- EBRD has lots in the pipeline for Egypt as Renaud-Basso’s visit enters second day. (Development Finance)

- FAB begins share transfer in Bank Audi acquisition. (M&A Watch)

- CBE raises withdrawal + transfer limits from mobile wallets. (Regulation Watch)

- Evergrow is restructuring its debts with a new USD 400 mn loan. (Debt Watch)

- Egyptian illegal migrant workers returning from abroad could soon have access to training, jobs back home. (Policy)

- Ethiopia wants GERD talks to return to the AU. (Diplomacy)

- Vacsera signs agreements to manufacture Sinovac in Egypt. (Covid Watch)

- My Morning / WFH Routine: Ezzeddin Zahzah, co-founder and CEO of Waseya.

- Planet Finance — Abu Dhabi could sell a stake in Taqa to attract international investment for its flagship assets.

Thursday, 22 April 2021

EBRD has lots in the pipeline for Egypt as Renaud-Basso’s visit enters second day

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. One last sprint and we run headlong into the weekend. We’re unlikely to know before this afternoon whether we have a three-day weekend this weekend — or a five-day break next weekend. We’ll have the answer for you in this afternoon’s edition of EnterprisePM.

It’s a busy news day in the meantime, so strap in and let’s get started.

WHAT’S HAPPENING TODAY-

It’s the second and final day of European Bank for Reconstruction and Development President Renaud-Basso’s first official visit to Egypt. We have the rundown on her first day in Egypt — and the bank’s plans to continue supporting our development over the next decade — in the news well, below.

IT’S A BIG WEEKEND FOR: Climate, as 40 world leaders gather in the United States for the Biden administration’s Leaders Summit on Climate. US President Joe Biden could pledge to “help less wealthy countries combat climate change” and is expected to announce a new target to cut US greenhouse gas emissions in half by 2030, relative to 2005 levels, the Wall Street Journal reports, citing a personal familiar with the matter. The US and China have also signaled their plans to work together to set more ambitious goals to tackle the climate crisis.

REMINDER: Egypt has been left out of the summit, despite the US Chamber of Commerce encouraging the Biden administration to invite us to the summit in a bid to bolster Egypt-US ties in the energy, digital economy, health, education, and environmental sectors.

PICKING UP WHERE WE LEFT OFF YESTERDAY- The EU took another major green policy step by defining what it means for business to be “green” in a new set of rules (pdf) announced yesterday by the European Commission. The regulation is expected to make it easier for investors to channel investments into sustainable activities and help the EU achieve its goal of climate-neutrality by 2050. The new rules come as part of the EU’s wider climate strategy, which saw lawmakers reaching a provisional agreement on the European Climate Law yesterday.

So, what’s a “green” business? The new classifications define an activity as climate friendly or green if it reduces or prevents the adverse impact of climate change. Nuclear power and natural gas could be included at a later date, the commission said. The classifications will be discussed with member states and European lawmakers before becoming law. CNBC has the story.

***CATCH UP QUICK with the top stories from yesterday’s edition of EnterprisePM:

- Rail privatization? Private rail companies will operate news trains to be added to the network.

- Egyptian workers return to Libya: As many as 2 mn Egyptians could return to work in Libya as part of a reconstruction plan that would see the two countries cooperate in several sectors over the next three years.

- Raya offloads stake in transport arm: The company signed an agreement to sell its 62.3% stake in shipping company Ostool.

CORRECTION + UPDATE- In a story in EnterpriseAM yesterday on Aldar starting due diligence on upmarket real estate developer SODIC, we said SODIC shareholders would have 60 working days to decide on Aldar’s offer. That was incorrect: Aldar has 60 days from its expression of interest last month to make an MTO, ask for an extension from the Financial Regulatory Authority, or walk away. Also: Our friends at SODIC denied a report in the domestic press this morning that they have appointed Goldman Sachs as their international investment bankers. They tell us that they will make an announcement on their choice of international advisors once an appointment has been made. They have selected an investment bank and are finalizing the letter of engagement.

IN THE REST OF THE WORLD-

Italians: They’re just like us (but with fashion sense and, collectively, more money): How does Italy’s PM plan to overhaul his country’s economy? With a “radical” EUR 221 bn recovery package that emphasizes digitalization and infrastructure, including high-speed rail. The FT has the story.

Joe Biden isn’t going to get Eid greetings from Erdogan: The US administration looks set to recognize Ottoman Turkey’s act of genocide against the Armenians in the early 1900s as exactly what it was … an act of genocide. The WSJ has the full story.

