- Egyptian assets are Renaissance Capital’s top pick. (Speed Round)

- Commodities giant Louis Dreyfus submits rival bid for stake in National Company for Maize Products, following ADM’s lead. (Speed Round)

- Donald Trump wants to cut the State Department’s aid budget for Egypt by half. (Speed Round)

- Controversy over who appoints chiefs of judicial bodies mounts as House passes act. (Speed Round)

- El Sisi, Ismail address economy again at day two of youth conference; PM sees inflation falling to 15.2% in new budget year. (Speed Round)

- Health Minister says no role for private sector in Takamol hospital system; remarks are at odds with Cabinet decision last week. (Speed Round)

- E-visa coming in May / June; visa on arrival will still be a possibility for some foreign residents of regional countries. (Speed Round)

- Berzi, El-Gazayerli on the future of food exports from Egypt — and why the media isn’t helping. (Worth Watching)

- The Markets Yesterday

Thursday, 27 April 2017

Egypt is Renaissance Capital’s top pick

TL;DR

What We’re Tracking Today

Shares in Raya Contact Center will start trading today under the ticker RACC, opening at EGP 16.50.Raya reported a consolidated net profit of EGP 118 mn for FY2016, up from EGP 30 mn in FY2015. Forex gains reached EGP 93 mn, largely on the back of the EGP float, the company said in a regulatory filing. EFG Hermes was sole global coordinator and bookrunner for the transaction. Dechert LLP was international counsel to the issuer, Zaki Hashem and Partners was local counsel to the issuer, and Matouk Bassiouny was local counsel to the sole global coordinator and bookrunner.

Pope Francis’ two-day visit to Egypt, the first by a sitting pope in 16 years, kicks off tomorrow (in case you have been hiding under a rock for the past month). He take part in a peace summit at Al Azhar, which is facing criticism that its teachings, though moderate, uphold strict adherence to doctrine. These criticisms were a driver behind MPs proposing a law that would impact appointments to its upper echelon. Al Azhar Sheikh Ahmed El Tayeb condemned the criticism at a meeting with the World Council of Churches delegation, Al Masry Al Youm reports.

The Islamic month of Sha’ban starts tonight, Dar Al-Ifta said in a statement, You can begin counting down 29-30 days until Ramadan from Friday.

Air travel to the United States could yet become even more unpleasant as the Guardian reports that all travelers from Europe could face a ban on electronics in aircraft cabins. Anyone out there predicting the revival of trans-Atlantic passenger boat route?

