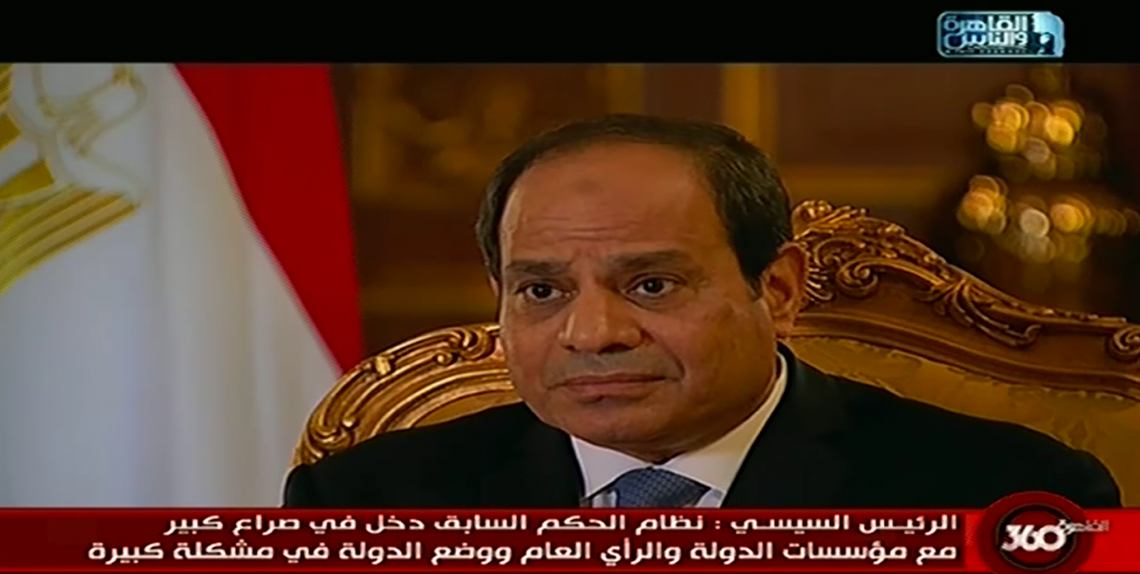

- El Sisi interview: FX shortage being dealt with, mega projects could generate significant returns. (Spotlight)

- Egyptian Propylene & Polypropylene Co. to list on the EGX. (Speed Round)

- Cleopatra shares up 6.9% in EGX debut. (Speed Round)

- Brokerage rankings for 5M2016 rankings are out. (Speed Round)

- EFG Hermes reportedly gets Central Bank of Lebanon approval for Crédit Libanais stake sale. (Speed Round)

- Beltone to expand into Africa, Euro markets; may acquire stake in US, Euro asset management firm. (Speed Round)

- British Airways to resume flights to Sharm El Sheikh 15 September. (Speed Round)

- Egyptian-American Enterprise Fund to invest USD 100 mn in Egypt this year. (Speed Round)

- Boxing legend Muhammad Ali in video and photo, including his walk through Egyptian Iron and Steel. (Worth Watching, Image of the Day)

- By the Numbers

Sunday, 5 June 2016

Spotlight on: El Sisi’s nationally televised interview

TL;DR

What We’re Tracking Today

The Markit / Emirates NBD purchasing managers’ indexes for Egypt, Saudi Arabia and the UAE are due out today at 7:30 am CLT. Tap here to see the releases when they’re out.

Investment Minister Dalia Khorshid will meet with the House Economics Committee today to discuss new amendments to the Investment Act and the ministry’s agenda, Al Mal reports.

Tonight may very well be the official start of Ramadan, meaning our moms were right and you may have to do without your usual caffeine jolt as early as tomorrow (Monday, 6 June). There is still a chance we start fasting on Tuesday, 7 June. When can we eat? For the observant: You’ll be breaking the fast at 6:54pm CLT. Fajr is at 3:09am CLT, according to Islamic Finder (totally old-school in its design, but always accurate).

Shortened hours: Commercial banks’ working hours will be restricted to 9:00 am until 1:30 pm during Ramadan, the Central Bank of Egypt has decided. The EGX is also cutting trading hours during the holy month, restricting them to 10:00 am until 01:3 0pm. Worth noting: Some analysts figure Egypt loses about 8% of the month’s GDP during Ramadan, The Economist wrote back in 2012.

This weekend’s heat wave will continue for most of this week, with highs fluctuating between 39°C and 42°C through Thursday.

What We’re Tracking This Week

Expect news on the final agreements for the Daba’a nuclear power plant this week after the Electricity Minister Mohamed Shaker set out on a six-day trip to Moscow on Wednesday, a senior ministry official told Al Shorouk.

