- World Bank says Egypt’s economy will grow at a 5.3% clip by 2019. (Speed Round)

- Brokerage watch: EFG Hermes to expand to Nigeria; ADI and Sigma reportedly eyeing merger, regulatory filing suggests. (Speed Round)

- INVESTMENT WATCH- Hero could open baby food factory, MD says. (Speed Round)

- Interest rate hike prompts some companies to shelve investment plans, as we predicted earlier this year. (Speed Round)

- Signs of debate within government on postponing fuel price increases scheduled to come into effect on 1 July. (Speed Round)

- El Sisi highlights auto industry in German investment pitch; Germans like renewable energy, but want to see progress on “rule of law.” (Speed Round)

- Smurf island discussions to continue today after a fiery session on Monday. (Speed Round, Last Night’s Talk Shows)

- Egypt’s adults are the fattest in the world. (Speed Round)

- The Markets Yesterday

Tuesday, 13 June 2017

World Bank sees Egypt growing at 5.3% by 2019.

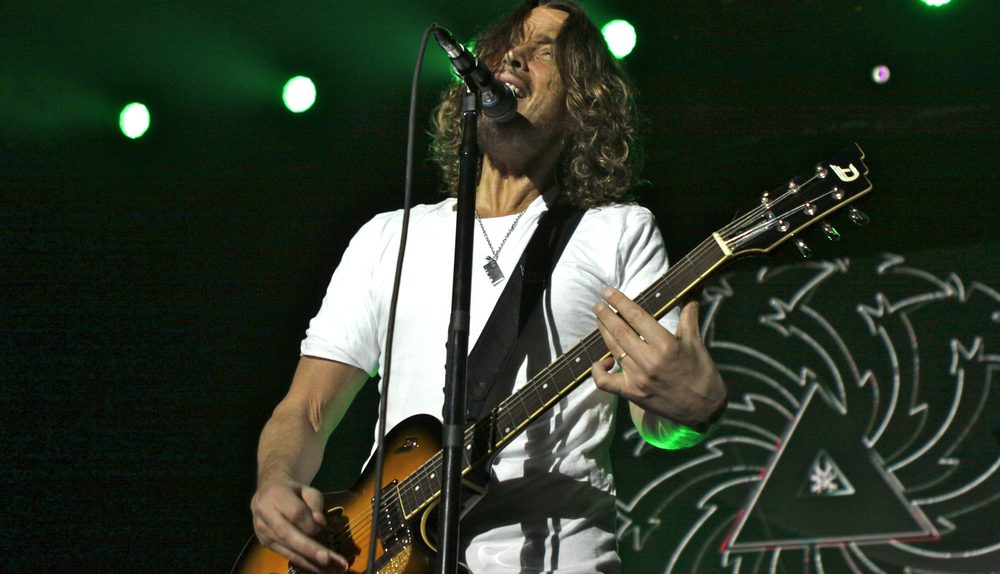

Plus: Sigma and ADI eye merger, EFG looks to expand to Nigeria, and a vintage Soundgarden set

TL;DR

What We’re Tracking Today

Today’s episode of Qatar Smackdown is brought to you by the UK, which is urging the GCC states to ease the blockade on the Statelet, Reuters reports. “I am also concerned by some of the strong actions which Saudi Arabia, UAE, Egypt and Bahrain have taken against an important partner," UK Foreign Secretary Boris Johnson said following meeting Qatar’s Foreign Minister Mohammed Al Thani. Al Thani had also said that Qatar is still waiting for specific demands from the bloc and therefore sees no basis yet for a diplomatic solution. Meanwhile, Egyptian authorities have reportedly renewed requests to Interpol for the extradition of 400 wanted terror suspects, including 26 in Qatar who were recently designated as terrorists, security sources said, according to Al Arabiya. Among the most prominent on the list is Ikhwan-affiliated cleric Yusuf Al-Qaradawi.

A message to Egypt from the Statelet? The WSJ’s daily logistics column notes that “Qatar diverted two U.K.-bound LNG tankers from Egypt’s Suez Canal last week, highlighting the potential for disruption of vital energy arteries.” The piece notes that Egypt nets mns in fees from Qatari LNG tankers and quotes a trader as speculating that “the diversion may have been meant as a message to Egypt: ‘It is Qatar flexing their muscles.’”

Now, shrug that off by reading “These Are the Corporate Winners and Losers of theQatar Standoff” by Bloomberg’s Filipe Pacheco and Ahmed Namatalla, which offers a great sector-by-sector rundown.

