- Lekela Power is eyeing investing up to USD 1 bn in Egypt over the next four years. (The Big Story Today)

- The news out of Ukraine today: civilian evacuation attempts and fresh sanctions. (The Big Story Abroad)

- Rising metal prices put further pressure on the automotive sector. (For Your Commute)

- Women all over the world still face laws that bar full economic participation — but here in Egypt, things are improving. (Gender Equality)

- Where does Islam stand on the world of crypto? (For Your Commute)

- Midnight at the Pera Palace follows a journalist who could single handedly change the state of modern Turkey. (On The Tube Tonight)

- The iconic Dolly Parton ventures into book writing, teaming up with James Patterson to create Run, Rose, Run. (Under The Lamplight)

Wednesday, 9 March 2022

PM — What’s the endgame?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy almost-THURSDAY, wonderful people. We have a relatively quiet news cycle here at home, coupled with the mandatory developments on the war in Ukraine as we collectively hold our breaths on more potential knock-on economic effects.

THE BIG STORY TODAY

Lekela Power is eyeing investing up to USD 1 bn in Egypt over the next four years, Al Borsa quoted the renewable energy firm’s general manager for Egypt Faisal Issa as saying. The renewables company inaugurated its USD 350 mn, 250 MW wind farm in West Bakr last November, and said in 2020 that it would funnel most of its investments to Egypt in “the coming period.” Private equity giant Actis, which backs Lekela, did not respond to Enterprise’s request for comment before dispatch time.

CORRECTION + UPDATE- We incorrectly said in the TL;DR section of today’s EnterpriseAM that First Abu Dhabi Bank (FAB) and Abu Dhabi Islamic Bank (ADIB) were considering a potential merger. The story was about a potential merger between FAB and Abu Dhabi Commercial Bank (ADCB). We apologize for the typo — the entry has been updated on our web edition.

The two UAE lenders have also since denied the news altogether, with FAB and ADCB saying in separate disclosures (here and here) to the Abu Dhabi Securities Exchange that media reports of the potential merger are false. FAB “currently has not entered discussions with ADCB to pursue any merger activity,” it said. A transaction would have created the region’s largest banking entity in terms of assets with more than USD 350 bn.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Gov’t weighs price controls to temper rising bread prices: The government could consider introducing price controls on unsubsidized bread through a mechanism similar to how the government regulates fuel prices on a quarterly basis according to global market movements.

- New IMF support program? Analysts at JPMorgan think that there is a “reasonable probability” the Madbouly government will open talks with the IMF on an assistance package to help us get through the fallout from Russia’s war in Ukraine in the event that “market conditions continue to deteriorate.

- Your morning commute isn’t as bad as you think (relatively speaking): Cairo was the 41st most-congested city in 2021, making it less congested than the likes of Paris, Dublin, Osaka, and Athens, with our average annual congestion level dipping one percentage point last year.

THE BIG STORY ABROAD

The news out of Ukraine is focused primarily on civilian evacuation attempts and fresh sanctions, alongside analysis on what the endgame could look like.

ON THE GROUND- Evacuations of civilians in Ukraine resumed this morning after Moscow and Kyiv agreed to set up humanitarian corridors out of some of the worst-hit cities, including Mariupol, Kharkiv, Kyiv, Chernihiv, and Sumy, Reuters reports. However, the corridor out of Sumy appeared to be the only one to open successfully, with local Ukrainian authorities reporting routes out of the other cities saying that Russia has not been abiding by ceasefire agreements.

The choppy evacuation plans come as Ukraine is running low on medical supplies, while Russia is reportedly stepping up attacks on ambulances and healthcare facilities, WHO officials said.

THE ENDGAME? Scholars and analysts suggest that Russia may be forced to go the “full destruction” route in Ukraine to score a victory, while a Ukrainian government official says that Kyiv needs to hold down the fort for another week to 10 days “to deny Moscow any kind of victory.”

ON THE DIPLOMACY FRONT- President Abdel Fattah El Sisi discussed the war in Ukraine with Russian President Vladimir Putin in a phone call earlier today, according to an Ittihadiya statement. El Sisi urged Putin to find a diplomatic resolution to the conflict and offered Egypt’s diplomatic support as part of a unilateral or multilateral mediation effort.

Meanwhile, the UK slapped more sanctions on Russia today, adding an aviation export ban to its list of punitive measures against Moscow. The new sanctions also ban Russian aircraft from flying over or landing in the UK.

Companies in China could also get dragged into the sanctions web if they are found to be “supporting” Russia in defiance of Western sanctions, including supplying Moscow with tech products such as chips, US Secretary of Commerce Gina Raimondo said, according to Reuters.

