- Lagarde says IMF will vote on USD 12 bn bailout on Friday, lauds reforms. (Speed Round)

- VAT executive regulations to be unveiled next week. (Speed Round)

- Net international reserves drop fractionally to USD 19 bn. (Speed Round)

- Businesses in Egypt are seeing “good signals” following the float of the EGP. (Speed Round)

- Banks starting to cover imports, importers whine it’s not happening fast enough. (Speed Round)

- El Garhy to testify on Sunday — is a new income regime hike in the works? (Speed Round)

- By the Numbers

Wednesday, 9 November 2016

IMF schedules bailout vote for Friday, Lagarde praises reforms

TL;DR

What We’re Tracking Today

If you absorb nothing else in your US-election-induced stupor, know that aside from whether Hillary or Donald wins, there are a handful Egyptian stories people will (or should) be talking about on this very slow news morning. (Slow if you discount what was, at dispatch time at least, a nail-biter in Amreeka.)

Good: The float of the EGP and prospects of an IMF facility sent the EGX30 up 2.5% yesterday (YTD: +44%), with the benchmark breaking through the 10,000 barrier. That’s nice, of course, but what’s particularly significant is that foreign investors were again heavy net buyers, snapping up shares to the tune of EGP 563 mn. Turnover was again high at EGP 1.8 bn, or about 4x the trailing 90-day average.

Great: IMF boss Christine Lagarde confirmed yesterday that the IMF’s executive board will consider the USD 12 bn extended fund facility for Egypt on the agenda for its 11 November executive board meeting. More on that in Speed Round.

Ugly: We’re business / finance / econ types, but longtime readers know our penchant for armchair political analysis, and we’re particularly concerned about the impact yesterday’s court ruling that effectively bars the transfer of the strategic islands Tiran and Sanafir to Saudi Arabia. Exactly how bad relations are with Saudi Arabia is an open question in view of the announcement yesterday that Saudi Aramco would be cutting off petroleum deliveries indefinitely. The ruling is salt in an open wound. We have a bit more in Speed Round, below. Guess we’ll still be diving there, after all.

Just over the horizon: We have nothing new to report on the so-called 11/11 protests, though one of the more astute observers of matters activist / political we know commented yesterday: “You know, Dream Park just did the government a solid by offering half-price tickets on Friday. Think of it: ‘Damn, I know I should go protest, but the Death Train is 50% off? See ya.’”

Finally: The CBE puts the average exchange rate at EGP 17.97 (sell) and 17.58 (buy) to the greenback yesterday. We’ve heard anecdotal reports that there’s some activity on the parallel market at about 18.25 (a figure confirmed by Ahram Online). Parallel volumes are virtually non-existent at the moment. (Oddly enough, we also witnessed a streetside transaction while stuck in Garden City traffic yesterday.) Just a friendly reminder to hoarders: When market-clearing rates are hit, currencies often fall rather quickly to their fair value. Y’all might want to think about locking in gains / minimizing potential losses sometime soon. Just saying.

No “Dewey Defeats Truman” here at Enterprise: We want to be optimistic:Our Tweet of the day is from our friend Ahmed Alfi, from yesterday morning: “Today, the American people will show once again that they believe in their dreams, not their nightmares.”

We want to believe in this world: One of us, recounting a chat with her teenage daughter and the daughter’s friend yesterday: “They don’t really see anything unusual or significant about that fact that isA America is about to elect a female president. They are so accustomed to the fact that a woman can do anything that a man can do that they really don’t see why I’m making a fuss over it.”

But we fear we live in this world: “Global Markets Rocked as Traders See Pathway for Trump Victory” (Bloomberg) and “Markets plunge worldwide as Trump shows surprising strength.” (Washington Post)

AS WE PREPARE TO SEND THIS: Trump is ahead something on the order of 167-122 (per CNN) or 168-109 (per New York Times). Clinton is projected to close Virginia and is ahead in Colorado, but Trump has won Ohio and is again ahead in Florida’s see-saw race. Still up for grabs: Pennsylvania, where Hillary holds the lead as we write this. If we don’t know by 6:30am today who’s won, it could drag out until late afternoon, if past precedent is any indicator. A reminder that the Washington Post and New York Times have both dropped their paywalls all day today.

