- VAT executive regulations are at hand as Finance Minister signs off on them (Speed Round)

- Protests break out across Egypt following El Moselhy’s cuts to bread point system (Speed Round)

- Last vestiges of brotherly love between Egypt and Saudi (electricity grid connection) postponed? (Speed Round)

- Is Egypt’s euphoria with malls coming at a bad time? (Speed Round)

- Amendments to Importers Registry approved (Legislation + Policy)

- Sorry Sawiris. But the role of Egypt’s big business will move away from politics (Worth Reading)

- “Messi is a moron,” according to Zahy Hawas’ professional opinion (Egypt in the News)

- By the Numbers — []

Wednesday, 8 March 2017

VAT regs are at hand

TL;DR

What We’re Tracking Today

Travel trade show ITB Berlin kicks off today and will go on until Sunday. The Egyptian delegation there is expected to hold a press conference at 3:30pm local time. Tourism Minister Yehia Rashed told Reuters on the eve of the conference that he expects the number of tourists visiting Egypt this year could come close to levels seen before its 2011 uprising, encouraged by investments in airport security and a cheaper EGP. He said that arrivals during the first two months of 2017 were "very, very good,” adding that receipts were also improving as visitors spent more and stayed longer on average. The data appears to back him up, as German market researcher GfK said last week that German holidaymakers’ bookings for trips to Egypt in the upcoming summer season were up 91% from last year, but were still 23% below pre-uprising levels. We also noted yesterday that Chinese tourists are staying longer, with overnight stays in Egypt increasing 158% year-on-year in January 2017. Egypt, however, continues to bank on Russian tourists arrival, as they made up 40% of tourists in 2015.

On a related note, Egypt was also named ‘Best Holiday Destination’ in 2017 by the Pacific Area Travel Writers’ Association, according to Al Shorouk. Rashed should be receiving the award during a ceremony in Berlin today.

Back to the Eastern front, an unnamed Russian foreign ministry official told Youm7 that an agreement on restoring Russian flights and airport security will come in May when the Egyptian-Russian Joint Committee meets. He added that there are no real impediments to Russian tourists coming back at this point. While normally we would take this with a grain of salt, the timing of the agreement coincides with other agreements expected to take place. Officials from the Electricity Ministry estimate that the USD 29 bn Daba’a nuclear power plant agreement will be signed in mid-2017. May is also when the Russians will sign for the Russian Industrial Zone.

A World Bank Group (WBG) delegation headed by Director of Trade and Competitiveness Global Practice Klaus Tilmes is reportedly in town and discussed the economic reform agenda with Trade and Industry Minister Tarek Kabil on Tuesday, Al Ahram reports. Discussions focused on the ministry’s strategy to support and grow industry by providing incentives and cutting red tape. It is unclear as of yet whether this is THE World Bank which is expected to evaluate the reform agenda and resume talks on funding, or whether this delegation will solely be focused on trade and industry policy. Both Kabil and Investment and International Cooperation Minister Sahar Nasr have been engaged in talks over funding (on top of the second tranche of the USD 3 bn facility which has yet to arrive) during the past few months.

Also starting today is the fifth “India by the Nile” cultural festival, which will be held in Cairo, Giza, Alexandria, Port Said, and Ismailia until 27 April. The festival is described as “a celebration of the essence of India through classical music, dance, theatre, visual art, film, food and sports in a medium which perfectly amalgamates the contemporary with the classic.” Super star Amitabh Bachchan will also be in town this month and will be the guest of honor of Luxor’s 6th African Film Festival, the Indian ambassador said in a press conference.

Today is International Women’s Day, so let’s all take a moment today to celebrate women for their achievements and the strides they have taken over the years. Today’s Google Doodle has a few ideas to get the thinking ball rolling. Pharos Holding is also celebrating women in its own special way by canceling brokerage fees for women investors’ trades on the stock market for a week, starting from today, according to Al Mal. The award for unintentional sexism goes to Al Masry Youm, with its “pretty in pink” themed edition.

What We’re Tracking This Week

Both the FABEX Middle East 2017 and the second Egypt Projects Summit will take place on Thursday at Cairo International Convention & Exhibition Center and run through to the weekend.

On The Horizon

The House of Representatives will be voting on the State Contractors Act in a plenary session next Monday. The legislation will compensate suppliers and contractors for FX losses incurred after the EGP float and has been in the works since December.

On the legislative agenda as well: The Natural Gas Act, which will be voted on by the House general assembly at the end of March.