On the Horizon

Dimming prospect of a U.S. rate hike? The U.S. Federal Reserve’s Federal Open Market Committee will meet 14-15 June. A weaker-than-expected jobs report on Friday has dimmed prospects of a rate hike. On balance, that’s good news for emerging markets — for now.

Brexit vote: The United Kingdom will vote on Thursday, 23 June on whether or not to leave the European Union. Both the Financial Times and Bloomberg have nice, regularly updated Brexit meters that look at the odds UK voters will chose to decamp.

Speed Round

Egyptian Propylene & Polypropylene Company (EPP) will offer some of its shares on the EGX to finance expansions, Karim Saada, head of shareholder Amwal Partners’ Cairo office, told Al Mal. Amwal Partners own around 16.4% of EPP, Al Mal notes, and Saada says the company will be looking to increase its capital by USD 200-250 mn from USD 276 mn currently. EFG Hermes is reportedly managing the offering.

Shares of the Abraaj Group’s Cleopatra Hospital Company rose 6.9% on Thursday in their debut on the Egyptian Exchange, closing at EGP 9.62 after hitting an intraday high of EGP 10.00. CLHO shares were the most-traded on the EGX on Thursday, accounting for 14% of total market turnover. It’s the second successful Egyptian healthcare investment for Abraaj after Integrated Diagnostics Holdings and the second healthcare IPO in Egypt in the past year. Further reading: Abraaj’s release on the transaction and a joint release from Cleopatra and EFG Hermes.

Egyptian brokerage league tables for 5M2016 and and the month of May are out. Including main market, special transactions and Nilex activity, EFG Hermes ranks number one for the first five months of the year with an 18.4% market share, followed by CI Capital (9.9%), Pioneers (5.6%), Pharos (4.6%), and Sigma (4.2%). For May alone: The execution of Actis’ sale of Edita shares late in the month put more than EGP 900 mn in executions in CI Capital’s column, vaulting it to number one for May with a 20.3% share, followed by EFG Hermes (14.7%), Pioneers (5.7%), Pharos (5.3%), and Sigma (3.1%). Want to read for yourself? The 5M2016 league tables are here on our website, and the May 2016 file is here. (Both are pdfs.)

EFG Hermes has won regulatory approval for the sale of its stake in Crédit Libanais to a group of Lebanese and Arab investors, Lebanon’s Daily Star says, quoting unnamed bankers. EFG Hermes had announced in March (pdf) that it was looking to exit its more than 60% stake in Crédit Libanais. On Thursday, EFG Hermes’ board said it had approved an independent financial advisor’s valuation of Crédit Libanais that it had earlier commissioned from Grant Thornton. EFG Hermes Group CEO Karim Awad said in his note for the firm’s recently released 2015 annual report (pdf) that the CL sale will allow the firm to “reshape the business model in a manner that will be more accretive on the medium to long term. … Our transformation into a firm that comprehensively covers some of the world’s most exciting emerging and frontier markets will be a long journey, but it is the natural evolution for EFG Hermes.”

Bloomberg’s Tarek El-Tablawy and Tamim Elyan describe Beltone’s move to buy 51% of New York-based Auerbach Grayson as Naguib Sawiris “swooping” in to step up “efforts to create one of the largest financial advisory firms in Egypt.” The acquisition “comes as a surprise to us as CI Capital, which they are seeking to acquire, already has a foreign institutional platform,” Allen Sandeep, the Cairo-based director of research at Naeem Holding, said in a phone interview.

Beltone plans to expand into emerging markets in sub-Saharan Africa and Eastern Europe as well as Asia and Latin America, chairman Sameh El-Torgoman told Daily News Egypt. Beltone is also in acquisition talks with two asset management companies specialised in emerging markets (one in the US and one in Europe), he said. “Acquisition of a controlling stake of either company will achieve the goal of integration sought by Beltone through the acquisition of Auerbach Grayson, as well as the coverage of Beltone in Middle East markets through its headquarters in Egypt and Dubai,” he added.

Meanwhile, CI Capital has two IPOs and 10 M&A transactions in its pipeline for potential execution in 2016, head of investment banking Hesham Gohar told Al Borsa. The bank will not achieve the highs it reached in 2015, which Gohar says was CI Capital’s best-ever year, but will come close. Gohar says the market interest is now focused on defensive sectors, particularly food, medicine, and education. Beltone is waiting for regulatory approval to conclude its c. EGP 900 mn acquisition of CI Capital from CIB.

