- Covid and the US election are going to make this a week to remember. (What We’re Tracking Today)

- First Abu Dhabi Bank resumes talks to acquire Bank Audi Egypt. (Speed Round)

- Car sales up in September as sector continues recovery from covid slump. (Speed Round)

- Egypt’s remittance inflows could take a hit next year as GCC economies feel the crunch. (Speed Round)

- Banque du Caire could receive USD 50 mn EBRD loan to on-lend to small businesses. (Speed Round)

- House committee approves harsher penalties for late tax filing. (Speed Round)

- Cabinet approves streamlined budget legislation. (Speed Round)

- Egypt, Iraq sign flurry of agreements on everything from energy to exports. (Diplo + Foreign Trade)

- Ant Group IPO attracts USD 3 tn in retail bids. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 1 November 2020

Buckle up: It’s going to be a week to remember

TL;DR

What We’re Tracking Today

Good morning ladies and gents, and welcome to November — we hope you’re buckled up for what is shaping up to be one of the biggest weeks of an already too-eventful year. It’s something of a perfect storm for investors as the most uncertain US presidential race in a generation runs headlong into new lockdowns in Europe and surging covid cases in the United States, setting up what could be a volatile week in markets.

Here’s what you need to know:

#1- Lockdowns are back in full force as covid runs amok in Europe, the US and Canada. The US yesterday set a new world record for the most fresh covid-19 cases reported in a single day after a Reuters tally found that there had been 100k new infections on Saturday alone. Daily figures in Europe are well above anything seen during the first wave and continue to rise. In response, France, Germany, Belgium and Austria have all since Thursday announced new lockdowns, joining Spain and Italy which earlier last week significantly tightened restrictions. The UK is the latest to follow suit, with PM Boris Johnson announcing overnight that restaurants and bars will close for four weeks, as well gyms and “non-essential” shops. The UK will also require people to stay home except for work, school and exercise.

#2- All of this is happening as economic support falters in the US and UK: The failure of bipartisan talks to agree a new stimulus package before the election now means that new fiscal support will not be forthcoming until at least the end of January when the next president is sworn into office. Over in the UK, the new national lockdown is taking place just as the government’s mortgage payment holiday and furlough scheme come to an end.

#3- The small matter of the US election. US citizens will go to the polls on Tuesday — or at least those who haven’t already voted — to cast their ballots in what is expected to be the most turbulent election in years. If you’d have asked us a month ago, we’d have probably told you that Biden was a shoo-in for the presidency. Not anymore. Trump has trimmed Biden’s huge lead in the national polls, and in the battleground states of Florida and Pennsylvania — states so significant they could determine who wins the presidency — the race is too close to call.

Be ready to wake up Wednesday morning and not know who won the election: The risk of a more drawn-out and altogether more toxic re-run of the 2000 election is significant, pundits say.

The party already got started at the tailend of last week as investors freaked out over the resurgence of covid, delivering US and European stocks one of their worst weeks since the panic in March. We have all the details below.

We’ll know later today the results of round one of elections to the House of Representatives, the National Elections Authority said on Thursday. The next round of elections for Egyptians abroad runs from Wednesday to Friday, while voting here at home kicks off next Saturday, 7 November and wraps on Sunday, according to the NEA’s breakdown of the election timeline (pdf). Voters in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai will all be voting in the second phase of the election.

Egypt, Ethiopia and Sudan are back at the negotiating table today to discuss the filling and operation of the Grand Ethiopian Renaissance Dam, Sudan’s Irrigation Ministry said in a statement on Saturday. The meeting was agreed upon during the last joint meeting of the countries’ foreign and water ministers on 27 October, the first meeting of African Union-brokered negotiations following a seven-week hiatus. Cairo and Khartoum are standing firm that the talks must produce a legally binding agreement.

On the agenda in the House today: MPs will discuss draft amendments to the Unified Tax Act that would impose harsher penalties for tax evasion (more on this in this morning’s Speed Round, below) and the renewal of the three-month state of emergency in its plenary session today.

The bylaws governing the Senate will be published within the next two weeks, Speaker Bahaa Eldeen Abou Shoka has said, Al Shorouk reports.

News triggers coming up in the next two weeks as we begin a new month:

- PMI figures for October will land on Tuesday;

- Foreign reserves figures should be out next week;

- Inflation data for October will be released on 10 November;

- The Central Bank of Egypt’s Monetary Policy Committee will meet to review rates on 12 November.

