- Vaccine registration for elderly + chronically ill Egyptians opens on Sunday. (Covid Watch)

- Vodafone is looking to snap up 20% in each of Bee Payments + Masary. (M&A Watch)

- EM private equity firm Affirma Capital is investing USD 20-100 mn in Egypt this year. (Investment Watch)

- Our newest potential natgas export market: Hungary. (Energy)

- MoneyFellows has its eyes on regional expansion. (Startup Watch)

- The Water Resources Act is back from the dead. (Legislation Watch)

- We just had our first human rights talk with the Biden administration. (Around the World)

- Catch up from EnterprisePM: Output from the Damietta LNG plant could pick up next month + EgyptAir grounds Boeing 777 planes. (What We’re Tracking Today)

- Will the SFE be tapped for a pan-African infrastructure plan? (Hardhat)

- Planet Finance: When stimulus is too much stimulus, according to El Erian.

Wednesday, 24 February 2021

EnterpriseAM — Mark your calendars for vaccine registration

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We have a rather stacked issue for you today, so let’s get right to it.

THE BIG STORY AT HOME is that the next phase of our vaccination program is getting underway next week, when elderly citizens and those with chronic illnesses will be able to sign up to get their jab. All the details are in this morning’s Covid Watch, below.

THE BIG STORY INTERNATIONALLY is US Federal Reserve boss Jay Powell’s pledge to keep interest rates low to prop up the country’s economic recovery, saying in a testimony to Congress yesterday that “the economic recovery remains uneven and far from complete, and the path ahead is highly uncertain.” Inflation remains “soft,” Powell said, but the Fed’s focus will be bolstering job growth. Powell’s statement helped US tech stocks claw back some of their losses yesterday, with the S&P 500 ending the day in the green after falling 1.8% in intraday trading. Bloomberg and the Wall Street Journal have the story.

Did you apply to get your old car swapped out under the government’s natgas auto program? You’ll be hearing back on whether your vehicle is eligible for replacement on 15 March as the Trade and Industry Ministry sifts through applications, El Watan reports. Applicants were originally set to hear back by mid-February but the ministry has pushed the timeline due to high demand for the program. The Sisi administration has a multi-year plan to convert or replace 1.8 mn cars to run on natural gas in a bid to reduce dependence on petrol-fuel.

If you or your spawn is an American Diploma high school student, register for the standardized Egyptian Scholastic Test before 9pm CLT tomorrow. That’s the deadline to register for the exam, which will replace the SAT for admission into Egyptian universities, according to an Education Ministry statement. The deadline was previously 15 February.

*** CATCH UP QUICK on the top stories from yesterday’s edition of EnterprisePM:

- Output at the Damietta LNG plant could pick up next month when a new ownership agreement is signed on 15 March.

- EgyptAir has grounded four Boeing 777-200 planes after an engine failed over Denver on Saturday.

- We featured our analyst of the week — Sigma Capital’s AbouBakr Emam — who gave us his outlook for Egypt’s stock market performance.

|

CIRCLE YOUR CALENDAR-

HAPPENING TODAY- Calling all exporters: Learn how to navigate the new Nafeza pre-registration customs system at this webinar hosted by the Food Export Council and the Customs Authority. The event takes place today at 12pm CLT. Tap or click here to register.

The Afro Future Summit is taking place tomorrow. The summit will be held virtually.

The Egypt International Art Fair also kicks off tomorrow at Dusit Thani Lakeview Cairo, and is set to wrap on Saturday, 28 February.

Prime Minister Moustafa Madbouly is talking about Egypt’s economy in a webinar held by AmCham and the Egypt-US Business Council tomorrow at 4pm. The event, headlined "Egypt: 2021 and Beyond," will have Madbouly tackling Egypt’s strategy to curb the effects of the global downturn as well as revealing the country’s future plans to maintain economic growth.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: The Sovereign Fund of Egypt (SFE) — along with other state-run funds from several countries in Africa — is being called to invest up to 5% of its capital in a planned pan-African infrastructure fund. The goal? To plug the continent’s annual infrastructure funding deficit of USD 60-90 bn, and finance the building of roads, power plants, and railways. Boosting Africa’s regional infrastructure is key to making use of the recently-launched African Continental Freetrade Agreement (AfCFTA), which brings together 24 countries in a pan-African freetrade bloc.

