- The elderly + chronically ill may now register for a covid-19 vaccine. (Covid Watch)

- Don’t expect exports from the Damietta LNG plant to ramp up until the end of the year. (Energy)

- Taaleem plans Zoom roadshow for 1Q2021 EGX debut. (IPO Watch)

- Zeta Investment bids for 90% stake in ANFI. (M&A Watch)

- Tourist rates could go back to pre-covid levels by Fall 2022 -El Enany. (Tourism)

- Private sector investments will take the lead in Egypt’s economy within five years -Madbouly. (Policy)

- Catch up from EnterprisePM: The first and second waves in Egypt, in numbers + the SFE wants 10% of Amoun Pharma. (What We’re Tracking Today)

- Egypt-based 1Trolley is the only MENA business among the prizewinners of the EBRD’s Startup Innovation Challenge. (Startup Watch)

- Planet Finance: The global economic recovery is looking increasingly uneven, IMF’s Georgieva says.

Sunday, 28 February 2021

EnterpriseAM — You may now get in line for a covid jab

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to the start of a new workweek. We’re a day away from a new month, but really we’re still emotionally processing last March.

THE BIG STORY HERE AT HOME is the Health Ministry opening the door for the elderly and those with chronic illnesses to register for covid-19 vaccines. Expect this to be the topic du jour for at least another day or two. We have more details in this morning’s Covid Watch, below.

THE BIG STORIES INTERNATIONALLY are all coming out of Washington but pertain to the Middle East, including the release of a report that says Saudi Crown Prince Mohammed bin Salman approved journalist Jamal Khashoggi’s brutal murder in 2018. Also making headlines is US President Joe Biden’s first airstrike in the region. We have more on both in Around the World, below.

*** CATCH UP QUICK (and refresh your memory if you woke up with weekend amnesia). The big stories from Thursday’s EnterprisePM:

- Capmas has everything you wanted to know about the first and second waves here in Egypt;

- The Sovereign Fund of Egypt is reportedly eyeing a 10% stake in Amoun Pharma;

- The global economy lost the equivalent of as many as 255 mn full-time jobs in 2020, according to a report from the International Labor Organization.

Mid-term exams are under way at public schools and universities, as per the timeline laid out by Education Minister Tarek Shawki and Higher Education Minister Khaled Abdel Ghaffar earlier this month. The exams are being held with strict precautionary measures — including wearing face masks and greater physical distancing — to contain the spread of covid-19, the Higher Education Ministry said in a statement. Public schools and universities got an extra week tacked onto their mid-year holiday last week, with their second term starting today instead of 21 February. We have more on the first day of exams in Last Night’s Talk Shows, below.

Egypt’s women empowerment plan is now officially in execution phase: Backing women’s representation and leadership in the corporate world, promoting career-family balance and encourage private investment in elder and child care, and offering training programs in sectors in which women are underrepresented are among the three-year goals for the Closing the Gender Gap Accelerator program, cabinet said in a statement. The program was launched last July by the International Cooperation Ministry, the National Council for Women (NCW), and the World Economic Forum. The ministry has all you need to know about the program here.

Four corporate figures are now in the driver’s seat alongside the ministry and the NCW: CIB chief Hussein Abaza, Qalaa Holding Managing Director Hisham El Khazindar, Travco Vice Chairperson Karim El Chiaty, and Delta Shield Chairperson Neveen El Tahri.

Meanwhile, the “Decent Life” initiative is now among the UN’s registry of programs that promote sustainable development. The initiative, which was rolled out at the beginning of 2019 to improve living conditions for the country’s most needy, was admitted into the Partnership for SDGs platform as a way to highlight its positive impact on rural communities, Planning and Economic Development Minister Hala El Said said.

|

US President Joe Biden’s USD 1.9 tn stimulus bill is one step closer to fruition after it passed in a near party-line vote at the House yesterday morning. Dubbed the “American Rescue Plan,” the bill is designed to stabilize the economy and includes USD 1,400 direct stimulus checks, an extension of federal top-ups of USD 400 per week to unemployment ins. through the end of August, USD 350 bn for state and local governments, USD 50 bn for covid-19 testing and tracing, and USD 130 bn for K-12 schools, in addition to a major expansion of the child tax credit, CNN reported.

The bill is now on its way to the Senate for a vote, where it will likely meet more resistance than it did at the House, even with Biden urging lawmakers to fast-track passing the package. Pundits widely expect the Senate to strike down a USD 15 / hour minimum wage increase from the current USD 7.25 / hour.

