- Qatar Energy eyes a part of Shell’s Red Sea assets. (The Big Story Today)

- The TRY is sinking to new record lows. (What We’re Tracking Today)

- Buybacks are booming amid the bull run on US equities. (For Your Commute)

- Deepfakes are more convincing — and more dangerous — than ever. (For Your Commute)

- It’s all riding on the season finale of Succession. (On The Tube Tonight)

- Have you booked your Russell Peters tickets yet? (Out And About)

- The essays of Hasanthika Sirisena’s Dark Tourism collection tread sinister ground. (Under the Lamplight)

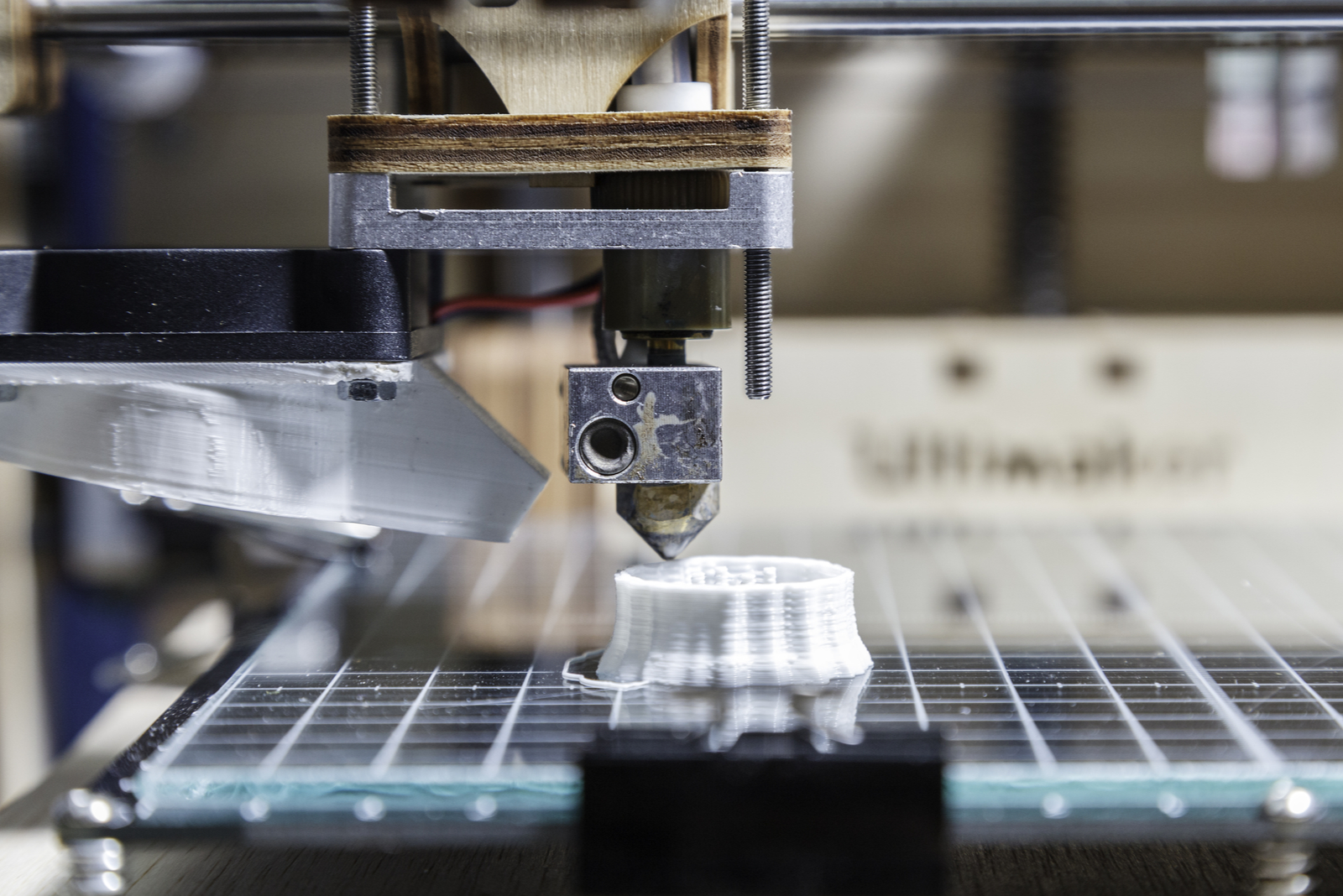

- Egypt’s 3D printing scene is building itself up, layer by layer. (What’s Next)

