- Planning Ministry upgrades growth forecast to 6.2-6.5% in FY2021-2022 + House signs off on key bills. (The Big Story Today).

- World markets brace as Russia and Ukraine tensions mount with troops on the move. (The Big Story Abroad)

- G20 countries fell short of their USD 100 bn pandemic aid pledge to developing countries. (For Your Commute)

- Calling all lovers of The Godfather trilogy — the mob drama is returning to cinemas for a theatrical re-release to mark its 50th anniversary. (On The Tube Tonight)

- Meet our analyst of the week: Al Ahly Pharos’ Omar El Watan. (Go With The Flow)

- Go for coziness and comfort as the weather gets more outdoor-friendly at cafe and eatery Bittersweet. (Eat This Tonight)

Tuesday, 22 February 2022

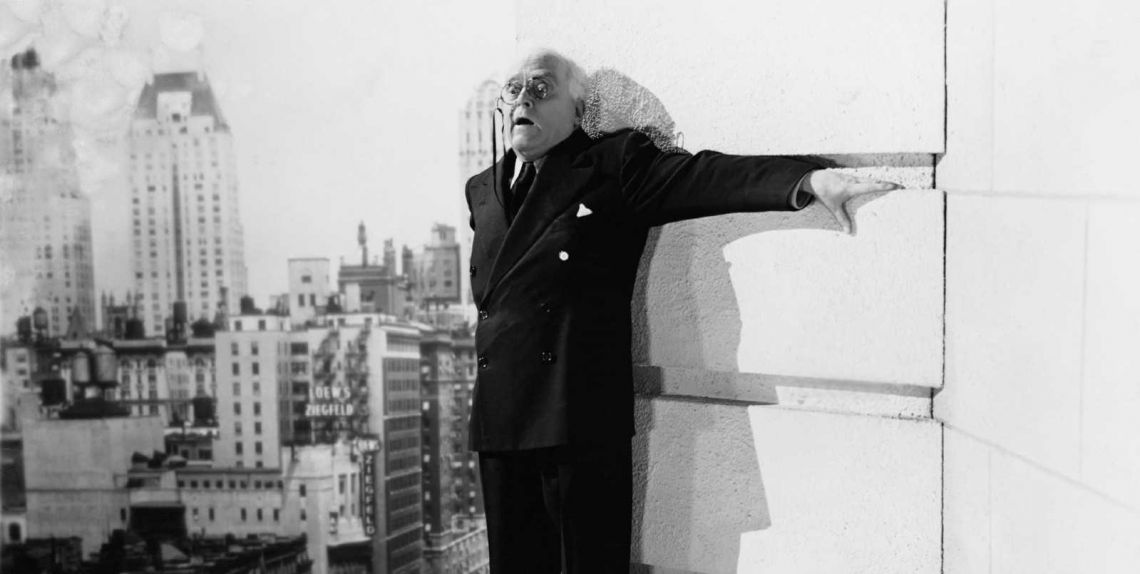

PM — The drums of war

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

It’s hump day, ladies and gentlemen, but it’s far from news dump day on the local front as all eyes are fixed firmly abroad on the developing situation between Ukraine and Russia. We have chapter and verse on all the latest, below, but first…

#1- Planning Ministry upgrades growth forecast: Egypt’s GDP is expected to grow between 6.2% and 6.5% in FY2021-2022, Planning Minister Hala El Said said today. The new forecast is an upgrade from El Said’s most recent expectation that our economy would grow at a 5.6% clip this fiscal year. This comes after Prime Minister Moustafa Madbouly announced earlier this month that our 2Q2021-2022 growth came in at 8.3%, marking a significant increase from previous expectations.

#2- House signs off on several pieces of legislation: The House of Representatives’ general assembly gave its final approval today to the “old rent” law, amendments to the Real Estate Registry Act, and amendments to the Capital Markets Act.

^^We’ll have more on this story and other stories in tomorrow’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Elevate PE to establish cancer treatment facility in Cairo: Elevate Private Equity is investing at least EGP 500 mn to establish a dedicated cancer treatment facility in Egypt, a company spokesperson told Enterprise yesterday. This came on the same day that Elevate announced (pdf) the signing of an MoU with the France-based Gustave Roussy Institute, one of Europe’s leading cancer hospitals, to collaborate on the facility.

