- USD 2-3 bn Saudi deposit within weeks -El Garhy. (Speed Round

- CIT Ministry pressures mobile network operators. (Speed Round)

- Egypt rejects wheat at Romanian port over ergot, Ministry official defends policy, decries overconsumption. (Speed Round)

- New Supply Minister, six new governors sworn in. (Speed Round)

- Is the FX crunch about to claim its first retail casualty? Centrepoint and Max Fashion owner Landmark Group denies plans to exit Egyptian market. (Speed Round)

- MP continues to scandalize Egypt over FGM remarks. (Egypt in the News)

- House of Reps to open inquiry after train accident kills five, injures 27. ( Egypt Politics + Economics)

- Umm Kolthoum statue restored, more or less. (Image of the Day)

- By the Numbers — powered by Pharos

Thursday, 8 September 2016

First retail casualty of FX crunch?

(Also: Happy Eid. We’re back 18 September)

TL;DR

What We’re Tracking Today

El Garhy speaking in London today: The 6th EFG Hermes London MENA and Frontier Conference wraps up today at the Emirates Arsenal Stadium in London. Finance Minister Amr El Garhy is due to discuss the government’s reform agenda in the keynote address. The minister will address plans to “restore macroeconomic stability through well-crafted and coordinated fiscal and monetary policies; implement structural reforms in the areas of streamlining the business environment, enhancing export activities, and supporting the industrial sectors; and adopt ambitious, well-targeted social programmes that provide adequate support to the vulnerable and the poor.”

Deputy Finance Minister Ahmed Kouchouk will meet with advisors BNP Paribas, JPMorgan, Citi and Natixis today to determine the size of the upcoming eurobond issuance, the interest rate on the bonds, and the roadshow strategy for the issuance, according to statements by Kouchouk on Sunday.

A Russian delegation arrived in Cairo yesterday to discuss resuming charter flights and met with Civil Aviation Minister Sherif Fathy. The delegation will run an inspection of Cairo Airport and will begin planning for the resumption of flights, Al Mal reports.

Habemus iPhone: The new iPhone 7 and 7 Plus made their debuts last night, featuring more storage, new colors, better cameras (including optical zoom on the 7 Plus), a display that’s 25% brighter and that has a wide color gamut, stereo speakers and a honking-fast processor. Oh, and it’s water and dust resistant and has no headphone jack, running EarPods through the Lightning connector instead. (Don’t worry — a headphone adaptor comes in every box.) New wireless “AirPods” (ie: headphones) will launch later this fall, but will offer only five hours of listening time. Go check out the official iPhone 7 page, see the Apple Watch Series 2 or watch the full keynote. The Verge’s Dieter Bohn (one of the best electronics reviewers out there) says the phones “feel newer than you expect,” while the Wall Street Journal called the phone “practical, but not jaw-dropping.”

What We’re Tracking This Week

Regeni prosecutors meet: Prosecutors from Egypt and Italy working on the case of murdered graduate student Giulio Regeni are set to meet in Rome today and tomorrow.

Eid Al Adha vacation starts in just a few hours: Banks and the stock market will be off Sunday through Tuesday of this coming week (11-13 September) for the Eid Al-Adha vacation. They’ll be back in business on Wednesday, 14 September.

*** Enterprise is on vacation next week: There will be no Weekend Edition tomorrow, and Enterprise is on vacation for the whole of next week. We’ll be back to our usual publication schedule on Sunday, 18 September.

Speed Round

Egypt is expecting a USD 2-3 bn deposit from Saudi Arabia within weeks as part of the USD 6 bn Egypt is required to arrange as a precondition of its staff-level agreement with the International Monetary Fund, Finance Minister Amr El Garhy told Al Borsa. Egypt is expecting the first tranche of the IMF loan, valued at USD 2.5 bn, before the end of 2016.