We’re probably going to need annual booster shots of a covid vaccine, just like we have for the flu, according to scientists at Pfizer and BioNTech, who say both vaccine and natural immunity to the virus wane over time. CNBC has the rundown.

A big Apple contract manufacturer is the victim of a ransomware attack and the blackmailers are leaking specs they’ve stolen for upcoming products. MacRumors says that among the schematics that have so far appeared online are drawings that suggest an upcoming MacBook Pro will have an HDMI port, an SD card reader — and that MagSafe is finally coming back. Read about it here.

MORNING MUST READ FOR MARKETING TYPES-

The real reason so many in the field love data is because they’ve run out of good ideas, writes AdAge in its Fletcher on Marketing column. “Too many brands are betting the future of marketing is data, not ideas. That’s because brands and agencies, on the whole, have run out of ideas. Alienate or lay off enough creative talent to make the margins work and soon the well of creativity runs dry. Like Hollywood turning to sequels and remakes, the ad industry is recycling ideas for clients.” Read: The real reason marketers are anti-privacy.

**So, when do we eat? We’ll break our fast this evening at 6:26pm, and will have until 3:48am to finish up sohour.

CIRCLE YOUR CALENDAR-

Transport Minister Kamel El Wazir will address the House of Representatives next Tuesday to discuss his ministry’s plan to overhaul the country’s transportation system, according to the House agenda. El Wazir’s planned appearance in parliament comes after multiple calls from MPs to question the minister or otherwise hold him accountable for the recent streak of railway accidents, including the Qalyubia train crash, which left 23 dead and another 139 injured.

The Central Bank of Egypt will meet to review rates a week from today, on Thursday, 29 April. We’ll have our customary poll of economists and analysts on the expected outcome from the central bank’s Monetary Policy Committee at the beginning of next week.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

MARKET WATCH- New accounting guidelines by the Securities and Exchange Commission could make SPACs a lot less appealing to investors. New SPAC listings ground to a near halt in the US after the SEC said it could classify SPAC warrants as liabilities instead of equity instruments, meaning existing SPACs and transactions in the pipeline would have to go back and recalculate their financials and value the warrants for each quarter, rather than at the creation of the SPAC — a costly and time consuming process that could detract from the ease and speed promised by the blank cheque companies compared to traditional IPOs. Only 10 new SPAC issuances went forward so far this month, according to data gathered by CNBC, compared to 100 in March. The blank-check companies became the subject of increased regulatory scrutiny and skepticism, after they became the flavour of the day on Wall Street in recent months.

