- Lamees hosts El-Garhy, El-Erian, Negm and El-Etriby. (Last Night’s Talk Shows)

- Youm7 editor, talk show host declares war on the rich. (Last Night’s Talk Shows)

- Gov’t to reform tax code, works with FEI on FX expenses. (Speed Round)

- Egypt in talks with international lenders for up to USD 1.6 bn in financing. (Speed Round)

- Mobile network operators relying on parent companies for USD to pay 4G license fees. (Speed Round)

- FT’s ranking of executive MBA programs is out. (Speed Round)

- Wall Street Journal package looks at “The Dying Business of Picking Stocks.” (Speed Round)

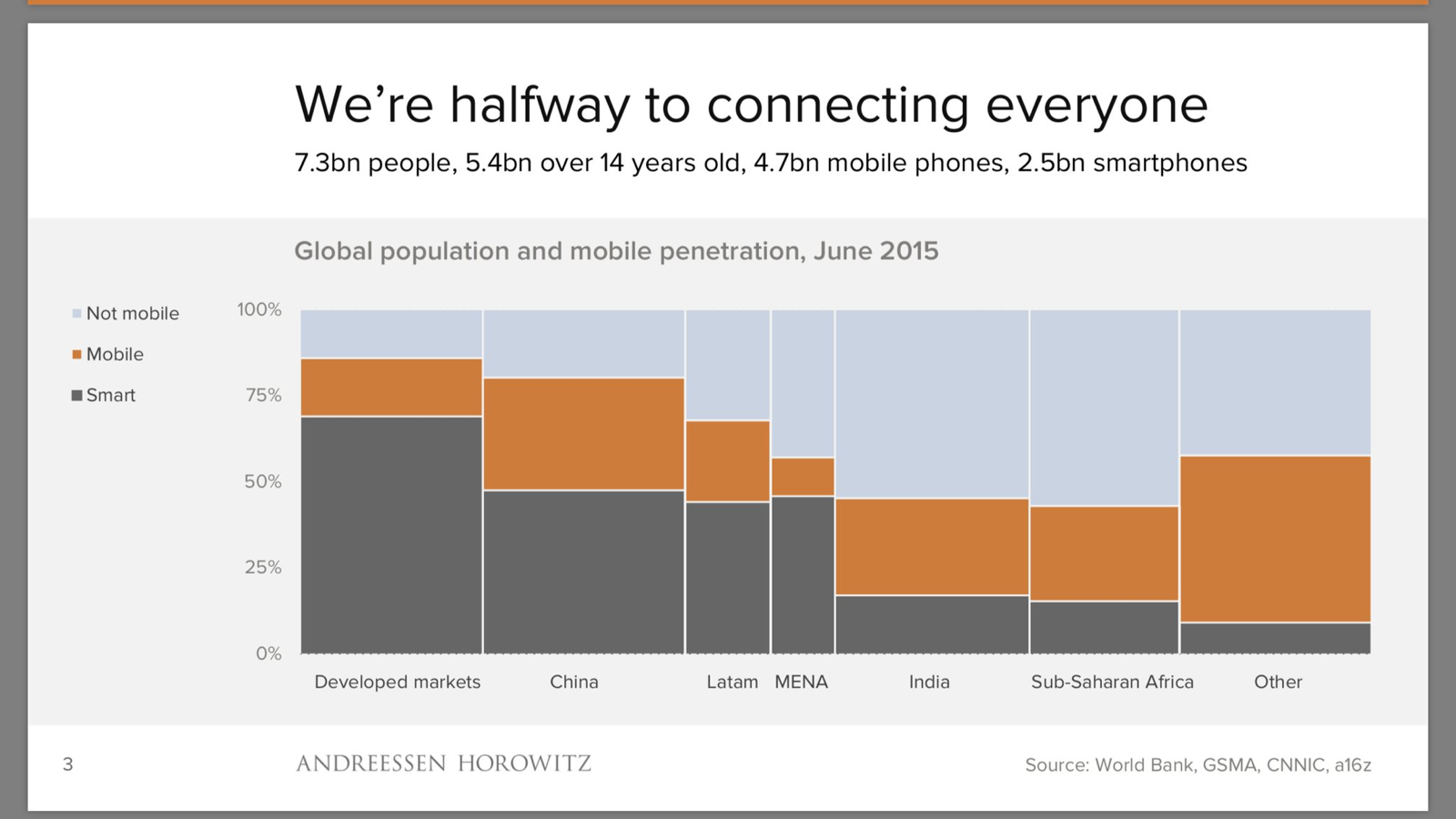

- Mobile is Eating the World 2016 –Andreessen Horowitz. (Image of the Day)

- By the Numbers

Tuesday, 18 October 2016

Epic Lamees episode: El-Garhy, El-Erian, Negm, El-Etriby.