MARKET WATCH-

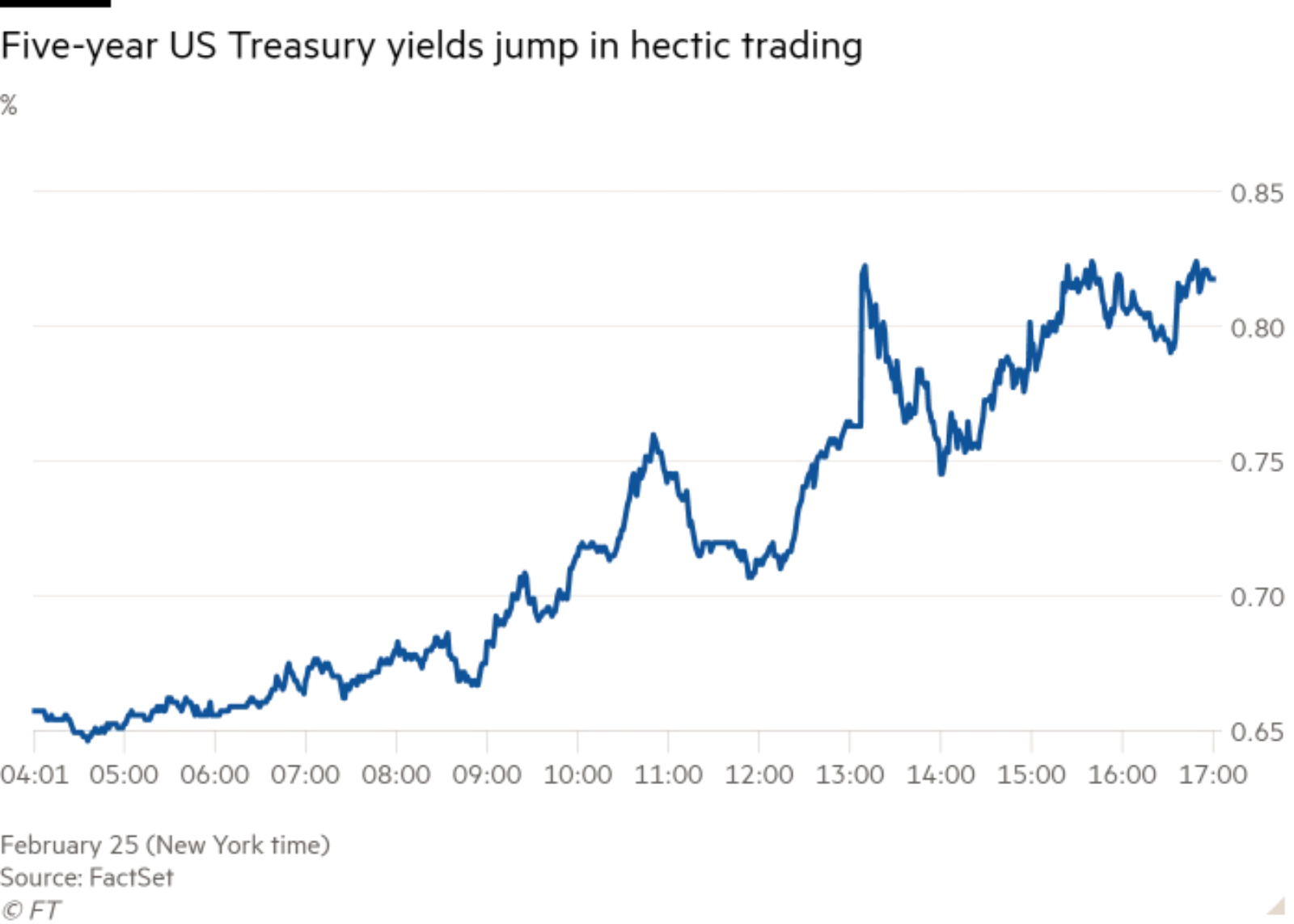

Jitters in the US bond market evolved into a tantrum on Thursday as investors anxious about incoming inflation dumped treasuries. Bond yields spiked to their highest levels in almost a year, triggering an equity sell-off which saw tech stocks have their worst day since October. Rates on 10-year bonds surged as high as 1.61%, caused by an “extraordinarily weak” auction of seven-year notes. “It was big … It was almost as if a dam broke,” analysts at Rabobank wrote.

What’s happening here? The jitters began as the Biden administration was readying the USD 1.9 tn stimulus bill, and with the Fed continuing to buy bns of USD of treasuries every month, investors are growing increasingly fearful that a pickup in inflation will eat into their returns and are dumping bonds. Not only this, but traders — with one eye on the run of positive economic data — are beginning to price in rate hikes further down the line, an idea that the European Central Bank is already moving to quash. Analysts are now concerned that rising yields will start to dim the attractiveness of the stock market, triggering flight from equities into bonds.