DEVELOPMENT FINANCE

EBRD has lots in the pipeline for Egypt

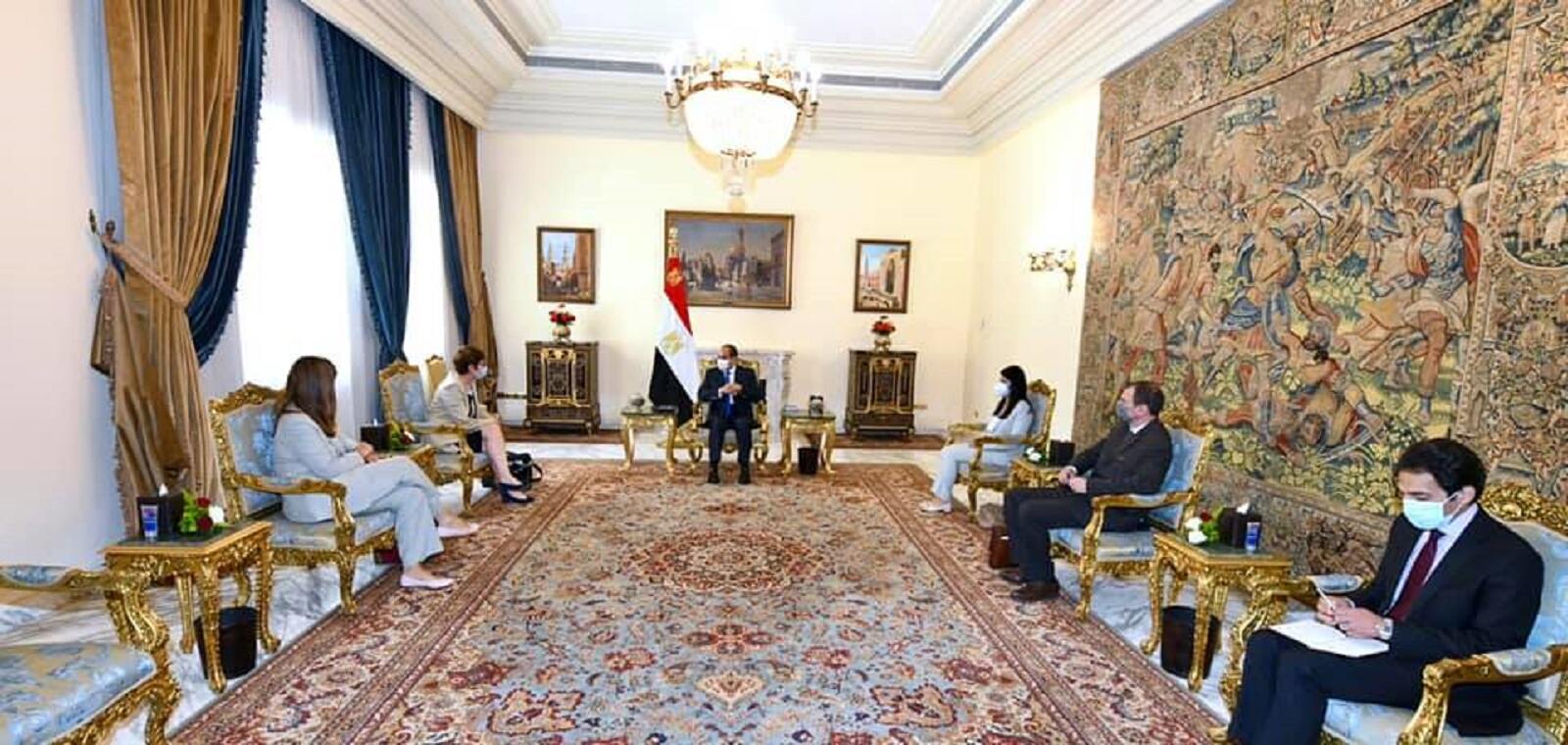

Fresh investment and cooperation in Egypt’s development projects are coming from the European Bank for Reconstruction and Development (EBRD) to continue supporting the government’s Egypt Vision 2030. That was the main takeaway from EBRD President Odile Renaud-Basso’s meeting yesterday with President Abdel Fattah El Sisi.

Renaud Basso told El Sisi EBRD remains interested in renewable energy, climate change, digital transformation, education, SMEs, housing, and rural development, according to an Ittihadiya statement. Startups were also on the agenda for Renaud-Basso during a meeting with International Cooperation Minister Rania Al Mashat, in which they discussed supporting entrepreneurship, with a focus on fintech, according to a statement.

The major themes of the trip? The green economy and private sector, Renaud-Basso said in a tweet. The EBRD president is expected to sign agreements to develop sustainable infrastructure and renewable energy in the country to support the transition to a green economy, the bank previously said in a statement.

In case you needed a reminder, the EBRD ❤ Egypt: The bank has poured EUR 7.2 bn in Egypt since 2012. In 2020 alone, the bank provided development financing worth EUR 784 mn for the private sector, making Egypt the top destination of EBRD investments in the Southern and Eastern Mediterranean. The bank has pledged another EUR 1 bn in financing and investment in Egypt in 2021.

M&A WATCH

FAB begins share transfer in Bank Audi acquisition

First Abu Dhabi Bank (FAB) has begun the share transfer process in its acquisition of 100% of Bank Audi’s Egypt operations, FAB said in a statement (pdf). Once the share transfer is complete, FAB will begin merging the assets and operations of both Bank Audi Egypt and FAB Egypt, with the two banks expected to become fully integrated in 2022. FAB Egypt’s CEO Mohamed Abbas Fayed (LinkedIn) will be appointed as country CEO of the combined entity, according to the statement. The value of the transaction has yet to be made public.

FAB is jockeying for position among the ranks of top foreign lenders in Egypt: FAB now expects to have pro-forma total assets worth more than EGP 130 bn post-acquisition, compared to the previously reported EGP 120 bn, making it one of Egypt’s largest foreign banks in terms of assets, the statement read. FAB’s branch count will more than triple to 70, adding Bank Audi’s 53 branches to its existing 17.

Background: FAB had signed in January a final agreement to fully acquire Bank Audi’s operations in Egypt. Fayed said earlier this month that FAB is still waiting for the Egyptian and Emirati central banks to sign off on the transaction, but expects to complete the acquisition by the end of 2021. Bank Audi and Lebanese rival Blom Bank are both exiting Egypt as they go through a tough time in their home market, which has been grappling for months with liquidity issues.

