The MENA region is planning more gas + petrochems investments in 2020-2024, despite covid-19

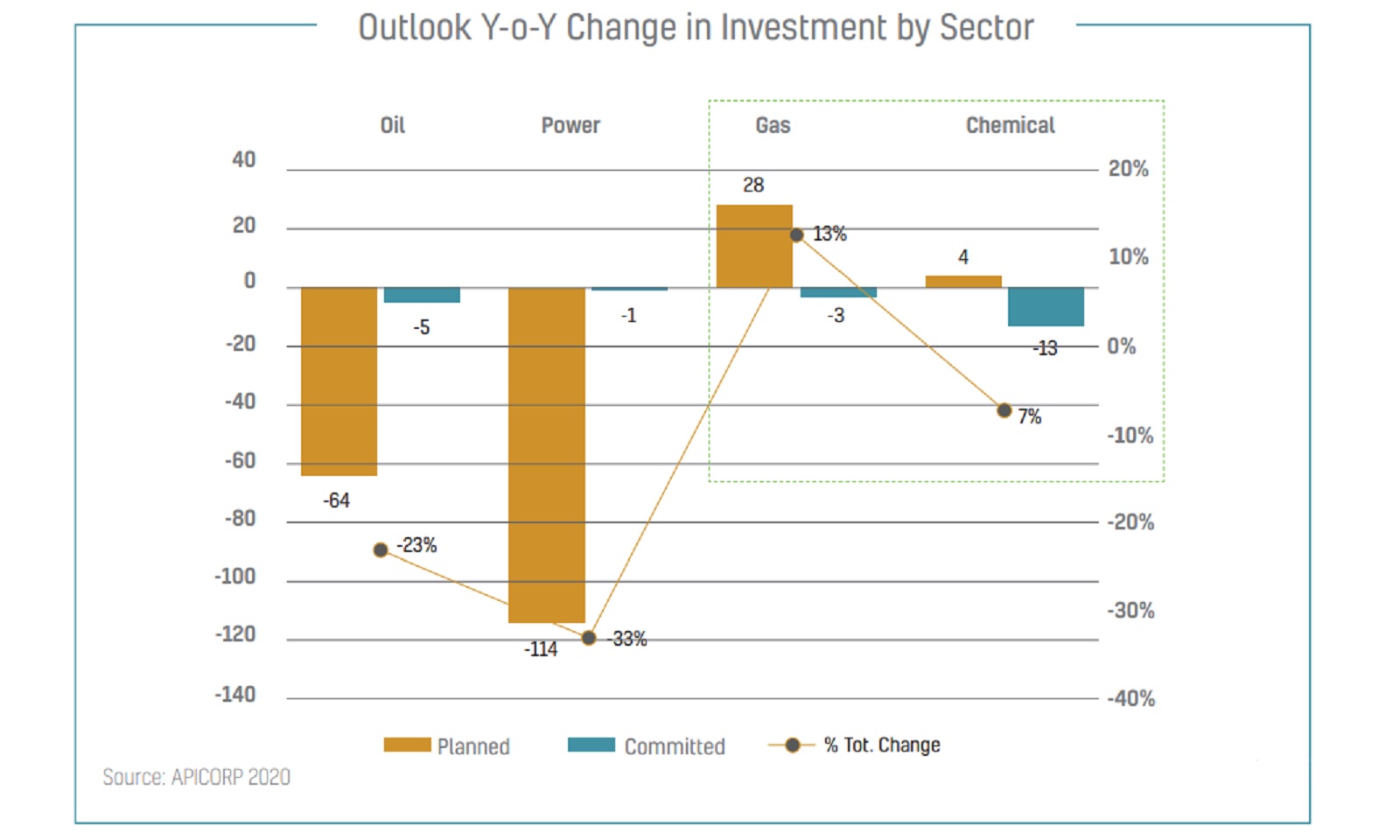

The MENA region is planning more gas + petrochems investments in 2020-2024, despite covid-19: There’s a rise in planned investments in gas and petrochemicals projects in the MENA region over the next five years compared to the 2019-2023 outlook, multilateral development bank Arab Petroleum Investments Corporation (Apicorp) says in its latest MENA Gas & Petrochemicals Investment Outlook report. According to the report, planned gas investments across the region for 2020-2024 are up 29% from the 2019 outlook figure, rising to USD 126 bn, while planned investments in the petrochemicals sector are also up around 4.4% to USD 95 bn when compared to last year’s outlook. Of the 12 countries included in the report, Egypt is expected to see the largest petrochemicals investments, but comes in seventh place in terms of planned gas investments.

