What we’re tracking on 13 June 2019

Monday’s inflation figures are still receiving attention as we prepare to slide into the weekend. Shuaa’s Asset Management Portfolio Manager Aarthi Chandrasekaran tells Bloomberg TV that the spike in annual headline inflation to 14.1% in May will not have come as a surprise to the central bank, adding that the figures will accelerate further in the coming months due to the planned cuts to fuel and electricity subsidies.

Do we have to wait until inflation falls to 10% for further monetary easing? Chandrasekaran predicts that the central bank will hold off on further rate cuts over the next two months. We can expect easing to resume when inflation falls to around 10%, she says.

How far do interest rates have to fall before businesses go on a capex spending binge? That’s the question we posed to nine of Egypt’s leading companies in the food, healthcare, construction, automotive, and financial sectors. Find out what they told us in this morning’s Speed Round below.

It looks like we’ll have to wait at least another week before we have the final FY2019-2020 budget: The House of Representatives’ general assembly is off next week and will reconvene the following week to tie up any loose ends and vote on the budget, which is expected to be the last item on the agenda before representatives depart for the three-month summer recess (we can’t help but feel that we’re in the wrong line of work). Look for plenty of committee-level news next week.

Among the events you may want to mark on your calendars before you head off for your own summer breaks:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada this month from 19-20 June;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs from 18-21 June;

- Middle East and Africa Rail Show will take place at the Egypt International Exhibition Center, Nasr City on 16-18 June;

- Seamless North Africa will be held at the Nile Ritz-Carlton on 17-18 June;

- Cairo Technology Week will run next week at the Hilton Heliopolis on 17-19 June.