Advisors: FAB and UBS AG are buy-side financial advisors, while EFG Hermes was the sole sell-side financial advisor. Freshfields Bruckhaus Deringer and Matouk Bassiouny & Hennawy were legal advisors to FAB on the transaction, while Dechert as well as Zulficar and Partners were counsel to Bank Audi. JPMorgan gave Bank Audi a fairness opinion, while Broadgate Advisors also offered advisory services to the bank.

REGULATION WATCH

CBE raises withdrawal + transfer limits from mobile wallets

SMART POLICY- Mobile wallet users can now borrow, withdraw, and transfer larger sums per day under new regulations (pdf) released by the Central Bank of Egypt (CBE). Individual users can apply for one-year finance of up to EGP 5k, while informal micro enterprises and self-employed craftsmen can borrow up to EGP 10k. The ceiling for licensed microenterprises is now EGP 15k. These facilities, which could be provided in real time, should be repaid over one year on a predetermined payment schedule. Banks will be able to allow clients to request finance through ATMs, e-wallet applications, or messaging channels such as unstructured supplementary service data (USSD) and interactive voice response (IVR) messaging.

New daily withdrawal + transfer limits: The regulations also raise the daily limits for mobile wallet users’ withdrawals and transfers to EGP 30k for individuals and informal micro enterprises or self-employed craftsmen, with the monthly limit set for these users set at EGP 100k. Licensed microenterprises can now withdraw or transfer up to EGP 40k per day, or EGP 200k per month.

The new limits come a few days after the CBE granted mobile wallet users access to real-time loan and saving services, while allowing funds to be transferred between mobile wallets and bank accounts. The CBE also instructed banks to determine potential borrowers’ creditworthiness based on “behavioral evaluations” to ease lending for those who don’t have credit histories or any prior records with the traditional banking system.

DEBT WATCH

Evergrow is restructuring its debts

Egyptian fertilizer company Evergrow has signed a USD 400 mn loan agreement with a syndicate of 12 banks led by Mashreq Bank and the National Bank of Egypt (NBE), who acted as the facility arrangers, Hapi Journal reports, citing a company statement. Some USD 326 mn will be used to restructure previous debts Evergrow owes to the same banks, while the remaining USD 74 mn will finance the construction of the third phase of the company’s fertilizer plant in Sadat City, slated for completion within nine months.

Background: Evergrow faced financial difficulties following the EGP float, which significantly raised the cost of the plant’s third phase. In 2020, the company had sought a USD 312 mn loan from a syndicate of Egyptian banks, which had approved the facility last December. The consortium included NBE, Mashreq Bank, Banque du Caire, Arab African International Bank, HSBC, Arab Bank and Arab African International Bank, while Banque Misr, Suez Canal Bank, the Housing and Development Bank and EG Bank were planned to participate in the loan.

OTHER DEBT NEWS-

Real estate developer Inertia has signed a EGP 1.1 bn, eight-year Islamic financing agreement with Banque Misr for the development of the fourth phase of its EGP 66 bn Jefaira project in the North Coast, according to a statement (pdf). Lots of details in the statement if you want more.

POLICY

Illegal migrants get a helping hand

Egyptian illegal migrant workers returning from abroad could soon have access to training and jobs back in Egypt as part of a “rehabilitation program” currently under discussion in cabinet, according to a statement. The proposed program — which is being put together by the social solidarity, migration, and foreign ministries in cooperation with the European Union — would be modeled after similar programs already instituted by other countries, the statement said. The program is meant to take a “comprehensive approach” to the issue of illegal migration, including taking into account the developmental perspective, Deputy Foreign Minister for Migration Nevine El Husseiny said.

What’s next? The three ministries and EU representatives will form a technical committee to assess the social and economic implications of the program, and will create a working document that will serve as a starting point for the program.

It’s not quite the Turkey-style migration pact we’ve been wanting for years: The EU has lauded Egypt’s longstanding efforts to curb illegal migration from its shores multiple times in the past, and the two sides had appeared to be working towards reaching a Turkey-style agreement since 2017. The agreement would have seen Egypt step up its efforts to stop the flow of migrants in return for substantial investments and other financial investment from the EU. Despite plenty of back-and-forth between the two sides on the matter, no such agreement ever materialized.