CIT minister threatens international tender if MNOs don’t act: The National Telecommunications Regulatory Authority will tender 4G licenses with new terms and prices in USD to international mobile operators if domestic MNOs do not apply, CIT Minister Yasser El Kady told Al Shorouk. The ministry will not extend the 22 September deadline to receive bids from local players, he says, and Telecom Egypt is ready to acquire any 4G spectrum not taken by the MNOs. El Kady says a number of GCC-based and Asian operators have expressed interest. El Kady has had meetings with players including Kuwait’s Zain, Saudi’s STC and virtual operator Lebara KSA — and has gone out of his way to note that each is interested in bidding. NTRA chief Mostafa Abdel Wahed confirmed yesterday there are ongoing 4G license negotiations with GCC companies and says “we will continue procedures in anticipation of all options.”

Sources at the MNOs say, unlike Telecom Egypt, they were offered no instalment plans on the 4G licenses and are assessing whether the license terms are financially viable. As we had previously reported, Etisalat Misr and Orange Egypt are in talks with their parent companies to see whether head office can help with financing the payment, particularly the foreign-currency tranche. Telecom Egypt signed a 4G agreement last week worth EGP 7.08 bn, of which EGP 5.2 bn is paid in advance, with the balance due in equal installments over the next four years. Half of the total license cost will be paid in USD.

Meanwhile, the NTRA has prepared new regulations on the bundling of telecom service ahead of Telecom Egypt entering the market as an integrated mobile network operator, Al Borsa reports. Licensed service providers may offer bundled services (ie: fixed-line, mobile and ADSL) as long as they do not “harm the consumer or competitors” and no loss-leaders will be allowed: The bundle’s cost has to cover all of the costs associated with offering the service. NTRA has also said it will watch for evidence that service providers are abusing privileged data they may obtain by renting infrastructure to a competitor. The watchdog signaled concern that existing MNOs could trigger a price war to target TE and reiterated what is already law, MNOs cannot make it difficult for customers to switch providers and must respect number-portability for switchers.

Egyptian inspectors rejected a c.63k tonne shipment of wheat at a Romanian port on Wednesday, Reuters reported in an exclusive, in what would be the first such shipment rejected at its source since Egypt resumed its zero tolerance policy on ergot. Previously rejected shipments had already been paid for by the private sector, save for a shipment sold to state buyer GASC by Bunge in December. “This is a catastrophe… They are giving everyone problems at the moment at ports of origin. There is a problem with Russian wheat at Novorossiysk and with another Romanian shipment as well,” said one unnamed Cairo-based trader to Reuters

Let them eat cake: Assaad Hamada, head of the Agriculture Ministry’s Central Authority for Seed Production, tacitly justified the zero tolerance policy in a televised debate (runtime: 40:03) by stating that the average Egyptian consumes 186 kg of wheat annually while the global average is 70-80 kg of wheat per capita per annum, blaming this for Egypt’s growing import needs.

Is the FX crunch about to claim its first retail casualty? Retail conglomerate Landmark Group, which runs value brands Centrepoint and Max Fashion, had to deny reports yesterday that it plans to exit Egypt and shut down its stores here. The company had temporarily shuttered some of its stores yesterday and plans to reopen them today, a source from the company tells Al Mal. The company did not make clear why it closed stores on Wednesday. Anecdotally, we’ve been noticing signs of stress in the retail supply chain, including the disappearance of common brands from shelves (largely imports, but also domestically manufactured or packaged) and the wholesale disappearance of some categories of goods. Worst of all, Starbucks has had repeated shortages of bagged beans for sale: Our neighborhood shop now hides them in the back room and sells them only when asked.

EFG Hermes, JPMorgan working on IPO of “world’s largest indoor theme park.” The two investment banks are reportedly preparing Ilyas & Mustafa Galadari Group (as IMG is formally known) to list in 2017, Bloomberg says. The story, which notes that “Share sales announced by companies in the Middle East and Africa [have] declined 44% this year from the same period in 2015,” notes that IMG would be the second regional theme-park operator to go public, following the 2014 listing of Dubai Parks & Resorts, whose shares are up 57% so far this year. Notes the business news service: IMG Worlds of Adventure, which cost about $1 billion to build, opened in Dubai this summer and is the world’s largest indoor theme park, stretching across 1.5 million square feet and featuring attractions based on Marvel’s Avengers and Cartoon Network’s Powerpuff Girls.”

