- Caretaker boss named as Mohamed Omran finishes his term as EGX chairman. (What We’re Tracking Today)

- Economy returning to brighter prospects, need balance between monetary targets and fiscal reforms -BNP Paribas. (Speed Round)

- The EGX is considering removing restrictions on GDR transactions. (Speed Round)

- Gripes from the private sector on interest rate hikes, inflation hit the pages of the FT. (Speed Round)

- It doesn’t matter that nobody asked them: The House Economics Committee seems set on making changes to executive regulations of the Investment Act. (Speed Round)

- Egypt could hold local council elections following the presidential elections in 2018. (Speed Round)

- PR firm APCO Worldwide has taken on lobbying for Egypt in the US. (Speed Round)

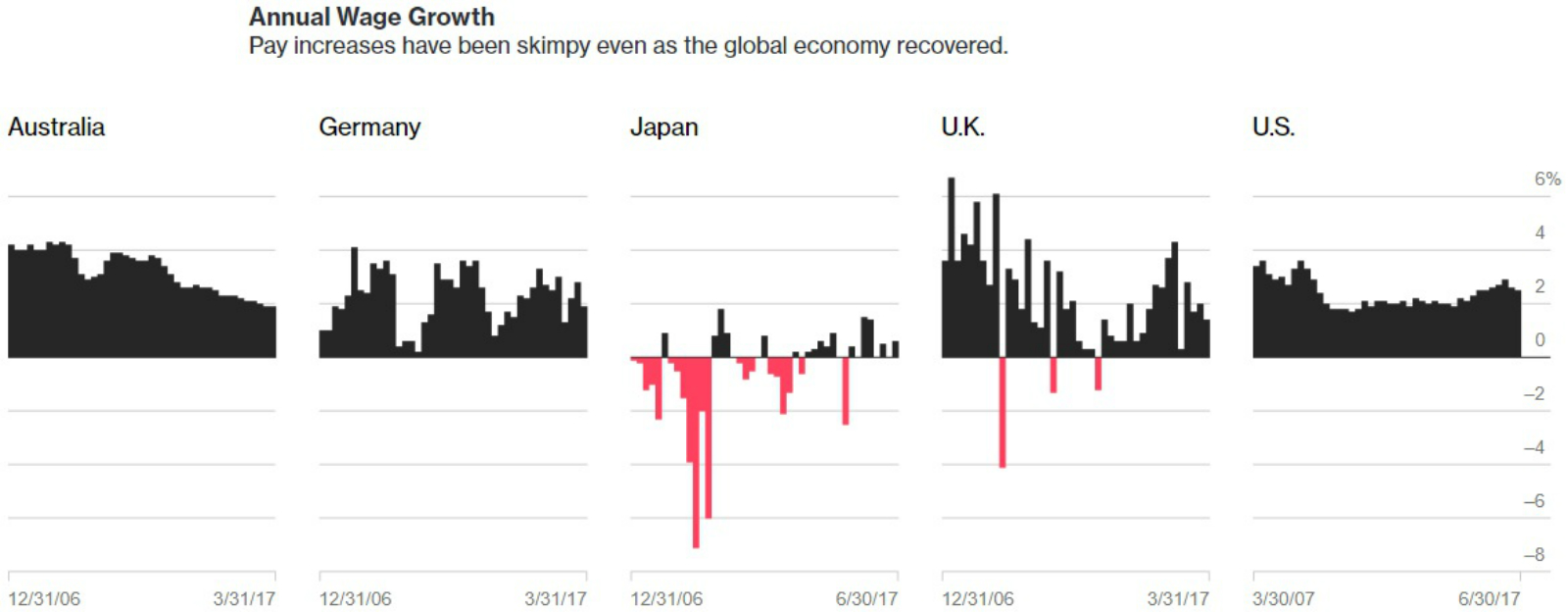

- No matter where in the world you are, don’t expect a raise anytime soon. (Worth Reading)

- Forget about terror, Trump, climate change and dead celebrities: Humanity has never had it better.

- The Markets Yesterday

Monday, 31 July 2017

Be happy: Humanity has never had it better

TL;DR

What We’re Tracking Today

EGX says goodbye to Mohamed Omran: As of yesterday noon, Mohamed Omran is no longer chairman of the EGX following a four-year run as head of the bourse. Omran said his goodbyes at a presser yesterday afternoon, Al Ahram reports. The newly constituted board of directors took their seats yesterday, helmed by the recently appointed vice chairman Mohsen Adel, who was reportedly appointed as acting chairman until a new one is named, according to Youm7. We have more on Omran’s comments in the Speed Round.