The MENA region’s biggest online retailer is going public: Souq.com outlined plans for an IPO in the next 18-24 months, CEO Ronaldo Mouchawar said. “The plans are just being drawn up so I cannot say how much of the company will be public or where we will list right now,” he added. New York-based Tiger Global Management and South Africa’s Naspers provided Souq with USD 275 mn in second round funding in February. The National writes that “most of its growth is from Saudi Arabia, where Souq now has 10 fulfilment centres, and the UAE, but Egypt is becoming an important market.”

The Egyptian-American Enterprise Fund (EAEF) plans to invest USD 100 mn in Egypt this year, said Amal Anan, head of policy at the EAEF. The fund, which has invested USD 100 mn in Egypt already, is interested the food, manufacturing, restaurants, healthcare and [healthcare compounds] sectors, she tells Al Borsa. The fund is also interested in SMEs, Anan added. Back in January, the EAEF had announced that is developing a ‘parallel fund’ to “facilitate the entry of other institutional investors into the Egyptian market.” The EAEF invested last year in both Fawry (where it acquired a majority stake as part of a consortium of other global investors including Helios and the MENA Long-Term Value Fund) and Sarwa Capital.

Airlines still face challenges repatriating receipts from ticket sales, with the volume of funds stuck in the country “steadily growing,” the International Air Transport Association (IATA) said on Friday, according to Gulf News. Egypt is blocking the repatriation of USD 291 mn, IATA said, warning that the restrictions could prompt airlines to start cutting flights. “The sort of measures the airlines can take is they can stop selling in the country, only sell through their websites and people pay with a [USD] credit card [or a] foreign exchange credit card, and then of course traffic suffers and falls off and airlines are forced to cut capacity and reduce frequency,” IATA director-general Tony Tyler said at a media briefing at the group’s annual industry meet in Dublin.

British Airways is set to resume flights to Sharm El Sheikh on 15 September, pending UK government approval, Al Borsa reported. The decision comes as security at Egyptian airports has been upped significantly, the newspaper quotes British Airways regional customer service manager Sherif Barsoum as saying. British Airways suspended its flights to Sharm El Sheikh in November, a month after the Metrojet crash in Sinai.

Egyptian Steel founder Ahmed Abou Hashima is making a play in the cement industry, applying for one of the new cement licenses, government sources tell Al Borsa. He joins Chinese fiberglass firm Jushi Egypt (a subsidiary of China National Building Materials), which applied for two cement licenses and submitted letters of guarantee worth EGP 300 mn for both, said a company executive. Jushi is planning to produce 4 MTPA. El Sewedy Cement had also applied for two licenses, while South Valley Cement and Misr Beni Suef Cement have applied for one license each. As we noted on Thursday, eight companies had applied for one of the 14 available cement licenses, according to the head of the Industrial Development Authority.

Search teams are zeroing in on the wreckage of flight EgyptAir MS804 as the search zone for the flight’s black boxes was reduced to a 2 km radius from 5km, according to Reuters. French transport minister Alain Vidalies “said it would be about eight days before the flight recorder was recovered from the Mediterranean seabed.” Reuters adds that “EgyptAir’s chairman, Safwat Musallam, denied French media reports the aircraft had sent a series of technical warnings during flights to Asmara in Eritrea and Tunis in the 24 hours before it disappeared off radar screens and crashed.” Vidalies refused to make a clear statement, saying “we have … a sudden event which could point towards an attack. On the other hand we have other information which points more towards an accident.”

Egypt received the first of two Mistral class helicopter carriers on Thursday from France as part of an agreement signed last year. “We now have advanced capabilities in confronting terrorism within our borders and on our shores … It increases our combat capabilities and our ability to carry out long-term missions at sea…and we are awaiting on the arrival of the second in September,” Defence Minister Sedky Sobhy was quoted by Reuters as saying. Egypt paid EUR 950 mn for the two helicopter carriers. Al Masry Al Youm said the vessel was named Gamal Abdel Nasser, with the one due to be delivered in September to be named Anwar El Sadat. The paper also provided photos and a video from the handover ceremony, whereas ONTV aired footage of the other carrier, Anwar El Sadat. “The LHD Gamal Abdel Nasser will leave Saint-Nazaire in the next few days with the associated support vessels … Before sailing to its home port of Alexandria, the helicopter carrier Gamal Abdel Nasser will participate in a joint exercise between the Egyptian and French Navies,” Defense World reported.