Plus: Youm7 boss wants to hike taxes on the rich

TL;DR

What We’re Tracking Today

It’s day two for our first-ever reader poll. Thank you, a mn-fold, to the hundreds of you who took a minute out of your day to respond yesterday. We’re going to be immodest and suggest that this is the largest poll of the most senior cohort of business leaders, investors and fund managers ever undertaken on this scale. We’re really looking forward to reporting back to you next Monday on your answers to our key economic questions.

If you haven’t yet had time to answer the survey, tap here whenever you have a moment. You don’t need to answer all of the questions, and even if you do, it won’t take you more than a minute. We’ll be so pathetically grateful for the feedback that we’re going to send 10 readers who complete all nine questions a set of Enterprise mugs. The poll closes at 1pm CLT on Sunday, 23 October.

Our review of Last Night’s Talk Shows is back for a one-morning guest appearance. Partially in response to reader feedback yesterday in our survey, and largely because the editor had insomnia and stumbled first into Youm7 / Al-Nahar’s Khaled Salah suggesting we all eat the rich (apologies to Liv Tyler’s dad and his little band) and then Lamees El Hadidi grilling the CBE’s Gamal Negm over credit cards. Which led to Mohamed El Etriby. Which led to Mohamed El-Erian. Which led to Amr El Garhy… All of which translated into a call to the overnight editor asking him to bring back Talk Shows — for this morning’s edition, at least.

The EGX had its worst close in four months yesterday, with Bloomberg’s Ahmed Namatalla pointing to “rising concerns about the country’s willingness to weaken its currency as required by International Monetary Fund for approval of a loan request.” The EGX30 closed down 2.2%, with c. EGP 969.7 mn in shares changing hands, about 123% above the trailing 90-day average. “The stand-still pose by the government on currency devaluation is finally kicking in with institutional investors, and is raising concerns of implementation risk when it comes to meeting IMF requirements to secure the loan,” Pharos Holding head of equities Mohamed Radwan is quoted as saying.

From our Snopes file: Wolf of Wall Street author Jordan Belfort is denying he’s involved in an upcoming seminar in Egypt, referring to the alleged (and unnamed) Egyptian organiser as a “[redacted]hole” and demanding Egyptian police investigate. We could find no evidence of the event on El Face or anywhere else on the interwebs; Belfort’s staff did not answer an email asking for comment. His complaint is on Facebook here.

Wait, isn’t foreign policy the prerogative of the executive branch? House of Representatives Speaker Ali Abdel Aal said “he is seriously contemplating a joint meeting with Saudi Arabia’s Shura Council to put relations between the two countries back on track,” reports Ahram Online’s Gamal Essam El-Din. He is, of course, merely answering the clarion call of one of Egypt’s most honorable MPs: “Mostafa Bakri told parliament Monday that a large number of MPs have signed a request asking that an Egyptian parliamentary delegation be formed to visit Saudi Arabia and meet with leading members of its Shura Council, to help erase any tension between the two countries.”

What We’re Tracking This Week

Hillary Clinton and Donald Trump square-off tomorrow in the third and final debate of the 2016 US presidential election. They’re set to clash starting 9pm Eastern on Wednesday, 19 October (that’s 3am CLT on Thursday, 20 October). Politico expects Clinton to trounce The Donald. Can’t stay up to watch it live? We’ve found CNN International rebroadcasting the last two clashes at c. 7am CLT. CNN International’s Wednesday / Thursday schedule has yet to be updated for the exact broadcast time.

Also on tomorrow: The Digital Media Forumtakes place at the Four Seasons Nile Plaza.

Meanwhile, CNN’s “Poll of Polls” shows Clinton with an eight-point advantage over Trump among likely voters. Zooming-in on key states, Politico sees Trump ahead in Ohio and in a “dead heat” with Clinton in North Carolina and Nevada, while Clinton is looking to throw always-Republican Arizona into her column.

Last Night’s Talk Shows

We haven’t exactly secured the USD 6 bn in third party-funding the IMF wants in place before approving the USD 12 bn extended fund facility. But we’re close, Finance Minister Amr El Garhy told Lamees El Hadidi’s Hona El Assema last night on an epic episode that also featured appearances by Mohamed El Erian, Deputy Central Bank Governor Gamal Negm, and Banque Misr CEO Mohamed El-Etriby. Deputy Finance Minister for International Affairs Ayman Al-Qaffas had suggested last week that Egypt has finished cobbling together the funding and said we had informed the IMF. We are almost there, though, El Garhy assured Lamees.