COVID WATCH

Mark your calendars

Egyptians over the age of 40 and / or those with chronic illnesses will be able to register to receive the covid-19 vaccine online as of next Sunday, 28 February, Health Minister Hala Zayed said at a press conference following the arrival of a 300k shipment of China’s Sinopharm vaccine in the early hours of Tuesday, according to a cabinet statement.

What do you need to prepare? Applicants will be required to submit three medical reports to determine their medical history, which the platform will use to determine their priority level and automatically schedule appointments accordingly. Applicants will receive a text message with the time and date of the appointment for the first dose, and will receive a follow-up card to track their receipt of the second dose.

The administration of the vaccinations will begin in the first week of March, Zayed told Kelma Akhira’s Lamees El Hadidi. The ministry will only inoculate as many people as it can ensure will have access to the second dose, meaning that the vaccination process for the wider population will take longer but will be efficient, Zayed said (watch, runtime: 5:06).

Egypt is waiting on some 8.6 mn doses of the Oxford-AstraZeneca vaccine through international vaccine alliance GAVI to arrive in the coming days, the minister said. This batch is part of a total of 40 mn doses expected before the end of the year. Egypt had signed on to receive a total of 100 mn doses from GAVI and individual companies.

The ministry is planning to have vaccinated at least 35-40 mn citizens by the end of the year, the minister told Lamees (watch, runtime: 1:03).

Where will the jabs be given? Forty medical centers in all 27 governorates will be administering the vaccine, the minister said.

The vaccine will be provided without charge to those who cannot afford it, or to those who lost their jobs during the pandemic, the minister said, according to Al Mal. For those able to pay, the two doses will cost around EGP 200, Zayed said (watch, runtime: 0:59).

The Health Ministry reported 633 new covid-19 infections yesterday, up from 623 the day before. Egypt has now disclosed a total of 179,704 confirmed cases of covid-19. The ministry also reported 39 new deaths, bringing the country’s total death toll to 10,443.

Central European countries’ healthcare systems are buckling under the weight of a surge in covid-19 cases, after being spared high infection rates during the first wave, Euronews reports. The Czech Republic has said it is in need of international assistance and only has 14% of its ICU beds available, while Slovakia topped the world in covid deaths per capita last week.

And things are not looking promising on the vaccination front for the rest of the continent: AstraZeneca looks set to deliver less than half of the 180 mn doses it was contracted to provide to the EU in 1Q2021 due to supply chain issues, an EU official told Reuters.

M&A WATCH

Vodafone to acquire 20% in fintech players Bee and Masary

Vodafone Egypt is set to acquire a 20% stake in each of Bee and Masary — both subsidiaries of non-banking financial services provider Ebtikar — under the terms of an MoU between Ebtikar and Vodafone, Hapi Journal reports. Vodafone will acquire the stakes through a capital increase. The acquisition comes as part of the mobile network operator to ramp up its investments in Egypt and expand its non-banking financial services products. The companies will now begin the due diligence process, which is expected to take around three months, Al Mal reports, citing sources close to the sale.

Vodafone’s share purchase opens the door for Bee and Masary’s expansion in Africa, B Investments’ IR head Omar El Labban tells Al Mal. Ebtikar is a joint venture between B investments, BPE Partners and MM Group for Industry and International Trade.

Advisors: Zaki Hashem & Partners is advising Ebtikar, Al Mal reports, while Alliance Law Firm is providing counsel to Vodafone on the transaction, according to an emailed statement.

Background: Ebtikar had said last year that it had received “several” offers from unnamed local and foreign investors for stakes in Bee and Masary. Ebtikar holds a 72% stake in Masary, with the remainder held by Bahrain’s Sadad. The company also acquired a 60% stake in Bee in October 2017, with the remaining 40% held by two other investors.

