- Inflation cools month-on-month in February. (Speed Round)

- Yields on treasuries fall on Thursday. (Speed Round)

- World Bank VP says Egypt needs to “focus on making its bureaucracy more transparent for investors.” (Speed Round)

- M&A Watch: Archer Daniels Midland looking to acquire National Company for Maize Products, Amazon and Souq are dancing again. (Speed Round)

- Toyota could source parts in Egypt for potential Saudi auto factory. (Speed Round)

- SODIC, TMG among 15 companies bidding for New Admin Capital land. (Real Estate)

- Amr Adib hospitalized for exhaustion. (Enterprise+: Last Night’s Talk Shows)

- A very busy month of March for the House of Representatives. (On the Horizon)

- The Markets Yesterday

Sunday, 12 March 2017

Inflation is cooling month-on-month

TL;DR

What We’re Tracking Today

Good morning from Cairo, where we’re happy this morning to mark both our return home from Dubai, where we attended the EFG Hermes One on One, and our 600th weekday edition of Enterprise.

The best news we’ve read in ages: Month-on-month inflation is cooling, a key indicator we suggested last month that you folks look for. We have chapter-and-verse in Speed Round, below.

Random observation from the road: China loves Egypt. We reported in February that volumes to Egypt were up 58% last year over 2015, a development that came after Beijing named Egypt a preferred market. Well, it’s very real: Emirates Airlines was running full DXB-CAI return flights both days we were in the air, almost entirely thanks to hundreds of middle-aged and older Chinese tourists heading to Omm El Donia on package tours. Others flying EgyptAir to the One on One also reported heavy volumes of Chinese holidaymakers.

Finance Minister Amr El Garhy has been meeting with a team from the International Monetary Fund in London over the weekend to discuss the government’s progress on economic reforms. The sit-down comes ahead of a scheduled visit by an IMF delegation in April to review progress on the reforms to which we’ve committed before the fund disburses the second tranche of the USD 12 bn bailout package. El Garhy tells Reuters’ Arabic service that he is also meeting with London investment banks to promote investing in Egyptian paper.

El Garhy added that he will present the FY2017-18 budget to the cabinet economicgroup sometime this month. El Garhy had previously said the IMF delegation had postponed its visit to April from March to allow the Finance Ministry to iron out its budget for the next fiscal year. Policy watchers will scour the budget looking for signs that the reform program is moving forward. Last week, a bid by Supply Minister Ali El Moselhy to reform a small facet of the bread subsidy program was reversed after protests erupted in multiple governorates. On the flipside, sources from the Electricity Ministry have been telling the local press that there is no turning back from raising electricity prices in July.

Meanwhile, Prime Minister Sherif Ismail said that spending will break EGP 1.1 tn in thenew budget year,up from EGP 975 bn in FY2016-17, according to Al Mal. GDP is anticipated to come in at EGP 4 tn, Ismail said. Deputy Finance Minister Mohamed Maait had said last week that budget spending will rise in part because the Finance Ministry is looking to make good on the government’s constitutionally mandated minimum spending on health and education.

Public service announcement #1: This lousy weather we had this past weekend is due to continue this morning. Quoting the National Meteorological Authority, Ahram Online tells us that, “Rain will be dominant in the north of the country, reaching to Cairo and Sinai along with wind carrying dust that could limit drivers’ visibility.”

PSA #2: Time changes in the United States and Canada this morning, so add an hour to any time quoted to you in the US of A or the Great White North. Clocks move ahead an hour starting at 2am. Time won’t change in the United Kingdom until 26 March, and Egypt no longer observes daylight savings time.

PSA #3: There are something on the order of 76 days left until Ramadan.

Our favorite thing of last week: State Street’s statue of a young girl about the same age as our resident nine-year-old, staring down the famous bull of Wall Street. As part of its drive to see more women in c-suites and on corporate boards (among other gender equity issues), the world’s third-largest asset manager pulled off a piece of guerilla art last week for International Women’s Day. The statue commissioned by State Street Global Advisors (SSGA, which has about USD 2.5 bn in AUM) became a viral sensation — and had us smiling since we first saw it toward the end of last week. SSGA deputy chief investment officer Lori Heinel says the firm wants to see at least one female board member at every company in which it invests, telling Business Insider, “There has been a lot of discussion on this topic, but the needle hasn’t moved materially. We’re not going to always automatically vote against the company, but we want to make sure there are tangible, concrete measures they are taking.” Read the State Street press release, tap the link above to check out a cool New York Times Instagram video, meet the artist behind the statue (WSJ, paywall) and join us in being happy that New York City officials have extended the statue’s permit to 30 days from the original one week as a movement grows to have it become a permanent thing.