** The New York Times is presently forecasting a 94% chance that Trump will win.

The Suez Canal Authority is expected to resume talks with nine shipping lines today on paying fees in advance in exchange for discounts, sources tell Al Mal. It’s looking like MCS and CMA are interested in the offer. The CBE has authorized the Suez Canal to cap discounts at 5%. The authority is offering a 3% for the prepayment of three years’ transit fees and a 5% discount for a five-year prepayment s. A decision from the three majors — Maersk, MCS, and CMA — was expected this week.

We’re goin’ to Tunis: A delegation of Egyptian officials and businessmen arrives in Tunisia today ahead of a joint monitoring committee meeting, Ahram Gate reported. The delegation includes Domty Chairman Amr El Damaty, Tropic International Chairman Mohamed El Masry, Tenth of Ramadan Investors Association Chairman Mohamed Aref, and Electrolux Chairman Mohamed El Menoufi.

On The Horizon

Russian president Vladimir Putin will visit Egypt sometime this month to sign an agreement to construct the Daba’a nuclear power plant, Al Masry Al Youm reported.

Bank of America Merrill Lynch’s MENA 2016 Conference will run from Monday, 14 November till Wednesday, 16 November in Dubai.

The Egypt Trade & Export Finance Conference 2016 begins on Tuesday, 15 November. The Egypt Mega Projects Conference also begins on the same day.

The Central Bank of Egypt’s Monetary Policy Committee will convene on Thursday, 17 November to review interest rates, which we’re guessing will be left on hold after this past Thursday’s 300 bps hike.

Speed Round

IMF Managing Director Christine Lagarde will recommend the executive board approve Egypt’s request for a USD 12 bn bailout package at its meeting on Friday, 11 November, she said in a statement issued late yesterday. “The Egyptian authorities have embarked on an ambitious reform program to put the country’s economy on a sustainable path and achieve job-rich growth. The liberalization of the exchange rate and the adoption of the second phase of the fuel subsidy reforms are important measures in the authorities’ reform agenda,” she said. “I will recommend that the board approve Egypt’s request in support of this ambitious economic reform program that will help restore macroeconomic stability and bring Egypt’s economy closer to its full potential.”

First tranche next Tuesday? Finance Minister Amr El Garhy confirmed that the IMF would disburse the first tranche of the loan on Tuesday 15 November after the two sides wrap the paperwork, Al Borsa reports. The first tranche could be larger than anticipated: The IMF has raised the first payment of the loan to USD 2.75 bn from an expected USD 2.5 bn, following talks with the government, Deputy Finance Minister Ahmed Kouchouk told Reuters on Tuesday.

The caveat: This doesn’t necessarily mean the Central Bank of Egypt is going to be dumping the funds into the market in an extraordinary auction. From what we’re told, the CBE’s stance remains for the moment to see whether the banks can get the interbank market up and running and deliver a market-clearing rate in the process.

The long-awaited executive regulations of the value-added tax (VAT) will be revealed next week and will be put out for “national dialogue,” Deputy Finance Minister Amr El Monayer tells Al Ahram. No precise date was given for the big reveal. The regulations are expected to address a number of outstanding issues in the law including:

- How contracts signed prior to the passing of the VAT will be amended;

- Clearly defining some of the goods and services that will be subject to VAT;

- Outline capital goods and production inputs eligible for rebates;

- Define the status of certain sectors including pharma, accounting, law firms, etc.;

- Identifying which goods and services will be part of the schedule tax — the fixed tax on goods that are not subject to the baseline rate

- Setting regulations for businesses that do not meet the EGP 500K minimum income requirement to register for the VAT.

Net international reserves fell to USD 19.04 bn in October, down from USD 19.59 bn in September, according to a statement from the Central Bank of Egypt. The CBE provided no explanation for the drop. That number could be bolstered this month by the arrival of the first tranche of the IMF loan and the finalization of the USD 2.7 bn currency swap with China, which Finance Minister Amr El Garhy confirmed last night requires “only administrative procedures” to complete.