Separately, Ebtikar is also reportedly looking to up its stake in Bee to 80% by acquiring the stake held by software services company Techno Beez, Al Mal reports, citing unnamed sources. Techno Beez will then purchase an undisclosed stake in Ebtikar in exchange for exiting Bee. Ebtikar is set to disclose the details of these agreements to the EGX this morning, according to the sources.

RETAIL

Foreign investors want minority stake in HyperOne, Carrefour expanding

Unnamed foreign investors and funds are interested in acquiring a 20% stake in Egyptian retail chain HyperOne, Mohamed El Hawary, the chairman of the supermarket chain’s business group, told the local press. Talks are still in very early stages, El Hawary said, without putting an estimated closing time for a transaction.

HyperOne opened a new branch on the outskirts of Cairo in New Sphinx City last summer. The new location, on the Cairo-Alexandria desert road towards the capital’s toll gate, cost the company some EGP 650 mn to get up and running. According to its website, the company has another branch in Tenth of Ramadan City, besides its flagship store in Sheikh Zayed.

IN OTHER RETAIL NEWS-

Carrefour Egypt plans to invest EGP 400 mn to open 20 new branches this year in several governorates, Country Manager Jean Luc Graziato told the local press. These include Cairo, North Coast, Alexandria and Damanhour, and will take the company’s total branch count to 77. March will see the opening of one of four branches planned to open in Omar Effendi’s stores in 2021 as part of a partnership signed in January, he said, adding that another store will launch in coordination with the military’s National Service Products Organization.

Other plans: The company is in talks with real estate developers to roll out two branches in the new administrative capital, Graziato noted, referring to a possible purchase of two land plots offered by the Internal Trade Development Authority.

INVESTMENT WATCH

Affirma Capital eyeing Egypt debut

Emerging markets private equity firm Affirma Capital is planning to invest USD 20-100 mn in at least one Egyptian business this year, marking its first entry into the Egyptian market, Middle East and North Africa head Taimoor Labib said, according to a report in Al Mal’s print edition. The firm is currently considering investments in five different businesses in the healthcare, medicines, food, and consumer goods sectors, and will give priority to medium sized businesses, Labib said, without giving further details. Affirma had in 2019 said it was looking at potential investments in Egypt’s food and beverage and retail sectors, and that it had earmarked USD 700 mn for acquisitions in the Middle East and Africa.

