- Readers see business conditions improving — but investment plans are being pinched by interest rates. (Speed Round)

- The IMF thinks Egypt is on track with the economic reform program. (Speed Round)

- Mercedes Benz may have been allocated assembly line space in the SCZone, but a spokesperson refuses to confirm it resume assemble here. (Speed Round)

- Central bank seen leaving rates on hold tomorrow. (What We’re Tracking This Week)

- Council of State completes its review the executive regulations to the Investment Act. (Speed Round)

- ERC to shift focus towards real estate development outside of Sahl Hasheesh for the first time? (Speed Round)

- Rencap looks to set up Egypt office before the end of the year. (Speed Round)

- El Moselhy announces logistics-focused internal trade strategy at AmCham luncheon. (Speed Round)

- The Market Yesterday

Wednesday, 27 September 2017

Reader poll: It’s been an okay year for business and you’re optimistic about next year — but interest rates and inflation are hurting

TL;DR

What We’re Tracking Today

Our readers expected business conditions in 2017 would improve, and they were right: Almost half of all respondents to our 3Q2017 business sentiment survey believe the business climate in Egypt has improved so far this year. That’s up from just a fifth of you who said at the end of last year that 2016 was a good year to do business in Egypt. At the time, 64% of you expected that business conditions would improve this year.

Looking forward, 63.5% of our readers expect the business climate in Egypt to improve in 2018 and 46.1% say their companies will growth their investments in Egypt in the next six months. Our readers are also more confident, with over half of all respondents saying they expect will edge-out their competition over the next six months.

Inflation remains a concern to everyone in the market, but concerns over regulatory uncertainty and the interest rate environment are also significant. Nearly 74% of you said your investment plans have been negatively impacted by current interest rate levels.

40.6% of our readers say they do not want to move away from Egypt, up from 37% in 4Q2016, and 43.8% of you are not looking to move their possessions abroad, up from just 32% in 4Q2016.

A third of you think Cabinet understands the needs of business, about on par with our last survey, and slightly fewer of you look negatively on the Council of Ministers.

Readers see potential in industries including tourism, real estate, food, and oil and gas. Our readers also think this is the right time to invest in manufacturing and export-oriented businesses, with fintech also getting honorable mentions.

We also got lovely messages of support and encouragement that put a big smile on all of our faces. Many of you are concerned about corruption, bureaucracy, and the increased cost of living. One reader in particular pointed out that he found “the summer of 2017 to have set an absolute record regarding ineffective, disruptive, discontinuous business patterns,” because of the number of holidays that followed Ramadan. We do love our holidays, but we definitely see his point. Below are the complete results:

What We’re Tracking This Week

The central bank’s Monetary Policy committee is expected to keep interest rates unchanged when it meets tomorrow, Reuters suggests. Ten out of 12 economists polled by the newswire said the CBE would keep the deposit rate at 18.75% and the lending rate at 19.75% as post-float inflationary pressures continue to ease. “Although monthly inflation is declining, annual headline inflation is still too high for the CBE to cut interest rates … We believe the cut will most likely occur when headline inflation breaks the 20 percent in Q1 of 2018,” Arqaam Capital senior economist Reham Eldesoki says. The two outliers in the poll are Pharos Holding COO Angus Blair and Naeem’s head of research Allen Sandeep, who both expect rate cuts. Blair says “we expect (and hope that) the MPC will bite the bullet and begin cutting rates again, to revive the private sector” and Sandeep sees a 100 bps cut, noting that “it should be turning increasingly less cost-effective to banks to operate at these rates, given the substantial drop in T-bills yields (now trading well below the corridor rates) and with lending growth unable to catch-up with rising deposits.”

The management and board-level shakeup at state-owned banks remains under wraps, reportedly pending security clearances, but that hasn’t stopped the rumor mill. Youm7 reports that sources at the Central Bank have told it that we can expect a big shakeup at Banque du Caire, which remains stuck in the government’s IPO pipeline. The newspaper still has CBE Deputy Governor Tarek Fayed becoming chairperson, but writes that Mohamed Mashhour will hold onto his position as executive vice chairman. Interestingly, our friend Wael Ziada, the former head of research at EFG Hermes founder of the firm’s finance subsidiary, is said to be joining the board. Hit the link for the name-by-name rundown.

We’re also waiting to hear that the Council of State has concluded its review of the Dabaa nuclear power plant’s four contracts this week, potentially paving the way for the return of Russian tourists.