Enterprise+: Last Night’s Talk Shows

Supply Minister Ali El Moselhy’s recent changes to the bread subsidy system and subsequent protests were the talk of the town last night (more in the Speed Round), receiving sharp criticism from Kol Youm’s Amr Adib, who said that the decision did not take people’s needs into account or factor in the harshness of current economic conditions on the average citizen. “Bread is all that people have now,” he said (watch, runtime 2:19).

El Moselhy defended his decision in an interview with Yahduth fi Masr’s Sherif Amer, explaining that the golden card was meant to be employed in exceptional cases. El Moselhy said he had discovered serious fraud and that the system needed to be tightly monitored.

El Moselhy repeated his statements to DMC’s Osama Kamal, who also hosted the minister for the evening. “I’ve been in this job for two weeks and I decided to tackle this casefile because it wastes a lot of money” (watch, runtime 5:00). He also told Kamal that he would never enforce any major changes to the subsidy system without first consulting with the people through the House of Representatives and industry groups and members (watch, runtime 4:13).

Meanwhile on Hona Al Assema, Lamees El Hadidy jumped on the grandstanding bandwagon and criticized the government for not giving people prior notice, but advised everyone — after reassuring them that their bread rations remain unchanged — to not be so quick to join the rumor mill (watch, runtime 57:32). MP Anisa Hassoussa, who phoned into the show, concurred, saying that El Moselhy’s press conference should have been held before the decision was made official (watch, runtime 2:46).

The host also spoke to the head of the bakeries division in Alexandria, Abdel Aal Darwish, who told her that 75% of subsidy beneficiaries in the city are not smart card holders. “We were hoping that the Supply Minister was going to give people smart cards first before enforcing this new decision,” he said. MP Ali El Kayal told Lamees that El Moselhy’s undersecretary confirmed that some 54,800 smart cards will be handed to people in Minya within 48 hours, and that other governorates would also follow suit (watch, runtime 4:42).

Speed Round

VAT executive regulations are at hand: Finance Minister Amr El Garhy signed off on the executive regulations for the value-added tax (VAT) last night, top government officials tell Al Borsa. El Garhy had told President Abdel Fattah El Sisi in a Tuesday meeting that the regulations would be official “in a few days’ time” and had been amended to incorporate some of the opinions of Egypt’s business community and a number of recommendations by the Egyptian Council of State (Maglis Al Dawla) from last week. The Maglis had proposed around 30 amendments to the draft regulations that state officials said would not all be accommodated. We’ll be on the lookout for a copy of the executive regulations for the value-added tax in the pages of the official gazette over the next few days, but you can tap here for a refresher on the regs.

The drop in the FX rate is accelerating, Ihab Farouk writes for Reuters’ Arabic service. Demand for USD has been increasing given the anticipated Fed rate hike as well as seasonal demand in preparation for Ramadan. Beltone Financial’s Hany Genena says all currencies are losing ground to the USD in anticipation of the rate increase and what is happening now shows that the central bank is not intervening directly in the market. There is an uptick in clients’ activities to withdraw USD from their accounts, bankers told Reuters.

… In the market between banks, however, there was a lack of activity: The interbank market has stagnated this month “after the flurry of activity in February caused by an influx of foreign inflows died down,” Asma Alsharif writes for Reuters. "There was a snowball effect which started after the sale of the Eurobonds … The funds came in and the [USD] price started declining and people started to panic and sell their [USD]," one banker said, and this drove the price of USD down. “The market is fragile and not very deep so if [USD 200-300 mn] enters the market at once they can make a difference,” the banker explains “foreign investors did not leave but no new inflows came in either and the market stopped for a bit at that level … In the third week of Feb things started slowing down. Currently there is no supply and the interbank market is stagnant.” Banks will need to raise their USD rates in order to attract more liquidity into the banking system again, another banker noted.

A wave of protests broke out in Alexandria, Kafr El Sheikh, Minya, Assiut, Giza, and Fayoum yesterday in opposition to Supply Minister Ali El Moselhy’s decision last week to cut down on the number of subsidized loaves of bread bakeries can sell per day through the golden card system to 500 from 3,000, Al Mal reports. Police moved to disperse the protests in Alexandria, where demonstrators cut off the tramway and blocked roads.

For the unacquainted with the complexities of the bread subsidies system, some background: Egyptians eligible for bread subsidies who travel for work in a different governorate than where they reside officially are issued temporary cards that allow them to obtain subsidized bread from bakeries. These bakeries are issued golden cards that track the distribution of bread to temporary card holders. It is these temporary card holders causing all the fuss.