Monday, 13 December 2021

PM — Qatar Energy could be about to enter Egypt’s oil and gas upstream sector for the first time

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone, and welcome to an uncharacteristically gentle Monday newsflow, giving us a much-appreciated window in which to decorate our Christmas tree here at Enterprise HQ (though the supply chain crisis means there might not be any presents to go under it, as explained below). Here at home, Qatar Energy is looking to buy itself the gift of a minority stake in two Shell-operated blocks in the Red Sea, while the global press remains fixated on whether central bank policymakers plan to be naughty or nice on inflation at this week’s rate meetings.

One reason not to be Christmas-cheerful: Deepfake tech is exposing women to abuse. And one reason to be: the season finale of Succession drops tonight.

THE BIG STORY TODAY-

Qatar Energy could be about to enter Egypt’s oil and gas upstream sector for the first time with the purchase of a 17% stake in two Shell-operated blocks in the Red Sea. The Dutch energy giant said this morning that it had agreed to sell the ownership to Qatar Energy, in a transaction that still needs government and regulatory approvals from both sides of the fence.

^^We’ll have more details on this and others in tomorrow’s EnterpriseAM.

** CATCH UP QUICK on the top stories from this morning’s EnterpriseAM:

- Consolidation in the steel sector: Ezz Steel will acquire Ahmed Abou Hashima’s 18% stake in Egyptian Steel for EGP 2.5 bn.

- CI Capital’s tender offer for 26% of CHG goes live: Cleopatra Hospital Group shareholders have until Sunday, 26 December to subscribe to CI Capital’s voluntary tender offer, which it announced last week to acquire 26.2% of the company.

- Alameda gets contract for new capital hospital: Healthcare group Alameda is planning to invest EGP 1 bn to operate and manage a 300-bed hospital in the new administrative capital.

It’s interest rate week at home and abroad: The Central Bank of Egypt is meeting Thursday to review interest rates. It’s highly unlikely we’ll see any changes during the final policy meeting of the year, with everyone we surveyed in our customary poll telling us that policymakers will hold fire due to uncertainty over foreign inflows and inflation.

Potentially playing into the CBE’s calculations will be the decision made by the Federal Reserve a day earlier: The US central bank could announce plans to hike rates in 2022 and accelerate the tapering of its bond-buying programme as political pressure builds on policymakers to do something to slow inflation, which last month reach its highest rate in almost 40 years. The two-day meeting kicks off tomorrow.

The TRY is continuing to plumb new depths today, falling past the USD 14 handle for the first time ever and prompting yet another intervention by the country’s central bank. The currency has now plummeted 39% since cutting interest rates in September, making it the world’s worst-performing emerging-market currency this year. Bloomberg has more.

|

FOR TOMORROW- The Egyptian Economic Summit takes place at the St. Regis Hotel. The one-day event will feature a range of panelists from institutions including CIB, EFG Hermes, the Sovereign Fund of Egypt, Eastern Company, Oriental Weavers, Microsoft and Danone, among others. The full agenda is here (pdf).

???? CIRCLE YOUR CALENDAR-

Subscription begins for CI Capital’s CHG acquisition: Cleopatra Hospitals Group (CHG) shareholders have 10 working days, starting today, to weigh in on the voluntary tender offer from CI Capital to acquire 26% of the healthcare company. We had the full details on the next steps in the acquisition bid in this morning’s AM.

The UN Convention Against Corruption kicks off this morning in Sharm El Sheikh and wraps this coming Friday, 17 December.

Cairo-based joint stock and investment companies have until Wednesday, 15 December to register for the government’s e-invoicing platform.

ALSO-

- The Food Africa expo runs through tomorrow at the Egypt International Exhibition Center, after getting underway yesterday.

