- Has Hosni Mubarak seen his last day in court? (What We’re Tracking Today)

- Five questions for Osama Bishai: The Orascom Construction boss on what you do after you inaugurate the world’s two largest power plants. (Speed Round)

- EFSA signs off on CI Capital sale (Speed Round)

- Angela Merkel talks aid-for-refugees support, bashes automotive directive (Speed Round)

- Egypt’s foreign reserves rise to USD 26.54 bn in February (Speed Round)

- LafargeHolcim finds evidence of its Syria factory paying off armed groups to protect its facilities (Speed Round)

- Sukari gold mine reserves worth USD 20 bn (Basic Materials + Commodities)

- By the Numbers —

Sunday, 5 March 2017

Has Hosni Mubarak seen his last day in court?

TL;DR

What We’re Tracking Today

Hosni is out: Former President Hosni Mubarak’s was practically acquitted of charges of involvement in the killing of protesters during the 2011 uprising, after the Court of Cassation rejected an appeal by prosecutors on Thursday, allowing an acquittal verdict from 2014 to stand. The judge also rejected a civil petition for compensation from families of some of the 239 protesters killed during the uprising, the Associated Press reports. During the hearing, Mubarak denied the charges when he was read them, according to Reuters. He was originally sentenced to life in prison in 2012 for conspiring to murder 239 demonstrators, but an appeals court ordered a retrial which was then dropped and appealed again by prosecution, reaching the Court of Cassation.

Mubarak does not face any other charges and is technically free to go, but it was unclear whether he would leave the hospital, where he has been under informal house arrest in recent years. In his first statement since the acquittal, Mubarak tells an extremely annoying, giggly reporter from Sada El Balad that he wants to go “home,” but “not Sharm El Sheikh” (watch; runtime: 1:33). Mubarak, who seemed as annoyed as us by the interviewer, brushed off all other questions on chances of further court appearances or who was responsible for the protester deaths. Sada El Balad also has footage of Mubarak being flown by helicopter from his hospital to the courthouse (watch, runtime: 4:40).

Foreign Minister Sameh Shoukry is heading to Brussels today for a one-day visit, during which he will meet with the EU’s 28 foreign ministers, according to the State Information Service. The details of a Turkey-style migration pact with the EU will likely take center-stage in Shoukry’s discussions on cooperation with the European leaders. Our chances for an agreement look good as German Chancellor Angela Merkel — who was in town over the weekend — promised to provide additional aid in Egypt in return for assistance in stemming the flow of illegal migrants to Europe (we have more on the Speed Round).

One thing to look forward to this week is EFG Hermes’ 13th annual One on One conference — the region’s leading investor conference which takes place in Dubai tomorrow and will continue until Wednesday.

Something which should be looked at during the conference is HSBC Global Research’s latest report for Egypt (pdf) which suggests that 2017 “the year of rebalancing, not the year of recovery.” While the country has made progress on each the conditions laid out by the USD 12 bn IMF facility, the real challenge will be sustaining the momentum and commitment needed to follow through on these changes. Recent developments — such as the EGP float, the introduction of the value-added tax as well as other structural policy and fiscal reforms — has led HSBC to revise its macro forecasts for Egypt, seeing the exchange rate stabilize at EGP 18 per greenback, down from EGP 20. “It is the adjustment in the FX regime that has been the most striking evidence that the first phase of the reform process has substance.” Growth forecasts for 2018 also saw an upward revision, with expectations seeing reserves rising on the back of higher foreign currency inflows than originally estimated. Much remains to be done, however, and we must remain cautiously optimistic as we weather this difficult transition period, especially as the economy “must pay the bill for six years” of decline.

We’ve also picked reports over the weekend that Trump might be holding a summit on fighting Daesh this month. Diplomatic sources confirmed to Arab News that plans for the summit on a strategy for a combined anti-Daesh coalition had been in the works for weeks and could take place as early as 21 March. Egypt will be among the 60 countries expected to participate in the ministerial-level conference.

Patterson making a comeback? Former US ambassador to Egypt Anne Patterson had been tapped by US Defense Secretary as his undersecretary of defense for policy, Politico reports. The move is unsurprisingly unpopular with the White House, as Patterson gained a reputation for being an Ikhwani sympathizer here in Egypt during her tenure as ambassador.