Former anti-corruption watchdog Hesham Genena was referred for criminal prosecution on Thursday for “spreading false news about the cost of the country’s corruption,” judicial sources said, according to Reuters. Genena, who headed the Central Auditing Organisation (CAO), was fired in March after he had pointed out that government corruption cost the state bns of USD. Defence attorney Khaled Ali told the wire his client was detained on Thursday after being charged with spreading false news and refusing to pay bail. He will remain in detention until the first session of his trial, which is scheduled for Tuesday, Ali said. Genena has since been released on bail to visit his daughter in hospital, according to Al Arabiya. The Wall Street Journal also has coverage, and IkhwanWeb is just lapping it up, carrying what it claims is a statement from Genena.

Meanwhile, the trial of Press Syndicate head Yahia Qalash and board members Khaled Elbalshy and Gamal Abd El Rahim for charges of harboring fugitives and spreading false news was postponed to 18 June after it was scheduled to commence today, Al Mal reports.

CIB chief Hisham Ezz Al Arab received the Euromoney Award for Excellence for “Outstanding Contribution to Financial Services in the Middle East” in 2016 last week at a ceremony in Dubai. The award recognizes his 15 years at the helm in CIB, leading it from a wholesale lender to leading financial institution. The award is a testament to the contributions that Egypt is making to the financial services sector in specific, and to the region as a whole, said Ezz Al Arab in his acceptance speech, Youm7 reports.

SPOTLIGHT

Everything you need to know about El Sisi’s two-hour interview: Economy, human rights, civil service act, and foreign policy

President Abdel Fattah El Sisi’s interview with Ossama Kamal was syndicated to most other broadcasters in Egypt. The nearly two-hour-long interview was covered everything from mega projects to corruption, bureaucracy and the president’s relationship with the press, but steered clear of real policy discussions. The interview has yet to make a splash in international media.

On Mohamed Morsi and foreign powers

As defence minister under former President Mohamed Morsi, El Sisi said Morsi focused on clashing with state institutions and “the public opinion.” Morsi was putting the country in a very challenging situation: “They [the Ikhwan] did not know the Egyptian people.” And while there have been a number of attempts over the past two years by “foreign powers” to incite the Egyptian people to “act,” they have refused, he said, stopping short of naming the entities, who he added are present domestically and internationally.

National mega projects and domestic investment

The extra cost associated with completing the Suez Canal expansion project ahead of schedule was needed to lift the public’s morale: “It was the Egyptian people working on these projects, they have accomplished this,” El Sisi said. Over 1,000 companies and two mn Egyptian workers are working on national projects currently. This has been going on for two years, will go on for the next two years, and the number could even increase, he noted. El Sisi said the Armed Forces’ Engineering Authority only has a supervisory role with regard to the projects; the military cannot undertake all those national projects, he said; they are being executed by private companies.

Meanwhile, the administration is now working on developing the previously neglected Sinai, with a focus on expanding industrial and agricultural activities there. But even with all the national mega project activity, El Sisi is not pleased. “We have to work harder … we are far behind and need to catch up.” On the new administrative capital project, El Sisi dismissed the idea that it wasn’t important, adding that it would generate a large return. He says he is planting the seed for generations to come, even if this means he will not be president by the time Egypt’s first nuclear power plant project is delivered in eight years.

It will take us 12-13 years to see tangible improvements in education, El Sisi said, adding that both education and healthcare are pressing issues. He said the government’s plan to improve healthcare includes improving conditions whenever possible and trying to optimise resources.

State spending

Egypt will continue to spend on strengthening its “abilities.” These are partly related to expanding its economic capacity, but will also include military spending. “We need to be able to protect ourselves … we need to stay part of the geostrategic equation,” El Sisi says. He notes that there is a “gap” in the regional balance of power that was created after a number a regional players were impacted, “we are just filling that gap … we do not have hidden agendas.” Having the “capability to respond” is a sufficient deterrent.

Don’t complain about increasing prices, El Sisi urged Egyptians, even after the cost increases, services are still being subsidised. “We need to rationalize our consumption.” Development has a cost, and we spent years trying to avoid paying our “cost of development.” On the FX issues, El Sisi says “we are tackling the USD shortage already.”

On corruption and bureaucracy

Egypt is also combating corruption and improving data collection. The line between corruption and getting business moving is now clear, El Sisi says. Ministers and officials should not be hesitant in taking decisions, but state institutions and regulators need to have better communications.

“I was not unhappy the parliament rejected the civil service law,” El Sisi said, “We respect the democratic process, the parliament is a state authority… The parliament will even discuss the issue of the [Tiran and Sanafir] islands.” The civil service law was part of the attempt to make the executive branch of government more efficient. The state employs 6.9 mn people and only requires “one mn or less” to function. 900k were added after “the revolution” alone.

