- Listing on the EGX just got a little easier + a boost to margin trading. (Capital Markets)

- Oppo becomes the latest handset maker to announce plans to assemble mobile phones in Egypt. (Investment Watch)

- Nitro fertilizer producers are going to have to pay more for their gas. (Energy)

- Deadline day for Domty shareholders. (What We’re Tracking Today)

- What can we expect from El Sisi’s talks with the Qatari emir today? (What We’re Tracking Today)

- The central bank really doesn’t want us getting involved in crypto. (Last Night’s Talk Shows)

- US stocks just had their worst day since June 2020 after inflation data was slightly worse than expected. (What We’re Tracking Today)

- Infrastructure players reported solid earnings in 2Q 2022 despite global headwinds. (Hardhat)

- Dubai toll operator Salik’s IPO covered on day one. (Planet Finance)

Wednesday, 14 September 2022

AM — Madbouly gov’t signals it’s serious about making nice with private business

TL;DR

WHAT WE’RE TRACKING TODAY

The Madbouly government has a message for you this morning: “We’re serious about making nice with private business. Begad.” (Okay, we’re paraphrasing. But still…)

EXHIBIT #1- The super-detailed rundown on where things stand with nine companies that pledged to make investments worth a combined USD 1 bn. Government communiques are usually written in bureaucrat-speak and full of vague generalities about “pumping” untold sums of investment and all of the wonderful things policymakers are “ordering.” Instead, the PM and the companies in question (local and international alike) provided a detailed rundown — project by project — of where things stand, what the obstacles are, and the price tag and timeline on each.

EXHIBIT #2- The FRA + EGX presser yesterday. New FRA boss Mohamed Farid got off to a good start a couple of weeks ago with his promise to fast-track M&As (and, we hope, IPOs, too), a perennial sticking point for the private sector. Business doesn’t need a yes-man as regulator of the financial industry — but it craves clarity and speed. Give a clear “Yes” or “No” by a set deadline and everyone walks away happy.

Farid and new EGX chief Ramy El Dokany struck the right notes yesterday with a series of measures designed to make local investors a bit happier. More significantly, Farid is signaling that he plans to make it much less bureaucratically onerous to list your company on the EGX in a move that he hopes will build a strong pipeline of IPOs for when market sentiment improves (on EM in general and Egypt in specific). We’re looking forward to more details on all of the changes and initiatives in the coming weeks.

^^ We have chapter and verse on both stories in this morning's news well, below.

WATCH THIS SPACE #1- What will President Abdel Fattah El Sisi bring home from Doha? It’s the final day of the president’s landmark two-day visit to Qatar, and he’s slated to sit down with Qatari Emir Tamim bin Hamad Al Thani, Ittihadiya spokesman Bassam Rady said in a televised interview last night (watch, runtime: 9:51). El Sisi will meet Qatari business leaders in an expanded meeting later, where renewables, green hydrogen and liquefied natural gas (LNG) will be high up on the agenda, Rady said. We’re also looking for signs that Qatar might pull the trigger on its promise of several USD bn worth of investments here. El Sisi’s visit comes months after Al Thani visited Egypt in June. Egypt and Qatar re-established diplomatic ties in early 2021.

BACKGROUND- Doha committed in March to invest USD 5 bn in Egypt, sparking reports that Qatar’s sovereign wealth fund and some of the country’s biggest companies are considering acquiring stakes in Egyptian companies and investing in various projects. Qatari officials discussed investing USD 2-3 bn in the country during talks with the Madbouly government, Finance Minister Mohamed Maait said in June.

Improving ties started to bear fruit last year: The value of trade exchange between Egypt and Qatar jumped 76% to USD 44.8 mn in 2021, up from USD 25.4 mn a year earlier, data by statistics agency Capmas (pdf) showed. The trade relationship wasn’t particularly balanced, with Qatari exports coming in at USD 40.3 mn.

WATCH THIS SPACE #2- The IMF is considering giving unconditional emergency to countries hit by the war in Ukraine, sources with knowledge of the plans tell Reuters. Under the plans, the Fund would allow countries most susceptible to food price shocks to access finance without having to agree to the stringent conditions that usually accompany a program. Some 50 countries meet the criteria set under the plan, with 20-30 in need “immediately,” IMF Managing Director Kristalina Georgieva told Center for Global Development President Masood Ahmed in a virtual interview, according to Bloomberg.

Egypt won’t be on the list of beneficiaries: Countries that have already received or are negotiating IMF assistance would not be able to apply, former IMF official Masood Ahmed told the newswire.

WHAT’S HAPPENING TODAY-

Today is the last day for shareholders to sell their shares to the consortium of investors led by Expedition Investments, which is bidding to take a 34% stake in the EGX-listed cheesemaker. Expedition sweetened the offer by upping its offer price by 10% last week.

Expedition has more than half of its targeted shares in Domty: Shareholders have reportedly agreed to sell almost 53 mn shares to the consortium, according to Al Borsa. This is roughly 55% of the 96.2 mn shares it is targeting.