Traffic Alert: Traffic coming from the Alex Desert Road into Lebanon Square through the Mehwar (26 July corridor) will be rerouted for the next 45 days, while authorities shut down the highway for renovations, Youm7 reports. Take heed, those who hail from Six October or do the Smart Village commute.

On The Horizon

Finance Minister Amr El Garhy has postponed his Tuesday budget discussion at the House of Representatives to mid-March as he will be out of Egypt, Al Borsa reports without detailing where El Garhy is traveling. The Finance Ministry is expected to deliver a draft of the FY2017-18 budget to the House by the end of March.

Reports last week had also said that El Garhy was due before the House Economic Committee on Monday and Tuesday to talk about the Investment Act, alongside Central Bank Governor Tarek Amer. The bill is expected to come to a vote before the House as a whole by the end of March.

A World Bank delegation is due in town in the first half of March to evaluate the economic reforms and negotiate further loans as Egypt anticipates receiving the next tranche of the USD 3 bn development loan sometime soon.

Enterprise+: Last Night’s Talk Shows

All’s quiet on the airwaves front apparently, with the topic discussions of the day centering around Investment and International Cooperation Minister Sahar Nasr’s visit to Cyprus and Russian Federation Council Chairwoman Valentina Matviyenko trip to Egypt.

On the latter, Al Hayah Al Youm’s Lobna El Assal spoke with Egypt’s Ambassador to Moscow Mohamed El Badry on how Russian Federation Council Chairwoman Valentina Matviyenko’s visit to Cairo this weekend (more on that in the Speed Round) is a harbinger for a return of flights. El Badry said that Egyptian officials were in talks with the Russia’s civil aviation authorities to get the lowdown on what remains to be done before flights can officially(watch, runtime 5:12). “The decision to return flights ultimately belongs to the Russian parliament,” House of Representatives Deputy Speaker Soliman Wahdan also told Assal in a call-in (watch, runtime 3:19).

Hona Al Asema’s Lamees Al Hadidi covered reports of interest by Cypriot investors in a Cypriot-Egyptian agreement to process gas in Egypt for export to Europe on the sidelines of Investment and International Cooperation Minister Sahar Nasr’s visit to Cyprus. Egypt’s Ambassador to the country, Hussein Mubarak confirmed this interest to her, adding that investors were also looking keenly into opportunities in the Suez Canal Economic Zone projects, especially in logistics and maritime transport.

Al Hadidi then continued to follow up on the Coptic Christian families that fled their homes in North Sinai after targeted attacks by Daesh last week. Al Hadidi spoke to Ismailia Governor Yasser Taher, who told audiences that the first 50 displaced families will be given housing in two days’ time, with the rest to follow (watch, runtime 5:32).

Speaking out of a freshly revamped studio, Al Hadidi reminded us that her show will now run from Saturday to Wednesday, and will have an extra episode dedicated to women’s issues called Hona Al Settat (watch, runtime 58:29). We applaud the move Lamees.

Amr Adib and Sherif Amer were off last night.

Speed Round

The first phase of the Burullus (pictured above) and New Cairo power stations were inaugurated on Thursday by President Abdel Fattah El Sisi and German Chancellor Angela Merkel. Once complete, the power stations will be the largest gas-fired combined cycle power plants in the world, Orascom Construction says. “Orascom and its consortium partner, Siemens, already connected a total of 2,400 MW to Egypt’s national grid at both power plants, exceeding delivery targets by 20%. Once complete, each power plant will generate a total of 4,800 MW.”

We had a quick talk with Orascom Construction CEO Osama Bishai to ask, for starters, how do you exceed delivery target by 20% on what are already the world’s two largest power plants?

Osama Bishai: The original plan from Siemens was for a staggered target based on the delivery sequence of the equipment: First Beni Suef, then Burullus, then the New Capital. It turns out that the New Capital site is almost ideal in its closeness to Cairo — and it had none of the onsite challenges of Burullus or Beni Suef. We added an additional 400 MW over the target capacity at the New Capital. Meanwhile, we’re also involved in other power plant projects and are converting 1,500 MW simple cycle plants we delivered in 2015 to combined cycle by adding an additional 750 MW. We’re also in final negotiations on a 250 MW wind farm with French and Japanese partners.

Tap here to read “Five Questions with Osama Bishai,” which also covers:

- The industries driving Orascom Construction’s Egyptian order book in the next few years;

- How Orascom Construction is doing post the float of the EGP;

- Why the government should tap the private sector to invest in infrastructure.