Commercial 4G services will be going live tomorrow, the national telecoms regulator confirmed this week. Maybe that’s why they turned off all the telephone lines on the block that is home to Enterprise World Headquarters yesterday afternoon? To drive sales to “We,” as they insist on calling their network? (No phone line, no internet — and that continues into this morning.)

On The Horizon

The German government will sign off on a USD 250 mn loan to Egypt in two weeks’ time. The funds will be used to help plug the budget deficit, Al Mal claims.

Enterprise+: Last Night’s Talk Shows

Apart from Lamees Al Hadidi dissecting the IMF report and celebrating Saudi’s decision to let women drive, there was not much to report from the airwaves.

Lamees dove head-first into the IMF’s inaugural review of Egypt’s economic reform plan, which she described as “promising” overall. Lamees pointed out that, while the report had plenty of positive points, it also made mention of some challenges, including inflation and rising debt levels (watch, runtime 10:53).

Egypt has never defaulted on its debt obligations, noted Arqaam Capital’s Reham El Desoki, who phoned in to offer color commentary. She also said that the concerns over social protection will continue to dwindle as the country moves forward with its reforms and the effects of the EGP float continue to wear off (watch, runtime 1:34).

Lamees then veered off to the strange case of Mowasalat Masr, Egyptian-Emirati transport company that has accused the government of demolishing a garage the company was renting for its fleet. The company’s head of PR, Abbas Kattan, lambasted the government, saying moves like that are driving investors away (watch, runtime 6:25).

Lamees all but popped some champagne (also illegal in KSA, we remind you) in honor of Saudi Arabia now allowing women to drive. Saudi writer Manal Masoud Al Sharif, who has long been an advocate of the cause, told Lamees that the kingdom’s critics will now have one less talking point (watch, runtime 3:05).

Kol Youm’s Amr Adib spoke to former MP Mohamed Anwar El Sadat on a possible run during next year’s presidential elections. El Sadat said he has yet to settle on whether or not to toss his hat into the ring and stressed that a multi-candidate election is a necessity (watch, runtime 16:02).

Yahduth fi Masr’s Sherif Amer spoke about the spike in school fees with Education Ministry official Haitham Fathalla, who told the host that most schools upped their prices 4-11%, while international school fees rose 14%. School owners enjoy a 15% profit margin on tuition fees, according to Fathalla.

Speed Round

The IMF thinks Egypt is on track with the economic reform program, according to the Associated Press. Egypt has made “a good start at reining in public spending, boosting investor confidence, and addressing the surging inflation generated by the new policies,” the Fund says in its first review since signing the funding agreement with Egypt. Egypt has so far received USD 4 bn out of the USD 12 bn agreed on. Egypt’s “good start” came despite “seeking waivers for missing some targets in June and a deeper-than-expected currency depreciation,” Reuters notes. The IMF says “it had agreed to a request for a waiver after Egypt missed primary fiscal balance and fuel subsidy bill requirements for end-June. The waiver was granted in part because of planned strong fiscal adjustments in the next two years.”

The full report is here in pdf for download, and we have key highlights below:

Inflation remains the main risk to macroeconomic stability, the IMF believes. “Entrenched, high and persistent inflation could pose a threat to macroeconomic stability. It may also impede credibility of the new monetary policy framework.” However, it noted that “the transition to a flexible exchange rate went smoothly. The parallel market has virtually disappeared and central bank reserves have increased significantly.” The Fund sees that “energy subsidy reform, wage restraint, and a new value-added tax have all contributed to reducing the fiscal deficit and helped free up space for social spending to support the poor.” Very ambitiously, also sees inflation falling to just over 10% by the end of FY 2017-18.

The IMF appeared supportive of amendments to the Central Banking Act that stirred controversy in the banking sector when they were announced in July. “Among other provisions the amendments envisage strengthening its governance structure, improving the recapitalization and profit distribution rules, normalizing the financial relationship with the government and commercial banks, enhancing transparency, and separating the emergency liquidity assistance and bank resolution frameworks.”

In its review of Egypt’s monetary policies, the report notes that the CBE will continue to tightly monitor inflation rates and that subsequent policy adjustments will depend on inflation dynamics and its assessment of inflation expectations. On the FX front, the CBE appears to have gone against the IMF’s recommendations by not phasing out the profit repatriation mechanisms as it believes it plays an important role in attracting investment. The CBE intends to manage reserves to be in line with investment goals, the report notes. The report writes that by December 2017 the CBE will also remove the USD 50,000 cash deposit cap for non-priority goods.

