EGP to remain stable through 2019, says Goldman Sachs

Don’t expect the EGP to continue to strengthen this year — in fact, it could slip a little. The EGP was more or less stable against the USD on Wednesday, closing at 17.57 from 17.58 at close the previous day as the currency held its ground after gaining around 2% against the greenback earlier in the week. Central Bank Governor Tarek Amer had told Bloomberg last week that some volatility in the EGP-USD exchange rate was to be expected.

The EGP gained this week as foreign holdings of Egyptian debt rose to USD 12 bn this month as investors regained their appetite for local securities, government sources told Al Mal. The Finance Ministry said on Tuesday that foreigners, who had pulled about USD 10 bn out of Egypt during the emerging markets selloff, scooped all 5-year bonds offered this week in a sign of Egyptian debt regaining attractiveness. Sources tell the newspaper that foreigners bought EGP 400 mn in treasuries this week alone.

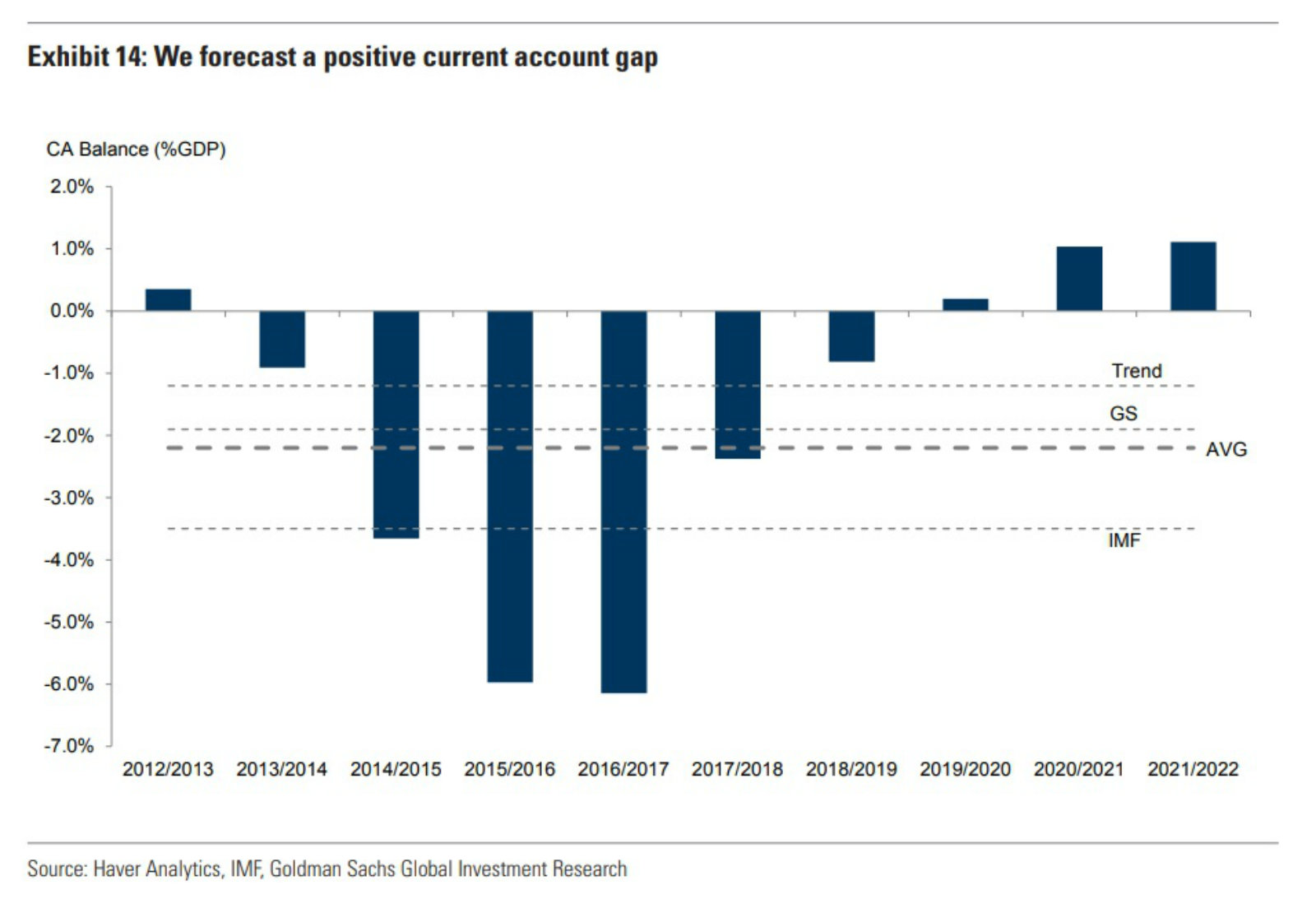

Don’t count on much volatility in the EGP this year, says Goldman Sachs: Writing in a research note, the investment bank says it doesn’t see much volatility in the USD-EGP exchange rate going forward. An improving current account position will help to support the EGP against downward pressures over the medium term, according to analysis from Goldman. Falling fuel imports, a gradual recovery in the tourism sector and steady remittance inflows will push the current account into surplus territory in FY2019-20, “removing any downside pressure on the nominal exchange rate,” the investment bank writes.

But expect a steady REER appreciation: Although the current account movement should keep the EGP on track, the real effective exchange rate will appreciate as inflation in Egypt continues to exceed that of its trading partners. Goldman’s model suggests the EGP “is now fairly valued and, under our inflation projections, should weaken from here by around 8% per year over the next three years.”

Weak FDI could put pressure on the currency, says our friend Ahmed Badr at Credit Suisse: The EGP could come under pressure if foreign investment levels do not pick up, Ahmed Badr, Middle East managing director at Credit Suisse, told Bloomberg. “We’ve reached a new cycle where we need to shift from the T-bill trade into actual investments, but that hasn’t happened yet,” he said. “If that continues, will it actually affect the currency? The answer is yes.” You can catch Badr’s full appearance in the last 15 minutes of the show (watch: 1:26:56), where he dives deep into Egypt, Saudi and the UAE.