- COP27: US, Europe pledge more than USD 550 mn to fund Egypt’s energy transition. (Development Finance)

- Inflation hits four-year high in October. (Economy)

- Egypt can cover USD 16 bn financing gap, says Maait. (Economy)

- Al Mansour, GM launch Cadillac EV in Egypt; Al Mansour plans to assemble EVs here (Automotive)

- COP27: Egypt’s “Just Financing” guide + Biden’s COP27 pledge headline the news from Sharm this weekend. (COP Watch)

- COP27: Biden + El Sisi discuss climate and Alaa Abdel Fattah as local press picks up on formal application for presidential pardon. (Diplomacy)

- German chemicals giant BASF to set up at Elsewedy’s Sokhan industrial city. (Infrastructure)

- Contact Financial closes EGP 1.1 bn securitized bond issuance. (Debt Watch)

- Blnk lines up USD 32 mn in funding, including debt, equity and proceeds from securitized bond. (Startup Watch)

- PIF sells 10% of Tadawul. (Planet Finance)

- Dems keep control of the Senate + the JPMorgan of the crypto world just filed for bankruptcy. (What We’re Tracking Today)

Sunday, 13 November 2022

AM — US, Europe pledge more than USD 550 mn to fund Egypt’s energy transition

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends — it’s a mandatory day off for folks attending COP27, but there’s no rest for the wicked: We have an absolutely packed issue for you this morning, so we’re going to jump right in.

What’s up at COP this week? Wednesday and Friday are this week’s “big days” for the business community: Wednesday is energy day and Friday is solutions day. Check out this week’s full schedule here.

HAPPENING TODAY-

The Senate is back in session after a two-week break for COP27. On the agenda today are final votes on:

- Amendments that would hand tax breaks to investors who use FX to finance projects;

- A bill related to the performance of the country’s diplomatic and consular corps.

Also on the agenda: The Senate Financial and Economic Affairs Committee will discuss the recent move by Fitch Ratings to cut its outlook on Egyptian debt from “stable” to “negative.” Meanwhile, the Senate Industry Committee will meet to discuss the industrial agreement the government made with the UN Industrial Development Organization last week.

Remember: The House is still on recess. MPs will return on Sunday, 20 November.

It’s the last day of the International Series Egypt golf tournament in Madinaty — and it looks like former US Amateur champion Andy Ogletree is in position to walk away with the title and the USD 1.5 mn purse after taking the lead in the third round, according to a statement (pdf). Ogletree is ahead of Austria’s Bernd Wiesberger and Canada’s Richard T. Lee, while James Piot (US), Jarin Todd (US), Sihwan Kim (US), and Prom Meesawat (Thailand) are currently tied for fourth place.

THIS WEEK-

It’s the G20 Summit in Indonesia this week: G20 leaders will be in Bali on Tuesday and Wednesday for the 2022 summit (well, most of them). US President Joe Biden and Chinese Premier Xi Jinping are scheduled to have their first-ever face-to-face meeting during the summit.

|

WATCH THIS SPACE #1- Emirati investments to Egypt could rise by 20-40% by the end of the year, Al Mal quotes Abdullah Al Saleh, under-secretary at the UAE Economy Ministry, as having said, citing “ongoing negotiations between the two countries.” Al Saleh did not say where the UAE may be looking to deploy capital.

REMEMBER– The UAE is one of Egypt’s largest trading partners and its companies have significantly ramped up investments in the country in recent months, with notable transactions including the sale of SODIC to Aldar / ADQ, Chimera Investments’ investment in Beltone, ADQ’s acquisition of Auf Group and its USD 1.8 bn purchase of shares in EGX-listed companies.

WATCH THIS SPACE #2- Egypt is wrapping up procedures to fully join the BRICs-led New Development Bank (NDB), Finance Minister Mohamed Maait said in a statement. Maait said a package will be shipped off to the House of Representatives in the coming weeks to pave the way to Egypt to fully join the bank. His statements come 10 months after the NDB admitted Egypt as a member, paving the way for Egyptian projects to be eligible for financing via the multilateral bank.

What is the NDB? The USD 100 bn Shanghai-headquartered bank was launched in 2015 by the BRICs group of major emerging economies: Brazil, Russia, India, China and South Africa. It funds infrastructure and sustainable development projects in the BRICs and other developing nations.

REALITY CHECK-

It’s going to take several years before Israel can export significant amounts of liquefied natural gas — with help from Egypt — to Europe, Israeli Energy Ministry Director General Lior Schillat told Reuters on the sidelines of COP27.

Reminder: Egypt and Israel are now BFFs with Europe, which is scrambling to secure new gas supplies as Moscow and European capitals sever energy ties over the war in Ukraine. The three sides signed a gas export agreement in June that will see Europe import Israeli natural gas via Egypt’s LNG facilities.

It’s a problem of supply: Though Israel is expecting to significantly increase gas production, it’s going to take at least another three years for the country to have the surplus to ship to Europe. “It is true that most of our surplus gas will be created in the next three to four years,” Schillat said. “So clearly, it’s not an immediate ability to supply gas in the short term. We’re talking about a relatively low amount here.”

