How do analysts feel about emerging markets going into 2020?

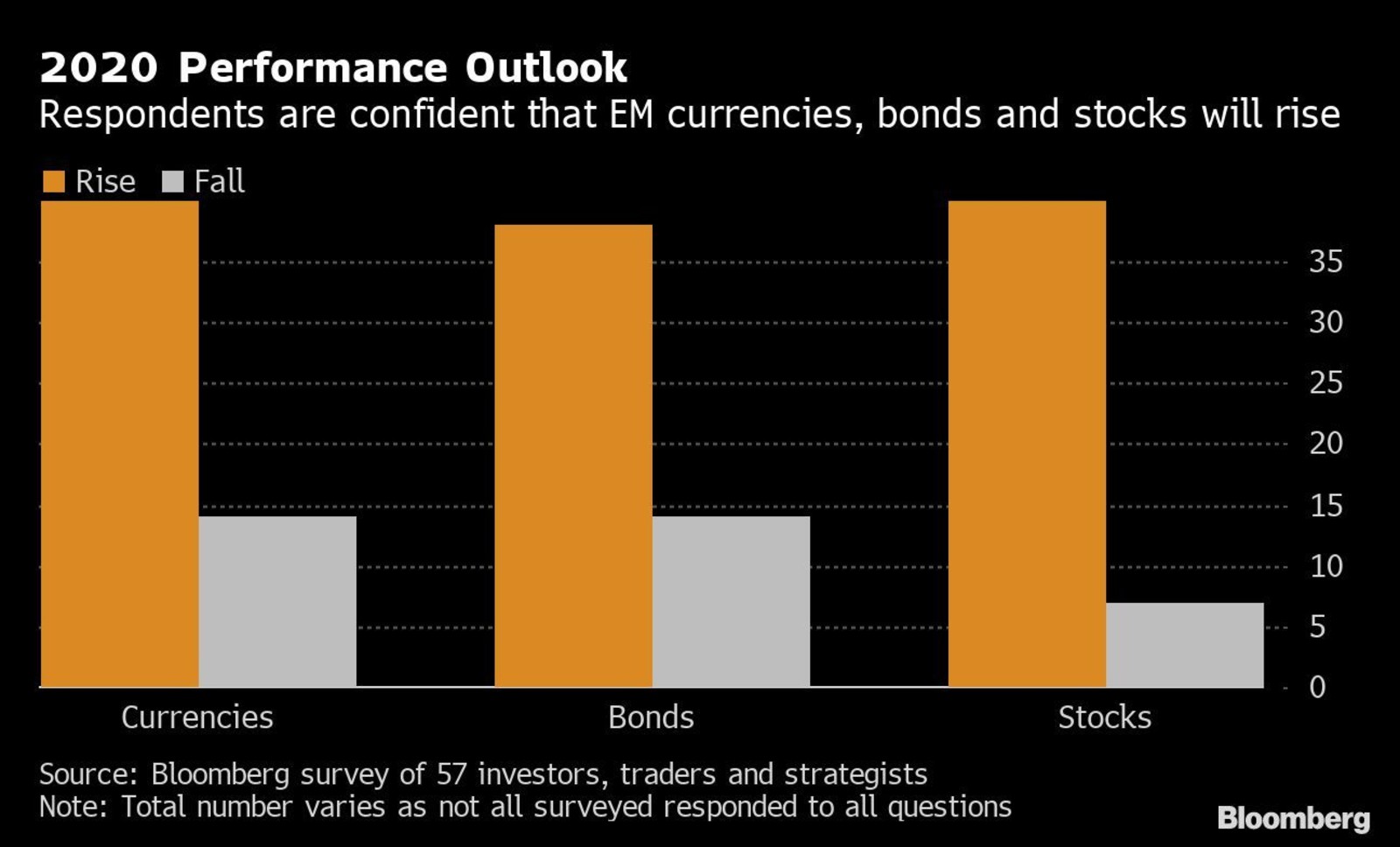

How do analysts feel about emerging markets going into 2020? Emerging markets are set to outperform developed markets in 2020, predict 57 global investors, traders and strategists in a Bloomberg survey, with all assets — currencies, stocks, and bonds — having rallied this year after 2018’s EM Zombie Apocalypse.

Total wealth in EM stocks and bonds now exceeds USD 25 tn, while data shows that EM investors have seen returns of USD 11 tn in the last decade. The combined equity value of the 26 markets on the MSCI EM Index has increased by USD 6.6 tn since 2010, while local currency bonds added USD 2.9 tn, USD bonds 1.7 tn, and EUR-denominated securities USD 237 bn during this time period. MSCI’s equities gauge is up 9.6% and its currency gauge rose 1.4% this year.

Hard currency bonds have performed particularly well, but while three-quarters of investor inflows into EM government bonds have gone into those held in hard currency in the last few years, a very recent shift may indicate increased investor appetite for local currency bonds, said Liam Spillane, head of EM debt at Aviva.

EM corporate bonds still don’t have the same pull, but awareness of their benefits as an asset class is increasing. Their risk-return profile has become more attractive, and there are indications that structural demand for them will continue to grow, a number of analysts say.

Not everyone’s so optimistic: EM equities have yet to resume their 1998-2008 bull market performance, says Philip Lawlor, managing director for global markets research at FTSE Russell, who sees concerns about the vulnerability of EM corporate profits and the impact of an appreciating USD on USD-denominated debt exposure as impeding growth.

But overall, sentiment is good. “I’m still quite bullish on emerging markets heading into 2020,” said Takeshi Yokouchi, a senior fund manager at Sumitomo Mitsui DS Asset Management. “Underlying supporting factors for EM still remain, with very low rates globally, and that will encourage investors to look at higher-yielding assets.”