Egypt’s reforms could shield the economy from covid-19 shocks -Moody’s

Egypt’s reforms could shield the economy from covid-19 shocks -Moody’s: Egypt’s track record of economic reform commitment and strong FX reserves are expected to shield its credit rating from shocks caused by the covid-19 pandemic, Moody’s said in a credit opinion last week (pdf). The ratings agency says remaining committed to reform measures moving forward could help Egypt achieve “higher sustained growth” levels down the road. By continuing to narrow its current account deficit, the country “may also reduce the economy’s borrowing needs and shore up resilience to changing financing conditions,” Moody’s says.

FX reserves act as a bulwark against EM outflows: Meanwhile, a “broad domestic funding base” and the country’s strong FX reserves, which can cover six months’ worth of imports “provide buffers against significant capital outflows from emerging markets in the wake of the coronavirus pandemic,” the ratings agency said. Moody’s notes that Egypt’s banking sector is also acting as “a deep and stable domestic funding base” that will further support the country’s external liquidity.

On the flipside, Moody’s points to Egypt’s debt affordability as a major point of weakness that leaves the country’s credit profile “vulnerable to a sharp and sustained tightening in financing conditions.” Based on this weakness, Moody’s has scored Egypt’s fiscal strength at “ca” — the lowest score on its overall scorecard.

That said, the ratings agency expects our debt-to-GDP ratio to continue declining this fiscal year, even when accounting for the expected shock impact covid-19 will have on our growth and fiscal position. Moody’s forecasts general government debt as a percentage of GDP dipping to 82.6% in FY2019-2020, down from 84.2% in FY2018-2019, before rising again during the upcoming fiscal year to 83%.

Unemployment, inflation could drive down credit rating: The ratings agency says “social pressures” resulting from youth unemployment, inflation, and “lingering susceptibility to political event risks” continue to pose credit challenges, particularly as inflation would drive up the cost of government debt.

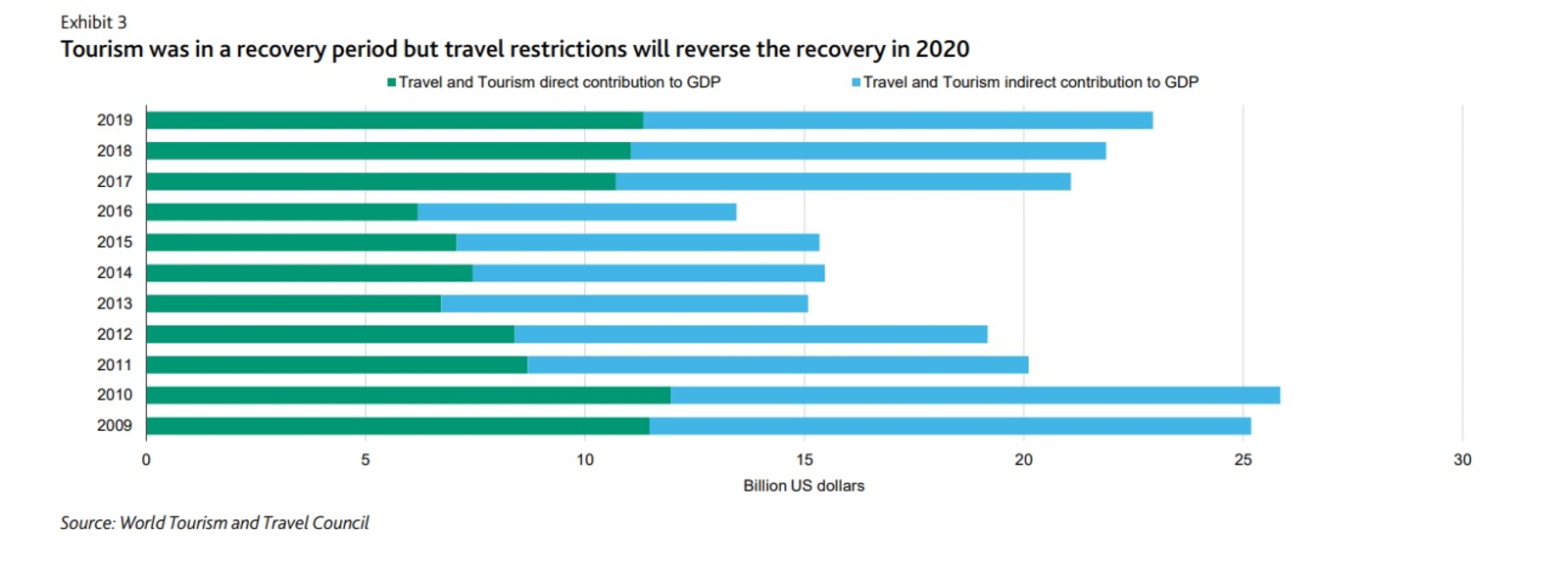

Egypt’s current account deficit is seen widening by the end of the current fiscal year on the back of tourism revenues and remittances falling sharply, which the agency says would “more than offset” the lower expenditure on oil as prices drop. Moody’s sees the current account deficit coming in at 4.5% in FY2019-2020 before narrowing again to 3.6% in FY2020-2021.

The impact of covid-19 will be most pronounced in the next fiscal year: The fall in tourism, coupled with disruptions in investment and trade, will drive down growth to 4.4% in FY2019-2020 and 2.7% in FY2020-2021, Moody’s says.