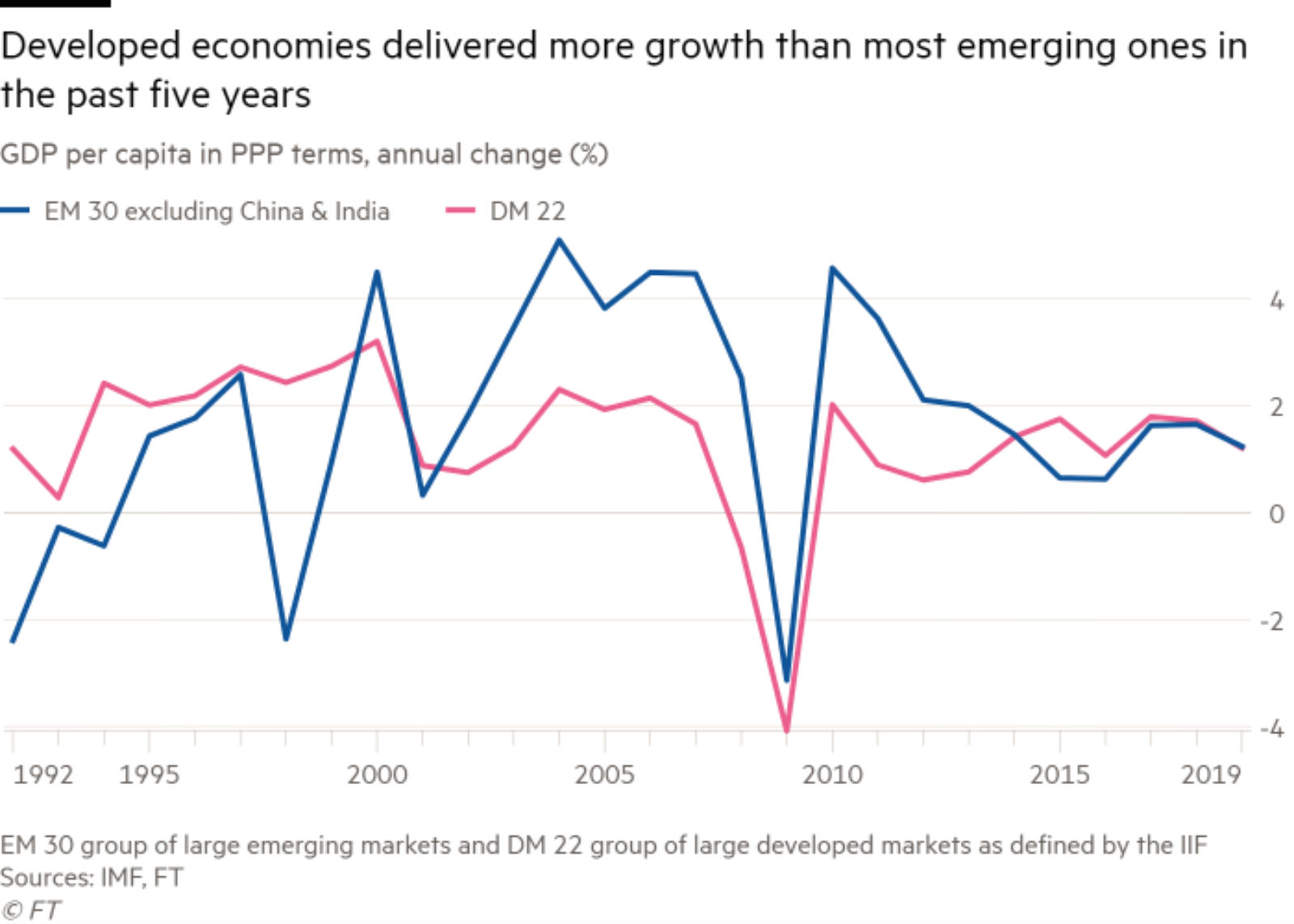

A reality check for EM enthusiasts? EM growth this century has been dominated by China and India, and the last five years have actually seen more growth in developed markets than in most emerging economies, the FT suggests. An analysis of IMF data by the salmon-colored paper appears to undermine the fundamental EM investment proposition (that they are the source of growth premium and high returns) while the US-China trade war may have exposed a pressing need for a new EM growth model.

SIGN OF THE TIMES- Global FDI flows contracted for the third consecutive year in 2018, falling to their lowest levels since the 2008 financial crisis, according to a UN report. We’ll be breaking this down for the macro junkies in Sunday’s issue, but until then the FT has you covered.

It’s not like we needed another reminder, but IMF chief Christine Lagarde and European Central Bank President Mario Draghi are warning that the protectionist trend is posing a threat to the global economy. (CNBC)

Thousands of protesters have amassed in Hong Kong as they demand the government drop bill that would allow extradition to mainland China. Protest organizers said that over 1 mn people took to the streets on Sunday, although official estimates are around 240,000. Protests turned into open clashes with police, who fired tear gas and rubber bullets, Tuesday night and during the day yesterday. Workers and small business owners joined a strike yesterday in opposition to the extradition bill. Officials shut “government offices in the city’s financial district for the rest of the week” today after the protests. The BBC has good coverage here and here.

The Hang Seng fell 2% yesterday as the protests added to the growing list of problems (read: the US-China trade war, a weakening yuan, a spike in the interbank rate) weighing down the Asian market. (Bloomberg)

In miscellany this morning:

Luc Besson was only three centuries out: Melbourne will be the first city outside the US to test the flying taxi-esque UberAir service, which will see “electric vertical take-off” vehicles travelling between “skyports”. Uber plans to commercially launch the futuristic transportation service in 2023. The Guardian has more.

*** Parents, read this: If you’re over the age of 25, your habits are set. You’re either a jerk who makes life miserable for the rest of us forced to share an airline with you. Or you’re one of those forced to suffer through the ill manners and boorish behaviour of the jerks with whom we sahre a metal cylinder in order that we may be hurtled across the earth. Enter the inimitable Tom Nichols, author of The Death of Expertise (which we’ve previously noted): His Six rules everyone should follow when flying must be taught to our children.

With Airbus and Boeing set to make trans-Atlantic flying infinitely worse than it already is, the least those of us who have spawned can do is ensure the next generation is composed of better-behaved air travelers than us.