Oh, and get this: Hedge funds run by women have outperformed “a broader benchmark of alternative investment managers over the past five years but fewer than one in 20 hedge funds employ a woman as a PM. The Financial Times has more.

On the Horizon

LEGISLATION WATCH- March looks set to be a busy month for the House on the economic front, with legislators due to consider a basket of laws and amendments to existing legislation, including:

- The Contractor’s Compensation Act will come up for a vote in a plenary session on Monday. The measure would give the government legislative cover to compensate suppliers and contractors for FX losses incurred on state contracts after the EGP float.

- The House’s Manpower Committee will begin talks on the Labor Act tomorrow. It is already being attacked by workers who claim it would take away the right to strike from workers in critical industries including transport, pharma, and food. The bill is also believed to include a clause that would force private sector companies to institute a 7% annual raise.

- We can expect the Investment Act in a few weeks’ time, General Authority for Free Zones and Investment chief Mohamed Khodeir says. The bill is currently being reviewed by the House of Representatives’ Economic Committee, which has already given a preliminary nod to 50 of its main articles, according to Khodeir.

- The House will vote in a plenary session on the Natural Gas Act by the end of March.

- The Council of State (Maglis Al Dowla) is expected to complete its review of the Bankruptcy Act and of the executive regulations to the Civil Service Act by the end of the month, legislative committee chair Ahmed Aboul Azm tells Al Borsa. Al Masry Al Youm has more on the civil service act.

Enterprise+: Last Night’s Talk Shows

Talking heads last night all wished Kol Youm’s Amr Adib well, as he was admitted to the hospital yesterday for exhaustion. Hona Al Asema’s Lamees El Hadidy canceled her show on Saturday to be with him, but she called in to Akher El Nahar to tell host Gaber Al Armooty that Adib was doing well (watch, runtime: 10:28). We wish them both well.

On Mehwar’s 90 Minutes, Moataz El Demerdash spoke to Deputy Planning Minister Saleh El Sheikh about the Administrative Control Authority (Egypt’s top anti-corruption watchdog) arresting the ministry’s head of purchasing in connection with an alleged kickback. El Shiekh said an investigation into other ministry contracts is ongoing (watch, runtime 7:04). (For more on the corruption case, hit up Youm7 here and here.)

On Masaa DMC, MP Atef Makhaleef was highly critical of the “poor excavation methods” used to unearth the statue (possibly of Ramses II) in Mattariya, Cairo (more on that in Egypt in the News). The MP wants the antiquities minister to resign (watch, runtime 3:26), but the head of the Egyptian-German excavation party confirms the statue was found broken and was not damaged during its extraction from the site (watch, runtime 7: 55).

The host then moved on to cover the delivery of 48 residential units in Ismailia to Coptic families displaced from their North Sinai homes by Daesh terrorists and spoke to Ismailia Governor Yassin Taher, who confirmed that the families have also received health insurance cards for free medical treatment in their host city (watch, runtime 6:31).

Meanwhile on Al Hayah Al Youm, Lobna El Assal was pleased to report that Egypt is finally jumping on the garbage recycling bandwagon. The host spoke to Cairo Governor Atef Abdel Hameed about an initiative he launched on Saturday to buy trash for recycling from citizens. The first two outlets are in Heliopolis and should pop up around the rest of Cairo by the end of 2018, the governor said (watch, runtime: 2: 41).

Speed Round

Inflation is now easing month-on-month despite having broken the 30% barrier on a y-o-y basis,according to data from the CBE, a sign that the one-off shock of the November 2016 float of the pound may now be starting to taper. Month-on-month food price inflation rate dipped to 4.1% in February from 7.0% in January. Similarly, headline inflation fell to 2.63% in February from 4.07% in January, while core inflation eased to 2.61% last month from 5.00% the month before. Annual headline inflation rose to 30.25% in February from 28.14% the month before, while core inflation jumped to 33.10% in February from 30.86% a month earlier. CAPMAS data also showed that food price inflation also surged in February, hitting 41.7% on an annualized basis.

What the analysts are saying: Renaissance Capital’s Charles Robertson is quoted by the Wall Street Journal as emphasizing that the easing of m-o-m inflation is the more important indicator, while Reham ElDesoki, senior economist at Arqaam Securities, told Reuters, “We expect headline inflation to remain elevated at similar and higher levels until Q4 2017, at least, as the pass-through effect from the higher FX rate continues, albeit at lower levels.” CI Capital senior economist Hany Farahat agrees, telling Bloomberg he expects the annual inflation rate to remain “very high until November” because it is calculated against a lower base, but noted that the monthly figure could mean that “the severe price shocks following the November measures are easing … This may mark the beginning of stabilization in prices.”