El Moselhy appeared to backtrack on the decision, announcing in a press conference that the cap will be lifted only in Alexandria and Giza — the two most affected governorates by the cap. Despite reassuring temporary card holders that they would receive their allotted five loaves, El Moselhy defended the caps, saying that the entire golden card system needed to be reformed. The system had made it hard to monitor distribution of bread and left the program vulnerable to fraud. The caps, he added, were necessary to “right a wrong” and ensure subsidies were not squandered. You can view the whole press conference here (watch, runtime 36:53).

It is hard to tell what impact these protests will have over El Moselhy’s move to reform the bread subsidies system as a whole, which he says is self-defeating and has been costing the state an additional EGP 500 mn per month. He has been considering cutting the daily allotment of subsidies bread to three loaves from five.

“No political reasons for postponement”: The Egyptian Electricity Holding Company said it is postponing ruling on bids to the financial and technical tender for the Egypt-Saudi Arabia electricity interconnection project to mid-April, according to Daily News Egypt. Sources said “the delay is not due to strained political relations between Egypt and Saudi Arabia, but the desire of both parties to complete the project in the best way possible.” The tender for the Medina-Tabuk substations will be posted by Saudi Arabia on 16 April and the tender for the Badr-Nabq lines in Egypt will be announced on 19 April. The tenders involve connecting 450 km of lines between the Badr City power station to the Nabq City switch station, from which 850 km in lines will be extended to east of the Medina power station, passing through the Tabuk station. Alstom, ABB, and Siemens have all applied for the tender, Daily News Egypt notes. The results of the tender were pushed back before in January.

Meanwhile, negotiations with Singapore’s PSA International over platform management at the East Port Said port ended after the latter insisted on being given rights to manage all platforms for 10 years, Youm7 reports. Suez Canal Authority chief Mohab Mamish said his team is currently studying seven other management offers, including one from China’s COSCO Shipping Lines. The Suez Canal Economic Zone had been in talks with PSA over building and operating a container terminal in East Port Said since last month.

EFG Hermes topped February 2017 brokerage league table for main market transactions, with a 19.56% market share, followed by Pharos Securities (11.69%), CI Capital (8.65%), Beltone Securities Brokerage (4.87%), and Pioneers Securities (3.78%).

A group of auto distributors is reportedly refusing to receive their March car shipments from agents due to the slump in sales they have been experiencing since the EGP float, Al Mal reports. Recent discounts that ranged from EGP 18k-51k for some brands were unable to reverse the downtrend in auto sales that began in November and carried through in the first quarter of 2017. GB Auto, Nissan Egypt, and Kia Motors were among those who announced price reductions.

Is Egypt’s euphoria with malls coming at a bad time? Mega malls opening in Egypt are coming at a bad time as high inflation slows down spending, argues Hossam Abougabal in a Middle East business intelligence piece. Abougabal writes that “living costs have increased drastically since November 2016, with the outlook for retail in the 2017 looking uncertain as prices continue to rise.” He cites Majid Al Futtaim’s (MAF) newly opened Mall of Egypt, its Almaza City Centre Mall which is due to open in 2019, Capital Mall which is launching at the end of 2017, and Madinaty Mega Mall, which is slated to open in early 2018. “Future supply is safe as Egypt’s economy looks to improve in the coming years. The shock of increased living costs will stabilise as incomes inevitably increase,” according to Abougabal. Opportunity lies in developing local brands, he says.

A court has issued an arrest warrant for steel magnate Ahmed Ezz in the case regarding obtaining a steel production license, Reuters’ Arabic service noted. The case was adjourned until 4 April. An arrest order was also issued for former Industrial Development Authority Chairman Amr Assal, a co-defendant in the case. According to lawyer Mohamed Hammouda, the court’s decision was procedural and came after the two defendants’ lawyers requested to postpone the plea hearing several times, Al Masry Al Youm reports.

A photo purportedly showing CBE Governor Tarek Amer and former investor minister Dalia Khorshid getting married has leaked, courtesy of Youm7. The photo appears to confirm rumors that have been circulating in low-tier newspapers for several months that the two married in secret. It remains unclear when the photo was taken.

***

COME WORK WITH US. We’re looking for bright, talented writers and analysts to join our team to work on the current Enterprise Morning Edition and new products we have in the pipeline. You’re likely an equities / macro / research analyst, IR professional or journalist, but we’re less interested in your formal education than we are in amazing writing and storytelling skills, intellectual curiosity, fluency with numbers and passion for business / finance / economics / politics. Bilingual candidates preferred (English-Arabic). A sense of humor is a must, as is healthy skepticism. We prefer Egyptian nationals, but can sponsor work permits for particularly talented foreign applicants. Want to get the conversation started? Send a great cover letter and an updated CV to editorial@enterprise.press. Bonus points for not starting your cover letter with “Dears.”

