- There is no parallel market for greenbacks. (What We’re Tracking Today)

- Russian business delegation lands in Cairo today. (What We’re Tracking Today)

- Government to meet with brokerages houses next week to hash out the stamp tax. (Speed Round)

- SODIC reports record earnings in 2016; CEO says only affordable land for developers will allow private sector to build low-income housing. (Speed Round)

- Tanmiya Capital Ventures announces new partner. (Speed Round)

- Is rapprochement with Saudi Arabia in the cards? (Speed Round)

- House undermined its own credibility by stripping Mohamed Al Sadat of his seat –Ahram columnist Osama Ghazaly Harb. (On Deadline)

- Egyptian sibling rivalry at its best. (Worth Watching)

- The Markets Yesterday

Wednesday, 1 March 2017

Ladies and gentlemen, the parallel market for USD is still dead

TL;DR

What We’re Tracking Today

Ladies and gentlemen, there is no parallel market for greenbacks. As we’ve noted a couple of times this week, there’s been chatter in Cairo since the weekend that “the black market is back” with the USD changing hands for north of EGP 17. We touched base with two senior bankers yesterday who dumped buckets of ice water on the notion.

What’s happening is simple: Foreign exchange offices have been boxed out of the FXmarket and are now making a play for market share. FX bureaux controlled the parallel market for FX prior to 3 November, capturing the lion’s share of the bns in remittances transferred into Egypt by expat workers every quarter. Their market share has since fallen to the single digits because banks have the liquidity to keep up with market demand. Said one banker: “We lost market share before November to the FX guys because we couldn’t offer above EGP 8.88 [per USD, the official rate at the time]. They had 90% of the flow and made a killing. Now they’ve lost market share to the banks because their customers are selling to us. The banks are easily meeting demand and the CBE hasn’t given us guidance on pricing one way or another. Not even a hint — none of that is happening.”

The central bank has indeed guided the banks to allocate 25% of their excess USD to the backlog queue, “and we’re doing that,” said another banker. “We can bid whatever we want for USD, flows to the interbank market are rising. If there was demand at 17 or 18, we’d be bidding that high. There isn’t, so we’re not.”

What to expect in the coming days: One of the smartest guys we know says it comes down to retail psychology: “Retail flows into the banking system have been dry the last two or three days because there’s confusion — ‘What’s this [redacted] about the black market being 17?’ They’re holding onto their USD because they don’t know which way to go. This is typical behavior: They stop when they don’t know what’s going on, and the moment it seems the USD is going to lose a bit of strength, they sell into the fall and will drive it down further.”

The Finance Ministry is reducing the exchange rate used to calculate customs duties to EGP 15.75 per USD 1 starting from today, Minister Amr El Garhy told Reuters. The rate was reduced and capped at EGP 16.00 per USD 1 mid-last month. The new rate will be valid until 15 March when it will be revisited according to the market exchange rates at the time, El Garhy added.

A Russian business delegation lands in Cairo today. The delegation, led by First Deputy Minister of Industry and Trade Gleb Nikitin, is on a two-day visit to discuss establishing a Russian industrial zone in East Port Said and will meet with a number Egyptian officials, according to an emailed statement from the Russian Industry and Trade Ministry. An unnamed source from the Trade and Industry Ministry claims that the Russians are looking to increase the amount of land allocated to the zone from 800 km² to 20,000 km², Youm7 reports. Russia’s Industry and Trade Ministry and the Russian Export Center are holding a media event this evening at 6:00 pm at the Russian Cultural Center on the industrial zone, according to our friends at Shahid Law Firm, who are advising the delegation.

The business delegation’s arrival comes after Defense Minister Sedki Sobhi and the Armed Forces’ Chief of Staff Mahmoud Hegazy met with Russia’s Deputy Prime Minister, Dmitry Rogozin, during which the two sides discussed regional and international security issues and increasing cooperation, Al Masry Al Youm reports.

Are we on the cusp of a virtuous cycle for emerging markets? The price of iron ore is rising thanks to recovering demand in China, which isn’t going to have a “hard landing” after all. Container shipping prices are spiking. Vietnam’s garment sector is booming. Quoth the Financial Times: “There is even a chance of the emerging world entering a virtuous cycle, says David Hensley, an economist at JPMorgan, in which optimism begets investment, which in turn begets higher productivity and earnings, leading to yet more investment and faster growth.” The wildcard: China’s housing market will be “central to the sustainability of the emerging market rally,” meaning there is a risk that “We may be becoming super positive on emerging markets just as Chinese housing begins to turn down.” Whether you work in EM or just invest here, you’re going to want to have a look at the Financial Times’ Big Read this morning: “Are emerging markets entering a new virtuous cycle?” The kicker is in the subhed: “Optimism over growth and returning investment on the back of Chinese demand is offset by fears of problems ahead.”