In other regional equity capital market news, Souq.com is said to have retained Goldman Sachs to find buyers for a 30% stake that would value the online retailer at USD 1.2 bn. Souq sells in Egypt, the UAE, KSA, and Kuwait.

CIB and the Suez Canal Economic Zone (SCZone) signed an agreement which would see the bank become one of the key lenders for the zone, facilitating loans for the development of ports and other logistics infrastructure in the canal, said Ahmed Darwish head of SCZone. Under the terms of the agreement, CIB will also help secure funding for investors in the SCZone, Al Borsa reports.

MOVES- Emirates NBD Egypt has appointed Fuad Mohammed as chief operating officer, according to a company statement. Mohamed, an Emirati national, had previously worked at Emirates NBD in Dubai, and has “over 20 years of operational and IT experience.”

AAIB puts limits on credit, debit cards abroad: The Arab African International Bank has set new monthly limits on the use of its pre-paid, debit, and credit cards abroad, Al Mal reported. Pre-paid card purchases have been capped at USD 50 a month whether outside Egypt or for online purchases. Debit cards were capped at USD 750 for purchases, and USD 150 for withdrawals. Classic credit cards are limited to USD 1,500 for purchases and USD 250 for withdrawals, Titanium cards are limited to USD 2,500 for purchases and USD 400 for withdrawals, while the Platinum cards are capped at USD 6,000 for purchases and USD 600 for withdrawals. The bank has also increased the service charge for the FX rate to 6% from 3.5% for purchases and 8.5% for withdrawals.

MOPCO began trading on the EGX yesterday, rising 295% during the trading session, Al Borsa reported. MOPCO is the first state-owned company to trade on the EGX in over 10 years.

New Supply Minister Mohamed Ali Elsheikh was sworn in as the new Supply Minister on Wednesday (watch, runtime: 2:44). Ensuring that all supplies including bread will remain available at reasonable prices is his top priority, Elsheikh said in his first statement after taking office, Al Mal noted. As we reported yesterday, Elsheikh’s background as the former chief quartermaster of the Armed Forces was seen as a positive by members of the House of Representatives. Six new governors also took the oath office yesterday, with the majority of them coming from military or security backgrounds. They include:

- Gen. Atef Abdelhamid, Cairo: Chief executive of EgyptAir during the Mubarak era and Transport Minister in the Essam Sharaf cabinet;

- Gen. Reda Farahat, Alexandria: Held senior positions with the Alexandria and Ismailia police forces and was a board member of the National Telecommunications Regulatory Authority;

- Gen. Essam El Bedeiwy, Minya: A high ranking officer who has held senior positions at the Interior Ministry;

- Gen. Ahmed Hamed Hassan, Suez: Former Dean of the Air Defence College;

- Amr Abdel Moneim, Qalyubiyah: Outgoing secretary-general of the Egyptian cabinet, a post he had held since 2013;

- Gamal Samy Ali, Fayoum: noted pediatrician and academicand formerVice President of Ain Shams University.

Meanwhile, rumors continue to make the rounds of Cairo that Prime Minister Sherif Ismail could consider a cabinet shuffle in October.

The Illicit Gains Authority is reportedly pushing for an investigation of bank accounts associated with former Supply Minister Khaled Hanafy,who resigned last month amid allegations that state funding was used to subsidize the acquisition of wheat that did not exist, judicial sources tell Youm7. We noted on Monday unconfirmed reports that Hanafy and 37 other government officials had been slapped with travel bans as part of its investigation into the scandal.