It’s not great news for emerging markets: Rising rates in the US typically suck capital out of emerging economies and strengthen the greenback, leaving developing nations with weaker currencies and hurting the finances of countries holding a lot of USD-denominated debt. This was seen on Thursday when a basket of EM currencies saw its worst day since the covid crash last March.

But on the upside, EMs are still attractive enough to eurobond investors thanks to negative yields in Europe, with the latest case in point being Saudi Arabia, which sold EUR 1.5 bn of eurobonds at a negative rate, according to a Saudi Finance Ministry statement. The sale was c.3x oversubscribed and yields stood at -0.057% for EUR 1 bn of three-year notes and 0.646% for EUR 500 mn nine-year notes. The strong appetite comes as recovering oil prices improve prospects for the world’s largest exporter.

Egypt is already setting the tone for eurobonds in the region, with the issuance of USD 3.75 bn of eurobonds in a sale that was c. 4x oversubscribed earlier this month.

Want the A-Z of what happened? Read John Authers’ piece in Bloomberg: Bond Tantrum Is a Big Test of Central Banks' Mettle.

CIRCLE YOUR CALENDAR-

Tomorrow is a brand new month — and you know what that means:

- PMI figures for February will land later this week, on Wednesday 4 March.

- Foreign reserves figures should be out at the end of the week.

- Inflation data will drop on Wednesday, 10 March.

- The Central Bank of Egypt will discuss interest rates on Thursday, 18 March.

Chairman and managing director of Misr Ins. Holding Co. Basel El Hini will deliver a speech at a breakfast hosted by the French Chamber of Commerce in Egypt, which will take place at the French ambassador’s residence tomorrow at 8:30am.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

COVID WATCH

Form an orderly line, ladies and gents

Citizens, foreign residents, diplomats, and refugees currently in Egypt who are 65+ years old — or suffering from a chronic illness — can now register for their covid-19 jab on the website the Health Ministry set up for vaccine registrations. The website, which became operational at midnight, asks those signing up for the vaccine to provide personal information, depending on which group they fall into. The website earned coverage on last night’s talk shows from Masaa DMC’s Eman El Hosary (watch, runtime: 4:13) and Al Hayah Al Youm’s Lobna Assal (watch, runtime: 14:40).

The ministry reported 588 new covid-19 infections yesterday, down from 601 the day before. Egypt has now disclosed a total of 181,829 confirmed cases of covid-19. The ministry also reported 49 new deaths, bringing the country’s total death toll to 10,639.

Ramadan-evening Taraweeh prayers will be allowed at the same “major mosques” that were previously selected for the resumption of Friday prayers, with worshippers required to adhere to strict safety measures to contain the spread of covid-19 infections, according to a Cabinet statement. Still not allowed during the Holy Month: Charity iftar tables (Ma’edat Rahman) and solitary retreats in mosques (itikaf). All other mosque facilities will also remain closed to the public until further notice, the statement said.

Moderna develops South Africa covid vaccine: US vaccine maker Moderna is trialing a new jab designed to protect people from the ultra virulent strain of covid-19 discovered in South Africa last year, the company said in a statement. The Phase 1 clinical trial will be funded and conducted by the National Institutes of Health.

Calls for pharma companies to waive some intellectual property rights to covid-19 vaccines just gained second wind from the African Union, with an eye to enable more equitable access for developing nations, Reuters reports. The proposal, which initially came from South Africa and India — both of which are manufacturing jabs — at the World Trade Organization last year, wasn’t met with open arms from developed countries.

A skeptical public and logistical difficulties are leading EU countries’ stockpiles of the Oxford-AstraZeneca jab to grow without being used, according to the Financial Times. Part of the problem is that there is “an acceptance problem with the AstraZeneca vaccine at the moment, German Chancellor Angela Merkel told Frankfurter Allgemeine newspaper. Merkel’s remarks come only weeks after the EU’s acrimonious battle with AstraZeneca over its delayed deliveries.

That makes the possibility of European countries demanding a vaccine passport all the more ironic. The proposal to introduce vaccine “passports” — aka certificates of vaccination — to allow people to travel in the EU could materialize within three months, after leaders broadly agreed at a virtual summit on Thursday that introducing certificates are necessary, Deutsche Welle reports. States have not yet set a framework for how they would be used, German Chancellor Angela Merkel. The controversial proposal received pushback from some states that fear it would lead to discrimination, while Southern European states whose economies are highly dependent on tourism have been more keen to implement the scheme.