Fintech types and lawyers beware: The robots giveth, the robots taketh away. The head of asset management at JPMorgan Chase “has cast doubt over the future of digital advisers, stressing that ‘human beings need human beings’ — especially in times of market stress,” the Financial Times writes. Mary Erdoes believes that “Once [asset] prices start to drop and anxiety rises, customers may no longer be happy to be guided solely by software.” Sounds great, right? But on the other side of the equation, legal robots at JPMorgan have just shown that they can crunch through 360,000 hours of contract work in in seconds, Bloomberg tells us.

What We’re Tracking This Week

German Chancellor Angela Merkel is due in Cairo tomorrow, accompanied by a 10-company trade delegation, Ambassador Julius Georg Luy told Al Borsa. Luy described Egypt’s economic reform program as bold and positive and said the EGP float helped attract foreign currency inflows. In addition to meetings with senior government officials including President Abdel Fattah El Sisi, Merkel will attend the inauguration of the first phase of three Siemens-built power stations, according to Al Mal. On that front, Emad Ghaly, CEO Siemens Egypt tells the Energy Collective that Egypt’s electricity challenges have been solved for good. The plants, Siemens’ biggest order to date, are being completed ahead of schedule and will fulfill Egypt’s power needs until at least 2022, maybe even 2023. All that’s missing now is delivering the combined cycle modules and converting the power plants from open cycle to combined cycle operation.

You can go skiing in Egypt starting from tomorrow: Majid Al Futtaim’s Mall of Egypt is set to open tomorrow at 10:00 am in Six of October City. The mall is a USD 722 mn investment and includes Egypt’s first indoor ski slope. It’s the sister property to MAF’s flagship Mall of the Emirates in Dubai. You can read the full press release here (pdf).

Enterprise+: Last Night’s Talk Shows

Finance Minister Amr El Garhy phoned in to Hona Al Assema last night. El Garhy said the2017-18 deficit should come in at c. 9.5% of GDP, with GDP growth estimated to reach 4%. The budget will be presented to the House on 1 April. “We are still not sure when the IMF mission will visit, as early April coincides with the Spring Meetings of the World Bank and IMF,” he said.

Speaking on the proposed stamp tax rate of 0.175% on stock market transactions, El Garhy stressed that this was not set in stone, but that the ministry was still studying it as an option. He added that we still have to wait for the House to formally and legally delay the capital gains tax for another three years. The minister also old host Lamees El Hadidy that the move to decrease the customs exchange rate to EGP 15.75 for the USD 1 would surely help drive down inflation (watch, runtime: 7:34).

Lamees Al Hadidi then covered the mounting tension between the House of Reps and the press. The latest: MPs have backed controversial Rep. Mortada Mansour’s demand that the House request the Prosecutor General’s Office open an investigation of columnist and former talk show host Ibrahim Eissa. Mansour claims Eissa is guilty of “insulting Parliament” and alleges the Suspendered One committed libel in a column for Al Maqal that likened parliamentarians to cartoon characters. MP Ahmed Imbaby was deputized to speak for the thin-skinned folk in the House, telling Lamees in a call-in that while MPs welcome criticism, “we have been witnessing attacks from many newspapers for a while.” Lamees took the MP to school on freedom of the press. Her comments fell on deaf ears (watch, runtime: 20:08).

(Paging Mr. Kafka: Elsewhere, House Speaker Ali Abdel Aal has lambasted state-owned Al-Ahram’s breaking news website for running a piece that was “insulting” to the House, but refused to identify the article in questions, Al Ahram reports. Al Ahram’s board of directors responded with a statement defending its reporters. Meanwhile, Al Shorouk has more on the Eissa-Mansour flap.)

Kol Youm’s Amr Adib interviewed Majid Al Futtaim CEO Alain Bejjani on tomorrow’s opening of the Mall of Egypt. “Mall of Egypt is MAF’s most important investment in Egypt,” said Bejjani, adding that the company envisaged a mall by the Pyramids that could compete on an international level. The mall will contain 350 commercial outlets, 21 VOX cinema screens, a Carrefour, hypermarket, and oh, yeah, a ski slope (watch, runtime: 18:24). We hate to say it, but we really like the ski slope…

Adib then spoke on investor interest in the government’s 1.5 mn feddan land reclamation project with Atter Hanoura, chairman of the Egyptian Rural Development Company, which manages the megaproject. Hanoura told Adib that demand for land in the first phase exceeded the 500K feddans on offer (watch, runtime: 2:25).

Al Hayah Al Youm’s Tamer Amin interviewed Environment Minister Khaled Fahmy on the ministry’s wastewater management program (watch, runtime: 2:13) and Germany’s ambassador to Egypt Julius Georg Luy German on Chancellor Angela Merkel’s itinerary for her trip to Masr (watch, runtime: 3:21).