Khaled Ismail makes the Financial Times: We don’t know why this wasn’t included in the FT’s Understanding Entrepreneurs package (which we noted yesterday), but it’s nevertheless always a delight when a friend of Enterprise winds up profiled in the salmon-colored paper. Heba Saleh has a very nice piece on Khaled Ismail’s one-man angel investment outfit KIAngel, the aim of which is not make a profit, but to “promote entrepreneurship in ways that make a difference to new companies, through the provision of capital, advice and connections.”Before becoming an angel investor, Ismail had created Egypt-based SySDSoft, an outfit that developed critical software for mobile phones — and sold the company to Intel in March 2011. “He says he had initially intended to give a chunk of [the proceeds] from the sale of SySDSoft to charity. But he decided traditional philanthropy was less effective than promoting business, which expands the middle class and allows it to become an employer.” Ismail argues that that legal framework for starting and winding down a business needs to be made easier. (Question for our fair MPs: Where’s that bankruptcy act we were promised?) Saleh writes that KIAngel has invested USD 1.4 mn in 13 companies since 2012, of which three failed. Ismail says he typically acquires 5-40% stakes at an average initial ticket size between EGP 300k-2mn.

US Attorney General Jeff Sessions will testify today in front of the same Senate committee before which former FBI boss James Comey appeared last week. Sessions will be grilled on his involvement in the ongoing probe into ties between the Trump administration and Russia, in both his current capacity and as a former Trump campaign official.

Pay close attention to where that email originated — and whether the tone is right — before you hit “reply”: The CEOs of Goldman Sachs and Citi joined the bosses of both Barclays and the Bank of England as the latest senior banking executives to be “hooked by an email prankster trolling top Wall Street brass, exposing a low-tech gap in banks’ cybersecurity armor.” The two men “responded over the weekend to emails sent by the anonymous prankster masquerading as top executives at the two banks,” the Wall Street Journal reports. Dealbreaker and RT have screenshots from the exchanges posted to Twitter by the ‘prankster.’

How to not lose your acceptance to Harvard: Shut your Face(book). In the wake of news that Harvard pulled acceptance offers extended to at least 10 incoming freshmen over their postings to a private Facebook group, the New York Times has recommendations that should be mandatory reading for any human being in ninth grade through to the c-suite, starting with: “If you wouldn’t want something you posted to end up on a jumbotron in Times Square, DO NOT POST IT.” We can’t remember the last time the Times used ALL CAPS TO SHOUT AT US, but have no problem with it at all in this case. The takeaway for adults and teens alike: Digital media literacy “is just as important as financial literacy now: Who we appear to be online can significantly impact earning power.”

The new 10.5” iPad Pro is getting rave reviews in both the mainstream and the tech press. You could do worse than to start this review by Italy’s Federico Viticci, the iPad productivity guru who predicted many of the features of iOS 11, which reviewers almost uniformly agree will make the 10.5” iPad a viable laptop replacement for many. 9to5 Mac has a roundup of other reviews you might want to check out if you’re considering dropping some coin on the device.

This morning’s edition of Enterprise is brought to you by: Soundgarden’s Badmotorfinger, the Super Deluxe Edition. Specifically: The tracks from the group’s 1992 performance at Seattle’s Paramount Theatre, which saw them share the stage with Nirvana and The Melvins. Listen to the album here, check out the poster here, and email us on editorial@enterprise.press if you know where we can find a recording of the whole concert (including Nirvana and The Melvins).

So, when do we eat? Maghrib prayers are at 6:57pm CLT in Cairo, and the cutoff time for sohour is 3:08am.

On The Horizon

MNOs to meet with NTRA on Wednesday to redistribute 3G frequencies: The National Telecommunication Regulatory Authority will be meeting with the nation’s mobile network operators on Wednesday to discuss the geographic redistribution of 3G frequencies, Al Mal reports. MNOs are expecting to receive 4G frequencies this month once they redistribute frequencies and after Vodafone Egypt finalizes its domestic roaming agreement with Telecom Egypt.

We’ve heard this before: President Abdel Fattah El Sisi is expected to receive two of the four contracts for the USD 30 bn Dabaa nuclear power plant next week, now that Egypt and Russia have completed the negotiation process, Al Borsa reports. The contracts outline the terms for fuel storage and the technical operations and maintenance of the plant. Electricity Minister Mohamed Shaker had said last month that the four final contracts will be signed within two months.

Enterprise+: Last Night’s Talk Shows

Egypt’s two main sagas of the season — Qatar and the Tiran and Sanafir handover agreement — reigned supreme on the airwaves last night.

There seems to be widespread consensus among MPs to vote in favor of handing the islands over to Saudi Arabia, Parliamentary Affairs Minister Omar Marwan told Lamees Al Hadidi on CBC Extra. He explained that a technical committee reviewing evidence in the case, adding that maps from 2004-06 demonstrate that Egypt was merely “managing” the two islands for Saudi (watch, runtime 11:07).