Average yields on Egypt’s one-year and six-month treasury bills dropped at an auction on Thursday, according to Reuters. The 182-day treasury bills dropped to 18.657% from 20.015% at the previous auction, and the yield for the 357-day treasury bills eased to 18.549% from 19.922% in a similar auction, the newswire reports.Al Borsa says foreigners bought 35.4% of the volumes on offer on Thursday after reducing their volumes significantly in the past three weeks as the EGP gained strength. Arabs and non-Arab foreigners were also net buyers on the EGX on Thursday.

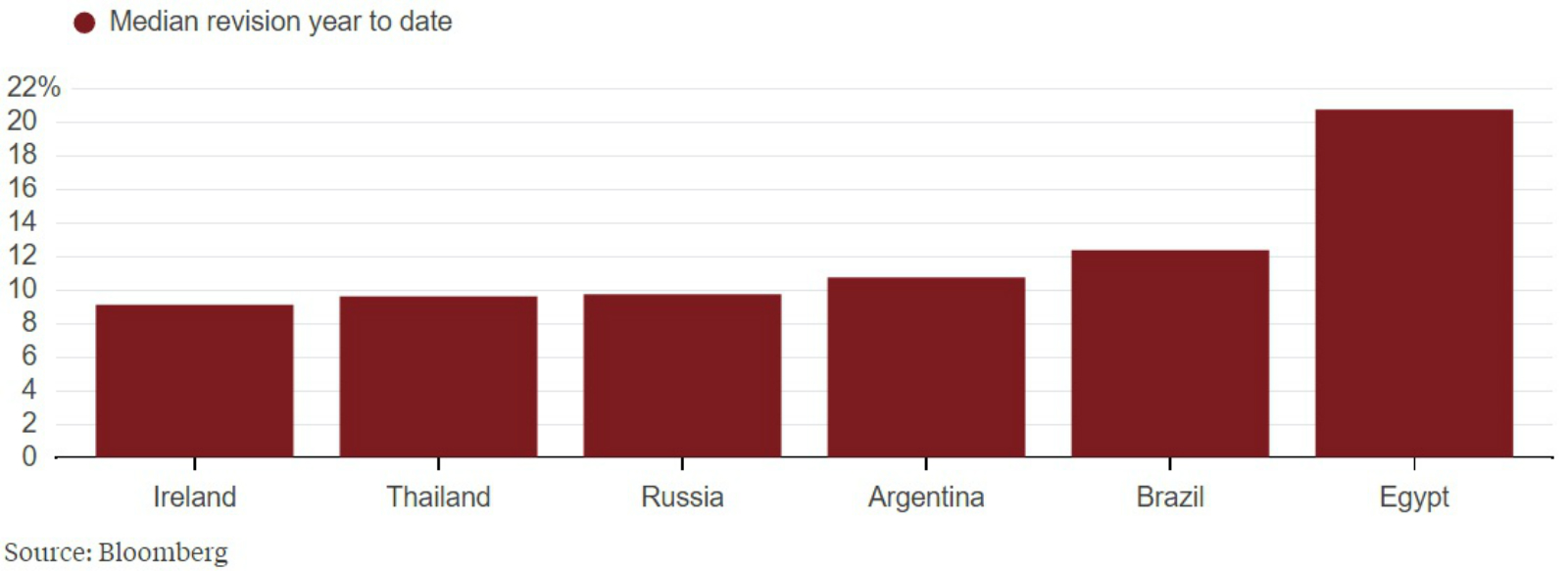

Do bank shares point to reduced political risk in Egypt? That’s the contention of BloombergGadfly’s Christopher Langer, who writes that “Financial institutions in countries with high political risk have seen some of the steepest positive earnings revisions so far this year. In Egypt, for example, the median bank is now expected to make 20.7 percent more in the next 12 months than was the case when 2017 started.” Langer cautions that while Egypt looks better now than it did six months ago, the recent bread protests are a sign that there may be more turbulence to come.

On a side note, the banking sector is reportedly gearing up to play musical chairs, reports Daily News Egypt, which cites unnamed industry sources as noting that a number of MDs and board members are due to step down by 15 April. The story reminds readers that the Central Bank of Egypt has to sign off on any change of management or appointment to a board at an Egyptian bank.