FOR TOMORROW-

B Investments is going to have to make up its mind over TotalEnergies Egypt: The private equity player has the right to preempt a bid by Abu Dhabi energy giant Adnoc to acquire a 50% stake in the company, which expires tomorrow.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

THE BIG STORY ABROAD-

It was a ‘sell everything’ kind of day in the markets yesterday: US stocks suffered the worst day since June 2020 yesterday after August inflation data reminded the markets that the fight against rising prices is nowhere near close to being over. The S&P 500 index tumbled 4.3% and the tech-heavy Nasdaq fell 5.2% after data showed that inflation unexpectedly rose last month, sparking fear that the Federal Reserve will approve another huge rate hike when it meets next week. The greenback was about the only asset that avoided the carnage, as investors dumped commodities and bonds, causing yields on short-dated bonds to hit their highest levels in almost 15 years.

Could we be looking at a previously unthinkable 100-bps hike? While a third successive 75-bps increase is now all but certain, the market is now giving a 1-in-3 chance that the Fed could go even larger and hike by a full 100 bps.

It’s ugly in Asia, too, this morning, where the sell-off has spread to stocks, bonds and currencies in the region. Shares in Japan, Hong Kong and Australia were all more than 2% in the red before dispatch, while the South Korean Kospi and shares in China were down more than 1%. There won’t be any let up in Europe or the US later today, according to stock futures.

The story is front-page news everywhere this morning from the Associated Press and Reuters, to Bloomberg, the Financial Times and the Wall Street Journal.

MEANWHILE- The UN is sounding an exceptionally gloomy note on climate, with UN Secretary General Antonia Guterres saying we’re entering “uncharted territory of destruction” through our collective failure to act on slashing greenhouse gas emissions. This morning’s edition of Enterprise Climate has more on his remarks and the multi-agency report that prompted them.

SPEAKING OF CLIMATE- Saudi hikes oil output by most in two years: Saudi Arabia upped output by 236k barrels per day (bpd) to 11 mn bpd in August, according to OPEC’s monthly oil market report (pdf). This comes after the oil giant agreed to ramp up production for the month in response to falling Russian output. The new influx of oil helped push Brent to its lowest level since January earlier this month, though it has since recovered and is currently sitting at USD 93.55 per barrel. The country’s oil output has “only rarely” reached the 11 mn mark, with the last time being the peak of the pandemic in April 2020, Bloomberg reported.

No cause for celebration: OPEC+ said it will cut supply in October in a surprise move meant to support oil prices.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, and urban development, as well as social infrastructure such as health and education.

In today’s issue: Despite a combination of headwinds, including soaring building and raw material prices and FX pressures, EGX-listed infrastructure players managed to weather the storm to a large degree in 2Q 2022. We look at the strategies they relied on to shield their bottom lines — and the outlook for the sector.

The Somabay Endurance Festival, organized by The TriFactory, returns this month for the fourth time. Featuring four different races that combine swimming, cycling, and running, as well as the 1K Kids Race (ages 5-10) and the 10K Race, the Somabay Endurance Festival has got something for everyone. Taking place from 29 September though 1 October, spots are running out for Egypt’s favorite multi-sport event. To find out more and sign up, head to www.thetrifactory.com/somabay.

CAPITAL MARKETS

Listing on the EGX just got a little easier + a boost to margin trading

SMART POLICY- FRA tweaks listing procedures + scraps margin trading caps: The Financial Regulatory Authority (FRA) has handed down a slate of changes designed to boost liquidity on the EGX. At a presser yesterday, the FRA made its first major policy statement of the Mohamed Farid era, announcing new measures to simplify listing requirements and boost margin trading.

Here’s the rundown:

#1- Listing on the EGX got a little bit easier: Companies can now “temporarily” list their shares on the EGX before getting regulatory approval from the FRA, under amendments to listing rules (pdf) approved by the regulator, Farid said during the presser.

More time for companies to get their ducks in a row: Companies will now have six months to meet listing requirements, including minimum quotas for the number of listed shares and shareholders. Companies were previously required to seek pre-approval from the FRA before listing their shares and were given a one-month window to begin trading after getting the FRA’s blessing.

#2- The FRA has also scrapped (pdf) proposed caps to margin trading: The rules, first proposed by the regulator last year, would have placed new limits on the number of shares investors could purchase on margin. In November the regulator delayed introducing the limits on fears that they could hurt activity at a time when the reintroduction of the capital gains tax was expected to depress trading volumes.

So… how does the watchdog plan to mitigate risk? Brokerages now have to conduct risk assessments on incorporated investors before lending them funds for margin trading. They also need to update them every year as needed, and be prepared to provide the data to the EGX and FRA when requested.

The EGX and the FRA will still butt in if needed: The amendments still give the two authorities the power to ban certain securities from being traded on margin or control price movements for securities when necessary.

SOUND SMART- Margin trading is basically a brokerage loaning money to a client so the client can buy more shares. Check out our explainer, which takes a deep dive into the topic, including its risks (margin calls) and benefits (more liquidity in the market).

ALSO FROM THE FRA + EGX-

- The shares of companies undergoing liquidation can now be written off at any stage of the process, meaning folks holding the shares can take charges today rather than waiting many quarters (or years) before wrapping things up.

- A proper secondary market for debt: Any of the Finance Ministry’s issued securities — like sukuk and variable bonds — can now be listed on the EGX, a move designed to help create an active secondary market for debt in Egypt (and, we hope, drive interest in a market for corporate paper).