On Qatar, Lamees spoke to an official from the Abu Dhabi Global Market, who said that reconciliation with Qatar is contingent upon the Statelet shutting down Al Jazeera, handing over members of the Ikhwan that it’s been harboring, and cutting off the flow of finance to terrorist groups (watch, runtime 1:07).

Over on Kol Youm, Amr Adib noted that reports in Al Jazeera suggested Doha has not been suffering and that Iranian and Israeli products have been flooding the Qatari market (watch, runtime 5:02).

Speed Round

Good news from the World Bank, which is projecting that Egypt’s GDP will grow at a 5.3% clip in 2019. The institution made the forecast in its monthly Global Economic Prospects report for June (pdf). The bank estimated Egypt’s GDP would grow 3.9% in FY2016-17, in line with government projections. The bank sees the growth rate rising to 4.6% in the following year and 5.3% by FY2018-19. This would it back to pre-2011 levels. “Egypt’s growth is expected to remain near 4 percent in fiscal year 2017 and strengthen in the two years thereafter, supported by the gradual implementation of business climate reforms and improved competitiveness, although high inflation weighs on near-term activity,” the report said.

BROKERAGE WATCH- EFG Hermes is looking to expand into Nigeria through an acquisition, Ali Khalpey, CEO of EFG Hermes’ Frontier market unit, told Reuters. Khalpey added that EFG Hermes also expects to get regulatory approval to start a brokerage business in Kenya this year as part of a big push into frontier markets. The investment bank is also boosting its frontier research team to between 12 and 15 over the next year from eight currently, Khalpey added. The firm has already entered Pakistan, and next on the expansion list could be Bangladesh and Vietnam. “We like to look at illiquid, non-transparent markets where being on the ground gives incredible competitive advantage over everybody else,” he said. Khalpey added that he is excited about the long-term prospects in Pakistan and noted that EFG is planning to have an office with 10 to 15 people in Kenya to serve as a base for Tanzania, Rwanda and Uganda, once regulatory approvals are obtained.

ADI, Sigma to merge? Meanwhile, in what we hope is a harbinger of consolidation in a very fragmented industry, Al Ahly for Development and Investment (ADI)’s board of directors approved opening talks to merge with top-five brokerage Sigma Capital Holding through a share swap, according to a bourse disclosure. ADI set a deadline of 30 September for submitting a fair value assessment, conducting due diligence, and negotiating the transaction.

INVESTMENT WATCH- Hero Middle East & Africa targets sales of EGP 1 bn, may open baby food plant: We sat down with Hero Middle East & Africa Managing Director Mahmoud Bazan yesterday, who tells us that the company is targeting 2017 sales of EGP 1 bn, up from EGP 720 mn last year. He also revealed that the company is studying the possible opening here of a baby foods factory. The company has increased its production capacity to 70,000 tonnes annually in the past year after restructuring its 20-feddan Qalyubia plant’s production lines.

On the export font, Bazan added that Hero expects its exports to the US, which started this year, would grow to USD 10 mn annually within three years. The company is looking to increase exports to African countries as well. Hero stopped exporting to Qatar following the decision by Egypt and GCC countries to cut diplomatic ties with the Gulf country. Bazan said sales to Qatar only accounted for 2% of the company’s total export receipts. He also made a point to note that Hero’s profits in Egypt will not be repatriated, but will instead be reinvested in growing the company’s business here.

Others are not so sanguine, saying high interest rates are prompting them to delay capex outlays. Some manufacturers have reportedly put planned investments on hold after the central bank hiked key interest rates by 200 bps last month, Al Borsa says. Alfa Ceramics is planning to cut investment in new production lines this year to EGP 20-30 mn, after initially budgeting in EGP 150 mn for five lines, company head Wageeh Besda said. Universal Group is also pushing back plans for electronic appliances production lines until next year due to the rate hike, while others such as El Welely Crops, decided to halt expansion plans indefinitely.

Why is this happening? It’s all about return on investment. Abraaj partner Ahmed Badreldin forecast this slowdown in our January 2017 CEO Poll, saying at the time, “High interest rates will definitely make investment decisions more difficult for some businesses. When you’re looking at deposit interest rates at 19-20% for 18 months offered by some banks, investing in capex and new capacity will demand higher returns compared to simply parking liquidity in a time deposit. His remarks — including his “counterintuitive” call for an interest rate cut — should be required reading for us all this morning.

Hello, inflation: Petrol prices to go up in July? The price of 92-grade octane petrol will rise at the pumps by EGP 1 per liter to EGP 4.5 per liter starting 1 July, government sources tell Al Mal. The price of 80-grade octane will also increase as the government moves ahead with its plan to cut spending on fuel subsidies. The moves could drive inflation levels up to somewhere near the 35% mark, Arqaam Capital Senior Economist Reham El Desoki tells the newspaper. A member of parliament said he was concerned that inflationary pressures could fuel social unrest.