Egypt is definitely postponing the USD 3 bn eurobond sale to mid-November at the earliest on account of Saudi Arabia’s USD 15 bn bond issue, El Garhy said, and the delay could stretch to the first week of December. Other international developments including the US election also factored into the decision. El Garhy added that the IMF board will decide on the facility within the month and reassured Lamees that Egypt won’t walk away from the facility. The Ismail government, he added, is committed to economic reforms.

Fiscal reform over FX policy? Tightening fiscal policy and moving forward with the reforms was the mantra of Lamees’ interviews with El Garhy and with Allianz advisor and Global Finance’s Most Popular Egyptian Mohamed El-Erian: “We have to stop obsessing over the exchange rate,” said El-Erian. The exchange rate is neither the cause of nor the solution to Egypt’s economic woes. El Garhy said he believes that the budget deficit is the most pressing issue facing the country.

Both men agree with IMF boss Christine Lagarde’s “recommendation” that subsidy cuts and devaluation should happen “in full” and not piecemeal. It needs to be done sooner rather than later, and doing it in fits and spurts will just prolong the inflationary agony for the average consumer.

El Erian believes the biggest challenge to the reform process is that it will be misunderstood at the street level. He says the government has to step-up communications to the street about why the reforms are necessary and how they will play out; it must build trust with the IMF (which has traditionally has been low); and consistently monitor the situation, because mid-course corrections may be needed. El Garhy promised that more policy measures will be put in place to shield the poor from inflation.

On building-up the private sector, El Garhy pointed to the new investment law, which he said is currently being looked at by the Cabinet economic group. Cabinet as a whole will then review the law before passing it on to the House of Representatives. El Erian, meanwhile, put the onus on the government to create a better environment for the private sector and FDI, saying “that in [Egypt’s] situation, the private sector follows, but doesn’t lead.”

AND THAT WAS ONLY PART TWO of last night’s show: In part one, Lamees discussed limits on credit cards with CBE Deputy Governor Gamal Negm, who refuted stories circulating the last few days that USD 8 bn has funneled out of the country by Egyptian expats and travelers withdrawing cash abroad. He puts outflows on credit cards at c. USD 2.5 bn in the last fiscal year. Negm justified what he characterised as the CBE’s stringent limits on card use outside Egypt by pointing to patterns including personal cards being used for commercial purposes and the pooling of credit cards so that one person can withdraw large quantities of FX. He assured the audience that limits on purchases and withdrawals abroad will not apply to health and education spending: In other words, you bank should honor your monthly payment plan for your kid’s college tuition, and hospital bills shouldn’t be a problem.

Banque Misr’s CEO Mohamed El Etriby took a hardline approach, announcing that bank will only issue new credit cards for EGP purchases. Travellers must show documentation and proof in order to be able to make withdrawals and purchases in USD. Furthermore, waiting times for credit cards will be increased to six months after a customer makes their deposit at the bank.

(For context: Readers may recall that the balance of payments report for FY2015-16 showed a USD 657 mn uptick in use of credit cards by Egyptians — and indicated that for the first time, Egyptians spent more while traveling abroad than did tourists visiting Egypt.)

You can view the full episode in Arabic here (runtime: 1:52:26; El Etriby’s interview begins at 29:19). Or view the interviews one-by-one: El Garhy Part 1 (runtime: 14:24); El Garhy Part 2 (runtime: 20:51); El Erian (runtime: 25:33); Negm (runtime: 25:33).

** ECONOMIC POPULISM IS BACK: Al-Nahar talk show host and Youm7 boss Khaled Salah channeled his inner Bernie Sanders last night as he called for President Abdel Fattah to stop being so polite and tax the rich into oblivion. Salah’s central claim: that Egyptian workers pay nearly three times the total taxes as do business owners and white-collar professionals. Among Saleh’s suggestions: Jacking taxes on the rich to 50% or more, a wealth tax and encouraging / compelling more charitable giving. As you might expect given Saleh’s position as chairman of Youm7, the measure now has its own hashtag and wall-to-wall coverage in the newspaper and on Twitter. This Youm7 story is your starting point, including a nine-minute highlight reel.

While we’re on the subject of credit cards: CIB is cutting the monthly maximum you can spend or withdraw abroad as of 20 October 2016. For what we believe is the first time, the limits are expressed in EGP terms, not USD. At the top end, Platinum customers are capped at the foreign-currency equivalent of EGP 1k for withdrawals and EGP 17.5k for purchases. Platinum clients with debit cards linked to USD accounts can withdraw USD 5k and spend up to USD 30k. The full announcement is here (pdf). CIB’s limits remain the most generous we have come across among private banks in recent weeks: HSBC is limiting both Premier and Advance clients to USD 100 (yes, one hundred) per month. Banque Misr has cut Platinum limits to USD 4k for purchases from a previous USD 10k.