- Clearing derivatives trades: The regulator wants to set up a central counterparty clearing house (CCP) to facilitate and oversee derivatives trading.

- Resuscitating short selling: The FRA, EGX and Misr for Central Clearing and Depository (MCDR) are in talks with foreign investors and experts — among them Citibank — on best practices to boost short selling activity and improve clearing procedures in the country.

- Expediting approvals for ins. products: The FRA discussed with ins. companies accelerating approvals by the regulator for new products.

WATCH THIS SPACE- Who’s in for the local carbon market? The EGX is in talks with asset managers about participating in a future local carbon market being planned by policymakers.

WHY THIS MATTERS-

Coming just a month into his term, these changes are a glimpse of the kind of FRA boss Farid will be. The regulatory tweaks, especially the scrapping of margin caps, see us moving more towards a free market in which the regulator’s direct presence is less pronounced than before, Arqaam Capital Associate Director Noaman Khalid told us. “This allows it to go back to its core function, which is to act when there’s suspicion of potential corruption or manipulation in the markets,” he added.

Farid is timing his move so that quality companies start thinking today about listing — his aim is clearly to have more high-quality paper on the runway in the hope we’ll see a string of attractive IPOs when market sentiment (globally and in Egypt, specifically) turns. Investors have long hoped to see a wider range of companies (and more depth within key industries) on offer on the EGX.

Remember that this comes just two weeks after Farid promised the FRA will fast-track M&A, granting or denying approval on proposed transactions without unnecessary delays. Regulatory delays prior to his taking office were the reason FAB walked away from its acquisition of EFG Hermes earlier this year.

Farid is looking to give a much-needed kick to both private and public markets: The EGX, still down 13% year-to-date, has only in the past few weeks seen trading volume break back past the EGP 1 bn per-day mark. Foreign and institutional investors fled public markets in a global risk-off following Moscow’s invasion of Ukraine — and have yet to return.

Waiting for Godot: Investors in private and public markets alike are holding back as they wait to see what happens with the EGP. No international investor is going to commit capital here — for an M&A, to take a position in an EGX-listed company, or to kick off a greenfield project — until it’s clear they won’t be taking a hair cut in USD terms.

“Before foreign investors can regain confidence in the Egyptian bourse, we need to first regain the confidence of the local investor,” new EGX boss Ramy El Dokany said during the presser. “We need new tools to facilitate smaller investments from regular investors,” El Dokany said, citing short-selling and exchange-traded funds (ETFs).

ALSO- MCDR to launch an app for clearing services: The clearing house is working to launch an app through which investors can easily collect returns and dividends, MCDR Managing Director Khaled Rashed said at the presser. The app — which will be dubbed EgyClear — is part of a digital overhaul for the company that will see it invest USD 15 mn over the next three years, he said. The MCDR board approved hiring Baker & McKenzie to help in the modernization strategy, MCDR Managing Director Hesham Mabrouk said in statements picked up by Al Borsa. It will prepare a comparative study between MCDR and global clearing houses, Mabrouk said, expecting the study to be finalized within two months.

INVESTMENT WATCH

Oppo set to assemble mobile phones in Egypt as Madbouly reviews investment pledges