The Electricity Ministry signed a EUR 238 mn agreement with Siemens to build six power transmission stations to help transport power generated from the new plants, which are expected to save Egypt an annual USD 1.3 bn in fuel costs, Minister Mohamed Shaker said on Thursday. Siemens will design, build, and operate the project, as well as supply the equipment needed, while Elsewedy Electric will take charge of the project’s electromechanical works, under the terms of the MoU signed during the Egypt Economic Development Conference in 2015.

Siemens also inked a nine-year maintenance contract for the three plants on Friday, Al Mal reports. The company’s financial services arm has already started drafting a financing plan for maintenance operations, Siemens CEO Joe Kaeser said in a press conference after the inauguration, adding that the larger portion of the funding needed for the construction of the plants has also been secured.

The Egyptian Financial Supervisory Authority (EFSA) has given the green light to the sale of CI Capital to a consortium of investors, according to a disclosure from CIB. CIB says EFSA said it had no objection to a number of investors with whom the bank had inked sale and purchase agreements (SPAs) in December. CIB says it is currently reviewing the non-objection and studying the final agreement structure. The SPAs were signed with a group of non-related Egyptian and Gulf investors for an aggregate 71.94% of CI Capital in transactions worth a combined EGP 683.4 mn that valued the investment bank at EGP 950 mn. At the time, the investor consortium was said to include: Arafa Group’s Alaa Arafa, construction magnate Mahmoud El Gammal, Tiba Group’s Saddiq Afifi, former Zamalek football club chairman Mamdouh Abbas, five unnamed stakeholders in Zahran Group, Compass Capital’s Shamel Aboulfadl and Ayman Mamdouh Abbas, and Alameda Healthcare’s Fahad Khater.

On Thursday, we reported that Saddiq Afifi and Mamdouh Abbas backed out of the agreement. Ayman Mamdouh Abbas followed the news by suggesting that the individuals making up the investor consortium would look into revising each of their proposed stakes to account for those who withdrew, but EFSA Chairman Sherif Samy threw cold water on that suggestion by saying that any investor looking to increase their stake to more than 5% would require obtaining a non-objection from EFSA first. A source tells Al Borsa the transaction could be completed this month.

A source close to the transaction credits Investment and International Cooperation Minister Sahar Nasr for moving the transaction along toward close. “She’s being very hands on — a nearly year-old transaction is closing because she is making the clearing of hurdles a priority,” the source said.

Nasr orders full report on stamp tax, including alternatives: Investment and International Cooperation Minister Nasr ordered a “full report” on the effects and alternatives to imposing a stamp tax on stock market transactions to ensure the market and the government’s reform program are not harmed, at a meeting with Egyptian Financial Supervisory Authority head Sherif Samy on Thursday. Samy tells Al Mal that a decision on the tax must be taken as soon as possible. The proposed stamp tax, which the Tax Authority had suggested last week would be “ideal” at 0.175%, is expected to be submitted to the cabinet’s economic group for discussion within days. Finance Ministry Amr El Garhy had said that the tax could be increased gradually, but gave no details on the increase. Nasr also discussed protecting minority shareholders at a meeting with EGX Chairman Mohamed Omran, according to a ministry statement. Nasr and Omran looked into the upcoming amendments planned for the Capital Market’s Law, which could entail changes to how private placements are regulated, the issuance of sukuks and give the EGX flexibility to set lower listing fees to attract smaller companies to the bourse.

Egypt’s foreign reserves rose to USD 26.54 bn in February, the central bank said in a statement, marking a gain of USD 178 mn from the previous month. The CBE also says that fluctuations in FX rates are reflective of supply and demand, and the USD/EGP rate reaching 16.10 shows the market is self-correcting, according to an emailed statement.

Inching closer towards a Turkey-style migration agreement with the EU: German premier Angela Merkel promised Egyptian President Abdel Fattah El Sisi additional aid to “help to thwart migration to Europe” through Egypt during her two-day state visit, according to Bloomberg. The EU has offered Turkey some EUR 6 bn in aid for refugees and has also offered to support Egypt through its refugee plight.

Merkel also pledged some USD 500 mn in funding through to 2018 to support economic reforms and SME development, Investment and International Cooperation Minister Sahar Nasr announced on Thursday during the Egyptian-German Business Forum — which saw CEOs of major German firms in attendance. The amount, which will be coordinated with the IMF, will be received “in the form of grants and concessional funds,” a top government official tells Reuters.