The GCC is also mulling a similar policy to facilitate movement between Gulf countries, according to Khaleej Times.

Correction: 28 February 2021. A previous version of this article stated that citizens, foreign residents, diplomats, and refugees over 40 years old can now register for a covid-19 vaccine.

ENERGY

A long, hot summer

Don’t expect exports from the newly-reopened Damietta LNG plant to ramp up until the end of the year, as increased local energy demand during the summer is likely to keep exports muted, traders and analysts tell S&P Global Platts Analytics. "We expect the facility's exports to be limited until after Egyptian summer demand recedes, with material exports from Damietta not expected until Winter 2021,” said Platts Analytics' managing analyst Samer Mosis in a view shared by market traders.

Damietta is key to our regional energy hub ambitions: The reopening of the Damietta plant earlier this month after eight years of being idled removes a major roadblock to Egypt’s plans to export LNG to Europe, and will allow us to maximize the potential of Israeli natural gas imports and the arrival of Cypriot natural gas from the Aphrodite field in the coming years. LNG exports fared terribly during covid-19, with Egypt completing only two LNG shipments since the start of the pandemic — one in July and one in October — as global gas prices hit record lows.

Exports have picked up so far this year — but this isn’t going to last: Egypt has exported 27 mn cbm of gas per day from Damietta and the Idku LNG plant so far in 2021, according to Platts Analytics data — more than double its export rates a year ago. But exports are set to decrease this summer, averaging around 16 mn cbm per day, with domestic gas production reaching 198 mn cbm per day by the end of the year, according to Mosis.

There’s no sign of when the Damietta plant’s next shipment might take place, with global trade flow softwares showing no tankers en route following the departure of two natural gas tankers from the port last week. Two Damietta cargoes scheduled for late February and early March have reportedly been canceled, sources told S&P. Damietta is running a series of trial shipments before formally resuming exports, with the next trial shipment likely heading to Europe, Oil Ministry spokesperson Hamdy Abdel Aziz previously told Enterprise.

And more investment is needed for our export plans to materialize: Though Egypt has potential to be the “centerpiece of any regional gas ambitions,” we will continue to need foreign oil and gas investment to “maintain, let alone expand, domestic gas production and LNG exports,” S&P’s Mosis says. Egypt launched its first gas exploration tender of 2021, covering 24 blocs, earlier this month.

Egypt is taking other steps to boost its ambitions as a regional energy hub: In addition to its establishment of the East Med Gas Forum last year, Egypt and Israel agreed last week to build a pipeline connecting Israel’s offshore Leviathan gas field to Egypt’s liquefaction plants to help Israel ramp up its exports to Europe. A planned natural gas pipeline connecting Egypt and Cyprus, which authorities were reportedly in discussions over last year, should also boost Egypt’s supplies of LNG for liquefaction, and allow it to re-export to Europe. Hungarian Foreign Minister Péter Szijjártó also said last week that Hungary would import natural gas through Egypt once connecting infrastructure in Greece and Bulgaria is complete.

IPO WATCH

Egypt’s first all-virtual IPO roadshow?

Taaleem plans Zoom roadshow for 1Q2021 EGX debut: Investors in South Korea, the UK, the US, and the Gulf will be among those Taaleem Management Services targets in a virtual roadshow to drum up foreign interest for its upcoming IPO of a 49% stake on the EGX, Al Mal reported, citing people familiar with the matter. The company will rely primarily on video-conferencing technology to market the listing, which is expected to take place before the end of March. An IPO prospectus will specify the size of the institutional component of the IPO, and how much a single investor can hold, the sources added, without mentioning a timeline.

Background: Taaleem, which operates Upper Egypt-based Nahda University, announced earlier this month it is planning to offer up to 347.7 mn ordinary shares (49%) in a secondary sale to both institutional investors in Egypt and abroad and retail investors here at home. CI Capital, which acquired a 60% stake in the company from its former parent Thebes Education Management Holdings as part of a group of investors in 2019, is expected to be among those selling down. At the time CI Capital acquired the stake, it partnered with co-investors including StonePine ACE Fund, a JV between StonePine Capital and ACE.

Why it’s important to keep an eye on this: The EGX sale would end an IPO dry spell Egypt has endured these past couple of years. Emerald was the only IPO of 2020. Rameda and e-payments darling Fawry were also the only two IPOs of 2019 after Hassan Allam and Carbon Holding pulled hotly anticipated transactions.

