulatory body the authority to govern field work and to ensure that an NGOs work is supportive of the state’s “plans, development goals and priorities.” The story is getting widespread attention in the international press, with the Associated Press and the New York Times also running takes on the issue.

Look for this issue and others like it to be framed in context of next year’s presidential election. From the NYT’s lede: “strict new regulations on aid groups stok[e] fears that his government intends to accelerate its harsh crackdown on human rights activists before a presidential election scheduled for next year.”

Egypt’s trade deficit fell 48% y-o-y in 4M2017 to USD 8.5 bn, Trade and Industry Minister Tarek Kabil said, Al Masry Al Youm reports. Non-oil exports rose 14% y-o-y to USD 7.4 bn and there was a 30% y-o-y decrease in imports to USD 15.9 bn. The ministry singled out growth in exports of construction materials, agricultural products, readymade garments, and food products, according to Al Borsa. The bulk of the exports went to COMESA, Agadir, GCC, and EU countries. Standouts included Turkey and the United States, the ministry said.

Arafa Holding plans to expand sales to the US, supported by the drop in the EGP’s value, Ahmed Feteha and Tamim Elyan write for Bloomberg. Chairman Alaa Arafa says the American market was out of reach for his company prior to the flotation as the “currency was overvalued.” Arafa says “since the beginning of 2017, we have started rebuilding export markets lost in previous years … Before that we were thinking when will our business shut down; but now there is hope; now we can sit with clients and speak about the future.” The company is looking to expand its production to 6,500 suits per day in 2H2017, from 5,800 currently. Arafa says his company is also looking to introduce its Concrete brand in outlets in GCC countries by 2019. In Egypt, the company will introduce one of the brands it owns in the UK as part of a plan to aggressively target the middle income segments, he says. Read Armani’s Egyptian Supplier Mulls U.S. Foray on Weaker EGP.

INVESTMENT WATCH- India’s TCI Sanmar Chemicals has plans to increase as much as USD 300 mn in Egypt, bringing its total invested here to USD 1.5 bn, Chairman PS Jayaraman told Investment Minister Sahar Nasr, according to Al Masry Al Youm. The company says it wants to increase its caustic soda production lines by investing USD 300 mn in doubling its PVC production output to 400,000 tonnes as well as including a new plant to manufacture 135,000 tonnes of calcium chloride. Separately, Nasr met with the Finnish ambassador to Egypt to discuss that country’s investments in renewable energy and electricity, Al Shorouk reports.

Dana Gas’ board of directors has approved carrying out limited drilling activitiesin Egypt. “In light of the recent collections received from the Egyptian government the board considered and approved that additional limited drilling activities should be carried out,” the company said in a bourse statement picked up Gulf News. Egypt made payments last week covering 25% of the arrears owed to Dana Gas in 1Q17. The company says it is owed USD 275 mn as of the end of 1Q17.

Supreme Media Council to discuss website ban today: The newly-founded Supreme Media Council will meet today to discuss the Ismail government’s decision last week to block access to 21 news websites for allegedly publishing fake news and hosting pro-terrorism content, Al Mal reports. The decision, which restricted access to news websites including Mada Masr, Huffington Post Arabic, Qatar’s Al Jazeera, as well as Al Borsa and Daily News Egypt, is “standard procedure” when sites pose a threat to national security, council member Nadia Mabrouk tells Al Mal.

Rumors have been circulating that the ban has been lifted, the newspaper says, but local news website Mada Masr, which is still accessible from overseas and locally through virtual private networks, put out an official statement through Facebook saying that it can’t confirm the news “as accessibility varies for users on the same service providers and is still completely blocked on others,” promising to update readers once it gets official word.

Al Borsa and Daily News Egypt are intermittently accessible from inside Egypt, while other sites including Al Jazeera and HuffPost are broadly inaccessible. Al Borsa’s backup domain — elborsanews.com — is steadily accessible.