Speed Round

Government to meet with brokerages houses next week to hash out the stamp tax: Investment and International Cooperation Minister Sahar Nasr is planning to sit down with brokerage firms next week to address their concerns about a proposed stamp tax on stock market transactions, Al Borsa reports. Finance Minister Amr El Garhy said on Sunday that the stamp tax is coming before May, but that the rate was yet to be set. Brokers were still wary of the idea after the Tax Authority suggested a 0.175% rate on both the buy and sell side of each transaction on Sunday, saying that while it may have little-to-no effect on foreign and institutions, it could be an issue for the retail investors that account for most of the EGX’s turnover. The Egyptian Capital Markets Association, an industry lobby group, believes a tax higher than the 0.1% levy imposed in 2013 and scrapped the year after would harm the EGX.

Developers of private free zones may now take a deep breath: GAFI overlord Mohamed Khodeir reassured investors in private free zones investors that they would be allowed to extend their agreements with the state under the new Investment Act, even though the act will not allow the creation of new private FZs. Youm7 has the story.

Subsidy system purge on hold? Supply Minister Ali El Moselhy reportedly plans to pursue structural reforms to the subsidy system before pushing on with his predecessor’s drive to purge welfare cheats from the rolls of citizens eligible for support, Al Shorouk reports, citing unnamed senior ministry officials. Former minister Mohamed Ali El Sheikh had planned to strike mns of citizens off the list of ration card holders, including the dead, individuals living abroad, people owning more than one piece of real estate, and anyone with a monthly income of more than EGP 3k (view the full list of criteria here). Some citizens had complained that their welfare access was unlawfully revoked in early February, after the government cut about 1.2 mn names (mostly the dead and duplicates) from the list. An ensuring review of the list found that 60 mn out of 70 mn registered citizens are eligible beneficiaries, the officials add. The other 10 mn citizens will reportedly be allowed to provide proof of their need for welfare by a deadline that the ministry intends to set soon, after which, after which any files with insufficient data will be permanently cleared.

Meanwhile, the Supply Ministry appears to be working with much greater enthusiasm on price controls with the Consumer Protection Authority and has apparently adopted a plan to establish a database of products and their market prices in a possible bid to get vendors to comply with them. The database will rely on input from both private and public sector companies, Supply Minister Ali El Moselhy said, Al Borsa reports. El Moselhy said that the ministry and the CPA are working together on amendments to the Consumer Protection Act that will force manufacturers to label their products with a cost breakdown of their goods to prevent traders from over-inflating their prices. The amendments, which were first floated last month, caused the expected uproar among food producers at the Federation of Egyptian Industries.

SODIC announced record results yesterday with net profit after tax and minority interest coming in at EGP 429 mn for 2016, up 38% y-o-y. Revenues for the year also grew by 40% y-o-y to record EGP 2.07 bn. “The main contributors to revenue growth during 4Q16 and the 12 months ended December 2016 were Eastown Residences and Westown Residences. Deliveries in Eastown Residences commenced in May of 2016 while in Westown Residences 80% of projects units were delivered by the end of the same year,” the company said in a filing. SODIC says 2016 saw cancellations dip to 4%, a record low, and deliveries and collections increase by 46% and 31% y-o-y, respectively. The EGP float impacted the company’s cash balances positively, causing a revaluation of EGP 68.5 mn in 2016. For 2017, SODIC expects contracted sales to reach EGP 5.6 bn and is looking to deliver 1,150 units across its projects. The company also plans to invest EGP 3 bn during the year.

We also attended SODIC’s roundtable with Managing Director Magued Sherif yesterday. The key points from the discussion were:

- Sherif said expectations of devaluation “helped in accelerating buying decisions,” as Egyptians invest in real estate as a hedge against devaluation, which was reflected in SODIC’s earnings in 2016.

- “We will not decrease our prices,” Sherif said, explaining that he does not think prices should keep changing with exchange rate fluctuations, especially as contractors continue to jack up prices on the other end.

- The company is on the lookout for additions to its land bank, Sherif said, adding that SODIC is open to partnerships with the state and private entities. The challenge for SODIC is that no large areas of land have been tendered last year and that it only considers land plots that are dispute-free.

- Sherif also tempered expectations about SODIC participating in affordable housing projects. Low income housing will demand that the state make a conscious decision to make land available to developers at lower prices, he said.

- SODIC is looking into projects in the new administrative capital, but has not reached a decision yet on whether to invest there or not. “What is lacking is communication with the community of developers so that we have a complete picture about the city … the timeline for execution is out of step with the magnitude of the project,” Sherif said.