Egypt’s next set of economic reforms should “focus on making its bureaucracy more transparent for investors,” World Bank MENA Vice-President Hafez Ghanem told Reuters. Ghanem believes Egypt should implement reforms aimed at encouraging more private investment and moving away from subsidies toward targeted transfers for the poor. “The next set of reforms need to focus on the micro level, regulatory reforms, making the system more transparent, easier for investors to come and invest in Egypt,” he says. Ghanem adds: “We need to see a big increase in private investment, and not just private investment by big companies, big ticket items. We need to see encouragement for SMEs, for young people to develop more entrepreneurship.” Ghanem also praised the macroeconomic reforms taken so far on the FX front and the freer movement of capital.

M&A WATCH- Archer Daniels Midland (ADM)’s Swiss unit is seeking to buy a stake in Egyptian sweeteners-maker National Company for Maize Products (NCMP), according to a regulatory filing. The transaction could see ADM acquire Misr Capital Investment’s 43% stake in NCMP, but there are no details on price or conditions. ADM will also bid for 100% of NCMP if the transaction is successful. The potential transaction is a sign the EGP float “has made some local companies more attractive to foreign investors,” Bloomberg’s Tamim Elyan writes. Radwa El Swaify, Pharos Holding’s head of research, says this “tells us about the attractiveness of the Egyptian market for mergers and acquisitions activity because it has become very cheap … They are buying a much cheaper asset compared to what they would pay if they build a similar factory.” ADM’s last investment in Egypt was announced in late 2015, when the company took a 50% stake in Medsofts.

Zooming out to a regional scale: Amazon could be buying Souq.com after all. Seattle-based Amazon has reportedly restarted talks to acquire Dubai-based regional e-commerce platform Souq.com for a reported USD 650 mn, Bloomberg reports. Amazon and India’s Flipkart had walked away from talks to acquire the company January after disagreeing over price, after which it was reported that Souq.com began negotiations with Majid Al Futtaim, among other potential investors. Bloomberg’s sources say that Al Futtaim and other bidders have pulled out of negotiations and Amazon is currently the only potential investor. Amazon refused to comment. Souq.com had appointed Goldman Sachs to find buyers for a stake last year; last November, it was reported that Amazon was in talks to buy the company for a valuation of USD 1 bn.

Toyota could be sourcing parts from Egypt and Turkey to develop a potential auto factory in Saudi Arabia, Reuters reports. Toyota Motor plans to launch a feasibility study as early as this year on building the factory in Saudi Arabia and plans to sign an MoU on the study with the Saudi government after King Salman meets with Japanese Prime Minister Shinzo Abe in Tokyo on Monday, according to Nikkei Asian Review. It will make a final decision based on whether importing parts from Egypt and Turkey is more profitable than simply exporting finished vehicles to the region as it does now.

The Africa Finance Corporation will invest USD 25 mn in Carbon Holdings Ltd, the multibn USD petrochemicals project led by Basil El-Baz, Al Borsa reports. Or you can tap here to read the full press release announcing the investment, with comment from El-Baz and Africa Finance Corporation chief Andrew Alli.

Egypt is back in talks with Singapore’s PSA International to build and manage acontainer terminal in East Port Said, the head of the Holding Company for Maritime and Land Transport Mohamed Youssef tells Al Borsa, explaining that his company had asked to receive an updated feasibility study that also covers terminal maintenance. The statement follows reports last week that disagreements over the contract led Egypt to freeze negotiations with PSA and begin looking at offers from players such as China’s COSCO Shipping Lines.

Amer hires EFG Hermes, Matouk Bassiouny for GDR issuance: Real estate developer Amer Group Holding has hired EFG Hermes to manage the issuance of company GDRs on the London Stock Exchange (LSE) in two months’ time, Al Borsa reports. Matouk Bassiouny is serving as legal counsel.

** EARNINGS WATCH: Top dairy and juice products maker Juhayna reported that “severe inflationary pressures on the company’s cost base owing to the float of the Egyptian Pound on 3 November 2016 took a toll on bottom-line profitability, with the company turning a Net Loss of EGP 115 million in 4Q16 compared to a profit of EGP 61 million in the same period last year,” it said in a regulatory filing. On a full-year basis, an 18% year-on-year rise in revenues to EGP 4.9 bn wasn’t enough to prevent an 81% dip in net income to EGP 54 mn. The company said rising sales will help it return to profitability through operational efficiencies, increasing reliance on domestically produced raw materials and through cost discipline.

Russia and Egypt have given a preliminary nod to a draft of the travel security protocol they are meant to sign before direct air travel between Moscow and Cairo is restored, Russian Transport Minister Maxim Sokolov said, according to Russian wire service Interfax. No official date for the signing has been set, but a Russian foreign ministry official had told Youm7 last week that the agreement should come in May, which coincides with the expected signing of agreements for the roughly USD 29 bn Daba’a nuclear power plant with Rosatom.