Egypt has not yet taken action to devalue the EGP, months after CBE Governor Tarek Amer hinted it would, Patrick Werr writes for The National. Keeping the EGP’s value “inflated” ensures the parallel market is thriving as the gap between the official and parallel market rates is wider, making the returns on the trade more lucrative. In addition, the delay is creating a disincentive for investors to enter the Egyptian market right now as they fear they could be hit with a 20-30% devaluation overnight. Werr says “there is one silver lining to this otherwise dismal economic cloud. Businessmen say there is such a pent-up demand to invest in Egypt, that should the government ever get around to devaluing the currency, investments should surge.”

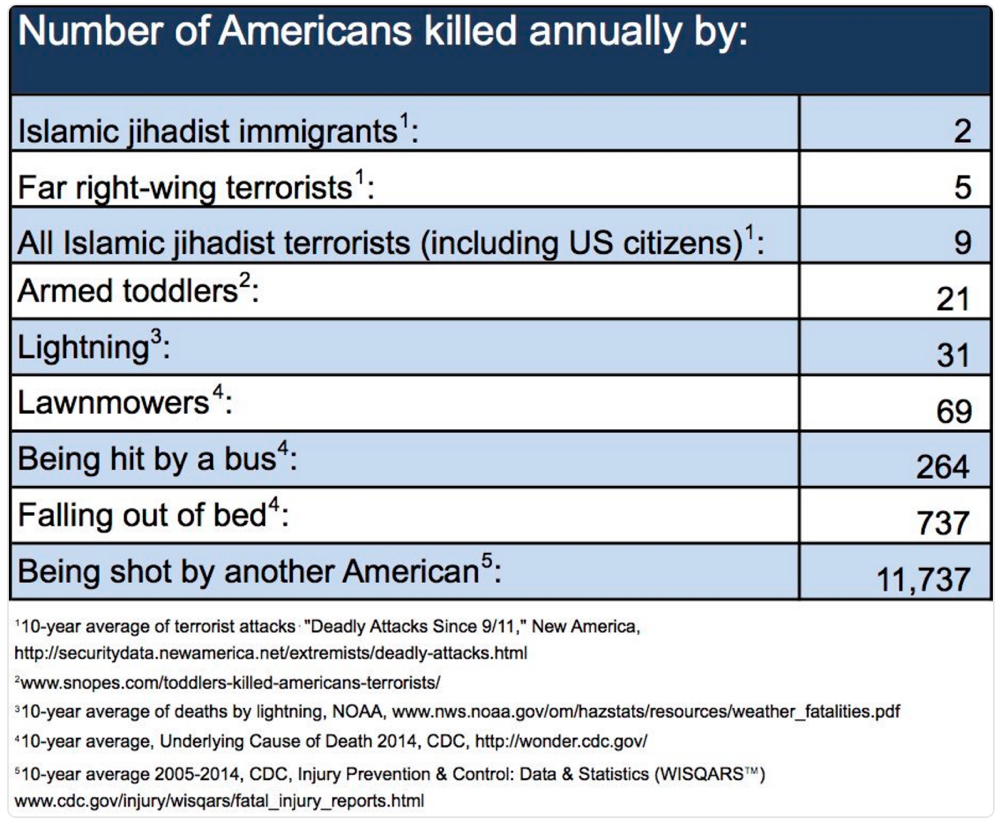

Yo, Donald: Armed toddlers kill more Americans each year than do Islamist terrorists according to a table that’s been blowing up our Twitter feeds for the better part of two days now. The worst part of it: The good people at Snopes have researched the armed toddlers part of the claim and found it to be true.

The Macro Picture

RenCap sees 14% chance of regime change in developing countries, according to a report by Bloomberg, which notes “Thailand and Egypt are among the most likely to undergo regime change, according to the study of 7,776 data points. They both have a 10 percent chance of downgrading to an open anocracy.” (Yeah, we had to look it up, too. Per the people at Wikipedia: “An anocracy is a government regime featuring inherent qualities of political instability and ineffectiveness, as well as an ‘incoherent mix of democratic and autocratic traits and practices.’”