It takes two to tango, Moscow says: Russia is thinking “seriously” about its response to the raft of sanctions imposed by Western governments, particularly after the US and UK announced overnight they would ban the import of Russian fossil fuels, Kremlin spokesperson Dmitry Peskov told reporters, according to Reuters.

|

FOR TOMORROW- US Deputy Secretary of State Wendy Sherman will be in town for two days this week starting tomorrow. Sherman will meet with Foreign Minister Sameh Shoukry and “other senior officials,” including National Council for Human Rights chief Moushira Khattab.

Inflation figures for February will be released tomorrow: Annual urban inflation hit its highest level in almost two and a half years in January due to rising food prices and an unfavorable base effect.

Our fellow coffee nerds may wish to attend the three-day 2022 National Barista Championship, which gets underway tomorrow at the Egypt International Exhibition Center. Hit up IG for more.

???? CIRCLE YOUR CALENDAR-

Contemporary art and culture center Darb1718 is hosting its 3031 Art Festival until this Saturday, 12 March on its premises in Fustat, Old Cairo.

Green energy forum: The German Arab Chamber of Industry and Commerce is hosting the Egyptian German Green Energy Forum on Tuesday, 22 March. Planning Minister Hala El Said, Vice Minister of Finance Ahmed Kouchouk and German Ambassador Frank Hartmann are among those slated to attend. The event runs 5:30-9pm CLT at the InterContinental Cairo Semiramis.

Interest rates: The Central Bank of Egypt will hold its next monetary policy meeting on Thursday, 24 March.

(Much) further afield: Egypt will host the World Urban Forum in 2024 in cooperation with UN Habitat. Prime Minister Moustafa Madbouly yesterday met with the regional director of the UN Habitat, Erfan Ali, to discuss preparations for the event, the two sides announced (here and here). The forum aims to discuss rapid urbanization and its impact on communities, cities, economies, climate change and policies. This year’s edition will be held in Poland this June.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Tomorrow will be our last semi-warm day before a cold spell, with temperatures to reach 20°C during the day before falling to 10°C at night and staying in the teens until the end of next week, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Automakers just can’t catch a break: The Russia-Ukraine war is pushing up prices of metals — including aluminum, palladium, and nickel — which is expected to hit the automotive industry, which uses these metals to manufacture vehicles, writes Reuters. Car buyers are likely to foot the increase in costs from metals as the auto sector already suffers through the chip shortage, supply chain disruptions, and soaring energy costs — which are also often passed on to the consumer. Aluminum and palladium both hit record highs this week, while nickel’s price doubled to more than USD 100k a tonne, leading the London Metal Exchange to temporarily suspend trading on nickel contracts. The price increase of nickel could deter the world’s EV ambition as the metal is a core component in EV batteries.

Where does Islam stand on the world of crypto? The short answer is that the jury is out on whether the currency and its trading is “halal,” the Washington Post writes. Several religious scholars have issued religious edicts, or fatwas, against crypto, saying that its uncertainty and price fluctuations puts it on equal religious footing with gambling, which is forbidden in Islam. Technoid Muslims argue otherwise, suggesting that crypto provides an accessible alternative to the traditional banking and financial systems (including interest-bearing loans). The debate over crypto and how it meshes with Islamic Sharia is gaining traction s mns in Muslim-majority countries — particularly in Indonesia and the Gulf — begin to invest in the digital assets.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Midnight at the Pera Palace follows a journalist who could single handedly change the state of modern Turkey: The Turkish-language TV show is based on the novel of the same name by Charles King and is a hybrid of time-travel, historical fiction, murder mystery, and comedy. The show follows Esra, a 21st-century journalist and Agatha Christie superfan — who often makes the latter fact known. Esra wants to report on big, important stories but is often assigned fluff pieces instead. This all changes, however, when she inadvertently time travels 100 years into the past and accidentally alters the course of history. Everything Esra has ever learned must now come into play as she single handedly defines what modern-day Istanbul will look like. Actress Hazal Kaya provides an interesting take on the main character, giving her a goofy and often ditsy demeanor that makes her task all the more difficult, but still shows enough emotional intelligence to make the character relatable and loveable. Midnight at Pera Palace is currently trending in Egypt, making it to Netflix’s top 10 list for the country.

⚽ Today in the Champions League: Real Madrid hosts Paris Saint-Germain in the second leg of matches between the two teams after the last game ended with the victory of the French team thanks to a goal bearing the signature of its star Kylian Mbappe. Meanwhile, Manchester City is also meeting Sporting Lisbon once again following a 5-0 victory for the citizens during their away match in Portugal. The two matches kick off at 10pm.