- Egypt, US launch climate working group ahead of COP27: Foreign Minister Sameh Shoukry and US Presidential Climate Envoy John Kerry met for the inaugural session of a working group that will set priorities for COP27 in Sharm El Sheikh this November, according to a Foreign Ministry statement.

- Schneider eyes EUR 500-600 mn contract for 10 control centers: Schneider Electric Systems is in talks with the Electricity Ministry for the contract to build 10 energy control centers, which are expected to cost EUR 500-600 mn.

HAPPENING NOW-

El Sisi talks regional tensions + security with Kuwait’s emir, crown prince: President Abdel Fattah El Sisi discussed increasing economic and political cooperation with Kuwait in two separate meetings in Kuwait with Emir Sheikh Nawaf Al Ahmed Al Jaber Al Sabah and Crown Prince Mishal Al Ahmad Al Jaber Al Sabah, Ittihadiya said. The president discussed with the emir and crown prince a handful of regional political and security developments, according to the Ittihadiya readouts.

THE BIG STORY ABROAD-

The unfolding events in Ukraine is all anyone can talk about today as the world responds to Russia’s decision to move “peacekeeping” troops into separatist-held areas in the east of the country and formally recognize them as independent territories.

Nordstream 2 is all but dead: German Chancellor Olaf Scholz has suspended the approval process for the controversial Nordsteam 2 pipeline that would have shipped Russian natural gas directly to Germany.

But European nations are divided on sanctions: Diplomatic sources tell the Guardian that there are “worrying signals” that countries are not on the same page as governments decide on how to respond to the incursion. One diplomat said that Austria, Germany and Italy are favoring an incremental approach, while others want to immediately hit Moscow where it hurts.

The UK’s sanctions response hasn’t yet lived up to the “barrage” promised by PM Boris Johnson: In an address to parliament an hour before dispatch, the prime minister announced that the government would place sanctions on five, minor Russian banks and three oligarchs with close ties to the Kremlin who were already under US sanctions.

We’re still waiting for the response from Washington: After initial sanctions were imposed on the separatist administrations in the early hours of this morning, the US is yet to reveal how they plan to sanction Russia itself. Expect a response later today, Reuters reports.

European banks are bracing for impact: European banks are preparing for blowback ahead of potentially severe financial sanctions placed on Russian financial institutions, according to Reuters. Banks on the continent are highly exposed to Russia, particularly those in Austria, France and Italy. The share price of Austrian bank RBI suffered heavy losses today as the bank said it was readying “crisis plans” ahead of sanctions.

The key question right now: Whether Russia recognises territory held by the separatists or territory claimed by the separatists is crucial. Currently, the self-proclaimed republics only hold parts of the Donetsk and Luhansk provinces, potentially setting us up for a Russian invasion of Ukraine-held territory should Moscow recognize lands outside of these borders.

The oil market reacted exactly as you’d expect, surging closer to the USD 100 per barrel mark in early trading. The price of Brent has since pared gains and was up 1.7% to USD 94.60 a barrel shortly before dispatch.

European stocks are recovering from the initial shock: After suffering losses early in the session, shares in Europe are now slightly in the green. On the other side of the Atlantic, Wall Street is expected to open slightly lower. The S&P 500 is currently down 9.3% YTD and further losses today would put it in danger of falling into correction territory.

A dead cat bounce? The head of HSBC warned today of the threat of “wider contagion” for global financial markets should the situation continue to deteriorate. "It's clear that there is a likelihood of contagion or some second-order effect, but it will depend on the severity of the conflict and the severity of the retaliation if there is a conflict," Noel Quinn told Reuters.

Stay up-to-date here: Bloomberg | FT | BBC | Washington Post.

|

FOR TOMORROW-

Two Egyptian startups will pitch their businesses to leading tech investors at the pan-African Africa Tech Summit in Nairobi, which kicks off tomorrow. Blockchain-based communications platform Pravica and agritech startup Visual and AI Solutions (VAIS) are among the nine startups that have been selected for the two-day event, which will bring together African startups, VC and private equity investors, lenders, and global tech leaders.