How do the world’s economies stack up against five potential scenarios? Bloomberg’s Luke Kawa details five scenarios developed by Deutsche Bank AG’s Chief Economist Peter Hooper and his team to forecast how various shocks would have on the real GDP of 24 countries (Egypt doesn’t get a mention) over a two-year period. Hooper examines: a rate increase from the US Federal Reserve, an increase in oil prices, a fall in equities around the world, a slowdown in Chinese growth and the depreciation of China’s currency. The results are negative for all countries in all scenarios, save the oil exporters in the event of an uptick in oil prices and, interestingly, India manages to weather and even thrive in each possible scenario.

Egypt in the News

Associated Press’ coverage of a court order for the conditional release of four members of the satirical group Atfal Shawera (Street Children) is getting wide pickup across the U.S., Canada and the UK this morning. Prosecutors can still appeal the ruling, lawyers for the group’s member said.

Meanwhile, the Wall Street Journal’s Dahlia Kholaif and Tamer El-Ghobashy do a very nice job with “Egypt’s money woes hit a touchstone of marriage,” which sees the two use the spiraling cost of shabka (the traditional gift of gold made by a bridegroom) as a way into the FX story.

MP Ilhami Agina has succeeded in having his opinion that women should be subject to mutilation to compensate for the [redacted] dysfunction of Egyptian men broadcast to the entire world, with the British, Chinese and Saudi media — among others — taking note. Making the incredibly foolish mistake of giving the MP the benefit of the doubt, we mistakenly noted on Monday that his remarks amounted to a joke made in poor taste, which is clearly not the case. Agina voted against recently passed legislation that sought to toughen the penalties for performing or abetting FGM procedures, using his aforementioned argument in all seriousness. The MP could now face an investigation by the House Ethics Committee after Speaker of the House Ali Abdel Aal receiving “hundreds of complaints from MPs and ordinary citizens” demanding it, according to informed sources speaking to Ahram Online. Agina defended his statement by invoking the 2014 constitution’s guarantee of freedom of expression.

British architecture firm Weston Williamson + Partners recently announced their design won a commission to build Egypt’s “Science City” near 6 of October City. Set to be run by Bibliotheca Alexandrina, the futuristic complex of buildings and canopies is set to span 1.3 mn square feet and who knows what it’s supposed to cost.

The Dubai-esque initiative to bring about a scientific revolution in Egypt by building a subject matter “city” may gloss over more fundamental, non-building related challenges to doing research in Egypt, as outlined by Aya Nader for Al Monitor on Tuesday in ‘Research: No man’s land in Egypt.’ The piece cites researchers who lament “the security mentality governs every aspect” of their work. The article highlights the government’s longstanding controls on what is permitted for research, from considering foreign funding “espionage” to deliberately hindering the process of getting a permit to access official documents. There is also the issue of the declining state of the Egyptian educational system, which has failed to engrave academic integrity and freedom into the minds of students, resulting in thousands of plagiarized theses and mere translations in place of original output.

Middle East Eye’s Karim El Bar cites a Daily News Egypt article that Egyptian mothers who wish to continue benefitting from the subsidized infant formula program will be forced to undergo medical testing to establish that they are unable to breastfeed. Vice’s Farid Farid has been doing a much better job covering this story than anyone else.

On Deadline

Al Ahram columnist Farouk Goweda says the G20 Summit marks Egypt’s return to its international role. The summit is an opportunity for Egypt to make use of the Chinese and Indian experiences, who in a half century jumped to two of the leading economies in the world, he says. Meanwhile, Leftist Al Shorouk columnist Abdullah El Senawi says Egypt was invited to the G20 Summit because its strategic location serves Chinese interests, not because Egypt’s economy merits it.