She also assured El Sisi that German companies are eager to expand their investments in Egypt, encouraged by recent economic reform measures. Talks between the two also looked at cooperation on regional stability, countering terrorism, and reinforcing the role of German development agencies under the terms of a 1959 cooperation agreement signed between the two countries. As we noted last week, Merkel views investment as a crucial means to help stem inflows of refugees in host nations. Merkel also extended a formal invitation to El Sisi to attend an African development summit in Berlin next June, according to an emailed statement from Ittihadiya.

Merkel wants to kill the automotive directive? Merkel reportedly voiced her objections to the automotive directive,which she says violates the terms of Egypt’s trade agreements with EU countries and could compromise future dealings and investments, according to sources close to the German delegation. Speaking to Al Mal, they added that members of the Federation of Egyptian Industries (FEI) have reportedly promised Merkel that the directive — which would give tax breaks to Egyptian manufacturers and protect them against unfair advantages now enjoyed by EU, Turkish, and Moroccan imports — will not be issued until they’ve conducted a comprehensive study to ensure that none of its clauses are in direct conflict with standing agreements. European car makers and their local importers had expressed similar thoughts on the bill in a letter to the European commission last week, but FEI members had then said it was unlikely for the government to move based on European reactions to the bill. The automotive directive, which is currently before the House of Representatives’ Industry Committee and should be heading into a plenary session by mid-March, has been delayed by a lobbying war pitting auto assemblers and auto importers against each other.

Egypt has implemented 90% of Russia’s security requirements to resume flights, and four items remain, Russian Federation Council chairwoman Valentina Matviyenko said at a joint presser with House of Representatives speaker Ali Abdel Aal yesterday, Al Shorouk reports. Once Egypt completes the remaining requirements, a Russian delegation will visit to discuss the possibility of resuming flights, which is a step “everyone is waiting to announce as soon as possible,” said Matviyenko — who is in town as part of a larger trade delegation to discuss investments in the Russian Industrial Zone. Russia’s Transport Minister Maksim Sokolov had said last week that flights to Egypt could “in principle” resume in March, and expects Russian carrier Aeroflot to be the first Russian airline to resume flying to Egypt, starting with direct flights to Cairo. Matviyenko also touched on the Daba’a power plant, saying it is a “strategic and the biggest joint project” between Russia and Egypt, and that Moscow is invested in seeing the project through, Sputnik reports.

Matviyenko also met with President Abdel Fattah El Sisi, during which the two sides discussed Egypt’s fight against terrorism, according to Al Mal. Prime Minister Sherif Ismail discussed with the chairwoman furthering economic cooperation between Russia and Egypt, including in the pharma and steel industries, as well as attracting more Russian investments in gas and oil exploration projects, the newspaper reports.

As for the Russian Industrial Zone, a final agreement establishing it will be signed in May, Trade and Industry Minister Tarek Kabil said, according to Ahram Gate. The signing is expected to take place during meetings of the Russian-Egyptian Joint Committee in Moscow. His statements follow a meeting with Russia’s First Deputy Trade and Industry Minister Gleb Nikitin, who also met with Military Production Minister Mohamed Al Assar to discuss cooperation in manufacturing health and transport equipment, as well as in the auto feeder industry, Daily News Egypt reports.

Ampal says arbitrator’s decision means Egypt has to pay up: Ampal-American Israel Corporation, the Israeli company involved in the failed plan to import natural gas from Egypt through its 12% stake in Eastern Mediterranean Gas (EMG), says a decision by the International Centre for Settlement of Investment Disputes (ICSID) means that it is on track to receive compensation from Egypt. Globes says that “the arbitration panel has ruled that Egypt was responsible for confiscation and other violations” and was disclosed “after being submitted to New York Bankruptcy Court hearing the case of Ampal, which filed a lawsuit against the Egyptian government in 2013.” ICSID has yet to set the size of the award, but the ruling caps it at USD 174 mn. In 2013, Ampal was liquidated under Chapter 7 bankruptcy proceedings, but its bondholders, who expect to be the main beneficiaries of the ruling, have not been compensated. A partner at an Israeli law firm representing EMG told Haaretz: “The uniqueness of the arbitration panel is that its decisions can’t be appealed … Since you can’t appeal the verdict, the decision can be enforced and the property of Egyptians abroad, who aren’t entitled to any government protection, can be confiscated.” The Ampal case is unrelated to the EMG in 2015 where the International Chamber of Commerce court of arbitration in Geneva also ruled against Egypt.