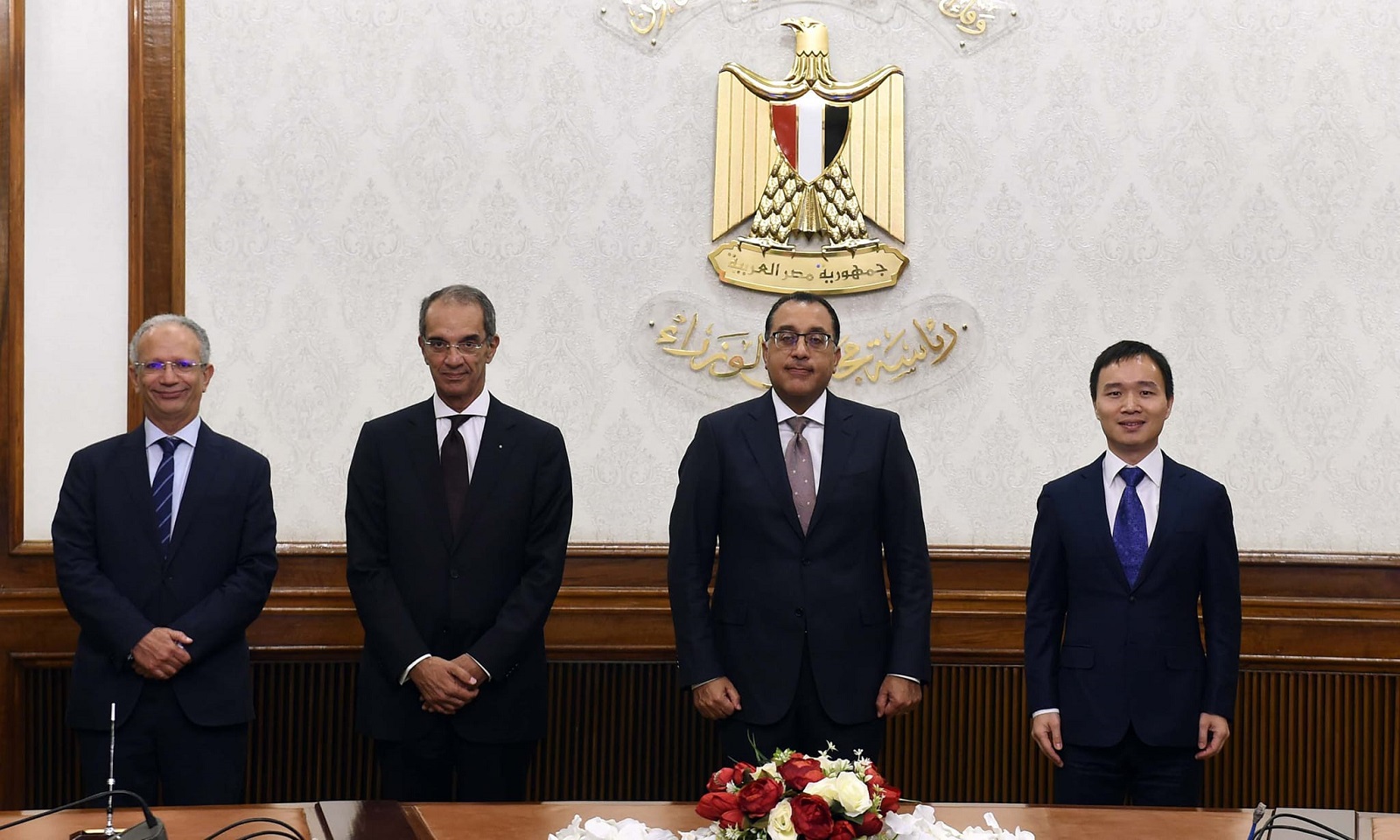

All the industrial investment: Chinese mobile maker Oppo has inked an agreement to build a USD 20 mn factory in Egypt. The announcement came the same day Prime Minister Moustafa Madbouly met with nine foreign and local companies to follow up on pledges to invest more than USD 1 bn in new production facilities.

Oppo will set up a USD 20 mn mobile phone plant in Egypt under an agreement signed yesterday with the Communication Ministry’s Information Technology Industry Development Agency (ITIDA), according to a cabinet statement. The facility will have an initial production capacity of 4.5 mn devices per year and create some 900 jobs within the next three to five years, with the potential to expand further according to market demand, according to the statement. The move comes as part of ITIDA’s Egypt Makes Electronics initiative, which aims to position Egypt as a regional hub for electronics assembly. The ministry in March discussed setting up a factory with the Chinese firm, which is a dominant player in the local mobile market and has been eyeing opening a factory from as far back as 2017.

This is the third multinational phone manufacturer to have signed an agreement to set up shop in Egypt in recent months, following Vivo and HMD Global. Between them, the three companies will invest USD 75 mn and produce some 16 mn phones every year, Communications Minister Amr Talaat told Kelma Akhira’s Lamis El Hadidi last night (watch, runtime: 2:26). Companies will be required to source at least 40% of the components from local suppliers, the minister said in a separate interview on Ala Mas’ouleety (watch, runtime: 3:33).

MEANWHILE- Prime Minister Moustafa Madbouly followed up on more than USD 1 bn worth of MoUs for industrial investment by nine foreign and local manufacturers amid the state’s localization push, cabinet said. The government is ready to issue licenses for the projects, Madbouly said, offering the investors a helping hand to overcome any obstacles and get the new factories up and running. The factories are set to create more than 35k jobs combined, he added.

Companies shared updates on the projects:

- Emirati fertilizer company CFC Group will start contracting in February for its USD 400 mn industrial complex in Qena Governorate.

- Japanese conglomerate Sumitomo will start work on its huge factory in Tenth of Ramadan City in the next three months. The facility will be the largest of its kind in the world, and will produce pigtail cables used in cars and cable harnesses.

- Local pharma firm Gennecs asked the PM for help obtaining licenses for its USD 150 mn vaccine manufacturing facility. Madbouly said he would discuss the issue with the national meds regulator.

- Chinese appliance manufacturer Haier Electrics has obtained land for its USD 130 mn industrial complex to produce household appliances, with a first USD 80 mn phase set to launch in 2024.

- Turkish retailer Beko has set up a company to build a USD 100 mn refrigerator and oven plant in Tenth of Ramadan, with production to start within a year.

- Japanese auto parts maker Yazaki is waiting to receive land to start building a EUR 20 mn factory in Fayoum that will export auto parts under freezone rules. Operations are set to kick off in December 2024.

- Italian chemical producer Mapei has begun building a USD 20 mn chemical and insulation materials factory, which is on track to begin operations in 3Q 2023.

- Local clothes manufacturer Alex Apparel is developing two clothing factories it acquired earlier this year to bring them up to European quality standards and increase annual output to more than 33 mn garments, with operations slated to begin in 2023.

- IT infrastructure contractor Benya Group has so far invested some EGP 750 mn and completed 90% of construction for the first phase of its EGP 1 bn fiber optic cable plant, which is set to launch in November.