DIPLOMACY

Ethiopia wants GERD talks to return to the AU

Ethiopia asks Sudan to bring back GERD talks to the AU: “The way forward” on the stalled Grand Ethiopian Renaissance Dam (GERD) negotiations could be to request a meeting of the African Union (AU) Bureau of the Assembly, Ethiopian Prime Minister Abiy Ahmed suggested in a letter to Sudanese Prime Minister Abdalla Hamdok, according to a statement. Ahmed’s proposal appears to be his idea of RSVP-ing to Hamdok’s invitation for the prime ministers of Egypt, Sudan, and Ethiopia to attend a summit to revive the negotiations, after they failed yet again to yield any concrete progress.

Ethiopia also doesn’t think negotiations are stalled at all (because apparently all negotiations take a decade): In his letter to Hamdok, Ahmed pointed to “tangible results” from the negotiation process between the three countries, including the signing of the Declaration of Principles and setting up the National Independent Scientific Research Group. For context, Egypt, Sudan, and Ethiopia signed the Declaration of Principles in 2015 and the research group was set up in 2018. Ahmed also suggested that the three countries reached some sort of agreement on “the continued and enhanced role of the observers, namely EU, South Africa, and United States,” although Ethiopia had previously signaled its categorical refusal to bring in the US, EU, UN, and AU as international mediators.

Bringing the talks to the AU now could actually turn out great for Egypt, considering Foreign Minister Sameh Shoukry’s ongoing diplomacy blitz to rally support from the continent’s leaders for Egypt’s position on the issue. The minister made stops yesterday in Senegal and Niger to discuss the GERD talks with the two countries’ leaders. Shoukry has already visited Kenya, Comoros, South Africa, the Democratic Republic of Congo over the past several days, and is expected to make one last stop in Tunisia. Egypt could also continue drumming up support from the rest of the international community, including from Europe and Russia, Ala Mas’ouleety’s Ahmed Moussa suggested (watch, runtime: 2:22).

COVID WATCH

Vacsera inks Sinovac manufacturing agreements

We just took a big step towards locally-made Sinovac vaccines after state-owned Vacsera signed two joint manufacturing agreements with China’s Sinovac Life Sciences Company to locally produce the vaccine, according to a cabinet statement yesterday. Sinovac will provide Vacsera with all technical information related to the jab, while also conducting chemical and mechanical quality control testing of finished products and lab equipment. Under the agreement, Sinovac will also ensure maintenance of Vacsera’s manufacturing facilities. The country plans to manufacture 80 mn doses of each year, the Health Ministry said.

And Vacsera could build additional manufacturing facilities if necessary under the agreements. For the final packaging and quality control, Vacsera could ask Sinovac to train its employees at the Egypt-based manufacturing facilities, or at the company’s plants in Beijing. Egypt plans to manufacture 80 mn doses of the Chinese vaccine each year. Sinovac reportedly has an efficacy rate of 50.4% in preventing symptomatic infections — which is well below the 79% efficacy rate Sinopharm has claimed.

We’re also still working on an agreement to locally manufacture Russia’s Sputnik V, which was at the top of the agenda for Health Minister Hala Zayed and Russian Ambassador Georgiy Borisenko during a meeting this week, although no agreement was reached, according to a statement. Sputnik V — which is nearly 92% effective — has earned emergency use approval from the Egyptian Drug Authority.

Russia is separately looking to fast-track procedures for the delivery of an unspecified number of doses of Sputnik V to Egypt, Borisenko said.

And we’ve apparently upped our orders of Sinopharm to 40 mn doses, the delivery of which China is working to expedite, Chinese ambassador in Cairo Liao Liqiang told Prime Minister Moustafa Madbouly yesterday, according to a cabinet statement. That’s double the number of Sinopharm jabs Health Minister Hala Zayed said last week Egypt had purchased. We have so far received 680k doses of Sinopharm, while another 500k-dose batch of the vaccine should arrive “soon,” Zayed previously said.

Could Egypt get its Covax jabs faster thanks to a push from France? Paris has pledged to send 500k doses of the AstraZeneca vaccine to the Gavi / Covax scheme by mid-June, including 100k this month in a bid to compete with China and Russia’s vaccine diplomacy pushes, an advisor to French President Emmanuel Macron said, according to Reuters. The move would be the first donation of actual vaccine doses, rather than funding, to the Covax cheme, which has been bogged down by delays.

Egypt is set to get its hands on as many as 4.5 mn doses of the AstraZeneca jab through Covax by the end of May, as part of a 5 mn-dose batch that is promised to deliver to Egypt.