Could there be a possible impact on current investment regulations? ICSID had found Egypt’s revocation of the tax exemption status of the EMG project until 2025 — afforded to it under the private free zones system — to be tantamount to expropriation and in breach of the bilateral investment treaty, according to IAReporter (paywall). Basically, by canceling private free zone status to companies, Egypt could be holding itself liable in international arbitration. We do not see this as being a problem, as we noted last week that the Investment Ministry plans to honor existing agreements with companies and allow them to extend their agreements under the new Investment Act.

On a related note, Yossi Abu, CEO of Delek Drilling and Avner Oil, said a new 500 km pipeline from the Leviathan gas field “could have gas flowing to Turkey by the end of 2020, about a year after it comes online for the Israeli market,” Reuters reports. “Additional export destinations being discussed are Egypt, Europe and the Palestinian territories, including power plants in the Gaza Strip and West Bank, Abu said.”

Auto companies are reportedly looking into reducing their prices to counteract a recent slump in sales, following the lead of big industry names such as GB Auto and Mansour Group, Al Mal reports. The move to reduce prices has stimulated car sales, encouraging other companies to follow suit, an unnamed auto distributor tells the newspaper. The Finance Ministry’s decision to cap customs duty exchange rate at EGP 15.75 until mid-March has also provided companies with the space to reduce prices, particularly as most vehicles currently in the market were imported at a higher USD rate, the source says. Companies will likely resort to slashing prices as a temporary measure to speed up the sale of current stockpiles, and will reassess their pricing schemes once these stockpiles are cleared, according to the newspaper. GB Auto had announced last week it is offering discounts ranging from EGP 18k-51k on all Hyundai, Chery, Geely, and Mazda cars. Al Borsa has the full list of GB Auto’s prices before and after the reductions.

Among those following the trend is Nissan Egypt, which is expected to announce price reductions of up to 2-3% today, an official distributor tells Al Borsa. The company had reportedly ordered distributors to halt all auto sales until it comes up with a new pricing scheme. Kia Motors has reportedly also cut its prices by EGP 10-80k, the newspaper adds.

Int’l business journalists get a taste of Egypt at AUC benefit dinner in Manhattan: On Wednesday evening at the Mandarin Oriental in New York, the American University in Cairo held its 6th annual benefit dinner honoring Suad Al-Husseini Juffali, an AUC advisory trustee and chair of the Ahmed Juffali Foundation, a philanthropy dedicated to social work in the Middle East. Two AUC students shared their academic experiences at AUC as examples of the impact Mrs. Juffali’s generosity has had on the lives of many students. The extraordinary and internationally acclaimed Egyptian soprano Fatma Said gave a magical performance: Said is the first opera singer in Egypt to be awarded the country’s Creativity Award for her outstanding artistic achievement on an international level.

Of special note, at CIB’s table, trustee Hisham Ezz Al-Arab’s guests included senior editors and journalists from the leading international media outlets: The Financial Times, New York Times, Wall Street Journal, Bloomberg and Reuters. Also at the table were fellow trustee and Qalaa Holdings Managing Director and Co-Founder Hisham El Khazindar and AmCham Inc. CEO Hisham Fahmy.

An internal investigation carried out by French cement giant LafargeHolcim uncovered that a Lafarge cement plant in northeast Syria’s Jalabiya indirectly paid off local armed groups to protect the facilities from being overtaken by Daesh, Al Mal reports. According to the report, the factory’s management paid an intermediary to arrange with various armed groups to allow the facility to continue operating and to protect its employees, which the company has described as “unacceptable.” The French government reportedly also suspects the company purchased oil in Syria to continue powering the plant, defying EU sanctions at the time against the Syrian government.

Egypt in the News

It is perhaps unsurprising that former President Hosni Mubarak’s acquittal topped international coverage of Egypt this morning, with many outlets, including the Washington Post, playing into the trope of “the death of the revolution” and how its goals have been sidelined.

This was followed by coverage of Angela Merkel’s visit to Egypt to hash out a migration agreement and the aid which Germany is prepared to grant Egypt to stem inflows of refugees into Europe. Some, including the AP, take offense at the idea of such an agreement.