Finally: In response to a chat we had recently with a reader: Myth of the morning: Foreigners are now / will soon be required to settle Egyptian credit card bills in hard currency for purchases made abroad or online in FCY. We’re channeling our inner Snopes.com to debunk this one. Says one of our favourite bankers: “Not true. We’ve received nothing from the Central Bank of Egypt on this at all. The only time anyone — Egyptian or foreign resident — would be required to settled in USD is if they have a USD card. EGP accounts are settled in local currency. Sounds to me like the reader’s bank is looking for a way to source USD from the market at the official rate.” The reader now reports that the bank in question is accepting payment in EGP for all purchases he makes, up to his monthly limit.

Speed Round

Taxing times: The government is working on a five-year strategy to comprehensively reform the tax code, said Deputy Finance Minister Amr El Monayer, according to Al Mal. The strategy, which will be announced soon, aims to increase Egypt’s tax intake to 18% of GDP from a current 13%, he added.

In the meantime: “We cannot on principle acknowledge the parallel market,” said El Monayer, who noted the suffering of companies calling for the full variance between the official and parallel market rate be counted as an FX expense, Al Borsa reports. He proposed temporarily counting part of that variance as unrealized liabilities until the crunch blows over, a proposal rejected by members of the Federation of Egyptian Industries, which attended a meeting yesterday with the Tax Authority to discuss the issue. Both parties have agreed to look into the problem, said the head of the FEI’s tax committee Mohamed El Bahy, AMAY reports.

On the value-added tax (VAT), El Monayer stated that legislative changes could be introduced to the VAT law at a later date, adding that the ministry will be willing to work with the House on that, according to AMAY. His statement were made to appease the FEI after the barrage of criticism lobbied against the act. Meanwhile, we’re still waiting for the executive regulations to for the VAT.

The Finance Ministry will also begin forming the committees tasked with settling tax disputes this week, El-Monayer said, according to Al Mal. Settlement forms will be available within days, as part of implementing the short-term Tax Disputes Settlement Act that was signed into law by President El Sisi in September.

Egypt is in separate talks with international lenders as much as USD 1.6 bn in financing and assistance, primarily targeting the SME sector. The African Export-Import Bank (Afreximbank) is set to extend USD 800 mn in financing to Egyptian financial institutions, of which USD 500 mn is earmarked for SME projects, Al Mal reports. The balance of USD 300 is structured as trade finance for exports to African countries. Meanwhile, the National Bank of Egypt is set to sign before the end of the month a USD 400 mn facility with the European Investment Bank (EIB) to finance SME lending, unnamed sources tell Amwal Al Ghad. Finally, the International Cooperation Ministry is negotiating with the World Bank for USD 400 mn in new loans to support the SME sector and labor-intensive industries, minister Sahar Nasr told Al Borsa. Nasr also said yesterday that 25% of the World Bank’s USD 500 mn Upper Egypt development loan will be issued once the agreement is approved by the House of Representatives.

Mobile Network Operators are relying on their parent companies for the USD portion of the 4G license, sources tell Al Mal, leading the newspaper to conclude that domestic banks are involved in sourcing USD.

Vodafone Egypt paid EGP 1.5 bn toward it license on 15 October, an unnamed company official told Reuters in a comment later picked up by Al Borsa, which cites other sources as speculating the funding came from an EGP 4 bn credit facility that was agreed upon with a seven-bank consortium last year, but never drawn down. Reuters adds that VFE will pay 50% of the total fee in USD, adding that after the initial EGP 1.5 bn, “we will pay the remaining fee within the coming days in coordination with our parent company.” Al Mal also has coverage.

Al Mal and Al Borsa report that Etisalat has contacted domestic banks for an ‘emergency’ EGP 2 bn credit facility that will be paid back through an EGP 5 bn facility currently in negotiation, but Reuters says Etisalat Misr has yet to pay for the license fees, but is considering “capital hike, loan, other means to pay.”

Meanwhile, Orange Egypt said it would reach a financial agreement with one of the Orange subsidiaries without clarification on whether the agreement would cover both portions of the 4G license, but Director of Legal & Corporate Affairs at Orange Ayman Essam said there are no negotiations with domestic banks. As we had previously reported, Vodafone Egypt signed the 4G license for USD 335 mn, while Etisalat signed the agreement for USD 535.5 mn, and Orange for USD 484 mn.

Looking for color and background? Naeem Holding director of research Allen Sandeep spoke yesterday with Bloomberg TV’s Yousef Gamal El-Din yesterday (watch, run time: 5:49).

