- Mystery men who accidentally deactivated New York bomb before making off with luggage identified as Egyptian tourists (Speed Round)

- Ahmed Ezz makes a compelling case for a little bit of economic optimism. (Speed Round)

- Government to complete studies on capital gains tax in 1Q2017 (Speed Round)

- OPEC agrees to modest oil output curbs in first agreement since 2008 (Macro Picture)

- Egypt up one place on the World Economic Forum’s Global Competitiveness Report. (Speed Round)

- House ICT committee to regulate ride-sharing apps, online privacy; El Sisi signs one-year tax dispute resolution act into law. (Speed Round)

- Why did Wael Fakharany leave Google? Fear, hunger and dissatisfaction. (Worth Reading)

- By the Numbers

Thursday, 29 September 2016

Mystery men who accidentally deactivated bomb in NYC (before making off with the bag in which it was left it) were Egyptian — and possibly EgyptAir pilots.

TL;DR

What We’re Tracking Today

On our reading list this morning: Steel tycoon and former Mubarak-era NDP operative Ahmed Ezz makes a lot of economic sense in a letter he penned for Al Masry Al Youm arguing for economic optimism. Love the man (as many do) or loathe him (as many do), the piece is worth reading. His primary point is that everything is relative to the size of the economy. Egypt’s budget deficits have historically been over triple their current ratios to GDP, ditto the debt levels, which were at over 200% in the late 1980s (just after Ezz escaped his phase as a drummer in a 1980s rock band).

Increasing the GDP growth rate is key now, Ezz argues, saying that achieving a growth rate of 8% annually would automatically decrease the budget deficit by a quarter within two years, expand the Egyptian economy by a third in four years, and double its size within a decade. He also quashes the infamous myth that Egypt is perpetually on the verge of default, noting the facts that Egypt overwhelmingly borrows domestically and in EGP — with comparatively little reliance on foreign funding. Ezz also says letting the EGP’s value fall closer to the real exchange rate will improve economic activity significantly, despite the immediate price impact, which would taper over time while improving real income levels. H/t Marwan S.

Also on our reading list: Answers to 108 frequently asked questions about the value-added tax, as published by the Ministry of Finance. We’re still waiting for the executive regulations within about a week’s time (give or take — we’d imagine the Finance Ministry getting an extra couple of days due to Islamic New Year and Armed Forces Day). That having been said, the FAQ is a start and tackles the tax from the viewpoint of both the consumer and of business, giving some reasonable hints as to where certain questions might break in the exec regs. You can read the full FAQ in Arabic here (pdf).

The document was released as Deputy Finance Minister Amr El Monayer says the government is working on a marketing campaign to increase awareness about the number of goods and services that are now taxed at a lower rate. The government is also holding meetings with banks to clarify the treatment of non-banking activities under the law.

The FAQs appear to not be enough for the Egyptian Tax Experts Group which is stating that many major elements of the VAT need further clarification and must be addressed in the executive regulations, Al Mal reports. Issues the group notes include the amendments to contracts that stipulate that taxes are included. This could impact contracts signed with foreign developers working on key national projects, said the group’s head, Ashraf Abdel Ghany. The organization is also very critical of the application of the tax retroactively as this would severely impact many business with preexisting contracts and have conducted financial and feasibility studies on a number of projects, which must now be redone.

Administrative Court to issue ruling on appeal of its decision to void Tiran and Sanafir agreement today: The country’s High Administrative Court will reportedly issue a ruling on the government’s appeal of the court’s initial decision in June that voided a border demarcation agreement with Saudi Arabia, Al Borsa reports.

Russian nuke talks: The head of Russia’s state nuclear corporation Rosatom, Sergey Kiriyenko, is expected in Cairo today for talks on the Dabaa nuclear power plant, Russian state news agency TASS reported.

This is probably a long weekend, with Sunday off in observance of Islamic New Year — but we may well not find out until Saturday evening for certain. Your HR team has their own sources, and if you run a smaller shop, check in with your banker or broker this afternoon, as the odds are good the CBE and / or EGX will say something today. The following weekend is also a three-day break, as we’re off on Thursday, 6 October for Armed Forces Day.

On The Horizon

Russia is due to lift its ban on imports of fruits and vegetables from Egypt, excluding potatoes, starting Saturday, 1 October, according to Russian state watchdog Rosselkhoznadzor speaking to Russian state news agency TASS on Tuesday. We noted on Tuesday that the ban was to be lifted following the dispatch of an Egyptian delegation on Sunday, though the exact date had yet to be confirmed at the time. The ban has been in place since 22 September. Egypt’s Agriculture Export Council will hold a meeting with Egyptian exporters on Sunday to explain to exporters the conditions for allowing exports, which include international certifications for produce and meeting international quality control standards, Al Mal reports.

