- Car sales drop again in June, industry data shows. (The Big Story Today)

- Is this a recession? US GDP contracts for a second consecutive quarter. (The Big Story Abroad)

- Glaciers in the Alps are disappearing at record speed. (For Your Commute)

- There’s a game-changing HIV injectable to prevent and treat HIV. But it’s expensive and in low supply. (Health)

- Get your feet on the ground for better health + a better mood. (For Your Commute)

- Jeff Goldblum’s delightful take on the non-controversial joys of life. (On the Tube Tonight)

- Egypt’s first éclair bar covers everything from the unexpected to the unorthodox. (Eat This Tonight)

- For eaters, not foodies: Getting to know people through a joint love for food. (Ears to the Ground)

- WHAT’S NEXT- What it’s like to be “12% machine” in Hybrid Human. (Under the Lamplight)

Thursday, 28 July 2022

PM — The recession bells are ringing

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. We’re always giddy when we can say happy THURSDAY, but this week makes us feel like we’ve earned it just a little bit more than usual.

THE BIG STORY TODAY

The automotive market is still struggling: Passenger car sales fell for the fourth consecutive month in June, dropping 35.2% y-o-y to 19,054 units sold during the month, according to the latest figures from the Automotive Information Council (AMIC). The continued decline in sales comes as the automotive industry in Egypt has been facing headwinds including changing import rules that led to car shipments being stuck at port.

THE BIG STORY ABROAD

Recession alarm bells ringing: The US economy contracted 0.9% in 2Q 2022, marking a slower contraction than the 1.6% recorded during the first quarter of the year, according to the US Bureau of Economic Analysis’ quarterly report. The slight q-o-q improvement “reflected an upturn in exports and a smaller decrease in federal government spending that were partly offset by larger declines in private inventory investment and state and local government spending,” the report said. The figures — and whether two consecutive quarters of negative growth qualifies as a recession — are leading the conversation in the international business press this afternoon: Wall Street Journal | Bloomberg | CNBC | Reuters

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt is working to resolve differences with the IMF in talks for a fresh assistance program, Finance Minister Mohamed Maait said in a round of interviews yesterday.

- The government is still holding out hope that it could sell stakes in as many as 10 companies before the end of the year, Maait also said, insisting that a state program to divest assets through IPOs and secondary sales of already-listed companies still has legs despite ongoing market turbulence.

- It’s official: CIRA’s future flow securitization program has gotten the nod from the Financial Regulatory Authority, which has given EFG Hermes the final go-ahead to take EGX-listed education provider CIRA’s planned EGP 800 mn issuance to market.

|

???? CIRCLE YOUR CALENDAR-

The government’s public consultations on its state ownership policy continue on Sunday, with a workshop for representatives from the printing and packaging sector. Every Sunday, Tuesday, and Thursday see workshops on how privatization plans will affect specific industries. You can find more details on the schedule of the meetings here.

☀️ TOMORROW’S WEATHER- We’re looking at quite a hot weekend with daytime highs of 40-41°C on Friday and Saturday, and nighttime lows of 24°C, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Good luck to Sid and the rest of the gang from Ice Age: The Alps’ glaciers could be on track for their biggest mass loss in at least 60 years of record tracking as climate change spells disaster, Reuters reports, citing glaciology data. The Alps saw two major heat waves this summer, with the elevation at which water froze measuring at 5.1k meters, compared with the normal summer level of approximately 3k meters to 3.5k meters. Mountain glaciers in the Alps remain the most susceptible to climate change due to their smaller size and little ice cover. Temperatures in the Alps are also rising at around 0.3°C per decade — nearly double the global average — therefore augmenting the risk of the glaciers disappearing altogether.

And if we continue with business as usual, the glaciers could lose over 80% of their current mass due to climate change by 2100, according to a 2019 report by the UN Intergovernmental Panel on Climate Change. Recent heat waves this year in several regions across the world are sparking worries that Alps glaciers may disappear sooner than predicted. “We are seeing model results expected a few decades in the future are happening now,” Matthias Huss, who heads Glacier Monitoring Switzerland, said. “I did not expect to see such an extreme year so early in the century.”

In case you needed more reasons to flee to Sahel this weekend (or any beach, anytime you can): While the fact that spending time in nature is good for us is hardly new information, it turns out that kicking off your shoes and literally keeping your foot on the ground — also known as grounding — can boost your immunity, reduce stress, and help improve sleep, research has shown. Grounding is when we make direct contact with the earth for at least 30 minutes, according to Kayla Barnes, host of the podcast Brain Biohacking. This includes walking barefoot in the sand, grass, or dirt. The Earth’s surface holds an abundant supply of mobile electrons, making most of the planet’s surface electrically conductive. This electrical potential has been found to hold many health benefits for humans. Through grounding, people can absorb electrons from the earth and neutralize freeradicals (which can damage cells), providing an antioxidant effect, Barnes explains to Vice. Grounding may also improve biological rhythms by reducing nighttime cortisol levels, leading to better sleep, less inflammation, and an improved mood.