???? CIRCLE YOUR CALENDAR-

A call for tech startups: The Information Technology Industry Development Agency (ITIDA) and US-based VC firm Plug and Play have launched an incubator and accelerator program for digital transformation-focused startups in partnership with our friends at USAID. The newly launched “Smart Cities” innovation hub will select 20-30 Egypt-based companies for its inaugural three-month program, which starts in March. Startups can apply here before applications close on 28 February.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- A bout of warm weather: The mercury will rise to a daytime high of 25°C tomorrow, marking the warmest day these past few weeks, our favorite weather app indicates. The temperature will fall to 11°C at night ahead of a cold front on Thursday and Friday.

???? FOR YOUR COMMUTE

G20 countries fell short of their USD 100 bn pandemic aid pledge to developing countries: The world’s most advanced economies agreed last week to provide a combined USD 60 bn to developing countries struggling under the financial fallout of the pandemic, marking a significant reduction from their original USD 100 bn pledge, the Financial Times reports. This is also less than a quarter of the USD 290 bn given to members of the G7 group of advanced economies last year by the IMF as special drawing rights (SDRs), the FT notes. The US and China made the biggest pledges, agreeing to shell out USD 21 bn and USD 14 bn, respectively, after the meeting of G20 finance ministers and central bank governors in Jakarta ended last week.

And they’ve turned the tables on the IMF: The G20 said it would continue to work towards the USD 100 bn target, and called on the IMF to set up the Resilience and Sustainability Trust before the IMF and World Bank spring meetings in April. The trust would provide developing countries with loans — at low or zero interest rates — but are still considered unfavorable by debt-heavy emerging economies that would benefit more from the no-strings-attached kind of aid that comes through SDRs and the G20’s pledges.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

An offer you can’t refuse: Calling all lovers of The Godfather trilogy — the mob drama is returning to cinemas for a limited theatrical re-release in 4K to mark its 50th anniversary. The re-release will only include the first film in the trilogy on the Corleone family (which is, in any true cinephile’s opinion, the best of the three). The movie will land tomorrow at Vox cinemas across Egypt. Watch the restored trailer here (watch, runtime: 2:02).

⚽ The night of the Champions in Europe: The UEFA Champions League will kick off its first leg of round 16 today, with Chelsea clashing with LOSC Lille, and Villarreal going up against Juventus, both at 10pm.

In the Egyptian Premier League, Al Ahly will play against Misr Lel Makkasa at 8pm, where the red devils hope to emerge on top to rank first in the table. Enppi v Al Ittihad will kick off at 5:30pm, while the 3pm clash between Ceramica Cleopatra and Ghazl El Mahalla is waiting for the whistle to blow on its first half as we dispatch this issue.

☕ EAT THIS TONIGHT-

Go for coziness and comfort as the weather gets more outdoor-friendly at cafe and eatery Bittersweet in Arkan Sheikh Zayed’s new extension, which is home to many of our favorites. The bright red-colored cafe, with a cherry blossom tree in the middle of its indoor area promises a cozy vibe, even if you only settle down for coffee and a book. The menu is simple yet diverse, ranging from breakfast savories, including make your own croissant, to homemade salads, pastas and sandwiches and refreshing juices and freshly made coffee. We’re pretty old school, so we recommend their class margherita pizza, topped with fresh buffalo mozzarella and basil leaves. Don’t miss their Quatro Leches Cake, for some milk goodness or their Gorilla Tiramisu, which uses its single soil origin Gorilla coffee.

???? OUT AND ABOUT-

(all times CLT)

Alternative singer/songwriter Aya Metwalli and shaabi musician Maurice Louca are performing at Cairo Jazz Club’s Alt Tuesday Night in Agouza at 9pm tonight. Reservations are required.

On the opposite end of the musical spectrum, Cairo Opera House is hosting a harp, flute, and strings ensemble led by Manal Mohei Eldin at 8pm.