Then there’s the issue of infrastructure: Oil Minister Tarek El Molla has also said that without additional investment in infrastructure, it could take two or three years before Egypt is able to increase exports.

THE BIG STORIES ABROAD-

#1- The biggest business story in the world this morning: One of the world’s largest crypto exchanges has gone bust. FTX announced on Friday that it is filing for Chapter 11 bankruptcy and that its CEO Sam Bankman-Fried, once one of the most successful figures in the crypto world, would be stepping down. The collapse came just a few days after Binance abandoned its plans to acquire FTX, saying that the firm’s issues were “beyond our control or ability to help.” Bns of USD were withdrawn from FTX last week after a report revealed a multi-bn USD hole in its balance sheet.

How did the JPMorgan of crypto exchanges collapse so suddenly? That’s the post-mortem being reported out everywhere in the global business press this morning, with regulators investigating mns of USD of unauthorized transactions. (Bloomberg | FT | WSJ | Reuters | CNBC)

#2- The Democrats have retained control of the Senate after Nevada’s incumbent senator, Catherine Cortez Masto, was declared the victor against Republican candidate Adam Laxal a few hours ago. The latest result gives the Democrats 50 seats in the upper house to the Republicans’ 49, meaning that next month’s runoff vote in Georgia will not be the decider, thanks to Vice President Kamala Harris’ tie-breaking vote. The race for the House is also going down to the wire, with Democrats closing the gap as results continue to trickle in. The GOP currently have 211 seats to the Democrats’ 202, meaning that they only have to win seven of the remaining 22 states to secure a majority.

The story is everywhere in the US this morning from the Associated Press and Reuters to Politico.

#3- Important for the region: There’s more signs of progress coming out of Tigray after the Ethiopian military and local rebels have agreed to allow humanitarian aid into the region and set up a joint committee to disarm militias fighting in the conflict, according to the Associated Press. This comes 10 days after the two sides agreed to a ceasefire, raising hopes of an end to the two-year civil war.

The Enterprise Climate X Forum, our first industry-specific conference, is taking place on Tuesday, 6 December. The Enterprise Climate X Forum will give insiders and newcomers alike the chance to talk about how to build a climate-centered business — and how to make sure your business continues to have access to the funds it needs to grow. Expect it to be heavy on lessons learned in Egypt and other global growth markets — and lots of success stories.

Stay tuned very soon when we reveal the venue. You’ll love it, we promise.

Some of the biggest names in business and finance are on board — are you? The Enterprise Climate X Forum is taking place with the generous support of our friends, including:

- Banking partners: HSBC | Mashreq | Attijariwafa Bank

- Telecom partner: Etisalat by e&

- Event partners: Hassan Allam Utilities | Infinity

DO YOU WANT TO ATTEND? The first wave of invites is going out now. If you’re a C-suite exec, business owner, climate professional, DFI staff, investor or banker, please email us at climatexrsvp@enterprisemea.com to signal your interest, letting us know your name, title and where you work.

2CELLOS — LIVE AT SOMABAY on 18 November, 2022: Mark your calendars — world-renowned and wildly popular cellist duo, 2CELLOS will be performing at Somabay on 18 November, 2022. Having racked up a bn-plus audio streams, countless sold-out concerts, and mns of fans across the globe in their 10 years together as 2CELLOS, the Croatian duo of Luka Šulić and HAUSER will be visiting Egypt in their long-awaited 2022 Dedicated World Tour. Book your ticket now: https://www.ticketsmarche.com/tickets/buy-tickets-2-cellos.html. Call us 16390.