ALSO WORTH NOTING- The Suez Canal Economic Zone (SCZone) approved a proposal to grant five-year residency permits to investors in the zone in a bid to help improve the investment climate, according to an SCZone statement.

ENERGY

Nitro fertilizer producers will now pay more for gas

Producers of nitrogen fertilizers could see their natural gas bills rise following a government decision to link them to the price of urea fertilizer.

What’s going on exactly? Companies will now have their gas bills calculated based on a new formula that takes into account the price of a ton of urea supplied to the government and its export price, according to the decision published in the Official Gazette yesterday. The mechanism will be updated monthly, the decree said, without providing further information.

There are exceptions: The decree does not include companies that buy gas at price formulas in natural gas contracts. Producers of other kinds of fertilizers also won’t be affected and will continue to purchase natural gas at the current USD 5.75 per mmBtu price.

This could eventually cut costs for producers: Under the decision, the gas price for nitrogen fertilizer producers has been lowered to a minimum USD 4.5 / mmBtu from USD 5.75.

But this isn’t likely to happen for a while: Global fertilizer prices have soared since the beginning of last year on surging post-pandemic demand, rising inflation, and more recently the Western sanctions on Russia, the world’s largest exporter of fertilizers. Urea has been no exception. The price per ton on the global market is currently at USD 850, almost double the price it was this time last year.

The short-term damage? Gas prices will likely rise more than 35% to reflect the current price of urea. Companies will now pay around USD 7.8 / mmBtu for their gas, up from USD 5.75 currently, Radwa El Swaify, head of research at Pharos, told Al Arabiya. This is based on the USD 760 export price currently being charged by Egyptian companies and the USD 225 price at which the fertilizer is supplied to the government, she said.

The sky’s the limit: How much companies pay for their gas will depend on how much further urea prices rise. Global prices surpassed USD 1k per ton earlier this year on the back of the war in Ukraine, and after falling back in 2Q have surged more than 50% since June.

The rationale: This is the government looking to capitalize on the spike in urea prices. Profits at fertilizer companies have ballooned over the past 18 months, providing an opportunity for the government to up its natural gas revenues.

Producers could ask the government for permission to hike subsidized urea prices if costs rise rapidly. The government already allowed companies to raise prices by 50% to EGP 4.5k a ton in December following the previous gas price hike.

MOVES

Biola Alabi joins Cairo Angels Syndicate Fund as venture partner

Angel investor Biola Alabi (LinkedIn) has joined Cairo Angels Syndicate Fund (CASF) as a venture partner, the fund said in a statement (pdf). Alabi is a leading angel investor and advisor to African technology and media firms, and recently co-founded Atika Ventures, a female-led venture fund that offers pre-seed and seed stage capital to consumer technology and product startups in West and East Africa. Alabi will “take the lead on origination, investments, portfolio management and investor relations” at CASF.

LAST NIGHT’S TALK SHOWS

Last Night’s Talk Shows: El Sisi in Doha + Crypto is bad, says CBE (again)

Qatar, crypto and local industry were all over the airwaves last night. We have the rundown on the local industry story in this morning’s news well, above. Meanwhile:

El Sisi in Doha: President Abdel Fattah El Sisi’s visit to Doha was everywhere on the airwaves last night, with Ala Mas’ouleety’s Ahmed Moussa getting hyped to" stick it to the Ikhwan (watch, runtime: 4:07) and Lamees El Hadidi striking a more measured tone on the landmark visit (watch, runtime: 2:25). Ittihadiya spokesman Bassam Rady told Moussa (watch, runtime: 2:19) about the agenda for the visit while El Hadidi noted that the trip comes ahead of UN Security Council meetings this month and the next Arab League summit in Algeria in the first week of November (watch, runtime: 2:25). The story was also picked up by Salet El Tahrir (watch, runtime: 6:44), Yahduth Fe Masr (watch, runtime: 4:34) and Masa’a DMC (watch, runtime: 0:56).

The Central Bank of Egypt slapped another parental advisory sticker on the crypto market yesterday, warning Egyptians not to get involved in trading digital assets. This is the latest of many messages from the central bank, which has constantly tried to steer the public away from investing in crypto, warning about the high levels of risk to the individual and the stability of the banking system at large. The warning got coverage from Salet El Tahrir (watch, runtime: 8:48), Al Hadath Al Youm (watch, runtime: 5:53) and Yahduth Fi Masr (watch, runtime: 4:48).

You can read the statement for yourself here (pdf), if you like.

SOUND SMART- Uneducated twentysomething individual investors engaging in crazy gymnastics to open wallets abroad? Not good. But also not good is the fact that the UAE is emerging as a major global crypto hub. That Bahrain has a crypto sandbox to let companies (safely) work out innovation — with a startup founded by an Egyptian on the bleeding edge. And that even KSA is studying crypto regulation and has brought in a chief. We’re both crypto-curious and crypto-skeptical, but this cannot be the CBE’s answer to crypto forever.

The economic conference taking place at the end of this month also got coverage, with Masa’a DMC talking with Vice Minister of Finance Ahmed Kouchouk about the plans (watch, runtime: 13:37). Kouchouk didn’t offer many new details, and instead talking in broad terms about the importance of investment, industrial development and the private sector. It’s possible that the upcoming conference could see some additions to the first draft of a State Ownership Policy document, after the state held over 30 societal dialogues with industries and experts, he said.