Businesses in Egypt are seeing good signals following the float of the EGP, Ahmed Feteha (who, you may recall, never writes anything nice about Egypt) writes for Bloomberg. Importers are able, to some degree, to source USD from banks now and the stock market has gained 19% since the central bank’s decision. “So far we’re on the right track, flows are starting to gain momentum … We’re coming from a very low base so it’s not sizable yet. But this is a change in trend, and we’re seeing all the good signals on many levels,” EFG Hermes economist Mohamed Abu Basha says. “Exchange-rate and fiscal adjustments have to deliver rebalancing for six years of economic dislocation and policy mistakes,” Simon Williams, HSBC’s chief economist for central and eastern Europe, the Middle East and North Africa, says. Williams says that while Egypt has a tough task ahead, “it’s imperative policy makers follow through.”

… On the FX market yesterday, one banker told Reuters the volumes of USD inflows to banks “are increasing, relatively speaking, compared to when there was central bank interference… The number of transactions we are executing with clients is increasing daily. All these are good signs, regardless of the weakening pound. This is the only way to attract [USD] back into the banking system." One trader does not think the parallel market will re-emerge: “I don’t think people will jump right back to the black market because the banks are trying to get the liquidity from the black market as well.”

The National Bank of Egypt and Banque Misr have reportedly put up a combined USD 130 mn since Sunday to cover import backlogs. USD 80 mn in letters of credit came from NBE, the bank’s chairman Hisham Okasha tells Youm7. The imports consisted of production inputs, pharmaceuticals, petrochemicals, and a number of basic goods, he tells Ahram Gate. Banque Misr has cleared USD 50 mn since Sunday, according to the bank’s chief Mohamed El Attreby. As we noted on Monday, Citibank analysts estimate that backlog at USD 9-11 bn.

“Banks are not covering demand fast enough,” said Mohamed Rostom, secretary general of the importers division of the Federation of Egyptian Chambers of Commerce. He tells Al Mal that he and other importers have been waiting for days for banks to come clear their imports. (Yes. We pulled back from the brink of economic disaster four business days ago, and — gasp — not everyone has all the USD he / she requires just yet. Please visit your local pharmacy, acquire a pacifier, and wait your bloody turn.)

Helping build the liquidity that will make Mr. Rostom happy, NBE vice-president Yahia Aboul Fotouh claims: remittances were up fourfold since last Thursday, which he attributed to the appeal of the new 20% interest CDs offered by the public banks, Al Mal reports.

Auto industry still tapping parallel market: Automotive distributors and importers tell the newspaper that they are continuing to be passed over for LCs and had to continue to resort to the parallel market which offered greenbacks for EGP 18.75. And as some banks, including Crédit Agricole have begun exchanging greenbacks for over EGP 18.00 on Tuesday, Rostom and other importers are once again crying foul and calling the float a failure. “It’s not too late to reverse the policy,” he suggested. The CBE puts the average exchange rate at EGP 17.42 for the USD 1 on Tuesday, so we can’t really sympathize. (And, again, please see our note about the pacifier, above.)

And speaking of the parallel market: The Egyptian Exchange Company has sold USD 1 mn to the National Bank of Egypt at 16.25 per greenback, Al Masry Al Youm reported. The move is “unprecedented,” the paper notes, explaining that the CBE gave its blessing to the transaction.

Against that backdrop, the Egyptian Automobile Manufacturer’s Association (EAMA) will meet today, Al Mal reports, to discuss customs duties on cars, which as we noted on Sunday, have increased to 66% and which are now filtering down into sticker prices in showrooms. EAMA members are predicting a continuing slump in car sales as a result. (Auto industry reps are also due to appear before the House Industry Committee to discuss the automotive directive next week, Al Borsa confirms.)

Spiking customs duties was one of five major issues affecting business identified by the Federation of Egyptian Industries (FEI) at its meeting on the float yesterday. Other concerns include: projected losses for the pharma industry, pricing of gas for industry, and a lack of clarity on how to revalue USD debt held in corporate books as well as the value of government contracts, FEI sources tell Al Mal.