***

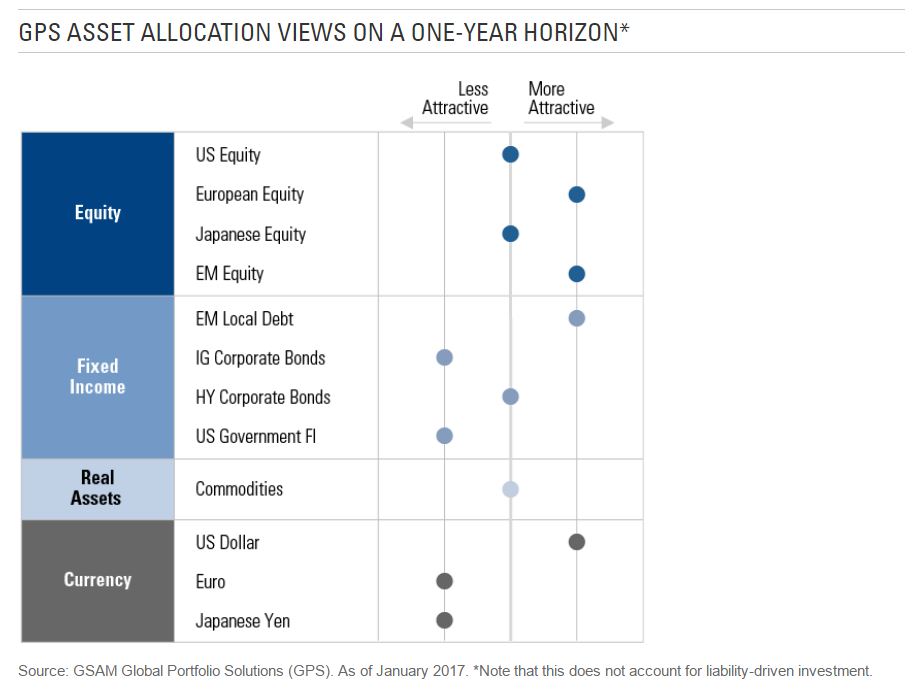

The Macro Picture

Goldman Sachs Asset Management’s Global Portfolio Solutions (GPS) Co-CIO Neill Nuttall thinks 2017 will have a steady but broader global growth. Nuttall says he does not expect global growth to be much higher this year, “but we see positive contributions from more countries. We are focusing particularly on emerging markets among this broadening base, notwithstanding trade dynamics, which will have individual winners and losers. We think a potential rewidening of growth rates between emerging- and developed markets, plus depressed sentiment and valuations and improved external balances, are supportive for our current overweight to emerging market equities. The main counterbalancing risk is China, where very high and rising debt levels increase the chances of a policy error or hard landing that could have a material impact on global growth. However our analysis suggests the real estate market is in reasonable health and, even allowing for the growth in shadow financing, non-performing loans are unlikely to reach a scale to threaten the broader Chinese economy.” GPS’ asset allocation for 2017 sees emerging marketing equities and local debt, European equity, and the USD as more attractive investments and is less bullish on US government fixed income, the EUR, and JPY. Nuttall says that while policy uncertainty and increasing populism pose risks across global markets, they are not necessarily a threat to global growth.