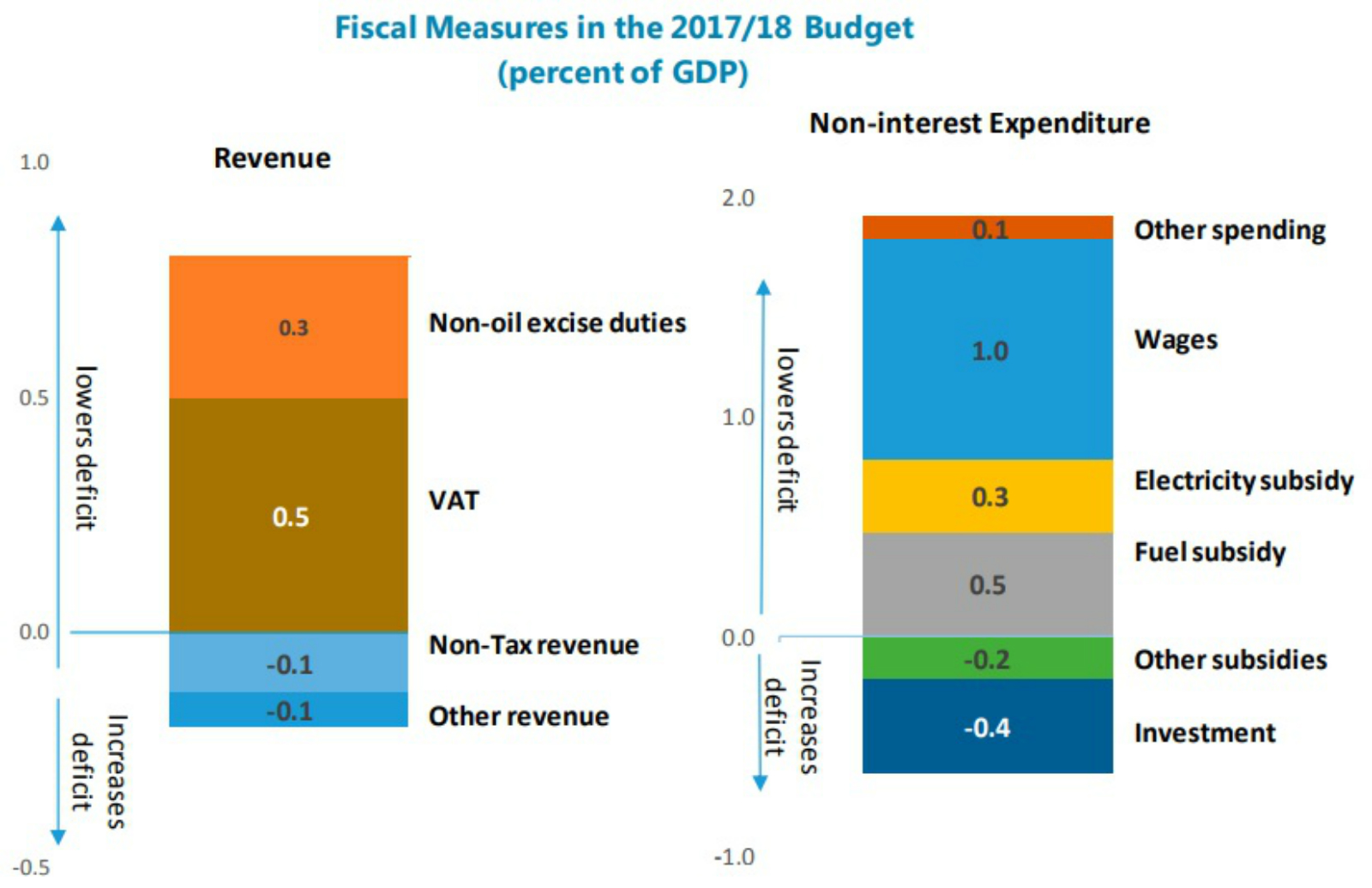

The IMF says that the FY2017-18 budget is consistent with the government’s medium-term objectives and that the expenditure framework reflects policies as agreed under the program. The primary surplus is projected at 0.4% of GDP, which would constitute fiscal consolidation of 2.2% of GDP. The overall deficit is projected to decline by 1.8% of GDP as monetary tightening will temporarily raise debt service costs. Tax revenue is projected to increase by 0.7% of GDP due to the increase in the VAT rate. The structure of expenditure will improve by lowering wage spending and energy subsidies, while increasing investment and strengthening targeted social protection, the report reads. The wage bill will decline by 1% of GDP, while energy subsidies are expected to decline by 0.8% of GDP.