With the new bread subsidy system going into effect tomorrow, more systemic changes may be on the horizon. Supply Minister Ali El Moselhy hinted at the possibility of making income levels the determining factor in setting daily bread allocations (we have more in Enterprise+: Last Night’s Talk Shows). Meanwhile, bakers are holding an “emergency meeting” today to discuss the phase-out of the subsidies, and millers are complaining the ministry has yet to settle on a price for wheat bran, Al Borsa reports.

On a related note: Supply Minister Ali El Moselhy is scheduled to hold a presser on Thursday to discuss the changes to the smartcard and bread points system, Ahram Gate reports.

There’s no word on when Foreign Minister Sameh Shoukry will head to Khartoum.The visit had been expected before the end of July. The ban on imports from Egypt is on the agenda.

Your (mobile) internet stinks because it may soon get faster (and the same cannot be said for your ADSL): It would appear that the poor mobile internet service about which many have recently complained — with the bellowing reaching a crescendo yesterday — may be because of the redistribution of frequencies going on ahead of the official 4G launch, unnamed Vodafone officials tell Al Mal.

Another good quarter in the US of A: “America’s largest companies are on pace to post two consecutive quarters of double-digit profit growth for the first time since 2011, helped by years of cost-cutting, a weaker USD and stronger consumer spending,” the Wall Street Journal notes. Too bad we’re looking at another lost quarter of chopped, ground-up margins covered in mystery sauce here at home: With certain exceptions such as export-led SWDY and ORWE, we’re thinking corporate Egypt’s bottom line will need until next year to start turning the corner, particularly after that last rate hike, “temporary” though it may be.

Speaking of earnings: Apple is reporting tomorrow, and “Wall Street is already braced for delays in the launch of the next iPhone … [as] reports from Apple’s supply chain have caused concern about a short-term squeeze on sales and could leave Apple vulnerable to renewed competition from Samsung,” the Financial Times reports. The WSJ’s Christopher Mims, meanwhile, thinks it is “not crazy” that the next iPhone could ring in at about USD 1,400 at the register.

If you, like us, are fans of both active fund management and of Mohamed El-Erian, it’shard not to smile at this one: “Pimco has staged a ‘remarkable turnaround’ to become the world’s best-selling active mutual fund manager, after investors pulled 100s of bns of USD from the investment house following the departure of bond king Bill Gross in 2014.” Pimco has pulled in nearly USD 50 bn in the six months to 30 June, according to the Financial Times, making the actively managed firm the third-largest asset manager behind BlackRock and Vanguard. Hit the salmon-colored paper for the rest. And while you’re on the interwebs, this short piece from the WSJ about publicly traded fund managers being hit after confessing they will need to invest in future growth (shocking, we know) is worth a skim.

You have never had it better: The world has never been a better place, and anyone who wants to have lived in a past century is simply nuts, The Guardian suggests. “The headlines have never been worse … but humankind has never had it so good – and only our pessimism is holding us back.” So forget about climate change, global terrorism, Donald Trump, the nutter in Pyongyang getting nukes, and the rising tide of celebrity deaths, the newspaper says: We’re living in something like a golden age of humanity, according to a small group of “New Optimists” that includes prominent journalists, academics and think-tank types. The full story is certainly worth checking out.

What We’re Tracking This Week

The Finance Ministry will cut the exchange rate for customs the first time in four months to EGP 16.25 to the greenback, Finance Minister Amr El-Garhy told Reuters. The new rate, a drop from EGP 16.50, will come into effect from Tuesday. The reduction came in line with the “drop in the FX rate … the customs exchange rate is usually set at 90% of the FX rate,” the minister said.

Enterprise+: Last Night’s Talk Shows

The talking heads are clearly concerned about the lot of the nation’s poor — or, at least, what the poor might do to them if their concerns aren’t addressed. That manifested itself in extensive talk of the phase-out of the wheat subsidy system, affordable housing and the ‘redevelopment’ of slum areas.

Supply Minister Ali El Moselhy unveiled to Yahduth fi Masr’s Sherif Amer a possible new strategy to further overhaul the bread subsidy system. Ration cards would be divided into categories according to the holders’ income bracket. Those at the bottom income bracket would be allowed to purchase loaves at today’s price (EGP 0.05 each), while those making more can expect an increase to EGP 0.10 per.