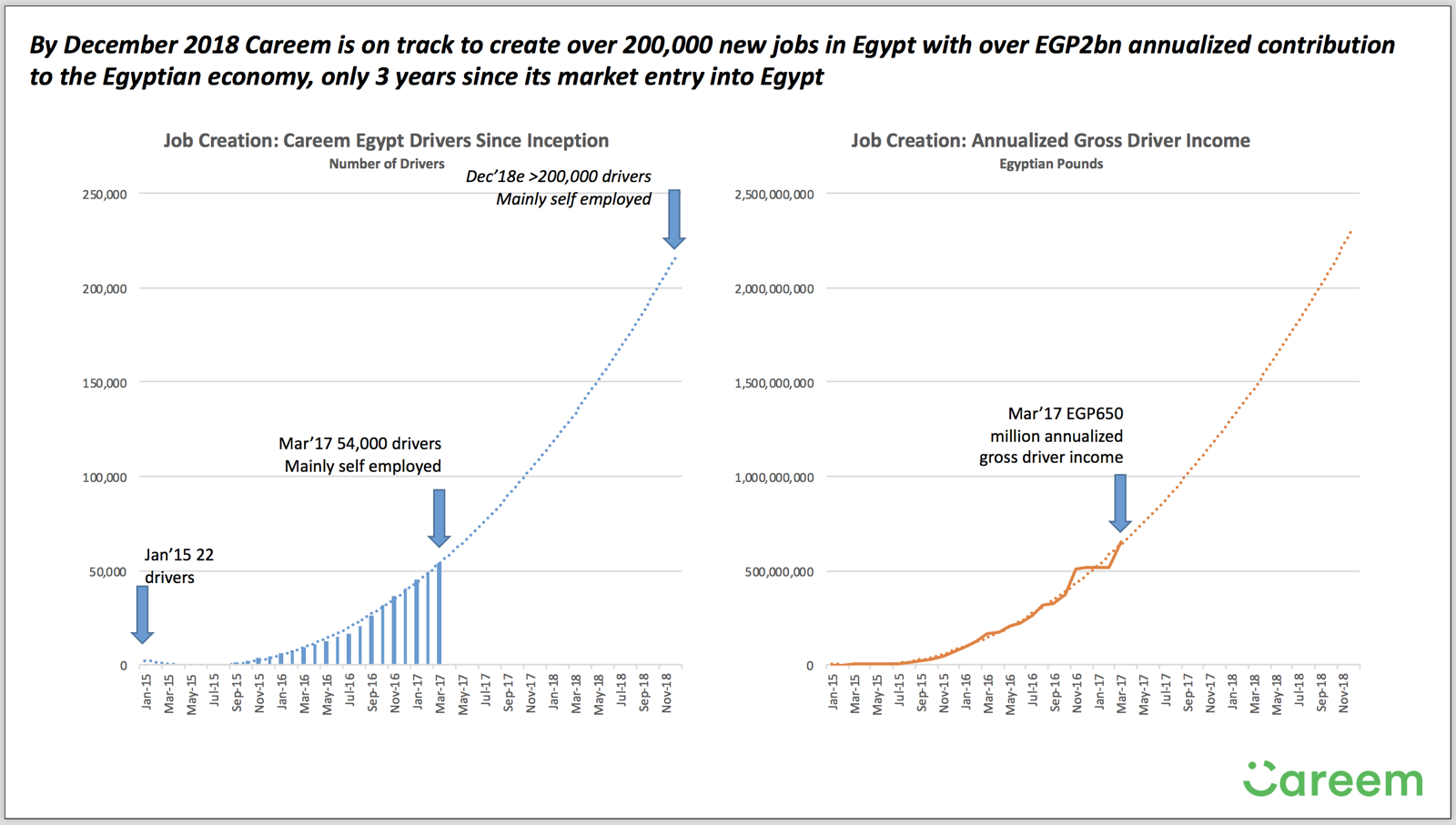

How do you create 200k new jobs in four years? Start a ride-sharing service. Careem is projecting that it will create more than 200k new jobs and EGP 2 bn in annualized gross driver income by the end of next year. As of last month, the company had more than 54k drivers on the road in Egypt with EGP 650 mn in annualized gross driver income, according to a slide from its investor deck. Tap the photo above for a pdf of the slide. H/t Ahmed B.

On The Horizon

Dates for IMF review in Cairo confirmed: An International Monetary Fund delegation will be in Cairo from Monday, 30 April until Thursday, 11 May to assess Egypt’s progress on the economic reforms for which we signed up as a condition of the USD 12 bn extended fund facility, IMF Mission Chief for Egypt Chris Jarvis tells Al Shorouk. Disbursement of the next tranche of the USD 12 bn extended facility fund is contingent on the delegation’s assessment.

Enterprise+: Last Night’s Talk Shows

By far the most talked about issue in the airwaves last night was the House of Representatives’ passing of controversial amendments which would see the President appoint the heads of the judicial authorities.

Judges Club head Mohamed Abdel Mohsen Mansour took to Yahduth Fi Masr to rail against the move and outline the course of action judges will take next, including holding a general assembly of the judges club to issue a unified statement of condemnation on 5 May.

Concerns of the validity of the vote was the focus of Al Hayah Al Youm’s episode last night. 25-30 Coalition member Diaa Dawoud tells host Tamer Amin that a quorum was not there for the vote to pass. He also decried how the vote did not include discussions on the Egyptian Council of State’s objection to the amendments (watch, runtime: 4:22). Deputy head of the Council of State Hassan Badrawi told Amin that ignoring of their report is “unconstitutional” (watch, runtime: 4:09).

House Legislative Committee chair Ahmed Helmy El Sherif argued that Parliament followed constitutional procedure in issuing that law on last night’s Hona Al Asema. “We spent six months studying that law,” he tells host Lamees Al Hadidi, adding that the bill maintains the independence of the judiciary (watch, runtime: 7:05).

Away from the war of words brewing between the House and seemingly the entire judicial branch of government, talking heads looked at President Abdel Fattah El Sisi’s comments from the second day of the Youth Conference in Ismailia (more on those in the Speed Round).

Lamees praised El Sisi’s honesty in discussing the state of inflation in the country. She also agreed with his view that the events of January 2011 were not a solution to the country’s problems (watch, runtime: 5:42).

Over on Kol Youm, Amr Adib urged Egyptians who disagreed with the president to go vote for someone else next year. He called on those who will vote for El Sisi to bear his policies without complaints (watch, runtime: 2:00).