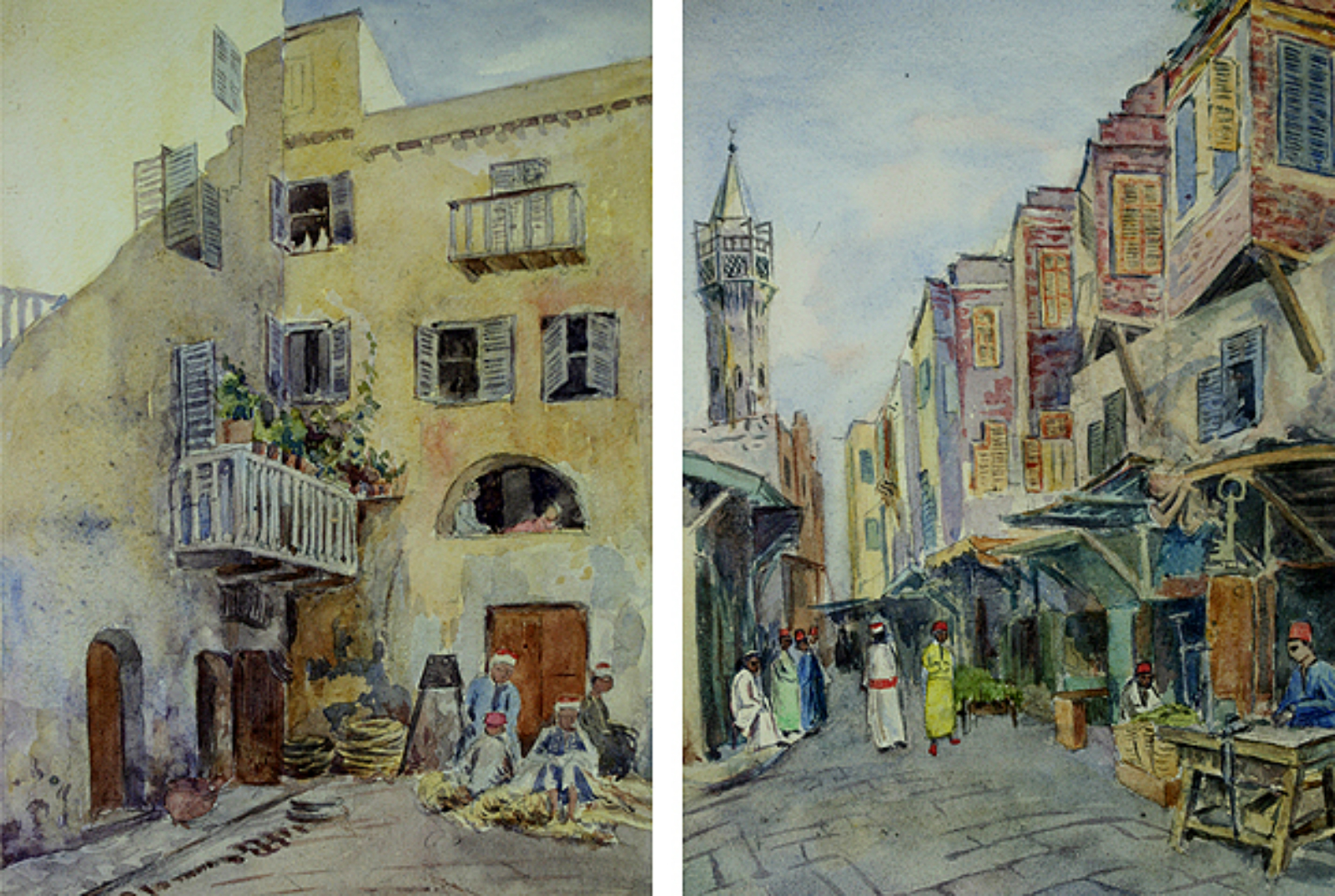

Image of the Day

A British soldier hailing from Plymouth documented his time in Egypt during World War I through a collection of bright watercolor paintings, which were unearthed along with his diary from the war. Wilfred Owen Reynolds first arrived in Alexandria in 1915, and seems to have stayed in Egypt well into 1918, Jon Bailey writes for the Plymouth Herald. “In one [journal] entry he talks about the highly-coloured wares for sale, men wearing fez hats, veiled women skillfully carrying heavy loads on their heads and people engaged in crafts on the pavements outside their shops … in other entries he also describes the heat [and] the donkeys.” Sounds about right.

Egypt in the News

In a day of slow news coverage on Egypt in the international press, we found ourselves bawling with laughter at this gem:

Lionel Messi is a “moron,” Zahi Hawass, who showed the footballer around the pyramids, said. “I don’t think he was at all interested. I didn’t see any interest in his face in what I was telling him,” he said. Egypt’s patron saint of tour guides contrasted Messi’s visit to Will Smith’s, saying Smith is “an intellectual … He reads and asks questions all the time.” Hawas later apologized to Messi, saying his comments were misconstrued and that the Argentine speaking Spanish only was probably why there was not a clear communication line between the two, according to Al Mal. Instead, Hawas berated the translator.

Print press could be dying in Egypt: “The transformation print press in Egypt has undergone in the past few years is too radical to go unnoticed and too ominous to be overlooked,” Sonia Farid writes in Al Arabiya. She notes that Egyptian households have substituted buying around three newspapers each day, “two official and one independent, to not buying any or keeping one official, usually for the obituaries.” Journalist Ahmed El Samani argues that Egyptian newspapers need a “Washington Post revolution” to survive. He says WaPo changed by developing “its website so that it becomes the primary source of information with the majority of journalists working there instead of the paper publication … Some of the content of the electronic newspaper is then chosen to be included in the print issue.”

