What we’re tracking on 17 September 2019

Saudi Arabia and the ramifications of last week’s attack on Aramco facilities have been dominating the headlines in the foreign press, thanks to renewed accusations that Iran had a hand in the attacks.

Global stock markets also saw a dip as a result, with airline stocks and those of other fuel-intensive businesses taking the hardest knocks, while inflation expectations were pushed up, amid a climate of general uncertainty. Both S&P 500 and Dow Jones futures were down 0.4% on Monday, AP reports. We cover all the happenings from yesterday in the Speed Round below.

The story is casting a cloud over Fed day. The US Federal Reserve’s Federal Open Market Committee will meet today and tomorrow to decide on interest rates. US President Donald Trump is not done dropping hints towards Fed Chairman Jerome Powell, going so far as to use the current troubles in Saudi Arabia as reasons to urge Powell to drop rates. “Federal Reserve, is paying a MUCH higher Interest Rate than other competing countries…And now, on top of it all, the Oil hit,” he wrote. “Big Interest Rate Drop, Stimulus,” Trump said in a tweet on Monday. Markets are anticipating a rate cut will be announced on Wednesday, particularly after the European Central Bank did just that last Thursday.

Our central bank’s Monetary Policy Committee will meet next Thursday, 26 September, to decide on interest rates. Analysts are projecting a rate cut, in light of inflation for August falling to a six-year low of 7.5% and an expectation that the Fed will join the ECB in rate cuts, followed by other countries.

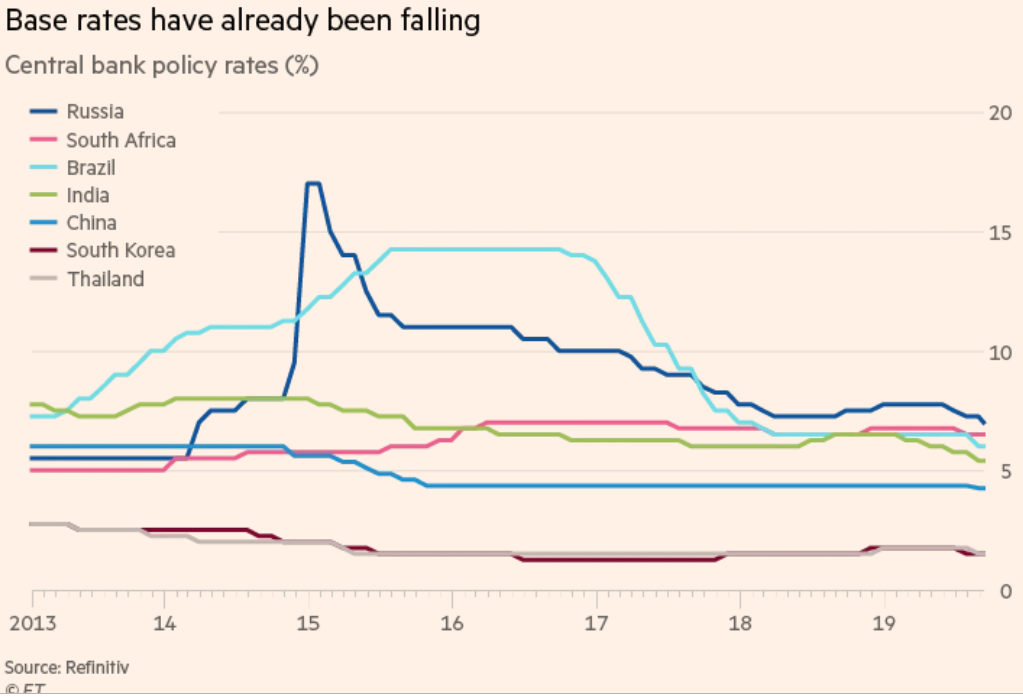

This would have us rowing in the same direction as other emerging markets, whose central banks are apparently more inclined towards monetary easing than at any other time since the global financial crisis, according to the Financial Times (paywall), which cites data from Bank of America Merrill Lynch’s Emerging Monetary Mood Indicator. These EMs have in August have apparently dropped more hints that they were inclined towards monetary easing than at any moment since the DotCom crash in 2000. “There are quite a few emerging markets where we are comfortable saying we think [central banks] will cut more than the market is expecting,” said David Hauner, head of EM cross-asset strategy and economics at BofA, who cited Russia, Brazil, China and the Czech Republic as examples.

The United Nations General Assembly opens today in New York City, and will wrap on 30 September. The General Debate doesn’t kick off until next Tuesday, 24 September, which is when we expected President Abdel Fattah El Sisi to land in New York. You can check out the full schedule of high-level events set to take place over the next two weeks here.

Back in Egypt, the fall conference season’s next few days is all about tech, with a number of tech conferences, summits, and competitions kicking off across the country:

The E-Commerce Summit kicks off today at the Nile Ritz Carlton Hotel in Cairo. The summit will focus on the reshaped world of retail in light of tech innovation and how to break the barriers of moving your business online. 80 speakers from high-profile local and multinational companies will be taking part, along with government officials, including Vice Minister of Finance Ahmed Kouchouk. The sessions will explore many aspects of e-commerce, from laws and regulations to strategies on how to grow e-commerce businesses. You can catch the full agenda here.

Mediterranean Business Angels Network to launch in Techne Summit: The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria, according to VentureBurn. The angels network aims to bring together a large number of business angel networks, groups, funds as well as individual angel investors from Mediterranean countries.

Meanwhile, ITIDA and Huaweii announced the launch of the “Egypt App Cup” competition to offer university students and fresh graduates the opportunity to develop innovative mobile-based solutions and android applications that support transportation, health, and tourism sectors, according to a statement (pdf). The submitted applications will get exposure by being a part of the HUAWEI AppGallery, the official application market for HUAWEI and HONOR smartphone, with millions of users around the world. Those looking to register can sign up here.

Other events to look for this conference include the Egyptian Private Equity Association will host their venture capital event (pdf) on Wednesday, 18 September at the Conrad Hotel and the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

Deutsche Bank has joined the JPMorgan-led Interbank Information Network (IIN), financial services industry’s biggest blockchain project, in a move that will be formally announced this week, the Financial Times reports. The network comprises 320 banks that have agreed to use the medium to swap information about global payments, aiming to reduce delays by making transfer information instantly accessible to every bank in the payments chain.

Business books of the year: The short list for the Financial Times / McKinsey Business Book of the Year is out, featuring “heavyweight books on data privacy, bias against women and the rise of the politically powerful conglomerate Koch Industries.” The list includes Raghuram Rajam’s The Third Pillar (“a broad prescription for reform of capitalism), The Man Who Solved the Market (a narrative biography on the founder of Renaissance Technologies) by Gregory Zuckerman, and Invisible Women by Caroline Criado Perez, an activist.