Your 1Q earnings: How to manage your board through covid-19

(Originally published on 31 March 2020)

Good afternoon, everyone,

You’re juggling BlueJeans and Teams. And Zoom, FaceTime, WhatsApp and God knows what else. Your kid walked in and started yelling at you in the middle of your last call. And your email is full of webinar invites and “covid-19 updates” from everyone you’ve ever made the mistake of giving your email address.

And here I come telling you that today is the last day of 1Q and it’s time to start working on your board pack and earnings.

(This week’s topic is intended primarily for leaders of listed companies, but a lot of you will find ideas here that apply just as much to privately held companies.)

It’s easy to feel a bit overwhelmed right now, but let me suggest this:

You know what to do. If you’re reading this note, you’re either leading a company based in the Middle East or Africa. Or you’re leading an investor relations program in the same geography. Odds are good you’ve coached investors through a revolution (or two). An “Arab Spring.” Crashing oil prices. A currency devaluation. You’ve been here before, and if you take a step back, you’ll remember you already have the playbook you need.

What’s different this time is that everyone else’s hair is on fire, too. Covid-19 is a pandemic — a global event by its very definition. And this time, the PMs and FMs are living a version of the same pain. Their kids are interrupting their calls, too. They have five new VoIP apps on their phone and they don’t like any of them. And while you have exactly one problem — your company — their entire portfolio has melted down.

And every other listed company in the world is going through what you’re going through now. We haven’t even bothered keeping up with the torrent of announcements since CNBC said in early March that at least 150 companies warned they were not going to meet guidance. And that was before the FCA in the United Kingdom “strongly urged” LSE-listed companies to delay publishing their results until their auditors have time to see whether they want to raise a “going concern” flag.

Remembering this makes it a lot easier to contemplate how you’re presenting your 1Q results to your board and to investors.

THE BOARD NEEDS TO SEE YOU’RE IN CONTROL

Your board pack is going to be a back-breaker to prepare this quarter, but in some respects the changes you should consider making are obvious.

You need to show them scenarios, and if you’re like us, you realize we’re at an inflection point. Things could get a lot worse — or a lot better — in the weeks ahead. Which scenario leads is something you’ll want to wait until much closer to the board meeting to decide, but start modeling them through now.

Don’t be afraid to think outside the box: What’s the absolute worst case? The absolute best case?

In working though those scenarios, look for what you’re forgetting. Earlier in the crisis, the biggest question about China was, “How soon will factories reopen?” Today, it is, “When will their traditional buyers get out of lockdown?” Most of us forgot to imagine a scenario in which the maker didn’t find a market.

Remember that boards and investors sometimes miss the obvious. You may need to be explicit, for example, that your 1Q sales were not affected by shutdown / lockdown because you had already built your order book — and booked the revenues. Instead, you’re taking the hit in 2Q because the shutdown meant you couldn’t build a new book for the second quarter. They may forget Italy is a key export market or that you source xx% of your APIs from China.

You’re going to address covid-19 right up top, after the agenda and before the summary IS that presents actual vs. budget vs. last year.