On youth

Egypt’s youth should be prepared to lead the country, said El Sisi, adding that the state is preparing is grooming “cadres” young people who can assume leadership positions in government, the legislature, city councils, and in the private sector. El Sisi also refused to accept that a large number of young people are being arrested by the state. 90% of the imprisoned youth are there for criminal offences, not political, he added. For the remaining “10%,” El Sisi hinted that there could be another wave of presidential pardons.

El Sisi wants football stadiums to reopen to the public and called on the Ultras to, effectively, behave themselves in the stands and work with the Youth Ministry and the MOI on the matter.

The domestic media:

The state and the media are not in conflict, but the media lacks — and needs — leadership to properly contextualize the news for the people. This is the case in all countries, including democratic ones, the president said. The constitution prevented the re-establishment of an information ministry, so we need a new framework. As for social media, El Sisi reiterated his earlier warning, urging Egyptians to be mindful of who operates social media channels and their intentions.

On human rights

When pressed on the “exaggerated” attacks on Egypt’s human rights record, the president stated that it was a matter of keeping our ducks in order. Egypt has been prioritizing housing, education, health, and employment, which are all human rights, said El Sisi. As for freedom of expression, El Sisi said the days of imprisonment for freedom of expression had been over for five years. He also added that the freedom of expression must be constructive.

On foreign policy

Some foreign countries have been actively trying to impede Egypt’s reemergence in regional affairs. These efforts include stirring up the issue of Tiran and Sanafir to break down the relationship it has with GCC partners. Egypt has also been doing its best to contain crises with Russia (over the Metrojet crash) and Italy (over the death of Giulio Regeni) but these efforts must be coordinated between the state and the media. When questioned on US-Egyptian relations, El Sisi reaffirmed their strategic ties and noted that the US’s role in regional politics is important by virtue of being a superpower. He also stressed Egypt’s role in the Middle East peace conference in Paris and Egypt’s peace initiative.

The Macro Picture

More bad news for emerging markets: EM economies could be set to slow “inextricably” (not a word we’d have used; maybe they meant “inexorably”?), according to analysis by Capital Economics quoted by the Financial Times (paywall). “During the next decade or so, reduced scope for catch-up growth in some EMs, and continued underperformance in others, will probably mean that aggregate GDP growth in EMs will be lower than in the past 15 years,” says Nikita Shah, global economist at CE.

Meanwhile, net inflows of portfolio investment into emerging markets in March and April appear to have come to a halt in May “as the prospect of rising US interest rates once more overshadows the EM investment universe,” according to the FT (paywall). The Institute of International Finance said Friday the combined flows to EM debt and equities were just USD 1.2 bn in May compared to USD 17.3 bn in April and USD 26.4 bn in March.

Egypt in the News

Egypt, Tunisia, and Turkey are becoming too scary for tourists to visit, CNN Money says. The network says “travelers have been nixing their dreams of visiting places like the pyramids in Egypt and the Tunisian coast due to heightened terrorism concerns.”

Quartz joins in on the tourism chorus, calling resorts along the red sea ghost hotels. “These ghost hotels are a product of the collapse of Egypt’s tourism industry after the revolution of 2011 and the political turmoil and terrorist attacks that followed.” But it doesn’t stop there. The piece claims the fact the resorts began being built at all is “a symbol of greed, haste, and the Egyptian government’s neglect of the Sinai’s local Bedouin population.”

Survivors of a shipwreck on Friday off Crete had said their boat set sail from Egypt and carried about 350 people, the Greek coastguard said on Saturday, according to Reuters. On Friday, Greek authorities said 340 people were rescued and nine bodies were recovered in Egyptian waters, according to Reuters. The New York Times’ Dan Bilefsky puts the death toll at at least four, writing that “1,000 migrants may have died trying to cross the Mediterranean to Europe over a recent eight-day period,” the International Organization for Migration reported on Tuesday.

Worth Watching — In Video

Boxing legend Muhammed Ali died on Friday at the age of 74 after a battle with respiratory illness complicated by Parkinson’s disease. It is impossible for us to include all the great moments of Ali’s career, so please forgive us for any omissions as we present some moments that captured Ali’s fighting skills, sense of humor, and political beliefs:

- Ali vs George Foreman, 1974, “Rumble in the Jungle,” Kinshasa, Zaire, fight highlights (Watch, running time: 4:50)

- Ali dodging 21 consecutive punches, vs Michael Dokes (Watch, running time: c.10 minutes, his dance is in the first minute)

- Ali vs Howard Cosell, one of the more combative sports journalists to cover Ali’s career, as show in this interview from 1968 (Watch, running time: 5:08)

- Muhammad Ali on refusing to serve in the Vietnam war (Watch, running time: 1:10)

Image of the Day

From Ali’s visits to Cairo, our favourite image is his June 1964 visit to Egyptian Iron and Steel in Helwan. Also on the list: The Greatest at the Pyramids, visiting the Citadel, sitting on his namesake’s throne, at prayer, and kissing a photo of Gamal Abdel Nasser.