Stronger Egyptian-Iranian ties could undermine US foreign policy: US failure to help contain the dispute between Egypt and Saudi Arabia could jeopardize American efforts to contain Iran, as Egypt looks more reticent to fully normalize relations with Iran, Haisam Hassanein writes for the Hill. He argues that Egypt’s fear of Sunni Islamism, Egypt’s desire to re-position itself as the regional power, and its deep financial crisis is driving it to push for a regional alliance with Iran, something which would undermine US policy.

Heir to Egyptian composer Baligh Hamdy, Osama Fahmy, filed a court appeal to the 2015 decision that said they lost the rights to the song “Khosara,” which was used in Jay Z’s “Big Pimpin’,” by licensing it, The Hollywood Reporter says. Fahmy’s attorney says “his client may have licensed the economic rights to ‘Khosara’ but, under Egyptian law, he could not have given up his moral rights to ‘prevent unauthorized fundamental alterations’ to the work. The story has also been picked up by Forbes.

North Korea has allowed the growing use of mobile phones and domestic internet access in return for detailed information the network feeds the state’s surveillance operations, a US government-funded report says. "By giving citizens new networked technologies like mobile phones and tablets, the government is able to automatically censor unsanctioned content and observe everything citizens are doing on their devices remotely," Nat Kretchun, the report’s lead author, told Reuters. North Korea’s official mobile phone network, Koryolink, is used to send subscribers propaganda via text messages and its network calls and data are subject to surveillance. Koryolink was set up as a joint venture between OTMT and the North Korean State, but OTMT had said it effectively lost control of Koryolink in 2015.

North Korea also made headlines as a UN report found that it had been skirting sanctions by providing military aid to countries in Africa. The report cites a shipment of 30,000 RPGs allegedly bound for Egypt, smuggled under iron ore and seized back in August, according to the Associated Press.

Other international coverage of Egypt worth noting in brief:

- Reuters’ Nadine Awadalla took note of the news of researchers at Nile University who are developing ways to turn dried shrimp shells into biodegradable plastic. We first covered this last month from The Week.

- Reuters also covered a shootout between Egypt’s police force and suspected terrorists in Giza, which left four dead.

- The Trumpet’s Callum Wood traces the complicated and drawn-out history between Egypt and Ethiopia as far as the Grand Ethiopian Renaissance Dam is concerned.

- Stratfor is looking at the extent social media is becoming the medium of choice for political action and discourse, citing the events leading up to the 25 January uprising.

- AFP News took note of the young girls learning ballet in Minya’s Alwanat Center in the traditionally conservative Upper Egypt in a video report (runtime 01:53).

- Malaysia’s Higher Education Ministry is still facilitating the entry process of Malaysian students to Egypt, Malaysian Digest reports. “The ministry said the number of Malaysian students furthering their studies in Egypt had increased by 15.46% since 2001 and currently more than 11,000 Malaysian students are studying there.”

On Deadline

Egypt is losing ground against Russia on the return of flights because it’s not playing its cards right, Gamal Taha writes in a column penned for El Watan.Rather than focusing on the Russian government’s conditions to bring back flights from Moscow, Egypt should rest assured that its attractiveness and affordability will bring them back. Many Russian tourists have been bypassing the flight ban since 2016, Taha says, and yet Russia continues to place the return of its nationals over Egypt’s head to force its demands on the country: The USD 30 bn Daba’a nuclear power plant, a new Russian industrial zone, a gold exploration tender in Sinai, wheat imports from Moscow, and (so far) more than USD 800 mn in airport security upgrades.

Worth Watching

President Abdel Fattah El Sisi and German Chancellor Angela Merkel visited the Giza Pyramids during Merkel’s two-day trip to Cairo. A video posted to El Sisi’s official Facebook page shows the two leaders arriving at the historical site for a photo op, after which they enjoyed a dinner with an appropriately themed Pharaonic dance for entertainment (runtime 02:33).

Diplomacy + Foreign Trade

Egypt signs investment information exchange agreement with Cyprus: Investment and International Cooperation Minister Sahar Nasr signed three MoUs, including one on facilitating investments through the exchange of information with Cypriot Finance Minister Harris Georgiadis during the Egyptian-Cypriot Joint Committee for Economic, Scientific, and Technical Cooperation held in the Cypriot capital on Friday, according to a ministry statement.

An American company is looking to establish a pharmaceutical factory in the Suez Canal Economic Zone (SCZone), and a delegation from the company will be visiting Egypt “within the coming period” to discuss the project, SCZone chairman Ahmed Darwish said, according to the State Information Service. Darwish did not provide details on the company or the expected size of its investment.

