EGP devaluation pushes private sector into sharper decline in January

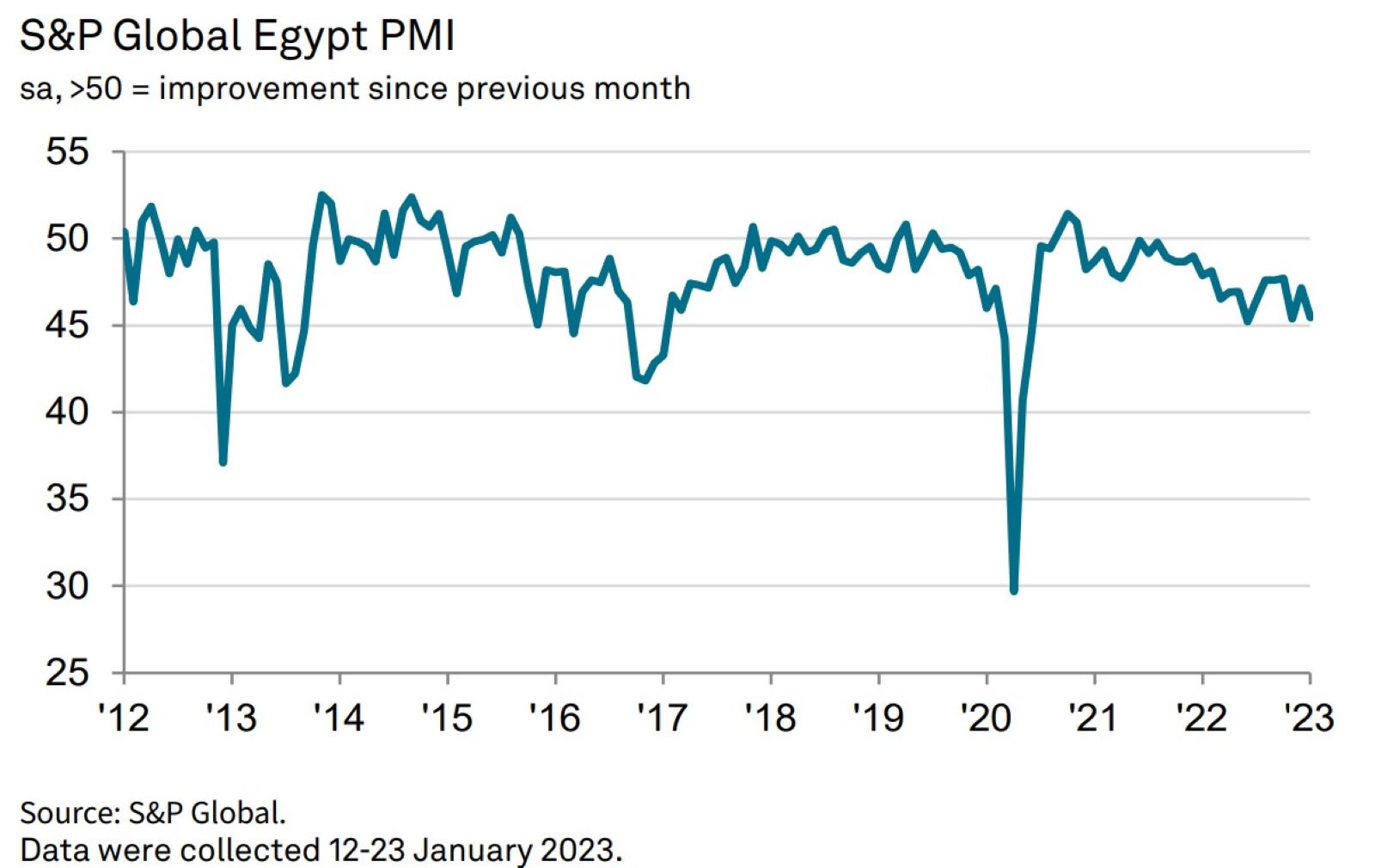

Private sector starts the year with sharper contraction: Activity in Egypt’s non-oil private sector contracted for the 26th consecutive month in January as high inflation continued to weigh on businesses, according to S&P Global’s purchasing managers’ index (pdf).The PMI reading fell to 45.5 in January from 47.2 a month before, dropping further below the 50.0 mark that separates growth from contraction. “The reading indicated a sharp deterioration in the health of the non-oil sector that was one of the quickest seen in the current 26-month sequence of decline,” S&P Global said.

EGP depreciation drives inflation: Purchasing costs rose at their fastest pace in 4.5 years as the January devaluation of the EGP added to inflationary pressures, with half of those surveyed reporting a rise in purchasing costs during the month. Output prices increased at their fastest in nearly six years, as businesses passed on rising costs to clients.

And inflation suppresses activity: “TheP build-up of inflationary pressures led to a marked and faster decline in new business inflows,” S&P wrote. The contraction in activity was exacerbated by ongoing supply issues at some firms thanks to import restrictions and a foreign-currency shortage. Amid this backdrop of high prices, falling demand, and supply shortages, managers cut purchasing at their steepest pace in the 12-year history of the PMI survey.

Employment fell for the third time in four months, though staff costs rose as employers hiked salaries amid high inflation.

Looking ahead: Confidence among purchasing managers hit its third-lowest level in the PMI’s history amid a “gloomy” outlook on inflation, S&P Global Senior Economist David Owen said. Sell-side price hikes suggest “inflation could climb further from December's 21.3% and remain elevated throughout much of the year,” he said, echoing the sentiment of all seven analysts we polled recently. “The USD shortage added significantly to Egypt's economic challenges in 2022 and will likely remain a major problem this year,” he said.

The story is getting ink in the foreign press: Reuters | Bloomberg.

FROM THE REGION-

Saudi Arabia’s non-oil private sector registered its second-fastest growth since September 2021 on the back of easing inflation and rising optimism, according to the country’s PMI (pdf).

Non-oil business activity in the UAE also remained strong in January, with output and new orders both rising sharply, according to the PMI (pdf). This was the lowest PMI reading in a year for the UAE, which has enjoyed a strong recovery from the pandemic since 2021.