Meanwhile, Agriculture Minister Essam Fayed has issued orders to enforce Russian quality standards on potato exports. Russian food safety regulators had pointed to the prevalence of the potato tuber moth in Egypt’s exports, Al Shorouk reports.

The upcoming annual meetings of the IMF and World Bank Group will be make or break for the economy. Finance Minister Amr El Garhy and Central Bank Governor Tarek Amer are due to attend the 7-9 October gathering at the head of a government delegation that will also include International Cooperation Minister Sahar Nasr and Planning Minister Ashraf El Araby. The aim: Secure IMF executive board approval for the USD 12 bn extended fund facility they negotiated in Cairo with local IMF staff. Government sources tell Al Masry Al Youm the delegation will arrive in DC on 5 October to start laying the groundwork.

Egypt, Greece and Cyprus will hold a tripartite summit on 11-12 October, following PM Alexis Tsipras’ expected visit to Egypt on 9-12 October, Al Masry Al Youm reports.

Can we make it 12 in a row? The Emirates NBD/Markit purchasing managers’ indices for Egypt, Saudi Arabia and the UAE are out at 6:15 am CLT. The Egyptian gauge has deteriorated for 11 straight months through September.

Speed Round

FROM EGYPT WITH LOVE: The two previously unidentified men captured on surveillance footage discovering and accidentally deactivating one of Ahmed Khan Rahami’s pressure cooker bombs in Manhattan before making off with the luggage he had left it in have been identified as Egyptian tourists, according to local New York media sources early this morning. “They were staying at a Manhattan hotel and were strolling on West 27th Street when the floral patterned luggage containing the device caught their eye,” local New York outlet DNA reports. “They inspected the suitcase, opened it and left the pressure cooker on the curb, apparently dislodging a flip phone that was attached to the bomb as a triggering mechanism,” according to unnamed sources. “They then walked off with the luggage and have been sought ever since, apparently unaware of their unwitting role in the international terrorist event.”

This story, however, is further complicated by reports that the tourists are believed to be EgyptAir pilots. The two men are wanted by American authorities for questioning in their capacity as witnesses and are not suspected to be involved in the plot. However, the wider dissemination of the story and the detail that the men in question are believed to be pilots — who did not report the unattended bag, nor were they able to identify a bomb when holding it in their hands — could reflect poorly on the country’s airport staff. Think about it: What’s the first question anyone is asked by airport security? “Did you pack your bag? Did you leave your bag unattended? Did anyone ask you to carry this bag?”

THE FUTURE OF CAPITAL GAINS TAX on stock-market gains: The government is set to complete studies on the capital gains tax in 1Q2017, Deputy Finance Minister Amr El Monayer told Reuters. El Monayer says the main point behind the evaluation is to look at whether the tax was suspended for two years on merit or just due to market factors at the time. The ministry is currently reviewing the reasons that led to its suspension in 2015 following backlash from investors, with El Monayer claiming problems could have stemmed from the principle of the tax, the legislation, the method of its implementation or just weak marketing in general. The 10% tax on gains made on the EGX was announced in 2014, and subsequently suspended in 2015 for two years after complaints from retail investors, but the suspension is set to expire on 16 May 2017. The IMF had criticized Egypt’s decision to delay collection of the tax, but El Monayer denied that an IMF delegation demanded its return during their visit a couple of months ago.

We were never backers of the CGT on stock-market profits. And El Monayer — a competent professional on a competent team at Finance, led by a competent minister — wasn’t in office when the whole imbroglio when down. But we were even less happy with the message sent by the measure having been “stayed” for two years. Setting it aside while leaving in place a levy on dividends rewards the speculation of day-trading retail investors whose contribution to the real economy is zero, while limiting upside for entrepreneurs and business owners who create jobs and meaningful growth. El Monayer and his colleagues deserve credit for having the political foresight to tackle the issue openly and in public.

EGYPT UP ONE PLACE on the World Economic Forum’s Global Competitiveness Report 2016-2017: Egypt came in 115th globally out of 138 countries in the WEF’s Global Competitiveness Report 2016-2017 (pdf), up one place from last year. Policy and government instability, as well as access to funding and FX regulations, were the biggest challenges to doing business in Egypt. The nation can take advantage of its large market (ranked 25th globally), as well as its close proximity to the European market in order to “step up its reform efforts and address the major rigidities that plague goods, labor, and financial markets, on which the country ranks 112th, 135th and 111th, respectively,” the report suggests. Switzerland, Singapore, and the United States cemented their status as the most competitive markets globally, while Chad, Mauritania, and Yemen were the least competitive.