DEVELOPMENT FINANCE

US, Europe pledge more than USD 550 mn to fund Egypt’s energy transition

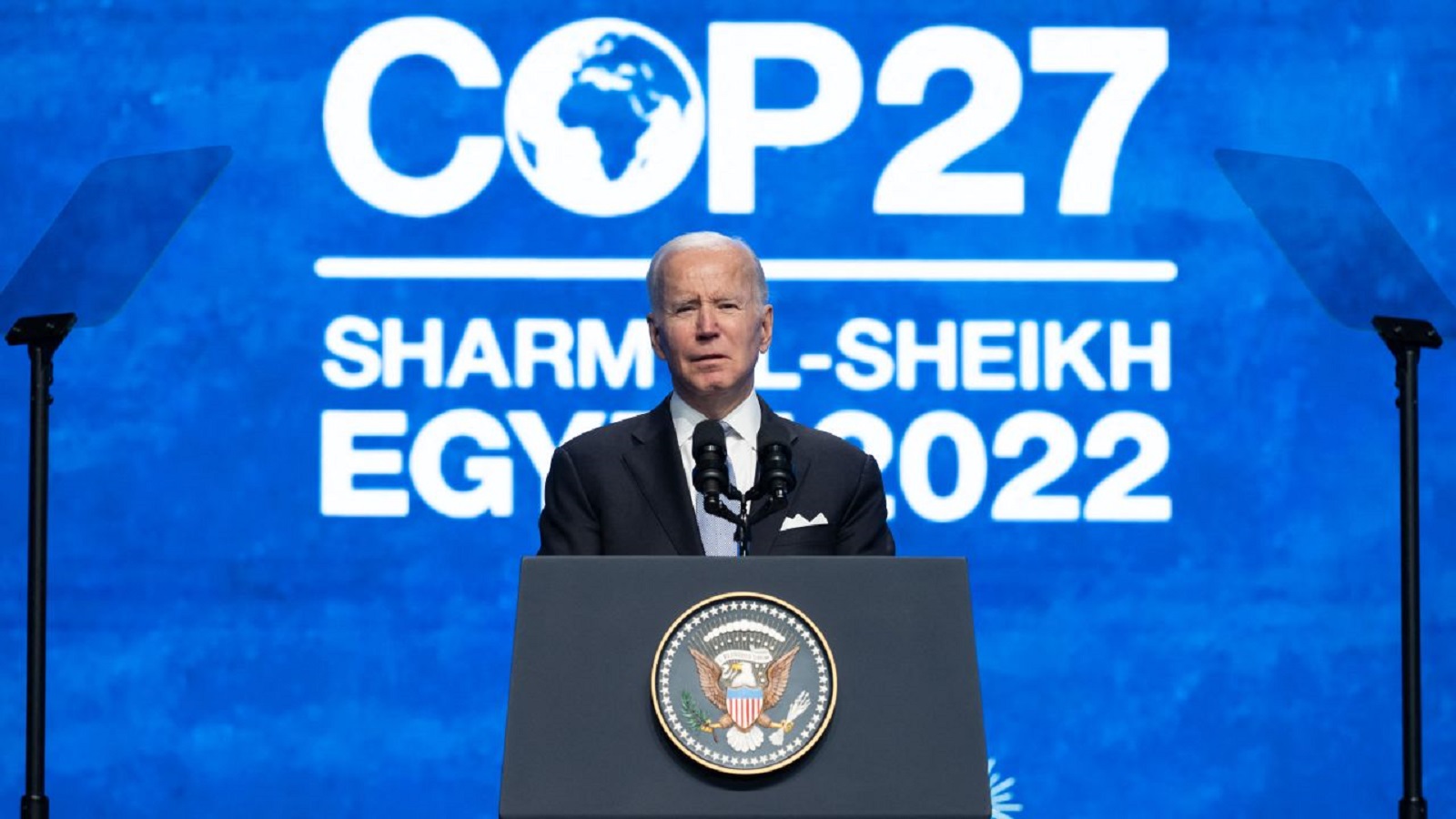

The US, Germany and other European countries have pledged to provide more than USD 550 mn to help Egypt decarbonize its power infrastructure and install new renewable energy capacity. Under a political declaration (pdf) with Egypt announced during President Joe Biden’s visit to COP27 on Thursday, the US and Germany agreed to provide more than USD 250 mn for the energy pillar of Egypt’s Nexus on Water, Food and Energy (NWFE) initiative, which aims to close 5-GW of gas-fired power plants and add 10-GW of new wind and solar energy by 2028.

The breakdown: Of the money pledged by Germany and the US, the equivalent of EUR 100 mn will come in the form of “highly concessional loans,” EUR 100 mn will be in the form of debt swaps, and EUR 85 mn in grants. More than USD 300 mn in grant and concessional finance will come from the European Commission, France, the Netherlands, Denmark, and the UK, as well as donors to the EBRD’s High Impact Partnership on Climate Action.

This brings to more than USD 1.8 bn the total funding for the energy transition we’ve raised in recent days after our friends at EBRD confirmed on Thursday that they have committed “USD 1 bn of private renewable finance, USD 300 mn in sovereign finance and grants of USD 3 mn from its shareholder special fund.”

Now we have to prove we’re serious about meeting our clean energy targets: In return for their support, Egypt has committed “quadrupling its deployment rate,” the EBRD statement quotes US climate envoy John Kerry as having said, adding “we’re going to help them with concessional financing to get the first 10 GWs done quickly and cost effectively.” Egypt will submit a revised NDC by June 2023 and will also consider committing to a net zero greenhouse gas emissions target as well as expand the use of zero-emission vehicles and sustainable public transport.

And as a bonus: The countries will help us save some of our natgas: Germany and the US will also help us capture bns of cubic meters of natural gas that we currently flare, vent, or allow to leak from oil and gas operations. Just how much we’re not quite sure: Biden said 4 bn cbm in his speech but the White House fact sheet says 2 bn cbm.

BACKGROUND- NWFE is expected to draw as much as USD 15 bn in investment under agreements Egypt signed with financial institutions and DFIs last week. It is hoped that the energy component of the initiative alone will receive as USD 10 bn in private investment.