ENERGY

Hungary is ready for Egypt’s natgas

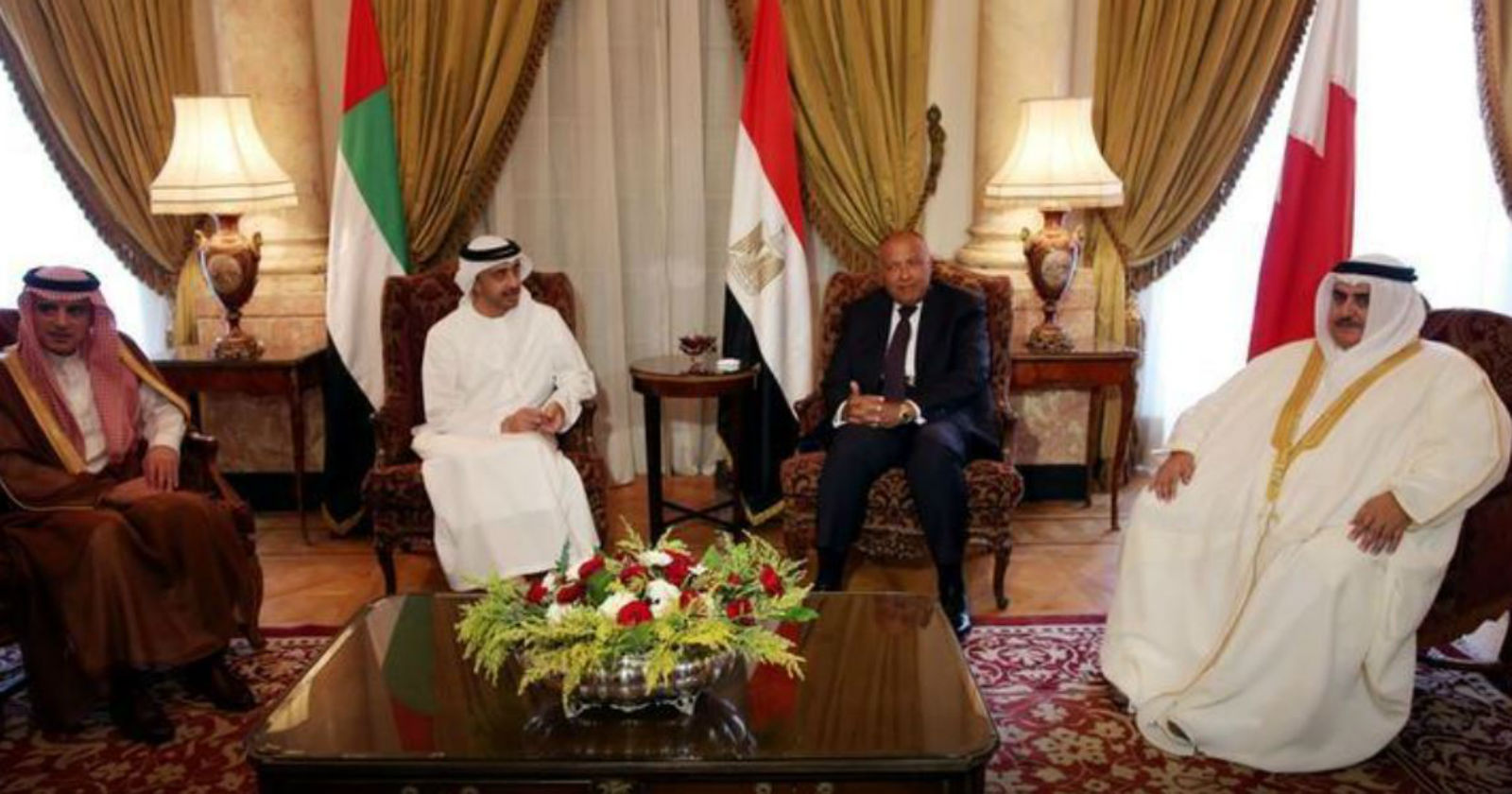

Hungary plans to import Egyptian natural gas once a Greek-Bulgarian pipeline is complete, Hungarian Foreign Minister Péter Szijjártó said at a press conference (watch, runtime 19:56) with Egyptian Foreign Minister Sameh Shoukry yesterday after a meeting on trade, cooperation, and curbing illegal migration to Europe.

What does a pipeline to Bulgaria have to do with Hungary? Greece and Bulgaria are currently working on constructing a 182 km pipeline that would then help connect South-East and Central Europe countries to the gas supply. Since Hungary is landlocked in Central Europe, its access to Mediterranean gas supplies — including those shipped from Egypt — would likely flow through the Greek-Bulgarian pipeline.

This is great timing, with the long-idle Damietta LNG plant coming back online earlier this week. Damietta is running a series of trial shipments before formally resuming exports, with the next trial shipment likely heading to Europe, Oil Ministry spokesperson Hamdy Abdel Aziz told Enterprise.

ELSEWHERE IN OUR GAS NEIGHBORHOOD- A newly proposed gas pipeline from Israel’s Leviathan field to Gaza could finally materialize by 2023, providing much needed energy to the impoverished and blockaded enclave, Reuters reports. The project to build a USD 70 mn extension to the existing pipeline in Israel would be funded by Qatar, while the USD 20 mn section that extends into the Gaza strip would be funded by the European Union, Israeli and Palestinian officials told the newswire. Egypt is also set to work with Palestine to develop its Gaza Marine gas field, we noted earlier this week.

DIGITIZATION WATCH

Alexa, bring some AI to Egypt Post

The Egyptian Postal Service is trialing a new AI and GPS-powered logistics management software provided by Softec International, the postal service said in a statement picked up by Hapi Journal. The new service will allow users to get their online purchases delivered to their homes through the national post, as opposed to private couriers, the statement said. Users will be able to track their packages, receive updates on their delivery through SMS, and communicate with the delivery person through the Egypt Post’s app.