So-called “black swan funds” are booming in popularity as markets sink: Black swan funds — designed for investors to make gains when markets tank — are gaining popularity as risk-management software booms and investors look for ways to cut risk and hedge against market turmoil, Bloomberg reports. Black swan funds have gained about 11.6% this year, giving them a rare positive position in the current market downturn — but just enough to make up for their losses over the past year’s losses during a bull market.

It’s unlikely that we’ll see a rerun of the 2020 black swan fund jackpot: Compared with the gains these funds made in the early days of the pandemic (which were around 24%), the rewards this time around have so far been negligible. This is because “the longer, the more protracted the drawdown, the less benefit you usually get from those strategies,” one analyst explains to the business information service, adding that sudden market crashes tend to be more profitable due to the specificity of wagers that contracts under these types of funds often make.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The World According to Jeff Goldblum is nothing short of delightful: Each episode of the National Geographic-produced docuseries features the Jurassic Park star exploring a single topic that everyone seems to love — think ice cream, sneakers, or pools (watch, runtime 1:57). The show, which was part of the rollout of shows on Disney+, delves into the history and appeal of these seemingly simple items, and questions why things are the way they are. Disclaimer: Your appreciation for the show is almost entirely dependent on how you feel about Goldblum as your host, who brings his own quirkiness to the table and isn’t embarrassed to geek out in front of an international audience. Ultimately, the show is more an expression of curiosity rather than a deeply educational experience.

⚽ The Egyptian Premier League continues to heat up: At 6:30pm, El Gouna will face Ismaily, while Pharco play El Gaish at the same time. Zamalek and Future will face off at 9pm.

Saturday is going to be a busy day: We have Manchester City v Liverpool facing off at 6pm in the season’s curtain-raiser: The FA Community Shield.

The German Super Cup between Leipzig and Bayern Munich will kick off at 8:30pm, also on Saturday.

European friendlies: Arsenal will play against Sevilla in the Emirates Cup at 1:30pm. Manchester United will face Atlético Madrid at 1:45pm. Roma faces Tottenham at 8:15pm, and Inter plays against Lyon at 8:30pm.

Bonus for late Saturday / early Sunday: If you’re a night owl (or a super early riser) keep an eye out for Real Madrid v Juventus at 4 am on Sunday.

????EAT THIS TONIGHT-

Egypt’s first éclair bar: Chouchou, which opened in Arkan this May, brings us 13 different varieties of the French pastry thanks to executive pastry chef Joakim Chambon. Varieties range from the traditional dark chocolate to more unorthodox flavors like lime and basil cream. The store also offers chouquettes — choux pastry puffs covered with crunchy sugar and cinnamon. We recommend the pistachio éclair, with a rich, flavorful pastry cream that goes perfectly with the light and airy choux pastry and the lemon éclair, which is the right amount of tangy. The Design Avenue store design, which aims to express magical realism through the store’s pale pink interiors, adds to the experience of picking out a flavor.

???? OUT AND ABOUT-

(all times CLT)

Swing by Swaying Luck: Driven as an Adjective this weekend: The exhibition features art by Alaa Abdelrahman, Alaa Ayman, Khoshoua ElGohary, Rama Disuky, and Rana Samir. Their artwork will be on display at Bibliothek Egypt through 7 August.

Jazz singer/songwriter Noha Fekry is taking the stage at Room Garden City tonight at 9 pm.

???? EARS TO THE GROUND-

For eaters, not foodies: The Sporkful — which earned a James Beard Award (Academy Awards of the food world) — is not about Michelin star restaurants, fancy chefs, healthy eating, or cooking advice. Rather, it’s based on the concept that a shared obsession with food is one of the greatest ways to connect with and learn more about people. The podcast is hosted and created by Dan Pashman, who, frustrated with the shortcomings of every pasta shape from spaghetti to penne, made it his mission to create the perfect shape. A mission that culminated with the invention of the cascatelli, which Pashman insists is the superior pasta shape based on its “forkability” — how easily you can get the pasta on your fork and keep it there — “sauceability,” or how well sauce coats the pasta, and “toothsinkability,” which measures how satisfying it is to bite into. You can hear all about the three-year process of inventing cascatelli on the podcast’s “Mission: ImPASTAble” series.