So, when is the next round of funding coming? The IMF says to expect a third installment of around USD 2 bn in funding to disbursed to Egypt after a second review at the end of this year, Reuters notes.

INVESTMENT WATCH- Is Mercedes-Benz really back? The automaker, which suspended assembly in Egypt in 2015 as the FX crisis deepened, has apparently agreed to reopen assembly operations in Egypt, Suez Canal Economic Zone (SCZone) Chairman Mohab Mamish announced in a presser on Tuesday to much fanfare. He added that 96,000 sqm have been allocated to Mercedes-Benz for an upcoming facility in the SCZone. The area will serve as the distribution hub for Mercedes-Benz operations in Egypt and the MENA region, he said, according to Youm7.

Not yet, it seems: Almost immediately after the announcement, a Mercedes spokesperson told Reuters that no decision has been made to re-start local production of passenger cars in Egypt. The spokesperson declined to comment on an agreement about a distribution center. “Mercedes is continuously examining conditions in all markets and regions with a view to market growth and sales prospects and adjusts its market strategy accordingly,” the spokesperson said. Mamish had announced earlier this month that the company had agreed in principle to assemble passenger cars in Egypt.

Council of State completes its review the executive regulations to the Investment Act: The Council of State (Maglis Al Dawla)’s legislative committee has completed its review of the Investment Act’s executive regs and will send them back to the Ismail cabinet this week, sources tell Al Borsa. Investment Minister Sahar Nasr had promised that the regs would be out by the end of the month.

The Council has, meanwhile, stalled on the Universal Healthcare Act: The long-awaited Universal Healthcare Act is reportedly being held up at the Council of State, whose review of the bill has so far stretched for six months, head of the legislation’s drafting committee Abdel Hamid Abaza tells Al Masry Al Youm. Abaza noted that the council usually wraps its legislative reviews within two months and said it may be stalling to give the government time to approve actuarial studies that will be key to costing the law. Despite the delays, Abaza said he still expects the act go into effect next year, saying the House of Representatives will likely sign off on it quickly once MPs receive the legislation during the upcoming session.

European execs, fund managers mull increase in Egyptian investments: There’s good appetite for Egypt among corporations and fund managers, whether that takes the form of strategic investment or inflows into T-bills and eurobonds, according to a Finance Ministry statement issued after Amr El Garhy met yesterday with investors from the UK, France, the Netherlands, Denmark, and Germany with combined AUM of more than USD 1 tn. Investors on the BNP Paribas roadshow reportedly expressed interest energy and infrastructure, the statement adds. BNP is considering organizing roadshows like this on an annual or semi-annual basis given strong appetite for Egypt these days, BNP Paribas senior banker Youssef Beshay told us.

ERC to shift focus towards real estate development outside of Sahl Hasheesh for the first time? Egyptian Resorts Company is considering shifting its strategic focus towards real estate development beyond its flagship project of Sahl Hasheesh while the tourism industry recovers, CEO Wael Hatow tells Bloomberg in an interview. The company is too exposed to the risks of the tourism industry, as ERC’s strategy has relied on selling land to sub-developers in Sahl Hasheesh on the Red Sea coast, “but this business has been hit by the drop-off in tourist arrivals since the 2011 uprising that toppled President Hosni Mubarak.” While Sahl Hasheesh will remain a “major part” of ERC’s business, Hatow says a full rebound in the tourism industry is still years away, which means the company is going to develop new revenue streams while that happens.

Emerging markets specialist Renaissance Capital plans to begin operations in Egypt before the end of the year, Al Mal reports. CEO Ahmed Badr says Rencap has already applied for operating licenses from EFSA and the company is now finalising the setting up processes in Egypt. Badr also noted that Rencap has no plans to enter the brokerage business domestically and will stick to underwriting and financial advisory.