Egypt cracked into the 20th spot of FIFA’s latest worldwide rankings, released last week, eNCA reports. Eight spots ahead of Senegal, Egypt sits at the top of all African teams’ rankings and is the only team from the continent to be included in the top 20 teams worldwide.

Pope Francis is considering stopping by Egypt, the Vatican confirmed in a statement on Saturday. Italy’s state-run RAI reported Francis would visit Al-Azhar on May 20-21, according to the Associated Press. We’re rather fond of Francis and his generally liberal take, so we’re crossing our fingers we get a glimpse of the “Popemobile,” otherwise known at Enterprise World Headquarters as the “Holy Tuk-tuk.”

Rumors in the UK press that Exxon is in acquisition mode are driving BP shares up, Bloomberg reports, but analysts aren’t biting — they’ve heard the tune before, in both 2015 and 2010. Speaking against the acquisition: USD 20 bn in penalties Exxon would take on as a result of BP’s Gulf of Mexico oil spill. Analysts also suggest an M&A of this size would surely attract the ire of UK regulators. BP holds sizeable concessions in the West Nile Delta, acquired a 10% stake in Zohr back in November, and could increase its investments in Egypt by another USD 13 bn over the next five years.

Image of the Day

The Permanent Mission of Egypt to the United Nations was the setting for a “tahteeb” performance last week. Tahteeb, originally a form of martial art, dates back to Ancient Egyptian times. It progressively became a folk practice — mainly in Upper Egypt — and is now a protected heritage, having been inscribed in UNESCO’s Representative List of the Intangible Cultural Heritage of Humanity in 2016. The ancient stick dance was hosted by Faika Zaki, wife of Egyptian Ambassador to the United Nations Amr Aboulatta, and the UN Delegations Women’s Club. Over 100 women from all over the world attended the performance with standing room only. Each guest left with a copy of “Scents of Egypt,” CIB’s 2017 annual book that is a collection of renowned photographs spanning across every geographic pocket of the country.

Egypt in the News

“My Name is Ozymandias, King of Kings. Look upon my slums, ye mighty and despair”: Like the Shelley poem, an eight-meter quartzite statue likely depicting Ancient Egyptian ruler Ramses II was unearthed in Mattariya over the weekend. Found in fragments, the statue was excavated from under a low-income district (watch, runtime 0:52). Archaeologists from Egypt and Germany found parts of the colossus and are hoping to move the statue, once restored, to the entrance of the Grand Egyptian Museum, Reuters’ Ahmed Aboulenein reported. The story topped coverage of Egypt in foreign outlets over the weekend, including National Geographic, CNN, and The Guardian.

The Sisi administration’s economic reform agenda is getting some overduerecognition from The Economist. In a piece headlined “Egypt’s economy shows signs of life,” the newspaper (as it insists on calling itself) runs down all the positive steps that have led foreign investors to eye Egypt’s economy, including the devaluation, subsidy cuts, and the eurobond issuance. It stresses, however, that Egypt has a long way to go, with Emirates NBD’s PMI showing non-oil activity decreasing for the 17th straight month, inflation rising, and red tape continuing to be an obstacle to investment. It cites Juhayna’s losses as typical of troubles local firms face and warns that investors will be looking for signs that the government is backtracking on reforms either because of popular opposition or because Zohr coming online eases pressure. The Economist concludes on a positive note that the bitter medicine is starting to work, a far cry from its hatchet job last summer.

Debate over appointment of Anne Patterson plays out in the US press: The controversy over Defense Secretary Jim Mattis’ appointment of former US ambassador to Egypt Anne Patterson to be undersecretary of defense for policy is playing out in the US press. Fox News ran a piece tracing Patterson’s support for ousted Ikhwani president Mohamed Morsi, and the Trump White House’s objections to her appointment — coming at a time when the Trump administration is considering classifying the Ikhwan as a terrorist organization. It shouldn’t be surprising then that Democratic lawmakers are happy about the appointment, praising her credentials and career, the Weekly Standard reports.

Egypt’s relations with Hamas are warming and this is causing concerns to Israel and the Palestinian Authority, Elior Levy and Roi Kais write for Ynet. “There is no doubt that in reality things are changing in relation to Egypt and the strip. The more frequent opening of the Rafah crossing in recent months and the even more recent sending of concrete pumps, despite Israel’s stance on them, is clearly an indication for that,” they write. Levy and Kais say sources said that “Hamas has agreed to two demands by the Egyptian side of the talks: border safety and stopping the passing through the tunnels. However, it did not agree to extradite wanted suspects, such as Saliman Sawarka, who is considered to be a senior member of ISIS.”