EGYPT IN THE NEWS

El Sisi in Doha: President Abdel Fattah El Sisi’s first visit to Qatar since the two countries restored diplomatic ties last year is driving the conversation on Egypt in the foreign press this morning: Associated Press | Reuters.

The Foreign Ministry isn’t happy with HRW: The Foreign Ministry yesterday rejected a report by Human Rights Watch that alleged authorities were tamping down environmental activism in the lead up to COP27. (AP)

Court rules against university lecturer: Suez University lecturer Mona Prince has lost a legal battle against the university, which fired her after she shared a video of herself belly dancing online. (Reuters)

ALSO ON OUR RADAR

Elsewedy Electric opens second phase of Tanzania industrial park: Elsewedy Electric opened a transformer factory in Tanzania yesterday, the company said in a statement (pdf) to the EGX, marking the second phase launch of its USD 50 mn Kigamboni industrial complex. The factory has an annual production capacity of 2.5k transformers. Elsewedy last year launched the industrial park with the start of operations at its USD 35 mn wires and cables factory. The industrial complex will eventually also host factories for meters and PVC and a logistics center.

Sawiris brothers inherit their late father’s OC shares: Some 12.9% (15 mn shares) of Orascom Construction (OC) that was owned by Onsi Sawiris Sr has been transferred to his three sons following the family patriarch’s death in June last year, OC said in a regulatory filing (pdf). Nassef and Naguib Sawiris each received 6.4 mn shares (5.5%), while Samih Sawiris received 2.1 mn shares (1.8%). The transfer means the Sawiris family continue to own some 51.8% of OC — Nassef Sawiris owns 34.5%, Samih Sawiris owns 11.8%, and Naguib Sawiris owns 5.5%.

Edita close to acquiring a new production line: Edita is in the final stages of acquiring an additional production line for its cake segment for around EGP 20 mn, it said in a disclosure (pdf) to the EGX yesterday. The company didn’t disclose the name of the company it’s negotiating with or the line’s production capacity.

PLANET FINANCE

Dubai toll operator IPO covered within hours: Investors booked all 1.5 bn shares in Dubai’s state-owned road toll operator Salik on the first day of subscription, Bloomberg reports, indicating continued strong demand for Gulf IPOs at a time when the listing pipeline in other markets has all but dried up. Dubai hopes to raise USD 817 mn by selling a 20% stake in Salik at AED 2.0 (USD 0.54) per share, valuing the company at some USD 4.1 bn. The company is expected to make its market debut on 29 September. The sale marks the emirate’s third IPO of the year as part of a plan to add depth to the market by listing 10 state-owned firms.

Advisors- Our friends at EFG Hermes and HSBC are joint bookrunners alongside Citigroup, while Emirates NBD, Goldman Sachs and Merrill Lynch are global coordinators.

Saudi wealth fund dives into local tourism: Saudi Arabia’s Public Investment Fund will acquire a 30% stake in Seera Group Holding’s tourism arm Almosafer Travel and Tourism in a SAR 1.5 bn (USD 413.5 mn) transaction, it said in a disclosure to the Saudi stock exchange. Around a quarter of the investment is an earn-out linked to company KPIs for the next two years. The move comes as the fund looks to diversify its investment portfolio, and against the backdrop of a Saudi push to open the country to tourists as it looks to reduce its dependence on oil revenues.

ALSO IN PLANET FINANCE-

- Serbia is the latest country to turn to the IMF: Serbia wants to negotiate with the IMF and the UAE for emergency funding as it struggles amid soaring borrowing costs. (Financial Times)

- “Debt monsters”: The FT lists some 207 companies whose debt burdens spell danger as rates rise and cashflows tighten — including Chinese real estate firms, a French supermarket chain, an Indian miner, and a Belgian toilet manufacturer. (Financial Times)

- When low unemployment is a bad sign: The UK’s unemployment rate fell to its lowest level in almost 50 years in July, recording 3.6% — but the decline was mostly down to more people dropping out of the workforce, while high wage growth suggests a shortage of jobseekers. (ONS | Reuters)

|

|

EGX30 |

10,397 |

-0.4% (YTD: -13.0%) |

|

|

USD (CBE) |

Buy 19.30 |

Sell 19.41 |

|

|

USD at CIB |

Buy 19.33 |

Sell 19.39 |

|

|

Interest rates CBE |

11.25% deposit |

12.25% lending |

|

|

Tadawul |

12,084 |

+0.5% (YTD: +7.1%) |

|

|

ADX |

9,986 |

+0.6% (YTD: +17.6%) |

|

|

DFM |

3,458 |

+1.6% (YTD: +8.2%) |

|

|

S&P 500 |

3,933 |

-4.3% (YTD: -17.5%) |

|

|

FTSE 100 |

7,386 |

-1.2% (YTD: 0.0%) |

|

|

Euro Stoxx 50 |

3,586 |

-1.7% (YTD: -16.6%) |

|

|

Brent crude |

USD 93.55 |

-0.5% |

|

|

Natural gas (Nymex) |

USD 8.38 |

+1.6% |

|

|

Gold |

USD 1,712.90 |

-1.6% |

|

|

BTC |

USD 20,131 |

-9.9% (YTD: -56.3%) |

THE CLOSING BELL-

The EGX30 fell 0.4% at yesterday’s close on turnover of EGP 1.44 bn (35.5% above the 90-day average). Foreign investors were net sellers. The index is down 13.0% YTD.