El Watan’s Mahmoud Khalil tackles what he says are the two main challenges facing newly-appointed Supply Minister Mohamed Ali Elsheikh in his latest piece. He says the first is the need to monitor the market to track rising prices — and the second is how the public may interpret Elsheikh’s decisions given his military background. Khalil concludes that the first challenge is the most critical, given that prices in Egypt “easily swell, but contract with difficulty.”

Image of the Day

A restoration, of sorts: Prime Minister Sherif Ismail has put his foot down, extending a nationwide moratorium on repairs to statues or installing new statues in public spaces without the Antiquities Ministry’s prior approval, Al Mal reported. The decision followed the unveiling of a number of hideous-looking statues (such as the Frankenstein’s monster Nefertiti bust in Minya) and botched “renovations” to existing works of art. In related news, the statue of Umm Kolthoum in Zamalek has been restored to something more closely resembling its original color, though not quite. Nonetheless, it is a vast improvement on the abomination that passed for a makeover in recent weeks. (View image, Photo credit: Zeina Abaza / Enterprise)

Worth Watching

Fight for Egypt, 1943: This black and white newsreel from the FDR Presidential Library features footage from battles in Egypt between the Allies and the Nazis under Rommel, including infuriating footage of soldiers burying landmines. (Watch, running time: 9:24)

Diplomacy + Foreign Trade

FEI and Chambers of Commerce lobby Germany for assistance in getting the IMF loan: Members of the Federation of Egyptian Industries and the Federation of Egyptian Chambers of Commerce have been actively lobbying for Germany to use its pull in the IMF to get its board to sign off on the USD 12 bn loan facility to Egypt, said Ahmed El Wakeel, head of the Chambers of Commerce. The delegation met with German politicians in Berlin at the sidelines of a meeting with the Association of German Chambers of Industry and Commerce and the German-Arab Chamber, where agreements to bolster exports to Africa and the Middle East, Ahram reports.

Int’l cooperation negotiating Sinai aid with Kuwait: The International Cooperation Ministry is negotiating with the Kuwait Fund for Arab Economic Development (KFAED) to finance three new projects under the Sinai Peninsula development project, Amwal Al Ghad reported. The projects include road expansions, a fishing boat port in Tor, and extending electricity to 17 new developments, sources said. The ministry had recently signed a USD 105 mn loan agreement with KFAED to finance five water desalination plants in South Sinai.

Energy

Israel could look to export gas to Turkey instead of Egypt

Israel could resort to exporting gas to Turkey instead of Egypt following the recent reconciliation agreement between the two governments, Bloomberg suggests in a Quicktake Q&A. The agreement raises the possibility that Israel could build its first pipeline northward and sell, say, to Turkey’s state-owned BOTAŞ Petroleum Pipeline Corporation, but private sector estimates of gas reserves at the Leviathan field hint another pipeline to Egypt would also be a possible. Bloomberg says both options carry risks and different sets of incentives, but notes that the US is “keen on a pipeline going north, adding an energy corridor to Europe to compete with Russia’s.”

Infrastructure

Safaga Port reopens in a month

The renovated Safaga Port will reopen within a month, Al Borsa reports. The renovations and upgrades set the Red Sea Ports Authority back EGP 510 mn, said authority chief Hesham Abou Senna. The renovations and upgrades included infrastructure, the passenger terminal and car parking lots.

Basic Materials + Commodities

GASC to issue tender to import sugar for October delivery

The General Authority for Supply Commodities (GASC) issued a tender to import white sugar that is set to close on Saturday, Reuters’ Arabic service reported. The government has asked for delivery between 1-30 October, without mentioning a specific country of origin. The piece does not mention the exact amounts GASC is seeking.

Manufacturing

Heidelberg Cement considers increasing investment in Egypt

Germany’s Heidelberg Cement is reportedly interested in increasing its investment in Egypt, said Federation of Egyptian Industries head Mohamed El Sewedy, AMAY reported. A delegation from the cement company is expected to arrive in Cairo sometime in October to discuss the expansion. In July, the firm had completed the acquisition of a 45% stake in Italcementi, making Suez Cement, in which Italcementi owns a 55% stake, part HeidelbergCement Group.