Ismail Elshikh, an American citizen from Egypt, joined the state of Hawaii in lodging the first challenge to US President Donald Trump’s executive decision to restrict entry to refugees and travelers from six Muslim-majority countries. The state says Elshikh, an Imam at the Muslim Association of Hawaii whose mother-in-law lives in Syria, is being subject “to discrimination and second-class treatment” along with his family and members of his mosque. The state is arguing the ban violates the constitution, Reuters reports.

Other international coverage of Egypt included:

- Egypt’s Eman Abd El Aty, who was branded the world’s heaviest woman, underwent surgery and lost 100 kg since arriving to India, according to BBC News.

- Egypt has a growth problem, Jahd Khalil writes in City Metric. Khalil says in the longer term, “Egypt may need to learn to break with thousands of years of tradition, and start growing horizontally – east to west, rather than north to south along the Nile. If it can’t, Egypt’s burgeoning cities will choke the fertile farmland of the Nile on which its heritage was built.”

- TheAssociated Press has picked up on the death of two security officers in the line of duty in Sinai.

Worth Watching

Umm Ali is “like heaven on earth”: It is safe to assume that BuzzFeed fell in love with Egyptian food after getting to sample some of our dishes. The BuzzFeed team got to try koshari, a very posh-looking hawawshi, molokhia, and have Umm Ali for dessert. You could hear one of the guys in the video saying joyously after tasting koshari: “Yep, yep, I could eat this everyday” — words you would never hear at Enterprise headquarters given our overlords’ blanket ban on the dish at our offices. Hawawshi, on the other hand, remains the breakfast of champions (runtime 02:08).

Diplomacy + Foreign Trade

The Egyptian-Turkish Business Forum convenes today for the first time in three years to discuss potential investments and partnerships, Al Mal says. 11 Turkish companies are expected to attend.

A delegation of 250 Polish businessmen will accompany Polish President Andrzej Duda during his visit to Egypt during the second half of 2017, Trade Minister Tarek Kabil said, according to Al Shorouk. Last week, President Abdel Fattah El Sisi invited Duda to visit Cairo. Kabil is set to visit the Polish capital this week to discuss increasing economic cooperation.

FAO Director-General Jose Graziano da Silva “expressed his strong support” to Egypt’s efforts to address water scarcity and promote sustainable agriculture, including the 1.5 mn feddan initiative, while visiting Cairo, according to a UN statement.

Energy

10 solar power companies to update feasibility studies for FiT projects after relocating from Zaafarana to Benban

10 solar power companies must update the feasibility studies for their solar power plants to reflect the change in location from Zaafarana to Benban, as required by their various lenders, Al Borsa reports. These companies — which include Enara Energy, Zaafarana Solar, Alef Solar, Arena Energy, MID Energy, and Rah Solar — had requested the transfer to benefit from the government’s cost sharing agreement under the feed-in tariff program. In related news, German companies Ib Vogt and Solizer have reached financial close on a 64.1 MW photovoltaic plant in Egypt in partnership with Infinity Solar, reNews reported. The Infinity 50 solar park in Benban secured 85% of the funding from Bayerische Landesbank and the remainder from the Arab African International Bank. Ib Vogt has started construction and aims to commission the facility in the fourth quarter of the year, it said.

Egypt begins work on exporting power to neighbors

The Electricity Ministry has begun work on electricity interconnection projects with Saudi Arabia, Jordan, Syria, Lebanon, Iraq, Morocco, Libya, Tunisia, and Algeria, in a bid to export the surplus power it is generating, government officials tell Al Borsa. This comes despite reports we noted last week that the electricity interconnectivity grid tender with Saudi has been postponed. The ministry is expecting the country’s surplus electricity to rise to 10 GW from a current 5.5 GW once the Siemens power plants come online at the of the year and will be downgrading the generating capacity at some of its other fuel-intensive power plants once that happens to save up on gas.

Manufacturing

SCZone, Military Production Ministry to set up the largest pharmaceutical production area in the region

The Suez Canal Economic Zone and the Military Production Ministry are cooperating with the Armed Forces Medical Services Department to set up the region’s largest area to produce pharma and medical supplies, Al Masry Al Youm reports. Military Production Minister Mohamed Al Assar said that the ministry is now mandated to manufacture locally the various devices, medical equipment and supplies, whose imports are a strain on the state budget. The ministry announced last week it has two projects in the health sector worth USD 115 mn in the pipeline.