OTHER IPO NEWS-

Ebtikar wraps up bringing Vitas Egypt under Basata: Another company with plans to hit the EGX this year, non-banking financial services provider Ebtikar, is well on its way to begin the formal process in 2H2021 after it finalized a new structure for its portfolio companies. Microfinance provider Vitas Egypt, which used to operate directly under Ebtikar, is now a subsidiary of Basata, a holding company Ebtikar set up to separate its non-bank business from its e-payments ventures, Vitas CEO Hossam Abou Heiba told Al Mal. The company earlier this month transferred its shares in Tamweel Holding to Basata and received regulatory approval to move Vitas, allowing it to IPO its e-payments businesses, Bee and Masary.

M&A WATCH

Zeta Investment bids for 90% stake in ANFI

It’s official: Zeta has eyes for ANFI: The UAE branch of Hong Kong’s Zeta Investment has submitted an offer to acquire 90% of brokerage house Alexandria National Company for Financial Investments’ (ANFI) shares at EGP 5.48 per share, the Financial Regulatory Authority said in a statement (pdf) last week. This offer values the company at around EGP 25.8 mn. The regulator is currently studying the offer.

This is down slightly from what we were expecting: Zeta had previously offered to purchase the shares at EGP 5.51 apiece according to a disclosure by ADIB (pdf), valuing ANFI at more than EGP 25.9 mn, shareholders El Kahera El Watania Investment (KWIN) and the Abu Dhabi Islamic Bank said earlier this month.

And it’s a substantially weaker bid than what others have offered: A group of investors including Egyptian businessman Ahmed El Saba and Saudi Arabia’s Mostafa El Humeidan, have offered to acquire 75-90% of the company for EGP 7.48 per share, and were given the green light by ANFI to start due diligence last week.

Also in the running: The company also received offers of EGP 5.30 per share from Kayan Sustainable Development, and EGP 5.50 per share from Zaldi Capital (pdf).

ADIB heading for the exit: ADIB is looking to exit both ANFI and Assiut Islamic Trading, which it considers non-core businesses. The Gulf lender owns almost 85% of ANFI, holding 9% directly and the remainder through its KWIN and ADI Lease subsidiaries.

TOURISM

Could we see pre-pandemic tourism levels by 2022?

Tourist rates could return to their pre-pandemic levels as early as Fall 2022, Tourism Minister Khaled El Anany told El Hekaya’s Amr Adib on Friday (watch, runtime: 4:25). The last three months have seen between 270k and 290k tourists visiting Egypt on average per month, the minister said, up from 90k when commercial travel resumed in July following the covid-19 lockdown. El Anany suggested that other global destinations could take until 2024 to recover, while Egypt could stage a quicker turnaround thanks to the fact that many of Egypt’s tourist destinations, such as beach resorts, are open air, as well as the appeal of the new Grand Egyptian Museum, should push for a faster recovery in Egypt than global estimates predict.

This is a somewhat more optimistic view than others: Former chairman of the Egyptian Tourism Federation Elhamy El Zayat told the local press earlier this month that pre-pandemic numbers were unlikely to return before 2024.

Tourism revenues plunged by 75% in 2020 to just USD 4 bn, with only 3.6 mn tourists visiting Egypt, down from 13 mn the year before. With hotel occupancy down by about 60%, Egypt lost out on some USD 14 bn in foreign currency revenue last year.

But things are looking up: The sector made USD 800 mn in revenues from July through September 2020, a 162% increase from the previous quarter, though still significantly less than the USD 4.2 bn recorded over the same period in 2019.

In the meantime, we’re looking inwards, with the civil aviation and tourism ministries extending a campaign to promote domestic winter tourism until 15 May. The campaign, which saw national flag carrier EgyptAir slashing its airfare on domestic flights and hotels across several tourist destinations offering lower prices, was originally set to expire today.

POLICY

Egypt’s private sector will lead growth in five years

Private sector investments will take the lead in Egypt’s economy within five years, by which time public investments will be gradually tapered off, Prime Minister Moustafa Madbouly said at a webinar hosted by AmCham and the Egypt-US Business Council on Thursday. Over the next 3-5 years, the government will continue to invest heavily in the economy, with an eye to attract investments and help the economy stage a post-covid recovery, Madbouly said. After that phase is over, the private sector will be given the reins.

In the meantime, the government knows where it wants private businesses to invest: In addition to a portfolio of unspecified projects cabinet will outline for the private sector in the coming period, Madbouly called on businesses to invest in national projects and initiatives, including the EGP 500 bn Decent Life initiative.