That’s not to say it’s all smooth sailing: Projects that are already in the proverbial pipeline are expected to “face headwinds in terms of payments, supply chain issues and delays” as governments and the private sector alike cope with significant fiscal pressure caused by this year’s economic downturn. And any new planned projects — “specifically in upstream and international downstream ventures” — will be under the microscope and more likely to be postponed altogether.

Covid-19 is also taking a toll on oil and gas exports, meaning demand is turning inwards. According to Apicorp, industrial demand is set to account for a larger share of petrochemicals and gas demand on a domestic level, which is also slowing down because of the pandemic. Across the region, slower GDP growth and lower industrial output mean gas demand will grow between 3.8 and 4% this year — a downwards revision from the 6% growth in demand seen last year.

What’s driving the growth in planned regional gas investments? The ramped up investment plans are mostly accounted for by Qatar’s USD 50 bn North Field Expansion — USD 22 bn of which will be invested in the five-year outlook period. This is in addition to the regional push towards cleaner power generation and “improved monetization of gas as a feedstock for the industrial petrochemicals sectors.”

In Egypt, LNG facilities “will remain heavily underutilized” until 2022 on the back of reduced domestic gas prices for heavy industries, and “depressed global prices” in 1H2020 meaning LNG exports are largely on hold, the report says. Egypt will export only 35% of its production capacity over the next two years, according to Apicorp.

What’s driving the growth in planned regional petrochemicals investments? Egypt, Iran, and Saudi Arabia are driving regional petrochemicals investments, “driven by the localization of specialty chemical industries and feedstocks import substitution,” the report says. Egypt’s push to pursue its “petrochemicals ambitions” comes despite the slump in LNG exports and as we continue to push ahead to cement our status as a regional energy hub.

Key drivers of the expected growth in Egypt’s petrochemicals industry: The Oil Ministry’s 2020-2035 national plan for the industry includes a USD 8.5 bn crude and condensate refinery plant in Al Alamein, which is expected to produce 1 mtpa of petrochemicals and 0.85 mtpa of refined products. The facility is set to cover domestic consumption needs by providing industry with “specialty chemicals feedstocks,” while earmarking surplus output for exports. State-owned Enppi is expected to issue a tender for the project before the year is out, according to the report. The ministry’s plan also covers the Egyptian Petrochemicals Holding Company’s (ECHEM) planned petrochemical plant and refinery in the Suez Canal Economic Zone, the construction of which will be managed by the US’ Bechtel. Previous reports had indicated the project is expected to cost USD 6.7 bn, but Apicorp suggests the figure is now at USD 7.5 bn.

As for the private sector, there’s the Egypt Hydrocarbon Corporation’s (EHC) planned Ain Sokhna ammonia plant. EHC had signed a USD 550 mn agreement with Italian company Maire Tecnimont in May to set up the plant, but the project has yet to reach financial closure, according to Apicorp. The plant could come online as early as 2025 if EHC manages to reach financial closure next year, the report says.

You can read the full report here (pdf).

Your top infrastructure stories

Your top infrastructure stories for the week include:

- Data centers: Liquid Telecom is planning a new wave of investment in Egypt’s internet infrastructure.

- Solar energy: B-Electric-led consortium signed an initial agreement with the New and Renewable Energy Authority to establish a 50 MW solar power plant in Zafarana.

- 5G tussle: The US State Department is urging Egypt to avoid working with China to develop its 5G infrastructure and instead work with American firms.

- Vocational schools: Elsewedy Technical Education (STA) signed an MoU with the Education Ministry to establish 10 vocational schools in the next five years.

- Road safety: Deaths in Egypt from road accidents fell 44% y-o-y during the last fiscal year.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.