In the green: Cleopatra Hospitals (+4.0%), Fawry (+1.4%) and Oriental Weavers (+0.7%).

In the red: Qalaa Holding (-2.7%), Egypt Kuwait Holding-EGP (-2.1%) and e-Finance (-1.9%).

DIPLOMACY

The Egyptian navy will take command of the US-led Red Sea taskforce from November, the US military said Monday following talks between Centcom commander Gen. Michael Kurilla and Defense Minister Mohamed Zaki in Cairo. Task Force 153 was set up in April by a US-led coalition to patrol the Red Sea and the Gulf of Aden. Egypt joined the group last year, becoming its 34th member.

Fast-tracked arms: Kurilla pledged to work with the US government “to expedite the bureaucratic and cumbersome foreign military sales process with partners in the Middle East.” His predecessor in March expressed optimism that the US would provide Egypt with long-awaited F-15 fighter jets, but described the process as “a long, hard slog.” US military sales and aid to Egypt are a regular source of controversy on the Hill, with some lawmakers calling to withhold arms on human rights grounds.

Climate talks with Singapore’s senior minister: Foreign Minister Sameh Shoukry, Environment Minister Yasmine Fouad and Egypt’s high-level climate champion Mahmoud Mohieldin discussed preparations for COP27 with Singapore Senior Minister Teo Chee Hean during his visit to Cairo this week, Singapore’s Foreign Ministry said in a statement. Mohieldin and Teo discussed setting up local carbon markets and the use of blended finance to fund climate projects in the developing world.

Egypt backs China on Xinjiang: Egypt was among 21 countries to sign a statement criticizing a recent UN report which accused Beijing of “systematic” and “grave” human rights violations against ethnic Uyghurs in Xinjiang province, Reuters reports.

AROUND THE WORLD

Kenya finally gets a new president: Kenya’s former deputy president William Ruto was sworn into office yesterday following last month’s contentious election, Reuters reports. Ruto is the country’s fifth head of state, and was inaugurated a week after Kenya’s Supreme Court rejected vote rigging allegations by rival presidential candidate Raila Odinga.

The UN isn’t buying what Putin’s selling on the Ukraine grain pact: A senior UN official has rejected Russian Vladimir Putin’s criticism of the Ukraine grain pact, saying that the arrangement is working as planned, the Financial Times reported. The Russian president last week claimed that most of the wheat being exported by Ukraine is heading to developed countries, and threatened to intervene to direct more shipments to poorer nations in Africa and Asia. Turkey, which brokered the agreement between the warring countries with the UN, voiced support for Putin’s position.

Infrastructure players remained resilient in the face of global pressures in 2Q 2022: A toxic mix of local and global economic headwinds have buffeted both construction and the infrastructure industry throughout the first half of the year, with players having to withstand raw material shortages, FX pressure, rising commodity prices, spiraling inflation, and fears that demand could slump. The second quarter of the year saw the full impact of the fallout hit local industry players, but they managed to offset the challenges to their earnings through their diverse portfolios and a proactive approach to managing inventory and working capital, according to analysts we spoke with.

IN CONTEXT- Soaring prices of commodities and building materials, rising global interest rates, and volatility in international financial markets have seen USD 20 bn in portfolio outflows from Egypt this year. This has also put pressure on the EGP, which has slipped more than 22% since March, and which is projected to fall further as the government embraces a more flexible exchange rate amid talks with the IIMF for an assistance package. Add to that import restrictions that have hobbled businesses from obtaining building and raw materials, and you have a pretty difficult quarter for contractors.

Today, we look at the two major players listed on the EGX: Elsewedy Electric and Orascom Construction (OC). Despite the obstacles, both companies performed better in 2Q 2022 than the first quarter of the year. Elsewedy Electric saw revenues rise 50% y-o-y to a record EGP 20.4 bn, with turnkey projects accounting for nearly half of its total revenues, according to its latest earnings release (pdf). Net income was also up 27% y-o-y to EGP 1.1 bn — a near 45% improvement to its bottom line over the first quarter of the year. OC saw an 8% y-o-y rise in revenues to USD 934.9 mn in 2Q 2022, with net income of USD 20.8 mn (down 13% from the same period last year in a high-inflation environment), according to its latest earnings release (pdf). However, its net income in the period was up nearly 60% compared to 1Q 2022 as its Belgian subsidiary Besix Group returned to profitability. Besix had seen its net income fall 45% y-o-y in 1Q 2022 on the back of rising energy prices and raw material shortages due to the Russia-Ukraine war.

Price hikes + strong margins helped both contractors adapt: In OC’s case, its EBITDA margin came under pressure in the Middle East and Africa at the same time as its margins in the US improved substantially, benefiting from the strength of the USD, Arqaam Capital Associate Director Noaman Khalid said. Elsewedy, on the other hand, enacted “significant increases in prices” for its wires and cables segment, which helped it grow its bottom line.