Egypt is preparing to tackle the “black cloud” smog, Mariam Rizk writes for BBC. The smog, which comes from burning rice straw, spread rapidly and now it accounts for 42% of the country’s air pollution, according to the Environment Ministry. The ministry is tackling it by striking an agreement with a local company to use rice straw in cement production as well as using the waste and recycling it into fertilizer and fodder. Other “creative” solutions are yet to be picked up, Rizk notes, citing an attempt by an Egyptian engineer to use the gases coming out of burning the rice straw “to produce biodiesel, fertilisers, vitamin B and hydropower.”

Other coverage worth noting in brief:

- The plight of Christians continues to make the rounds in the foreign press this morning with Fox News being late to the game, while Anadolu thinks it is adding context by running comparative census on the different Christian religious sects in Egypt.

- Anadolu is also running a piece on allegations that former president Mohamed Morsi’s son Osama is being abused in Al Aqrab prison.

- “No, Egyptians do not live in pyramids,” one person had to explain to the Daily Mail as part of their piece on dispelling “baffling misconceptions” about countries.

On Deadline

Egypt should not be moving to increase but reduce its entry visa fees to remain in the ring with competing destinations, which include Turkey, Tunisia, Greece, and Morocco, among others, Mostafa El Naggar writes in his latest column for Al Masry Al Youm. El Naggar cites the results of a study which concludes that reduced visa fees are a prime factor in attracting tourists. The study finds that the higher visa fees currently being considered by the government would only reduce Egypt’s share of the holiday market and deter vacationers — who are usually mid-income budget travelers or groups and families.

Worth Reading

Big business in Egypt has been excluded from politics post-2011 but will now focus on the country’s economic revival, Amr Adly writes in a research paper for the Carnegie Middle East Center. Adly says “businessmen who were influential under the Mubarak regime have seen a reduction in their political role and their ability to influence and implement policies.” He believes “big business” would in the coming years “limit the focus of its policy activism and influence to corporate institutions—whether business associations or chambers of commerce and industry—instead of aiming to occupy executive or parliamentary posts… Large enterprises will become less reliant on political connections to secure profits, market shares, and rent; these enterprises’ growing transnationalization will allow them to be shielded from upheavals at home; and influential businessmen will begin exploiting their enterprises’ impact on economic revival. As all of these developments take place, the role of large enterprises will likely expand further.” Adly concludes his arguments by saying that “a more balanced relationship between enterprises and the state would benefit both, inducing them to develop institutional avenues of mutual cooperation. The Egyptian economy can only gain as a consequence.”

Worth Watching

One of our heroes now is Captain Nevin Darwish. Darwish is a pilot at Emirates and is the first woman of Arab origin to have captained the Airbus A380. Emirates celebrated International Women’s Day by recording the A380’s flight from Dubai to Vienna and back with Darwish captaining the flight and assisted by UAE national Alia Al Muhairi, a First Officer who is currently the youngest Emirati female pilot operating the Emirates A380 aircraft (runtime 02:00).

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry appears to have made headway in setting a strategic partnership framework between Egypt and the EU for the next three years, according to a statement by the Foreign Ministry which hailed the move as a new phase in strategic ties. Both sides presented their list of priorities which will be carried into future negotiations. The previous EU-Egypt Partnership framework which expired last year had set poverty alleviation and improving the business environment as priorities for aid with Egypt. We can only speculate that the new provisions might include aid to refugees, as the EU and Egypt attempt to reach an agreement which would see Egypt host asylum seekers. Urgency for the agreement could see new light considering a decision by the Luxembourg-based European Court of Justice to allow states the right to deny visas to refugees.

Meanwhile, Italy said it has no objections to Egypt’s strategic partnership agreement with the EU and harbors no animosity towards it over the death of Italian grad student Giulio Regeni last year, Italian Foreign Minister Angelino Alfano told satellite channel DMC on Tuesday night (watch, runtime 0:54). He confirmed, however, that Italy will continue to “seek the truth” about Regeni’s death.

UN Assistant Secretary-General Mourad Wahba concluded a three-day visit to Egypt where he “discussed support to Egypt’s development agenda and regional cooperation,” according to a UNDP release. Wahba discussed “sustainable development and the launch of mega projects in addition to progress on women’s agenda” with Foreign Affairs Minister Sameh Shoukry, among others.