MOVES- Youssef Ayoub has joined Tanmiya Capital Ventures (TCV), the mid-cap private equity firm, as a managing partner. TCV’s other partners include founding partner Ahmed El Guindy (former head of investment banking at EFG Hermes), ex-Raya Holding Chief Investment Officer Karim Hassan and former EFG Hermes investment banker Omar Ekram. Ayoub was previously marketing manager at Coca-Cola, where he was marketing manager responsible for strategy and execution across Egypt. TCV tells us that Ayoub joins to "bring hands-on experience to the consumer, healthcare, export-led and other primarily defensive sectors in which we’re looking to invest. Our key differentiator is the mix of financial, investment and operational experience we bring our portfolio companies to help them unlock growth." Ayoub is a turnaround and new-product-launch specialist with long experience in the FMCG sector. TCV, which invests alongside existing owner-operators, is presently raising its first fund.

Is rapprochement with Saudi Arabia in the cards? Senior Egyptian and Saudi officials are laying the groundwork for a visit to Cairo by Saudi Foreign Minister Adel Al-Jubeir next week. Al-Jubeir could meet with Foreign Minister Sameh Shoukry and possibly President Abdel Fattah Al Sisi, an unnamed diplomatic source tells Youm7.

Egypt can expect to receive the second USD 1.25 bn tranche of the USD 12 bn IMF extended fund facility sometime in June after a review that had been set for March was tentatively postponed to April, Egypt mission chief Chris Jarvis tells Al Shorouk. The delegation — which will assess the Ismail government’s progress on its economic reform program as a condition for disbursing the tranche — will need between 6-8 weeks to prepare and process its report after the visit. Finance Minister Amr El Garhy and Deputy Finance Minister Amr El Monayer told us on Sunday that the visit was postponed to allow the ministry time to focus on finalizing and delivering the FY2017-18 state budget to the House of Representatives by the end of March. Egypt and the IMF had never fixed a date for the disbursement of the second tranche.

The final contracts with Russia for the Daba’a nuclear power plant won’t be signed until the second half of the year instead of the first quarter, as was previously expected, an unnamed source from the Electricity Ministry tells Al Mal. Drafting is still in progress, and in any case the government won’t sign the contracts until it wraps up public consultations.

33% of Egyptians apparently approved of keeping Sherif Ismail on as prime minister after the latest cabinet shuffle, according to a poll by the Egyptian Center For Public Opinion Research (Baseera) conducted a little over a week after the new cabinet was sworn in. 25% of survey-takers felt that Ismail should have been replaced in the shuffle, while 41% were undecided. Baseera had conducted a survey a week prior to the cabinet shuffle in which 22% of those polled believed Ismail was doing a good job; 25% of those surveyed were less enthusiastic, but could live with him; 18% disapproved of his performance; and 35% were undecided.

The Cairo Court of Cassation acquitted Mubarak-era Tourism Minister Zoheir Garana of charges of corruption, profiteering and squandering public money on Tuesday, Ahram Online reports. The ruling overturns a five-year prison sentence against Garana back in 2014, when a Cairo criminal court found him guilty of buying land in Ain Sokhna resort of Gamsha in violation of the Auctions Act. The Court of Cassation — the nation’s highest appeals court — acquitted two other defendants.

** Earnings watch- Emaar Misr said its net profit for 2016 grew by 98% y-o-y to EGP 1.68 bn on revenues of EGP 4 bn (up from EGP 3.23 bn a year ago).

Global demand for gas is expected to increase by 2% a year between 2015 and 2030, with LNG set to rise at twice that rate at 4 to 5%, according to Shell’s first-ever LNG outlook report. By 2020, the size of global LNG trade is projected to grow 50% compared to volumes in 2014. The report also noted that China and India, which are set to continue driving a rise in demand, were two of the fastest-growing buyers in 2016, increasing their imports by a combined 11.9 mn tonnes of LNG. Egypt was one of six new importing countries that have bolstered global demand for LNG since 2015. Others include Colombia, Jamaica, Jordan, Pakistan, and Poland. Egypt, Jordan, and Pakistan were among the fastest-growing LNG importers in the world in 2016. Due to local shortages in gas supplies, they imported a total of 13.9 mn tonnes of LNG. Egypt should see a significant reduction in imports and a return to exporting by 2018 after the Zohr supergiant field comes into production late this year. You can hit the landing page for the report here, catch an overview of the report (pdf), or check out slides or an infographic.

Other international news stories of local relevance worth noting this morning:

- US President Donald Trump “toned down the dark rhetoric” in his first address to Congress. We’ll be reading takes this morning by Politico (the entire homepage at press time) and the New York Times.

- Lining up at the trough: Citigroup is said to be in “advanced discussions” for a banking license in Saudi Arabia, “returning after a more than 10-year absence from the kingdom, as the bank looks for ways to capitalize on financial reforms,” Bloomberg reports.