Speed Round

Egyptian assets are Renaissance Capital’s top pick: Egypt is now reaping the rewards of the EGP devaluation, according to Rencap’s Global Chief Economist Charles Robertson. He says the weaker EGP “should spur exports and encourage foreign direct investment over the next few years.” Robertson told Bloomberg “Egypt is one of the most interesting stories in emerging markets right now for any investor anywhere … There is an investment opportunity in Egypt now that’s as good as it was in South Africa when the rand was 16 to the [USD] a year ago.” Speaking on the sidelines of Rencap’s Egypt conference, Robertson said even with the risks in terms of regime change, the cheap EGP makes it already priced-in and if there is a change, what is more likely is that Egypt “becomes a little bit more like a Turkey or a Russia or a Malaysia, where Parliamentary elections do happen, more parties can compete in them, but it’s not full democracy.”

Foreign investors have reportedly grown their holdings of Egyptian treasuriesto EGP 91.8 bn since the EGP float, Al Borsa reports, citing government sources. Foreign investors snapped up EGP 1.4 bn in T-bills in Sunday’s offering alone, the newspaper said on Wednesday. By Bloomberg’s last count (citing the Finance Ministry), the figure was EGP 79 bn as of March, a rate of government borrowing already 11% higher than this year’s target and 18% over budget. The pace of borrowing may have slowed down at Tuesday’s sale, where the government reduced its offering of 5 and 10-year bonds, borrowing EGP 1 bn from an initial target of EGP 1.5 bn, according to Al Borsa.

IPO WATCH- Government officials are in talks with local and international investment banks to advise on the sale on the EGX of stakes in state-run companies, Alaa Shahine and David Westin write for Bloomberg. “Egypt has already hired HSBC and EFG-Hermes to advise on the planned IPO of state-owned lender Banque du Caire, while officials have said the program would also include oil companies,” Shahine and Westin say.

M&A WATCH- Global commodities giant Louis Dreyfus’ local affiliate, Al Mona Misr, has presented a bid to acquire Misr Capital Investment’s 42.96% stake in National Company for Maize Products (NCMP), according to an EGX filing. Al Mona’s bid is non-binding, but, if approved, the company will submit a mandatory tender offer to purchase 100% of NCMP. Archer Daniels Midland (ADM)’s Swiss unit made a rival bid for NCMP last month. Al Mal says Cairo Three A Group is also interested in the company. NCMP produces fructose and glucose syrups as well as starches for the pharma, food, paper and other industries. ADM and Dreyfus are two of the four “ABCD” companies that dominate the global commodities trade, alongside Cargill and Bunge. ADM moved directly into Egypt back in late 2015 when it announced it would acquire a 50% stake in Medsofts; the transaction was completed (pdf) last July.

Donald Trump wants to cut the State Department’s aid budget for Egypt by half: The Trump administration is proposing a 47.4% cut to the US State Department’s Economic Support Fund aid for Egypt, according to State Department documents published by Foreign Policy on Monday (scroll down the page to view the embedded document). The cut would see assistance under the fund fall to USD 75 mn from USD 142.7 mn. The documents are part of an internal budget plan and are part of the administration’s stated goal of cutting more than a third of the total budgets of the State Department and USAID. Jordan would see a 21% cut in aid under the budget plan. The move comes despite the warm reception Trump gave to both President Abdel Fattah El Sisi and Jordan’s King Abdullah earlier this month. The proposals are creating backlash in Congress, with some congressmen warning that the step could undermine alliances with key partners in the region. Trump had previously stated that he would spare Israel from aid cuts and appears to have marginally increased aid to the Palestinian Authority, Syria, Libya and Iraq.

Also yesterday, Trump roiled global markets as he signaled the United States could pull out of the North American Free Trade Agreement and proposed “radical” tax cuts that would see the rate for corporations fall to 15% in what White House officials said was the biggest tax cut in US history.

The big brawl over who gets to appoint the heads of judicial bodies: The House of Representatives had what may its most productive day ever on Wednesday after passing controversial amendments to the judicial code without so much as holding discussions on the Council of State’s objections to the act. The amendments, which would grant the president the right to appoint heads of the judicial committees, have been widely condemned by jurists, who claim the law would curb the independence of the judiciary guaranteed under the constitution. Two-thirds of MPs voted to pass the act, Al Masry Al Youm reports. A number of MPs walked out of the session in opposition to the law, including members of the 25-30 Coalition. Some have called into question the validity of the voting procedures, Al Shorouk reports.

What are these judicial bodies? They are the State Council (Maglis El-Dowla, effectively the nation’s top administrative court), the Court of Cassation (the nation’s top appeals court), and the State Lawsuits Authority and the Administrative Prosecution Authority.

What power does the law grant the presidency? It will allow the president to choose the head of each of the nation’s primary judicial bodies, selecting in each instance from a list of three nominees proposed by each body. “The current judicial authority law stipulates that the heads of judicial bodies are selected based on seniority by their judicial councils, and that the president simply ratifies the council’s selection,” Ahram Online notes.