- It’s also the second and final day of a conference of the AU’s Committee of Intelligence and Security Services of Africa. Egypt took over the committee’s rotating presidency during yesterday’s session.

- The Arab Conference on the Peaceful Uses of Atomic Energy also kicked off yesterday in Aswan and runs until Thursday.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 21°C tomorrow, with the mercury falling to 10°C at night, according to our favorite weather app.

???? FOR YOUR COMMUTE

US stock buybacks hit a new quarterly record in 3Q2021 in a huge reversal from 2020 which saw repurchases plunge as the effects of the pandemic gripped the financial markets. S&P 500-listed companies repurchased USD 234.5 bn worth of shares during the July-September period, surpassing the previous USD 223 bn record set in 4Q2018, the Wall Street Journal reports, citing preliminary S&P data.

It might be a short-lived record if analysts are to be believed: One market watcher is expecting buybacks to reach USD 236 bn during the current quarter. Microsoft, Dell and car rental firm Hertz have all recently announced new repurchase programs.

The aim of buybacks: Support the share price. By reducing share count, buybacks boost a company’s share price, and support investor sentiment by signalling management's confidence in the future of the firm. Microsoft’s aggressive buyback program allowed its CEO to sell half his holdings without impacting its share price. And juicing the share price higher helps maximize the returns for exiting investors. Hertz, which only last year filed for bankruptcy, is planning to spend up to USD 2 bn buying its share as its private equity backers head for the exit.

Buybacks are partly fuelling this year’s bull run on equities: The S&P 500 is up 25% this year, logging 67 record closes — and buybacks are partly responsible, along with the US Federal Reserve’s stimulus measures, and corporate earnings that have consistently outperformed analysts expectations.

But they’re not without controversy: Some US lawmakers have criticized firms for shoring up their share prices rather than investing in the business. A 1% tax set to come in on the net value of buybacks as part of US President Joe Biden’s landmark Build Back Better bill. That could be a catalyst for more buyback schemes before the law comes in, though the levy was described by one wealth management exec as “so low that I don’t think it will impact anything.”

Deepfake tech is increasingly advanced, widespread — and dangerous. Just four years after its inception, synthetic media software (AKA deepfake tech) can replace a person’s face in a video so seamlessly that most viewers struggle to tell a fake from reality, Reuters reports. The tech has also become accessible to any and everyone with a smartphone, leading experts to warn that a turning point is nearing where deepfakes could start to pose serious ills for society.

Women are most likely to have their faces stolen: Non-consensual deepfake [redacted] accounted for 96% of the total deepfake videos online, according to a 2019 report from deepfake monitor Sensity. “The vast, vast majority of harm caused by deepfakes right now is a form of gendered digital violence,” one of the study’s authors told Reuters, adding that mns of women have been targeted globally.

And there’s little justice to be found: Even in the few places worldwide where deepfake abuse is criminalized, cases are difficult to prosecute. Many deepfakes are distributed anonymously — and until now, it's only the perpetrators (not the platforms that allow them to make and share the content) who bear liability. New legislation proposed in the US and EU could bring in more restrictions, such as requiring deepfakes to be marked as such. But whether that will deter people from creating, sharing and watching non-consensual deepfakes is another matter, researchers told the newswire.

Santa vs. supply shortages: Global supply issues are coming for US and European gift lists this year, as the world continues to deal with bottlenecks and shortages in the aftermath of the pandemic. The cost of air freight has reached record highs, reports the Financial Times, with more companies turning to air cargo as they scramble to stock shelves before Christmas. Air freight prices have nearly doubled in the past three months on key routes linking Chinese manufacturing hubs with European and US consumers. Half of these parcels would normally go on passenger flights, but the pandemic has grounded jets, leaving freight planes piled high.

It could also be more challenging to get your hands on a new phone, Xbox or PS5 in time for the festivities, as the global chip shortage lingers. Semiconductor-rich products like smartphones, games consoles, and computers are in short supply, according to CNBC.

Not even Amazon Prime can help with this one: Consumers have increasingly found themselves waiting two to three weeks for their gadgets to arrive, instead of the usual one or two days, according to one analyst. Meanwhile, a rise in the use of automated bots that snap up popular products to sell them on at inflated prices means some are being forced to pay a premium on their gadgets.