From the missed opportunities department: In related news, Morocco — which ranks 70th on the index and whose automotive industry (non-existent a generation ago) now outpaces ours — has signed an agreement with Boeing to boost the kingdom’s aeronautics industry. “The ‘Boeing ecosystem’ project aims to bring around 120 suppliers of the company to help raise Morocco’s aeronautics exports by [USD 1 bn] and create 8,700 jobs,” Reuters says.

THE EGP CONTINUED TO PLUNGE in the parallel market Wednesday, with greenbacks changing hands for EGP 13.25 per USD 1, Al Mal reports. Traders attributed the declining value of the EGP on the parallel market to a market expectation of devaluation.

REGULATING UBER, ONLINE PRIVACY: The House of Representatives’ ICT Committee is planning to draft legislation to regulate car-hailing apps including Uber and Careen, said the committee’s chair May El Batran, Al Borsa reports. She proudly and shamelessly takes credit for getting ride-sharing apps to incorporate taxi drivers into their business model. The committee’s agenda also includes plans to draft a data security law — not to protect citizens’ privacy, it seems, but to spur the creation of new businesses working in that particular field. The committee is also working with the ICT Minister on amendments to the Telecommunications Act, she said, stopping short of saying what those might be.

Meanwhile, President Abdelfattah El Sisi has officially signed into law the Taxation Disputes Resolution Act, which aims to expedite the settlement of tax disputes with the government, Al Shorouk reports. As we noted earlier this month, Finance Minister Amr El Garhy had stated that the law will only be in effect for one year, meaning it’s a one-time bid to break the backlog of cases and not a permanent measure. El Sisi also signed into law the bill that would impose lengthier sentences for involvement in FGM cases, the newspaper reports. Parliament had approved the decree designating FGM a felony and raising the penalty up to 15 years or a life sentence (in some cases) in late August. El Sisi also ratified the controversial Church Construction Act, which restricts the size of churches to a proportion of a district’s Christian population.

Moody’s issued their Annual Credit Analysis on the Government of Egypt (pdf) on Wednesday. There isn’t that much that’s new here that wasn’t discussed in the Moody’s roundtable we attended and wrote on in yesterday’s issue, but some key highlights include:

- Moody’s projects Egypt’s real GDP growth to average 4.2% from 2016-2020

- Negative net export growth contribution for the coming years driven in part by weak global demand for Egyptian exports

- For FY16, Moody’s expects a fiscal deficit of 13% of GDP compared to the deficit target of 8.9% of GDP

- Moody’s estimates total FDI inflows for FY16 to reach 2% of GDP, up slightly from 1.9% in FY15

- Moody’s projects inflation in FY17 to average 12.5%, up from the average of 10.2% in FY16

RUSSIAN TOURISTS WILL NOT GET an exclusive passenger terminal at Hurghada Airport, said the airport’s general manager has said, according to a report in Russia’s Sputnik. An unnamed source from the Civil Aviation Authority had earlier told Youm7 that Terminal Two would be allocated exclusively for Russian flights at the request of a Russian security delegation; that story was also picked up by Pravda. The source had also said that flights from Russia to Hurghada are reportedly set to resume in October, with charter flights due to restart in November. There’s been no confirmation or denial on the last point, and the same source is claiming that the Russian security delegation was basically satisfied with security procedures at Hurghada airport. We had noted yesterday that an agreement to resume flights from Russia is imminent, albeit gradually and with provisions on security measures that Egypt must guarantee.

EGYPTIAN STARTUP FARMINAL wins in France: Dairy farm management technology solutions company Farminal’s founder and CEO Waleed Sorour won French competition Agreen Startup for innovation in agroecology in Châteaudun town in northern France, where eight teams were competing, L’écho Republicain reported (in French). He was one of the 23 winners of last year’s French Tech Ticket startup competition.

