- El Garhy sees inflation peaking by end 1Q17, t-bill yields dropped again yesterday. (What We’re Tracking Today, Speed Round)

- In the fight to cut subsidies, the House is proving to be a bigger nuisance than expected. (Speed Round)

- A settlement agreement for pre-float LCs of less than USD 5 mn? Not quite yet. (Speed Round)

- Al Nouran to start operations at greenfield sugar plant by May. (Speed Round)

- Cairo to have 62% hotel occupancy in 1Q2016, per Colliers forecast. (Speed Round)

- Oil and gas discoveries are at a 60-year low + Fund managers hating on Erdogan. (Macro Picture)

- One of the dumbest (business-focused) op-eds we’ve ever read. (On Deadline)

- House Ethics Committee to strip Al Sadat of committee seat. (Egypt Politics + Economics)

- By the Numbers

Monday, 13 February 2017

House engages in magical thinking on subsidies, demands electricity price hike be pushed back a year

TL;DR

What We’re Tracking Today

Will we see the new cabinet lineup today? The House of Representatives will vote on the composition of the next Council of Ministers in plenary session tomorrow, MP Moustafa Bakry tells MBC Misr 2’s Sabahak Masry. If MPs were to reject the lineup, Prime Minister Sherif Ismail would have the option of shuffling the deck once more or sticking with the current cabinet. Ismail was reportedly in meetings with President Abdel Fattah El Sisi to agree on the final list yesterday, Al Shorouk reports.

Finance Minister Amr El-Garhy expects inflation to peak by the end of 1Q17, Bloomberg reports. In an interview with Bloomberg TV on the sidelines of the Second Arab Fiscal Forum in Dubai, El Garhy said, “It is all resulting from supply shocks rather than demand driven kind of inflation. We knew that this is still peaking when it comes to inflation, we expect this to happen.” Headline inflation rose to 29.6% last month, according to state statistics agency CAPMAS.

El Garhy is right — which brings us to one of the smartest guys we know, who growled at us yesterday that year-on-year inflation is meaningless — we should all be looking at month-on-month right now. We think he has a point. The one-time shock to the system that was devaluation on 3 November is a breakpoint that makes y-o-y comparisons essentially meaningless until November 2017.

Also in Dubai yesterday, Egypt’s value-added tax (VAT) and reform program received props from IMF Director Christine Lagarde, who spoke about the need for more focused tax policies and diverse revenue streams to really aid GDP growth in the region, according to Gulf News. “Egypt, for example, last year approved the replacement of the old general sale tax with a new VAT,” Lagarde said. “Once fully implemented, the new VAT will raise 1.5% of GDP more in revenue than the old tax.” Tap here for the full text of Lagarde’s speech at the Forum yesterday.

Finally, Dubai’s ruler Sheikh Mohammed bin Rashid Al Maktoum praised UAE’s special relations with Egypt at the World Government Summit held concurrently with the fiscal forum yesterday, describing the latter as “the heart and soul of the Arab world,” Arab News reports.

An annual exercise in group self-pleasure by and for music industry hacks — commonly known as “the Grammys” — took place last night. Yes, rock n’ roll is still dead (in the mind of industry execs, at least), but hip-hop is slowly catching up, as Drake’s horrendous Hotline Bling beat out newcomer Chance the Rapper’s No Problem for Best Rap Song. You can catch the Guardian’s live blog for the rest.

‘Tis the day before Valentine’s Day. Please tell us you’re not staying home on red silk sheets with Michael Bolton on Netflix. It’s meant to be a comedy, Wired tells us, which suggests it may be safer to read about it than to watch it. As one of our former colleagues was wont to say: That which has been seen cannot be unseen. On a perhaps more serious note: You may wish to give thought to a gift for your partner; forwarding a link to the Michael Bolton special on El Whats does not count.

What We’re Tracking This Week

New UN secretary general to visit El Sisi: Newly-appointed UN Secretary General António Guterres (the former prime minister of Portugal and former UN refugee boss), will be visiting Egypt, Qatar, Oman and the UAE as part of his Middle East tour, Reuters reports. He was in KSA yesterday, and we can’t for the life of us find a reference to when he’s expected in Egypt: The UNSG’s appointments page simply notes that from 9-20 February, Guterres is in the Middle East and is then due to hit a G20 ministerial summit in Bonn. It appears from the schedule that Egypt is the final stop on the Middle East leg.

The Central Bank of Egypt’s Monetary Policy Committee will meet this Thursday (16 February) to review rates. Pharos Holding said in a research note yesterday it expects the CBE to leave rates on hold.