Trading in Beltone Financial shares was suspended by the EGX for a period yesterday pending a statement from the Egyptian Financial Supervisory Authority (EFSA), Reuters reports. The decision came two weeks to the day after the Naguib Sawiris-controlled company that controls Beltone said it was calling for a board meeting to discuss how the company will “continue its business given its current inability to expand and perform its core business normally” amid a months-long dispute with EFSA. The recent background is here; Beltone is suing the heads of EFSA and the EGX over repeated cancellation of trades in its shares.

The suspension seems to have been prompted by what Fincorp characterized as a “mistake”(pdf) in its fair value report on Beltone. The error saw Fincorp give Beltone’s shares a fair value of EGP 10.07 instead of EGP 9.30 per share. Beltone said it was not notified of the error in calculating the fair-value reported on Sunday, Al Mal reported. Beltone reiterated that it did not amend the report itself, which was originally approved by EFSA. The authority then sent a statement to the EGX notifying it of the amendment, after which trading on Beltone Financial shares resumed.

The House of Representatives passed yesterday a law clamping down on illegal migration, Al Shorouk reported. The measure comes after a migrant boat capsized last month off the nation’s Mediterranean coast, killing more than 200. The law stipulates prison sentences of individuals convicted of membership in a criminal ring engaged in the smuggling of people as well as fines equivalent to EGP 50k-200k or the full value of funds prosecutors prove the accused earned from smuggling — whichever is greater. Middlemen and individuals who shelter migrants or arrange their transport will also face prison sentences. Reuters notes the law includes provisions protecting “the rights of migrants to humanitarian treatment and access to healthcare and legal assistance, with special emphasis on women and children” as well as the creation of a cabinet-level committee to coordinate efforts to combat illegal migration.

The House will (hopefully) also be looking into the Local Administration Act when it is introduced next Sunday. The Egyptian Council of State (Maglis El Dowla) will complete this week its review of the law, which introduces local council elections.

The European Bank for Reconstruction and Development is working on a new cooperation strategy with the Ismail government that will focus on strengthening the private sector. Key elements of the four-year strategy include infrastructure development with a focus on power and water utilities, developing an energy efficiency strategy, and improving governance, Al Borsa quotes EBRD Egypt chief Philip ter Woort as having said. The government should give the private sector a more prominent role in its development strategy, Al Borsa quotes ter Woort as saying. Ter Woort declined to say how much EBRD planned to earmark to support its new cooperation strategy, nor did he divulge how much the bank is considering injecting in phase two of the feed-in tariff program. Separately, Al Mal claims EBRD may still finance FiT projects, but its involvement is contingent on how many companies sign on to the program.

The newly set market share caps for M&A activity in the brokerage industry won’t be applied retroactively, Egyptian Financial Supervisory Authority Sherif Samy told Al Mal. (Yes, we know, that should be obvious — but the fact that it appears to have been necessary to say it…) The amendments to the executive regulations of the Capital Markets Law will require EFSA board approval for the acquisition of a stake greater than 33% in any brokerage with a market share of 10% or more. EFSA’s guidelines for approving mergers will be similar to those in the banking sector, whereby the “experience” of the acquiring party, prospective value-add to the sector and the effect of the acquisition on competitiveness on the market will all be taken into account, Sami added.

El Farasha for Printing and Packaging will IPO 35% of its shares on the EGX in early December, said Ahmed Younis, head of investor relations at the company. IPO runner Beltone Financial will begin marketing the EGP 400 mn float in the US, the GCC, and Europe next week, Al Borsa reports. 70-80% of the newly listed shares will be on offer to institutional investors, Younis added.

The EGP slightly weakened ahead of today’s regularly scheduled FX auction, with traders putting its value at EGP 15.35- EGP 15.50 to the USD, according to Al Mal, compared to Sunday’s EGP 15.05-15.20 figure.

In the eternal struggle between good and evil, the Agriculture Ministry has won: The committee drawing up regulations for the upcoming wheat harvest has gone with the Agriculture Ministry’s proposal to raise to increase the payout to farmers to EGP 450 per ardib from a current EGP 420, squashing the Supply Ministry’s plan to pay them at international market rates and a EGP 1,400 top-up per feddan. It gets better: The private sector has been squeezed out of storing wheat, said agriculture’s spokesperson. Private sector silos were largely blamed for the siphoning of wheat during this year’s season, culminating the in now infamous “wheat scandal” which toppled the former Supply Minister. The recommendations have been sent to both ministers for review, Al Borsa reports.

Mubarak-era cabinet minister and former Egypt Post chief Ali El Moselhy has been re-elected as chairman of the House Committee on the Economy. We have a full rundown on the House of Representatives’ election of 25 new committee chiefs in Egypt Politics + Economics, below.