With the same concerns in mind, others in government are trying to delay fuel price hikes, especially since electricity prices are also slated to rise when the new budget comes into effect on 1 July, top officials tell Al Shorouk. Security officials reportedly backed the idea, worried that inflation coupled with issues like the Tiran and Sanafir debate could escalate existing tension.

ISPs look for another year of VAT exemption, citing unfair market practices by TE Data: The country’s private internet service providers are asking the ICT Ministry to go to bat for them with the Finance Ministry to extend their one-year exemption from the value-added tax (VAT) for a second fiscal year, Al Borsa reports. The companies say that they are already beholden to TE Data by paying it utilization fees on its infrastructure, which they are still trying to reduce. Representatives of Orange, Vodafone, and Etisalat say that they continue to incur losses year in and year out, in no small measure to TE Data’s monopoly of the market.

El Sisi pitches investment opportunities in Berlin: President Abdel Fattah El Sisi urged German companies on Monday to capitalize on investment opportunities and build industrial zones in Egypt, highlighting his administration’s economic reform drive and efforts to improve the country’s business climate, according to an emailed Ittihadiya statement. In his opening speech at the fourth session of the Egyptian-German Business Forum in Berlin, El Sisi stressed in particular investment in Egypt’s auto industry as one of the country’s “promising sectors,” noting that there is a “national strategy” underway for the industry (an obvious reference to the automotive directive, which faces opposition in the European Union in general and in Germany in particular). The president also noted opportunities in renewable energy.

German Economy Minister Brigitte Zypries also zeroed in on renewable energy and said Germany is offering export and investment guarantees to pave the way for more business. Zypries also said Egypt needs to “strengthen its rule of law and allow greater religious freedom if it wants to attract more foreign investment.” She made the remarks at a joint press conference with El Sisi yesterday, according to Reuters.

El Sisi and German Chancellor Angela Merkel spoke on illegal migration (among other topics), with the chancellor reiterating that Germany is prepared to support Egypt’s effort to stem the flow of migrants, according to Ahram Gate. Nothing as significant as Merkel’s pledge last March of USD 500 mn in new aid for Egypt was announced. Their meeting came at the sidelines of a conference on investment in Africa attended by African leaders and representatives from the African Development Bank, IMF, the World Bank, and major German firms. El Sisi also discussed security cooperation and Egypt’s anti-terror strategy with Germany’s Interior Minister, according to an Ittihadiya statement.

El Sisi also met with CEOs of major German companies to discuss investment in Egypt’s private sector. On the president’s agenda, as always, was Siemens CEO Joe Kaeser, who touted his company’s achievements in the power industry, according to Youm7.

Also in Germany was Investment Minister Sahar Nasr, who signed three agreements worth EUR 203.5 mn yesterday, according to a ministry statement. EUR 141.5 mn is earmarked for a wind power facility in Suez, an energy efficiency program, an SME development project, and a program for irrigation and wastewater treatment. The balance will support renewable energy, technical education and SMEs, among other projects.

Separately, Trade and Industry Minister Tarek Kabil met with German officials to push for more investment in national megaprojects including the 1.5 mn feddans desert reclamation drive and the Golden Triangle development project, Al Shorouk reports.

MOVES- MM Group for Industry and International Trade approved the appointment of lawyer and former Deputy Prime Minister Ziad Bahaa Eldin as a non-executive board member of the company, according to a regulatory filing.

Smurf island discussions to continue today after a fiery session on Monday: Discussion at the House of Representatives yesterday over the agreement to hand Tiran and Sanafir islands over to Saudi Arabia reached a boiling point as MPs, Ahram Gate reports. House Speaker Ali Abdel Aal was forced to adjourn the session and restrict attendance at future sessions to the Legislative Committee after members of the majority and opposition blocs came close to blows.

The agreement can’t go to national referendum and is not up for amendment sinceink was already put to paper with another sovereign state, constitutional law expert Salah Fawzy told MPs in testimony yesterday. Meanwhile, opposition MPs held a meeting yesterday to discuss ways of building popular opposition to the agreement, and politically active journalists have reportedly called for a protest against the pact tonight at the Press Syndicate.

Egypt has blocked 62 websites since 24 May, according to an update to the Association of Freedom of Thought and Expression (AFTE)’s initial estimate of 52 picked up by Reuters. “The spike in censorship has come as a surprise, even to journalists long-accustomed to reporting within strict red lines in Egypt where direct criticism of the military, the president, and judiciary are considered taboo and punishable by jail time,” Eric Knecht and Nadine Awadalla write. Journalist Khaled El Balshi, whose website Al Bidayah was also blocked, and others believe the censorship is related to the ongoing debate over the Tiran and Sanafir islands.