Bigger policy picture: The new service comes as a part of the government’s digitization plans and aims to support e-commerce activities, particularly for smaller businesses, Egypt Post Chairperson Sharif Farouk said. The post had launched a number of digital services in 2019, including the EasyPay card that can be charged at any post office, through which users can make online purchases.

FINANCIAL INCLUSION

Meeza rollout to finish in December

All public sector employees will receive their salaries via Meeza cards by December, Finance Minister Mohamed Maait said in a statement. The government plans to issue 1.2 mn cards during February-April, the minister said, adding that the government-issued cards currently in use won’t stop until the new cards are activated. The ministry said in August that it planned to distribute 5 mn cards by June 2021. Meeza cards enable users to withdraw cash through ATMs, make purchases online, and pay government fees through its e-payment portal.

Background: The government began rolling out Meeza cards in 2019 and trialed their use to pay salaries in August. Employees will receive a 30% salary advance at no charge in the first six months of using the card.

STARTUP WATCH

MoneyFellows has its eyes on regional expansion

Egyptian fintech startup MoneyFellows has plans to expand its services to other MENA countries in the coming period, founder and CEO Ahmed Wadi tells Masrawy. The app currently operates in Egypt’s major cities, and in some parts of the Delta, Wadi said. MoneyFellows had previously said it planned to expand in the MENA region in 2020 and to establish a presence in other countries in Africa in 2021.

The startup is also looking to expand its product line, and will offer smart savings services, as well as installment payment plans for purchases made through the app. The company has so far raised around USD 7 mn in funding, Wadi said.

How does it work? MoneyFellows creates digital “money circles” — known in the region as a gameya — using a scoring model, as a way to offer peer-to-peer, no-interest lending. The members of each circle commit to paying an installment into a pool every month, with a different member taking the whole pool as a payout each month.

LEGISLATION WATCH

Water Resources Act: The great revival?

The long-dormant Water Resources Act is coming back from the dead at the House of Representatives, where MPs will discuss committee reports on the legislation next Tuesday ahead of a final vote on the bill, Al Shorouk reports. The act is expected to unite disparate laws on water into a single bill, and will introduce stricter penalties for water waste, and address pollution, dwindling resources, and climate change issues. The legislation has been in the works since at least 2017, when it received cabinet approval, before being discussed extensively in at least 27 House Agriculture Committee meetings. After sub-level committees were formed to resolve some of its contentious articles, the long-awaited draft finally received a nod from the committee in 2019.

Other legislation to be discussed during the week: A bill governing blood donation and the manufacturing and collection of plasma and its derivatives, a bill concerning the establishment of a central authority to manage exports, and a planned online portal for Egyptians seeking to go on the Umrah pilgrimage.

POLITICS

Breaking bread with Doha again

Delegations from Egypt and Qatar met in Kuwait yesterday for the first time since the end of a 3.5-year diplomatic rift, according to a Foreign Ministry statement. The two sides talked bilateral cooperation and advancing the relationship between the “brotherly” countries, as well as national and regional security. The delegations welcomed initial confidence-building measures taken by each since the signing of the accord, the statement said. The meeting followed the signing of an accord during a summit in Saudi Arabia last month, which ended the blockade of Qatar by Egypt, Saudi Arabia, Bahrain, and the UAE, restoring diplomatic and trade ties and opening up airspace to Qatari planes.

The rest of the quartet is doing the same: Qatar met a UAE delegation on Monday, and each of the four countries is set to speak to Qatari officials one on one to resolve individual issues, Reuters reports.

EARNINGS WATCH

State-owned Telecom Egypt recorded EGP 4.9 bn in net income in 2020, up 10% y-o-y and marking the landline monopoly’s largest bottom line to date, the company said in its earnings release (pdf). Consolidated revenue grew 24% y-o-y, reaching EGP 31.9 bn, off the back of a 39% increase in data revenues and a doubling of cable projects revenue.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The conversation on the airwaves was driven by the same topics as the rest of the news cycle: The vaccination program being rolled out to elderly Egyptians and those with chronic illnesses (which we cover in Covid Watch, above) and the capsizing of a boat in Lake Mariut (which is leading coverage of Egypt in the News, below).