The Egypt Petroleum Show Egyps 2017 will take place on Tuesday, 14 February at the Cairo International Convention Center, Nasr City.

On The Horizon

Egypt, welcome to the 1950s: It looks like we’ve made it to the nuclear age, with the Electricity Ministry expected to officially announce and discuss the details of the USD 25 bn Daba’a nuclear power plant in a conference from the site of the plant in Matrouh on Saturday 25 February, Al Borsa reports. The ministry is holding several meetings with representatives of Russia’s Rosatom this week to discuss the final details of the contracts for the project, which should be finalized during March and signed shortly after. The announcement will be accompanied by the standard “national dialogue,” where the ministry will meet with members of parliament and other groups to discuss the project.

Our take: If contracts for Daba’a are finalized and signed in March, look for an announcement on the resumptions of flights to Egypt from Russia shortly thereafter.

Sound smart: The first nuclear power plant to produce electricity for commercial use was APS-1 in Obninsk, USSR. The plant came online on 26 June 1954.

Enterprise+: Last Night’s Talk Shows

Hona Al Assema’s Lamees Al Hadidi appears to not be listening to guests who keep telling her not to obsess on the exchange rate, choosing this as her main topic of the evening.

CI Capital’s Hany Farahat said that despite the EGP’s appreciation, it is still hard to forecast the exchange rate on the short term. (Shocking, no?) He expects exchange rate volatility to temper in May or June (watch, runtime: 2:13). Federation of Egyptian Chambers of Commerce secretary general Alaa Ezz told Lamees that the EGP will stabilize at between EGP 14-17 by June and between EGP 13-14 by the end of 2017. Responding to a question on when the prices of goods in the market will consequently decrease, Ezz expects it will take the market three months to respond to the decline in the exchange rate. “We also have to keep in mind that there was substantial demand for the USD in December and January as foreign companies were transferring their profits out of the country,” he said.

The episode then shifted to pharma, with the industry’s rep at the Federation of Egyptian Industries reminding Lamees that the Health Ministry promised big pharma it would consider raising prices of meds again in August to adapt to any changes to the exchange rate.

Kol Youm’s Amr Adib started his episode by criticizing Egypt’s need to import all of its the cooking oil, and asking what is so complex about manufacturing cooking oil in Egypt (watch, runtime: 5:28). Please, God, grant us patience.

Adib also joined House MPs in calling for Electricity Minister Mohamed Shaker to delay new electricity price increases to the following July (watch: runtime: 7:23).

Amr then aired a report on the New Administrative Capital, where land tenders launched yesterday. Mohamed Abdel Maqsoud, head of the New Capital City Council, said that half of the 700 homes slated for construction have already been completed. A total of 24,500 buildings are planned for the city, said Maqsoud, adding that the new capital will be connected to four metro lines (watch, runtime: 6:28).

Yahduth Fi Masr’s Sherif Amer spoke with House Deputy Speaker Soliman Wahdan on the delays in reaching a final list of candidates in the upcoming cabinet shuffle. Wahdan speculates that the Prime Minister is still negotiating with potential candidates, adding that the House will vote on the whole lineup, not on individual ministers.

Speed Round

Reason #321 to be optimistic about the outlook for the economy: Foreign investors bought 97.5-98.5% of the T-bills Egypt sold on Thursday, Samy Khallaf, head of the public debt department at the Finance Ministry, told Bloomberg. The demand pulled the average yield on the six-month T-bills by almost 200 bps, the most on record, according to data compiled by Bloomberg. The average yield on one-year securities dropped by 187 bps as well. This adds to the evidence that “confidence in the economy is growing” after the EGP float, Bloomberg’s Ahmed Feteha writes.

The drop continued on Sunday as the treasury auction saw rates on 266-day bills drop by nearly 292 bps as well, according to Al Borsa, with foreign investors buying EGP 2.4 bn worth of 91-day and 266-day bills. “This decline in yields follows a previous decline so it’s a big drop and this is mainly from foreign investor interest… For foreigners these rates don’t exist anywhere else," one banker told Reuters. Another banker expects the rate decrease to continue, saying “the decline in yields is rapid and aggressive and I believe it can continue. Historically foreign investors used to buy Egyptian local debt since the previous managed float and yields used to drop below the corridor rate.”

…Egypt’s economy is being “overhauled” and investors are betting on an earnings recovery and taking advantage of cheaper USD-based valuations, John Sfakianakis, director of economic research at the Gulf Research Centre in Riyadh, writes for The National. “Egypt is taking the necessary steps to improve its economy, and slowly signs are emerging that this effort is paying off,” he writes. Sfakianakis expects the government to “tighten Egypt’s fiscal position, improve the business environment and liberalise the economy” within the next few months.