The private sector continues to lag behind other areas of the economy: The need for more private sector involvement in the economy was made clear in a World Bank/International Finance Corporation report last year that said that private businesses are yet to feel the benefits of the government’s economic reform program. Although the private sector accounts for some 70% of the country’s GDP, private investment continues to lag behind historical averages and FDI inflows remain low by international standards, the bank said.

One indicator: PMI data shows that private sector business activity outside the oil and gas sector has grown in only five months over the past three years.

The large presence of state-owned enterprises, the presence of tariff and non-tariff trade barriers and a slow and inconsistent court system were all among the biggest impediments to meaningful private sector growth the World Bank identified.

LEGISLATION WATCH

Lawmakers want more time to comply with new Real Estate Registry Act

Property owners could get an 18-month grace period to comply with new rules under the Real Estate Registry Act. Members of the Egyptian Social Democratic Party, a Senate and House minority, are planning to propose amendments that would give homebuyers a grace period and allow them to take out temporary contracts with utility providers while getting their property’s affairs in order, Senate Rep. Mahmoud Sami said, according to Al Mal.

If these MPs get their way, a 2.5% property disposal tax could also be slashed to 1%, the newspaper reports.

The matter could be put to discussion at the House of Representatives as early as this week considering its time sensitivity, and could see a decision made within a few days, House majority leader Ashraf Rashad told Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 3:25). Rep. Soliman Wahdan of Al Wafd Party separately told Moussa that he has also put forth an “urgent” request to the House of Representatives to discuss the amendments (watch, runtime: 3:40). Although Rashad did not succumb to Moussa’s poking and prodding in hopes of promising a breakthrough, he said that “all options are on the table” but would require consultations with the Finance Ministry to determine whether a tax reduction would be possible (watch, runtime: 3:20).

The Senate also looks set to move on the issue as well, and will likely call for community dialogue on the legislation, Senate spokesperson Akmal Nagaty told Moussa (watch, runtime: 6:38).

Lawmakers could also put forth a request to suspend the implementation of the law to buy more time to find a feasible solution, Kelma Akhira’s Lamees El Hadidi suggested (watch, runtime: 2:18).

What exactly is going on here? Changes to the Real Estate Registry Act that passed this month, which will require a visit to a local ma’moreya and a judge to validate property sale and purchase agreements before heading down to the Real Estate Registry. This also led to confusion that the government is introducing a new 2.5% tax on real estate disposal, forcing the Finance Ministry to clarify that the changes are only administrative, and that the levy has been flat since 1996. We broke down the story last week.

STARTUP WATCH

1 Trolley among the prizewinners in EBRD’s startup innovation challenge

Egyptian pick-up and delivery platform 1Trolley is the only MENA business among the prizewinners of the European Bank of Reconstruction and Development’s (EBRD) Startup Innovation Challenge, the bank said in a press release (pdf). The company beat 226 competing businesses from the 30 EBRD countries, and will share a USD 500k prize with the other four winners, which will be doled out partially in kind and partially through advisory vouchers. The vouchers give businesses access to business diagnostics, as well as technical support, mentoring and access to international investors.

About the business: 1Trolley operates a mobile app allows users to order different categories of products from nearby grocery stores, gift shops, restaurants, and pharmacies.

EARNINGS WATCH

GB Auto reports record bottom line despite revenue slump

GB Auto reported a record high bottom line in 2020 despite poor market conditions caused by the covid-19 pandemic weighing on revenues, according to the company’s annual earnings release (pdf). Full-year net income income exploded to EGP 917 mn, up from EGP 42.7 mn in 2019 even as revenues slipped 8.2% to EGP 23.3 bn due to the disruption caused by the pandemic. GB Auto CEO Raouf Ghabbour attributed the huge income growth to good management of working capital, inventory and debt levels — the latter of which was helped by the lower cost of borrowing — as well as the improved market conditions in the second half of the year.

In detail: Annual revenues at the company’s auto and auto-related segment came in at EGP 17 bn, down 15% from 2019 due to the impact of the lockdown in Egypt and poor economic conditions in Iraq. Nonetheless, net income in the segment came in at EGP 328 mn. GB Capital, meanwhile, saw its revenues rise 20% to EGP 6.4 bn, thanks to an expansion of its loans/receivables portfolio which grew by almost a third.

Looking ahead: “We are already witnessing continued growth in demand in the first quarter of the new year and are optimistic about our outlook going forward,” Ghabbour said. The auto segment is seeing improved conditions and rising consumer demand, and the global vaccine rollout and the return of tourism should help to pick up the company’s commercial vehicles and construction equipment business. It is also planning to launch two dual-fuel cars to coincide with the government’s drive to increase the use of natural gas in vehicles.