Seven companies apply for new cement licenses

Seven companies have filed papers to acquire cement production licenses from the Industrial Development Authority (IDA), said IDA head Ahmed Abdel Razek, according to Al Mal. Abdel Razek did not reveal the names of the companies. The IDA tendered 14 cement licenses at the end of 2016, but only awarded three (to Egyptian Cement, South Valley Cement, and El Sewedy Cement), and opened tenders for the remaining 11 in January. Aswan Cement had announced last month its intention to apply for a license in a bid to boost its production capacity, while industry players said there is a glut in the market.

Electronics manufacturers backtrack on price reductions after USD strengthens again

Electronics manufacturers have backtracked on announced price reductions due to the USD rate rising again, Industrial Investors Union chairman Mohamed Geneidy tells Ahram Gate without revealing who these companies were. According to Geneidy, banks are only supplying USD for basic commodities, causing manufacturers to struggle to get their hands on enough greenbacks to fulfill their needs. LG said last week it would reduce prices of its home appliances by 9% and home entertainment products by 11% as the EGP strengthened, while Samsung reduced smartphone prices by 25% and announced it would cut 20-22% from television prices until 15 March.

Health + Education

Finance Ministry to complete actuarial study on Universal Healthcare Act before end of March

The Finance Ministry’s actuarial study on the Universal Healthcare Act — which will determine the necessary costs and resources to implement the program — will be completed in March, Deputy Finance Minister Mohamed Maait tells Al Mal. The study should help the government choose the best way to roll out the act in light of rising inflation. The act was expected early in 2017 but had been pushed to the second half of the year due to rising costs. Earlier reports suggested that the plan will be paid for in part through a new tax on cigarettes, alcohol, and automobiles, while employers cover the balance, by paying the equivalent of 3% of each employee’s salary into a healthcare fund and deducting a further 1% of each staff member’s pay cheque.

Social Solidarity Minister approves forming a federation for private school owners

Social Solidarity Minister Ghada Wali approved forming a federation for private school owners, Al Borsa reports. The federation’s formation comes as relations between the Education Ministry and international and private school owners continue to be tense due to the ministry stipulating that schools must get approval from the ministry before raising tuition fees, and hinting at the possibility of imposing caps on tuition.

Real Estate + Housing

15 companies including SODIC, TMG bid for land in New Administrative Capital

SODIC and Talaat Moustafa Group (TMG) are among 15 companies that have submitted bids to buy land in the New Administrative Capital, a source at the company managing the project told Reuters’ Arabic service. The companies submitted financial and technical offers, the source said. The source said the technical bids were evaluated and the financial ones will be reviewed in a month.

Tourism

Ismail cabinet to discuss possibly repealing entry visa price hikes this Wednesday

Tourism Minister has been taking some flak at the ITB Berlin Travel Expo this weekend over the government’s decision to raise entry visa prices to USD 60. Concerns about travel to Egypt were less about security and more about visa fees jumping to USD 60 from USD 25 and reflecting negatively on the sector, according to the South Sinai Governor Khaled Fouda, who attended the show. The Ismail cabinet will be discussing the hike — and the possibility of its repeal — during its weekly meeting on Wednesday, Tourism Minister Yehia Rashed told reporters at the ITB Berlin travel trade show this weekend, Germany’s fvw says. For their part, German MPs reportedly promised to lobby for the reduction of the departure tariff imposed on travel to Egypt, which is currently higher than other competing destinations, according to Al Shorouk.

Telecoms + ICT

CIT Minister heads to US to discuss ICT partnerships

CIT Minister Yasser El Kady is heading to the US tomorrow for a 10-day visit to promote investment in the ICT sector, according to a ministry statement. El Kady is set to meet with the heads of ICT development, research and advisory, and big data management companies to develop partnerships in the ICT industry.

Automotive + Transportation

Auto companies to reimburse distributors for losses incurred during promotional wave

Some auto companies will be reimbursing their distributors for losses incurred after a recent wave of promotions that saw prices slashed by as much as EGP 55k for some brands, Al Mal reports. The amounts will be determined based on an average price calculation and paid in quarterly installments to distributors who paid a higher purchasing than selling price for their stocks. Auto distributors who refused to receive their monthly car stocks from agents will not be eligible for reimbursement, one distributor tells the newspaper. GB Auto. Nissan Egypt, and Kia Motors were among those to discount their prices in late February and early March.

Banking + Finance

Union National Bank to expand in Egypt, open branch in China

Union National Bank, which is 50% owned by the Abu Dhabi government, plans to expand "aggressively" in Egypt by opening more branches this year, CEO Mohammed Nasr Abdeen said, according to Reuters. The bank has 42 branches in Egypt currently. Abdeen also announced that Union National Bank has gotten approval from China’s central bank to convert its representative office into a branch in Shanghai.