Egyptians are “ditching imports” and substituting local products, Asma Alsharif and Mohamed Zaki write for Reuters. They mention the story of a local chocolate manufacturer “struggling” to keep up with demand since the EGP float. Unofficial figures suggest the weaker EGP is also supporting exporters and Alsharif and Zaki support the story with anecdotal evidence. "This is a golden opportunity for Egyptian producers … Local producers used to be unable to compete but now is the right time to go in to compete against imported goods due to the price advantage after the [USD] rises,” said Abu Bakr Emam, head of research at financial firm Prime Holding.

In the fight to cut subsidies, the House is proving to be a bigger nuisance than expected: Emboldened by a spike in headline inflation to 29% last month, the House of Representatives has embraced its inner populist and begun ratcheting up pressure on the Ismail government. MPs are trying to dissuade Cabinet from implementing subsidy cuts just as the IMF is coming to inspect progress on the reform agenda before deciding to disburse the second payment of the USD 12 bn facility. The House Energy Committee is asking Electricity Minister Mohamed Shaker to postpone a hike in electricity prices slotted for July 2017 to July 2018, when the country’s economy is expected to improve, committee member El Sayed Hegazy tells Al Borsa. According to Hegazy, Shaker has vowed to look into the committee’s request, but did not clarify when he would issue a decision. As we noted last week, the Electricity Ministry announced it is repricing electricity following the increase in fuel prices as a result of the EGP flotation, but has yet to provide details on the new pricing formula. New price increases were expected anyway as part of the five-year plan to cut subsidies on electricity.

The pressure didn’t stop there as Supply Minister Mohamed Ali El Sheikh promised the House Economics Committee to revisit the price increases on subsidized goods, following a contentious hearing at which MPs skewered the minister on inflation, Al Mal reports. He said he would propose reducing the price of subsidized goods to Prime Minister Sherif Ismail at the next cabinet meeting. El Sheikh went back to his usual tactic of blaming everything wrong with prices on the private sector, telling MPs that “businessmen” were the reason the ministry was “forced” to raise prices. On a related note, El Sheikh told the committee that in addition to the 1.2 mn welfare cheats who were cut from the food subsidies system, 12 mn saw their supply cards suspended for incomplete data. These will be restored once card holders provide their full information, AMAY reports. El Sheikh also said his ministry would make available on an as-needed basis stocks of strategic commodities built-up using a USD 1.8 bn facility from the CBE to cobble together a six-month reserve, Al Borsa reports.

A settlement agreement for pre-float LCs of less than USD 5 mn? Not quite yet. Companies with pre-float letters of credit worth less than USD 5 mn could be given up to seven years to repay their bankers, Al Borsa says, if a settlement mechanism for which an industry association is pushing goes through. Others with debts north of that figure will have to wait until a later stage of talks between Central Bank Governor Tarek Amer and members of the Union of Investor Associations. Rhetoric or reality? UIA member Mohamed Khamis Shaaban is quoted as saying that companies that have “suffered too much damage” as a result of the float will enjoy debt forgiveness, a notion we find unimaginable. Amer is set to meet with members of the association next Sunday to discuss the guidelines for the settlement and is said to have tasked a committee with working to resolve disputes that may arise between the banks and companies. Why are we skeptical? This story should be seen as part of a lobbying effort by the association. While we do not doubt that Amer is giving the association face time, but that’s a far cry from the CBE directing banks (formally or verbally) to reschedule payments. We’ll be speaking with friends in banking today and will report back if there’s anything to say.

What is going on with the Transportation Ministry’s projects? In a peculiar piece of news, the Transportation Ministry has denied to the House Transportation Committee that it signed an agreement for a USD 1.2 bn electric rail project connecting El Salam City to 10th Ramadan City — one of the projects from the 2015 Egypt Economic Development Conference— with the Aviation Industry Corporation of China (AVIC). Last we heard on the electric rail project, the ministry was awaiting cabinet approval on the agreement after reviving talks with AVIC last November. The ministry also denied that it had signed a EUR 900 mn agreement with Hungary to buy train carriages, said committee member Mohamed Zein El Din. Back in June, the International Cooperation Ministry announced in an official statement that Egypt and Hungary signed letters of intent. It is unclear whether the ministry is saying that final contracts for these have yet to be signed or whether these projects have been put on hold.