El Moselhy bravely suggested on national television that some currently benefiting from the subsidy program may have to buy bread at market price. It was unclear whether his proposal could replace plans to cut daily bread rations to four loaves from five. El Moselhy reiterated that the bread system had cost state coffers some EGP 4.5 bn per annum.

Meanwhile on Kol Youm, former Supply Minister Khaled Hanafy had his day in kangaroo court after El Moselhy essentially pointed to his predecessor’s bread points system as being behind the inefficiencies in subsidies. Hanafy told host Amr Adib that he was acquitted of all charges of illicit gains, but says he has not yet received official word that he’s in the clear (watch, runtime: 13:20).

Adib then brought on Housing Minister Mostafa Madbouly to discuss compensating contractors for losses they incurred on government contracts after the EGP float. Madbouly said Cabinet agreed to push back projects’ deadlines to give contractors some breathing space (watch, runtime 2:23).

Madbouly also downplayed the clashes at Warraq island earlier this month, saying residents were not evicted from their homes and that authorities needed to clear out the informal settlement to build schools and hospitals (watch, runtime 1:13).

Hona Al Asema’s Lamees Al Hadidi also had housing on her agenda, speaking to Assistant Housing Minister Walid Abbas about the ministry’s tender of 24,000 plots of land in 19 cities. According to Abbas, 12,000 plots will be allocated to low-income housing projects, while the rest will be used for higher-end residential developments (watch, runtime: 5:06).

Lamees circled back to the power outage at Cairo International Airport’s Terminal 3, where the Prosecutor General reportedly ordered the arrest of 11 people on suspicion they may have been involved. The host expressed hope that low-ranking employees will not be used as scapegoats for high-level mistakes (watch, runtime: 3:58).

Over on Masaa’ DMC, Foreign Minister Sameh Shoukry said that the Arab quartet can take further measures to escalate their boycott of Qatar, but that they have not set a deadline for Doha to respond to their 13 demands (watch, runtime 5:17).

Speed Round

Three factors have helped the Egyptian economy “return to brighter prospects,” Pascal Devaux writes in a research note for BNP Paribas (pdf): The EGP float, major fiscal reforms with the support of international donor funds, and the “accelerated” development of natural gas resources that are expected to “trigger a significant reduction in the trade deficit and ensure the country’s energy supply.” However, Devaux says the reforms came at the cost of impacting households’ purchasing power and that the ensuing monetary responses create “a threat for public finances.” Devaux expects FDI to be concentrated in the energy sector with higher interest rates scaling back investment decisions. “Excluding the energy sector, nonresident investment decisions are generally made by companies that are already present in the Egyptian market, and many foreign companies are taking a wait-and-see approach. An increase in public investment, which is one of the government’s priorities, could provide additional support.” He stresses that some moves brought about imbalances to the market: “in an economy with a low level of bank penetration, the massive increase in interest rates did not bring down inflation, but increased the cost of servicing the public debt.”

The EGX is considering removing restrictions on global depository receipt (GDR) transactions, outgoing bourse chairman Mohamed Omran said yesterday on his last day in charge, according to Ahram Gate. The restrictions were put in place when access to FX became restricted, he says. Omran hints that the EGX could cancel a regulation that forces the proceeds of GDR sales be converted to EGP before being distributed to beneficiaries. This would allow people selling GDRs to receive their proceeds in foreign currency. Omran also said foreigners have increased their exposure to Egyptian stocks by a net EGP 11 bn since the EGP float, according to Reuters. Egypt’s stock exchange has attracted a total of EGP 15 bn in foreign investment since 2013, Omran told a news conference. He expects “the EGX will also begin trading bonds in 1Q2018,” Reuters notes.Omran also talked about privatising the EGX being a possibility, according to Al Masry Al Youm.

…In related EGX news, EFSA has greenlit plans by Amer Group and Porto Groupto issue up to one third of their issued and paid-up capital as GDRs. Both companies are planning on listing GDRs on the LSE, according to regulatory filings.

Gripes from the private sector on interest rate hikes, inflation hit the pages of the Financial Times: With the end of the FX crunch, Egypt’s private sector has been squeezed by inflation and the 700 bps in interest rate hikes pushed through in its wake, the Financial Times’ Heba Saleh writes. Despite making Egypt an attractive destination to some foreign investors, the combination of the float, inflation, and the hikes have driven operating costs of companies to new highs, with many being unable to pass the costs on to the consumer. “We have increased prices on average by 15% because consumers’ purchasing power cannot take more, whereas the increase should have been more like 30%,” says Ibrahim Soudan, who heads cheese manufacturer Riyada. These gripes come despite reassurances from the IMF’s Chris Jarvis that raising rates will lead to inflation falling to 11-13% by mid-2018. “It is ‘imperative for interest rates to go down as quickly as possible,’ said Pharos Holdings COO Angus Blair. ‘Without private sector investment, economic growth will remain below par and there won’t be an improvement in employment figures,’ he says.”