Don’t expect flights from Russia to be reinstated after Lavrov’s visit: Moscow has not imposed new conditions for resuming direct flights to Egypt, said Russian Foreign Minister Sergey Lavrov, who is in Cairo with Russian Defense Minister Sergey Shoigu for ‘2+2’ talks with their respective counterparts. He said at a joint press conference on Monday with his Egyptian counterpart Sameh Shoukry, however, that the resumption of direct flights between Russia and Egypt would be possible only when Cairo fully implements security agreements, Sputnik and Reuters report. The caginess isn’t surprising considering last week’s statements by Russia’s Deputy Transportation Minister Valery Okulov, who essentially said that talks on restoring flights have gone nowhere. This comes despite repeated reports of an improved security situation at Egypt’s airport. Senior adviser to the Tourism Ministry Waleed El Batouty expresses our frustrations well when he says that all of Russia’s security demands for security have been met, Al Shorouk reports.

The meetings aren’t really about Daba’a or the restoration of flights… Both sides appear to want to these issues forward, judging by statements by Foreign Ministry spokesperson Ahmed Abou Zeid picked up by Al Shorouk. Economic issues that tie in to the restoration of flights — including the Daba’a nuclear power plant agreements — will be part of the 2+2 talks, according to a statement from Ittihadiya on a meeting between both Russian ministers and President Abdel Fattah El Sisi.

…security cooperation is at the core of the visit: “Collaboration between Egypt and Russia is crucial for struggle with terrorism. Coordination of efforts in that sphere is already underway,” Russian state news agency TASS quotes Shoukry as saying at the press conference. Cairo and Moscow are closely coordinating their efforts to eliminate sources of terrorist financing and to take action against states that sponsor terrorists, he added. As we noted yesterday, Libya will likely take center stage in the talks. Moscow is conducting operations there, and media reports continue to cite a Russian presence in Western Egypt (a claim both countries have consistently denied). Security talks also generally include a whiff of an arms agreement, but we have yet to hear anything from either side on where we stand on the deliveries Russian shipborne Ka-52K Katran combat helicopters for Egypt’s Mistral-class helicopter carriers.

Speaking of Libya: Shoukry will discuss the situation there with his Algerian and Tunisian counterparts in Algiers on 5-6 June, according to Algeria’s Foreign Ministry spokesperson, ANSAmed reports.

Security officials let their guard down and allowed terrorism to thrive even though they knew of ongoing security threats, the head of the pro-government Support Egypt Coalition, Mohamed Elsewedy. Elsewedy said officials whose incompetence allowed the attack must be held accountable, according to Al Shorouk. Elsewedy’s remarks were made in the wake of a weekend terror attack that claimed the lives of 29 people traveling to a monastery.

Elsewedy spoke the same day that Minya’s security chief was reportedly sacked. Police Gen. Faisal Doweidar has been reassigned to a new post as deputy chief of security at the Interior Minister effective Wednesday, three security sources told Reuters. Interior Minister Magdy Abdel Ghaffar also ordered a shakeup of deputies in the ministry, including the heads of the Tourism Police, economic crimes unit, and the heads of security for Ismailia and Cairo, AMAY reports.

Also yesterday, the House of Representatives announced its support of President Abdel Fattah El Sisi’s decision to launch airstrikes against terrorists inside and outside Egypt, Al Mal reports.

MP Mohamed Abu Hamed of the Support Egypt Coalition proposed yesterday an anti-hate crime bill meant to replace the religious contempt clauses in the criminal code, Al Shorouk reports. The legislation would see those who accuse any individual or group of being infidels sentenced to either the death penalty or life in prison if their accusations result in a hate crime. The bill, which has the support of at least 80 MPs, also stipulates that discussion and debate of the scriptures of the three Abrahamic religions will not punishable by law and would clearly define what falls under “contempt of religion,” Abu Hamed told the newspaper.

The Macro Picture

Pakistan’s USD 500 mn headache: EFG Hermes Frontier CEO Ali Khalpey says “Pakistani equities [could be] so popular with overseas funds this week that the country’s stock market could attract more money than it can handle the day before MSCI Inc. restores the nation to emerging-market status,” Bloomberg reports. Says Khalpey: “It’s a big number and there isn’t enough capacity in the system to handle the volume and value we expect. We have worked with similar investors when Qatar and the United Arab Emirates were upgraded by MSCI. The flows won’t be staggered. Tracker funds have to execute on the day.” Read the piece for a nice Q&A with Khalpey and for a video on what to expect of Pakistan’s upgrade (runtime: 3:04).