The denials come as the ministry, which has never been prompt about clarifying the status of its major projects, is under pressure from the House, with the House Transportation Committee pushing the ministry to explore more “economical” and local alternatives. The ministry could simply be just keeping things close to the chest vis-a-vis MPs, going on the time-proven idea that MPs are like mushrooms — keep them in the dark and feed them [redacted].

Al Nouran Sugar is due to start operations at its new plant in Sharkia by May, VP for sugar production Ahmed Abdel Moneim told Reuters. The facility will have an annual production capacity of over 600k tonnes divided into 280k tonnes from sugar beet and around 350k tonnes from raw sugar, he added. 30% of production is earmarked for export, he said.

The latest Colliers International MENA Hotels Forecast report expects a 62% occupancy rate in Cairo in 1Q2017. The average cost of a night in Cairo is USD 137, with an average return of USD 85 per room, the report adds. Meanwhile, the occupancy rate in Sharm El Sheikh is expected to be around 32% with the average cost at USD 54 and the return at USD 13 per night.

CI Ratings set the Banque Du Caire’s Financial Strength Rating at ‘BB-’ with a ‘Stable’ outlook “on the grounds of its comfortable liquidity, though subject to systematic risk, strong operating and net profitability, and increase in capital adequacy.”

**Earnings watch: Union National Bank reported a 12.8% y-o-y rise in net profit to in FY2016 to EGP 180.5 mn from EGP 160 mn a year ago, the bank said in a statement. Interest income grew 65.2% y-o-y to EGP 1.73 bn from EGP 1.05 bn.

Meanwhile, Misr Cement Qena reported net profits of EGP 312.5 mn in FY2016, according to a regulatory filing.

***

Investor relations analyst wanted: Inktank Communications, the Cairo-based investor relations firm that works with both major EGX-listed companies and privately held groups, is looking for two investor relations analysts. The position with our parent company entails working on everything from investor presentations, earnings releases, board material and client transactions to investor-focused press releases and correspondence. Outstanding English-language writing skills are a must. While we have a hiring preference for Egyptian nationals, applications from foreign candidates based in Egypt are welcome. Learn more about the position at inktankcommunications.com/careers or apply now with a cover letter and CV to patrick@inktankcommunications.com.

***

The Macro Picture

Oil and gas discoveries are at a 60-year low, with the Zohr gasfield discovered off Egypt’s shore in 2015 being the most recent giant discovery, the Financial Times reports. As large fields have become more difficult to find, many companies are putting exploration on ice, pushing the number of oil and gas discoveries in 2016 to 174, down from a previous average of 400-500 per year. The downward trend “reflects both the cyclical cuts made by companies struggling to stay afloat after the drop in oil and gas prices since 2014, and the structural shift in the industry towards onshore shale and similar reserves, especially in North America.” However, this year could see exploration activity recovering slightly, as several wells planned around the world have high potentials for discovery.

Fund managers don’t like you, Erdogan: Brazil and Russia are in and Turkey is out in a survey of 16 fairly high-profile emerging market investors carried out by Bloomberg. Turkey’s economic outlook and vulnerability to both US Fed rate hikes and political instability (among other factors) all come in at or near the bottom of 10 markets included in the poll.

Egypt in the News

US Army Colonel Derek Harvey has been handed the job of running Middle East policy for the Trump administration, Steven A. Cook writes in Salon. He says Harvey has more mainstream views on Islam than national security advisor Michael Flynn, “but he still has strange baggage.” Cook points to what he claims is Harvey’s insistence on using phrases like “radical Islamic extremism” and “militant Islam,” his shifting stance on Saudi Arabia, and his views on Turkey. He adds, “Harvey seems to like Sisi, lauding the Egyptian leader for his public stance opposing extremism — something the American right gives Sisi too much credit for and the American left too little,” but Cook is of the opinion that “Egypt is not the regional force for stability it once was, even if, like Harvey, one sees the world almost entirely in terms of the fight against Islamist extremism.” He believes Harvey’s underlying ideas about how to achieve US foreign policy goals are either “confused, uninformed or burdened with unhelpful ideology.”

And speaking of national security advisor Michael Flynn: The latest parlor game of liberal media outlets in the US is to interpret Donald Trump’s apparent silence as indicating that Flynn is soon to be thrown under the bus for talking with Russia before Trump took office. Case in point: The Washington Post’s “As Flynn falls under growing pressure over Russia contacts, Trump remains silent.”

The editorial board of Bloomberg think it’s a mistake to designate the Ikhwan as a terror group. The author(s) can’t get beyond the standard arguments, writing, “That’s because the Muslim Brotherhood isn’t a single organization so much as a collection of loosely affiliated groups in dozens of countries, each deciding on its own policies and programs” before going on to discuss what nice people the beardos are in Tunisia and Syria. Read the piece here, if you must.