???? UNDER THE LAMPLIGHT-

WHAT’S NEXT – Find out what it’s like to be “12% machine” in Hybrid Human: Former soldier Harry Parker lost both his legs in Afghanistan in 2009, and had to be fitted with two prosthetic limbs. Since then, Parker began exploring life as a “hybrid human” — as he prefers to be referred to — and started exploring how AI, robotics, and computing are altering our understanding of what it means to be human in general and disabled in particular. What makes this book stand out is that this is not a scientist talking us through the intersection of biology and technology, it’s an actual memoir with Parker drawing from his own personal experience. His writing is elegant, entertaining, and eye-opening, especially when he examines the psychology of hybridity. The human mind has the ability to meld with the machine, he explains, by enlarging its map of the body to encompass the tool in question until it feels like a physical part of us. This is why you may find yourself ducking when your car passes under a low barrier – you have almost become the vehicle, in some sense.

???? GO WITH THE FLOW

EARNINGS WATCH-

Abu Qir Fertilizers saw a 157.5% y-o-y increase in its net income after tax to EGP 9.05 bn in FY 2021-2022, according to the company’s financials (pdf). The company’s top line grew 84.8% y-o-y to EGP 16.33 bn during the fiscal year.

MARKET ROUNDUP-

The EGX30 rose 0.9% at today’s close on turnover of EGP 741 mn (9.7% below the 90-day average). Foreign investors were net sellers. The index is down 21.6% YTD.

In the green: Abu Dhabi Islamic Bank-Egypt (+4.3%), Egyptian Kuwaiti Holding-EGP (+4.2%) and Rameda (+3.8%).

In the red: Ibnsina Pharma (-1.7%), Credit Agricole Egypt (-1.5%) and Telecom Egypt (-1.3%).

???? HEALTH

Open letter calls on ViiV Healthcare to make new HIV injectable more globally accessible: Nobel laureates, business leaders, artists, a former Malawian president and former New Zealand prime minister are among 74 prominent figures that have signed an open letter (pdf) to the CEO of HIV specialist company ViiV Healthcare calling for fairer and more affordable global access to its groundbreaking new HIV medication. The letter was published last week in the run-up to the 24th International AIDS Conference in Montreal on 29 July.

What exactly are they asking for? The letter asks that ViiV substantially reduce the price of its newly-developed antiretroviral injectable for HIV prevention — CAB-LA — as well as quickly finalize licenses to produce generic versions, share tech knowledge so global producers can start manufacturing it, and commit to supplying enough of it to meet global demand until other producers come online.

The bottom line? If life-saving medication isn’t more accessible, the HIV/AIDS pandemic will roll on: Global access to HIV prevention and treatment is already deeply skewed in favor of wealthy countries, and if CAB-LA isn’t made widely available and affordable, it will deepen the inequalities fueling the pandemic, the letter argues. Currently, almost 10 mn people living with HIV globally aren’t accessing treatment, leading to 680k preventable deaths from AIDS every year, it adds.