The judiciary responds: The Judges Club of Egypt has already fired back, announcing it will hold a general assembly on 5 May to “reaffirm the independence of the judiciary” and calling on the Supreme Judicial Council to reaffirm its opposition to the law. The club is also demanding President Abdel Fattah El Sisi veto the law, according to AMAY. The Judges Club (effectively a cross between a union and an industry association for Egypt’s judges) appears to have also issued a veiled threat to the head of the Court of Cassation — the nation’s highest appeals court — demanding he call an assembly of all of the nation’s judges for next Tuesday. The club said it will call for the gathering if he doesn’t and would then move to replace him (a power the club doesn’t enjoy). A petition now circulating calling for the meeting apparently has some 400 judges’ signatures on it.

The House also approved amendments to the Emergency Law that would allow for the indefinite pre-trial detention of those charged on terrorism cases, Al Masry Al Youm reports. MPs also made changes to the criminal code to expedite the prosecution of those charged with terrorism-related offenses, according to the newspaper.

Another controversial bill up for debate was the proposed National Elections Act, as the House Legislative Committee reportedly refused a compromise by the government. The law, which caused the “rumble in the parliament jungle” last month, had been sent back to the House Legislative Committee after MPs failed to agree in a civilized way on whether to approve clauses that mandate judicial supervision of the proposed national elections regulator. The Ismail cabinet had proposed a compromise that would see the role of the judiciary limited to the next ten years, according to Al Shorouk.

The House passed a number of measures related to the economy on Wednesday — none of them had anything to do with the proposed Investment Act, which was supposed to have been approved by the Economic Committee this week. The decisions included:

- Approving a law that would grant the Industrial Development Authority an independent budget (as opposed to tying it to the Trade and Industry Ministry) to give it more flexibility to operate, Al Mal reports.

- Approving a law that would require manufacturers to receive approval from their industry’s division at the Federation of Chambers of Commerce and the Federation of Egyptian Industries before being listed in the Commercial Registry.

- Approving a EUR 68 mn grant from the French Development Agency to supply gas to homes, according to Al Shorouk.

- The House Energy Committee also gave its preliminary approval for establishing a Nuclear Energy Authority which would supervise nuclear facilities.

Inflation will average 21.6% by the end of state’s 2016-17 fiscal year, Prime Minister Sherif Ismail said at a government-run youth conference in Ismailia yesterday. Inflation is running at over 30%, but Ismail sees it dropping by the end of June, Al Masry Al Youm reports. The prime minister sees the average inflation rate falling further still to 15.2% in FY2017-18. He noted that the country’s heavy reliance on imports has played the biggest role in pushing up inflation, according to Al Mal. Egypt’s food exports have risen 25% over the past three months and there are plans in place to increase local production of the foods we import in large quantities, Agriculture Minister Abdel Moneim El Banna said at the conference, Al Mal reports. The prime minister also said that tax revenues account for 15% of Egypt’s GDP, a low figure in comparison to other countries, Al Borsa reports. Ismail said he expects the state to end the current fiscal year with a 10% budget deficit. On a separate note, Ismail said the Health Ministry is studying several scenarios to address rising meds prices, but maintained that the ministry’s decision to hike prices earlier this year was necessary to ensure industry kept producing, the newspaper reports.

Ismail also announced that the new Investment Act should be in place in May, with the government having already “approved a draft for the law in March 2015 with a view to bolstering investor confidence, easing bureaucracy and attracting foreign investments.” The government is aiming for FDI of USD 9.4 bn in FY2016-17. As of last week, the law was stalled in the House Economics Committee amid what appear to be disagreements about semantics.

President Abdel Fattah El Sisi was also focused on the economy and the government’s effort to improve living conditions in his speech at the conference. He pointed to the ballooning population as one of the country’s biggest hurdles, noting that Egypt’s economy must grow 9% per annum to keep up with our annual population growth rate. Acknowledging that times are tough for the average citizen, El Sisi said that the country’s economic progress came to a halt in 1967, as successive governments shied away from taking necessary steps to spur growth. Repeating his previous (and controversial) statement that Egypt is a poor country with scant resources, he said that our economic renaissance will take several years and called on Egyptians to hang in there for one more year. The government is struggling to finance three agricultural projects it launched to provide food at affordable prices, according to El Sisi. He also pointed to the inefficiency of state bodies in implementing the government’s vision on the ground as another culprit for the lack of progress, singling out the 1.5 mn feddans project in specific.

El Sisi said that he respects the judiciary’s conclusion on the Tiran and Sanafir island agreement, and that the House of Representatives also has a role to play in determining the outcome of the case. You can watch his remarks in full here (runtime 27:48).