Why Europe is investing here: “Egypt has world-class renewable energy resources and is close to markets in Europe and Asia, giving it the potential to transform its own energy sector and become a global hub for green fuels and products,” EBRD said.

CIF HAS USD 350 mn FOR EGYPT, KENYA, OTHERS

Egypt is among several countries that will receive finance from a new, USD 350 mn platform of the Climate Investment Funds (CIF), according to a statement. The CIF, which bills itself as among the world’s leading multilateral funds for climate action in emerging markets, said its CIF Nature, People and Climate investment platform will “finance nature-based solutions to the climate crisis” in countries including Egypt, Kenya and Fiji.

Who’s kicking in the money? Italy, the UK and Sweden have provided more than USD 350 mn to the CIF’s Nature, People and Climate platform, which in Egypt will deploy the funding to “promote sustainable agriculture along the Nile River.

Wait, what’s the CIF? The USD 8 bn CIF, which includes sub-funds on clean tech, forest, scaling up renewable energy, and climate resilience, is a “multi-donor trust” and since 2008 has been “the only multilateral climate fund to work exclusively with multilateral development banks as implementing agencies.”

When will the funding be available? Egypt and others are expected to start with preparing investment plans against accessible financing, with implementation expected to begin as early as 2023, the statement said.

MORE GREEN FINANCE + ONLENDING FOR SMES-

EBRD is giving funding to QNB Al Ahli to onlend to youts, green economy The EBRD signed over the weekend an agreement with QNB Al Ahli to extend a USD 20 mn loan for onlending to MSMEs led or owned by folks 35 years or younger, it said in a statement. The EBRD and EU also signed a separate agreement with QNB Al Ahli under the lender’s Green Economy Financing Facility (GEFF) to provide EBRD funding to “private sub-borrowers, including companies and MSMEs, for green investments, such as renewable energy and energy efficiency projects.” The statement does not clarify how much fresh funding it will provide under the GEFF, but noted that the new financing will bring the total amount the EBRD has provided to QNB Al Ahli for on-lending to green projects to USD 185 mn.

COP WATCH

Egypt’s “Just Financing” guide + Biden’s COP27 pledge headline the news from Sharm this weekend

Egypt launches guide to “Just Financing,” to boost multi-stakeholder partnership and unlock private sector climate finance: The International Cooperation Ministry launched last week the Sharm El Sheikh Guidebook for Just Financing (pdf), in cooperation with a host of international development partners, according to a ministry statement. The guide was developed over the course of year-long consultations with over 100 partners — government representatives, DFIs, the private sector, commercial and investment banks, climate finance funds, think tanks, and nonprofit organizations, the statement notes.

A focus on practicality and collective action: The guide offers a practical roadmap to unlock innovative financing mechanisms through multi-stakeholder participation, information sharing, and strengthening technical capabilities to create a pipeline of bankable climate-friendly projects. In the short-term, it aims to increase efficiency and equity in global climate finance structures. Long-term, it seeks to catalyze a rethink of these structures.

Just Financing — the guide’s key theme — is a distinct “finance-specific concept” similar to the idea of climate justice, but more focused in scope, it says. It’s a “process-oriented” approach that seeks to direct energy transition mechanisms towards sustainable economic growth, while “avoiding negative distributional, equity and climate impacts.”

BIDEN: “VERY LIFE OF PLANET” AT STAKE

US President Joe Biden doubled down on climate change warnings during his speech at COP27, saying that “the very life of the planet” is at stake, as he made new pledges that aim to support the world’s fight against climate change. The US doubled its pledge to its “adaptation fund” for poorer countries to USD 100 mn, and pledged a further USD 150 mn to support climate change efforts in Africa. Biden also promised the US will meet its emissions targets by 2030, after unveiling a plan to cut methane emissions from its oil and gas industry to 87% below 2005 levels by 2030.

But the pledges fall short of what developing countries need: Climate activists criticized Biden for failing to call wealthy nations for more climate change support for developing countries and for his “radio silence” on loss and damage finance, Reuters reports. “He announced a slew of new climate programs, but he couldn’t deliver what the developing world most wants — enough money to adapt to climate extremes," one expert said. A recent report showed that developing countries will need USD 1 tn a year in external financing by the end of the decade to combat climate change.

Biden’s speech got a lot of play in the foreign press: Financial Times | WSJ | CNN | Washington Post | The Guardian | NYT.

COUNTRIES AGREE ON PLAN TO ACCELERATE INDUSTRY EMISSION CUTS-

Egypt among countries agreeing on a plan to cut industrial emissions: Countries accounting for half of the global economy have set out a year-long plan to cut industrial gas emissions at COP27, according to a United Nations Framework Framework Convention on Climate Change (UNFCC) statement. Countries including the US, Germany, Japan, Canada, and Egypt have agreed on 25 “priority actions” to be unveiled at next year’s COP28 in the UAE to help cut emissions across power, transport, steel, hydrogen and agriculture. Countries involved will form coalitions that ensure the delivery of the priority agenda items, the statement said. Reuters also picked up the story.