FAMILIES OF 9/11 VICTIMS CAN SUE KSA: The US Congress overrode on Wednesday US President Barack Obama’s veto on a bill that would allow surviving relatives of victims of the 11 September terror attacks in the US to sue Saudi Arabia, in what is the first override of one of Obama’s vetoes ever, Reuters reported. The law creates an exception to sovereign immunity in the case of terrorism committed in the United States, allowing families to seek damages from the Saudis. The law could have a number of unintended consequences that compromise American national security, according to the US Secretary of Defense Ash Carter among others. However, the newswire notes that “some lawmakers who supported the override already plan to revisit the issue,” as President Obama himself explained what could have served as the rationale behind the Congress’ vote: “If you’re perceived as voting against 9/11 families right before an election, not surprisingly, that’s a hard vote for people to take.”

OTHER STORIES worth noting this morning, at home and abroad, include:

- Veteran finance writer Patrick Werr skips devaluation this week to discuss the New Administrative Capital, writing for the National in Abu Dhabi that it is “potentially an admirable idea – but one fraught with many a pitfall.”

- BlackBerry isn’t going to make physical devices anymore (coverage here and here), but the company’s CEO told a reporter that its once-loved physical keyboards will live on.

- If you’re a banker and tech geek (or a nerd who likes banking), you’ll want to read John Gapper’s column in the Financial Times (paywall) on why Deutsche Bank and Twitter have a lot more in common than you’d think.

- 204 people are now confirmed dead, including a 4 year-old child, in last week’s migrant ship capsizing, according to an emailed statement from the International Organisation for Migration. Egyptians accounted for 119 of 162 survivors and at least 92 of the 204 dead.

CORRECTION- Sigma Capital contacted us to say they are not currently involved in talks with DBK Pharma regarding the rendering of advice towards the relisting of the said company on EGX. Al Borsa had cited unnamed sources in reporting that Sigma and Pioneers were the frontrunners DBK Pharma is considering as advisors for its EGX listing. H/t Khaled H.

The Macro Picture

OPEC agrees to modest oil output curbs in first agreement since 2008: OPEC agreed on Wednesday to make a small cut to output, in the first such agreement of its kind since 2008, Reuters reported. While oil prices jumped at the news, the proposed cuts of around 700k barrels of oil per day is not nearly as significant as the very fact that Saudi Arabia and Iran were able to reach a consensus in the first place. “OPEC made an exceptional decision today… After two and a half years, OPEC reached consensus to manage the market,” Reuters quoted Iranian Oil Minister Bijan Zanganeh as saying. The sticking point is that each country will define its production levels at the next OPEC meeting in November, which will be attended by non-OPEC members including Russia.

Egypt in the News

DRIVING INTERNATIONAL COVERAGE OF EGYPT this morning: News that the duo that unwittingly disarmed a bomb in Manhattan were not only Egyptian, but quite possibly EgyptAir pilots. The story is getting pickup on the wires as well as original coverage in the Wall Street Journal and New York Times.

Authorities at the maximum security Scorpion Prison are alleged to routinely abuse inmates, a practice that is believed to have led to deaths, according to a Human Rights Watch report. Staff beat inmates, isolated them in cramped “discipline” cells, cut off access to families and lawyers, and interfere with medical treatment, the 80-page report ‘We Are in Tombs’: Abuses in Egypt’s Scorpion Prison alleges. The piece has led Al Jazeera to dub Al-Aqrab as “Egypt’s Guantanamo.”

Reform plans will spell a rise in inflation and erode domestic incomes, with the brunt of these fiscal pains borne by the 30 mn Egyptians living below the poverty line, an analyst writes for the Financial Times’ Beyond BRICS blog (paywall). The IMF agreement only vaguely mentions “strengthening the safety net to protect the vulnerable during the process of adjustment,” he says.

General Manager of Al Arabiya television Abdulrahman Al Rashed doesn’t have many kind words to say about Egypt’s stance on Syria in his latest op-ed for Asharq Al Awsat, of which he is the former editor-in-chief. “Not many people are interested in the official statements made by the Egyptian Foreign Minister Sameh Shoukry that some portrayed as being biased towards Bashar Al Assad’s regime,” he writes. “What is the impact of the statements? At a time when the Syrian sky is congested with dozens of Russian and US fighter jets, and there are thousands of troops and Iranian mercenaries on its soil, these statements add nothing at all.”

WaPo picks up on Egyptian host’s support for murder of Jordanian writer: The Washington Post took note of Alhadas Alyoum TV host Hani Nahhas’s declaration of support of the recent assassination of Jordanian author Nahed Hattar. Nahhas said that the writer deserved to “now stand trial in God’s court” for sharing an allegedly blasphemous cartoon, titled “the God of Daesh.” Egyptian blogger Nervana Mahmoud subsequently declared his murder as a triumph of “religious escapism” and “political manipulation.”