IPO WATCH: Rooya Real Estate Investment Company reportedly filed yesterday to list its shares on the EGX, according to Al Borsa. As we noted yesterday, the firm has tapped Helmy and AAIB as advisor, though it is not yet clear if a lead manager of the listing has been chosen.

The House Economics Committee seems set on making changes to executive regulations of the Investment Act, which it began reviewing yesterday, despite its input not being required at all. MPs want to raise the minimum local manufacturing component requirements to 60% from 50% and minimum export requirement to 40% from 20% for businesses to be eligible for incentives offered under the act, Ahram Gate reports. Also under fire is the ceiling for foreign labor in a company’s hiring, which the executive regulations cap at 20%, Al Mal reports. The list of gripes goes on, leaving us hoping cabinet is simply letting our fearless elected representatives to have their say before moving on with the draft as it stands.

MOVES- Pierre Finas was appointed managing director of Credit Agricole Egypt, replacing François-Edouard Drion, according to a filing with the EGX. The appointment is yet to be approved by the Central Bank of Egypt.

EARNINGS WATCH-

- Edita reported a net loss of EGP 1.7 mn in 2Q2017 down from a net profit of EGP 41.6 mn in the similar period last year. Despite the bottom line loss, Edita’s revenues continued to grow, recording an 11.2% y-o-y increase to EGP 611.6 mn. For 1H2017, Edita registered a net profit of EGP 38.7 mn, down 47.9% y-o-y. The company says “inflationary pressures on the company’s cost base along with higher interest expenses weighed down on Edita’s bottom-line profitability for the quarter… Edita’s continued ability to deliver double-digit revenue growth, despite operating in an exceptionally challenging environment and during the trough of industry seasonality, is a direct consequence of management’s early roll-out of its repricing and portfolio optimization strategy starting late 2015.”

- Credit Agricole Egypt reported a 49.4% y-o-y increase in 1H2017 consolidated net profit after tax to EGP 941.7 mn, according to a filing with the EGX.

Lebanon has hopped on the bandwagon, banning import of an Egyptian fruit: The Lebanese Agriculture Ministry has reportedly imposed restrictions on imports of Egyptian mangoes, sources close to the matter tell AMAY. Egyptian exporters are lobbying for the measure to be postponed, saying they can produce paperwork proving their produce meets international benchmarks. Iraq imposed import restrictions on Egyptian produce this week, and GCC countries have done the same this year. The news came on the heels of word that Egypt’s Agriculture Ministry signed off yesterday on a new strategy meant to boost and ensure the quality of agricultural products slated for export, according to Al Shorouk.

Meanwhile, despite import restrictions imposed by Saudi Arabia, Sudan and Kuwait and hepatitis A concerns, Egyptian strawberry exports rose 30% y-o-y in 1H2017 to 41.4k tonnes, up from 31.8k tonnes during the same period last year, Agriculture Ministry spokesperson Hamid Abdel Dayem said, according to Al Borsa. The UAE has also banned imports of Egyptian strawberries.

Egypt could hold local council elections following the presidential elections in 2018, as the House of Representatives has yet to complete its review of the Local Administration Act, Al Masry Al Youm reports. The act, which will establish elected local councils throughout Egypt’s governorates, was held up at the Egyptian Council of State (Maglis El Dawla) before being passed onto the House in October, where it has yet to see the light of day. Sources tell the newspaper the legislation will likely be passed at the end of parliament’s next session, which comes to a close in mid-2018.

PR firm APCO Worldwide has taken on lobbying for Egypt in the US after Weber Shandwick withdrew earlier this month from a contract with Egypt six months after signing, according to industry publication the Holmes Report. “[The firm would help Egypt] tell its story. … As the country returns to stability, they are paying more attention to increasing trade and investment in the region. The economy is improving, tourism is up by about 50% this year. There is a positive story to be told,” said APCO founder and chairman Margery Kraus. Unfazed by criticism that the initial account was hired by the Egyptian Intelligence Directorate, which contributed to Weber’s exit, Kraus added that said that the funding came from the intelligence service because “Egypt views its relationship with the United States as a national security issue.” Cassidy & Associates, formerly a subsidiary of Weber Shandwick, will reportedly also continue to lobby for Egypt’s General Intelligence Service.