Spanish trade delegation eyes investments in mining, transport and construction: Members of the 25-company Spanish delegation have been looking into investments in mining in the Golden Triangle, construction of the New Capital, and a high-speed train between Cairo and Aswan, the Latin American Herald Tribune reports.

Energy

ExxonMobil, Qatar Petroleum, Eni, Total successfully bid on offshore concessions in Cyprus

ExxonMobil, Qatar Petroleum, Eni, and Total have successfully bid for rights to explore for oil and gas off the coast of Cyprus as part of a third licensing round to be approved by the cabinet on March 17, Cyprus trade minister George Lakkotrypis told reporters on Tuesday. Eni and Total jointly negotiated a license for a block off the island’s south coast while Eni secured another on its own. ExxonMobil and Qatar Petroleum successfully bid for a third, Cyprus’ Expatica reports. Cyprus and Egypt are looking into the possibility of transferring gas from the Aphrodite field to Egypt via an undersea pipeline. Cyprus hopes to begin exporting gas, and possibly oil, by 2022.

Elsewedy in talks for Benban solar power plant loan, transformer stations

Elsewedy Electric is in talks with financial institutions for a loan to fund its 50 MW solar power plant project in Benban as part of the feed-in tariff (FiT) program, according to a bourse filing. Elsewedy has also confirmed it is in negotiations for a USD 75 mn loan to finance the project and moving forward as planned in 2016. On a related note, Separately, Elsewedy and Siemens are in negotiations with the Egyptian Electricity Transmission Company (EETC) to build two 500kV transformer stations at a cost of EGP 2.2 bn in Gharbeia and Beheira, Elsewedy said in a bourse filing.

FAS Energy, Infinite, Elf are the companies that qualified for FiT phase one

Law firm Riad & Riad says FAS Energy, Infinite, and Elf are the three companies that made the cut for the first phase of feed-in tariff (FiT) program, which we reported on last week. The six developers who did not qualify for first phase projects have been moved to the second, which comes with solar projects with capacities between 20-50 MW and a different financing structure. Riad & Riad is the legal advisor for FAS Energy. On a related note, the Egyptian Electricity Transmission Company formalized cost increases under the FiT cost-sharing agreement which we noted last month, raising it to EGP 955k per MW from EGP 583k per MW. Installments and payment schedule will be circulated by EETC soon and developers will be required to sign on the cost-sharing agreement amendments then, Riad & Riad said.

Basic Materials + Commodities

Egypt wheat shipments from Russia, Argentina

Two Russian wheat cargoes and one Argentinian cargo destined for Egypt were rejected at their ports of origin on quality concerns, traders told Reuters. The cargoes were purchased by state grain buyer General Authority for Supply Commodities (GASC) recently, but the nature of the quality concerns were not described. “The companies responsible for the cargoes are expected to replace the shipments,” Reuters says.

FLSmidth receives cement plant order from Elsewedy

Danish engineering company FLSmidth says it was awarded an order from El Sewedy Cement Company for engineering, procurement, and supply of equipment for the expansion of a cement production line in Suez. The order is for a complete range of equipment, FLSMidth says, including a mill and rotary kiln that would be the first of their kind to be installed in Egypt. "This order reflects the strong relations we have had with one of the biggest industry groups in Egypt for almost a decade,” said FLSmidth’s cement division Executive VP Per Mejnert Kristensen.

Al Khaleej Sugar interested in establishing factory in Egypt

Al Khaleej Sugar expressed interest in establishing a factory in Egypt with an annual production capacity of 450K tonnes, according to an Investment and International Cooperation Ministry statement. The announcement follows a visit by Minister Sahar Nasr to the company’s factory in the UAE port of Jebel Ali. Nasr also met with executives from Abu Dhabi Investment Authority (ADIA), Deutsche Bank, Waha Capital, NBK Capital, Franklin Templeton Investments, Schroders, at EFG Hermes’ One on One Conference in Dubai.

Tourism

Luxor plans to reduce dependence on tourism

“Neglect” by the government in promoting tourism destinations in Luxor is forcing the governorate to diversify outside the tourism sector, write Keiichi Honma and Yomiuri Shimbun for the Japan News. Luxor Governor Mohammed Badr tells them that Luxor will move away from a reliance on tourism as it is too unreliable and prone to shocks, the latest being the Metrojet crash of 2015. Badr’s statements jive with the government’s economic plans for the area, which has designated investment and development projects for it.

Telecoms + ICT

Orange Egypt deploys Oscilloquartz technology ahead of 4G

Orange Egypt deployed Adva Oscilloquartz’s OSA 5421 technology — a precision timing protocol that synchronizes and distributes accurate timing required for LTE networks — necessary for the rollout of 4G services, Telecompaper reports.