Amira Salah, writing for the Africa Report, questions whether a fintech revolution is imminent in Egypt, especially with the rise of startups such as Fawry and Feloosy. “Egypt needs fintech […] since our financial markets are not properly regulated at the level of payments and ecommerce -all of it is more informal, so any solutions would boom,” said RiseUp summit founder Abdelhameed Sharara. However, Salah adds that access to finance and the complex regulations that govern the financial system in Egypt could stand in the way.

Worth Reading

It came about because of fear, hunger and dissatisfaction: Wael Fakharany, Managing Director of Careem Egypt, penned a piece on why he chose to leave a nine-year career at Google, culminating in a run at Google X conceptualizing solutions to problems that still didn’t exist. “The fear of feeling I had settled for what was a safe and cushiony option, having never gambled on a bet of my own,” he says. “The hunger for making a bigger dent than I already have,” he added, and the dissatisfaction with the view that we as a region were not seen as able to create a multi-bn USD company that could provide service just as good as — if not better than — a global giant. (ReadWael Fakharany’s Why I left Google to join Careem)

Image of the Day

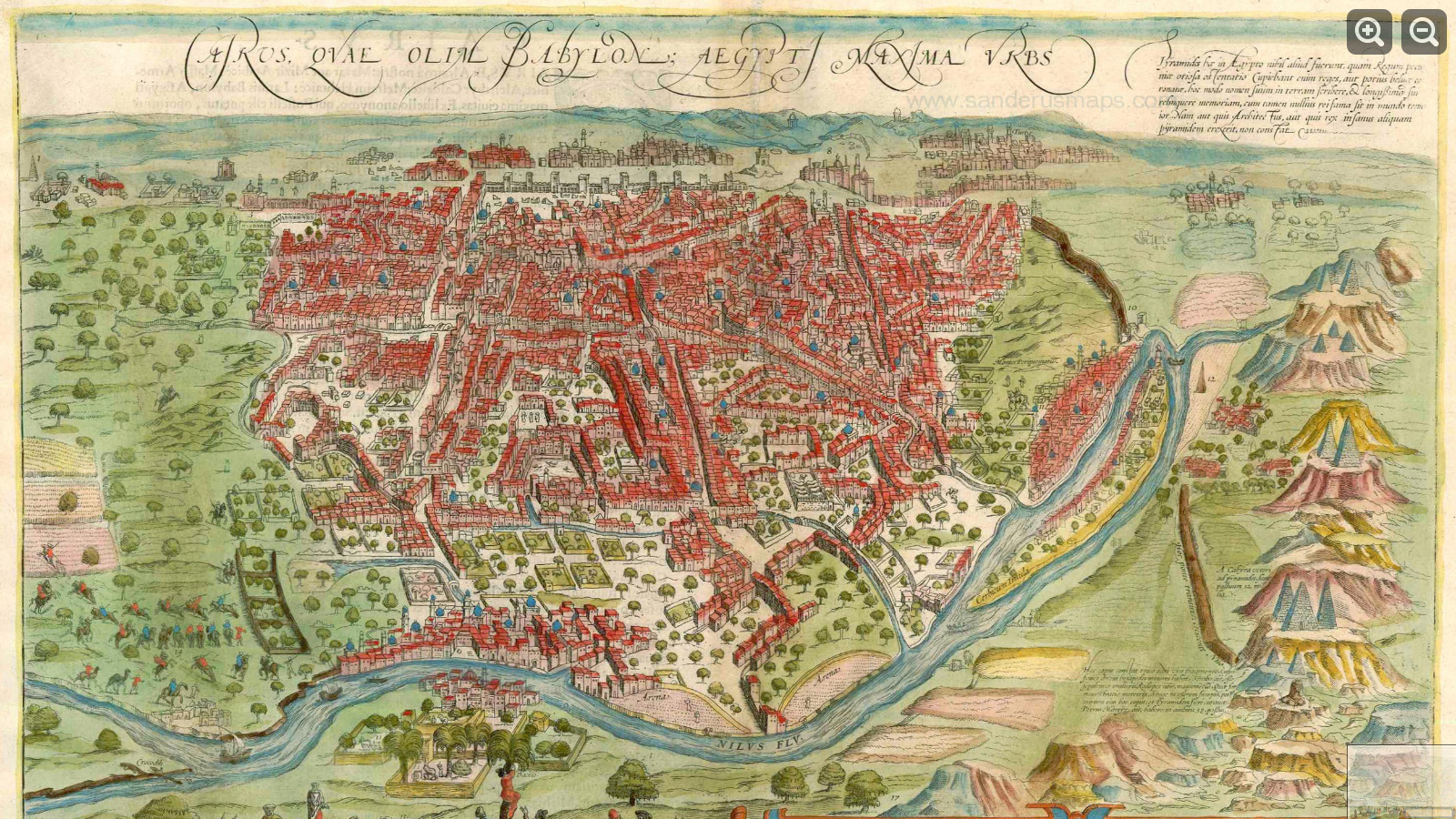

Cairo, 1593: This map comes from the Civitates orbis terrarum, an atlas of cities around the world, first published in Cologne in 1572 until its final volume in 1617 by German cartographers Georg Braun and Frans Hogenberg. The Cairo map appeared in more or less the same presentation throughout the various editions.

The translation of the text accompanying the map reads in part: “Cairo is said to number 30,000 houses altogether. There are very many princely palaces and temples here, but also many hospices, schools and baths and large buildings containing the tombs of important persons.” And it would seem Cairo has had traffic jams since at least the 16th century: “The streets contain such a throng of people, horses and mules that it is not possible to pass without obstacle.” Lastly, on the clothing of its inhabitants, according to Braun: “The women, too, wear trousers, made of silk, trimmed with pearls and precious gems, like the men.” Clicking or tapping on the above image will link to its source from the Belgian gallery Sanderus Antiquariaat, where one may zoom in for slightly more detail.

Worth Watching

Footage of scuba diving in Hurghada, featuring the Numidia and El Mina wrecks and hammerhead sharks. Best viewed in HD; depending on your automatic settings you may need to set them manually. You may also want to turn down the audio a bit on the easy listening soundtrack. (Watch, running time: 6:32)

Diplomacy + Foreign Trade