- “The Iranian economy has had an ‘impressive recovery’ following sanctions relief last year, though uncertainty regarding the fate of the nuclear deal and relations with the U.S. threaten to undermine it, the International Monetary Fund said.”

The Macro Picture

“Certainly conditions are in place for the bull market in bonds to be over,” Ashok Varadhan, Goldman Sachs’ global co-head of the Securities Division says. “The catalysts that have spurred the dramatic rise in bond yields over [the last three decades] — globalization, disinflation, central banks’ zero-interest rate policies and their nominal bond buying programs, regulations and fiscal retrenchment — may all be on the cusp of changing.” Varadhan believes the Bank of Japan’s efforts to keep Japanese government bond (JGBs) yields near zero are the main reason behind the depressed overall bond yields globally as “Japanese savers are buying US Treasuries instead of JGBs.” One thing investors might be underestimating, Varadhan says, is the impact on emerging markets (EMs). He says EMs have been “huge beneficiary of the global bond bull run. If all the factors that have supported bonds start to reverse and if inflation and interest rates in developed markets start to rise, that could put pressure on EMs. If the manifestation of a trade war is a forced devaluation in EM currencies or one in which we see aggregate demand slow because of added tariffs, locally denominated currency debt could come under pressure.

One fund that plowed deeper into emerging and frontier markets in 2016 was Norway’s USD 900 bnGovernment Pension Fund Global, according to Bloomberg. The fund, which announced a return of 6.9% in 2016, gaining approximately USD 53 bn, says emerging market holdings were USD 92 bn by the end of 2016 and accounted for 10% of its investments. The fund, known for its transparency, says its equity investments returned 8.7%, fixed income investments 4.3%, and real estate investments 0.8%. By the end of 2016, the fund was investing 62.5% of its capital in equities, 34.3% in fixed income, and 3.2% in real estate.