A softer tone on Qatar? The Arab quartet boycotting Qatar said yesterday they would allow Qatari airlines to use emergency air traffic corridors as of 1 August, according to a Saudi Press Agency statement. Doha denies the news, saying the quartet is spreading “false information,” Reuters reports. Reconciliation talks have not yet begun, Reuters says in a report noting that the foreign ministers of Egypt, Saudi, the UAE, and Bahrain met in Manama yesterday. The quartet’s 13 demands have reportedly trimmed down to six. Doha, meanwhile, has reportedly been busy complaining to the UN that Riyadh should “internationalize” the Hajj. Saudi called the suggestion a “declaration of war” and Doha has denied the report.

Meanwhile, international banks have started serving Qatari clients from New York and London instead of Dubai, as the spat with Qatar has been “making it harder to do business” with it from the region, Bloomberg reports. “Lenders that handled clients such as the Qatar Investment Authority and wealthy family offices out of the Dubai International Financial Centre are shifting coverage to other global financial hubs to avoid damaging relations with the UAE and Saudi Arabia,” unnamed sources revealed. Some Qatari clients reportedly “prefer to work with bankers outside of the Gulf region,” the article says.

That’s just one way the blockade is hitting the Qatari economy: Reserves fell 30% in June as Qatar uses them to ease the liquidity crunch, imports have plummeted nearly a third, and the stock market is rocky, Bloomberg notes in a separate piece.

The person who stabbed three foreigners to death in Hurghada had tried to join Daesh, two security sources said, according to Reuters. “Investigators have recommended he face terrorism charges, the two sources said. Authorities have so far not commented officially on motives for the attack.”

The government appears to have made population control a national priority, after President Abdel Fattah El Sisi named it as the top challenge for development after terrorism last week. The Health Ministry announced that it is targeting a population of 112 mn by 2030 by curtailing the birth rate,says the Egypt Independent. Egypt currently has a new birth every 5 seconds and is on pace to have a population of 128 mn by 2030. Social Solidarity Minister Ghada Wali noted that the larger the number of children a family has, the more likely it is to be poor, with data showing that 65% of all households with nine or more people in them are below the poverty rate. The Social Solidarity Ministry will provide EGP 100 mn to 239 charity organizations working in the fields of family planning and to bring down birth rates in 10 governorates, Wali said, according to Al Mal.

Putin says the US will have to cut its embassy staff in Russia by 755, according to Reuters. Both diplomats and local staff will be impacted by the cut. The move, which would bring total staff in Moscow to the same level as Russia has in Washington, DC, comes after the US hit Russia with fresh sanctions over accusations of meddling in the US elections last year and the annexation of Crimea. The US has until 1 September to comply. US President Donald Trump has said he will sign the sanctions bill, which passed with a veto-proof margin in the Senate.

Egypt in the News

On an otherwise unremarkable morning: Reports that the Hurghada knife attacker may have ‘joined’ the Daeshbags is leading the conversation on Egypt in the foreign press this morning. According to security officials, two Daesh leaders recruited 29-year-old Abdel Rahman Shaaban via social media and gave him daily lessons for a month, the Associated Press reports. One of the leaders “asked him [to] carry out an attack against tourists in either the resort city of Sharm al-Sheikh or Hurghada, to prove his allegiance to the group.”