UN Secretary-General António Guterres has a “golden opportunity” to help Egypt’s democratic transition during his visit to Cairo as part of his Middle East tour this week, Brian Dooley writes for the Huffington Post. Taking note of recent developments such as the shuttering of the Nadeem Center for Rehabilitation of Victims of Violence, the listing of 1500 individuals on a terror watchlist, and travel bans against human rights lawyers, Dooley says “the attack on human rights is intensifying.” We’re sure any one of you out there could finish the rest, so we’re going to stop there.

Other stories making the rounds this morning:

- The Egyptian economy is making a “slow, but painful recovery” since its USD 12 bn loan agreement with the IMF, notes the Financial Tribune in a piece that offers a quick and rather limited glance at current conditions;

- The UAE’s Hamdan Bin Mohammed Smart University is collaborating with the Egyptian ICT Ministry to develop “an innovative model for smart learning in the Arab world,” supported by both countries endeavors, Al Bawaba says;

- The appointment of a former army spokesman as head of the Al-Aseema TV network (old news) has raised questions about the extent of state control over Egyptian media, Khalid Hassan writes in a piece for Al-Monitor.

On Deadline

Why are we bending over backwards to bring back tourism? (Or: Quite possibly the dumbest op-ed AMAY has ever run.) In return for complying with other countries’ demands to beef up security in order to lift travel warnings, Egypt should set its own terms and conditions for returning tourists, Abbas El Tarabily — who has never heard of the term ‘buyer’s market’ in his life — writes in an op-ed for Al Masry Al Youm that suggests he needs to be briefed on what the lack of tourism has done to the economy. El Tarabily says we should immediately hike the prices of hotel rooms and all touristic activities, as the prices currently in place are among the lowest worldwide. Somebody please explain to him the basics of supply and demand.