Egypt’s adults are the fattest in the world: This Ramadan (and food subsidies for that matter) should be seen in a new light as we’ve officially become one of the fattest nations in the world, according to a study by the University of Washington in Seattle published in the New England Journal for Medicine. The study showed that among the 100 most populous countries in the world, Egypt’s overall obesity rates reached 26.8%, second only to Saudi Arabia (27.5%) and even beating out traditional heavyweight champion the US (26.5%). Egypt had the highest obesity rates among adults at 35.3%. Not to make us feel better, but it should be noted that the trend towards obesity has been growing worldwide, with 2.2 bn people across the globe are now either overweight or obese. That’s almost 30% of the world. The trend has been rising in both rich and poor countries and among children. The study is being widely picked up, including in the Associated Press and Newsweek.

GE’s titan of industry steps down: Jeff Immelt is stepping down as chairman and CEO of General Electric (GE), following mounting pressure from activist investor Trian Fund Management for operational changes, Bloomberg reports. John Flannery, a 30-year company veteran who oversaw a jump in profits at the health-care unit, was chosen to replace Immelt. His 16-year tenure at the helm of GE saw the company shed its volatile GE Capital business, the USD 10 bn acquisition of Alstom SA’s energy business, and refocused the company as an industrial manufacturer. GE’s long term earnings struggles, however, cast serious doubts among investors including Trian. GE’s stock rose 3.6% on the back of the announcement, its biggest one-day gain since 2015. Flannery is said he would scrutinize the performance of GE’s portfolio, something much needed, said Barclays Plc analyst Scott Davis.

REAX: The Financial Times has an interview with Immelt looking back at his career and featuring the advice the outgoing GE chief says he gave Flannery. Both the WSJ and the New York Times note that activist investor Trian Fund Management had nothing to do with Immelt’s decision to step down now. The Wall Street Journal’s solid take on the story includes a rundown on the succession process. On the short list was Steve Bolze, a familiar face to some Enterprise readers from his time at the company’s power business and, previously, GE Healthcare. The reaction here at Enterprise was somewhat different: At least one of us remembers reading in near-real time the handover from Jack Welch to Immelt back in 2000-01, so we’re simply feeling old.

Leadership shakeup at Uber begins: Immelt’s resignations comes at the same times as a leadership shakeup gets underway at Uber, where its senior vice president of business, Egypt-born Emil Michael, was forced out, according to Bloomberg. As we noted yesterday, Michael’s ouster was recommended by a probe conducted by former US Attorney General Eric Holder investigating a series of scandals in the company. These include [redacted] harassment of employees, denial of an assault by an Uber driver in India, and investigating a critical reporter, the last two incidences apparently directly involve Michael. Embattled CEO Travis Kalanick is also reported to see his role at the company change or to take an extended leave of absence.

Fast Company is noting that the move comes as Uber has a decision to make whether it will reveal customer data to the Egyptian government if the Ride-sharing Apps Act passes. The story, which was first revealed by the New York Times’ Declan Walsh, suggest that Uber and Careem have been approached on surveilling customers and that the law will make that a condition of operating in Egypt. The news is gaining traction among tech-focused outlets, including Engadget.

Image of the Day

India and Egypt have a deep-rooted connection in culture and architecture that is too often overlooked, R.V. Smith writes for The Hindu. The connection first originated from the Delhi Sultanate (13th-16th centuries) and persisted through the Mughal dynasty, which was dissolved in 1857. Smith says the sloping walls of the fortress of Tughlakabad (pictured above) are one standing example of how India was influenced by Egyptian architecture.

Egypt in the News

A supposed increase in the number of websites blocked by Egypt topped coverage of Omm El Donia in the foreign press this morning. Al Jazeera, itself among the banned websites, is noting a condemnation by the Index on Censorship, which called on Egypt to uphold its commitment to freedom of speech. The Committee to Protect Journalists put out a piece focusing on other alleged attempts to crack down on the media including phishing attacks, trolling, software to monitor social media posts, and a draft law that would require registration for social media users.

Also getting lots of digital ink this morning is the House debate over the handover of Tiran and Sanafir islands to Saudi Arabia. Lawyer Khaled Ali called President Abdel Fattah El Sisi a “traitor” at an opposition meeting on Sunday, prompting the Associated Press’ Hamza Hendawi to suggest Ali may face further legal action as a result. Meanwhile, Al Monitor’s Rania El Abd suggests that parliamentary approval is the final step in pushing the agreement through, despite legal obstacles in the courts.

Germany’s Press Agency, DPA, took advantage of President Abdel Fattah El Sisi’s visit to Berlin to ask whether he will be able to create the atmosphere for a fair poll in next year’s scheduled presidential elections. “The situation appears murky. The election is expected to be held in the spring, but its exact date is not known yet,” DPA says.