MOVES- Prime Minister Sherif Ismail has appointed Mr. Justice Ahmed El-Sisi as chairman of the board of the newly created Anti-Terrorist Finance and Money Laundry Unit. El-Sisi is vice-president of the Court of Cassation, the nation’s highest appellate court, and the brother of President Abdel Fattah El-Sisi. Also appointed to the board: Gamal Negm (deputy governor of the Central Bank of Egypt), Sherif Samy (head of the Egyptian Financial Supervisory Authority), Hisham Sobhi (Prosecutor General’s Office), and Hisham Okasha (chairman of the National Bank of Egypt, representing the Federation of Egyptian Banks).

MOVES- Abu Qir Fertilizers and Chemical Industries boss Saad Abo El-Maati has been elected to head the Arab Fertilizer Association (AFA) for Fertilizers, Al Shorouk reported. He is also the Africa representative to the International Fertilizer Association

Public-sector zombie company Egyptian Iron and Steel will issue a tender “within two months” for advisors to help restructure the company and upgrade its production lines, Chairman Mohamed Nagida told Al Borsa. Five companies from Russia, Italy, China, and Japan have already presented proposals, he said, as has Mitsubishi Heavy Industries.

If you / your brightest direct report / your daughter is looking for an executive MBA program, you’ll want to check out the Financial Times’ 2016 ranking. The survey ranks what it sees as the world’s 100 top executive MBA programs according to “how successful alumni have been in their career in terms of salary, seniority and achievements since graduating.” The top 10 schools on the China-heavy list are:

- Kellogg-HKUST EMBA (China)

- Tsinghua-Insead EMBA (China / Singapore / UAE / France)

- Trium Global EMBA (France / UK / US)

- Insead Global EMBA (France / Singapore / UAE)

- Washington-Fudan EMBA (China)

- UCLA-NUS EMBA (US / Singapore)

- Antai EMBA (China)

- EMBA-Global Americas and Europe (US / UK)

- Oxford EMBA (UK)

- IE Business School Global EMBA (Spain)

Links above are to the individual programs. Check out the FT’s introduction the package here (paywall) or the full ranking here.

It’s not a great time to be an asset manager, anywhere. Readers in the industry may have noticed our pickup in recent months of the growing drumbeat of stories heralding the rise of passive funds. The Wall Street Journal is out this morning with one of the bluntest assessments we’ve yet read. “The Dying Business of Picking Stocks” (paywall) declares that in the US, “pension funds, endowments … retirement plans and retail investors are flooding into passive investment funds, which run on autopilot by tracking an index. Stock pickers, archetypes of 20th century Wall Street, are being pushed to the margins.” It’s the latest in a stellar series on what the paper is calling “Wall Street’s ‘Do-Nothing’ Investing Revolution.” Hit up the link for its scene setter and the five pieces the Journal has run on the topic to-date.

Other national and international news worth a quick look this morning if you have time:

- Saudi Arabia’s first international bond offering looks set to be 2.5-5x oversubscribed, the Financial Times (paywall) reports in its rundown on “what to watch for” as “one of this year’s hottest debt sales beckons.” The FT sees the USD 10-20 bn offering meeting demand of as much as USD 50 bn.

- The slowdown in GCC economies continues: Emirates NBD missed analyst expectations with its 3Q2016 earnings even as earnings rose 8% year-on-year. The bank noted an uptick in provisions at its shariah-compliant unit on the back of “increased delinquencies” (pdf) among SME clients.

- Iraqi government troops and Kurdish fighters launched a major offensive to retake Mosul from the Daeshbags, which have made the city their stronghold since June 2014, BBC reported. CNN has live updates.

CLARIFICATION- The CIVETS, EAGLES and Next 11 classifications in which Egypt is included — and around which various and sundry sales teams have been building stories — have indeed been around for years, as several readers wrote to point out yesterday. The news was in the fact of the BRICS holding a “summit” in Goa 15-16 October at which to spin their wheels — and at which the notion that Egypt and Argentina had “applied” for membership came up, as the AP noted. We could have done a better job making that clear. Our coverage of yesterday is here and the BRICS’ Plato-to-NATO “Goa Declaration” (read: desperate cry for relevance) is here in full if you require a sleep aid this evening.

The Global Picture

As if the gloomy picture painted by the IMF’s World Economic Outlook wasn’t enough, the Wall Street Journal (paywall) suggested last night that “Some big global investors worry that the broad slowdown in world trade and growing populist opposition to new trade agreements are undermining corporate profits and could be the next big drag on the stock market.”

Egypt in the News

It’s a mixed day for Egypt in international news. The lead story for the foreign press corps is the country’s passage of laws clamping down on people trafficking on the migrant route to Europe, but that largely good-news story is competing with the family Aya Hijazi, who readers will remember has been in pre-trial detention for more than 900 days. As we’ve noted for more than a year now, the young woman and her husband appear to have been arrested for trying to help street children. The case has been raised by members of Congress and by US presidential candidate Hillary Clinton. The Washington Post has kept the issue in the spotlight with a series of op-eds.