Worth Reading

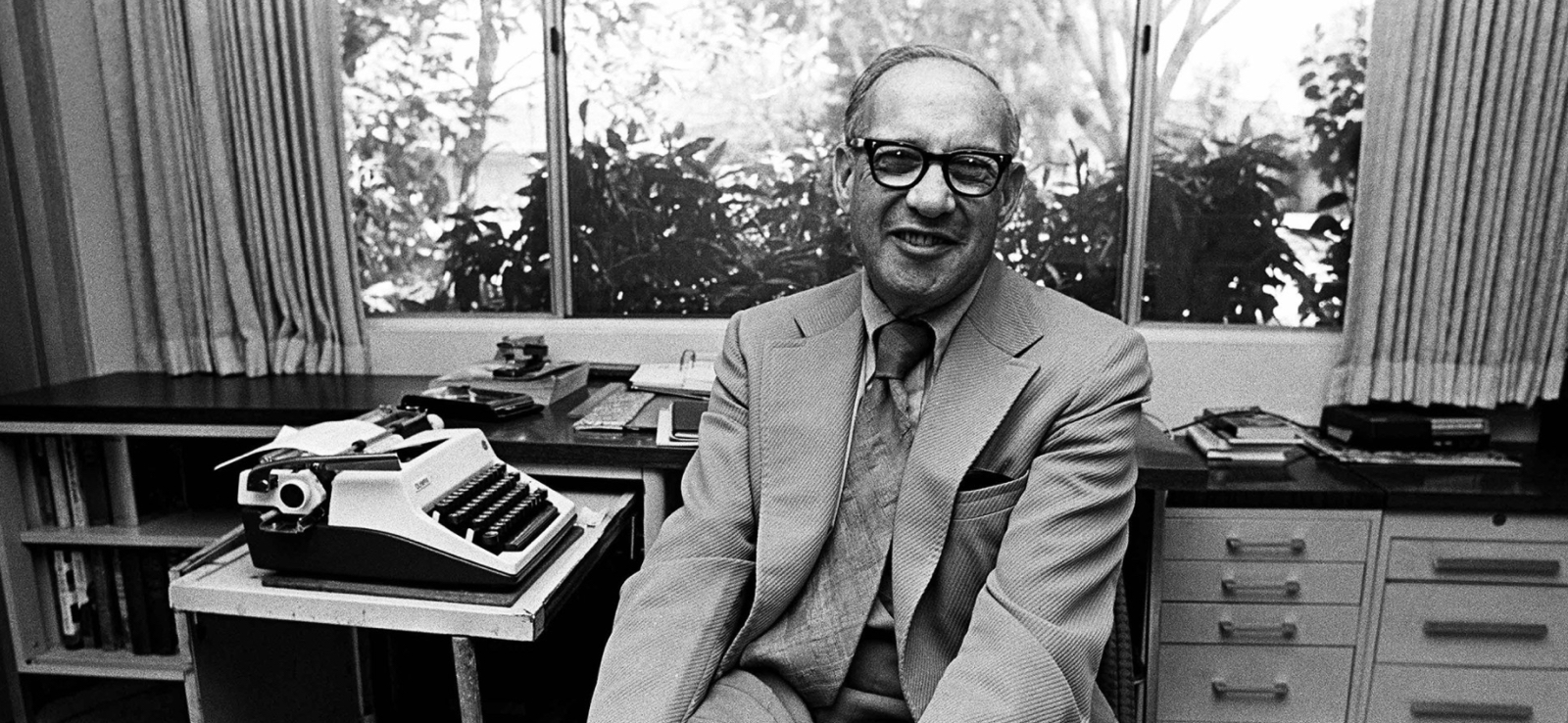

We’re more “entrepreneurs” than we are “managers” and we don’t much care for Inc magazine’s contributor network (much as we love its staff writers), but “The 50-Year-Old Business Book You Need to Read (or Reread) Right Now” has us wondering whether it’s not time to acquire a copy of Peter Drucker’s The Effective Executive. The 50-year anniversary edition of the book is out now on Amazon and (hopefully) coming soon to a Diwan branch near you.