INVESTMENT WATCH- Ezdehar is in talks with the IFC for a USD 10-15 mn commitment to its inaugural Ezdehar Egypt Mid-Cap fund, sources told Al Mal. A delegation from the IFC will be in Egypt in October to resume talks. The source add that Ezdehar has acquired a majority stake in aluminum fabricator Alu Nile and is also targeting USD 10 mn worth of acquisition targets before the end of the year. Ezdehar’s investors include the EBRD, the CDC Group, Dutch development bank FMO, and other Egyptian business leaders. The Ezdehar Egypt Mid-Cap fund has raised USD 85 mn so far and is a generalist fund eyeing growing Egyptian companies and family enterprises.

M&A WATCH- Infinity Solar has acquired a 97% stake in TAQA Arabia subsidiary TAQA Solar Resort in a EGP 50 mn transaction, Al Borsa reports. The acquisition comes as Infinity is nearing financial close for a 50 MW solar power plant in Fayoum under phase two of the feed-in tariff (FiT) project well ahead of the 28 October deadline set by the Electricity Ministry, sources from the company tell Al Borsa. TAQA Arabia is a Qalaa Holdings company.

Okay, UK. Time to put up, or shut up: A very rightfully frustrated Egyptian government has renewed calls for the UK government to relax its ban on direct flights to Sharm El Sheikh after working closely with UK security officials for nearly two years to improve safety measures at its airports. Despite repeated and condescendingly positive remarks from UK officials and nearly every other European country having resumed flights to the resort, Theresa May’s government continues the ban. “The airport has passed every test set for it by British security officials, and it is now time for the government to lift this ban and allow British tourists to visit this popular destination,” a senior Egyptian government official tells The Telegraph. “If it is safe for British holidaymakers to travel to Tunisia, then it is just as safe for them to travel to Sharm El Sheikh,” the official added. We get Putin’s realpolitik approach (you give me the nuke plant, I’ll give you your tourists back), but from an ally such as the UK, the situation has become simply ridiculous.

Supply Minister Ali El Moselhy unveiled his ministry’s strategy to overhaul the country’s domestic trade framework at an AmCham luncheon held yesterday. The strategy is particularly focused on logistics for agricultural commodities and appears to draw heavily on years of work on the question funded by USAID.

Cutting spoilage from farm to table: The strategy relies largely on establishing logistics centers — the first of which will be launched in Gharbiya next month — and hypermarket complexes across 22 governorates to reduce the number of times commodities are transported before reaching the end user. Streamlining the process would drive down costs by cutting out middlemen and also push down spoilage, which El Moselhy says currently hovers at 15-20%.

Clear role for the private sector: El Moselhy minister stressed that while he was setting a policy vision, the strategy will be implemented entirely by the private sector. Land for the logistics and market centers will be allocated through public tenders. The strategy comes as part of the ministry’s vision of transforming Egypt into a regional trade destination, the minister added,

Other takeaways from the gathering:

- El Moselhy said his decision earlier this year to force producers to clearly display prices on their goods was “misconstrued” as requiring them to print the prices on the individual packages. The minister said that he is open to negotiating how the decision is implemented — whether by adding price labels to cartons carrying several packages, or clearly listing the cost on invoices — as long as manufacturers’ suggested retail prices are available somewhere to avoid price-gouging by merchants.

- El Moselhy again hinted that a new tier-based system may be in the works as the ministry continues to overhaul the subsidy system

- Sugar reserves are currently “more than enough” to cover 4.5 months’ worth of consumption until production season kicks off in January, so there’s no imminent shortage of the white stuff as was the case last year.

- The rejection of two wheat shipments (one Romanian and the other French) out of a total of 10-15 since July came simply because the shipments did not meet specs. El Moselhy had said a day earlier that sieving of Romanian wheat had been completed, a statement refuted by Agriculture Ministry source to Reuters. The source said that the decision on what to do with the shipment will be made after the sieving is completed. The government is trying to send the markets a message that everything is under control, one trader said, explaining El Moselhy’s statements.

Separately, El Moselhy announced yesterday that subsidy card holders will only be allowed to receive their daily allocation of subsidized bread from bakeries in the governorate where they officially reside, according to Al Mal.

MOVES- Mohamed Abdel Aziz, an assistant to the Investment and International Cooperation Minister, has submitted his resignation, according to Al Masry Al Youm. Abdel Aziz was also a board member of GAFI as well as of the Electricity Holding Company and the Tourism Development Authority. Al Masry Al Youm says Minister Sahar Nasr accepted Abdel Aziz’s resignation.