This morning, Hijazi’s sister has a piece in the Washington Post and The Guardian has also picked up the story.

Dips and pundits on Tweeter: Britain’s ambassador to Egypt is chuffed, tweeting photos of joint naval exercises between the Egyptian and UK Navies, while the Canadian embassy took to Twitter to announce the opening of a new Canadian International University in the New Administrative capital. Pundit Eric Trager, meanwhile, is upset at rising anti-American conspiracy theories in the Egyptian press.

Elsewhere this morning: If it’s Tuesday, then Foreign Affairs must be cross with Egypt, if Steven Cooke’s “Egypt’s Nightmare: Sisi’s Dangerous War on Terror” is any gauge. Meanwhile: Egypt says domestic strawberries are safe for export; the New York Daily News continues with the story of the burned teenager who showed up on an EgyptAir flight to New York; the London tabloid The Sun is sickeningly happy to pick up the story of the self-immolating taxi driver in Alexandria; and The Atlantic’s Citylab looks at the New Administrative Capital.

Image of the Day

@BenedictEvans may come across as a bit of pedant in his podcasts, but the man is one of the best thinkers out there on the future of mobile. We can’t for the life of us track down the presentation with the slide above, but for more of his thinking, check out Andreessen Horowitz’s Mobile is Eating the World 2016. Whether you’re a startup type or in a mature industry, there’s no better way to spend 30 minutes this morning if you’re in the mood to think about threats to — and opportunities for — your business today.

Diplomacy + Foreign Trade

A delegation of government officials and business leaders will head to Moscow on Sunday for talks on the ban of potatoes exports to Russia, Al Borsa reports. Talks will also tackle the much anticipated free trade zone between the two countries.

Energy

Upper Egypt Electricity Production Company receives bids on Walidiya power plant next week

The Upper Egypt Electricity Production Company (UEEPC) is set to receive bids on the five tenders for the 650 MW Walidiya power plant next week, Chairman Ibrahim El Shahat told Al Mal.

Shell to process 650 mcf/d of natural gas at BP’s Burullus processing plant

BP and Shell signed an agreement to process 650 mcf/d of natural gas from Shell’s North Alexandria concession at BP’s Burullus processing plant at a cost of USD 0.3 per 1 mcf, sources told Al Borsa.

Two LNG importers agree to extend payment deadline

Two unnamed international LNG importers have reportedly agreed to extend the payment deadline for its shipments to five months from a current three, unnamed sources from EGAS tell Al Shorouk. Oil Minister Tarek El Molla had requested the delay at a meeting with LNG importers last week, the source added. EGAS is planning to import between 48 and 56 shipments next year. In the meantime, EGAS will issue a tender next month to import 48-56 shipments of LNG over the course of 2017 to cover domestic demand, an unnamed official tells Al Masry Al Youm.

Electricity ministry to complete studying GE wind farm projects offers next week

The Electricity Ministry will finish studying technical and financial offers by General Electric to build a 2,000 MW in wind power next week, a source told Al Borsa. NREA was to have reviewed the proposals in September. The studies then go to the Cabinet economic group for review.

Automotive + Transportation

Construction on third phase of Cairo Metro Line Three begins in a month

The Transportation Ministry has completed all financial and contractual procedures for the third phase of the Cairo Metro Line Three and will begin construction within a month, Transport Minister Galal Saeed told Al Shorouk.

Banking + Finance

Banque du Caire, HSBC issue EUR 200 mn loan to AC Boilers to finance Six October power plant

Banque du Caire and HSBC have issued an EUR 200 mn loan to AC Boilers to finance a power plant in Six October city, Chairman of Cairo Electricity Production Company Mohamed Mokhtar told Al Mal. The delay in issuing the loan had stalled the project, which is being built under the EPC+Finance system, he added.

Egypt Politics + Economics

MPs vote to appoint chairs to House of Representatives committees

The House of Representatives announced yesterday the results of elections to appoint chairs, deputy chairs and secretaries-general to its 25 committees. Al Masry Al Youm and Shorouk News have the story, while Ahram Online has background on some new chairs in English.

Budget deficit at EGP 68.5 bn in July and August, stable year-on-year

The budget deficit was stable year-on-year in the first two months of FY16-17 at EGP 68.5 bn. That compares to EGP 68.3 bn in the same period last year, according to a Finance Ministry report, Al Mal reported.

Non-performing loans down compared to last year

Non-performing loans fell to 5.9% as a percentage of total lending activity in the banking sector as of June, compared to 6.7% in March and 7.2% in September 2015, Al Borsa reported, citing CBE data. The system’s loan-to-deposit ratio stood at 44.5% as of June compared to 41.5% last December.