NBK is not bothered by the float of the EGP, saying rising profits will compensate for FX losses: National Bank of Kuwait (NBK) said its Egyptian unit’s profits are rising and that this increase will offset the impact from currency devaluation, Reuters reported. The bank, however, warned that climbing inflation will add to its operating costs and spending in 2017. “NBK Egypt is expected to continue to grow, positively benefiting from the structural reforms programme, as confidence in the economic reform measures is expected to increase with more foreign and local investments in Egypt that will provide for an opportunity for lending and financing to grow,” the bank continued. NBK Egypt will invest in government debt instruments to bring higher returns, and has invested a “chunk” of its funds in short-term investments to benefit from changes in interest rates.

El Garhy to testify on Sunday — is a new income regime hike in the works? The House Economics Committee has called Finance Minister Amr El Garhy to testify on Sunday about the impact on the state budget deficit of last Thursday’s float of the EGP, the 300bps interest rate hike and rising fuel prices, Al Borsa reports. Committee member Yasser Omar expects the 300 bps increase in interest rates will increase debt service burden to EGP 400 bn, driving the budget deficit to 14% this year from both a revised target of 9.8% and the government’s original budget of 9-9.5% (see page 4 of the original budget document, pdf, Arabic). Another committee member tells the newspaper that the government may be forced to push through a progressive tax bill to help close the gap.

Speaking of the finance ministry, the quarterly budget deficit fell from 2.8% to 2.4% in 1Q2016-17, unnamed government sources told Reuters. “The total deficit for the first quarter of the year was around EGP 76.816 bn from EGP 78.280 bn a year earlier,” one of the sources said. Both sources confirmed the government debt service to EGP 57.189 bn from EGP 50.704 bn a year earlier, but subsidies, grants and social benefits costs fell to EGP 32.094 bn from EGP 37.942 bn.

Finance Ministry and FEI reach agreement FX losses for 2014-15 taxes: The Finance Ministry and the Federation of Egyptian Industries (FEI) have reached a preliminary agreement that would see the Finance Ministry allow businesses to record some of the variance between the official and parallel market rates as FX losses in their 2014-15 taxes, Mohamed El Bahey, head of the FEI’s tax committee tells Al Borsa. The FEI and the ministry plan to meet on Wednesday to discuss how to handle the variance between the two rates this year and whether only importers will be allowed to record the FX loss.

Court rejects government appeal, says Tiran and Sanafir are Egypt’s: The Administrative Court of the Council of State upheld a lower tribunal ruling to annul President Abdel Fattah El Sisi’s decision to transfer the Tiran and Sanafir Islands to Saudi Arabia through a maritime demarcation agreement, The AP reported. The government had earlier appealed the court’s decision in front of three separate courts, one of which was the Council of State. The remaining two have yet to rule on the case.

Egypt in the News

On an exceptionally slow news day in which global media attention is focused squarely on the US presidential race, the only significant coverage of Egypt are wire service pickups of Christine Lagarde’s statement of late yesterday and the court ruling on the Tiran and Sanafir islands case.

Demand for jewelry in Middle Eastern markets continued to decline, hitting a record low in Egypt and the UAE, the Economic Times reports. According to the World Gold Council’s Gold Demand Trends report for 3Q2016, the backdrop of regional conflict resulted in a sharp drop in tourist demand, with high gold prices and lower oil revenues contributing to the weakness. Egypt’s currency crisis almost doubled the domestic price for gold over 9M2016, with YTD demand down by 42%, and 3Q2016 demand halving to just six tonnes.

On Deadline

Former Deputy Prime Minister and Al Shorouk columnist Ziad Bahaa El Din says floating the EGP was a move that was required immediately as the economy could not operate with “two prices” for one commodity. While this does not address why the EGP’s value was falling, it merely processes the problem through official channels. Bahaa El Din is more critical of the increase in fuel products’ prices. He says the timing and extent of increases could have been managed better to lessen the impact of the price shock. Additionally, he says the policies adopted in the last two years that drove up the budget deficit and public debt to GDP ratio, including mega projects, public spending, and involvement in investment projects, must be revised.