Egypt launched a program with engineering giant Bechtel to “decarbonize existing oil and gas facilities” in Egypt as part of a new private-public decarbonization coalition, according to a statement from the COP27 Presidency (pdf). Egypt currently has 126 energy efficiency projects in action and has invested some USD 2.4 bn in decarbonization, which are saving around 7 mn tons of CO2 per year, according to the statement. Egyptian LNG (a joint venture between EGAS, EGPC, Shell, and Petronas) also tapped a Bechtel-led coalition to conduct feasibility studies on using a zero-flaring system at the Idku liquefaction plant, Bechtel said in a statement.

The East Mediterranean Gas Forum also launched a regional decarbonization initiative for the oil and gas industry, COP27 Presidency statement says, without providing further information. The issue of gas decarbonization was on the forum’s radar last year.

ALSO- World heritage sites get some attention: The Islamic World Educational, Scientific and Cultural Organization also kicked off an initiative to better protect world heritage sites from climate change-induced damage, the COP27 presidency statement said.

CLIMATECH RUN PRIZES ANNOUNCED-

Ryp Labs, Earthly, and Koltiva took home the USD 100k, USD 50k, and USD 25k awards, respectively, after pitching their businesses among 15 finalists selected as part of the Climatech Run competition during COP27, the US embassy in Egypt said in a statement. The top two African startups also received investments: Cameroon-based BleagLee took home USD 50k while South Africa’s LiquidGold received USD 25k. The startups will also participate in an acceleration program. The competition was supported by our friends at USAID through their Business Egypt program.

AUTOMOTIVE

Al Mansour, GM launch Cadillac EV in Egypt; Al Mansour plans to assemble EVs here

Electric Cadillacs are coming to Egypt: General Motors (GM) and Al Mansour Automotive will debut electric Cadillacs in Egypt by the end of 2023, the two companies announced in a statement (pdf) Thursday. The Cadillac Lyriq, an all-electric mid-size luxury SUV, will go on sale late next year, with five luxury electric models expected to be available by 2025, according to the statement.

Al Mansour Auto is still planning to assemble EVs in Egypt: In an interview with Bloomberg last week, Mohamed Mansour said that he intends to produce 15k EVs over the next three years. Under an MoU signed last December, Al Mansour Auto and GM are looking at partnering up to produce EVs in Egypt. “I feel it’s going to be a big success,” Mansour told the news outlet.

You might have spotted Lyriq in COP: The Lyriq is one of EVs on show during COP27 by GM and Al Mansour Auto, who are the summit’s mobility partners.

The Lyriq is really popular in the West: It’s sold out for 2023 delivery in the United States, where GM is now accepting orders for 2024 delivery. It’s getting positive reviews from Car and Driver, Edmunds and Motor Trend.

ECONOMY

Inflation hits four-year high in October

Inflation accelerates again in October: Urban inflation hit its highest level in four years in October on the back of surging food prices. The annual rate of inflation rose to 16.2% during the month from 15.0% in September, according to figures (pdf) released Thursday by state statistics agency Capmas. This is the highest level since October 2018, when it recorded 17.68%. On a month-on-month basis, urban inflation rose 2.6% in October, accelerating from 1.6% in September.

Food was the main driver: Food and beverage costs — the biggest component of the basket used to measure inflation — jumped 23.8% y-o-y from 21.7% in September.

But there are inflationary pressures throughout the economy: Annual core inflation, which strips out volatile items such as fuel and food, jumped to a near-five-year high of 19.0% in October, up from 18.0% the previous month, according to Central Bank of Egypt data (pdf). This is the 14th month in a row that core inflation has accelerated.

We haven’t seen anything yet: October’s data doesn’t reflect the impact of the decision by the CBE to float the currency at the end of the month, which has led to the EGP falling almost 24% against the greenback. “The upcoming months, mainly November and December, are likely to reflect the full pass-through effect of the EGP devaluation,” Al Ahly Pharos analyst Esraa Ahmed wrote in a note Thursday. “This would coincide with unfavorable base effect during 4Q 2022 and 1Q 2023, fueling expected annual inflation readings that might hit the 20% y-o-y border for some months.” Meanwhile, analysts at CI Capital see the rate averaging 18% between November and February due to the depreciation of the currency and the repealing of the government’s import restrictions.

Goodbye 7% target: The central bank is planning to scrap its 7% (±2%) target and will announce a new target range before the end of the year.

ECONOMY

Egypt can cover USD 16 bn financing gap, says Maait

More funding, investments coming in “days, weeks, months” -Maait: Egypt expects to see more FDI and more funding inflows, including from the Gulf and “other sources,” after reaching a staff-level agreement with the IMF for a USD 3 bn, 46-month loan, Finance Minister Mohamed Maait told Bloomberg on Thursday (watch, runtime: 6:33). These sources of funding should be arriving within the next “days, weeks, and months,” Maait said, without providing further details on the size or timeline for these anticipated inflows. He did note that Qatar’s sovereign wealth fund deposited USD 1 bn at the Central Bank of Egypt last week.