Also making the rounds this morning:

- Al Jazeera is the primary target of the Saudi-led Arab ban on Qatar, Erika Solomon says in a piece for the FT (paywall).

- A House of Representatives committee will be looking into a proposal that seeks to stop parents from giving their children western names, QZ says.

- Mohamed Nosseir says that rule of law is “Egypt’s gateway to progress” if the country manages to apply it “fairly and firmly” in his latest piece for Arab News.

- BBC takes a look at how women’s sanitary products “confuse and alarm security staff” in Egypt.

Worth Watching

It’s not just our MPs who throw punches when civil discussion breaks down. With debate in the House on the Tiran and Sanafir handover agreement reaching a fever pitch, we should thank our lucky stars that fists aren’t swinging (yet). It has happened before, but nowhere near as savage as representatives in these countries in Time’s rundown of parliamentary beatdowns (runtime: 2:22).

Take MP Mr. Miyagi in Korea (the honorable representative of stupid Asian stereotypes) who flings his opponents with martial arts flips (0:28). Or the abduction of a Ukrainian MP by another after handing him flowers (1:51). And what about that smoke bomb that went off in Kosovo (0:45)? This video will really give you a new found appreciation of our honorable representatives, their oratory skills notwithstanding.

Diplomacy + Foreign Trade

Israeli Prime Minister Benjamin Netanyahu and Knesset opposition chairman Isaac Herzog flew secretly to Cairo for a meeting with President Abdel Fattah El Sisi in April 2016, Haaretz claims. The paper says the February 2016 Aqaba summit, which also included Jordan’s King Abdullah and then US Secretary of State John Kerry, was not the only meeting between El Sisi and Netanyahu that year. Haaretz says the meeting with El Sisi was part of “marathon talks” amid a genuine possibility of a peace agreement with the Palestinians, but “failed due to Netanyahu’s refusal to give the Palestinians what was required.” Herzog said Palestinian demands at the time included “significant construction in Palestinian cities in Area C, a freeze on construction outside the settlement blocs, recognition of various elements in the Arab peace plan and other things.”

Egypt’s power lines into Gaza are being disconnected for maintenance, Gaza Power Company says, according to Times of Israel. The power lines have not been functioning in recent weeks, IDF sources said. The paper notes another report that the disconnection is a threat to cut provisions of electricity to the Gaza Strip.

MPs meet White House officials in Washington: An Egyptian parliamentary delegation currently in Washington, DC, met yesterday with US President Donald Trump’s senior adviser for the Middle East and the assistant secretary of state for Near Eastern affairs, Youm7 reports. The delegation is in the American capital until tomorrow to lobby members of Congress to support a bill designating the Ikhwan as a terrorist organization and discuss politics in Egypt with think tank representatives.

Nigeria will support Moushira Khattab for UNESCO director-general, Nigeria’s Education Minister Mallam Adamu Adamu said, according to Nigeria portal Leadership. Khattab is a former minister of family and population.

The World Bank has disbursed the first USD 125 mn tranche of a USD 500 mn loan supporting the Sisi administration’s Upper Egypt development program, Investment and International Cooperation Minister Sahar Nasr announced. The funding is earmarked for infrastructure development as well as for potable water and wastewater treatment programs. It will also support programs that help develop the food industry.

Egypt made its first delivery of humanitarian assistance to South Sudan yesterday, Al Mal reported. The paper says Egypt is planning on sending a number of humanitarian assistance packages to South Sudan over the next two months. The packages include food and medical equipment.

Energy

Elf looks to expand into waste-to-energy projects once FiT is set

EMG subsidiary Elf will be looking to jump on the waste-to-energy bandwagon once the Egyptian government sets the feed-in tariff (FiT), Elf Managing Director Islam Soliman tells Al Borsa. Officials had said last month that the government will not be announcing a new tariff for waste-to-energy projects before October due to the existing surplus in electricity. In the meantime, Elf — in partnership with SAG Germany — will be working on its 50 MW solar power plant in Benban Aswan, where construction is due to begin in August. The plant, which is being financed by China’s GEDI, should start feeding power into the national grid by 2Q18, Soliman adds.

Power plants run 100% on natural gas -sources

The Oil Ministry informed the Electricity Ministry it will commit to supplying power plants with natural gas instead of heavy fuel oil, sources tell Al Masry Al Youm. The Electricity Ministry has been looking to reduce the dependence on heavy fuel oil as it wears out the plants’ boilers and reduced their operational efficiency. Plants had been using diesel for 25% of its fuel for years, given the shortage in natural gas, sources say.