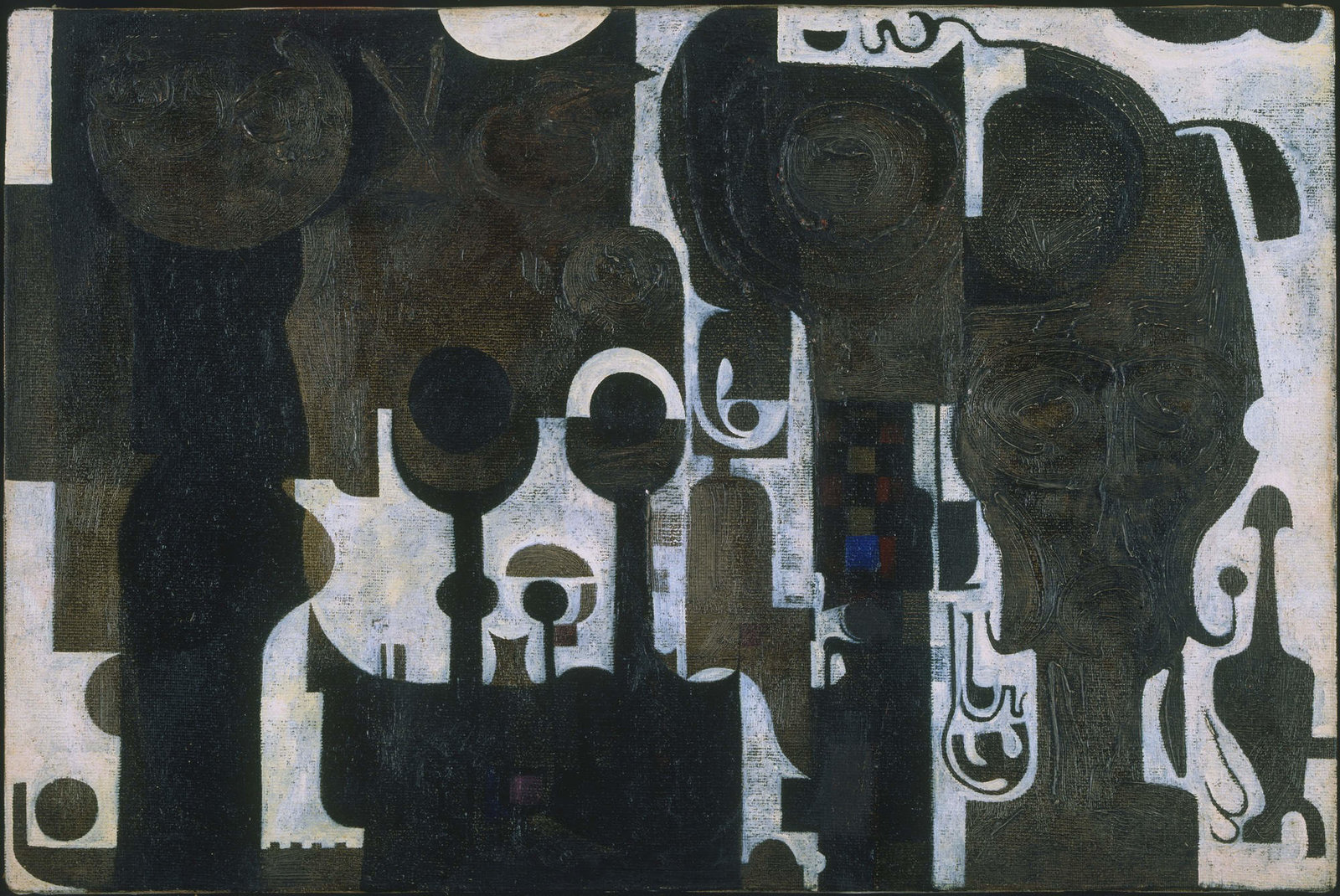

Image of the Day

The Museum of Modern Art (MoMA) in New York responded to when President Donald Trump ordered ban on citizens of seven majority-Muslim countries from entering the United States by installing a dozen works by artists from those countries. The displayed artwork, according to Art News, includes work by “the late Iraqi-born architect Zaha Hadid, the Sudanese master Ibrahim El-Salahi, and the young Iranian painter Tala Madani,” in the galleries devoted to MoMA’s permanent collection. Pictured above is El-Salahi’s 1964 piece The Mosque, which went on display. Alongside each artwork, MoMA placed a placard reading: “This work is by an artist from a nation whose citizens are being denied entry into the United States, according to a presidential executive order issued on January 27, 2017. This is one of several such artworks from the Museum’s collection installed throughout the fifth-floor galleries to affirm the ideals of welcome and freedom as vital to this Museum, as they are to the United States.” Art News says “acting quickly and wisely, MoMA has managed a feat that is far too rare in the museum world: it has made its collection a living, breathing thing, responsive to current events, and ready to educate and challenge visitors. Artworks have unique powers—the ability to transmit complex ideas instantaneously, to highlight unseen histories, and to question the status quo. MoMA is letting those powers get to work.”

Worth Watching

US mistakenly plays banned-in-Germany Nazi-era anthem at Tennis Fed Cup (or: On the lack of subtlety in the Alt-Right affiliations): Egypt’s marching bands have gotten a lot of flak over the years for playing wrong national anthems or playing them badly during state visits, but it has never gotten this bad: Germany’s tennis team attending the Federation Cup in Hawaii was shocked when an orchestra and opera singer played the first stanza of Germany’s national anthem (watch, runtime: 1:34) which has been banned in Germany since the end of the Second World War. “I thought it was the epitome of ignorance, and I’ve never felt more disrespected in my whole life, let alone in Fed Cup,” said Germany’s Andrea Petkovic, Haaretz reports. No words. Just face palm.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met with a bipartisan delegation from the US Congress led by chair of the US House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats (and proven friend of Egypt) Dana Rohrabacher, according to a US embassy statement. Head over to Al Shorouk for a pickup of the official post-meeting statement.

The congressmen also met with Defense Minister Sedky Sobhy to discuss regional security concerns, the ministry said in a statement. Rohrabacher, leader of the “Friends of Egypt Caucus,” had also met with Foreign Affairs Minister Sameh Shoukry. Rohrabacher had presented H. Res 113 last Thursday that expresses the sense that the House of Representatives that the United States should continue to authorize cash flow financing to Egypt and expand other areas of cooperation. The resolution most importantly calls for the restoration of cash flow financing in the military aid the US grants Egypt.

Separately, Sisi met with Kuwait’s parliamentary speaker Marzouq Al-Ghanim to discuss increasing Arab cooperation to solve regional issues, and ways to increase cooperation between Kuwait and Egypt in various areas, Al Ahram reports.

The EGP 33 mn joint British-Egyptian program to battle illegal migration, funded by the UK government, was launched on Thursday, Al Borsa reports. The program “seeks to tackle both the root causes and facilitators of irregular migration” by supporting Egypt’s vision for combating the issue, British ambassador to Egypt John Casson said at the launch. The British-Egyptian program comes one week after EU foreign policy chief Federica Mogherini said a Turkey-style agreement providing the Ismail government incentives to stem the flow of illegal migrants to the European Union, which Austria and Germany have since last fall promoted, is not on the table.