Mns of Kurds voted in favor of statehood in their Monday referendum, “defying the dire warnings from neighbors as well as the government in Baghdad,” Bloomberg reports. The referendum is expected to have far reaching repercussions, with countries like Turkey and Iran also expected to take action against it with sanctions on trade and diplomacy. The Egyptian government issued a statement expressing its “deep concern” over the fallout from the referendum.

Other international stories worth a moment of your time this morning:

- BIG TECH NEWS: For this first time since the advent of the automobile in the late 19th century, Saudi Arabia’s women will soon be able to drive in their own country. Saudi’s King Salman has issued a decree allowing women to drive, according to the Saudi Press Agency. The King ordered the formation of a ministerial body to advise on the matter within 30 days and see through its implementation by June 2018. The news is on front-pages worldwide this morning, to wit: the Financial Times, Reuters, the Wall Street Journal and the New York Times.

- Oil prices could rise in 2018: OPEC could face a supply shortage next year, Citi claims, saying that “Libya, Nigeria, Venezuela, Iran and Iraq may already be pumping at their maximum capacity this year” and aren’t investing enough in E&P to grow capacity in 2018.

- EM are leapfrogging developing nations on renewables: “Emerging markets are set to eclipse developed nations next year in their capacity to generate wind and solar power as equipment costs fall,” the Financial Times writes, citing a Moody’s report. There will be 14 GW of installed solar capacity in MENA by the end of 2018, up 7x from 2015.

- Twitter has doubled its character limit to 280 per tweet in a global test, the Verge reports.

- God help us, but Dubai is testing drone taxis.

Image of the Day

Big blunder Saudi officials make: Education officials from Saudi Arabia were sacked on Tuesday after they accidentally printed in national textbooks an image in which the Star Wars character Yoda had been photoshopped sitting next to the late King Faisal at the United Nations. It must have been the distraction of all those women not driving.

Egypt in the News

The arrest of seven concertgoers who raised rainbow flags at last week’s Mashrou’ Leila concert is still leading the conversation on Egypt in the western press this morning. The arrests are once again raising eyebrows and stirring discussion on Egypt’s human rights record, particularly as the detained men have undergone forensic tests that “are standard practice in Egypt, but they have been condemned by human rights groups as a form of torture,” the New York Times’ Declan Walsh says.

Some are also looking at the legal merits of the arrests, with Quartz reminding everyone that while Egypt technically does not have a law against being gay, “in a country where [redacted] violence is rife [the LGBTQ community] is frequently railed against by the Muslim majority and Coptic Christian minority.”

Thomas Cook says demand for destinations including Turkey and Egypt has “picked up as customers look for quality and value,” according to TTG. The company says overall bookings and pricing for summer 2018 was currently ahead of this time last year, “reflecting a good performance from the UK and Northern Europe in particular.” CEO Peter Fankhauser told Yahoo News that Turkey and Egypt “are wonderful countries with great hotels, great beaches, nice people, and really great value for money … We are not a security company, as long as we have the advice that we can fly to Egypt and Turkey, we will offer great holidays.”

Also worth noting in brief today:

- Brett Sholtis writes for USA Today about how Coptic Christians are settling in the US. “The migration is part of a broader movement of Copts that began at urban centers in places such as New Jersey and Southern California. Since then, Copts have established churches in most states.”

- Zahi Hawass refutes new archaeological findings on the construction of Giza pyramids (probably because he didn’t discover them), according to Asharq Al-Awsat.

- Irish citizen Ibrahim Halawa, who was acquitted of all charges last week, should be released from prison within “a short number of days,” The Independent reports.

Diplomacy + Foreign Trade

Sudan’s Prime Minister Bakry Hassan Saleh is expected to visit Cairo “soon,” amid rumors that the two countries had broken ties, Sudan’s ambassador to Egypt Abdel Mahmoud Abdel Halim tells Al Shorouk. Abdel Hamid reiterated that Sudan is not “freezing” its diplomatic ties with Egypt, but noted that the two countries need to overcome the “hurdles” in their relations. Sudan’s Foreign Ministry had said earlier this month that ties between Egypt and Sudan are in the midst of a crisis as a result of the dispute over the Halayeb Triangle.

Energy

Electricity Ministry to begin rerouting high-pressure power lines

The Electricity Ministry announced it has completed its preparations to implement a EGP 1 bn project rerouting high-pressure power lines away from densely populated areas, Al Shorouk reports. Unlicensed urban expansion over the past several years has encroached on the areas where the lines were initially placed, the ministry says.