The Trade and Industry Ministry is scaling down its presence in trade shows abroad due to FX constraints, Al Borsa reports. As such the ministry will be severing its contracts with companies hired to manage Egypt’s trade exhibitions, who are incensed at the decision. Proliferating the use of trade shows was a feature of the government’s policy to grow exports and gain recognition for Egyptian products in foreign markets.

US announces more funding for programs helping Syrian refugees in Egypt: The United States announced it is providing more than USD 364 mn in humanitarian assistance in response to the war in Syria, according to a release for the US embassy in Cairo. The US is increasing its funding in Egypt by nearly USD 5 mn, bringing the total amount spent since FY2012 to USD 112 mn, to improve protection and assistance to 118,000 Syrian refugees in Egypt. The funding “enables humanitarian partners to expand assistance in major refugee-hosting cities such as Cairo and Alexandria with community-focused projects for refugees and host families in an effort to address the deteriorating protection environment.”

Egypt and Indonesia plan to sign a number of MoUs and agreements in the healthcare, environmental, and agricultural sectors at an as of yet unscheduled Egyptian-Indonesian summit, according to statements by International Cooperation Minister Sahar Nasr in her speech at the 71st anniversary of Indonesia’s independence, Al Ahram reports.

The Social Fund for Development is in talks with the World Bank and the EU to renew USD 290 mn in grants for employment programs that are set to expire in 2017, said the head of the fund’s human development division Medhat Masood, according to Al Mal.

Energy

NI Capital contacts domestic investment banks for feasibility studies on IPO of 10 oil companies

NI Capital has contacted investment banks to prepare studies on 10 state-owned oil companies for potential IPOs or for follow-on offerings of equity, unnamed sources told Al Mal. The companies include Enppi, Petrojet, MOPCO, the Alexandria Mineral Oils Company, Abu Qir Fertilizers, and Sidi Kerir Petrochemicals.

Five companies apply to import natural gas

Five private companies have applied to EGAS for a license to import natural gas, unnamed sources told Al Shorouk. The five companies include two domestic operators that were unnamed, as well as Italy’s Edison, the source added.

Basic Materials + Commodities

Egypt, Sudan to hold talks on ban on Egyptian agricultural exports in October

Egypt will hold talks with Sudan on the lifting of a ban on Egyptian agricultural exports at the upcoming Egyptian-Sudanese High Committee meeting in October, said Aly Al Laithy, head of the Egyptian Commercial Service office, Al Mal reported. We had previously noted that Sudan’s Ministry of Foreign Trade has reportedly temporarily banned the import of Egyptian fruits, vegetables, and fish until inspections and testing is completed.

