Foreign portfolio inflows to Egypt could be nearing peak -Bloomberg

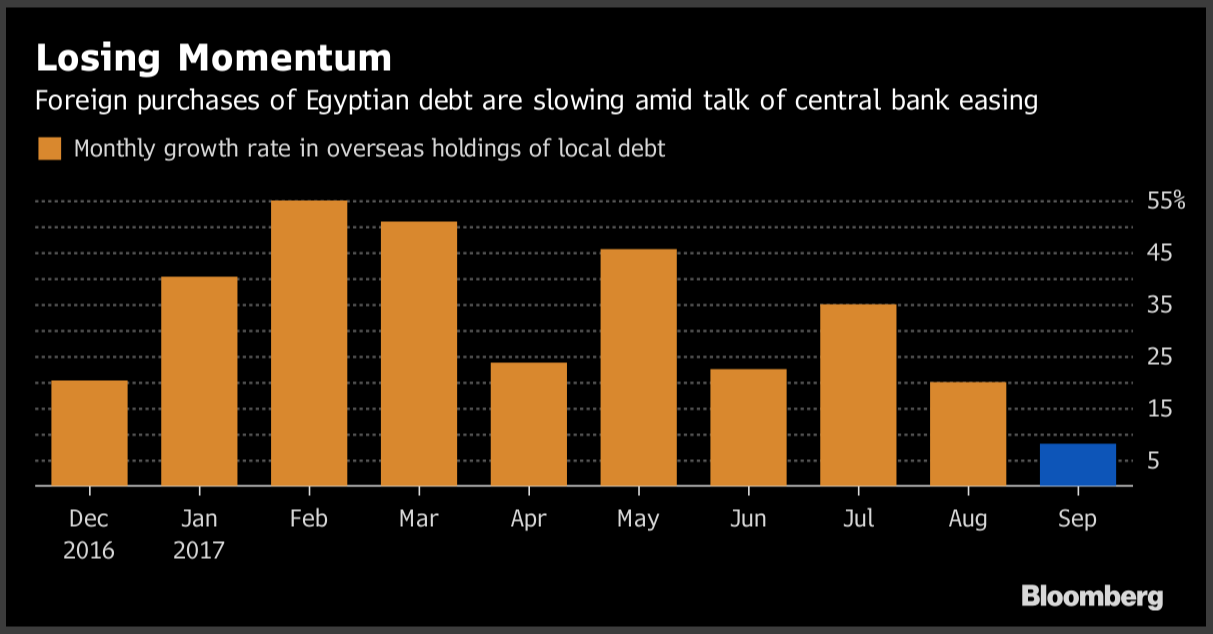

Foreign investors’ appetite for EGP-denominated debt might be easing, Bloomberg suggests. Ahmed Feteha and Mirette Magdy say that “the inflows from foreign funds are still growing, but the pace has slowed to an average of 2% a week since mid-August, down from 8 percent, as policy makers signaled they may lower record interest rates once inflation eases.” Foreign investors now hold a record of over 30% of all outstanding T-bills, “but attention is increasingly turning to the risks of over-exposure and of a sudden selloff in Egyptian assets, according to Bank of America Merrill Lynch economist Jean-Michel Saliba. Interest rates are too high for the economy to grow and the government to borrow, he said, so it needs to find other sources of foreign exchange to meet its funding gap.”

Vice Minister of Finance Mohamed Maait was unfazed by the suggestion, saying “we may not get the same inflows going forward, especially as inflation slows and yields fall … In any case, the coming stage is one where we get more permanent inflows like foreign direct investments — not just portfolio inflows in T-bills.” HSBC regional Chief Economist Simon Williams says that investors are trying to lock in higher returns now, with inflation expected to drop and rates to be cut, although he believes that Egypt has not seen the peak of inflows yet. Elina Ribakova, head of EMEA research at Deutsche Bank, says Egypt’s allure to investors is also a convincing “macro story,” not just high yields. While inflows are now at “capacity,” the country’s improving fundamentals should attract more “sticky money,” she says.