Health Minister Ahmed Rady denied that the government is looking to have the private sector manage the full-service “Takamol” hospitals, according to Al Mal. Rady’s comments are at odds with a cabinet decision last week to allow the private sector to bid to manage as many as 48 Takamol hospitals. Rady said the goal from having Takamol hospitals nationwide is to improve the provision of healthcare in rural areas, but they have not been completed adequately. He added that the ministry is looking to offer some of the Takamol facilities to charity organizations.

The e-visa program will go live in May for incoming tourists, who will not be allowed to obtain an entry visa on arrival at Egyptian airports, Tourism Minister Yehia Rashed said yesterday in Dubai, according to AMAY. Other reports, however, claim he said the e-visa will go into effect in early June, Al Mal reported. The minister added that foreign residents of the GCC will be granted an entry visa on arrival, and that his ministry has secured preliminary approvals to grant tourists from North African countries their entry visas on arrival as well. Rashed also said his Bahraini counterpart wants more flights on the Manama-Sharm El-Sheikh route to serve the expected increase in incoming tourists from the GCC this summer.

The ministries of agriculture and trade and industry are working new regulations governing agricultural exports, says Abdel Hamid Al-Demerdash, head of the Agriculture Exports Council. He added that these will set new quality control measures for the goods Egypt exports. Al-Demerdash noted in particular the excessive use pesticides in Egypt’s farming, Al Masry Al Youm reports. The move was apparently undertaken to bans on Egyptian produce of the type we saw both last year (see the Egyptian strawberries Hepatitis A scare) and this year (see our report on peppers yesterday). A delegation from the ministries of trade and industry, agriculture and the Agriculture Export Council is visiting the UAE to discuss reversing that country’s ban on Egyptian pepper, Al Borsa reports.

On a related note, food prices in the UAE are expected to surge following the ban on certain fruit and vegetables from five Middle Eastern companies, Caline Malek writes for The National, with the editorial board saying it is a “short pain for a long gain.” The ban is also expected to pose even more problems during Ramadan with the increased consumption of leafy vegetables, almost all of which came from the Middle East.

Dana Gas to keep full proceeds of Egyptian condensates sale as arrears continueto mount: Dana Gas has made its first international sale of Egyptian gas condensate, selling 150K barrels of condensate produced at its El Wastani gas fields in the El Manzala concession in the Nile Delta, for USD 7.2 mn the company said in a statement on Wednesday. It added, however, that arrears are still mounting as the Egyptian government paid only half of what it owed the company in 1Q17. The company said that it expects to sell three additional cargoes over the next 12 months if current production rates are maintained. The company plans to keep all the proceeds of the sales and says total arrears it is owed by the government have grown to USD 289 mn, up from USD 265 mn at the end of last year. "Collections of our overdue receivables in general remain well below our expectations. We are yet to receive a significant payment this year," said CEO Patrick Allman-Ward.

Lebanon’s government prequalified eight new companies for its first round of offshore E&P licences, Reuters reports. The government had already prequalified 46 companies in 2013. Of the new companies, India’s ONGC Videsh, had been prequalified to bid as an operator and the other seven are PJSC Lukoil , Qatar Petroleum, Britain-based New Age African Global Energy, JSC Novatek, Iran’s Petropars, Sonatrach International Petroleum Exploration and SapuraKencana. Prequalified companies will submit their bids to the Lebanese Petroleum Administration in September for consideration. The bidding process for Lebanon’s offshore blocks 1, 4, 8, 9 and 10, three of which border Israeli waters, was postponed for years as Lebanon was forming a government.

EARNINGS WATCH- Emaar Misr recorded a net profit of EGP 437.9 mn in Q1 2017, up from EGP 254.5 mn in Q1 2016, according to a regulatory filing.

Our friend Seif Fikry’s UCITS-compliant Afkar S&P UAE exchange traded fund hit a new volume record yesterday with 1.14 mn share changing hands. UBC was the executing broker and the transaction for clients including retail investors and family offices, Gulf News reports. “It’s a huge day for us. Today’s achievement was a clear example and is a testimony of a perfect environment for ETF’s in the UAE,” Fikry said, noting that he’s now working to bring in a second market maker. The fund is the first ETF in the Emirates launched under new UAE regulations for the industry.

Egypt Holiday Photo of the Day

Today’s Egypt Holiday Photo of the Day is of Ras Sedr. Ras Sedr was originally developed as a base town for one of Egypt’s largest oil refineries, but its beautiful coasts transformed it into a prime resort area. The image was shot for CIB’s 2016 Annual Report (microsite and print edition) by Zeina Abaza at Inktank Communications, which has produced the bank’s annual report for the past eight years.