Sidpec narrowly escapes the red in 2020: Sidi Kerir Petrochemicals (Sidpec) reported a near-20x drop in net income to EGP 26 mn in 2020, down from a EGP 487 mn the previous year, according to its annual earnings release (pdf). This came as topline sales registered EGP 3.5 bn, 30% lower than 2019’s EGP 4.9 bn, the company said, attributing the hit to the historic crash in energy prices last year.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The airwaves are still buzzing with discussions of the controversial amendments to the Real Estate Registry Act, which has people up in arms over what they see as more complicated procedures and too-high fees and taxes. We have more details on proposals from members of parliament to remedy the situation in Legislation Watch, above. Al Hayah Al Youm’s Lobna Assal also hosted a sit-down with former Real Estate Registry head Sami Emam, Senate spokesperson Akmal Nagaty, and Senate member Samaa Soliman (watch, runtime: 31:06).

The first day of public school exams saw some students facing technical difficulties, with the electronic system crashing intermittently. All school students who were unable to access their electronic exams were automatically given a passing grade, since these exams are pass / fail, Education Minister Tarek Shawki told Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 7:10). The system crashed because of the pressure of more than 600k students entering at the same time, state-run MENA’s education reporter Ayman Sakr told Lobna Assal (watch, runtime: 6:18).

University students had a smoother examination experience, with Higher Education Ministry spokesperson Adel Abdel Ghaffar telling Assal that the day went on without major issues (watch, runtime: 5:08). El Hekaya’s Amr Adib also took note (watch, runtime: 1:59).

Also from the airwaves last night: Kelma Akhira’s Lamees El Hadidi took note of the intelligence report that holds Saudi Crown Prince Mohammed bin Salman responsible for the killing of journalist Jamal Khashoggi, cautioning Washington against using human rights as a pressure point when dealing with the region (watch, runtime: 8:09). We have more in Around the World, below.

EGYPT IN THE NEWS

It’s a mixed bag of nothing and everything for Egypt in the foreign press this morning. A handful of stories to keep on your radar:

- Human rights: The Biden administration should focus on financing local development programs rather than threatening to cut funding and arms supplies if it wants to improve Egypt’s human rights situation, argues David Ignatius in the Washington Post.

- Tunisian farmers don’t like Egypt right now: Controversy over imported Egyptian agricultural products is sparking demonstrations by Tunisian farmers, who say a flood of Egyptian products in the local market is harming domestic industry, the Arab Weekly reports.

- President Abdel Fattah El Sisi’s recent directive to attract more traffic to the Suez Canal through “flexible marketing” is “critical” to help Egypt offset foregone FX income from tourism, Bloomberg says.

- A proposal to omit Quranic verses and hadiths narrated by Prophet Mohamed from the national curriculum has caused uproar and prompted diverging opinions from Islamic scholars and political figures to emerge, Al Monitor reports.

- And finally: The 25 January Revolution is still getting ink. (The Telegraph | France24)

ALSO ON OUR RADAR

Five consortia have eyes on a tender to establish the Tenth of Ramadan City dry port, Al Shorouk reports, citing sources from the General Authority for Land and Dry Ports. The consortiums include one led by Dubai’s DP World, one led by China International Marine Containers (CIMC) Group, and the Elsewedy Electric-DB Schenker consortium, among others. The authority is expected to formally issue the tender by mid-year, according to the sources.

Other things we’re keeping an eye on this morning:

- TAQA Gas’ 1.2 mn customers will be able to pay their gas bills online through digital retail payment platform Khales, under a partnership agreement signed between both parties on Friday. Khales is a subsidiary of the state-owned e-payments firm E-Finance.

- ITIDA will issue (pdf) up to three licenses for companies allowing them to provide e-signature and timestamp services, a step it says will help develop Egypt’s digital economy.

- An unidentified banking syndicate has agreed to restructure EGP 5 bn-worth of Rooya Group’s debts as the company faces a slump in sales.

PLANET FINANCE

The global economic recovery is looking increasingly uneven, with a “dangerous divergence” opening up between the developed and developing worlds, the IMF’s Managing Director Kristalina Georgieva said in a statement during the meeting of G20 finance ministers on Friday. Prospects for global growth remain promising, and the world’s GDP could surpass the IMF’s 5.5% projection. Yet the impact of the pandemic isn’t being evenly felt across the world: Developing countries are expected to suffer per capita income losses up to 22% by 2022, versus 13% in developed economies, she said.