Basic Materials + Commodities

El Sharkawy wants tobacco cultivation study ready

Public Enterprise Minister Ashraf El Sharkawy is urging Eastern Tobacco to complete a study assessing tobacco cultivation in Egypt and to expand exports, Al Masry Al Youm reports. A comprehensive study on tobacco cultivation domestically was supposed to be completed by mid-May. This came amid reports that the farmers syndicate is refusing to grow tobacco in Egypt citing seemingly religious concerns such as the cash crop being “intoxicating to the cultivated land and to citizens.” El Sharkawy’s comments were made during his review of Chemical Industries Holding Company’s AGM, of which Eastern Tobacco is a subsidiary.

Gebr. Pfeiffer to build coal grinding plant for BMIC’s cement plant

Cairo-based Building Materials Industries Company (BMIC) awarded Germany’s Gebr. Pfeiffer a turnkey contract for a complete coal grinding plant to serve its cement plant, CemNet reports. The plant is set to be operational in 1Q2018.

Rice prices will not increase anytime soon, FEI rep says

Rice prices are not expected to see any increase soon, the Federation of Egyptian Industries’ cereals chamber’s rice division chairman Ragab Shehata says, according to Al Masry Al Youm. Shehata says there is a sufficient supply of rice domestically and this might even drive prices down. He says current market prices are now around EGP 6-7 per kg for bulk rice and EGP 6.5-7.5 per kg for packaged varieties.

Egypt’s strategic wheat reserves stand at 4.4 mn tonnes, sugar at 1.2 mn tonnes

Strategic wheat reserves are at 4.4 mn tonnes, 3.4 mn tonnes of which are from local farmers, Supply Minister Ali El Moselhy said yesterday, Al Masry Al Youm reports. The minister’s statement came as the General Authority for Supply Commodities launched a global tender for an unspecified amount of wheat, to be delivered between 15 and 25 July, according to the newspaper.

Automotive + Transportation

Boeing bids on tender to supply EgyptAir with 33 new aircrafts

Boeing is bidding on an international tender to supply EgyptAir with 33 new aircraft, including wide-, medium-, and small-body vehicles, Al Borsa reports, citing remarks by Boeing MENA President Bernard Dunn. Dunn reportedly refused to disclose further details about the sale. Egypt had bought nine Boeing 737-800 for USD 864 mn.

Real Estate + Housing

Land tenders for 1,000 feddans at New Capital to be issued next month

The Administrative Capital for Urban Development is planning to issue tenders next month for 1,000 feddans for commercial and service developments at the New Administrative Capital, Al Borsa reports. The company is currently working on dividing the land into lots and pricing each piece ahead of the tender, a Housing Ministry source tells the newspaper. The company had tendered 15 pieces of land totaling 40k feddans in the first phase of the New Capital in February.

Misr Italia, CONSTEC to build EGP 55 mn project in New Cairo business park

Misr Italia Properties inked an agreement with CONSTEC on Monday that will see the two companies build two multi-level administrative buildings at the Cairo Business Park in New Cairo for an estimated EGP 55 mn, Daily News Egypt reports. The Engineering Consulting Bureau will be managing the project, which should be complete within ten months.

Tourism

Czech Republic resumes flights to Sharm El Sheikh

The first flight from the Czech Republic in two years landed at Sharm El Sheikh yesterday, Ahram Gate reports. The flight arrived carrying 150 tourists and is the first since the Metrojet flight crash in Sinai in October 2015. The report notes that tour operators have expressed willingness to increase the number of flights on this route if there are signs of stronger demand.

Egypt maintains relaxed visa requirements for GCC residents

Egypt is maintaining lax visa measures for incoming Gulf residents in a bid to encourage Gulf tourism, the Tourism Ministry said. These procedures apply to Maghreb nationals accompanying Gulf tourists, provided they have a residency that is valid for six months. Indian, Pakistani, Indonesian, Filipino, and Sri Lankan nationals who also reside in the GCC can get tourist visas on arrival, if their residency is valid for at least six months.

Banking + Finance

SME Development Authority secures EGP 25 mn funding for Reefy

The SME Development Authority signed a contract to provide micro-enterprise finance services company Reefy with EGP 25 mn from the French Development Agency, Al Masry Al Youm reports. 1,650 micro projects are expected to be implemented under the new funding scheme, with each new project receiving a maximum funding of EGP 35,000, the Authority’s acting Executive President Nevine Gamea said.

Central bank sold USD 713.1 mn in USD T-bills

The central bank sold USD 713.1 mn in one-year USD-denominated treasury bills yesterday, Reuters reports. Foreign and local financial institutions bought the T-bills at an average yield of 3.529%.

Other Business News of Note

National solid waste program launching in two governorates this week

The Waste Management Regulatory Authority is launching the National Solid Waste Management Program in Kafr El Sheikh and Gharbiya this week, and will expand the program to Assiut and Qena by the end of October, Al Borsa reports. CDM Smith, COWI A/S, and Environmental Resource Management had won in March the USD 62 mn tenders to manage the projects in the four governorates.