Update on Sohag covid-19 spike: Fever and chest hospitals in Sohag are currently 80-90% full as the governorate continues to see “slight but continuous increases” in covid-19 infections, according to a ministry statement. The ministry has ramped up the availability of medical facilities and equipment in the governorate to cope with the recent jump in cases, according to the statement.

On a brighter note, there has been a “significant” decrease in covid-19 infections and deaths among medical personnel, Zayed said at a cabinet meeting yesterday. The minister’s statement comes days after the Doctors Syndicate urged the ministry to ramp up its inoculation of medical staff, after 50 doctors died from covid-19 in the past two weeks.

We currently have 208 vaccination centers up and running nationwide, up from 193 at the end of last week, according to Zayed. The minister previously signaled that we could soon have as many as 350 operational centers as part of a plan to accommodate 112k individuals per day.

The Health Ministry reported 861 new covid-19 infections yesterday, up from 855 the day before. Yesterday was the 18th consecutive day our daily infection count increased. Egypt has now disclosed a total of 218,902 confirmed cases of covid-19. The ministry also reported 36 new deaths, bringing the country’s total death toll to 12,866.

The UAE is mulling imposing movement restrictions on unvaccinated residents aged 16 and above, including restricting their access to some locations and services, as the Emirates pushes forward with its inoculation drive, Saif Al Dhaheri, spokesman for the National Emergency Crisis and Disasters Management Authority, said in a statement.

THURSDAY KUDOS

Legal500 rankings: The Legal500 directory has released its 2021 rankings of Egypt’s top firms in different practice areas. Among the Tier 1 rankings in the key categories:

- International arbitration: Matouk Bassiouny & Hennawy; Shahid Law Firm; Shalakany Law Office; Youssef & Partners; Zaki Hashem & Partners; and Zulficar & Partners.

- Commercial, corporate, and M&A: Al Kamel Law Office; Al Tamimi & Co; Helmy, Hamza, & Partners; Matouk Bassiouny & Hennawy; MHR & Partners in association with White & Case; Shahid Law Firm; Shalakany Law Office; Zaki Hashem & Partners; and Zulficar & Partners.

- Banking and finance: Al Kamel Law Office; Helmy, Hamza, & Partners; Matouk Bassiouny & Hennawy; MHR & Partners in association with White & Case; Shalakany Law Office; Zaki Hashem & Partners; and Zulficar & Partners.

Crédit Agricole Egypt’s Foundation for Development and the Ibrahim A. Badran Charitable Foundation will purchase a mobile health clinic and send medical convoys to orphanages nationwide, the bank said in a statement (pdf). The bank’s foundation will finance the purchase of the clinic, while the Ibrahim Badran Foundation will provide the clinic with the necessary medical equipment and staff.

Families in need in Egypt, Jordan and Pakistan, have begun receiving food parcels as part of the UAE’s “100 mn Meals” campaign that covers 20 countries, Gulf Business reports. The program is organized by Mohammed bin Rashid Al Maktoum Global Initiatives, and is working with the Egyptian Food Bank and other local charity organizations across Egypt.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The Ramadan content you didn’t know you needed: Yahduth fi Misr’s Sherif Amer spent his evening as a chef, cooking beef (watch, runtime: 10:19) and answering hard-hitting questions like the difference between gas and electric cooking ranges (watch, runtime: 1:15). Ala Mas’ouleety’s Ahmed Moussa also had his own food segment to talk about the best juices to drink in Ramadan (watch, runtime: 2:24) and took a more serious tone in his recap of yesterday’s episode of Al Ekhteyar, which portrayed the 2013 assassination of national security officer Mohamed Mabrouk (watch, runtime: 9:17).

EGYPT IN THE NEWS

The Qalyubia train crash is still dominating the conversation on Egypt in the foreign press: The Associated Press noted the dismissal of railway officials including head of the National Railways Authority Ashraf Raslan, while the Arab Weekly suggests that the latest series of unfortunate railway incidents could lead to a cabinet reshuffle. Elsewhere, Amnesty International says that Egypt, Iran, and Saudi Arabia top the list of countries that used capital punishment last year.

ALSO ON OUR RADAR

Sahara Group is not buying Egyption Iron & Steel Company: State-owned Metallurgical Industries Holding Company denied reports in the local press suggesting that UK-based Sahara Group had submitted a USD 400 mn non-binding offer to acquire its subsidiary Egyption Iron & Steel Company, according to an EGX disclosure (pdf) yesterday. The company had announced earlier this year that it would make an offer, which company representatives told the local press they did, insisting that the offer is serious.