Management wisdom from the era of typewriters and Mad Men. What could be better? Drucker’s five core principles:

- Managing time

- Choosing what to contribute to the organization

- Knowing where and how to mobilize strength for best effect

- Setting the right priorities

- Knitting all of them together with effective decision-making

Egypt in the News

Topping headlines on Egypt in the foreign press this morning are pickups of wire coverageof the signing into law of the controversial NGO bill. The stories play up the criticism of the law by domestic NGOs and international rights groups, who uniformly say the law would effectively lead to the shutdown of many groups. Even non-political charities are fretting the requirement to get advance approval from the state before taking donations. Declan Walsh from the New York Times notes that the law comes in the run-up to next year’s presidential election and suggests that President Abdel Fattah El Sisi has to a degree been emboldened by his friendship with US President Donald Trump.

The weekend’s terror attack continues to generate headlines. Comments from Russian Foreign Minister Sergei Lavrov’s trip to Egypt were picked up by outlets including Sputnik. Lavrov expressed his condolences and insisted that joint efforts to combat terrorism are needed, saying “this evil should be fought jointly” in a meeting with Foreign Minister Sameh Shoukry.

Ahmed Aboulenein writes for Reuters that grief quickly turned to anger during funeral prayers at the Church of the Sacred Family in the village of Dayr Jarnous. Seven of the 29 Christians killed came from Dayr Jarnous. The attack itself raises many questions, Nazlet Hanna writes in La Croix: “Was it perpetrated by a dormant local cell that was reactivated? Or was it the work of a group that found support abroad?” There is no immediate response to these questions, she says, “especially since the perpetrators fled after the attack.”

The GCC press continued to express sympathy for Egypt war on terror. Egypt’s airstrikes in Libya were natural reactions to Friday’s terror attack, Meftah Chouaib writes for the UAE’s Al Khaleej. Palestinian journalist Mahmoud al-Rimawy wrote in the same publication that the systematic targeting of Christians is unprecedented, even when compared to the Lebanese Civil War. Egyptian writer Mohamed Noaman Galal took a veiled stab at Qatar in Bahrain’s Al Watan newspaper, saying that countries that fund terrorists and give them a voice through their media contradict their own national policies and claims of democracy.

Saudi’s Al Arabiya is noting a viral video on social from an Egyptian Daesh membercaptured in Libya. The man recounts his recruitment, which began in Tahrir and eventually saw him sent to Derna to be trained in Daesh camps there.

Egypt’s banks are increasingly looking east for growth, according to Frontera News’ series on Egypt and the One Belt, One Road initiative. Banking heads, including Banque Misr’s Vice Chairman Akef Al Maghraby, believe that Egypt’s USD 11 bn trade volume with China will only increase following the launch of the initiative and banks can be better poised by opening up there. The series looks at the extent to which Chinese banks have committed to Egypt, citing the Industrial and Commercial Bank of China’s USD 20 bn pledge for investments over the coming 10 years, and Banque Misr’s USD 500 mn loan from China Development Bank.

Elsewhere, Frontera is tipping American depositary receipts (ADRs) of CIB, GB Auto,Lecico, OCI NV and Remco Tourism Villages as ways to get exposure to Egypt without leaving the ‘safe haven’ that is the NYSE.

Other international news worth noting this morning in brief include:

- President Trump gets a glowing review of his “boldness” in pushing for Aya Hijazi’s release by the New York Post.

- House National Security Committee member Kamal Amer discusses the residency-for-deposits policy and its security ramifications with Al Monitor.

- Austin, Texas is getting a new ‘city artist’ (the latest inclusive trend among municipal governments) and she’s Egyptian, according to Austin’s My Standard.

On Deadline

The nation’s columnists remain focused on the state’s ability to fight terrorism. Mohamed Aboul Ghar takes to the pages of Al Masry Al Youm to question the security apparatus’ efficiency in stopping terrorist attacks before they take place, saying that they seem to be too preoccupied with monitoring activists on social media platforms to direct their attention to gathering intelligence on terror cells. Security forces evidently do not have adequate access to intelligence in desert areas, where terrorists are likely to strike, or are not trusted by citizens to inform, Aboul Ghar says. Meanwhile, Al Shorouk’s Emad El Din Hussein says the government must begin to tackle issues connected in one way or another to terrorism, pointing at corruption in particular. Increased effectiveness in curbing corruption would increase resources the state can direct to target poverty and create jobs, he says.