US backs more IMF firepower for emerging economies: US Treasury Secretary Janet Yellen came out in support of increasing the IMF’s lending power at the meeting which would boost liquidity for vulnerable countries hit by covid-19, but said that new parameters are needed to ensure the transparent use of the Fund’s reserves, Reuters reported. The expansion of Special Drawing Rights was opposed by the Trump administration, which prevented the fund from increasing lending to developing countries during the height of the covid pandemic.

And it could be playing ball on moves to tax Big Tech: Yellen said during the meeting that Washington will not proceed with the Trump administration’s measure to let some major tech firms like Amazon and Facebook opt into the global digital taxation voluntarily, according to the Financial Times. The US will come up with a resolution for the tax challenges of digitization and a global minimum tax by July, she added. The rules, proposed by the Organization for Economic Co-operation and Development last year, aim to make tech companies pay taxes in every country where they operate and crack down on tax avoidance.

Bitcoin is heading for its worst week since the pandemic-fueled selloff last March, reaching a 24-hour low of USD 45.1k on Friday after trading as high as USD 58.3k less than two weeks ago. The cryptocurrency’s prices turned choppy and slipped 5% since Friday after it was “ridiculously overbought” amid a sell-off in the broader stock market due to rising concerns over surging bond yields, analysts say, according to Bloomberg.

|

|

EGX30 |

11,618 |

+1.6% (YTD: +7.12%) |

|

|

USD (CBE) |

Buy 15.65 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.65 |

Sell 15.75 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

9,195 |

+0.9% (YTD: +5.8%) |

|

|

ADX |

5,628 |

|

|

|

DFM |

2,528 |

+0.8% (YTD: +1.4%) |

|

|

S&P 500 |

3,811 |

-0.5% (YTD: +1.5%) |

|

|

FTSE 100 |

6,484 |

-2.5% (YTD: +0.4%) |

|

|

Brent crude |

USD 64.42 |

-2.6% |

|

|

Natural gas (Nymex) |

USD 2.77 |

-0.2% |

|

|

Gold |

USD 1,728.80 |

-2.6% |

|

|

BTC |

USD 45,943.26 |

-4.3% |

The EGX30 rose 1.6% on Thursday on turnover of EGP 1.83 bn (20.7% above the 90-day average). Local investors were net buyers. The index is up 7.12% YTD.

In the green: Orascom Development Holding (+8.8%), Orascom Investment Holding (+3.4%) and Cleopatra Hospital (+3.3%).

In the red: MM Group (-1.6%) and El Sewedy Electric (-0.3%).

AROUND THE WORLD

Washington blames MbS for Khashoggi murder: Saudi Arabia’s crown prince and de factor ruler Mohammed bin Salman was personally involved in the brutal murder of journalist and Saudi dissident Jamal Khashoggi in Istanbul in 2018, according to an intelligence report (pdf) declassified by the Biden administration on Friday. US intelligence bases its claim on MbS’ complete control over Saudi security forces at the time, “making it highly unlikely that Saudi officials would have carried out an operation of this nature without the crown prince’s authorization.”

… But it didn’t really make much of a difference: The report didn’t include any new information or evidence, making its release a reason for MbS’ supporters to celebrate, rather than fret, Bloomberg notes. And while the US Treasury has imposed sanctions on the Saudi Rapid Intervention Force and an ex-Saudi intelligence official for their role in the killing but has not moved to punish the crown prince himself.

Also from the White House: US President Joe Biden checked his first military operation as commander-in-chief off his to-do list, ordering an airstrike against pro-Iran militias in Syria in response to rockets fired at US targets in Iraq. Biden defended the airstrikes, which were ordered without congressional approval, as part of his constitutional duty “to protect US citizens both at home and abroad.”

Also worth knowing this morning: Qatar is committing USD 60 mn to establish a natgas pipeline between Israel and Gaza in a bid to end the energy crisis in the Palestinian territory, Doha’s foreign ministry said in a statement. The project, slated for completion in 2023, will transport natgas coming from US energy company Chevron’s Leviathan field to Israel to supply the Gaza Strip’s sole power station, Reuters reported.

IN DIPLOMACY: Elsewedy Electric looks to be deepening its commercial links in Iraq after signing an MoU with the Iraqi National Investment Commission (NIC) on Thursday to establish a 5 mn sqm industrial zone in Baghdad, the NIC said in a statement. The company will also handle the management and marketing of different industries at the zone. The agreement comes as Egypt is working with Iraq on everything from oil and water resources to construction, transportation, environmental protection, as well an exchange of expertise in the stock market and judiciary.

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

22 February- 5 March (Monday-Friday): Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

28 February (Sunday): Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

2 April (Friday): Legendary Lebanese singer Majida El Roumi will perform at Egypt’s El Qubba Palace

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.