???? ENTERPRISE RECOMMENDS

The season finale of Succession is out today + This week has some major events happening + Dark Tourism with a twist of emotions

???? ON THE TUBE TONIGHT-

(all times CLT)

The season finale of Succession is out today, with CNN (spoiler alert) saying the show saved “left the best for last”. Now we sincerely hope that’s the case, because the pacing of the season left some of us here feeling highly underwhelmed, with several key, seasons-long plot arcs seemingly being resolved on a whim and even abandoned, and several plot-shaking curve-balls coming out of nowhere. That said, the season (as with the rest of the show) shines when focusing on the family drama and the sibling rivalries of the vapid and insecure bn’aire Roy clan. And from our take, the finale looks set to lean in on this drama and we’re excited to see how the writers push forward the conflicts ahead of the fourth season. You can watch the finale on OSN Streaming.

⚽ It’s a light day for football: There’s one match in La Liga today, with Cadiz facing Granada at 10pm, while in Serie A, Roma and Spezia will hit the field at 9:45pm.

There’s also a match in the Egyptian Premier League between Al Masry and Misr Lel Makassa at 5:30pm.

THIS JUST IN- The Champions League will redraw for the round of 16 after the first lineup of matches saw a glitch in the draw system. Several teams were drawn together even though they were not allowed to compete against each other in the next round (due to being from the same country or qualifying from the same group, for example). Goal, The Guardian, and BBC have the story. The redraw will take place at 4pm.

???? OUT AND ABOUT-

(all times CLT)

There isn’t much on today, but there are two big events happening in Cairo this week that you should plan in advance for:

Magic On Ice Ilusio: The world-renowned ice show has traveled to Berlin, Las Vegas, and Manhattan, and is now gliding into Egypt for the first time. The figure skating show’s run kicks off on Thursday at Cairo International Stadium in Nasr City, promising a breathtaking experience. You can get your tickets here.

Canadian Comedian Russell Peters’ “Act Your Age” tour comes to Egypt on 17 and 18 December, with material on cancel culture, aging, and the current state of the world. If you don’t already know who Peters is, check out his standup routines on Arab Men and Language Barriers — two of our favorites. You can get your tickets from TicketsMarche.

???? UNDER THE LAMPLIGHT-

Gripping recollections of visits to dark tourism hotspots: Back on Halloween, we delved into the concept of dark tourism — where people journey to the sites of disasters both natural and man-made. Hasanthika Sirisena offers dispatches from such sites in her new essay collection Dark Tourist, using her critical eye to explore the places where personal and collective histories meet. From the site of a 1961 plane crash that left a nuclear warhead buried near Sirisena’s North Carolina hometown, to places that witnessed the recent civil war in her birth country of Sri Lanka, Sirisena explores these tourist spots as a way to tell her own story, illuminating how these dark historical sites came to influence the person she is today.

???? GO WITH THE FLOW

Market roundup on 13 December

The EGX30 fell less than 0.1% at today’s close on turnover of EGP 1.23 bn (11.7% below the 90-day average). Foreign investors were net sellers. The index is up 7.9% YTD.

In the green: MM Group (+6.1%), Egyptians Resorts Company (+5.5%) and Fawry (+3.1%).

In the red: GB Auto (-3.8%), AMOC (-3.2%) and Mopco (-2.4%).

???? WHAT’S NEXT

The local 3D printing scene

Egypt’s 3D printing scene: Young, but the potential for disruption is there. A nascent technology in Egypt and the world, 3D printing has the potential to revolutionize industries like healthcare, automotives, aerospace and construction with its highly customizable, low-cost solutions. With the global market on course to triple in value over the next five years, the manufacturing technique is increasingly finding a foothold in Egypt, with fabrication labs appearing on university campuses and everyone from business incubators and hackerspaces to medtech startups eyeing international markets with their technology.

For the newbies: 3D printing is a form of additive manufacturing, which allows for the construction of 3D objects through computer-aided design (CAD). Objects are printed on 3D printers, which range from homemade DIY machines that can print small objects for, say, medical or engineering purposes, to 3m+ tall machines that are used to build houses.