Basic Materials + Commodities

El Molla participates in PDAC mining convention to promote gold exploration tender

Oil Minister Tarek El Molla is in Canada today to participate in the Prospectors and Developers Association of Canada (PDAC) mining convention and promote the Egyptian Mineral Resources Authority’s (EMRA) gold exploration tender in the Eastern Desert and South Sinai, Youm7 reports. The tender has raised concerns among international mining companies who feel that the production-sharing model would not work for them. El Molla is reportedly accompanied by EMRA head Omar Taima, who has basically been brushing off these concerns and insisting that the terms will remain as they are.

Sukari gold mine reserves worth USD 20 bn

The Sukari gold mine holds an estimated 14.5 mn ounces of gold, worth an estimated USD 20 bn, Sukari Gold Mining Company chairman Ali Barakat said, according to Al Shorouk. He added that USD 2.7 bn worth of gold was produced from Sukari since January 2010. On a national scale, the Egyptian Mineral Resources Authority (EMRA) expects gold extraction operations to be taking place at 100 sites nationwide, EMRA Chairman Omar Taima said, according to Al Borsa.

Banking + Finance

Mubasher and QNB Alahli sign agreement that allows bank clients to open brokerage accounts

Mubasher Financial Services signed an agreement with QNB Alahli that will allow clients to open brokerage accounts at any of the bank’s branches across the country, Al Borsa reports.

Egypt Politics + Economics

Cairo Court to look into yet another attempt to challenge the annulment of the Saudi island transfer agreement

The Cairo Court of Urgent Matters will hold its first hearing today on yet another attempt to challenge the Administrative Court’s verdict annulling the sovereignty handover agreement with Saudi Arabia over Red Sea islands Tiran and Sanafir, Al Mal says. The lawsuit was raised by lawyer Ashraf Farahat and comes almost a week after the Administrative Court had shot down the government’s attempt to get an injunction passed to suspend the ruling.

National Security

DynCorp International wins aviation field maintenance services contract in Egypt, Europe

DynCorp International was awarded a USD 14.5 mn cost-plus-incentive-fee foreign military sales modification for aviation field maintenance services in the Netherlands and Egypt, according to the US Department of Defense. Work will be performed in Germany, Honduras, and Kuwait, with an estimated completion date of 31 December 2017.

Russian engineer caught with a suspected homemade bomb at Egypt airport

A Russian electronics engineer was taken into custody for four days, after authorities found him carrying what they suspected was a homemade bomb at Alexandria’s Borg El Arab Airport on Friday, Youm7 reports. The suspect, who was trying to board a Turkish Airlines flight to Istanbul, has reportedly denied the charges and told authorities that he is only carrying cables he uses for work. If the allegations are proven true, this would be the most ironic twists ever in the saga of airport security and Russian flights.

On Your Way Out

Today’s Google Doodle celebrates legendary belly dancer Samia Gamal on what would have been her 93rd birthday. Gamal began her career in cinema in 1943, and quickly rose to stardom thanks to dancing skills that rival those of Taheya Karioka. “We celebrate Samia Gamal, an Egyptian icon whose talents are admired as much today by aspiring dancers and film fans as they were in the height of her fame,” the Doodle’s description reads.

