What we’re tracking on 06 March 2019

Good morning, friends, and happy Thursday from Enterprise Global Headquarters, where we are all looking forward to a warm and sunny weekend.

Egypt won’t go back to the IMF, cap in hand for more: Our future cooperation with the IMF on the reform program will not involve another loan, Madbouly Cabinet spokesperson Nader Saad told Extra News in a call-in on Wednesday (watch, runtime: 6:09). As the country presses ahead with the reform program, we will need to cooperate further with the IMF, but that would take the form of consultations and technical assistance, he added. Egypt will draw out the last tranche of the USD 12 bn extended fund facility it got from the IMF this year.

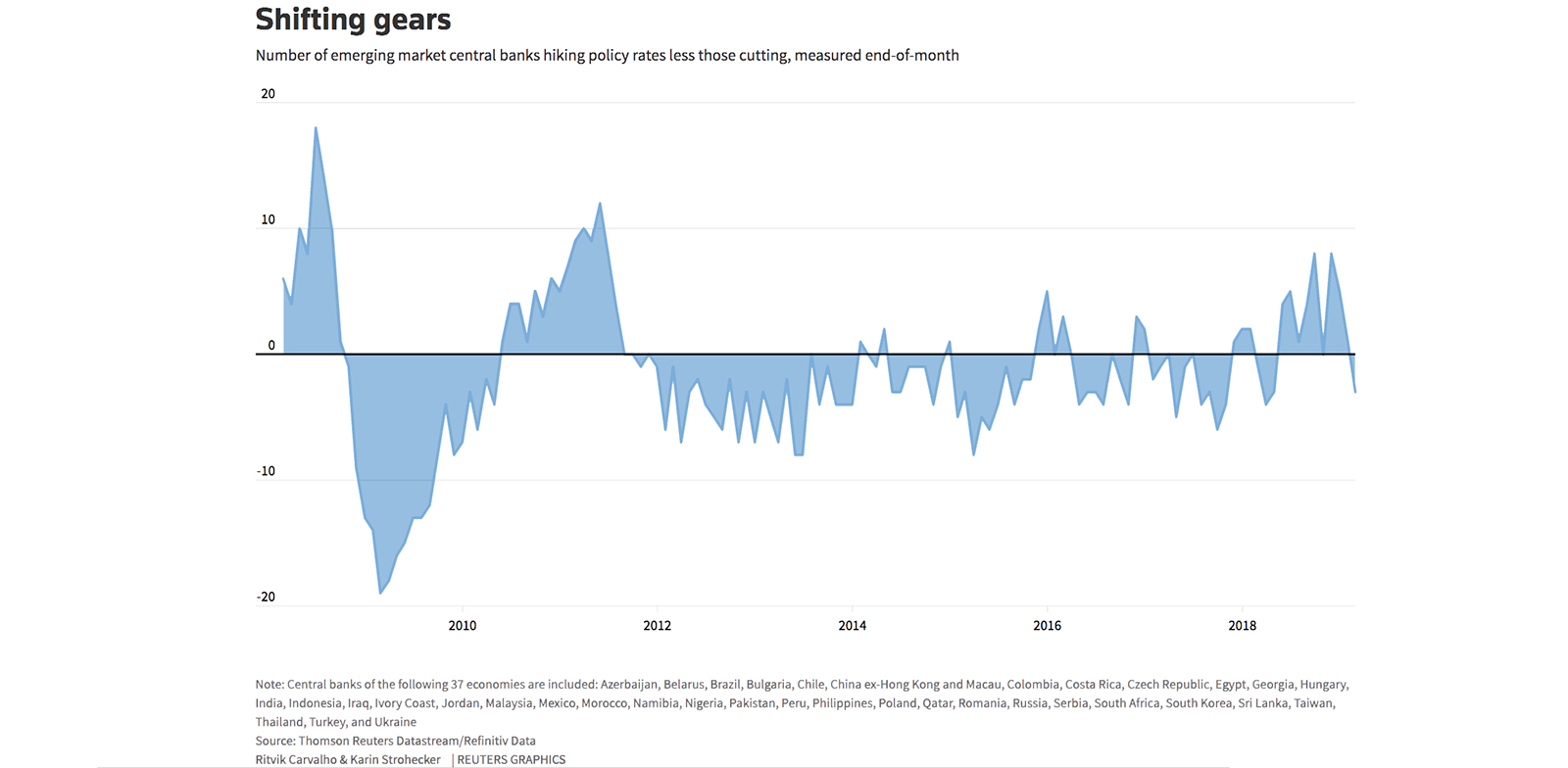

The CBE was one of several emerging market central banks to cut interest rates in February, according to Reuters. “Taking their cue from a dovish turn at the U.S. Federal Reserve and a USD rally that has run out of steam for now,” seven central banks in 37 emerging markets cut interest rates, while another four have raised rates, bringing the net rate cuts in February to three. EMs have seen net rate hikes every month since May 2018.

The job markets of both the UAE and Saudi Arabia are showing signs of faltering, the Emirates NBD Purchasing Managers’ Index indicates, with the index’s employment tracker in both countries at its lowest in ten and five years, respectively, Bloomberg reports. Although the UAE remains a strong economy (with growth anticipated to rise to 3.1% this year from 2.9% in 2018), the impact of lower crude prices and a weak real estate sector is being felt, especially in the non-oil private sector.

How’s that trade war working for you, Donald? Despite US President Donald Trump’s moaning about the “politician-made disaster” that is the trade deficit, on his watch, it rose to USD 891 bn — the largest it has ever been in US history— the Washington Post writes. A report from the Commerce Department underscores what numerous economic studies have been showing: that despite an increase in tariffs imposed on assorted foreign-made goods, imports have been pouring in and that, moreover, in many cases “it is the domestic consumers and purchasers of imports that bear the full cost of the tariffs.”