“Is visiting Iran a crime?” asks El Watan’s Khaled Montasser, who finds it baffling that the prospect of the Oil Minister doing so met with what he says was undue criticism. The two countries shared historical ties in the early-to mid-twentieth century, and Egypt is a “secular” state — what does the confessional difference between the two matter? The newspaper’s Emad Gad joins in on questioning why the shiaphobia (or a general fear of racial or religious differences) comes into play for the rumored visit, a practice history should have taught leads nowhere good.

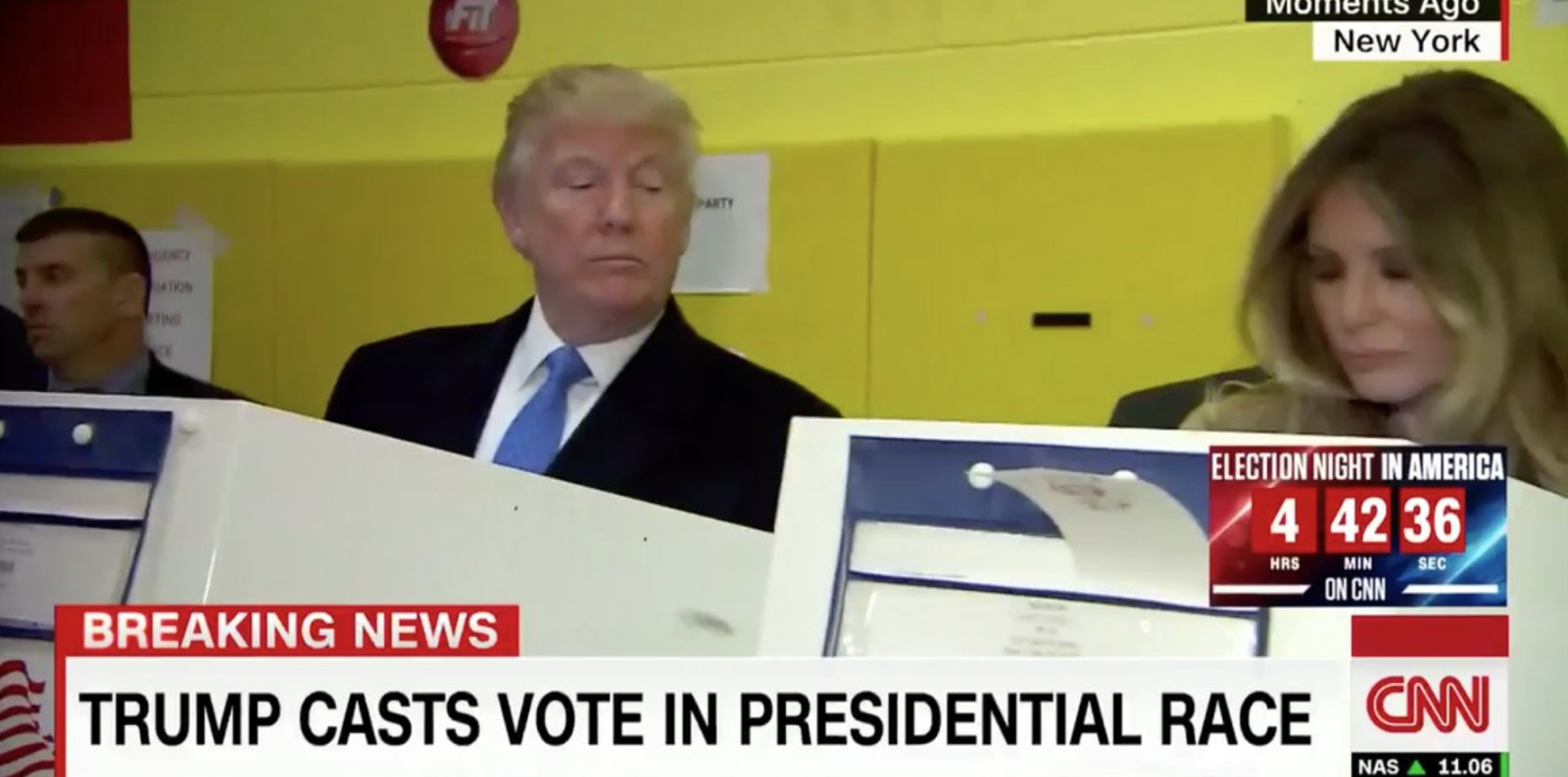

Image of the Day

Trump channels his inner Ronald Reagan: “Trust, but verify.” Checking out his wife’s ballot while casting his own in New York — after being booed while arriving at the polling station. His son pulled the same ballot-glancing stunt. Please don’t let this be the future “leader of the free world.”

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry met with French Senate President Gerard Larcherin in Cairo, Ahram Online reported. The two discussed regional and domestic issues including the EGP float, illegal immigration, terrorism, and the security situation in Syria, Libya, Iraq, Yemen, and Palestine.

The World Bank has offered Egypt a USD 300 mn grant to tackle transportation issues within the Greater Cairo region, World Bank representative Sami Ali told Al Mal. The comments come at a workshop on implementing an authority to regulate transportation in Greater Cairo. The details of the programme are unclear.

Energy

House Energy Committee pushes to consider 250 kWh consumption tier as limited income households

The House of Representatives’ energy subcommittee is asking the Electricity Ministry to consider consumption tiers up to 250 kWh as limited-income households’, Al Borsa reported. The committee is asking for the consumption tier adjustment to be implemented in the next fiscal year. Electricity subsidies account for EGP 30 bn this year, and are expected to rise after the decision to float the EGP. Total ministry expenses are expected to grow by EGP 100 bn as a result of the float. President Abdel Fattah El Sisi has requested the Electricity Ministry not raise prices and cover the costs incurred from the float.

EGP devaluation will help Egypt’s energy industry