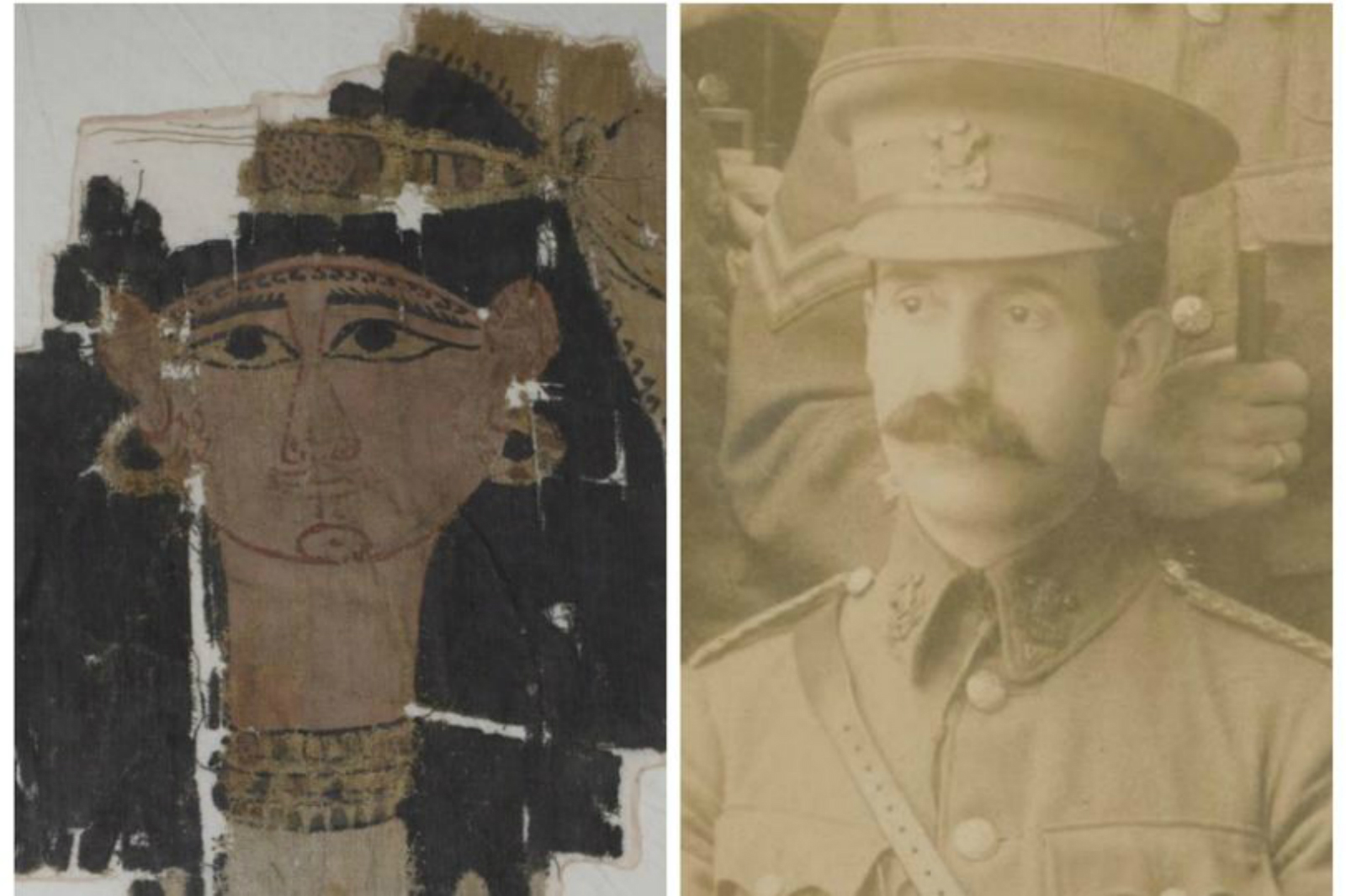

Image of the Day

The hypocrisy of antique collection: Egypt gets a lot of flak for the routine “misplacement” of historical and ancient Egyptian artifacts. Cut to Europe, whose entire knowledge of Egyptology has been arguably based on stolen artefacts. Take this gentleman up top: Major Harry Hartley Waite Southey, who is considered a celebrated explorer in his middle-of-nowhere town in Wales for “collecting” artefacts from ancient Egypt and Turkey at the turn of the 20th century. These will not be returned to Egypt, but have been donated to the middle-of-nowhere museum, with much gratitude from the town.

Egypt in the News

Topping coverage of Egypt in the international press this morning is the expulsionof MP Mohamed Anwar El Sadat from the House of Representatives, a move that has eroded parliament’s image and fed into the conventional Western trope of Egypt as a place where dissent is not tolerated. As we noted yesterday, the New York Times was the first out of the gate with a significant piece on the story and it’s spread like wildfire: Al Arabiya is positioning the expulsion as warning to the opposition, while the BBC and others have taken a positive line on El Sadat, who gained widespread credibility with rights groups at home and abroad for his opposition to the much-loathed NGO Act.

The international press is still reporting extensively on the targeting by Daesh terrorists of Copts in Northern Sinai, with Heba Saleh writing in the Financial Times that Daesh’s affiliates are driving them away from Arish. Extremism researcher Mokhtar Awad tells her it was a matter of time before the terrorists focused on targeting Egypt’s minorities systematically, but “the tactic itself is a sign of weakness strategically as the group’s efforts to cause significant havoc in Egypt have thus far been checked.” The issue is understandably being followed extensively by Christian media, with the Christian Post suggesting the issue will be discussed between President Abdel Fattah El Sisi and Trump when the El Sisi visits Washington. Bishop Angaelos, General Bishop of the Coptic Orthodox Church in the UK released a statement yesterday condemning both the attacks and what he feels is the world’s silence on the plight of Christians in North Sinai. “These horrific attacks have gone largely unnoticed by the international community, but Copts continue to suffer tragic violations daily,” read the statement.

Al Azhar is currently holding an interfaith dialogue in Cairo which includes top Muslim and Christian clerics from the Middle East. The conference is being picked up by a number of regional outlets including Khaleej Times, The National, and the Indian Express.

The Wall Street Journal carries an opinion piece by two of our favourite thinkers on Egypt headlined “The Muslim Brotherhood: Terrorists or Not?” (paywall). Their bottom line, Mokhtar Awad and Samuel Tadros write: “It’s complicated. The Islamist group splintered after 2011, and some of its spinoffs are violent.” To wit: “The old Egyptian Muslim Brotherhood is disintegrating. In its place stand two competing leaderships, along with spinoff groups engaged in terrorism.”

The police have arrested 22 people in Port Said after “hundreds went on a rampage” in Port Said following the death sentences upheld against 10 people convicted in the Port Said stadium riot that killed over 70 Al Ahly fans in 2012, according to The Associated Press. Security officials say the “protesters set tires ablaze, torched two police cars and pelted policemen with rocks on Monday night.”

Why is Egypt spending money to build a space agency, Ruth Michaelson asks in Newsweek. She says the Egyptian Space Agency is the “latest attempt to reinvigorate the Egyptian economy with a series of mega-projects.” Mohamed Adel-Yehia, head of Egypt’s National Authority for Remote Sensing and Space, tells Michaelson he does not believe the goal is at odds with immediate economic needs, “this is essential for us to provide those loaves of bread. Our dream is to use this technology to develop our country economically.”

Other international press coverage of Egypt worth noting:

- Skift took note of the AP’s piece on Egypt’s efforts to revive Russian tourism with airport upgrades. Skift’s Patrick Whyte says: “The market has been decimated by geo-political problems and needs big changes if it is to start to recover.”