Photojournalist Barry Iverson shot Ali at the Pyramids 20 years later.

Diplomacy + Foreign Trade

Egypt says Khamati’s “dogs and slaves” allegation bogus, demands her sacking: An investigation by Egypt’s foreign ministry (including a review of “videos and footage”) has found that Kenya’s Yvonne Khamati’s claim that a senior Egyptian official referred to Africans as “dogs and slaves” was false, the State Information Service said. The SIS said the foreign ministry is demanding Khamati be sacked.

MFA rejects EU criticism over jailing journalists: The Foreign Affairs Ministry’s spokesperson said the EU External Action Service’s spokesperson, Catherine Ray, should “look closely at reports made by the delegation of the EU on the large number of newspapers that are published on a daily basis in Egypt,” Ahram Online reported. The ministry is criticizing comments Ray made expressing worry over the indictment of the Press Syndicate head and undersecretary. “The EU should make efforts to support the Egyptian government in order to provide better services to Egyptian citizens,” the Ministry adds.

…NPR’s Leila Fadel covered the case for Morning Edition with comments from syndicate undersecretary Khaled Elbalshy saying, “It’s a crazy time. Anything could happen. In my opinion, we are facing a tyrannical regime, an old form of dictatorship… They want to silence the union, by breaking into it, by besieging it and now by putting us on trial for the first time in history.”

International Cooperation Minister Sahar Nasr signed the 2016-2018 cooperation agreement with Germany, Al Mal reported. The agreement includes a EUR 100 mn soft loan with 2% annual interest, a 10-year grace period, and a repayment period of 30 years, as well as a EUR 53 mn grant. The agreement is a 50% increase to its predecessor, said Nasr. The funds will be directed toward renewable energy projects, technical training, climate change, and SMEs.

Germany also pledged support for a project to build a 1,000 MW solar power plant by establishing a private German-Egyptian company, sending a delegation from the Federal Environment Ministry to study the project, and receiving funding from the Green Climate Fund, the statement added. International Cooperation Minister Sahar Nasr met with Germany’s Federal Environment Ministry to bolster cooperation on environmental issues and climate change, according to a statement from the ministry.

Egypt’s Trade and Industry Ministry will work with Germany on quality control and standards, Al Borsa reported. Cooperation will be between the Egyptian Organization for Standards and Quality Control and Germany’s TÜV SÜD, a technical service organization that focuses on “testing, inspection, auditing and certification,” as described on their website, as well as DIN, the German Institute for Standardization.

President Abdel Fattah El Sisi met with Iraqi Foreign Minister Ibrahim al Jaafari and President of the Sunni Endowment Diwan Abdul Latif Hamayim to talk about stability in Iraq and counterterrorism efforts, according to an Ittihadiya statement.

Energy

ACWA Power completes Safaga power plant studies in December

ACWA Power is set to complete the environmental impact studies for its 2,000 MW coal-fired Safaga power plant by December, ACWA Regional Manager Hassan Amin told Al Borsa. The power plant’s capacity could increase to 4,000 MW with an investment of USD 6 bn, he added. The company recently inked an addendum to the MoU signed with the NREA to extend the deadline to complete the necessary studies for a 50 MW solar power plant with an investment value of USD 80 mn, he added.

Electricity Ministry expands options to maintain the power grid

Siemens in talks to partner with the ministries of electricity and military production to establish a company to maintain power facilities, an Electricity Ministry source tells Al Borsa. The move appears to be an effort to combine two separate companies which Siemens and the ministry had planned to establish separately. Siemens had previously announced through its sales department that it was launching a EUR 60 mn power maintenance company this year, while the Electricity Ministry is studying the development of a EGP 100 mn company. Meanwhile, the ministry has begun receiving offers from five companies based out of the UAE, South Korea, Germany, France, and Egypt to provide maintenance work on the power grid.

Basic Materials + Commodities

FEP Capital acquires readymade concrete company for EGP 60 mn

FEP Capital acquired 100% of a readymade concrete company in Sixth of October for EGP 60 mn, Al Borsa reported. FEP Capital did not disclose the name of the acquired company, but said it will begin restructuring it and increase its capital to EGP 85 mn in 2H2016. FEP’s Managing Director says the company will benefit from the state’s plan to expand national mega projects and construction projects .