Dice has until 10 May to submit a fair value report on its shares, which the Financial Regulatory Authority (FRA) ordered after Dice’s shares lost more than half their value. The company was originally set to submit the assessment on 20 April but received approval from the FRA for a deadline extension (pdf).

PLANET FINANCE

Abu Dhabi is considering selling a 10% stake in power distributor TAQA as it attempts to attract international investment for some of its flagship assets, Bloomberg reports. The stake in the company is valued at some USD 4 bn, and investors may be attracted by TAQA’s plans to cut down on fossil fuel exposure and boost renewables. TAQA is the emirate’s largest utility provider and has a monopoly on energy and water distribution.

Norway’s sovereign wealth fund — the holder of the world’s largest stock portfolio — saw its portfolio beat the country’s benchmark index, recording a 6.6% gain and performing 24 bps better than the benchmark set by the Norwegian Finance Ministry, Bloomberg reports. The Government Pension Fund of Norway — which was created in the 1990s to invest in oil and gas abroad — earned USD 45.6 bn in 1Q2021, compared to a loss of almost USD 126 bn in 1Q2020.

|

|

EGX30 |

10,642 |

+0.2% (YTD: -1.9%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.63 |

Sell 15.73 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,095 |

-0.2% (YTD: +16.2%) |

|

|

ADX |

6,061 |

-1.5% (YTD: +20.1%) |

|

|

DFM |

2,600 |

-0.9% (YTD: +4.3%) |

|

|

S&P 500 |

4,173 |

+0.9% (YTD: +11.1%) |

|

|

FTSE 100 |

6,895 |

+0.5% (YTD: +6.7%) |

|

|

Brent crude |

USD 64.74 |

-0.9% |

|

|

Natural gas (Nymex) |

USD 2.70 |

+0.2% |

|

|

Gold |

USD 1,796.90 |

+0.2% |

|

|

BTC |

USD 52,787.02 |

-5.5% |

The EGX30 rose 0.2% at today’s close on turnover of EGP 906 mn (31.3% below the 90-day average). Local investors were net sellers. The index is down 1.9% YTD.

In the green: Ezz Steel (+3.2%), AMOC (+2.7%) and Orascom Development (+2.4%).

In the red: GB Auto (-5.0%), Palm Hills Development (-4.0%) and Pioneers (-2.5%).

AROUND THE WORLD

International news worth knowing this morning:

- Turkey’s trade minister just got the axe, fueling speculation of a wider cabinet shuffle over accusations of widespread nepotism in the government, Reuters reports, citing a press release (pdf) from Turkey’s official gazette.

- Russia is withdrawing from the 20-year-old International Space Station program after it launches its own orbital station in 2025, ending one of the few remaining areas of cooperation between itself and the US.

IN DIPLOMACY: El Sisi, Kamel meet World Jewish Congress head: President Abdel Fattah El Sisi and intelligence chief Abbas Kamel discussed US-Egypt relations and the Israeli-Palestinian conflict in a sit-down yesterday with World Jewish Congress President Ronald Lauder, according to an Ittihadiya statement.

MY MORNING ROUTINE

Ezzeddin Zahzah, co-founder and CEO of Waseya: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Ezzeddin Zahzah (LinkedIn), co-founder and CEO of Waseya.

My name is Ezzeddin Zahzah, I’m CEO and co-founder of Waseya, Egypt’s first online will-maker allowing users to create individualized and legally-sound will documents in less than 30 minutes. I’m an engineer by education and had 12 years of corporate experience under my belt before I jumped into the entrepreneurial whirlpool. I‘ve been an entrepreneur for about six years now and cut my teeth through a few ventures where I lost a molar and a canine but I’m still smiling and very excited to take on my latest venture, Waseya, with my co-founders Ali El Shalakany, Ahmed Sallam and Hanan Abdel Meguid.

I started my first venture back in 2005, before entrepreneurship was cool and everyone was trying to get into it. I started a boxing gym in Maadi with some highschool friends called Knockout before I got my MBA and jumped back into the corporate world as a management consultant. Later, I set up another fitness facility called Fight Fitness Factory and an F&B business called Sahtein, which didn't last very long. As the Egyptian idiom goes, “iddy el eish le khabazo,” or let the bakers do the baking.