PSA- Clocks just fell back an hour in much of Canada and the United States, giving our readers across the pond an extra hour’s sleep today. Egypt did away with the twice-yearly time change after a year in which we changed the clocks four times. New York and Toronto will be seven hours behind CLT today.

The Health Ministry reported 170 new covid-19 infections yesterday, down from 176 the day before. Egypt has now disclosed a total of 107,555 confirmed cases of covid-19. The ministry also reported 8 new deaths, bringing the country’s total death toll to 6,266. We now have a total of 99,452 confirmed cases that have fully recovered.

Churches will reduce the size of masses and other religious and educational events to 25% of maximum capacity starting today, Masrawy reports, citing a statement by the Coptic Orthodox Church.

African governments need to step up their covid restrictions ahead of a potential second wave, the Africa Centres for Disease Control and Prevention warned on Thursday as cases accelerate across parts of the continent, Reuters reports. In the past month, cases have spiked by an average 45% per week in Kenya, 19% in the Democratic Republic of Congo and by 8% in Egypt, according to the organization’s figures.

The number of flights operated by EgyptAir over the past three months was down 75% on the equivalent period last year, even as countries began re-opening their borders and reestablishing flight routes, the carrier’s media advisor Asma Al Saadi told Al Shorouk.

Confederation of African Football President Ahmad Ahmad tested positive for covid-19 on Friday and is self-isolating at a Cairo hotel, CAF said on Friday. Ahmad was in Morocco earlier in the week for the Confederation Cup and began experiencing “mild flu symptoms” after returning to CAF’s headquarters in the Egyptian capital on Wednesday.

Covid has also reached the heart of the Turkish government: Turkish President Recep Tayyip Erdogan’s spokesman and Interior Minister have both tested positive for covid-19, Bloomberg reports.

Iran is imposing strict measures to curb a third wave of the virus, prohibiting weddings, wakes and conferences and extending the closure of businesses for another week, Reuters reports.