Image of the Day

Investment and International Cooperation Minister Sahar Nasr was at the Women20 Summit 2017 in Berlin yesterday, alongside Ivanka Trump and US Deputy National Security Advisor Dina Habib Powell. Participants in the summit agreed to establish a new women’s economic empowerment fund — of which Egypt will be a member — to accelerate women’s inclusion in the labor market, according to a ministry statement.

Egypt in the News

“Francis Mania” is still gripping the foreign press: The Pope’s arrival in Cairo tomorrow tops international coverage on Egypt this morning, albeit with very little added substance. AFP gives a rundown of the pontiff’s itinerary once in Cairo for his “high security trip,” which Religion News Services says is nothing new for Francis, who has previously embarked on ‘perilous’ journeys to spread his message of peace. Meanwhile, right-wing news outlet Breitbart belatedly takes note of Francis’ video message and America Magazine’s Gerard O’Connell says that Francis’ “peace mission” is significant in more ways than one, including its “hopes to bring consolation and encouragement to the country’s tiny, hard-pressed Catholic community.” Many are curious to see how Pope Francis will maneuver the “tinderbox situation” created by religious tensions and human rights issues, O’Connell says.

The persecution of Christians is also getting some digital ink in foreign outlets, with an American Catholic Priest in Egypt telling Vatican Radio that “residents in several predominantly Christian villages … are anxious about their future” following the Palm Sunday terror attacks. The Eurasia Review says Egyptian security services’ failure to protect Christians against the spate of violence indicates their tacit approval of the attacks, and few Western leaders have taken solid steps to protect Egypt’s Christians against further violence.

…With the Pope’s visit to Egypt in sight, Francis X Rocca and Dahlia Kholaif write in the WSJ that some Catholics “want the pope to challenge Muslims more vigorously to repudiate religiously inspired violence and intolerance.” In contrast with Pope Francis’ conciliatory note, some are calling for an approach more similar to Pope Benedict’s “tough-love” approach in recognizing “that Islamic scripture and tradition offer justifications for violence, and to distinguish among traditions within Islam that are more or less open to peaceful coexistence with other faiths.” In a piece for Reuters, Philip Pullella quotes Italian historian Roberto de Mattei, who said the Palm Sunday attacks should be "a brusque reality check for Pope Francis” as the perpetrators were "not unbalanced or crazy but bearers of a religious vision that has been combating Christianity since the seventh century.”

There is a blistering feud over who speaks for Islam and how to bring reforms between politicians and Al Azhar, according to the Associated Press’ Hamza Hendawi, Lee Keath, and Mariam Fam. The report says pro-government media is accusing Al Azhar of “failing to modernize its teaching to counter militant thought that breeds jihadi movements and violence.” Hendawi, Keath, and Fam say, “Although it is traditionally touted as the bastion of moderate Islamic thought, it is also conservative in instinct — wary of new ideas and debate, and fixated on maintaining authority. It vehemently condemns militant attacks and denounces extremist thinkers as perverting Islam. But critics say it is plagued by the same sort of literalism and adherence to historic texts of interpretation that radicals thrive on and that feed intolerance and discrimination against women and minorities, including Christians.”

British holidaymakers should travel to Egypt now that its tourism sector is on the mend, Helen Coffey writes for The Independent. The Foreign & Commonwealth Office’s travel warning only applies to North Sinai, and not other highly popular destinations such as Cairo, Alexandria, Luxor, Aswan, and Hurghada, which she says “echoes the message that Egypt’s tourism officials are anxious to get across” that tourist sites are safe. Although the UK’s ban on flights to Sharm El Sheikh remains in place, British vacationers and tour operators are showing signs of being tempted to return. Hurghada is increasingly popular with Brits, the newspaper says. According to Thomas Cook CEO Peter Fankhauser, the travel agency is expecting around 150,000 bookings to Egypt from British travelers this year, but would have to cancel bookings for Sharm El Sheikh if the flight ban is not lifted.

Coverage in the international media worth noting in brief:

- Trump’s soft approach with President El Sisi, which he credits for the release of Aya Hijazi,is being touted by his chief of staff Reince Priebus as part of his “America First Doctrine,” according to Time Magazine. NBC News is noting that Aya Hijazi is crediting Trump for her release from Egypt.

- The Irish government said there is momentum in the trial of 21-year-old Ibrahim Halawa who has been in jail in Egypt for almost four years, Ireland’s Independent reports.

- Sufis are at “loggerheads” with the government because for a number of concerns starting with the state is imposing fees on their celebrations, Sonia Farid writes in Al Arabiya.

- Doctors treating Eman Ahmed in India have shared videos of her to prove she is healthy after her sister alleged she was in delicate health, according to Hindustan Times. Another report suggested she may be shifted from Mumbai to Abu Dhabi.