Manufacturing

Housing Minister meets with UK Trade Envoy

Housing Minister Moustafa Madbouli reportedly met with UK Trade Envoy to Egypt Jeffrey Donaldson to discuss plans to build a ready-made concrete plant in the SCZone to serve construction of the New Administrative Capital, Al Shorouk reported.

Health + Education

Saudi German Hospitals to open a branch in Alexandria

Saudi German Hospitals Group, broke ground on its Alexandria hospital complex on Wednesday, Al Mal reports. The hospital is scheduled for completion in 2020. The complex, which the newspaper is claiming is the largest in the country, will include a main hospital and six specialized clinics.

EBRD invests USD 50 mn in Jordan’s MS Pharma

The European Bank for Reconstruction and Development (EBRD) is investing up to USD 50 mn into an equity stake in Jordan-based MS Pharma. The EBRD funding will allow MS Pharma “to expand its operations in the region, including the purchase of a brownfield pharmaceutical plant in Turkey as well as further support its operations in Jordan.”

Tourism

JWT launches Egypt promotional campaign in 12 markets

JWT are launching Egypt’s largest-yet promotional campaign targeting 12 different markets at a total cost exceeding USD 20 mn, JWT Egypt CEO Hani Shoukry told Al Masry Al Youm. The campaign’s strategy involves inviting documentary filmmakers to visit different destinations in Egypt including Ras Sedr, Gouna, Marsa Alam, and Cairo.

Tatweer Misr sign hotel management contract with Six Senses for Il Monte Galala

Real estate developer Tatweer Misr has signed an MoU with Six Senses to manage a hotel that will be built at the company’s Il Monte Galala resort in Ain El Sokhna at a cost of EGP 1 bn, Tatweer Misr Managing Director Ahmed Shalaby told Al Mal. Tatweer Misr chose Six Senses to promote a natural therapy hotel, he added, noting that it will be the company’s first hotel in the MENA region. The hotel is expected to launch in 2022, said Shalaby.

Telecoms + ICT

CPA raises concerns that MNOs are setting conditions on additional airtime offered in pricing of recharge cards

The Consumer Protection Agency (CPA) is opposed to some of the conditions that mobile network operators have placed on additional minutes of airtime it is offering as part of the 10% increase in prices of mobile recharge cards, Al Borsa reports. MNOs have reportedly restricted the additional airtime usage to calls made to their own networks, CPA’s head Atef Yakoub believes that MNOs do not have the right to impose such restrictions on consumers which could constitute “profiteering on taxes,” a crime carrying a 5-7 year prison sentence. Yakoub has raised these concerns with the National Telecommunication Regulatory Authority (NTRA). As we noted earlier this month, the NTRA and MNOs have reached an agreement to raise the price of phone recharge cards 10%, 6 ppt of which will go towards the value-added tax (VAT), while the remaining 4 ppt will go to the consumer in the form of additional airtime. On a related note, retailers of these cards are reportedly continuing to raise prices well above the new pricing system in the absence of a clear mechanisms that factor in their profit margins, according to the newspaper.

Banking + Finance

EuroMena Funds to invest USD 30 mn in Egypt

The EuroMena Funds (sponsored by the Capital Trust Group) is planning to invest USD 30 mn in Egypt in the next four years, Executive Director Gilles de Clerck said, Al Mal reported. Plans for the investment have not been finalized yet, however, as they depend on investment and climate and the official FX rate, de Clerck said. The fund is particularly looking for investment opportunities in the food, healthcare, and renewable energy sectors. The move is part of a wider plan to allocate 60% of the EuroMena III Fund, which is valued at USD 147.9 mn, towards North Africa.

Other Business News of Note

McDonald’s to invest EGP 650 mn in Egypt, expand franchise to 170 restaurants by 2020

McDonald’s plans to invest EGP 650 mn in Egypt and is targeting a footprint of 170 restaurants by 2020, Al Shorouk reports. The expansion will focus on Upper Egypt. The company aims to launch six new branches in Egypt by the year’s end, McDonald’s Egypt’s head of marketing Hesham Abdel Wahab said. McDonald’s has already invested EGP 90 mn this year and is looking to make EGP 1 bn in sales in 2016.

SCZone picks McKinsey to prepare studies for investment projects

SCZone has picked McKinsey & Co to prepare detailed studies of prospective projects planned for the area to improve their competitiveness prospects, Al Mal reported. McKinsey will complete its work within 6-12 months, deputy head of SCZone Abdel Kader Darwish said. The assessments will be completed before the projects are presented to investors, he added.