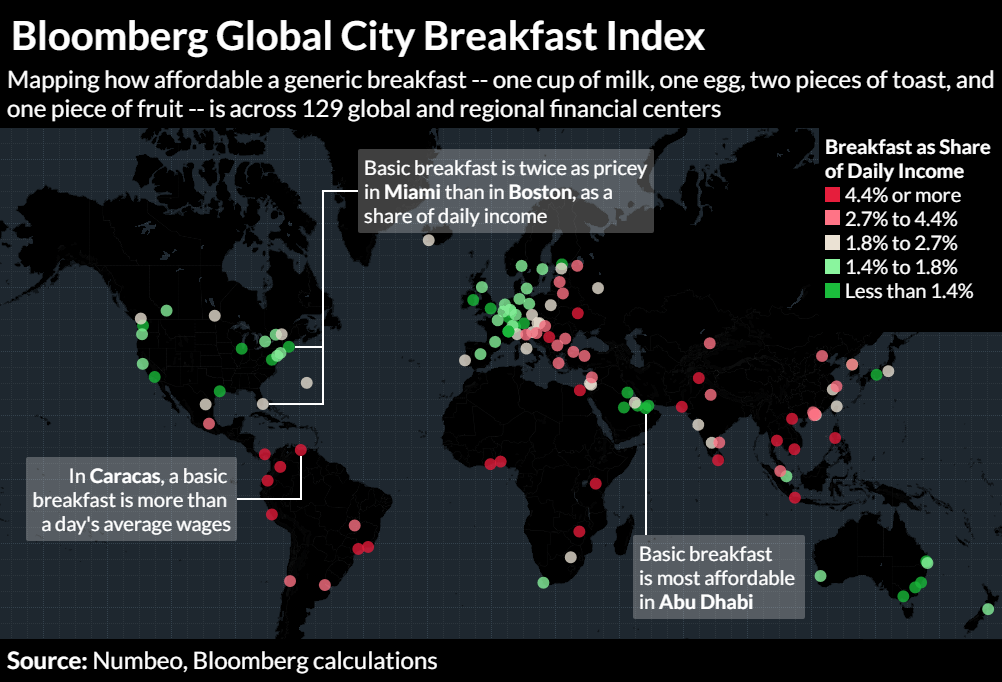

Residents of Abu Dhabi, Osaka and Zurich can earn enough in less than five minutes to buy their first meal of the day, according to the Bloomberg Global City Breakfast Index. The situation is significantly harder in less affluent cities, where, for example, it takes Ghanaians in Accra closer to an hour, and, in Caracas, where inflation is soaring, almost nine hours. Bloomberg says Cairo has the most affordable basic breakfast, as it defines it, at USD 0.35 because of food subsidies. However, when matched as a share of daily income, Cairo is among the cities where it takes the longest to earn enough money to pay for it, costing more than 4.4% of the daily income.

The markets yesterday

EGP / USD CBE market average: Buy 16.2303 | Sell 16.3359

EGP / USD at CIB: Buy 16.2 | Sell 16.3

EGP / USD at NBE: Buy 16.11 | Sell 16.21

EGX30 (Thursday): 12,310 (+2.6%)

Turnover: EGP 1.1 bn (163% above the 90-day average)

EGX 30 year-to-date: -0.3%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 2.6%. CIB, the index heaviest constituent rose 3.0%. The EGX30’s top performing constituents were: Pioneers Holding up 9.5%, EFG Hermes up 8.0%, and Global Telecom up 7.6%. Thursday’s worst performing stocks included Eastern Co down 2.3%, Domty down 1.5%, and Porto Group who ended the day flat. The market turnover was EGP1.1 billion, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +110.9 mn

Regional: Net Short | EGP -29.1 mn

Domestic: Net Short | EGP -81.8 mn

Retail: 69.2% of total trades | 61.6% of buyers | 76.8% of sellers

Institutions: 30.8% of total trades | 38.4% of buyers | 23.2% of sellers

Foreign: 16.6% of total | 21.5% of buyers | 11.8% of sellers

Regional: 6.8% of total | 5.5% of buyers | 8.1% of sellers

Domestic: 76.6% of total | 73.0% of buyers | 80.1% of sellers

WTI: USD 53.33 (+1.37%)

Brent: USD 55.90 (+1.49%)

Natural Gas (Nymex, futures prices) USD 2.83 MMBtu, (+0.82%, April 2017 contract)

Gold: USD 1,226.50 / troy ounce (-0.52%)

ADX: 4,596.4 (+0.6%) (YTD: +1.1%)

DFM: 3,583.7 (-1.0%) (YTD: +1.5%)

KSE Weighted Index: 424.5 (+0.7%) (YTD: +11.7%)

QE: 10,721.2 (-0.3%) (YTD: +2.7%)

MSM: 5,815.1 (+0.4%) (YTD: +0.6%)

BB: 1,341.5 (-0.2%) (YTD: +9.9%)

Calendar

23 February – 16 March (Thursday-Thursday): Glimpses of Upper Egypt exhibition at Accademia d’Egitto in Rome.

06-08 March (Monday-Wednesday): 13th EFG Hermes One on One Conference, Dubai, United Arab Emirates.

08 March (Wednesday): Microfinance forum, Nile Ritz-Carlton, Cairo.

09-11 March (Thursday-Saturday): Egypt Projects Summit, Cairo International Convention Center, Cairo.

14-15 March (Tuesday-Wednesday): The third Builders of Egypt conference, Ritz Carlton Hotel, Cairo.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.