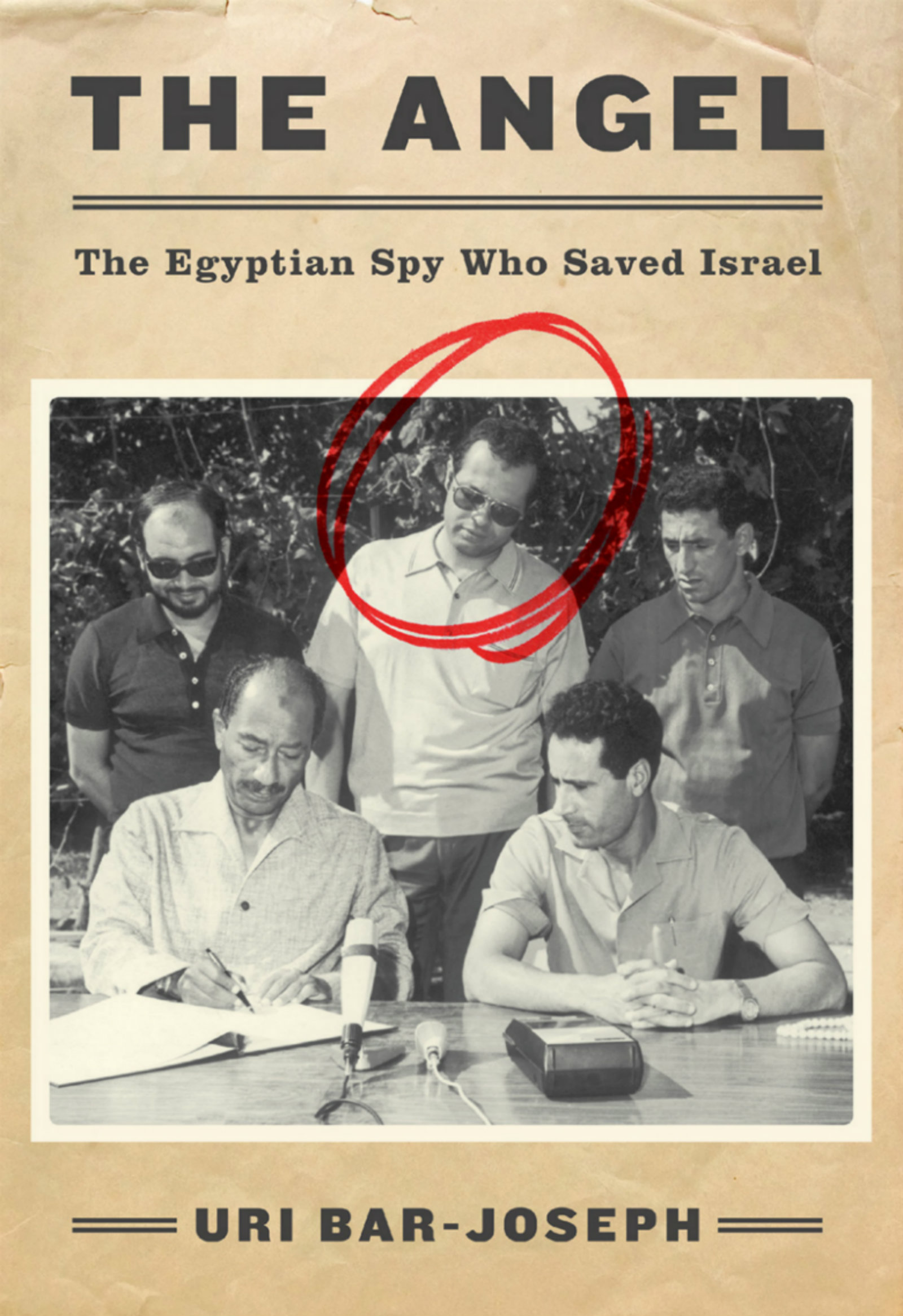

Netflix has bought the rights for Israeli director Ariel Vromen’s new spy thriller The Angel: The Egyptian Spy Who Saved Israel, according to Flickering Myth. The USD 12 mn low-budget production is based on Israeli intelligence scholar Uri Bar Joseph’s best-seller by the same name and tells the allegedly “true story of high-ranking Egyptian official Ashraf Marwan, who became a spy for Israel” despite being then-president Gamal Abdel Nasser’s son in-law and a close personal adviser to late president Anwar Sadat. The film, currently in production, stars Dutch-Tunisian actor Marwan Kenzari as “the most famous spy in the history of the Middle East.” The Daily Beast has an excerpt from the book, which we’ve noted in the past.

Egypt and Pakistan bear 80% of the hepatitis C “burden” in the EasternMediterranean region, according to the World Health Organization (WHO) statistics stating that Egypt has the highest rate of Hepatitis C infections in the world. “Efforts are underway in several low- and middle-income countries, such as Egypt, Georgia, Indonesia, and Rwanda, to test and treat neglected populations for hepatitis C and simplify care delivery,” note Neil Gupta and Paul Farmer in a piece for The Washington Post.

Other coverage worth noting in brief:

- We need to learn the lessons of Sadat’s failed 1977 economic reform drive, writes Abdellatif El-Menawy for Arab News in a piece very much worth a read this morning.

- US Senator Marco Rubio is using Egypt to raise his profile as a human rights defender in the era of Trump, The UK Progressive Reports.

- It’s been four months since Nahed Lashin, the first female mayor of Al Sharqiyah,has gone missing. Al Monitor looks into the mystery surrounding her disappearance.

- Smokers are likely to cut consumption amid rising prices, possibly leading to a 5-10% sales drop for the producers, Menna A. Farouk writes for Al-Monitor.