The IMF program + support from multilateral lenders will help us cover USD 16 bn financing gap: Egypt’s external funding gap over the next four years is expected to come in at USD 16 bn, but the Finance Ministry is confident that it will be able to find the money. “We are sure about getting this financing gap” covered during the loan period, Maait told the business newswire. The minister said this will happen with a combination of the USD 3 bn from the IMF, another USD 5 bn the IMF program helped us secure from multilateral lenders — which he said will likely land in state coffers during the current fiscal year — and more debt issuances and investments.

Egypt is searching for new sources of funding: With Egypt’s access to Western capital markets heavily curtailed, the government is continuing to focus on diversifying its funding sources, the minister said. “We are now in a good stage for issuing a USD 500 mn panda bond in Chinese capital markets [and] we are working on sukuk for private placement and also a public offering in international markets,” the minister said. “We’re trying to diversify at this stage and depend more on MDBs’ concessional loans,” as well as financing for green projects, he said.

Portfolio inflows are starting to trickle in, but we’ve learned our lesson: Portfolio investors have slowly started to dip their toes back into the EGP carry trade in the wake of the IMF announcement, but the lesson remains that “this kind of inflows is not secure” and that the priority should be to focus on attracting FDI and boosting exports, Maait said. Egypt has seen at least USD 20 bn in portfolio outflows this year due to tightening financial conditions and the economic shock caused by the war in Ukraine.

INFRASTRUCTURE

The first German green logistics hub in Sokhna 360

Elsewedy Industrial Development inked an MoU with German chemical producer BASF to build a green logistics hub in Elsewedy’s Sokhna 360 industrial city, the companies said in a joint statement (pdf) Thursday.

Sokhna 360? It’s a 10-mn sqm industrial area of the Ain Sokhna industrial zone featuring residential units and commercial areas. It offers multinationals a number of incentives including full foreign ownership of companies, 100% foreign control of import and export activities, and full exemptions from customs duties and sales tax.

What they said: “BASF trusted that Sokhna 360 suited their aspirations to allocate their first green logistic hub, assuring the high standards of safety, technology, integration and sustainability.” said Elsewedy Industrial Development’s CEO Mohamed El Kamah.

ALSO AT SOKHNA 360- Elsewedy Industrial Development, Geocycle, and Lafarge Egypt will work together on managing construction and infrastructure waste from Sokhna 360 under an MoU signed on Friday, the companies said in a statement (pdf). Geocycle will be given the right to directly enter into agreements with factories at the industrial city “to safely and sustainably manage their industrial waste,” while Lafarge Egypt is set to provide cement or concrete that are eco-friendly for construction in the city.

DEBT WATCH

Contact Financial closes EGP 1.1 bn securitized bond issuance

Contact Financial has closed an EGP 1.076 bn securitized bond issuance for its consumer finance arms Contact Creditech and Contact Credit, it said in a statement (pdf). The three-tranche issuance was backed by a EGP 1.54 bn portfolio and was part of a EGP 10 bn securitization program, the statement notes.

Who bought in: Unspecified banking and non-banking institutional investors, the statement says, without providing further information.

Advisors: Contact Financial Holding was bookrunner, arranger, and underwriter for the issuance. The National Bank of Egypt, CIB, and Al Ahly Pharos also acted as promoters and underwriters. Alieldean Weshahi & Partners were counsel.

DATA POINT- That brings us to nearly 3x of last year’s securitization activity: Contact’s issuance brings the total value of securitized bonds brought to market to around EGP 43.9 bn, according to data tracked by Enterprise. That’s nearly threefold the amount of securitized bonds that were sold last year.

STARTUP WATCH

Blnk lines up USD 32 mn in funding, including debt, equity and proceeds from securitized bond

Fintech startup Blnk has lined up USD 32 mn in funding, the company said in a statement Thursday. The money includes USD 23.7 mn in equity and debt capital, as well as the USD 8.3 mn (EGP 202 mn) securitized bond issuance that closed last week.

Among the company’s new investors: Abu Dhabi’s Emirates International Investment Company (EIIC), Sawari Ventures, as well as angel investors, invested USD 12.5 mn in a combined pre-seed and seed funding round, the company said.

And the creditors? Blnk said a number of “leading local banks” lent it USD 11.2 mn, but didn’t didn’t disclose their identities. Banque du Caire and the National Bank of Egypt underwrote the securitized bond issuance.

Where the money’s going: The funding will be used to expand its lending portfolio and further develop its AI-powered lending platform, according to the statement.

About Blnk: It’s a digital AI-powered lending platform that allows merchants to approve and finance customers’ purchases at the point of sale. It focuses primarily on “the unbanked and financially-underserved.” The company says it has has made USD 20 mn in loans since its launch in fall 2021 — its CEO and co-founder is Amr Sultan, the former Beltone head of investment banking who went on to co-found Akanar, the advisory shop that Arqaam later acquired.