Egyptian fan favorite Liverpool has qualified for the quarter-finals, despite losing at home to Inter, who scored one goal yesterday. Mo Salah’s team will now face Bayern Munich, who also qualified after beating RB Salzburg by a whopping 7-1 last night.

In the Egyptian Premier League: Ghazl El Mahalla are currently playing against Future as we dispatch. Meanwhile, El Gaish faces Al Masry at 5:30pm.

???? OUT AND ABOUT-

(all times CLT)

Bardo Clubhouse is hosting a listening event featuring music by artists Onsi and Ismael as well as the sound project Mūghazi. They will be accompanied by Castell Lanko, a Cairo-based multidisciplinary new media artist who uses mesmerizing visuals to tell her stories.

Massar Egbari are performing today at Cairo Jazz Club 610 at 9pm.

???? UNDER THE LAMPLIGHT-

The iconic Dolly Parton ventures into book writing, teaming up with James Patterson to create Run, Rose, Run. The novel follows Annie Lee (aka Rose), a young singer-songwriter who aims to make it big in Nashville, Tennessee. Rose only has a backpack to her name and has to convince a bartender to lend her a guitar to perform on stage. When given the chance, she wows the audience and is soon taken under the wing of megastar Ruthanna Ryder. From there, it’s the fast track to the top — with all the twists and turns that come with sudden fame. Parton’s storied career in entertainment comes in handy in painting a realistic picture of what it’s like in the industry… as well as how the past often comes back to haunt you.

???? GO WITH THE FLOW

EARNINGS WATCH-

Misr Fertilizers Production Company (Mopco) saw its bottom line rise 92% y-o-y in 2021 to EGP 4.79 bn, according to its financials (pdf). Meanwhile, Mopco’s sales increased around 40% y-o-y last year to EGP 10.3 bn.

MARKET ROUNDUP-

The EGX30 rose 0.2% at today’s close on turnover of EGP 864 mn (7.8% below the 90-day average). Foreign investors were net sellers. The index is down 12.8% YTD.

In the green: Rameda (+4.2%), Cleopatra Hospital (+3.6%) and AMOC (+3.5%).

In the red: e-Finance (-2.9%), Orascom Construction (-2.5%) and Telecom Egypt (-2.3%).

???? GENDER EQUALITY

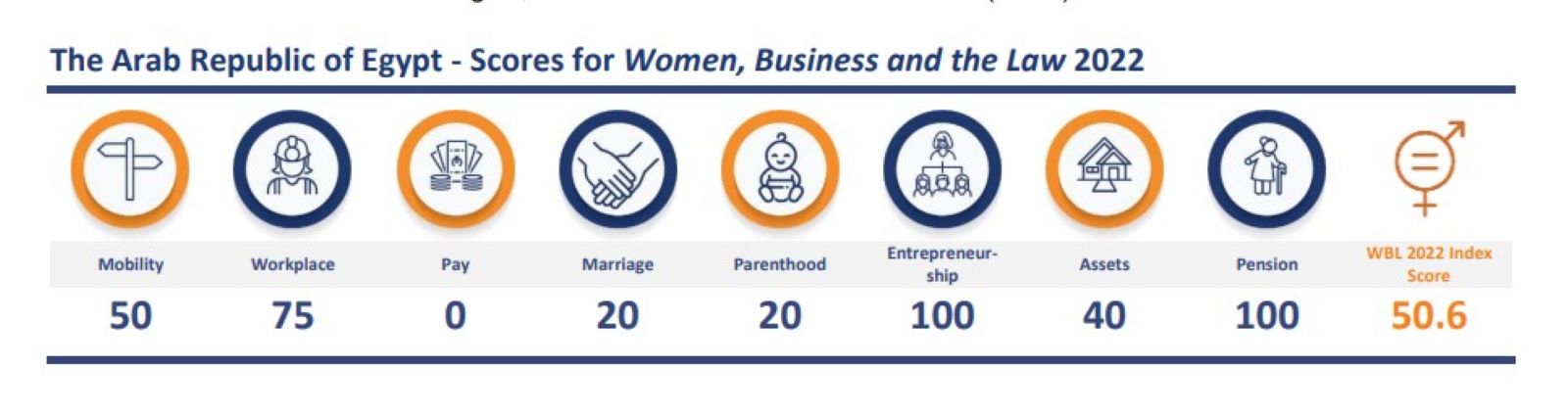

A new World Bank report serves up hard facts about laws that continue to bar women’s economic participation. There are about as many ways to address gender inequality as there are women in this world (some 3.8 bn). If your social media feeds are anything like ours, you’ll know that squeezing them all into one International Women’s Day can result in a cacophony of opinion that leaves us even less sure of where to go from here. The World Bank’s Women, Business and the Law 2022 (pdf) report cuts through the noise. The survey of 190 economies aims to answer one key question: To what extent to discriminatory laws continue to prevent women from “fully and equally contributing” to their economies?