Worth Watching

Why one would use fire to style someone’s hair is beyond us, but the practice has made its way to Egypt. Mohamed Hanafy sets his clients’ hair on fire while cutting and styling it, claiming it prevents split ends and dandruff, and helps maintain the style longer. Hanafy’s technique is inspired by Pakistan’s Shafqat Rajpur, but the Cairo-based barber uses flammable powders, lotions and a torch (we kid you not) for a strong, continuous flame that he says allows him to focus on the styling. He claims the method is perfectly safe. We suggest you refrain from trying it at home. (Watch, runtime 0:40).

Energy

EBRD offers EUR 350 mn to fund 16 feed-in tariff projects

The European Bank for Reconstruction and Development (EBRD) will present offers to provide EUR 350 mn in funding to finance 16 renewable energy projects as part of the feed-in tariff program on 7 June, Al Mal reports. Catarina Bjorlin Hansen, the bank’s deputy head for Egypt, says EBRD intends to increase the funds allocated to Egypt 25% y-o-y in 2017 to reach EUR 1 bn.

JICA provides USD 243 mn loan for electricity automated control centers

The Japanese International Cooperation Agency (JICA) is extending a USD 243 mn funding facility to the Electricity Holding Company to fund automated control centers in Alexandria at a at a 0.01% interest rate, Northern Delta, and Northern Cairo, Al Borsa reports. A tender will be launched next month to choose the implementing companies. Siemens, General Electric, ABB, Schneider, Dongfang, DFE, PSI, and Huawei, are interested in bidding, Electricity Minister Mohamed Shaker said. Technical and financial offers are due within six weeks.

Infrastructure

Planning Ministry allocates EGP 572.5 mn for wastewater treatment projects

The Planning Ministry approved an additional allocation of EGP 572.5 mn over what is budgeted for in FY2016-17 for sanitation and drinking water projects, Al Masry Al Youm reports. EGP 272.5 mn will be used to fund a wastewater treatment plant in Abu Rawash in Giza, Minister Hala El Said said. The remaining EGP 300 mn are additional allocations in the budget to fund other wastewater treatment and drinking water projects nationwide.

Basic Materials + Commodities

Egypt made up 46% of all Ukrainian wheat exports in April

Ukraine shipments of wheat to Egypt have reached a high in April, with the country exporting 553K tonnes of wheat to us in April alone. This constituted 46% of total wheat exports by the Ukraine for that month and the largest volume since October 2013, reports UkrAgroConsult.

Manufacturing

Gov’t launching venture capital fund to restart operations at idle factories

The government launched a venture capital outfit that will be focused on providing funding to struggling factories to get them to return to operations, Trade and Industry Minister Tarek Kabil said, according to Al Masry Al Youm. The outfit will have a capital of EGP 150 mn and is funded by the Industrial Modernization Center, Ayadi, the National Investment Bank, and the Tahya Misr fund. Kabil says the government reviewed 135 cases of idle factories, fixed issues in 63 of them, and will have the new venture capital fund address the remainder. The fund will be managed by Hani Tawfik’s Union Capital.

KIMA pays back EGP 300 mn to Italy’s Tecnimont

The Egyptian Chemical Industries company (KIMA) paid EGP 300 mn of its outstanding arrears to Italy’s Tecnimont rehabilitating KIMA’s factories, Al Borsa reports. KIMA paid back a total of EGP 2.6 bn, said director of investor relations Maher Al Abd. Another payment of EGP 200 mn is expected to be made by end of FY16-17.

Health + Education

Education Ministry to tender 51 pieces of land for 200 schools PPP project in mid-June

The Education Ministry will issue a tender in mid-June for 51 plots of land that will be used to establish 200 new schools under public-private partnership framework in 18 governorates, Al Borsa reports. The Ministry will meet next month with representatives from the 43 companies interested in the project before beginning the tender process.

Tourism

Air route linking China’s Xi’an with Aswan

Egyptian charter airline Air Leisure is starting a new direct route between Xi’an, capital of northwest China’s Shaanxi Province, and Aswan, Xinhua reports. The first direct flight between the two cities is set to take off on 13 July and will be on an Airbus A330-200 aircraft. Xinhua says the route connects “Xi’an, the starting point of the ancient Silk Road, with Aswan, a famous tourist city in Egypt,” and that it “will help strengthen exchanges between the two cities and boost their economic development, said Xu Mingzheng, a Shaanxi tourism official.”