Egypt Politics + Economics

House of Reps to open inquiry after train accident kills five, injures 27

A train in Ayat Giza derailed on Wednesday, killing at five and injuring 27, according to Al Ahram. The train’s locomotive overturned after the conductor suddenly moved it off the main track, said the head Egyptian National Railways chief Medhat Shousha, who noted that Casualties are still being tallied. Transportation Minister Galal Saeed has formed a committee to investigate the crash and ordered compensation be paid to the families of the victims. Both Shousha and Saeed took the opportunity to deflect criticism, saying the ministry is moving forward with a plan to overhaul the railway system, with Shousha promising tangible improvements within a year or two.

Meanwhile, the House of Representatives’ Transportation Committee plan to call Saeed and Shousha to an emergency hearing to discuss the incident in specific and what it says is a pattern of train derailments, Al Mal claims. The committee, which is taking time during the House recess to investigate the incident, will form its own panel of experts to look into the crash, Al Borsa said. As we reported last week, the committee is planning to launch a fact-finding mission to investigate losses at ENR that they claim now exceed EGP 43 bn. The commission will also look into the “continued state of disrepair of Egypt’s roads and bridges.” Train wrecks have repeatedly led to the sacking of transportation ministers, including Mubarak-era minister Mohamed Mansour and most recently Rashad El Miteiny.

Interior Ministry takes a more active role to curb “price gouging” as country goes crazy over butane cylinder shortages

The Interior Ministry will be taking a more active role in monitoring prices after Interior Minister Magdy Abdel Ghaffar ordered officers to step up efforts to curb price increases and end price gouging by traders “looking to create false shortages,” Al Ahram reports. This comes as the nation appears to be in the midst of another shortage, this time of butane cylinders, with prices jumping to EGP 60 per cylinder in the black market against an official price of EGP 15, Al Shorouk reports. The Supply Ministry has been flooding the market with 1.2 mn cylinders per day to combat the shortage and will continue to do so through the Eid break, said ministry spokesperson Hamdy Abdel Aziz (runtime: 3:35).

IFC says it invested USD 352 mn in FY2015-16

The IFC says it invested USD 352 mn in seven projects in FY2015-16, according to an emailed statement. The investments were directed to the banking, manufacturing, infrastructure, and hospitality sectors. The IFC says its investments in Egypt are to support the “private sector, create jobs, and spur growth.”

Sports

ECA says beIN is abusing its market power, takes action

BeIN Sports is abusing its dominant market position, the Egyptian Competition Authority (ECA) said in a statement. The ECA is pointed to abuses by beIN in forcing viewers to subscribe to its entire basic package for a year in order to be able to have access to the 2016 European football tournament as well as moving a number of its channels from NileSat to Es’hailsat, adding an extra financial burden on consumers. The ECA has it has taken action against beIN to rectify the situation, but no further details were provided.

On Your Way Out

The Finance Ministry raised the prices of both imported and locally-produced cigarettes by EGP 2-4, by amending the sales tax on cigarettes, according to Al Borsa citing the Official Gazette. The Federation of Egyptian Industries cigarettes division head Ibrahim Embaby said the price hikes are “in the market’s best interest”, although any vendors selling at prices higher than the set prices will be penalized. A Marlboro pack costs will now cost you EGP 27, while L&Ms and Rothmans will cost EGP 19. You can expect these prices to increase once the value-added tax is enforced, as tax on cigarettes will reach to 200%, Parlamany reports.

Egyptian films Nawara and Hepta were chosen as the opening and closing films of Sweden’s 6th Malmo Arab Festival, Ahram Online reported. The movies will be competing for an award in the best feature category at the festival, which will run from 30 September till 5 October. The festival will screen around 120 features, short films, and documentaries from around the world, and will also hold an industry forum to discuss collaboration between Arab and Nordic film industries.