Basic Materials + Commodities

Cabinet grants preliminary approval to establishing garbage collection holding company

The Ismail Cabinet has approved in principle establishing a holding company for garbage collection, Environment Minister Khaled Fahmy announced yesterday, Al Shorouk reports. Fahmy and Local Development Minister Hisham El Sherif met with other cabinet ministers and MPs to discuss the proposed company, which Fahmy said would be under the dual supervision of the environment and local development ministries. MP Mona Gaballah had said earlier this week the government would hold a 51% stake in the company, with the remainder being opened to other stakeholders including investors, banks, and garbage collectors unions.

Basic Materials + Commodities

Gov’t extends steel import tariffs

The Trade and Industry Ministry has extended temporary import tariffs on steel rebar from China, Turkey, and Ukraine for two months, Reuters reports. The tariff was set in June to protect local manufacturers and was to remain in place for four months, but the new extension pushes it to 6 December. The tariff is set at 17% for Chinese steel, 10-19% for Turkish steel, and 15-27% for Ukrainian steel.

Egypt and Turkey key buyers of Romanian corn

Egypt and Turkey imported 23% of the Romanian corn harvest for this export season,according UkrAgroConsult. Egypt imported 397 KMT of the harvest with Turkey grabbing 359 KMT.

Real Estate + Housing

Government asks contractors to submit thorough plans for New Capital

The New Administrative Capital for Urban Development asked Egyptian and Arab firms interested in developing land in the New Administrative Capital to submit detailed technical and financial presentations for consideration before any allocations take place, company sources told Al Borsa. The company met with contractors over the past week and asked for the thorough plans regarding land selection and intended investments. Standards for selecting winning bids will consider the importance of the intended investment, previous experience, value of the area after investment and the timeframe for payment and completion. The first phase of the new city is already being negotiated with contractors for investment. The move comes amid concerns that the government had been prioritizing foreign (and particularly Chinese) firms in the city’s development.

Tourism

468k Chinese tourists in the last four months

468k Chinese tourists made their way to Egypt from May till September, Hany Sharkawy, head of industry group the Egyptian Investment Group in China, told Al Shorouk. The group has a campaign to draw in 1 mn Chinese tourists which kicked off in May, said El Sharkawy.

Automotive + Transportation

Toyota aims to sell 11,000 cars by end of 2017

Toyota Egypt aims to sell 11,000 vehicles by the end of 2017 as it sees the market recovering in the coming period, CEO Ahmed Monsef said yesterday, according to Al Mal. The company’s sales were down by 30% y-o-y in 2016, impacted — as with the rest of the auto market — by the EGP float, soaring inflation rates, and diminished purchasing power and demand. The Automotive Information Council expects the auto market to remain in a slump, with sales seen dropping by another 50% in 2017.

Public Enterprise Ministry receives offers from int’l firms to develop Zombie Auto

Metallurgical Industries Holding Company has received two offers from international firms to jointly develop the assembly and manufacture of Walking Dead Socialist Car Company (Al Nasr Automobiles), Public Enterprises Minister Ashraf El Sharkawy said, according to Ahram.

Banking + Finance

Military Production Ministry waives bank-issued LG requirement for affiliated companies

Companies affiliated with the Military Production Ministry will be providing letters of guarantee officiated by the state, rather than banks, for its projects, Minister Mohamed El Assar announced yesterday, Al Masry Al Youm reports. The decision to waive the bank-issued letter of guarantee came during a Supreme Industry Committee meeting headed by Prime Minister Sherif Ismail.

Egypt Politics + Economics

Mohamed Elsewedy continues as Support Egypt leader following uncontested election

The Support Egypt Coalition — the largest political bloc in the House of Representatives — announced yesterday that Mohamed Elsewedy will remain in place as the party’s leader as his reelection bid was uncontested, Ahram Gate reports. The coalition announced nine members who also won uncontested seats in its political office, while the remaining seats will be subject to a vote. Support Egypt’s internal elections come as parties and coalitions are contending for control of parliamentary committees, elections for which will be held during parliament’s third session, Al Shorouk reports. The House of Representatives is expected to reconvene in October, but the official announcement awaits a decision from President Abdel Fattah El Sisi.

Campaign “demanding” El Sisi run for another term gains traction

Youth groups and MPs have allied and formed a campaign “demanding” President Abdel Fattah El Sisi run for another term, according to the Egypt Independent. Dubbed “Alashan Tabneeha” (To Build It), the campaign has taken to social media and digital platforms to highlight the challenges facing the country and why the President is the man with the right vision for the job.