The story is getting international coverage: Reuters | Techcrunch.

EARNINGS WATCH

Palm Hills revenues surge to EGP 9.5 bn in 9M 2022, up 62% y-o-y

Palm Hills Developments reported record-high net income after tax and minority interest of EGP 911 mn in 9M 2022, up 43% y-o-y, the developer said in its earnings release (pdf). The record bottom line comes on the back of revenues reaching an all-time high during the nine-month period to EGP 9.5 bn, up 62% y-o-y.

Sales see solid growth: New sales rose 36% y-o-y to EGP 17.5 bn during 9M 2022, with sales of residential properties rising 31% y-o-y to EGP 15.1 bn, and commercial sales hitting EGP 2.4 bn, up 83%, the company said. The sales performance is the best in the company’s history, it said in the release, noting that it is ramping up construction spending, with a focus on “Badya and Palm Hills New Cairo,” its largest developments.

A better-than-expected 2022: “I am encouraged by the company’s financial resilience and steady improvements across various fronts,” Executive Chairman Yasseen Mansour said. “We expect to surpass our previously announced operational and financial targets for full year 2022.”

LAST NIGHT’S TALK SHOWS

El Sisi-Biden meeting leads the conversation on the talk shows

President El Sisi’s tête-à-tête with Biden on Friday dominated the conversation on the airwaves last night, with El Hekaya’s Amr Adib praising El Sisi’s “pre-emptive step” of raising the thorny human rights subject during the meeting (watch, runtime: 1:16) and Kelma Akhira’s El Lamees Hadidi turning body-language expert and analyzing the photo of House Speaker Nancy Pelosi walking arm-in-arm with El Sisi (watch, runtime: 4:06). The sit-down is also getting coverage from Masa’a DMC (watch, runtime: 13:04), Al Hayah Al Youm (watch, runtime: 2:33), and Ala Mas’ouleety (watch, runtime: 13:15), who featured an interview with the State Department’s regional spokesperson (and Cairo veteran) Sam Werberg (watch, runtime: 3:08 | 3:35).

There was plenty of coverage of the conference: The launch of the Decent Life Initiative for a Climate Resilient Africa by 2030 is got a mention by Masaa DMC (watch, runtime: 8:09) and Al Hayah Al Youm (watch, runtime: 1:46). The launch of Brain Trust Africa by financial institutions is getting a note by Al Hayah Al Youm (watch, runtime: 3:01), as did the second day of the Saudi Green Initiative Forum (SGIForum) on the sidelines of COP (watch, runtime: 2:14). Meanwhile, El Hadidi said that Egypt has signed MoUs worth USD 23.6 bn during the summit so far in a segment highlighting how COP is benefiting Egypt and defending the large amounts of money that have spent preparing Sharm El Sheikh (watch, runtime: 3:44).

And more rebuttals to Western criticism: El Hadidi fended off accusations by Western media that food and drink was in short supply at the summit by speaking about her experiences at COP26 in Glasgow and accusing journalists of “exaggerating the problem” (watch, runtime: 5:22).

11/11: Ala Mas’ouleety’s Ahmed Moussa expressed his happiness that protests failed to materialize on Friday and thanked his viewers for staying at home (watch, runtime: 4:22). El Hekaya (watch, runtime: 3:36) and Al Hayah Al Youm (watch, runtime: 4:07) also took note of the calls to protest being snubbed.

A deadly crash that killed at least 21 people and injured eight others after a bus derailed into Dakahliya’s Mansuriya canal is also getting coverage. The region’s governor, Ayman Mokhtar, said that the bus driver has been arrested and tested positive for narcotics. Ala Mas’ouleety (watch, runtime: 4:27), Kelma Akhira (watch, runtime: 1:01) and others had coverage. The accident is getting international coverage from outlets ranging from Reuters and the Associated Press to Al Arabiya, among others.

EGYPT IN THE NEWS

COP27 in the foreign press: Biden’s visit, Alaa Abdel Fattah and climate protests

Jailed activist Alaa Abdel Fattah led the conversation on Egypt in the international press over the weekend after his family said he has “undergone a medical intervention” to maintain his health as he continues his hunger and water strike. Picking up the story: Reuters | BBC | Deutsche Welle | Haaretz | CNN | FT | NYT. Meanwhile, the Associated Press took note of Foreign Minister Sameh Shoukry reiterating his belief that COP27 should be focused on climate change, rather than on Abdel Fattah and other political issues.

Yesterday’s protests at COP are getting just as much attention, with foreign media commenting on a number of small climate demonstrations that took place yesterday in the blue zone. Abdel Fattah’s sister Sanaa Seif led a separate protest calling for the release of the jailed activist. Covering the protests: AP | Reuters | Washington Post | New York Times among others.

President Abdel Fattah El Sisi’s sit-down with US President Joe Biden on Friday is also making the rounds, with most outlets focusing on the human rights angle (Reuters | Bloomberg | The National). The White House is doing “everything we can” to secure the activist’s release and other political detainees, the Washington Post reported US national security adviser Jake Sullivan saying on board air force one. We have the full story in Diplomacy, below.