- Egyptians looking to improve their fitness are increasingly relying on running, and the suburbs on the city’s outskirts are prime locations for their fresh air and well-paved sidewalks, Gulf News’ Ramadan El Sherbini says.

On Deadline

Calls for the sacking of Al Azhar’s Grand Imam Ahmed El Tayeb are unwarranted and based on “directions” from hidden figures, Mansour Aboul Azm writes for Al Ahram. This is not to say that El Tayeb is a saint against whom criticism cannot be leveled, but such criticism must be based on facts and point to specific issues, Aboul Azm says, warning that undermining Al Azhar on the international stage is not in Egypt’s interest.

Worth Watching

The future of food exports from Egypt: Edita boss Hani Berzi (wearing his hat as chairman of the Food Export Council) and Chamber of Food Industries chief Ashraf El Gazayerli sat down with DMC’s Osama Kamal to discuss how Egypt’s food producers can compete on an international scale. The sector sees EGP 250 bn in recurring investments and a similar amount from the informal sector, El Gazayerli says. More should be done to support exports, Berzi says, asking the government to expand its export tax rebate program, saying “Turkey has over 15 rebate programs.” He says Egypt should be exporting more than the USD 2.7 bn worth of food it currently does — “we could double that.” Berzi also reassured consumers that an increase in exports does not mean that the producers will increase food prices domestically.

One issue Kamal’s panel hammered was the negative role often played by the domestic media in “blowing problems with the food sector out of proportion” without sufficient proof or checks, pointing implicitly to the campaign waged against by Heinz Egypt (and echoing what Berzi said in his interview with us in January). This hurts the image of Egyptian products, he says (watch the full interview, runtime 01:23:00).

Diplomacy + Foreign Trade

The Kuwait Investment Authority’s private equity arm plans to invest EGP 1 bn in Egypt and reportedly has appetite for industries including pharma, food and food products, a source tells Al Mal. The investments are part of a bigger package from the Kuwaiti government.

The Central Bank of Egypt is looking to make it easier for Egyptian banks to finance trade with Somalia, and the Ministry of Trade and Industry will send a delegation there next month to “discuss cooperation opportunities.”

Sudan’s journalists union called for the deportation of Egyptian reporters after Egypt denied entry to two Sudanese journalists, Egypt Independent reports. It also called for a ban on Egyptian publications and broadcasters in the country.

Energy

UK’s Rockhopper Exploration starts drilling new exploration well

Rockhopper Exploration started drilling the Al Jahraa SE-2X exploration well on the Abu Sennan Concession, according to Proactive Investors. The company said the well, in which Rockhopper holds a 22% interest and which is being drilled in partnership with Kuwait Energy, could add 20 mn bbl of in-place oil to the project, if it is successful. Drilling and evaluation are expected to be completed within 40 days.

Access Power to build 50 MW power plant with USD 100 mn investments in feed-in tariff 2 program

UAE’s Access Power has reportedly reached financial close on a USD 100 mn, 50 MW power plant under phase two of the feed-in tariff phase two, sources tell Al Borsa.

Basic Materials + Commodities

Fish exports halted due to local shortage

Egypt has stopped exports of fish in the face of a domestic shortage, President Abdel Fattah El Sisi said, Reuters reports. El Sisi says fish exports increased following the EGP float. “We used to export 40,000 tonnes of fish a year. Within the first three months [of this year] we exported 120,000 tonnes,” sending prices higher on the domestic market.

Supply commodities subsidies will reach EGP 70 bn this year -Moselhy

The nation’s subsidy bill will ring in at EGP 70 mn by the end of this fiscal year, up from an original projection of EGP 41 mn due to the import of strategic goods such as wheat, said Supply Minister Aly El Moselhy, Al Mal reports.

Manufacturing

Toyota and Hiflex in talks to build a USD 500 mn power and desalination plant

A consortium including Hassan Allam Sons, Toyota and Hiflex are in talks to build a USD 500 mn power and desalination plant, Al Mal reports.

Health + Education

Health Ministry to allow exports of IV solutions to resume “soon”

The Health Ministry will allow exports of IV solutions to resume “soon” as long as there is sufficient production to cover domestic consumption, an unnamed ministry source tells Al Shorouk. According to the source, domestic consumption hovers around 120 mn bottles per annum, of which United Pharma had produced 50 mn bottles prior to its shuttering in July 2015. United Pharma’s chairman Abdallah Mahfouz says the company ready to reopen its IV solutions factory, and is waiting on the ministry’s approval, according to Al Borsa.