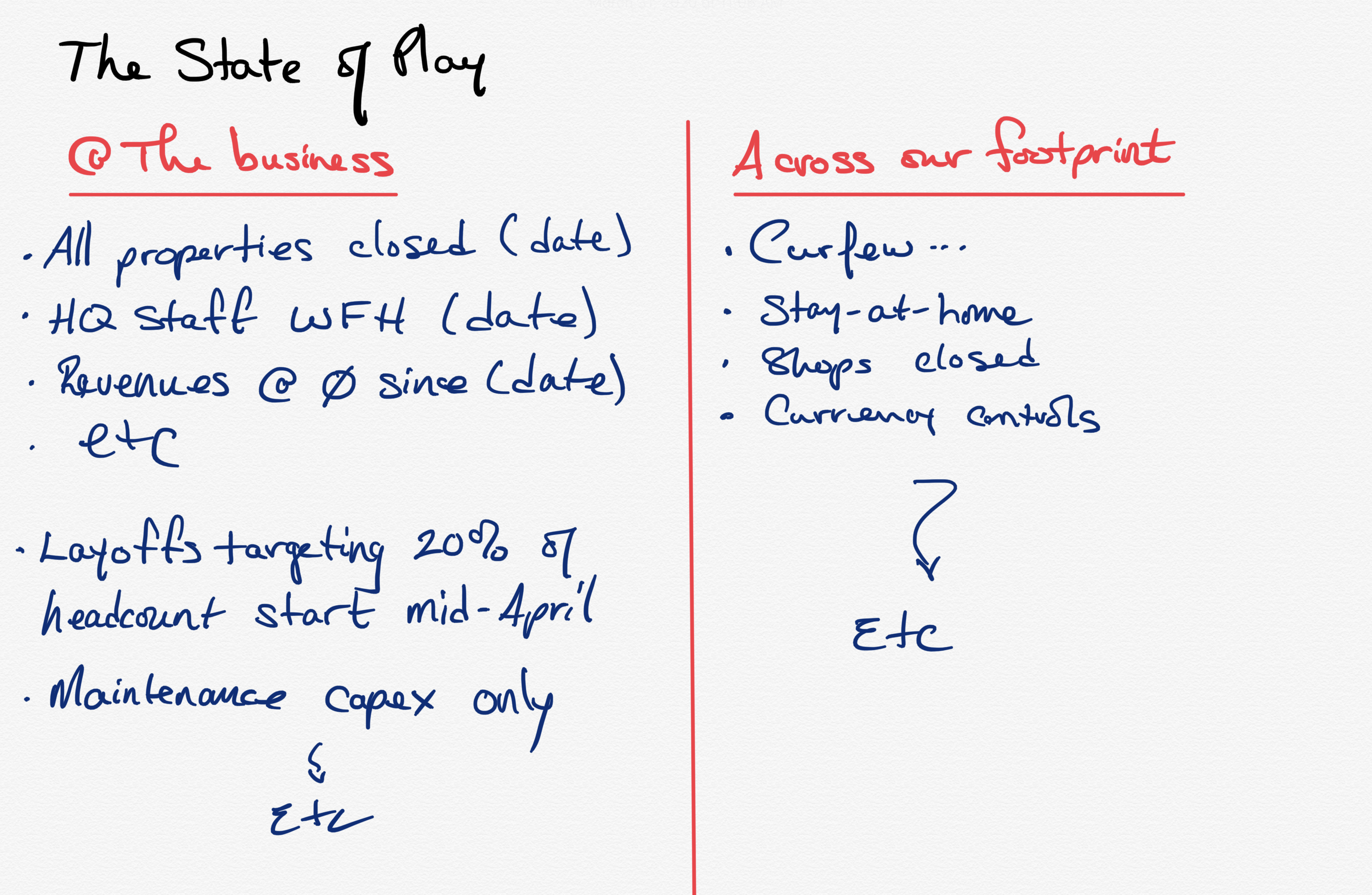

The first one or two slides you present are about the “state of play”:

- At your business: Are your factories / stores / malls open? Is your distribution network operating, if with reduced hours? Did you have to furlough your workers?

- In the countries in which you operate: Is there a curfew? A bailout package? (If so, do you stand to benefit?) Stay-at-home orders?

Now, drill down into what this means for the business. Use as few words as possible to minimize the information overload. Your objective here is to provide an overview — you’ll drill down in a moment. Use a two-column approach:

- Column one: What have covid and the resultant economic slowdown done to the business across key KPIs?

- Column two: What have you done to mitigate or take advantage of each change?

Next, remember that Cash is King. Hit the “Big Three” questions on the board’s mind:

- What does your liquidity position look like? Investors want to know, too.

- What do your cashflow projections look like? Don’t be surprised if you’re asked to provide weekly cashflows going forward.

- What about capex? You’re pushing plans back at least a quarter, right? If you have no visibility beyond that, be frank about it.

Then, walk them through actual vs. budget vs. last year across the IS and then your key operational numbers.

Then show them your scenarios for the shape of the 9 months to come. Be explicit in each about which variables you’re changing and which you’re holding constant — and why. What assumptions are you making?

Build out individual slides for each of the KPIs you chose to highlight up top. Walk the board in more detail through where you stand, what you’ve done — and what you’re doing next in the “most likely” scenario.

Don’t have a board pack? There’s never been a better time to start. It will help you organize your thoughts — and tap the expertise of people who are familiar with your business, but not head-down in problems.

Want more ideas on the questions your board and investors will ask? The SEC has a really long, very useful list here on its website.

WHAT INVESTORS ARE ASKING

Our recommendations are shaped by investor sentiment. We’ve been sitting in on calls between our clients across Egypt, KSA, the UAE and Bahrain and their investors. Our ideas here reflect the patterns and concerns we’re seeing across industries. And also by one simple fact:

They’re trying to sort out who’s going to live, who’s not going to make it — and then they’re taking stock of where they might commit whatever AUM they have left when the market comes back.

A day during the current crisis feels like a week. What’s keeping them awake right now may not be the same thing that’s bugging them when you release in 2-6 weeks’ time.

Today, investors are asking about near-term measures. Most of them are thinking a few weeks out. By the time you’re presenting earnings, they’re going to be asking for longer-term guidance.

The key here is to give guidance without giving guidance — to walk them through how you’re thinking about some of the scenarios you outlined to your board, but being only as specific as the situation allows. We’ll come back to this next week.

Before I sign off, two notes:

- You’re going to want to start earlier. You’re not as efficient right now as you’d like to be because you’re “WFH.” So is your auditor. And we all have a much bigger task this time around than last.

- Keep an eye out for extensions for those of you for whom 1Q results are mandatory and need to be based on audited financials. We’re not aware of any having been granted at the time of writing.

Next week’s note will focus on your earnings release and thoughts on how to handle your results call.

Good luck, and please do get in touch if we can be of help.