Egypt Politics + Economics

House Manpower Committee signs off on 15% pension raise for bureaucrats

The House of Representatives’ Manpower Committee signed off on a number of proposals on Monday, including one that amends social welfare laws to see pensions rise by 15%, AMAY reports. The increase is part of a EGP 46 bn social welfare package that the Sherif Ismail government had approved last month and will cost state coffers some EGP 20 bn. The committee also signed off on the 10% hardship raise for state bureaucrats not covered under the Civil service Act and sanctioned a proposal to set the minimum for public sector employees’ annual raises at EGP 65 a month. Also on Monday, the House General Assembly voted on a KWD 300k funding agreement with the Arab Fund for Social and Economic Development to finance the removal of landmines from the western north coast, Al Mal says. Representatives also sanctioned trade facilitation agreement that Egypt signed with the World Trade Organization in 2013 in Indonesia.

Sports

Egypt loses to Tunisia in 2019 AfCON qualifiers

Tunisia beat Egypt’s national team 1-0 in our first group stage match of the 2019 African Cup of Nations qualifiers held in Cameroon, the AFP reports. Tunisia now tops the qualifying group with three points, while Egypt, with zero points, is at the bottom of the group.

On Your Way Out

The government is taking the campaign to stop illegal migration to radio,TV, and social media, Menna A. Farouk writes for Al-Monitor. Awareness campaigns depict the risks illegal migrants face and educates them about processes of legal migration. The Immigration and Egyptian Expatriate Affairs Ministry’s social media campaign “Think before you migrate” includes interviews with residents of governorates with high illegal migration rate such as Fayoum, Kafr El Sheikh, and Gharbeya, Farouk writes.

The markets yesterday

EGP / USD CBE market average: Buy 18.0388 | Sell 18.1391

EGP / USD at CIB: Buy 18.05 | Sell 18.15

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Monday): 13,492 (-0.9%)

Turnover: EGP 834 mn (39% below the 90-day average)

EGX 30 year-to-date: +9.3%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.9%. CIB, the index heaviest constituent ended down 1.2%. EGX30’s top performing constituents were: Amer Group up 2.6%, Eastern Co up 1.6%, and ACC up 0.3%. Yesterday’s worst performing stocks were: Porto Group down 2.3%, Emaar Misr down 2.1%, and Arab Cotton Ginning down 2.0%. The market turnover was EGP 834 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +7.2 mn

Regional: Net Short | EGP -13.6 mn

Domestic: Net Long | EGP +6.4 mn

Retail: 60.4% of total trades | 65.8% of buyers | 54.9% of sellers

Institutions: 39.6% of total trades | 34.2% of buyers | 45.1% of sellers

Foreign: 23.7% of total | 24.1% of buyers | 23.3% of sellers

Regional: 9.6% of total | 8.8% of buyers | 10.4% of sellers

Domestic: 66.7% of total | 67.1% of buyers | 66.3% of sellers

WTI: USD 46.23 (+0.33%)

Brent: USD 48.46 (+0.35%)

Natural Gas (Nymex, futures prices) USD 3.01 MMBtu, (-0.40%, July 2017 contract)

Gold: USD 1,265.20 / troy ounce (-0.29%)

TASI: 6,822.43 (+0.19%) (YTD: -5.38%)

ADX: 4,511.28 (+0.28%) (YTD: -0.77%)

DFM: 3,427.28 (+1.16%) (YTD: -2.93%)

KSE Weighted Index: 399.18 (+0.31%) (YTD: +5.02%)

QE: 9,135.16 (+0.83%) (YTD: -12.47%)

MSM: 5,314.19 (-0.32%) (YTD: -8.10%)

BB: 1,322.30 (-0.08%) (YTD: +8.35%)

Calendar

26 May-23 June (Friday-Friday): Window for firms to submit expressions of interest to the European Bank for Reconstruction and Development for consulting on Egypt’s oil and gas sector reform, London, UK.

22 June (Thursday): Nile Summit scheduled to be held in Uganda.

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

06 July (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

13-15 July (Thursday-Saturday): AGRENA’s 19th Annual Poultry, Livestock, and Fish show, Cairo International Convention Center, Cairo.

15-19 July (Saturday-Wednesday): SSIGE’s GeoMEast 2017 International Congress and Exhibition, Sharm El Sheikh.

23 July (Sunday): Revolution Day, national holiday.

03-05 August (Thursday-Saturday): Watrex Expo Middle East, Cairo International Exhibition & Convention Center.

17 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26 August (Saturday): 27th Egyptian-Jordanian Joint Higher Committee meeting, Amman Jordan. (TBC).

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.