Prosecutors are investigating the capsizing of the small boat in Lake Mariut, which has so far left nine people dead and five others under hospital care, Alexandria Governor Mohamed El Sherif told Ala Mas’ouleety’s Ahmed Moussa. The boat was not fit to be used and was likely carrying too many people, El Sherif said (watch, runtime: 5:43). Kelma Akhira’s Lamees El Hadidi also got the details on the incident from El Sherif (watch, runtime: 4:08).

The talking heads are also still not done covering the Real Estate Registry Act amendments that have been causing a hubbub over the past couple of weeks. Real Estate Registry and Notarization head Gamal Yaqout reiterated that the “signature validation” is still a viable option to register real estate in a phone-in to Masaa DMC’s Ramy Radwan (watch, runtime: 14:14). The amendments set a tiered system for registry fees, based only on the size of the unit, former Real Estate Registry boss Sami Emam told Al Tase’a’s Youssef El Husseiny. Previous regulations also took into account the kind of building (villa, beachfront chalet, apartment building, etc), its location, and several other variables that created a complicated system, Emam said (watch, runtime: 9:15).

Also on the airwaves last night:

- US Secretary of State Antony Blinken’s call with Foreign Minister Sameh Shoukry yesterday highlights Egypt’s importance to the US, even if we have diverging opinions sometimes (Lamees El Hadidi on Kelma Akhira | watch, runtime: 2:15). We have the full story in Around the World, below.

- Canada’s Ryerson University has officially set up its satellite campus in the new administrative capital, as part of Egypt’s international branch campuses program. (Ramy Radwan on Masaa DMC | watch, runtime: 4:49)

- The Personal Status Act must be put up for community dialogue before being passed by the House of Representatives. (Ahmed Moussa on Ala Mas’ouleety | watch, runtime: 8:06) Youm7 was out with the text of the draft law.

EGYPT IN THE NEWS

Topping coverage of Egypt in the foreign press this morning: A fishing boat carrying at least 19 people has capsized in Lake Mariut near Alexandria, killing at least nine people — including three children. The incident likely occurred because the boat was small and overloaded, Alexandria governor Mohamed El Sherif said late Monday after arriving on the scene. At least five people were still missing as of midday yesterday. (Associated Press | Reuters | Xinhua | Africanews)

The espionage trial of suspected Egyptian-born spy Amin K., a former employee of Germany's Federal Press Office, started in Berlin yesterday, Deutsche Welle reports. The 66-year-old man is accused of getting intel for Egypt's General Intelligence Service between 2010 and 2019, and attempting to recruit another spy. The case was set to begin in January but got postponed due to covid-19. The accused could be imprisoned for five years if found guilty of espionage.

Also making headlines:

- A rare visit to Israel by Oil Minister Tarek El Molla on Sunday was as much about sending a message to the US and Turkey as it was about deepening energy ties, analysts say. (Times of Israel)

- Cairo University professor and activist Hazem Hosny was released yesterday after being held for a year and a half in pre-trial detention, the Associated Press reports.

ALSO ON OUR RADAR

A planned factory to manufacture railway tracks should be operational within 24 months, Transport Minister Kamel El Wazir said, according to a cabinet statement. Unnamed Transport Ministry officials had said last year the ministry was in talks with three international iron and steel companies to set up a complex to manufacture and supply railway tracks under a public-private partnership with the National Railways Authority (NRA) and another government entity. The project comes as part of Egypt’s plan to overhaul its national railway system by 2022.

Other things we’re keeping an eye on this morning:

- Avion Express plans to operate weekly flights between Lithuania and Sharm El Sheikh for six weeks during March and April, according to member of the Chamber of Hotel Facilities in South Sinai Rami Rizkallah.

- Careem Egypt plans to expand the vehicle fleet of “Go Awfar” (pdf) after seeing a 31% rise in demand since its launch six months ago.

- Archaeology and Ancient Egyptian history could be integrated into national school curricula as part of a proposal put forth by the education and antiquities ministries.

PLANET FINANCE

El Erian asks: When is stimulus too much stimulus? The Fed needs to think about how to start winding down its printing presses or the possible USD 4 tn in fiscal stimulus proposed by the Biden administration risks rising inflation and blunting the central bank’s policy toolkit, Allianz chief economist Mohamed El Erian writes for the Financial Times.