- Is the Egyptian justice system discrediting itself with quick rulings on death sentences? The Daily Star asks the question.

On Deadline

Yes, of course. It’s all the Evil Private Sector’s doing: The new milling system for wheat that will see mills pay market prices is “dangerous” and will give private sector mills an advantage at the expense of their public sector counterparts, Mahmoud Diab writes for Al Ahram. Private sector mills will now be encouraged to get a slice of the milling for subsidized bread traditionally undertaken by public sector mills, which will result in losses for the latter. Blah, blah, blah,

Worth Reading

No matter where in the world you are, don’t expect a raise anytime soon: Despite employment growth in the developed world, growth in pay is confounding the predictions of global economists, Cesca Antonelli and Christopher Cannon write for Bloomberg. In Germany, which boasts strong unions, record-low unemployment and booming exports, annual wage growth since 2013 has only averaged 2.1%. Japan, where unemployment was near a two-year low, earnings rose 0.7% in May — and that was the biggest increase since July 2016. Even China, which used to record wage increases of 10% or higher, has seen them significantly reduced of late. A possible explanation could be found in the US, where the employment-to-population ratio continues to slump to below where it was in the last recovery. Data appears to indicate that there some ways to go before we can expect wages to go up.

Diplomacy + Foreign Trade

The Alexandria Port Authority signed an MoU with the Romanian port of Constanta to study possibly establishing a maritime trade route between them, according to Al Borsa.

Health + Education

Health Ministry unlikely to yield to med price hike demands from producers

Health Ministry reports show no intention of increasing medication prices, but multinational manufacturers are pushing for a mandated price hike in August, said Osama Rostom, vice chairman of the Federation of Egyptian Industries’ pharma division, according to Ahram Gate. His statements came as the ministry completed assessing prices on 1,200 meds so far, says division member Mohey Hafez. The committee is scheduled to submit a status report to the House of Representatives in August.

Real Estate + Housing

Golden Pyramids says asset sequestration by OCI unlawful

Golden Pyramids Plaza says Orascom Construction Industries (OCI) and Consolidated Contractors International began sequestering some of its assets “without any legal basis,” according to a bourse disclosure. Golden Pyramids Plaza says it is taking immediate legal action against OCI, asking for the sequestration to be annulled. The company also says the move does not have any significant impact on its financial health. A court of arbitration had ordered Golden Pyramids to pay OCI EGP 260.8 mn and USD 43.4 mn plus interest in March 2015, but the former appealed a number of times the last of which was rejected in a 15 July hearing.

PHD successfully concludes negotiations to reduce interest on its debts

Palm Hills Developments (PHD) has successfully concluded negotiations with its lenders to reduce interest rates on its medium-term debts, the company said in a regulatory bourse filing (pdf). The rate on a EGP 2.4 bn syndicated medium-term facility will be slashed to 1.75% over the lending corridor rate from 3.25% currently, while the interest rate on a EGP 750 mn loan will be cut to 1.9% over the lending corridor rate from 2.9%. PHD expects to save c.EGP 100 mn in financing costs from the interest rate reduction during the tenor of both loans.

Aloula to spend EGP 350 mn on mortgage finance for low-income earners

El Taamir Mortgage Finance (Aloula) plans to lend EGP 350 mn as part of the CBE’s mortgage finance initiative to low-income house buyers, that will be funded by the Egyptian Mortgage Refinance Company, Chairman Hassan Hussein tells Al Borsa. The CBE’s initiative offers mortgage finance loans at 5% and 7% interest rates. The first phase of the CBE initiative, launched in 2014, offers EGP 10 bn in mortgage finance in total, of which EGP 6 bn have already been spent as of last May.

Arabella is looking to secure EGP 800 mn in funding

Arabella Tourist and Urban Development is tapping the Egyptian Gulf Bank to arrange an EGP 800 mn loan to finance construction at its Arabella Plaza development, an unnamed source tells Al Mal. The final value of the requested facility is yet to be determined and it could be provided by one or two banks.

Automotive + Transportation

GoBus could have licenses revoked after accident

GoBus is at risk of losing their license to operate after an accident that killed six last Friday,Road and Bridges Authority Head Adel Turk tells Al Mal. GoBus chairman Maher Nassif denied any wrongdoing on the part of the firm and also denied rumours that the driver had fallen asleep before colliding with a truck. He has asked for an official investigation before any decisions are made.