Banque Misr looking to borrow USD 600 mn from international institutions

Banque Misr is in negotiations to secure USD 600 mn in funding, Chairman Mohamed Eletreby told Al Mal. Eletreby says Banque Misr is in talks with the African Development Bank, the EBRD, and “some Chinese institutions” and he expects the negotiations to be concluded within months.

Legislation + Policy

EGX tightens controls on “harmful activities” in the market, gives chairman right to suspend trading

The EGX issued executive regulations on Thursday giving the bourse chairman the right to intervene to limit “harmful activities” in the market. According to the regulations, the chairman reserves the right to suspend trading for any market participant under investigation for violating the capital markets law by EFSA for periods of up to one month. The regulations also reserved the right of those who are suspended to appeal the decision.

Egypt Politics + Economics

Mubarak defense team permitted to amend appeal in trial on cutting communications during 25 January revolution

Former President Hosni Mubarak’s defense team will be allowed to re-submit an appeal against a verdict handed down to Mubarak, former Prime Minister Ahmed Nazif, and former Interior Minister Habib Al Adly for cutting electronic communications during the 25 January uprising, Ahram Online reports. The three were fined EGP 540 mn in May 2011 for damages to the economy resulting from cutting communications during the revolution, but appealed the ruling at the time.

National Security

Egypt participates in joint military drills with Bahrain, UAE

Egyptian ground, air and naval forces are participating this week in joint exercises with Bahrain and the United Arab Emirates, Al Masry Al Youm and Ahram Online report.

On Your Way Out

The European Bank for Reconstruction and Development (EBRD) and the EU celebrated the conclusion of the 500th advisory project for small businesses in Egypt under the Bank’s EU-funded Advice for Small Business Program. “SMEs are a priority for the EBRD in Egypt as they are the largest job creators in the country. Up to 90 percent of all employment opportunities come from this part of the economy and this is especially important to reduce youth unemployment. Many small businesses are also run by women and support for these enterprises is crucial,” EBRD Managing Director for SEMED Janet Heckman said. SMEs represent only 5% of Egyptian banks’ lending portfolios, despite the fact that they makeup about 90% of projects in the country, the Deputy Head of the EU delegation to Egypt Reinhold Brender said on Thursday.

The markets yesterday

EGP / USD CBE market average: Buy 17.6662 | Sell 17.7732

EGP / USD at CIB: Buy 17.6 | Sell 17.7

EGP / USD at NBE: Buy 17.5 | Sell 17.6

EGX30 (Thursday): 12,853 (+0.9%)

Turnover: EGP 1.3 bn (195% above the 90-day average)

EGX 30 year-to-date: +4.1%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.9%. CIB, the index heaviest constituent rose 2.1%. The EGX30’s top performing constituents were: Egyptian Iron and Steel up 7.0%, Arab Cotton Ginning up 4.4%, and Ezz Steel up 4.2%. Thursday’s worst performing stocks included Orascom Telecom Media and Technology down 2.9%, Juhayna down 2.4%, and Palm Hills down 2.4%. The market turnover was EGP1.3 billion, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +109.4 mn

Regional: Net Long | EGP +4.8 mn

Domestic: Net Short | EGP -114.2 mn

Retail: 65.0% of total trades | 62.0% of buyers | 68.0% of sellers

Institutions: 35.0% of total trades | 38.0% of buyers | 32.0% of sellers

Foreign: 20.5% of total | 24.8% of buyers | 16.3% of sellers

Regional: 6.5% of total | 6.7% of buyers | 6.3% of sellers

Domestic: 73.0% of total | 68.5% of buyers | 77.4% of sellers

WTI: USD 48.49 (-1.60%)

Brent: USD 51.37 (-1.57%)

Natural Gas (Nymex, futures prices) USD 3.01 MMBtu, (+1.14%, April 2017 contract)

Gold: USD 1,201.40 / troy ounce (-0.15%)

TASI: 6,916.8 (-0.8%) (YTD: -4.1%)

ADX: 4,457.3 (-2.9%) (YTD: -2.0%)

DFM: 3,520.2 (-0.3%) (YTD: -0.3%)

KSE Weighted Index: 422.8 (+0.4%) (YTD: +11.2%)

QE: 10,467.2 (+1.0%) (YTD: +0.3%)

MSM: 5,791.7 (-0.2%) (YTD: +0.2%)

BB: 1,353.6 (+1.3%) (YTD: +10.9%)

Calendar

08-12 March (Wednesday-Sunday): 2017 ITB Berlin, CityCube Berlin, Germany.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

04 April (Tuesday): Emirates NBD Egypt PMI reading for March announced. The report will be available here.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.