- Doaa Farid took note of UK Foreign Secretary Boris Johnson’s networking event with Egyptian startups and entrepreneurs at the British Embassy in Cairo. “Today is an important day because it is the first visit of a British foreign minister to Cairo since 2014,” UK ambassador John Casson told Wamda. So important.

- Egypt is a top foreign buyers of Chinese drones, according to a Reuters report. The report says China says it has received its largest foreign drone order from an unnamed buyer.

- Egypt’s Ahmed El Mohamady is Hull City’s most famous player, ranked by the number of Twitter followers, Hull Daily Mail says.

On Deadline

The House of Representatives has undermined its own credibility by stripping MP Mohamed Al Sadat of his membership, Osama Al Ghazaly Harb argues in a column penned for Al Ahram. The writer says that the rumor mill (particularly the international one) suggests that the House was pursuing a vendetta against Sadat for raising a stink about the assembly spending EGP 18 mn of state funds on three new cars. He says the move undermines Egyptian democracy and sends a message that freedom of expression is an illusion that not even an MP can indulge in.

Worth Watching

Egyptian sibling rivalry at its best: World number 6 Marwan Elshorbagy beat his older brother, and number 1 squash player in the world, Mohamed Elshorbagy at the quarter final of the 2017 Windy City Open squash tournament. “On seven previous attempts 23-year-old Marwan had failed take more than a solitary game from 26-year-old Mohamed but, under the chandeliers of the University Club of Chicago, he fought through the mental barrier to come through a compelling five-game battle,” the PSA World Tour notes. “It’s tough – we both new [sic] it was going to happen at some point … Every time we play it’s a battle on court – but we are best friends off court. I’m grateful for the sport – it has allowed me to have my brother as my best friend. We share the same life, have the same dreams and we support each other… We’re there for each other. It’s a tough day today for us. But I have a big match tomorrow to look forward to and a chance to reach a first World Series Final,” Marwan, who was visibly very emotional after the match, said (runtime 01:01).

Diplomacy + Foreign Trade

Foreign Affairs Minister Sameh Shoukry met with US National Security Advisor H.R. McMaster yesterday in DC, according to a ministry statement. Shoukry reviewed economic and political developments in Egypt and the region.

French Defense Minister Jean-Yves Le Drian arrived in Cairo yesterday and met with President Abdel Fattah El Sisi, Defense Minister Sedki Sobhi. El Sisi granted Le Drian Egypt’s Order of the Republic for his role in strengthening military cooperation between both countries, according to Al Masry Al Youm. For his part, Le Drian granted State for Military Production Minister Mohammed Al Assar the Légion d’Honneur. France 24 had called Le Drian, who oversaw the sale of French Rafale fighter jets and mistral-class helicopter carriers to Egypt, “France’s salesman” and “an oddity in the cabinet of President François Hollande” because of his popularity and success.

The House of Representatives have finally signed off on the Arab-Mediterranean free trade (Agadir Agreement) on Tuesday, which Egypt had signed 2004 with Jordan, Morocco, and Tunisia, Ahram Gate reports. About time.

Egypt abstained at a UN Security Council vote on a Western-backed resolution imposing sanctions on the Syrian government for chemical weapons use, Reuters reports. Russia and China had both vetoed the resolution.

Energy

Government begins reviewing tender offers for the 2022-2027 plan Hamrawein coal power plant

The government is reviewing tender offers for the 6 GW USD 8 bn Hamrawein “clean coal” power station, Al Borsa reports. The Egyptian Electricity Transmission Company has hired Belgium’s Tractebel Engineering Consultancy to review seven offers from international companies that include Shanghai Electric, a consortium made up of Elsewedy Electric and Marubeni, a APEC – Orascom consortium, and Mitsubishi – Hitachi. The plant had been postponed, among a few other projects to the 2022-2027 electrical power development plan.

Basic Materials + Commodities

GASC launches wheat tender on Tuesday

GASC launched a wheat tender on Tuesday for 60K tonnes of wheat for delivery on 1-10 April, Reuters reports.

Manufacturing

Paperwork forming new company for SME factory bailout fund finalized

State-owned Ayady, the Tahya Misr Fund, and the National Investment Bank and BPE Partners have finalized paperwork for establishing the EGP 150 mn Union Capital, which will manage a bailout fund for distressed SME factories, Al Shorouk says.

Health + Education

Two cases of bird flu infections reported in Egypt

Two cases of H5N1 avian influenza (that’s bird flu to you and me) in Egypt were reported by the UN’s Food and Agriculture Organization (FAO) on Monday, Outbreak News Today reports. The first case was in Minya, while the second and fatal case was in Fayum.