Manufacturing

Cabinet promises steel industry regular supplies a new prices by September

The cabinet has promised the steel industry that it would stabilize natural gas supplies to the sector by September, a government source tells Al Masry Al Youm. the cabinet assured the heads of 22 steel manufacturers that it would resume steady supplies to them at the new price of USD 4.5 per mmBtu by that time, but power stations and the fertilizer sector will take priority in the meantime.

Oriental Weavers plans 7% price hike on all products

Oriental Weavers is planning a 7% price hike on its products to cope with the currency devaluation driving up the cost production inputs, according to an investment report obtained by Daily News Egypt. The company’s high-end products are meeting higher domestic demand following recent restrictions on carpet imports.

Health + Education

Saudi German Group Hospitals open first branch in Cairo, over EGP 1 bn investments

Saudi German Group Hospitals announced on Thursday the opening of its first branch in Cairo with investments worth over EGP 1 bn, Al Borsa reported. The private healthcare provider already has seven branches in Saudi Arabia, the UAE, and Yemen, the branch’s executive director Mohamed Hablas said. The first phase of the Cairo hospital is due to include 300 beds. The coming years will see the opening of other branches in Egyptian governorates, Halbas said.

Pharmacist Syndicate votes to boycott six companies including Pfizer

The Pharmacist Syndicate’s general assembly voted to boycott products of six manufacturers and distributors including Pfizer for what it alleges are continued violations of directive 499 in light of the 20% increase on meds priced under EGP 30. The directive aims to increase the profit margins for pharmacies by having manufacturers and distributors provide them discounts and commissions. The other companies were Global Napi, Multi Apex, Eva Pharma, EIPICO. A source at EIPICO tells Al Borsa that the move is simply an extortion tactic by pharmacists.

Banking + Finance

Tahya Masr Fund agrees with Banque Misr on shares of Misr Leasing Company

Tahya Masr agreed to acquire 49% of Banque Misr’s EGP 50 mn Misr Leasing Company which will be founded next month, Al Borsa reported. The fund’s executive manager, Mohamed Ashmawy, told the newspaper that Tahya Masr and the bank agreed to increase the company’s capital to EGP 100 mn. On another note, Ashmawy said the fund’s donations and investment revenues reached EGP 5.5 bn since it was founded in July 2014.

Other Business News of Note

New VC players in town

Ideavelopers principal Ziad Mokhtar is close to closing a USD 50 mn venture capital fund called Algebra Capital, Eduard Cousin writes for Wamda. Algebra will target Series A and B investments primarily in technology startups and has raised USD 40 mn so far, Mokhtar says. The fund is already talking to entrepreneurs and expects to close its first agreement by August. The Egyptian-American Enterprise fund (EAEF) has injected USD 10 mn into the fund.

Egypt Politics + Economics

Gov’t to re-introduce VAT to the House this week

The government plans to introduce the amended value-added tax (VAT) legislation to the House of Representatives this week after the Egyptian Council of State (Majlis Al Dowla) completed its review of the legislation, said Deputy Finance Minister Amr Al Monayer. He expects that the House won’t discuss it until after the Eid Al Fetr break, Al Mal reports. His statements come as the Parliamentary Affairs Minister officially informed the House that it the government was pulling the VAT legislation to implement the amendments discussed last month, Al Borsa reports. These changes included new policy measures and exemptions. The government first sent the legislation to parliament back in April, according to statements by Finance Minister Amr El Garhy.

Abdel Rasik replaces Adly Mansour as head of Supreme Constitutional Court

President El Sisi ratified the appointment of Abdel Wahab Abdel Razik as head the Supreme Constitutional Court who will replace Adly Mansour, the one-time transitional president of Egypt. Abdel Rasik will assume his new post on 1 July, AMAY reports.

National Security

Russia wants to export armoured vehicles to Egypt

Russia’s Military-Industrial Company is looking to sign an agreement to export Tigr armoured vehicles to Egypt, Pravda reported. The company head said "if talking about signing and promotion of the [agreements], we have completed 85% for today. The vehicle is much in demand, its performance characteristics are known. We hope that the deal will be signed in the nearest future," he stated during KADEX-2016 exhibition in Kazakhstan.”

Falcon National Company to provide security for Sharm airport starting August

Falcon National Company for Security, a JV between Falcon Group and the Egyptian government, will provide security services at Sharm El Sheikh International Airport starting in early August under an agreement signed with the Egyptian Holding Company for Airports and Navigation (ECAN), Al Borsa reported Saturday. On a related note, ECAN has begun receiving more than 120 pieces of new equipment to help it screen luggage and cargo; the gear is being imported from Germany, the newspaper says, at a cost of EGP 282 mn.