Right, but how does it work? Additive manufacturing, unlike traditional manufacturing, works by adding layers rather than removing them to make a product — think of it as the difference between carving a sculpture out of wood (traditional manufacturing) and frosting a cake (additive manufacturing). This layering process eliminates waste and allows for the manufacturing of complex objects that would be much more difficult (and costly) to produce using conventional methods. In addition to being used for rapid prototyping, additive manufacturing allows designers to create spare parts at a lower cost.

It is highly customizable and decentralized, making it super versatile: The technology has come a long way since its inception in the 1980s, and today anyone with access to a fabrication lab and an internet connection can 3D-print. Open-access blueprints are easy to download online, or if you know your way around 3D modelling software, you can design your own creation. This makes 3D printing one of the most versatile manufacturing techniques — and one that is completely decentralized.

One of the first fabrication labs to introduce the technology in Egypt was Fab Lab Egypt (FLE), which launched back in 2012. A member of MIT’s global Fab Lab network, FLE has a network of fabrication labs and makerspaces across Egypt. Now run by San3a Tech — a company established by FLE’s founders in 2016 — the organization has worked with a number of multinationals including Intel, Orange, and Dell on digitally-fabricated products.

Another key player in Egypt’s 3D printing space: Creatables. Officially launched in 2018, the Mokattam-based engineering company was incubated by the makerspace Cairo Hackerspace and specializes in digital fabrication, offering CAD design, 3D scanning, and a 3D printing farm. The engineering, architecture, art, film and advertising sectors have all benefited from the technology, Hady Mohamed, one of the co-founders of Creatables, tells Enterprise.

Universities and business incubators are the perfect home for fab labs, so it’s no surprise that Heliopolis University’s (HU) Center for Entrepreneurship and Innovation hosts a small fabrication lab that they are now expanding in collaboration with San3a Tech. The lab is open to businesses and university students to create prototypes and develop models, Karim Mallawany, executive director of the center, tells us. So far, it has been used primarily for R&D purposes, but Mallawany hopes that adding a 3D scanner to the lab will enable the design of more sophisticated products.

It’s making ripples in health: At the height of the covid pandemic, 3D printing was used to print test swabs, protective gear, medical devices and respirator parts — but this is just skimming the surface of how the technology can revolutionize healthcare. Today, doctors are testing how 3D printing can be used in regenerative therapies to print small body parts and possibly even organs, and it is already being used for prosthetics and to prepare doctors for complex surgeries. Giza Systems’ digital fabrication lab, part of Giza Systems Education Foundation (GSEF), is working to design and print prosthetics, customized wheelchairs, and even bionic eye devices to assist people with disabilities.

Egypt’s dental industry is embracing the technology: Dental tech startup Mogassam has been in the business of making 3D printers for the dental industry for the past four years, selling 120 printers in that time, with plans to expand sales into the US next year. Cofounder Ahmed Adel tells us that the dental industry has been quick to embrace the technology, with dentists turning from “craftsmen to designers,” as they adapt to print everything from permanent crowns to transparent braces, dentures, veneers and surgical guides on in-house 3D printers. Adel, an engineer, is optimistic that Egypt can make strides in 3D printing for the health sector. “The field is new in the whole world, so the gap between Egypt and the rest of the world still isn’t that big.”

It’s also making an impact in manufacturing: Factories in Egypt are now using 3D printing to replace gears or spare parts on production lines, Mohamed says. In other countries, such as the US, the technology is routinely used for manufacturing and prototyping in industries including aerospace and automotives.

Ready to print the new capital? Not quite, but the potential is there: Imagine a house, built like a soft-cone ice cream, swirl upon swirl piling up to make a dwelling for a family within 24 hours. This is now possible with 3D printing. Some companies are even using it to build whole neighborhoods, while others are using it to mitigate homelessness by providing low-cost social housing and disaster relief shelters. With no long-term proof of concept, investors are still wary of the sustainability of 3D printed houses, but some companies are betting on automating the construction process because of its potential to cut labor costs, produce less emissions and turn around a final product faster.

Want more?