The EGP devaluation will make Egypt’s energy industry more attractive for investment and help pay off current contracts, Oil Minister Tarek El Molla said at the Abu Dhabi International Petroleum Exhibition and Conference, Gulf News reported. Egypt is expecting USD 30 bn in investments in oil over the coming three years, he added, and is aiming to export a small portion of its LNG production by 2021.

Power and Oil ministries in talks on the effects of the float

he electricity and oil ministries are discussing how to reduce Egyptian Electricity Holding Company’s increased expenses following the rise in fuel costs, according to Electricity Ministry spokesperson Ayman Hamza speaking to Al Shorouk. As we reported yesterday, the float, rising interest rates, and spiked gas prices have upped the ministry’s expenses by EGP 100 bn annually.

Basic Materials + Commodities

Supply Ministry pumps more sugar, rice, cooking oil, receives seven bids on int’l wheat tender

The Food Industries Holding Company (FIHC) has supplied 10k tonnes of sugar to retail outlets, chains, and supply markets, in addition to 3k tonnes of cooking oil, and 1,200 tonnes of rice last Monday to governorates, Al Mal reports. The additional supply came following demands for increased supply for different governorates amidst concerns of shortages. GASC bought 180k tonnes of Russian wheat and 60k tonnes of Romanian wheat in its latest international tender, Al Mal also noted, after the state wheat buyer received offers from seven suppliers for a 10-20 December delivery.

Food production companies mulling price hikes effective next week, steel already begins

Food production companies are mulling increasing prices next week, with Mohamed Shoukry of the Federation of Egyptian Industries expecting increases of 2-5%, Al Borsa notes. Domty is considering pegging its price increases to the exchange rate, while Golden Foods announced that it will be factoring in gas price hikes into its prices. Delta Sweets is increasing the prices of each of its products by at least EGP 3. In related news, Ezz Steel has just raised the price per tonne to a record high of EGP 9,150 from EGP 7,650, according to Al Mal, which adds that other suppliers have taken similar measures.

Health + Education

Investment Minister launches GSK pharma production line

GlaxoSmithKline launched an EGP 60 mn pharma production line with an annual capacity of 30 mn packs, Investment Minister Dalia Khorshid told Al Masry Al Youm. Expansions at any company in Egypt is a reassuring signal to investors, she added.