The markets yesterday

USD CBE auction (Tuesday, 06 Sep): 8.78 (unchanged since Wednesday, 16 March)

USD parallel market (Wednesday, 07 Sep): 12.70 sell, 12.60 buy (from 12.75-12.77 on Tuesday, 06 Sep, Sada El Balad)

EGX30 (Wednesday): 8,146.1 (-0.7%)

Turnover: EGP 363.3 mn (16% below the 90-day average)

EGX 30 year-to-date: 16.3%

Foreigners: Net Long | EGP +10.1 mn

Regional: Net Long | EGP +26.4 mn

Domestic: Net Short | EGP -36.5 mn

Retail: 55.2% of total trades | 57.4% of buyers | 53.1% of sellers

Institutions: 44.8% of total trades | 42.6% of buyers | 46.9% of sellers

Foreign: 14.0% of total | 15.4% of buyers | 12.6% of sellers

Regional: 13.8% of total | 17.5% of buyers | 10.2% of sellers

Domestic: 72.2% of total | 67.1% of buyers | 77.2% of sellers

WTI: USD 46.13 (+1.38%)

Brent: USD 47.98 (+1.52%)

Natural Gas (Nymex, futures prices) USD 2.68 MMBtu, (+0.26%, Oct 2016 contract)

Gold: USD 1,349.20 / troy ounce (0.00%)<br

TASI: 6,139.4 (-0.8%) (YTD: -11.2%)

ADX: 4,507.2 (-0.2%) (YTD: +4.6%)

DFM: 3,517.9 (-0.7%) (YTD: +11.6%)

KSE Weighted Index: 350.0 (+0.8%) (YTD: -8.3%)

QE: 10,634.9 (-0.7%) (YTD: +2.0%)

MSM: 5,783.1 (-0.2%) (YTD: +7.0%)

BB: 1,128.0 (0.0%) (YTD: -7.2%)

Calendar

05-08 September (Monday-Thursday): The 6th EFG Hermes London MENA and Frontier Conference, Emirates Arsenal Stadium, London, UK.

06-08 September (Tuesday-Thursday): Citi’s 2016 Global Technologies Conference, New York.

08-09 September (Thursday-Friday): Regeni case prosecutors from Egypt and Italy set to meet in Rome.

11-13 September (Sunday-Tuesday): Eid El Adha (national holiday, tentative date).

14-16 September (Wednesday-Friday): Bank of America Merrill Lynch Global Healthcare Conference 2016, London, UK.

19-20 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD.

19-20 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2016, Park Hyatt Dubai, UAE.

19-21 September (Monday-Wednesday): Bank of America Merrill Lynch Global Consumer and Retail Conference 2016, London, UK.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

22 September (Thursday): N Gage Consulting’s New Administrative Capital workshop powered by Hill International, Four Seasons Nile Plaza Hotel, Cairo. Register here.

22 September (Thursday): Deadline for mobile network operators to accept the final terms for 4G mobile broadband network licenses.

27-29 September (Tuesday-Thursday): Citi’s Frontier Markets Symposium – London 2016, UK.

28 September (Wednesday): Narrative PR Summit organised by CC Plus in partnership with the American University in Cairo, Four Seasons Nile Plaza, Cairo.

02 October (Sunday): Islamic New Year (national holiday, tentative date).

06 October (Thursday): Armed Forces Day (national holiday).

11 October (Tuesday): 2nd Annual Leasing Conference entitled “New insights to stimulate financing instruments”, Four Seasons Nile Plaza Hotel, Plaza Ballroom, Cairo.

11-12 October (Tuesday-Wednesday): Global Islamic Economy Summit, Madinat Jumeirah, Dubai.

26-27 October (Wednesday-Thursday): The Marketing Kingdom Cairo 2 event, Cairo.

31 October (Monday): Deadline for Telecom Egypt to reach an agreement with MNOs over using their 2G and 3G network infrastructure

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

ب

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.