Silicon Waha, Finland’s NxtVn sign MoU to establish joint stock company to invest EUR 40 mn over 4 years

Silicon Waha signed an MoU with Finnish technology company NxtVn to set up a company to develop data centers with investments of EUR 40 mn over four years, according to an ICT ministry statement. The agreement also included the establishment of a data center complex spanning 60k sqm in Borg El Arab. Meanwhile, officials from Panasonic meeting with ICT Minister Yasser El Kady yesterday said the company is willing to share its expertise with local electronics companies, in addition to providing trainings to support Egypt’s electronics manufacturing industry, Al Masry Al Youm reports.

Legislation + Policy

Amendments to Importers Registry Act pass

Amendments to the Importers Registry Act that would allow foreigners to hold a stake in an import company have officially been issued on Tuesday. According to our friends at Riad & Riad Law Firm, the amendments remove provisions prohibiting registered importers from entering into arrangements with non-Egyptians to import on their behalf. As we have previously noted, the changes also include increasing the minimum capital for individuals to be registered to EGP 500k from EGP 10k, for limited liability companies to EGP 2 mn from EGP 15k, and for joint-stock companies to EGP 5 mn. The law also imposes stricter penalties for violation of import regulations, including imprisonment for up to one year and fines of up to EGP 1 mn. The amendments — which were first announced back in January of last year — had been met with significant opposition from Egyptian importers, who are particularly loathful of having to compete with foreigners.

On Your Way Out

Egyptian athlete Manal Rostom is one of several Arab women Nike has enlisted to test-wear garments from its upcoming Pro-Hijab sportswear line, which is set to hit stores in Spring 2018, writes Al Arabiya’s Ismaeel Naar. The new line is in response to veiled women athletes’ complaints that finding veils that fulfil religious obligations, while also being practical and comfortable for sports, is challenging. “We live in the hottest countries in the world so covering the neck area specifically is always going to be a challenge,” says Rostom.

The markets yesterday

EGP / USD CBE market average: Buy 17.4053 | Sell 17.5109

EGP / USD at CIB: Buy 17.4 | Sell 17.5

EGP / USD at NBE: Buy 17.35 | Sell 17.45

EGX30 (Tuesday): 12,678 (+0.4%)

Turnover: EGP 1.6 bn (272% above the 90-day average)

EGX 30 year-to-date: +2.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.4%. CIB, the index heaviest constituent declined by 2.6%. The EGX30’s top performing constituents were: Elsewedy Electric up 3.6%, Sidi Kerir Petrochemicals up 2.4%, and Egyptian Iron and Steel up 2.2%. Yesterday’s worst performing stocks included Domty down 5.6%, Porto Group down 3.9%, and ACC down 3.5%. The market turnover was EGP1.6 billion, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +45.8 mn

Regional: Net Short | EGP -17.6 mn

Domestic: Net Short | EGP -28.2 mn

Retail: 69.9% of total trades | 69.5% of buyers | 70.3% of sellers

Institutions: 30.1% of total trades | 30.5% of buyers | 29.7% of sellers

Foreign: 14.1% of total | 15.5% of buyers | 12.7% of sellers

Regional: 7.0% of total | 6.4% of buyers | 7.5% of sellers

Domestic: 78.9% of total | 78.1% of buyers | 79.8% of sellers

WTI: USD 52.86 (-0.53%)

Brent: USD 55.92 (-0.16%)

Natural Gas (Nymex, futures prices) USD 2.84 MMBtu, (+0.71%, April 2017 contract)

Gold: USD 1,216.20 / troy ounce (+0.01%)

TASI: 6,993.1 (+0.2%) (YTD: -3.0%)

ADX: 4,591.5 (-0.3%) (YTD: +1.0%)

DFM: 3,502.4 (-1.5%) (YTD: -0.8%)

KSE Weighted Index: 421.1 (-1.1%) (YTD: +10.8%)

QE: 10,416.9 (-1.9%) (YTD: -0.2%)

MSM: 5,795.7 (-0.1%) (YTD: +0.2%)

BB: 1,333.0 (-0.4%) (YTD: +9.2%)

Calendar

06-08 March (Monday-Tuesday): EFG Hermes One on One Conference, Atlantis, The Palm, Dubai.

08-12 March (Wednesday-Sunday): 2017 ITB Berlin, CityCube Berlin, Germany.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

04 April (Tuesday): Emirates NBD Egypt PMI reading for March announced. The report will be available here.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.