On Your Way Out

GB Auto investor relations officer Andre Valavanis took home the World Boxing Federation’s African welterweight title this weekend.

Unbeaten Egypt will make its first appearance since 2010 at football’s African Cup after a 2-0 victory over Tanzania in Dar es Salaam yesterday, Ahram Online reports. BBC Sport has a look at all of yesterday’s matches.

Veteran finance writer Patrick Werr hopes Public Enterprise Minister Ashraf El Sharkawy will reconsider his stated plans not to sell public companies, “but rather exploit them to bring revenue to the state.” Werr says those companies “all too often they have become little more than places for politicians to stuff the unemployed, with scant regard for productivity.”

Gender-based violence cost women and their families in 2015 an estimated EGP 2.17 bn and could be as high as EGP 6.15 bn “if all violent incidents women experience during one year are calculated,” according to Egypt’s Economic Cost of Gender Based Violence Survey. The survey was launched by CAPMAS and the National Council of Women and United Nations Fund for Population Agency and was presented at a Wednesday conference, according to Ahram Online.

A young man reportedly lost a leg to a shark attack in the waters of Ain Sokhna over the weekend. Al Youm7 has pictures of the incident on its Facebook page. The paper’s coverage of the event says the boy has been taken to hospital and is in intensive care.

The markets yesterday

USD CBE auction (Tuesday, 31 May): 8.78 (unchanged since Wednesday, 16 March)

USD parallel market (Tuesday, 31 May): 11.00 (compared with 11.00-11.04 on (Sunday, 29 May, Reuters)

EGX30 (Thursday): 7,617.88 (+0.6%)

Turnover: EGP 534.5 mn (23% above the 90-day average)

EGX 30 year-to-date: +8.73%

THE MARKET ON THURSDAY: The EGX30 climbed for a third consecutive session, closing 0.6% higher at 7,618 points. Cleopatra Hospital was in the limelight on its first trading day, gaining 6.9%. Top gainers included Porto Group, SODIC, and South Valley Cement while the poorest performers were GB Auto, Arabia Investments, and Oriental Weavers. Market turnover came in at EGP 534.5 mm and foreign investors were the sole net buyers. Regionally, markets were mixed. The TASI ended 0.5% higher and Dubai’s DFM fell 1.6% and Abu Dhabi’s ADX 0.7%.

Foreigners:Net long | EGP +85.2 mn

Regional:Net short | EGP +22.4 mn

Domestic:Net short | EGP -62.8 mn

Retail: 63.5% of total trades | 54.8% of buyers | 72.3% of sellers

Institutions: 36.5% of total trades | 45.2% of buyers | 27.7% of sellers

Foreign: 19.6% of total | 27.6% of buyers | 11.7% of sellers

Regional: 7.3% of total | 5.2% of buyers | 9.3% of sellers

Domestic: 73.1% of total | 67.2% of buyers | 79.0% of sellers

WTI: USD 48.62 (-0.59%)

Brent: USD 49.64 (-0.08%)

Gold: USD 1,242.90 / troy ounce (+2.28%)

Nymex (futures prices) USD 2.4 MMBtu, (+0.84%, July 2016 contract)

TASI: 6,488.8 (+0.5%) (YTD: -6.12%)

ADX: 4,254.8 (-0.7%) (YTD: -1.22%)

DFM: 3,263.0 (-1.6%) (YTD: +3.55%)

KSE Weighted Index: 355.4 (+0.1%) (YTD: -6.90%)

QE: 9,532.6 (-0.4%) (YTD: +8.60%)

MSM: 5,819.8 (flat) (YTD: +7.65%)

BB: 1,116.2 (+1.0%) (YTD: -8.19%)

Calendar

06 June (Monday): First day of Ramadan (tentative date)

06-08 July (Wednesday-Friday): Eid El Fitr (national holiday, tentative date)

06-09 August (Saturday-Tuesday): The International Conference on Chemical Sciences & Applications, Arab Academy for Science, Technology and Maritime Transports, Alexandria.

11-13 September (Sunday-Tuesday): Eid El Adha (national holiday, tentative date)

02 October (Sunday): Islamic New Year (national holiday, tentative date)

06 October (Thursday): Armed Forces Day (national holiday)

01 November (Tuesday): Prophet’s Birthday (national holiday, tentative date)

27 November (Sunday): 2016 Cairo ICT Conference Group

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre, Cairo

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre, Cairo

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.