I started working on Waseya about a year ago when Ali El Shalakany proposed the idea for an online will-maker. Given my personal experience from a few years ago when my father passed away without leaving a will, which was a complicated and awkward process, I was very passionately on board. It took us about a year to do our legal and market research and build the platform with our tech partner with Kamelizer until we went live on 24 March 2021. Other than the initial capital from the co-founders there's been no fundraising just yet but we’re currently in the middle of our first seed fundraising round.

Due to the nature of what we do the pandemic works in our favor, and I say this with a very heavy heart. Given that people are thinking about their own mortality and looking into end of life planning tools, Waseya is very timely. That’s from the business side of things. Operationally, I’m actually surprised with how much you can get done and how much more efficient people are with their time. We’ve saved a lot by cutting out commutes, travelling and in-person meetings.

I’m an early riser so I wake up at 6 am to get my 12-year-old son and 10-year-old daughter ready for school. That means preparing lunch boxes, making sure they get dressed and of course some hustling and hurrying to make sure they’re not late. I really enjoy this time with them in the morning and I think I’m able to move things along quite efficiently. I take care of the morning and my wife handles the kids in the evening.

As soon as they walk out the door, I check my phone, follow up on messages and read the news. Enterprise is the first thing I read to help kick-start my day. The first half of my day is dedicated to follow up and execution. I follow up with my marketing and tech teams, work on business development, set up calls with clients and talk to partners. At around 3pm I have lunch with my wife and when I can afford it, take a 30-45 minute power nap afterwards.The second half of my day is spent on planning and communication. So we revisit our market strategy, map out contacts I have to reach out to and summarize discussions I’ve had with partners, clients and team members. We’re a very small team at the moment, we have one marketing executive, a tech partner, a project manager, a designer and a programmer. So we’re very efficient in that sense.

I’m a WFH veteran: I’ve been working completely independently and from home since 2013. I started WFH back when I worked with Booz & Company where I was the knowledge manager for their Middle East division reporting to someone based in San Francisco. My office has been my bedroom since 2013, so when the pandemic broke out and people started working from home and complaining, it felt like “welcome to my world.” Being an entrepreneur you learn to roll with the punches, so the lockdown definitely didn’t change much about my life

We still don't have an office yet, but that’s in the pipeline once we’re through with this funding round. We’ve already started looking at a couple of options and yes, we will be having a physical office space at some point in the near future. Despite my affinity for working from home I’m still a very passionate believer in face to face communication and eye contact. So I'm very much looking forward to returning to the “new normal,” which I think will probably be some sort of hybrid between remote and in-person work.

I wrap up my day when my wife puts her foot down, which typically happens around 8pm (If it were up to me I’d stay on my computer until I pass out). Then it's back to helping the kids with any reading, homework and getting them to bed. My son likes to have very existential and philosophical discussions, so it's a good time to wind down and get to know him at a deeper level. My daughter is a lot more joyful and bubbly so we usually play Would You Rather or 20 Questions for half an hour. By 10pm after the kids have gone to sleep we plop down by the TV and order food or cook ourselves. I personally love cooking quick dinners, which is great quality time for me and my wife.

Before I hit the sack I like to catch up on my personal reading. I’m fascinated by religion and spirituality in general. I’m reading a book called Islam In Restrospect by Maher S. Mahmassani right now which discusses modernization and fundamentalism and how the message of Islam got lost in the middle. Otherwise I keep at least one French and one Arabic book by my bedside to stay on top of my other languages. Right now, I have Naguib Mahfouz’s Children of the Alley.

As for podcasts, I listen to Fil50 but I’m a huge YouTube addict. I listen to a lot of Ted Talks, and the Economist videos. I like the Company Forensics series by Slidebean, which discusses success stories and failures of big businesses

I have a favorite quote from Rumi which can be applied to one’s personal and professional life: “Don’t be satisfied with stories, how things have gone with others. Unfold your own myth”. It’s about being authentic and true to yourself. In today’s slang this would roughly translate to “you do you.”

CALENDAR

April: The government’s fuel pricing committee is scheduled to meet for its quarterly review of prices.

20-22 April (Tuesday-Thursday): Renaissance Capital’s conference RenCap ESG – a New Focus for EM will take place virtually.

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC — the holiday could be observed on a Sunday or a Thursday).

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Coptic Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

16-19 May (Sunday-Wednesday): The Arabian Travel Market (ATM) is taking place in Dubai. ATM is an international travel and tourism event to promote the Middle East as a tourist destination.

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The 54th session of the Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday) Mediterranean Offshore Conference, Alexandria, Egypt

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.