PLANET FINANCE

PIF sells 10% in Tadawul Group through accelerated bookbuild: Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), successfully sold on Friday a 10% stake in Tadawul Group, via an accelerated bookbuild, according to a regulatory filing (pdf). The 12 mn shares were sold at SAR 191 apiece, 8.9% below its closing price on Thursday. HSBC Saudi Arabia and Morgan Stanley were joint global coordinators and joint bookrunners for PIF, while Al Rajhi Capital was also joint bookrunner.

|

|

EGX30 |

11,757 |

-0.2% (YTD: -1.6%) |

|

|

USD (CBE) |

Buy 24.36 |

Sell 24.44 |

|

|

USD at CIB |

Buy 24.39 |

Sell 24.44 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

11,212 |

-1.7% (YTD: -0.6%) |

|

|

ADX |

10,630 |

+0.1% (YTD: +25.2%) |

|

|

DFM |

3,407 |

+0.7% (YTD: +6.6%) |

|

|

S&P 500 |

3,993 |

+0.9% (YTD: -16.2%) |

|

|

FTSE 100 |

7,318 |

-0.8% (YTD: -0.9%) |

|

|

Euro Stoxx 50 |

3,869 |

+0.6% (YTD: -10.7%) |

|

|

Brent crude |

USD 95.99 |

+2.5% |

|

|

Natural gas (Nymex) |

USD 5.88 |

-5.8% |

|

|

Gold |

USD 1,769.40 |

+0.9% |

|

|

BTC |

USD 16,792 |

+0.2% (YTD: -63.6%) |

THE CLOSING BELL-

The EGX30 fell 0.2% at Thursday’s close on turnover of EGP 1.28 bn (13.6% above the 90-day average). Regional investors were net buyers. The index is down 1.6% YTD.

In the green: Credit Agricole Egypt (+6.9%), Rameda Pharma (+5.0%) and Ezz Steel (+4.8%).

In the red: CIB (-4.7%) and Eastern Company (-4.2%).

DIPLOMACY

Biden and El Sisi discuss climate and Alaa Abdel Fattah

El Sisi sits down with Biden: US President Joe Biden met with President Abdel Fattah El Sisi on Friday on the sidelines of COP27. The two promised to step up efforts to address climate change, according to readouts from the White House and Ittihadiya. Biden and El Sisi also reaffirmed the importance of the two countries’ strategic relations, along with security and political turbulence in the region, especially in Palestine, Libya and Yemen. The story got coverage in Reuters and Bloomberg, among others.

Human rights was on the agenda: El Sisi underscored Egypt’s efforts on the human rights front by pointing to the national human rights strategy Egypt launched last year, as well as the reactivation of the presidential pardon committee, Reuters reports. Biden brought up activist Alaa Abdel Fattah and called for his release, after his family submitted a fresh appeal for a presidential pardon. Biden’s discussion of Alaa’s detention with El Sisi comes after the Prosecutor General issued a statement on Thursday asserting that Alaa is in “good health.” Bloomberg had the story.

LOCAL REAX- Local media covered the family’s appeal for a presidential pardon, positioning it as the first time that an appeal was made in the “correct means” as opposed to in the Western press. Influential talkshow host Amr Adib waded into the topic on Friday night (watch, runtime: 3:48), saying that in this case, Egypt should do whatever is in its best interest. See more in Masrawy | AMAY | Al Shorouk | Al Dostor.

Shoukry, Kerry talk climate on the sidelines: Foreign Minister and COP27 President Sameh Shoukry met with the US climate envoy John Kerry to discuss climate topics on the COP agenda, the Egyptian Foreign Ministry said in a statement. Shoukry stressed that Egypt is looking to help countries participating in COP27 to reach common ground on global climate issues, while Kerry presented the US’ position on the topics at hand, the statement said, without providing further information.

CALENDAR

NOVEMBER

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7-13 November (Monday-Sunday): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

10-13 November (Thursday-Sunday): Asian Tour — International Series Egypt, Madinaty, Egypt.

13 November (Sunday): Senate back in session.

15-16 November (Tuesday-Wednesday): G20 summit, Bali, Indonesia.

20 November (Sunday): House back in session.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

22 November- 23 November (Tuesday-Wednesday): The Fingerprint Summit will be held at the Nile Ritz Carlton Hotel.

27 – 28 November (Thursday-Friday): The first edition of the Egypt Media Forum.

27-30 November (Sunday-Wednesday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

DECEMBER

1 December (Thursday): Sphinx International Airport will begin operating international flights.

1 December (Thursday): Contractors to break ground on Egypt-Saudi interconnection project.

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

5-8 December (Monday-Thursday): QS Reimagine Education Awards and Conference, multiple locations.

10 December (Saturday): The TriFactory’s Pyramids Half Marathon.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

December: Chinese President Xi Jinping visit to Saudi Arabia

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of November: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.