Banking + Finance

Banque Misr looks to borrow USD 1 bn from int’l banks in FY2017-18

Banque Misr is looking to borrow USD 1 bn from international financing institutions during FY2017-18, Banque Misr Vice Chairman Akef El Maghraby said on Sunday, Al Borsa reports. The European Bank for Reconstruction and Development is expected to vote on a USD 500 mn facility for the bank in September, El Maghraby added, explaining that Banque Misr borrowed around a similar amount last year.

Damietta Furniture City Company in talks with CIB and QNB for EGP 800 mn loan

Damietta Furniture City Company — which operates the Damietta Furniture City complex — is in negotiations with CIB and QNB for an EGP 800 mn loan, Al Borsa reports. Company CEO Moataz Bahaa El Din expects the two banks to agree to the financing within a week.

Arab Contractors inks USD 200 mn credit facility agreement with Afrexim Bank

Arab Contractors’ Chairman Mohsen Salah inked a USD 200 mn credit facility agreement with African Export Import Bank (Afreximbank) on Sunday, Ahram Gate reports. The funds will be used to finance various company projects as well as upcoming expansion plans.

EGX cancels trades on Egypt Gas for fifth consecutive trading session

The EGX decided to cancel trades on Egypt Gas for the fifth consecutive session on Sunday on fears of possible stock manipulation,the EGX said in regulatory filing.

Egypt Politics + Economics

Journalists Syndicate working on resolving case of 130 banned websites

The Journalist Syndicate announced that it will resolve the website ban issue by next week, Syndicate head Abdul Mohsen Salama said, according to Al Masry Al Youm. For those keeping count, the Association of Freedom of Thought and Expression currently puts the number of banned websites at 130.

Supreme Court sets 14 October as date for Smurf Islands agreement

The Supreme Constitutional Court will be convening over the mess that is the Tiran and Sanafir island handover agreement with Saudi Arabia on 14 October, AMAY said on Sunday. The court will have the final say on the contentious agreement.

On Your Way Out

Endeavour Egypt welcomed s Noha Khater and Rania Kadry, cofounders of biomed firm Al Mouneer, to its network of entrepreneurs, according to an email statement from Endeavor Egypt. Al Mouneer’s center works to prevent diabetic retinopathy (DR) and loss of vision, afflictions that affect 40% of diabetics. The center released a digital platform, making bookings and appointments a seamless process for their clients.

The markets yesterday

EGP / USD CBE market average: Buy 17.8344 | Sell 17.9344

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.80 | Sell 17.90

EGX30 (Sunday): 13,480 (-1.0%)

Turnover: EGP 597 mn

EGX 30 year-to-date: +9.2%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.0%. CIB, the index heaviest constituent ended down 0.7%. EGX30’s top performing constituents were: Amer Group up 3.1%, Sidi Kerir Petrochemicals up 1.6%, and Arab Cotton Ginning up 0.2%. Yesterday’s worst performing stocks were: Egyptian Resorts down 3.7%, Juhayna down 2.5%, and Heliopolis Housing down 2.5%. The market turnover was EGP 597 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -6.2 mn

Regional: Net Long | EGP +2.3 mn

Domestic: Net Long | EGP +3.9 mn

Retail: 59.4% of total trades | 62.3% of buyers | 56.4% of sellers

Institutions: 40.6% of total trades | 37.7% of buyers | 43.6% of sellers

Foreign: 10.0% of total | 9.4% of buyers | 10.5% of sellers

Regional: 6.8% of total | 7.0% of buyers | 6.6% of sellers

Domestic: 83.2% of total | 83.6% of buyers | 82.9% of sellers

WTI: USD 49.78 (+0.14%)

Brent: USD 52.59 (+0.13%)

Natural Gas (Nymex, futures prices) USD 2.89 MMBtu, (-1.87%, September 2017 contract)

Gold: USD 1,275.30 / troy ounce (0.00%)

ADX: 4,577.11 (+0.19%) (YTD: +0.68%)

DFM: 3,608.88 (+0.08%) (YTD: +2.21%)

KSE Weighted Index: 415.56 (-0.43%) (YTD: +9.33%)

QE: 9,469.59 (-0.98%) (YTD: -9.27%)

MSM: 5,063.95 (+0.32%) (YTD: -12.43%)

BB: 1,332.37 (-0.23%) (YTD: +9.17%)

Calendar

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

31 August-04 September (Thursday-Monday): Eid Al-Adha, national holiday (TBC) as specified by the Astronomical and Geophysics Institute. The Thursday is the waqfat Arafat, with the first day of the Eid on Friday, 1 September.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

7-9 December (Thursday-Saturday): Africa 2017 “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.