???? CALENDAR

12-13 December (Sunday-Monday): Conference of the AU’s Committee of Intelligence and Security Services of Africa, Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

12-16 December (Sunday-Thursday): The 15th edition of the Arab Conference on the Peaceful Uses of Atomic Energy is taking place in Aswan.

13-26 December (Monday-Sunday): Cleopatra Hospitals shareholders can subscribe to CI Capital’s voluntary tender offer for 26% of the company.

13-17 December (Monday-Friday): United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-15 December (Tuesday-Wednesday): Federal Open Market Committee meeting.

14 December (Tuesday): Inquiry session for the Industrial Development Authority’s licenses to manufacture steel products.

14 December (Tuesday): CDC event to announce the details of its 2022-2026 strategy period.

14 December (Tuesday): The Egyptian Economic Summit, The St. Regis Hotel, Cairo.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

15 December (Wednesday): Target date for snackmaker Edita to wrap up due diligence on its acquisition of the Ole brand owner Egyptian Belgian Company.

15 December (Wednesday): The European Bank for Reconstruction and Development will give its final approval for a USD 100 mn facility to state-owned Banque Misr to finance local SMEs working on green projects.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

16 December (Thursday): SODIC shares will be transferred to Aldar Properties / ADQ consortium by this date.

16 December (Thursday): Inquiry session for the Industrial Development Authority’s licenses to manufacture tobacco products.

End of December: El Nasr Automotive plans to sign contracts with a new partner to locally assemble EVs.

End of 4Q2021: EdVentures plans to have closed at least one more edtech investment round.

End of 4Q2021: Fawry plans to have launched its MyFawry card.

1H2022: The World Economic Forum annual meeting, location TBD.

1H2022: e-Aswaaq’s tourism platform will roll out its ticketing and online booking portal across Egypt.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

Second Half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

The end of January: The Egyptian-Romanian business forum will take place with the aim of strengthening joint investment relations.

January 2022: Tenth of Ramadan dry port tender to be launched.

1 January 2022 (Saturday): Capital gains tax comes into effect on the EGX for local investors.

1 January 2022 (Saturday): Private sector minimum wage introduced.

1-15 January 2022 (Saturday-Saturday): Qualified Industrial Zones (QIZ) Joint Committee.

4 January 2022 (Tuesday): OPEC+ ministerial meeting.

7 January 2022 (Friday): Coptic Christmas.

10-13 January 2022 (Monday-Thursday): World Youth Forum, Sharm El Sheikh.

15 January (Saturday): Target date for the finalization of snackfood giant Edita’s acquisition of the Egyptian Belgian Company, owner of the Ole brand.

17-19 January 2022 (Monday-Wednesday): World Future Energy Summit, Abu Dhabi.

20 January 2022 (Thursday): Kadmar Shipping’s new line transporting agricultural crops between Alexandria and Russia begins its operations.

27 January 2022 (Tuesday): National holiday in observance of 25 January revolution anniversary / Police Day.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February 2022: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

11 February 2022 (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February 2022 (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

March 2022: 4Q2021 earnings season.

March 2022: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March 2022: World Cup playoffs.

2 April 2022 (Saturday): First day of Ramadan (TBC).

3 April 2022 (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April 2022 (Monday): CDC Group will formally change its name to British International Investment.

22-24 April 2022 (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April 2022 (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April 2022 (Monday): Sham El Nessim.

25 April 2022 (Monday): Sinai Liberation Day.

Late April – 15 May 2022: 1Q2022 earnings season

May 2022: Investment in Logistics Conference, Cairo, Egypt.

2 May 2022 (Monday): Eid El Fitr (TBC).

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

30 June 2022 (Thursday): June 30 Revolution Day, national holiday.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

July 2022: A law governing ins. for seasonal contractors will come into effect.

8 July 2022 (Friday): Arafat Day.

9-13 July 2022 (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July 2022 (Saturday): Islamic New Year.

Late July – 14 August 2022: 2Q2022 earnings season.

September 2022: Egypt will display its first naval exhibition with the title Naval Power.

6 October 2022 (Thursday): Armed Forces Day, national holiday.

8 October 2022 (Saturday): Prophet Muhammad’s birthday.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November 2022: 3Q2022 earnings season.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.