Insulin reserves allegedly suffice for seven months

The Health Ministry has 4 mn packs of insulin in stock, enough to last seven months, Al Borsa reports. As we noted yesterday, there is anecdotal evidence of a shortage in hospitals nationwide due to reduced supply as a result of the EGP float, although domestic manufactures have dubbed such concerns as unwarranted.

Real Estate + Housing

Cairo Governorate warns Qatari Diar about civil protection infringements at St. Regis towers

The Cairo Governorate has sent out a second warning to Qatari Diar about incomplete civil protection requirements at the St. Regis towers overlooking the Nile, Al Borsa reported. The company is in violation of safety and civil protection codes, as well as the consulting and engineering agreements, an unnamed source at the governorate said. The governorate has tasked the Civil Protection Authority to complete construction work to cover up gas tanks in the bank of the building, as well as requested a detailed report on civil protection methods at the two towers. Qatari Diar is reportedly starting international arbitration procedures against Egypt relating to its City Gate project.

Palm Hills Development in talks with NUCA over October Oasis project

Palm Hills Development have presented their financial and technical bids on the October Oasis project to the New Urban Communities Authority (NUCA), Chairman Yaseen Mansour told Al Borsa. The project would see PHD develop 6k feddans in Six of October, he added. An MoU was originally signed for the project at EEDC in 2015 to build the project over 10k feddans at an investment cost of EGP 150 bn, but was later reduced by the NUCA to 6k feddans.

Tourism

Deutsche Hospitality rebrands Marsa Alam hotel

Deutsche Hospitality have rebranded the Marsa Alam Iberotel into Coraya Beach, Hotelier Middle East reported. This brings the group’s total representation in Egypt to eight hotels and three Nile river ships. The hotel is operated by the Egyptian company Sun Oasis for Hotels via a franchise agreement with the Steigenberger Hotels and Resorts brand.

Ayadi establishes Tourism Development Fund

After three years of waiting, state-run Ayadi Company for Development and Investment has established the EGP 50 mn Tourism Development Fund, after recently receiving approval from the Egyptian Financial Supervisory Authority, Al Borsa reports. Al Ahly For Development & Investment will be managing the fund and will begin marketing the fund in 1Q2017 with a target of USD 250 mn, said Hussam Heyba, head of investment at Al Ahly. The fund was first announced in December of 2013 with the aim of revitalizing the battered tourism industry, which had only continued to see worse days since.

Rashed meets with reps from British tourism companies on the sidelines of WTM

Tourism Minister Yehia Rashed met with representatives from British Airways on the sidelines of the World Tourism Market in London to discuss airline incentive programs as well as potentially resuming direct flights to Luxor and Hurghada, according to an e-mailed ministry statement. Rashed also met with representatives Travel Mole, A&K Travel, and Thomas Cook. Rashed affirmed that partners and organizations in the tourism industry are keen for resuming inflows.

Falcon Group to begin securing Cairo Airport terminal 2 next month

National Falcon Group will begin securing Cairo Airport Terminal 2 by next month, Al Borsa reports.

Automotive + Transportation

Transportation Ministry inks third phase of Cairo Metro Line 3 agreement

The Transportation Ministry has signed an agreement with the ETF – Orascom Consortium for the third phase of the Cairo Metro Line 3 project, Amwal Al Ghad reported. The agreement is valued at EGP 180 mn plus EUR 60 mn. Additionally, the project is also funded by a EUR 300 mn loan from the French Development Agency, and a EUR 600 mn loan from the European Investment Bank. The third phase stretches 15 stations between Ataba and Boulak El Dakrour.

Banking + Finance

EFSA grants Mubasher financial services license

The Egyptian Financial Supervisory Authority granted Mubasher International a financial advisory license in October, CEO Ehab Rashad told Al Mal. The company is establishing a holding company to serve as an umbrella for its brokerage, advisory and asset management offerings, he added.

CIBC to begin operating in Abu Dhabi mid-January 2017

CI Capital’s securities brokerage arm will begin operating in Abu Dhabi by mid-January 2017, brokerage chief Khaled Abdel Rahman said, Al Borsa reports. He added that the newly-acquired license solely allows trading operations.