TDA launches tourism promotion campaigns in Italy, Arab countries

The Tourism Development Authority (TDA) launched yesterday a 3-week tourism promotion campaign in Italy, TDA head Hisham El Demery announced, according to Al Shorouk. El Demery said Italian tourism increased 60% year-on-year during the first four months of 2017, and there are positive indicators these numbers will continue to rise during the summer season, according to Youm7. The TDA also launched on Saturday a campaign in Arab countries, including Saudi Arabia, the UAE, Kuwait, Bahrain, Lebanon, and Jordan. The campaign will run until the Eid break following Ramadan.

Egypt Politics + Economics

Cairo court postpones first session in lawyer Khaled Ali’s trial to 3 July

A Cairo court adjourned the first session of lawyer Khaled Ali’s trial to 3 July, Ahram Online reports. Ali is accused of offending public decency after a “photograph in which he appears to make an obscene hand gesture on the steps of a Cairo court house” was published, according to Reuters. Ali was arrested last week and released on EGP 1,000 bail.

Sports

Ahly crowned Egyptian Premier League champions

“Ahly have been crowned 2016/2017 Egyptian League champions with four matches to spare after playing out a 2-2 draw with rivals and second-placed Maqassa at Suez’s Army Stadium on Monday,” Ahram Online reports. King Fut has the rundown on the match.

On Your Way Out

Egyptian bot builder platform Widebot is focusing on the restaurant business and targets Arabic language users, writes Radwa Rashad for Wamda. Its Menu Maker platform makes ordering easier and allows restaurants to cut customer service positions and phone line costs, says CEO Mohamed Nabil. The startup will focus next on e-commerce by offering users links to the products they want.

The markets yesterday

EGP / USD CBE market average: Buy 18.0312 | Sell 18.1341

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Monday): 13,207 (0.0%)

Turnover: EGP 863 mn (39% below the 90-day average)

EGX 30 year-to-date: +6.9%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session almost flat. CIB, the index heaviest constituent ended almost flat as well. EGX30’s top performing constituents were: Orascom Construction up 4.6%, TMG up 1.7%, and SODIC up 1.4%. Yesterday’s worst performing stocks were: Qalaa Holdings down 2.4%, Egyptian Resorts down 2.0%, and Eastern Co down 1.9%. The market turnover was EGP 863 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +94.2 mn

Regional: Net Long | EGP +4.0 mn

Domestic: Net Short | EGP -98.2 mn

Retail: 64.0% of total trades | 61.4% of buyers | 66.6% of sellers

Institutions: 36.0% of total trades | 38.6% of buyers | 33.4% of sellers

Foreign: 17.1% of total | 22.5% of buyers | 11.7% of sellers

Regional: 13.9% of total | 14.1% of buyers | 13.6% of sellers

Domestic: 69.1% of total | 63.4% of buyers | 74.7% of sellers

WTI: USD 49.94 (+0.28%)

Brent: USD 52.25 (-0.08%)

Natural Gas (Nymex, futures prices) USD 3.21 MMBtu, (-3.08%, July 2017 contract)

Gold: USD 1,269.60 / troy ounce (-0.14%)

TASI: 6,821.71 (+0.56%) (YTD: -5.39%)

ADX: 4,492.92 (-0.08%) (YTD: -1.18%)

DFM: 3,318.12 (+0.74%) (YTD: -6.03%)

KSE Weighted Index: 401.16 (+0.04%) (YTD: +5.54%)

QE: 10,112.39 (-0.11%) (YTD: -3.11%)

MSM: 5,385.21 (-0.03%) (YTD: -6.87%)

BB: 1,318.72 (+0.10%) (YTD: +8.05%)

Calendar

26 May-23 June (Friday-Friday): Window for firms to submit expressions of interest to the European Bank for Reconstruction and Development for consulting on Egypt’s oil and gas sector reform, London, UK.

07-09 June (Wednesday-Friday): 19th Annual Africa Energy Forum, Copenhagen, Denmark.

11 June (Sunday): Egyptian Private Equity Association’s annual Sohour, Four Seasons Hotel Nile Plaza, Cairo.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

6 July (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

13-15 July (Thursday-Saturday): AGRENA’s 19th Annual Poultry, Livestock, and Fish show, Cairo International Convention Center, Cairo.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.