Inventory stockpiling offered an additional shield for Elsewedy: The company’s inventory came in at EGP 19.5 bn by the end of 1H2022, up nearly 50% from the EGP 13.32 bn recorded at the end of 2021, as it continues to build up higher stock in the midst of global supply-chain disruptions. “Inventory stockpiling protected Elsewedy’s operations against any disruptions [related to commodity prices and issues with imports],” EFG Hermes Associate Vice President Ali Afifi said. “Because of their stockpiling strategy from the beginning of the year, rising commodity prices were not captured in its costs this quarter,” he added.

There are key differences between the two contractors: Elsewedy Electric’s wires and cables segment accounts for more than half of its business, whereas OC’s main business segment is contracting, Mohamed Saad, vice president of research at Prime Securities, tells Enterprise. The export side of Elsewedy Electric’s business allows it to benefit from a weaker EGP, Saad explains, which does not apply to OC — though he notes that OC’s USD-denominated revenue streams still give it an advantage. The caveat: “With a large part of OC’s backlog being in Egypt, and with a lot of its needed materials being imported, more devaluation of the EGP is likely to have a negative net impact moving forward,” Khalid said.

Each company also has different priorities for growth: “While Elsewedy Electric has been making acquisitions and greenfield investments as part of expansions in its wires and cables segment, OC’s currently focused on maintaining business-as-usual,” Saad said. OC is focused on “project execution, controls, supply chain and collections,” CEO Osama Bishai said in the earnings release. “This is why OC is proposing making dividend payments to shareholders, while Elsewedy has not been paying them for a while,” Saad explained. OC proposed to pay out USD 27 mn dividends in 3Q 2022, equal to USD 0.2313 per share.

FX movements and shortages do not threaten either of the two: “Elsewedy’s operations are mostly dollarized and denominated in foreign currencies, which shields it from big FX movements,” Afifi said. For Saad, FX shortages do not pose a threat to either contractor because new contracts can be negotiated to accommodate for issues with the USD. He suggests that they can negotiate the use of different currencies, for example. OC is already in the process of renegotiating some existing contracts to help it mitigate the crisis, the company said in its earnings call.

Rising costs of executing national infrastructure projects could also have a slight negative impact on both companies’ earnings, since they both have a significant backlog of national civil and infrastructure projects, Khalid said. “The costs of these projects are rising and timelines are getting stretched as the government takes on additional public and social spending,” Khalid said.

The commodity price cooldown is good — but might not have a massive local impact: While global commodity prices have been cooling since June, with the price of oil falling by about 30%, the weaker EGP offsets this cooldown effect for Egyptian companies, Saad and Khalid agreed. Commodity prices will also likely only correct to up to a portion of their pre-war levels, Saad added. Still, the cooldown could relieve some of the pressure off of the working capital and debt that a company like Elsewedy has taken on (partially to finance its inventory stockpiling) by 4Q 2022, Afifi said.

The whole is greater than the sum of its parts when it comes to contractors: At times like these, what differentiates contractors from competitors is how different business segments perform to offset any challenges, like in the case of OC this quarter, Saad said. This means that, despite challenges threatening contractors moving forward, diverse portfolios and operational dynamics can still help them come out strong, he added. “The challenges will only begin to be addressed when USDs are redistributed, after we secure a package from the IMF and investments from the Gulf,” which is unlikely to reflect on company earnings before 1H 2023, Khalid said.

Your top infrastructure stories for the week:

- Shell, Petronas and EGAS have awarded a Bechtel-led consortium a contract to study integrating the power systems of the Idku LNG terminal and an onshore gas processing plant for the West Delta Deep Marine concession. (Statement)

- Siemens has been awarded an EUR 48 mn contract to equip two control centers in Alexandria and supply 300k smart meters. The project is being funded by the Japanese International Cooperation Agency. (Statement, pdf)

- Investors could have an easier time bidding for PPP projects and paying for the right to use industrial land after the Madbouly Cabinet approved a series of draft decisions and amendments last week.

CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 50 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

11-13 September (Sunday-Tuesday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

12 September (Monday): Consoleya will host a Business Meet-up by Cairo Angels, which will focus on Nigeria’s tech ecosystem.

12-13 September (Monday-Tuesday): Cityscape holds its first pre-summit ahead of the main annual exhibition.

13-15 September (Tuesday-Thursday): Hurghada will host the Regional Seminar on Airport Master Planning organized by ICAO.

14 September (Wednesday): Expedition Investments’ MTO for Domty expires.

15 September (Thursday): Deadline for B Investments to respond to Adnoc’s bid for TotalEnergies Egypt.

15 September (Thursday): Deadline to apply for the fifth phase of the export subsidy program.

15 September (Thursday): Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

15 September (Thursday): The deadline for receiving offers for the renovation of the historic Grand Continental Hotel.

15 September (Thursday): The first Gas Exporting Countries Forum Coordination Meeting in the Run-up to COP 27.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

18 September (Sunday): Deadline to apply for investor funding under the Planning Ministry’s Smart Green Governorates initiative.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 public school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10 October (Monday): The CEO Women Conference

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.