Sports

France’s Lagardère Group beats Abou Hashima’s Presentation Sports in signing long-term deal for exclusive coverage of African football matches

France’s Lagardère Group has reportedly beat Abou Hashima by signing a long-term deal with the Confederation of African Football (CAF), acquiring the rights to broadcast CAF events through 2028, the confederation said on its official Facebook page yesterday. Earlier on Wednesday, Ahmed Abou Hashima’s majority-owned Presentation Sports upped its bid on exclusive rights to air all African club and national team competitions until 2029 to USD 1.2 bn, according to Al Borsa, citing a company statement. CAF’s decision was taken at its general assembly in Cairo, which was attended on Wednesday by FIFA President Gianni Infantino, according to a CAF statement.

On Your Way Out

How to gauge Donald Trump’s chances of winning the US Presidential election? Track the performance of the Mexican Peso and Russian Ruble, Natasha Doff writes for Bloomberg. “The temperature gauge for Trump is the peso,” HSBC’s David Bloom says. “Amundi Asset Management has been selling the Mexican peso and buying the ruble to profit from the prospect of a victory for Republican nominee Donald Trump” — this is the Trump trade. Doff notes that “while the short-peso trade has been popular since the summer, adding the ruble position has given a boost to returns.” There are some skeptics, however, who “say the peso’s slump over the last few months means there’s little room left for it to fall, while a Trump victory may trigger such a broad sell-off in emerging markets that not even the ruble would be spared.”

President Abdelfattah El Sisi inaugurated the Gamal Abdel Nasser museum yesterday, which marked the 46th anniversary of the former president’s death, Al Shorouk reports.

The markets yesterday

USD CBE auction (Tuesday, 27 Sep): 8.78 (unchanged since 16 March 2016)

USD parallel market (Wednesday, 28 Sep): 13.25 (up from 12.99-13.15 on Tuesday, 27 Sep, Al Mal)

EGX30 (Wednesday): 7,907.9 (-0.5%)

Turnover: EGP 392.1 mn (10% below the 90-day average)

EGX 30 year-to-date: -12.9%

Foreigners: Net Long | EGP +12.4 mn

Regional: Net Long | EGP +26.3 mn

Domestic: Net Short | EGP -38.7 mn

Retail: 51.7% of total trades | 56.7% of buyers | 46.7% of sellers

Institutions: 48.3% of total trades | 43.3% of buyers | 53.3% of sellers

Foreign: 33.2% of total | 34.8% of buyers | 31.6% of sellers

Regional: 9.2% of total | 12.6% of buyers | 5.9% of sellers

Domestic: 57.6% of total | 52.6% of buyers | 62.5% of sellers

WTI: USD 47.31 (+0.55%)

Brent: USD 48.69 (+5.92%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (-1.47%, Oct 2016 contract)

Gold: USD 1,324.90 / troy ounce (+0.09%)<br

TASI: 5,534.4 (-3.4%) (YTD: -19.9%)

ADX: 4,448.7 (-0.5%) (YTD: +3.3%)

DFM: 3,452.6 (-0.4%) (YTD: +9.6%)

KSE Weighted Index: 352.3 (-0.4%) (YTD: -7.7%)

QE: 10,465.4 (-0.1%) (YTD: +0.3%)

MSM: 5,726.2 (-0.4%) (YTD: +5.9%)

BB: 1,141.9 (+0.2%) (YTD: -6.1%)

Calendar

27-29 September (Tuesday-Thursday): Citi’s Frontier Markets Symposium – London 2016, UK.

02 October (Sunday): Islamic New Year (national holiday, tentative date).

06 October (Thursday): Armed Forces Day (national holiday).

07 October (Friday): Deadline for phase one feed-in tariff investors to decide whether to remain under phase one conditions or move to phase two terms.

11 October (Tuesday): 2nd Annual Leasing Conference entitled “New insights to stimulate financing instruments”, Four Seasons Nile Plaza Hotel, Plaza Ballroom, Cairo.

11-12 October (Tuesday-Wednesday): Global Islamic Economy Summit, Madinat Jumeirah, Dubai.

19 October (Wednesday): Digital Media Forum Cairo, Four Seasons Nile Plaza Hotel, Cairo.

26-27 October (Wednesday-Thursday): The Marketing Kingdom Cairo 2 event, Cairo.

31 October (Monday): Deadline for Telecom Egypt to reach an agreement with MNOs over using their 2G and 3G network infrastructure

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

14-16 February 2017 (Tuesday-Thursday): Egyptian Petroleum Show, Cairo International Convention and Exhibition Centre.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.