Endless liquidity helps stave off corporate bankruptcy but it brings risks of its own: Expectations for a surge in inflation risks steepening the yield curve and increasing market volatility. And with monetary policymakers hesitant to turn off the taps, the Fed could find itself in a lose-lose position: “let the risk of financial instability rise and threaten the real economy or intervene further in the functioning of markets … and risk more distortions that undermine efficient financial and economic resource allocations,” he writes.

The answer? El Erian doesn’t suggest reneging on fiscal stimulus efforts, but to find a way for the Fed to back off its injections of liquidity, currently running at USD 120 bn a month. How this will be possible he doesn’t say, though he does point out that the task would be easier if regulators got serious about managing the risk building in the non-bank financial sphere.

Chinese financing for overseas energy projects has shrunk to its lowest level since the global financial crisis due to negotiation barriers caused by covid-19 and difficulties with loan repayment, Bloomberg reports. Boston University figures show state-owned financing institutions in China have already scaled back loans to developing countries by some 43% last year as they grapple with recessions that have made repayment all but impossible. Chinese lenders have instead started providing concessional loans to increase their chances of reimbursement for financing energy projects. The lion’s share of financing last year went towards the construction of a natural gas pipeline in Nigeria.

Nightmare on Wall Street: The Biden administration is interested in looking into a financial transaction tax as it considers how to protect investors following the GameStop trading mania, a White House spokesperson told CNN Business. A tax could potentially be introduced on GameStop-esque trades in a bid to deter destabilizing market activity, the spokesperson suggested. The thought of a so-called “Tobin tax” is despised by Wall Street which has warned that such a levy would end up harming retail investors by increasing trading costs and curbing liquidity.

|

|

EGX30 |

11,417 |

-1.72% (YTD: +5.27%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.63 |

Sell 15.73 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

9,152 |

+0.8% (YTD: +5.3%) |

|

|

ADX |

5,671 |

+0.2% (YTD: +12.4%) |

|

|

DFM |

2,547 |

+0.2% (YTD: +2.2%) |

|

|

S&P 500 |

3,881 |

+0.1% (YTD: +3.3%) |

|

|

FTSE 100 |

6,626 |

+0.2% (YTD: +2.6%) |

|

|

Brent crude |

USD 64.98 |

-0.6% |

|

|

Natural gas (Nymex) |

USD 2.87 |

-0.3% |

|

|

Gold |

USD 1,810.60 |

+0.3% |

|

|

BTC |

USD 50,194.21 |

-1.26% |

The EGX30 fell 1.2% yesterday on turnover of EGP 1.76 bn (17.7% above the 90-day average). Local investors were net sellers. The index is up 5.27% YTD.

In the green: MM Group (+5.4%) and Orascom Development (+4.7%).

In the red: Orascom Financial Holding (-4.2%), Orascom Investment Holding (-4.0%) and Fawry (-3.7%).

It’s a sea of red in Asian markets in early trading this morning and futures suggest US markets will follow suit to open in the red.

AROUND THE WORLD

We just had our first human rights talk with the Biden administration: The US is “concerned” about Egypt’s human rights record, as well as our potential acquisition of fighter aircraft from Russia, US Secretary of State Antony Blinken told Foreign Minister Sameh Shourky in a phone call yesterday, according to a US state department press release. Blinken’s statement came amid expectations that President Joe Biden is set to recalibrate Washington’s relationship with key allies in the Middle East. Blinken and Shoukry’s conversation also covered peace negotiations in Libya and Palestine, and combating terrorism in Sinai. Reuters also had the story.

Iran is enriching its uranium to a grade close to that needed to manufacture nuclear weapons for the first time in eight years, according to two reports by the International Atomic Energy Agency, adding strain to the fraught process of negotiating a return to a US-Iran nuclear agreement, Bloomberg reports.