Tourism

TDA forces companies to make overdue payments at post-float exchange rates

The Tourism Development Authority (TDA) will not be setting a fixed exchange rate for tourism industry companies with overdue mortgage payments, bills and fees, saying they must pay the piper and use the post-float USD exchange rates to calculate their dues in EGP terms, TDA boss Serag El Din Saad tells Al Borsa.

Banking + Finance

Banks allowed to recognize profit in capital after audit, without need for other approvals

The central bank has issued a directive allowing banks to factor interim profits as part of their capital base for capital adequacy purposes, according to Al Borsa. The laws previously allowed banks to include final profits recognized after annual general meetings.

NBE board approves EGP 30 bn capital increase

The National Bank of Egypt’s board of directors approved a EGP 30 bn capital increase to EGP 50 bn, funded through the bank’s reserves and retained earnings, AMAY reports.

Egypt Politics + Economics

M2 money supply up 41.51% y-o-y

M2 money supply increased by 41.51% y-o-y by the end of January, according to CBE data, as per Reuters. M2 money supply stood at EGP 2.7 tn at July’s end.

Sawiris sues Free Egyptians Party for expelling him

The Sawiris-Free Egyptians Party beef took another turn this week, with Naguib Sawiris filing a lawsuit against the party’s head on Monday for expelling him, Ahram Online reports.

On Your Way Out

Egypt’s policies towards Syrian refugees within its borders has been hailed as a model of social inclusiveness in a report (pdf) by the Regional Refugee and Resilience Plan (3RP) — a global organization which attempts to coordinate responses to the Syrian refugee crisis. The report notes the absence of the refugee camps and describes the country’s policy of allowing 117,350 Syrian asylum-seekers and refugees (including 50,697 children) access to public healthcare and education as a hopeful alternative.

The markets yesterday

EGP / USD CBE market average: Buy 15.7679 | Sell 15.8706

EGP / USD at CIB: Buy 15.7 | Sell 15.8

EGP / USD at NBE: Buy 15.7 | Sell 15.75

EGX30 (Tuesday): 11,938 (-0.7%)

Turnover: EGP 1.2 bn (177% above the 90-day average)

EGX 30 year-to-date: -3.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.7%. CIB, the index heaviest constituent inched down 0.3%. The EGX30’s top performing constituents were: Cairo Oils and Soap up 5.4%, Madinet Nasr Housing up 2.0%, and Elsewedy Electric ended almost flat. Yesterday’s worst performing stocks included Egyptian Iron and Steel down 7.9%, Telecom Egypt down 6.1%, and Arab Cotton Ginning down 5.9%. The market turnover was EGP1.2 billion, and local investors were the sole net buyers.

Foreigners: Net Short | EGP – 8.5 mn

Regional: Net Short | EGP – 79.4 mn

Domestic: Net Long | EGP + 87.9 mn

Retail: 49.9% of total trades | 54.3% of buyers | 45.5% of sellers

Institutions: 50.1% of total trades | 45.7% of buyers | 54.5% of sellers

Foreign: 23.8% of total | 23.4% of buyers | 24.1% of sellers

Regional: 19.1% of total | 15.8% of buyers | 22.4% of sellers

Domestic: 57.1% of total | 60.8% of buyers | 53.5% of sellers

WTI: USD 53.92 (-0.17%)

Brent: USD 55.59 (-0.61%)

Natural Gas (Nymex, futures prices) USD 2.76 MMBtu, (-0.47%, April 2017 contract)

Gold: USD 1,246.10 / troy ounce (-0.62%)

TASI: 6,972.4 (0.0%) (YTD: -3.3%)

ADX: 4,552.1 (-1.7%) (YTD: +0.1%)

DFM: 3,630.3 (-0.1%) (YTD: +2.8%)

KSE Weighted Index: 424.0 (-0.2%) (YTD: +11.6%)

QE: 10,702.1 (-2.2%) (YTD: +2.5%)

MSM: 5,780.0 (-0.7%) (YTD: 0.0%)

BB: 1,349.7 (0.0%) (YTD: +10.6%)

Calendar

23 February – 16 March (Thursday-Thursday): Glimpses of Upper Egypt exhibition at Accademia d’Egitto in Rome.

02-03 March (Thursday-Friday): German Chancellor Angela Merkel’s visit to Egypt.

06-08 March (Monday-Wednesday): 13th EFG Hermes One on One Conference, Dubai, United Arab Emirates.

08 March (Wednesday): Microfinance forum, Nile Ritz-Carlton, Cairo.

09-11 March (Thursday-Saturday): Egypt Projects Summit, Cairo International Convention Center, Cairo.

14-15 March (Tuesday-Wednesday): The third Builders of Egypt conference, Ritz Carlton Hotel, Cairo.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.