Representatives of 40 UK-based companies headed by the UK’s Trade Envoy to Egypt Jeffrey Donaldson arrived in Cairo on Sunday, in what Ahram Online has dubbed as the largest British trade delegation to ever visit Egypt. Companies will look for investment opportunities in healthcare, energy, infrastructure, waste management, construction, and food production.

The House of Representatives has approved a USD 450 mn loan from the Japanese International Cooperation Agency to finance the second phase development of the Grand Egyptian Museum, Al Shorouk reports.

Energy

EGAS looking to borrow EGP 2 bn

EGAS is in talks with domestic banks for an EGP 2 bn loan to cover debt obligations including those to international oil companies, Al Mal reported. The banks include NBE, Banque Misr, Banque du Caire, CIB, AAIB, QNB, ADIB, and Alex Bank, sources said. EGAS wants to pay the loan back over five years with a two-year grace period over which the loan will be completely issued and spent. This could come as good news for Dana Gas that has reportedly frozen its investments in Egypt over USD 265 mn of unpaid dues as of the end of 2016.

Eni to drill eighth well in Zohr

Eni began drilling the eighth well of the Zohr gas field last week after having completed drilling in seven other wells, an Oil Ministry source tells Al Shorouk. Eni will drill deeper on the eighth well to tap into larger reserves, the source added.

Infrastructure

Arab Contractors to undertake EGP 450 mn renovation of Sharm El Sheikh Airport’s Terminal 2

The Ismail cabinet has tasked Arab Contractors with the EGP 450 mn renovation of Sharm El Sheikh Airport’s Terminal 2, the head of the company’s Sinai branch said, according to Al Masry Al Youm. As we noted last year, the expansion project will increase capacity from 2.5 mn passengers to 4.5 mn passengers.

Basic Materials + Commodities

Cargill investing USD 10 mn into domestic market

Cargill is investing USD 10 mn into a wheat storage project in the Dekhela Port to add 42k tonnes of storage capacity, the Trade and Industry Ministry said in a statement, Aswat Masriya reported. The company is set to complete an expansion project at its vegetable oils factory in Borg El Arab by October, and is studying additional investments into Egypt, head of Cargill’s Agricultural Supply Chain in Europe, Middle East and Africa Roger Janson said.

Trade Ministry to maintain tariffs on some raw metals and minerals

The Trade Ministry will continue to impose tariffs on raw metals and minerals, including talcum powder (EGP 500 tariff per tonne), granite (EGP 400 per tonne), raw quartz (EGP 150 per tonne), raw feldspar (EGP 400 per tonne), and sand (EGP 100 per tonne), according to Youm7. The fees will not apply to minerals and metals being supplied to projects in the country’s free trade areas.

Manufacturing

Union Capital, BPE Partners to establish company to manage bailout fund for factories in distress

Union Capital and BPE Partners (formerly Beltone Private Equity) are planning a bailout fund to invest in distressed factories, Al Borsa reports and will file paperwork with the Egyptian Financial Supervisory Authority for the fund next week, Union Capital CEO Hany Tawfik tells the newspaper.

AOI’s Qader Factory in talks with German partner to launch ready-mix concrete production line

The Arab Organization for Industrialization’s Qader Factory for Developed Industries is in talks with a German partner to launch a new ready-mix concrete production line, Al Borsa reports.

Health + Education

Janssen provide the Health Ministry with 82.2k packages of hep C medication for no charge

Johnson & Johnson pharma arm Janssen donated 82.2k packages of its hepatitis C treatment Olysio to the health Ministry, according to an emailed statement. The treatment will be distributed through the National Committee for the Control and Prevention of Viral Hepatitis and aims to treat 27,000 patients.

Telecoms + ICT

Global Telecom gets CBE approval to provide USD equivalent

The CBE has approved making USD equivalent of EGP available to GDR holders outside Egypt who participated in Global Telecom Holding’s share buyback program, the company said in a statement. We had noted earlier that Global Telecom announced a share buy-back and cancellation of GDR program to acquire up to 10% of the total issued share capital.

Banking + Finance

HC Securities and Investment are looking to enter financial leasing market in 2017

HC Securities and Investment is looking to enter the financial leasing market in 2017, expecting a portfolio of around EGP 500 mn, Chairman Hussein Shoukry told Reuters. The investment bank had obtained the license and established a company in 2010, but the project was hindered by political unrest, he added.

NBE, Banque Misr to retain FY2015-16 earnings

Banque Misr and NBE are planning to retain their earnings for FY2015-16 to strengthen their capital base, unnamed sources tell Al Shorouk.