???? UNDER THE LAMPLIGHT-

Exploring power dynamics and financial inequality through the lens of a young working-class girl’s relationship with an older financier, “A Very Nice Girl” by Imogen Crimp follows the story of 24-year-old Anna, who dreams of being an opera singer. While working at a jazz club, Anna meets Max, a man several years her senior who is not yet divorced. Anna is seduced and falls in love, despite Max stressing that their whole relationship is based on “only fun,” even as he convinces her to abandon her studies altogether to spend time with him. Because of the relationship, Anna starts to lose herself and her once-strong love for art. Crimp’s debut novel highlights the complexity of being a vulnerable young woman in a new city trying to find your identity while falling into complicated toxic relationships that you know you should avoid.

???? GO WITH THE FLOW

OUR ANALYST OF THE WEEK- Omar El Watan, investment banking analyst at Al Ahly Pharos (Linkedin).

My name is Omar El Watan and I’m an investment banking analyst at Al Ahly Pharos. I’ve worked in similar roles at Zilla Capital and BKR Egypt. I graduated from Telfer School of Management at the University of Ottawa and I thought I would continue to live in Canada, but I eventually came back because ‘Om El Donia ghalya 3alaya’ [laughs].

Investment banking gives you new exposure every time you get a new mandate, which makes the job very interesting and full of things to learn and explore. It requires a keen eye for analysis and the linguistic ability to tie the narratives to the numbers. Investment banking is also a people’s job in that you have to get up close and personal with shareholders and management and try to have a good relationship with them. It’s a bit of everything and there really is nothing like it.

The worst part of my job is working on a transaction for so long and then just having it fall apart. Sometimes it’s due to the macroeconomic climate, other times the shareholders and new investors don’t see eye to eye — so oftentimes it’s something completely out of your control and you have to pick yourself up, dust yourself off, and start all over again.

The trend in the investment banking industry this year is to invest in defensive sectors. We’re seeing a lot of investments in F&B, healthcare, and education. Non-banking financial services are also getting a lot of attention, as well as any company that is linked to commodities.

I don’t see investors being more bullish on Egypt in the immediate future. Economically, we’re doing just fine, but there are still factors keeping the market bearish such as global risks, conflicts abroad, and the interest rate environment.

A sector I think is a gem is e-commerce. Anything that uses tech to enable individuals and simplify processes is the future. The VC culture is all over this because it’s high risk, high reward. Egypt in general has a lot of potential in this area. We skipped the industrial era, but we’re all over the internet era. Companies and legacy firms need to understand the importance of tech and incorporate it into their thinking. I think if this happens, it will be an inflection point for the country where we can only go up from here. However, I don’t see this happening in the next two years.

There are three important factors I look at before I decide on an investment. The first is competitive edge: Having something that differentiates the company and can’t easily be replicated. The second is competent management with a good corporate governance structure. Finally, a company has to have high growth potential in terms of the industry it works in.

My theory of investment is to search for high risk, high return investments… with good fundamentals. Maybe it’s because I’m young [laughs]. I think private investment is a really good way to go as it’s extremely beneficial not just monetarily, but also impact-wise. At the same time, you should have a traditional investment such as real estate to fall back on.

The last great thing I watched was a documentary by Al Jazeera Investigations called The Men Who Sell Football. It had a really interesting part that looked at how FIFA rigged the game in Africa. I highly recommend it.

I’m currently reading Meditations by Marcus Aurelius, the Roman Emperor during 161–180 CE. It talks about Stoic philosophy and it teaches a different mindset and how to look at things when they’re out of your control.

In my downtime I like to play padel tennis or try new places to eat. I’m just a typical ‘shab’ [laughs]. I also try to stay active as much as possible. This is all when I do have the luxury of time, of course [laughs].

MARKET ROUNDUP-

The EGX30 fell 1.7% at today’s close on turnover of EGP 837 mn (18% below the 90-day average). Local investors were net buyers. The index is down 5.4% YTD.

In the green: Eastern Company (+1.4%), Qalaa Holdings (+0.9%) and EFG Hermes (+0.5%).

In the red: Cleopatra Hospital (-4.4%), Ibnsina Pharma (-4.2%) and CIRA (-4.2%).

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

28 February-1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.