Qaradawi’s daughter and her husband take their case to the UN

Ola Al Qaradawi, daughter to Qatar based Muslim Brotherhood cleric Youssef Al Qaradawi, and her husband Hosam Khalaf have taken their case to the United Nations in Geneva, according to Reuters.

Sports

Egyptian tennis player the sole African and Arab on ITF junior rankings

Egyptian tennis player Youssef Hossam is the only African and Arab on the world junior rankings, but is struggling to find a sponsor, according to an AFP piece. “The three-time African Junior Champion from 2014 to 2016 is currently 334th on the ATP rankings, but a promising 22nd in the world junior rankings. Yet the player as well as his coaches say all this talent may fail to reach its potential without a sponsor to finance a team to guide Hossam towards his dreams.”

On Your Way Out

Respected Egyptian American law professor Cherif Bassiouni passed away on Monday at the age of 79, according to the Washington Post. The scholar was known for his human rights work on Yugoslavia as well as apartheid South Africa. Often called the “father of international criminal law,” his academic work helped create the International Criminal Court.

ON THIS DAY- On this day in 1822: Jean-François Champollion announced he deciphered the Rosetta stone. “What was so helpful, from a translator’s perspective, about the Rosetta stone was the fact that the decree was written on the stele three times: in hieroglyphics (the formal communication medium of the priests), Egyptian demotic script (the everyday notation used by most of those who could read and write), and Greek (used by the administrative apparatus of Egypt during the Ptolemaic dynasty),” according to Wired. The Society of Jesus, also known as the Jesuits, were founded on this day in 1540. More recently, in 1970, King Hussein of Jordan and the leader of the Palestine Liberation Organisation, Yasser Arafat, agreed to a ceasefire after 10 days of fighting in Jordan. In 1996, the Taliban took over Kabul. Enterprise readers this time last year were reading about German Chancellor Angela Merkel’s call for a Turkey-style agreement with Egypt and Tunisia, Russia lifting the ban on agricultural imports from Egypt, and the first whispers on the potential IPO of Enppi.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6155 | Sell 17.7155

EGP / USD at CIB: Buy 17.62 | Sell 17.72

EGP / USD at NBE: Buy 17.62 | Sell 17.72

EGX30 (Tuesday): 13,704 (+0.2%)

Turnover: EGP 1.3 bn (48% above the 90-day average)

EGX 30 year-to-date: +11%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.2%. CIB, the index heaviest constituent ended down 0.1%. EGX30’s top performing constituents were: Orascom Telecom Media and Technology up 5.6%, Oriental Weavers up 4.4%, and Domty up 4.1%. Yesterday’s worst performing stocks were: Sodic down 3.0%, Qalaa Holdings down 2.9%, and Egyptian Financial and Industrial down 1.9%. The market turnover was EGP 1.3 bn and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -27.3 mn

Regional: Net Long | EGP +0.3 mn

Domestic: Net Long | EGP +27.0 mn

Retail: 76% of total trades | 73.7% of buyers | 78.2% of sellers

Institutions: 24% of total trades | 26.3% of buyers | 21.8% of sellers

Foreign: 9.2% of total | 8.2% of buyers | 10.3% of sellers

Regional: 10.1% of total | 10.1% of buyers | 10.0% of sellers

Domestic: 80.7% of total | 81.7% of buyers | 79.7% of sellers

WTI: USD 52.08 (+0.39%)

Brent: USD 58.57 (+0.22%)

Natural Gas (Nymex, futures prices) USD 2.93 MMBtu, (+0.45%, October 2017 contract)

Gold: USD 1,298.20 / troy ounce (-0.27%)

TASI: 7,240.10 (+0.22%) (YTD: +0.41%)

ADX: 4,413.79 (+0.07%) (YTD: -2.92%)

DFM: 3,561.05 (-0.23%) (YTD: +0.85%)

KSE Weighted Index: 429.74 (+0.18%) (YTD: +13.06%)

QE: 8,569.26 (+1.42%) (YTD: -17.89%)

MSM: 5,114.12 (-0.30%) (YTD: -11.56%)

BB: 1,291.03 (-0.07%) (YTD: +5.78%)

Calendar

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

30 September-01 October (Saturday-Sunday): Techne Summit, Bibliotheca Alexandrina, Alexandria.

03 October (Tuesday): Egypt’s Emirates NBD PMI reading released.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.