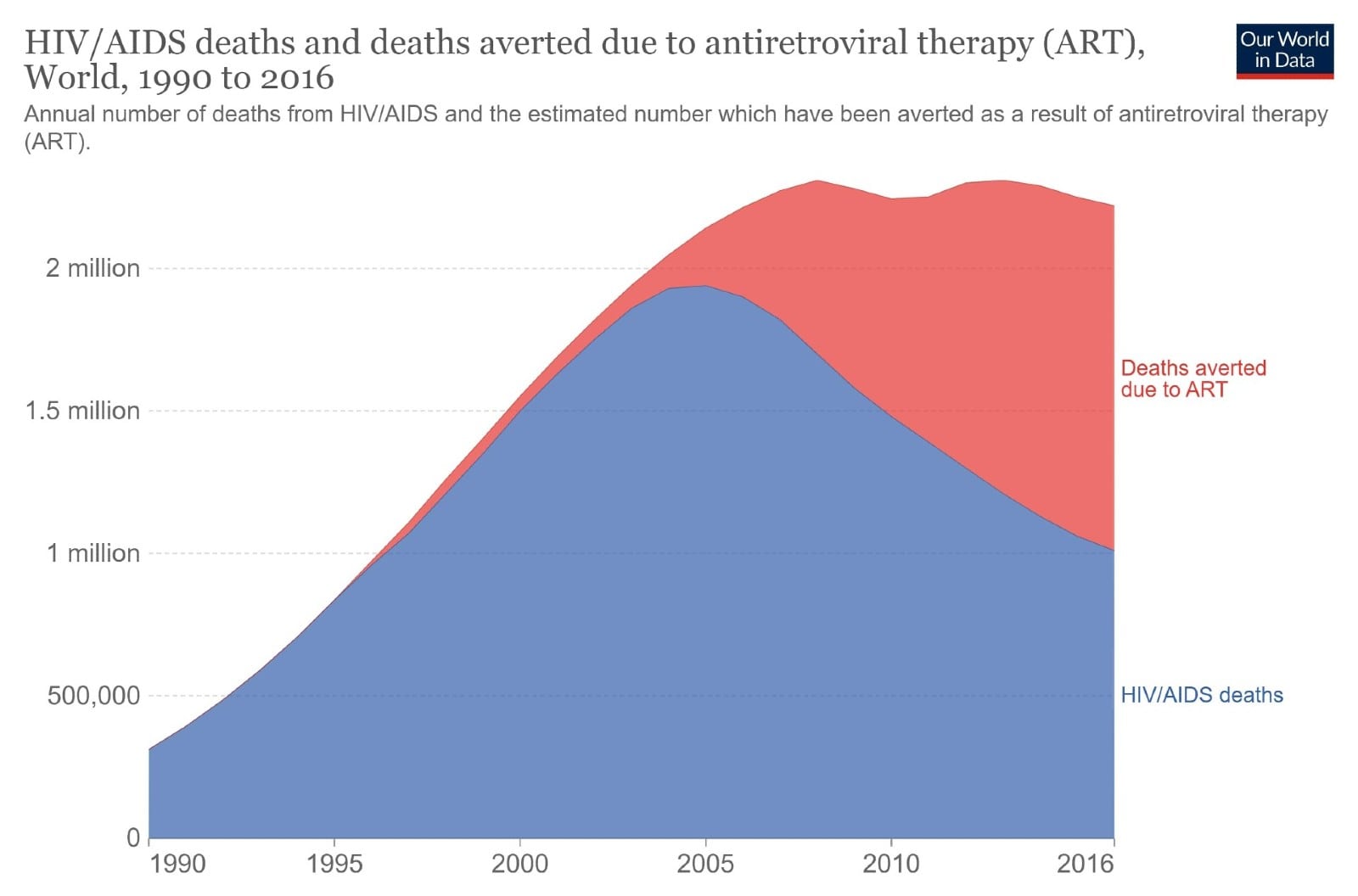

Antiretroviral medication has been game changing in the fight against HIV/ AIDS: After the first antiretroviral agent, AZT, was developed in 1987, widespread uptake of antiretroviral therapy (ART) in the developed world during the mid-1990s significantly reduced mortality, saving mns of lives. In 2016, an estimated 1 mn globally died from HIV/AIDS, but 1.2 mn deaths were averted because of ART, Our World in Data — a collaboration between Oxford University researchers and non-profit Global Change Data Lab — estimates. ART not only significantly extends life expectancy — with a person who starts it in their twenties in a high-income country perhaps living for another 46 years — but can also prevent HIV transmission to others.

But for many years, high costs made ART inaccessible to many in developing economies: In 2000, the cost of a year’s treatment with antiretroviral medication in sub-Saharan Africa was some USD 10k per person. By 2016, it had fallen to less than USD 100 per person. This lower pricing, and generic competition between medication providers, eventually made ART more accessible, “sparing an estimated 16.5 mn lives,” the open letter notes.

And as of December 2021, 28.7 mn people were accessing ART, up from 7.8 mn in 2010, UNAIDS notes.

Still, the stats of people living with HIV/AIDS make for sobering reading: Some 38.4 mn people on average globally were living with HIV in 2021, according to UNAIDS. 1.5 mn people on average became newly infected with HIV in 2021, and 650k people on average died from AIDS-related illnesses in the same year.

This all sounds very familiar: The World Health Organization notes that vaccine equity is an essential part of ending the covid-19 pandemic. But pharma giants — including ViiV co-owner Pfizer — have repeatedly faced strong criticism for perpetuating covid-19 vaccine inequity by keeping vaccine prices high, refusing to share their tech, and imposing “abusive” conditions on countries that want to purchase shots.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

28 July (Thursday): The government hosts public consultations on its state ownership policy with representatives from the healthcare industry.

29 July (Friday): Aleph Commodities shareholder meeting to vote on potential merger with Tenaz Energy Corp.

30 July (Saturday): Islamic New Year.

Late July-14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

August: Sharm El Sheikh will host the African Sumo Championship.

14 August (Sunday): Conference of Egyptian entities abroad.

16 August (Tuesday): MNHD’s general assembly meeting to decide whether to allow SODIC to go ahead with due diligence on its takeover bid.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Naval Power, Egypt’s first naval defense expo

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Kobba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

11-13 September (Tuesday-Thursday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

MARCH 2023

March: 4Q2022 earnings season.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.