Tourism

Swiss-Belhotel to manage new four-star hotel in the North Coast

Swiss-Belhotel International will manage Belresort Marseilia Beach 4 four-star hotel in Sidi Abdel Rahman Bay in the North Coast, Travel Trade Weekly reports. The 150-key hotel is slated for opening in 2020. “The new addition strengthens the company’s footprint in Egypt, one of its key growth markets, with over 2,296 rooms in development across four hotels,” reads the piece.

Telecoms + ICT

Ericsson celebrates 120 years in Egypt, says it is on the road to offering 5G

Sweden’s Ericsson celebrated its 120th anniversary in Egypt during the week. The company was founded in Egypt in 1897 when the country’s first telephone exchange system was established, connecting Cairo to Alexandria for the first time. It now says it is on the road to 5G after providing some of the first GSM networks as well as 3G and 4G.

Banking + Finance

United Bank studying setting up EGP 50 mn leasing arm

United Bank is studying setting up a EGP 50 mn leasing arm with an unnamed Saudi institution that will take a 10% stake in the company, United Bank Chairman Ashraf El Kady said yesterday, according to Al Mal reports.

Other Business News of Note

Catalyst Partners wins CFI’s 2017 award for Best SME Growth Investment Partner – MENA

Catalyst Partners won Capital Finance International’s 2017 award for Best SME Growth Investment Partner – MENA. Catalyst Partners completed a successful Initial Public Offering for MB Engineering on the Nilex exchange in 2016, which was 29.5x covered. In 2017, the company established Catalyst Leasing and Roznamgy, an online platform that matches SME loan applicants and financial institutions.

On Your Way Out

A fire broke out in a shop on Moez Street in Fatimid Cairo, with no Islamic monuments affected, says the head of the Islamic and Coptic Antiquities Sector, Ahram Online reports.

Egypt was ranked 161 out of 180 in Reporters Without Borders’ 2017 World Press Freedom Index, dropping two positions from last year’s ranking. Egypt has detained as many as 24 journalists and has entered the index “black zone,” North American director for Reporters Without Borders Delphine Halgand said during a conversation with the Washington Post on the index.

The markets yesterday

EGP / USD CBE market average: Buy 18.0388 | Sell 18.1418

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Wednesday): 12,671 (+0.7%)

Turnover: EGP 1.0 bn (9% BELOW the 90-day average)

EGX 30 year-to-date: +2.6%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.7%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were: Orascom Construction up 5.3%, Global Telecom up 4.2%, and SODIC up 3.4%. Yesterday’s worst performing stocks were: Telecom Egypt down 1.7%, CIB down 0.4%, and Egyptian Iron & Steel down 0.2%. The market turnover was EGP 1.0 billion, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +144.4 mn

Regional: Net Short | EGP -91.9 mn

Domestic: Net Short | EGP -52.5 mn

Retail: 53.1% of total trades | 50.5% of buyers | 55.6% of sellers

Institutions: 46.9% of total trades | 49.5% of buyers | 44.4% of sellers

Foreign: 29.8% of total | 37.0% of buyers | 22.6% of sellers

Regional: 10.6% of total | 6.0% of buyers | 15.2% of sellers

Domestic: 59.6% of total | 57.0% of buyers | 62.2% of sellers

WTI: USD 49.38 (-0.48%)

Brent: USD 51.63 (-0.37%)

Natural Gas (Nymex, futures prices) USD 3.26 MMBtu, (-0.43%, Jun 2017 contract)

Gold: USD 1,269.70 / troy ounce (+0.44%)

TASI: 6,917.0 (0.0%) (YTD: -4.1%)

ADX: 4,541.0 (-0.5%) (YTD: -0.1%)

DFM: 3,438.8 (+0.1%) (YTD: -2.6%)

KSE Weighted Index: 405.9 (+0.2%) (YTD: +6.8%)

QE: 10,205.6 (+0.5%) (YTD: -2.2%)

MSM: 5,510.2 (+0.8%) (YTD: -4.7%)

BB: 1,334.0 (-0.2%) (YTD: +9.3%)

Calendar

26-27 April (Wednesday-Thursday): Corporate Governance Case Study Workshops by the Egyptian Private Equity Association and IFC.

27 April (Thursday): Shalakany law firm’s VAT & the New Taxation Landscape conference, Nile Ritz Carlton, Cairo.

28-29 April (Friday-Saturday): Pope Francis visits Cairo.

30 April – 11 May (Friday-Monday): IMF delegation visit to Egypt to assess economic reforms.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

05-07 May (Friday-Sunday): Egypt Property Show, DWTC, Dubai.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

10-12 May (Wednesday-Friday) The 15th Middle East & North Africa International Franchise Exhibition, AUC Downtown Greek Campus, Cairo.

14-16 May (Sunday-Tuesday) CI Capital’s fifth annual Egypt Investor Conference, Gouna.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.