Newsflash: Most women still don’t enjoy equality under laws that impact economic prospects. The report gives countries a mark out of 100 for parity between men and women in eight key areas “structured around the life cycle of a working woman”: mobility, workplace, pay, marriage, parenthood, entrepreneurship, assets, and pensions. The global average score was 76.5 — up just half a point on last year’s report. Only 12 countries got a perfect score on all fronts.That means the average woman enjoys only three-quarters of the rights under law of a man in the areas measured, while some 2.4 bn women of working age worldwide live in countries where the law does not grant them equal economic rights.

Here at home, we’re making progress — but there’s still a long way to go. Our score improved for the first time since 2016, rising by a significant 5.6 percentage points to record 50.6. Nevertheless, that still means Egyptian women enjoy only about half the rights of men in areas that impact economic participation. The report ranks us 171st out of the 190 countries assessed, and below the MENA average of 53.0 — which itself was the lowest score of any region.

What’s improved for Egyptian women? Our score on marriage laws went from a dismal 0 to 20, after we introduced our first-ever legislation (pdf) specifically addressing domestic violence. Meanwhile, a central bank circular (pdf) last year “made access to credit easier for women by prohibiting gender-based discrimination in financial services,” the report’s Egypt snapshot (pdf) says, pushing our entrepeneurship score from 80 to a perfect 100.

Where we continue to do well: We’re still doing a good job on workplace rights, where our score of 75 is unchanged thanks to legislation in place prohibiting workplace [redacted] harassment and discrimination in employment based on gender. Our perfect score on pensions also remains in place, due to men and women getting the same pension benefits and having the same retirement age.

And where could we be a whole lot better: Egypt’s worst area is pay, where we still score a big fat zero thanks to a lack of laws mandating equal pay for equal work, as well as restrictions on women working in the same way as men at night, in jobs deemed dangerous, and in the industrial sector — a state of affairs the report says we “may want to consider” changing.

There’s also room for improvement in laws affecting marriage, parenthood, mobility, and assets. Divorce and remarriage rights remain unequal, sufficient maternity and parental leave is yet to be enshrined in law, women still face restrictions on movement (including unequal procedures to obtain a passport), and equal inheritance rights remain elusive.

Expect to see Egypt make further progress in next year’s report: The draft Labor Act, which got the greenlight from the Senate in February, will increase paid maternity leave to four months from the current three months. That should tick off a key measure in the report’s parenthood gauge, which gives points for countries that mandate paid leave for mothers of at least 14 weeks.

Elsewhere in the region: MENA came in last place of the seven regions surveyed — but it was also the report’s best improver, with countries in the region enacting ten of the 39 law reforms that improved women’s economic rights last year. Some 25% of MENA economies implemented at least one reform, pushing the regional score up by 1.5 points. That said, women in MENA continue to face some of the most entrenched barriers to economic participation, with 11 countries in the region placing in the bottom 20 worldwide. Coming in very last place globally was the West Bank and Gaza, with a score of 26.3, while Yemen and Qatar also came in with scores under 30.

On the bright side: We may experience more gender equality in practice than is enshrined by law. This year’s report newly surveys local experts on gender inequalities, in an attempt to measure the gap between the letter of the law and the way it’s implemented in practice. MENA “is the only region where expert opinions indicated more gender equality in practice than the index implies,” with Egypt and Oman registering the largest positive difference.

Why does this matter? Apart from being plain wrong, persistent gender inequality has a pervasive economic impact. Globally, the difference between men’s and women’s total expected lifetime earnings is USD 172.3 tn, or twice the world GDP. The report’s argument is that only by supporting women to work, own assets and businesses, make their own decisions about marriage and mobility, and access childcare, can we hope to produce truly resilient economies.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will

replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

9-18 March (Wednesday-Friday): The annual Cairo International Fair.

15 March: The first edition of Export Smart at Royal Maxim Palace Kempinski

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

22 March (Tuesday): Egyptian German Green Energy Forum, 5:30-9:30pm CLT at the InterContinental Cairo Semiramis.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): GB Auto Extraordinary General Assembly (pdf).

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.