Legislation + Policy

Cabinet proposes amendments allowing Finance Ministry to guarantee loans for state-owned companies

Cabinet has proposed an amendment that would allow the Finance Ministry to guarantee loans for state-owned companies, Al Shorouk reports, citing an unnamed government source. The amendments are currently being reviewed by the Council of State (Maglis El Dawla).

Egypt Politics + Economics

House Ethics Committee to strip Al Sadat of committee seat, MP denies knowledge of the decision

The House of Representatives Ethics Committee has recommended stripping MP Mohamed Al Sadat of his committee seat after he was questioned in a disciplinary hearing on 5 February, sources tell Ahram Online. The MP said he was not notified of the decision, Al Mal says.

On Your Way Out

IBM is investing in Africa’s workforce: IBM is ramping up its digital skills training program to accommodate as many as 25 mn Africans in the next five years, “looking toward building a future workforce on the continent,” Loni Prinsloo writes for Bloomberg. The company is investing USD 70 mn to roll out the program in South Africa, but other countries set to benefit include “Nigeria, Kenya, Morocco and Egypt, enabling the expansion of the project across the continent.” IBM’s aim is clear; the company projects Africa will have the largest workforce on the planet by 2040 and it wants “to lay the foundation blocks to build a digital workforce,’’ Juan Pablo Napoli, head of IBM Skills Academy, says.

The Religious Endowments Ministry officially appointed 144 female preachers, the first time women have earned that designation, Youm7 reported. The women will run all-female classes at major mosques around the country.

The markets yesterday

EGP / USD CBE market average: Buy 17.52 | Sell 17.66

EGP / USD at CIB: Buy 17.4 | Sell 17.5

EGP / USD at NBE: Buy 17.47 | Sell 17.52

EGX30 (Sunday): 12,922.44 (-1.47%)

Turnover: EGP 777.4 mn (79% above the 90-day average)

EGX 30 year-to-date: +4.678%

THE MARKET ON SUNDAY: The EGX30 closed down 1.5% yesterday as index heavyweight CIB fell 3.0%. Egyptian Resorts gained 3.6% to lead the day’s gainers, while EFG Hermes and Arabian Cement both tumbled 4.9%. Market turnover stood at a paltry EGP 777.4 million, with local investors the sole net sellers.

Foreigners: Net Long | EGP +6.4 mn

Regional: Net Long | EGP +2.3 mn

Domestic: Net Short | EGP -8.7 mn

Retail: 71.1% of total trades | 72.4% of buyers | 69.8% of sellers

Institutions: 28.9% of total trades | 27.6% of buyers | 30.2% of sellers

Foreign: 11.4% of total | 11.8% of buyers | 11.0% of sellers

Regional: 6.3% of total | 6.4% of buyers | 6.1% of sellers

Domestic: 82.3% of total | 81.8% of buyers | 82.9% of sellers

WTI: USD 53.86 (+0.86%)

Brent: USD 56.70 (+1.07%)

Natural Gas (Nymex, futures prices) USD 3.03 MMBtu, (-3.41%, March 2017 contract)

Gold: USD 1,235.90 / troy ounce (+0.07%)

TASI: 7,021.57 (+0.75%) (YTD: -2.62%)

ADX: 4,570.47 (+0.02%) (YTD: +0.53%)

DFM: 3,702.16 (+0.53%) (YTD: +4.85%)

KSE Weighted Index: 420.41 (+0.03%) (YTD: +10.61%)

QE: 10,663.49 (+0.32%) (YTD: +2.17%)

MSM: 5,818.60 (-0.02%) (YTD: +0.62%)

BB: 1,309.31 (+0.19%) (YTD: +7.28%)

Calendar

14-16 February 2017 (Tuesday-Thursday): Egypt Petroleum Show 2017 (EGYPS), CIEC, Cairo.

16 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

20-21 February (Monday-Tuesday): Fulbright Student Alumni Regional Conference: Contemporary Health Issues, Conrad Hotel, Cairo.

20-22 February (Monday-Wednesday): 20th International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Cairo.

23 February (Thursday): Potential date for resumption of flights between Egypt and Russia, according to Izvestia newspaper.

06-08 March (Monday-Wednesday): 13th EFG Hermes One on One Conference, Dubai, United Arab Emirates.

08 March (Wednesday): Microfinance forum, Nile Ritz-Carlton, Cairo.

09-11 March (Thursday-Saturday): Egypt Projects Summit, Cairo International Convention Center, Cairo.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

01 January 2018 (Monday): New Year’s Day, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.