Legislation + Policy

El-Sisi signs anti-immigration act into law

President Abdel Fattah El-Sisi signed the Anti-Illegal Immigration Act into law yesterday, Al Masry Al Youm reports. The law institutes new punishments for human traffickers.

Egypt Politics + Economics

Politics is nearly “dead” in Egypt -SDP Chairman

“The current political scene is reminiscent of the situation before 25 January 2011, as there were hypocrites, beneficiaries, and supporters of the ruling political regime, (and) political groups dedicated to political hypocrisy,” Chairman of the Egyptian Social Democratic Party Farid Zahran told Daily News Egypt. The reason political life has deteriorated, says Zahran, is because some political parties “do not mind surrendering all public and private freedoms and rights in exchange for security and stability.”

On Your Way Out

With over three mn entrepreneurs in Egypt, those undeterred by how the government handled the feed-in tariff program have been drawn to agriculture, industry, and renewable energy projects, Wamda reports. Nawart, a cross disciplinary incubation project for small scale renewable startups, has presented 15 projects it believes can help the government meet the renewable energy target if mentored properly. The projects range between biogas to solar street lighting, with three market ready prototypes out of the 15, including water pumping startup Sun City Energy and hybrid energy provider Taqa Gededa. “We strive to reach a point where [the Nawart startups’] products can be 100% manufactured locally and also start competing internationally,” said Trade and Industry Ministry representative Hanan El-Hadary, noting her ministry was willing to provide funding, technical support, marketing, and machinery for startups with a small price or even at no cost.

The markets yesterday

EGP / USD CBE market average: Buy 17.5837 | Sell 17.9723

EGP / USD at CIB: Buy 17.15 | Sell 17.35

EGP / USD at NBE: Buy 17.15 | Sell 17.35

EGX30 (Tuesday): 10,096.57 (+2.48%)

Turnover: EGP 1.777 bn (308% above the 90-day average)

EGX 30 year-to-date: +44.11%

Foreigners: Net long | EGP +563.9 mn

Regional: Net short | EGP -69.6 mn

Domestic: Net short | EGP -494.3 mn

Retail: 52.7% of total trades | 51.4% of buyers | 54.0% of sellers

Institutions: 47.3% of total trades | 48.6% of buyers | 46.0% of sellers

Foreign: 24.8% of total | 40.7% of buyers | 9.0% of sellers

Regional: 7.6% of total | 5.6% of buyers | 9.5% of sellers

Domestic: 67.6% of total | 53.7% of buyers | 81.5% of sellers

WTI: USD 43.93 (-2.33%)

Brent: USD 45.18 (-1.87%)

Natural Gas (Nymex, futures prices) USD 2.60 MMBtu, (-1.33, December 2016 contract)

Gold: USD 1,303.30 / troy ounce (+2.26%)<br

TASI: 6,327.8 (+2.1%) (YTD: -8.4%)

ADX: 4,347.9 (+1.4%) (YTD: +0.9%)

DFM: 3,306.7 (+0.8%) (YTD: +4.9%)

KSE Weighted Index: 360.3 (+0.4%) (YTD: -5.6%)

QE: 9,985.3 (+0.2%) (YTD: -4.3%)

MSM: 5,439.2 (-0.4%) (YTD: +0.6%)

BB: 1,144.3 (-0.4%) (YTD: -5.9%)

Calendar

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

15 November (Tuesday): Egypt Trade & Export Finance Conference 2016, Fairmont Nile City, Cairo

15 November (Tuesday): Egypt Mega Projects Conference, Four Seasons, Cairo

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

18-20 November (Friday-Sunday): 4th Africa-Arab Summit in Malabo, Equatorial Guinea.

25-26 November (Friday-Saturday): 27th Energy Charter Conference, Tokyo, Japan.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

30 November (Wednesday): OPEC’s 171st ordinary meeting, Vienna, Austria.

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

09-11 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

14-16 February 2017 (Tuesday-Thursday): Egypt Petroleum Show 2017 (EGYPS), CIEC, Cairo

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.