Will the Sovereign Fund of Egypt (SFE) be tapped for a pan-African infrastructure plan? The African Union (AU) is calling on state-run sovereign, pension and ins. funds from Egypt, South Africa, Morocco, Kenya, Angola, and Nigeria to invest up to 5% of their capital in a planned infrastructure fund that will finance the building of roads, power plants, and railways across the continent, Raila Odinga, the AU’s high representative for infrastructure, told Reuters. This comes as African authorities look for fresh sources of funding to plug an annual infrastructure financing deficit of USD 60-90 bn that has stunted development across the continent. Infrastructure has been a key obstacle to making use of the African Continental Freetrade Agreement (AfCFTA), which officially launched earlier this year and brings together 24 countries in a pan-African freetrade bloc with a combined GDP of USD 3.4 tn, making it one of the largest in the world in terms of participating countries.

Getting goods across the continent: The countries that comprise the bloc (including Egypt) began trading under the terms of AfCFTA, which removes tariffs on most goods, with the start of 2021. But with Africa’s infrastructure mainly geared to serve trade outside the continent, “infrastructure is urgent for the realization of the AfCFTA, otherwise it is just going to remain on paper,” Odinga told Reuters. Several landlocked countries are disconnected from major ports and transcontinental highways have missing links, making intra-regional trade difficult. Intra-African trade stands at only 15%, compared with 70% and 50% in Europe and Asia, Odinga said.

Turning to alternative sources of funding: The fund, which will be run by the newly established African Union Development Agency, is seeking to diversify funding sources by moving away from reliance on wealthy donor nations and international debt markets. With developed countries repurposing funds and large lender China scaling back on its involvement amid high debt levels to individual countries, “Africa is financially starved as far as the need for infrastructure development,” Odinga said. The AU has already begun courting investors, and is working to set up the planned fund’s legal and financial structure, according to Odinga.

Is the SFE on board? Infrastructure and energy are among the SFE’s key mandates, but the fund has so far focused on domestic projects, including the EuroAfrica transmission link to import electricity from Egypt, as well as the Sixth of October dry port. As of late last year, the SFE had EGP 26 bn in assets under management, and a EGP 13 bn portfolio of owned assets, CEO Ayman Soliman told CNBC Arabia in December.

One signal the SFE may be interested: Planning and Economic Development and SFE chairperson Minister Hala El Said sat down with Eli Bay, Senegal’s ambassador to Cairo, last month to look into partnering with the west African country’s sovereign wealth fund as part of a larger pan-African cooperation plan we have yet to hear more on. We reached out to officials from the SFE, but they hadn’t replied to our request for comment at dispatch time.

Infrastructure development would present new potential for contractors across the continent, President of the African Federation for Construction Contractors’ Associations Hassan Abd El Aziz told Enterprise, noting that many African countries are in need of road, rail, energy, water, and sanitation projects, though some Egyptian investors and exporters might shy away from trade with African countries that are politically unstable, said Abd El Aziz.

President Abdel Fattah El Sisi has been pushing for more business with Africa, launching an investment risk insurance fund, as well as a fund to invest in Africa’s information technology infrastructure. The president had also vowed that Egypt would turn its focus to infrastructure development during its chairmanship of the African Union in its 2019-2020 session.

Your top infrastructure stories for the week:

- Electricity: The North Cairo Electricity Distribution Company wants to establish seven control centers worth EGP 6 bn over the next five years, two of which will be undertaken by Schneider Electric in east Cairo, the local press reports.

- Natgas: The Damietta LNG plant is back online after eight years of being idled, with two liquefied natural gas shipments making their way out of the Damietta Port earlier this week.

- Renewable energy: Siemens Gamesa was awarded the five-year contract to operate and maintain the New and Renewable Energy Authority’s (NREA) 220 MW Gabal El Zeit 2 wind plant in the Gulf of Suez.

- Transit: The first domestically assembled electric buses will hit the road before the end of this year.

ON YOUR WAY OUT

Mars landing in 4k: NASA has published video footage of its Perseverance Rover landing on Mars last Thursday in addition to the first sounds from the Red Planet (watch, runtime: 3:26).

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

6-27 February (Saturday-Saturday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

26-28 February (Thursday-Saturday): The second edition of the Egypt International Art Fair will be held at Dusit Thani Lakeview Cairo.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.