National Security

Sedky Sobhi meets with US congressional delegation

Defence Minister Sedky Sobhi met with a US congressional delegation headed by congressman Mike Conaway yesterday in Cairo to discuss potential areas of military collaboration between both countries, Al Mal reports. Conaway serves on the House Armed Services Committee and the Permanent Select Committee on Intelligence, and chairs the House Committee on Agriculture. Senior Egyptian military officers also attended.

On Your Way Out

What’s on Prime Minister Sherif Ismail’s mind? The Prime minister is said to be mulling whether to push for tougher penalties for companies that engage in monopolistic or anti-competitive behaviour, Al Masry Al Youm reports. Elsewhere, Al-Mal briefly noted late last night that Ismail has said the government is not rushing to move to a system of cash benefits for qualified welfare recipients from the current approach of provided subsidized staples.

So corny, it’s almost cute: “A Lufthansa Cargo MD-11F freighter now bears the name “Marhaba Egypt” and will carry this message with it around the world,” reports an industry website. That’s sweet. Now, if Lufthansa would just make business class to Frankfurt something more than two economy seats with an empty seat between them…

The markets yesterday

USD CBE auction (Sunday, 16 Oct): 8.78 (unchanged since 16 March 2016)

USD parallel market (Monday, 17 Oct): 15.50 (from 15.40 on Sunday morning, 16 Oct, Al Mal)

EGX30 (Monday): 8,243.32 (-2.24%)

Turnover: EGP 969.65 mn (123% above the 90-day average)

EGX 30 year-to-date: +17.66%

THE MARKET ON TUESDAY: The EGX30 kicked closed down 2.3% yesterday, adding to Sunday’s losses as all EGX30 constituents closed in negative territory save Orascom Telecom Media and Technology (up 1.8%), Orascom Construction (up 1.1%) and Cairo Oils and Soap (0.3%). Foreign investors were the sole net sellers, with market turnover at EGP 969.7 mn.

Foreigners: Net short | EGP -38.5 mn

Regional: Net long | EGP +12.1 mn

Domestic: Net long | EGP +26.4 mn

Retail: 48.0% of total trades | 51.4% of buyers | 44.6% of sellers

Institutions: 52.0% of total trades | 48.6% of buyers | 55.4% of sellers

Foreign: 33.6% of total | 31.6% of buyers | 35.6% of sellers

Regional: 10.2% of total | 10.9% of buyers | 9.6% of sellers

Domestic: 56.2% of total | 57.5% of buyers | 54.8% of sellers

WTI: USD 50.20 (+0.52%)

Brent: USD 51.75 (+0.45%)

Natural Gas (Nymex, futures prices) USD 3.26 MMBtu, (+0.49%, November 2016 contract)

Gold: USD 1,259.20 / troy ounce (+0.21%)<br

TASI: 5,564.7 (-1.2%) (YTD: -19.5%)

ADX: 4,220.4 (-2.2%) (YTD: -2.0%)

DFM: 3,272.4 (-0.9%) (YTD: +3.9%)

KSE Weighted Index: 343.2 (-0.6%) (YTD: -10.1%)

QE: 10,425.9 (+0.6%) (YTD: 0.0%)

MSM: 5,581.1 (-1.2%) (YTD: +3.2%)

BB: 1,137.5 (-0.3%) (YTD: -6.4%)

Calendar

10 October (Monday) – 19 October (Wednesday): 19th COMESA summit in Magascar, attended by Industry and Trade Minister Tarek Kabil.

19 October (Wednesday): Digital Media Forum Cairo, Four Seasons Nile Plaza Hotel, Cairo.

24 October (Monday): EBRD executive meeting in Egypt on sustainable development strategy.

24-29 October (Monday-Saturday): The 2016 Dubai Design Week Iconic City exhibition Cairo NOW City Incomplete, Dubai Design District (d3), Dubai

26-27 October (Wednesday-Thursday): The Marketing Kingdom Cairo 2 event, Cairo.

30 October (Sunday): El Mal GTM’s Real Estate Debate Conference, Grand Nile Tower Hotel, Cairo

31 October (Monday): Deadline for Telecom Egypt to reach an agreement with MNOs over using their 2G and 3G network infrastructure

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

2-6 November (Wednesday-Sunday): Petroleum Housing Conference, Petrosport Club, New Cairo, Cairo

3 November (Thursday): The Emirates NBD PMI for Egypt, Saudi Arabia and the UAE compiled by Markit comes out here.

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

14-16 February 2017 (Tuesday-Thursday): Egyptian Petroleum Show, Cairo International Convention and Exhibition Centre.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.