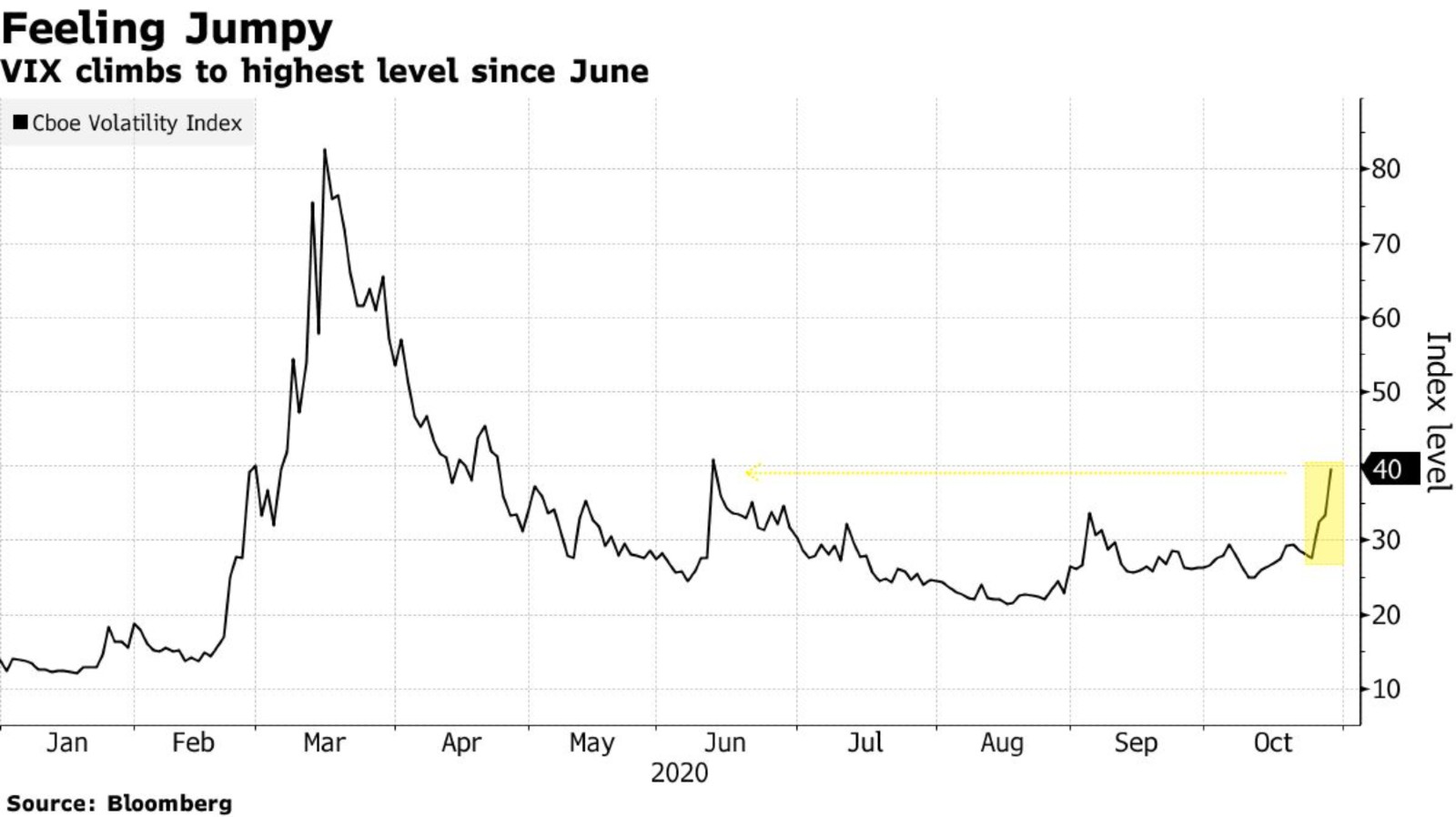

Global equities had their worst week since March as the upcoming US election and renewed covid-19 lockdown measures across Europe shook an already jittery market, the Financial Times reports. The MSCI All Country World Index fell by 5.2% over the week, while the S&P 500 lost 5.6%.

Bumper tech earnings weren’t enough to save the Nasdaq: The tech-heavy index fell 2.4% on Friday despite Alphabet, Amazon, Apple and Facebook all outperforming analysts earnings expectations in 3Q, leaving it down 5.5% for the week.

The fear index hit a four-month high: The VIX — an index that measures volatility in US equity markets — rose above 40 for the first time since June in response to the selloff.

The news of renewed lockdowns wasn’t kind to oil prices, which fell to their lowest level since early June on Thursday. Brent crude dropped 3.8% to USD 37.65/bbl on Thursday while US crude slid 3.3% to USD 36.17/bbl on concerns that the new lockdowns will precipitate another major demand slump.

All of this came despite the US and Europe reporting record quarterly growth figures: Output in the eurozone jumped 12.7% in 3Q2020 (pdf) — the fastest rate of economic expansion since records began in 1995 — while the US economy grew at a record 33.1% annualized clip during the quarter.

FINTECH WATCH- Ant Group’s blockbuster IPO drew around USD 3 tn of bids from retail investors — equivalent to the UK’s GDP — putting the sale on track to raise USD 37 bn and valuing the company at around USD 316 bn. The Chinese payments group’s dual IPO saw the Shanghai portion 872x oversubscribed, drawing in USD 2.8 tn of bids, while the Hong Kong tranche won orders for USD 168 bn worth of stock. The listing has eclipsed Saudi Aramco’s as the world’s largest IPO. The Financial Times and Reuters had the story.

And IPOs in the US are still going strong despite the uncertainty: Five companies listed on the US stock market last week, all of which priced at or above the estimated pricing range, Axios says. Chinese lender Lufax raised USD 2.4 bn on Thursday to become the second-largest IPO in the US this year.

The latest from the US-China tech war: Chip companies are no longer facing US sanctions for supplying Huawei with components, as long as they are not used for the Chinese company’s 5G business, the Financial Times reported, citing people briefed by Washington. Analysts believe that while sanctions will still negatively impact Huawei’s 5G operations, the US is willing to allow the company’s smartphone business to recover as it poses less of a security threat. Meanwhile, the Trump administration’s ban on TikTok has been blocked by a US federal judge issuing a temporary injunction, saying it would cause “irreparable harm” to the TikTok users who depended on the app to make a living, according to Bloomberg.

The original James Bond, actor Sean Connery, has passed away at the age of 90, the Associated Press reports. Best known for his Bond and Indiana Jones franchises, Connery won an Academy Award in 1987 as a Chicago cop who helped Elliot Ness’ team bring down gangster Al Capone, in Brian de Palma’s “The Untouchables.” Bond producers Michael G. Wilson and Barbara Broccoli said they were “devastated” while Scottish First Minister Nicola Sturgeon said the country was mourning “one of her best loved sons.”

Renowned women’s advocate and former head of the National Council for Women Farkhonda Hassan passed away on Friday at the age of 90, the council said in a statement. Hassan served as a member of parliament from 1979 to 1984, was a member of the Shura Council, and taught geology for more than five decades at the American University in Cairo.

In the age of online commerce, retail has to be an experience for its customers, Majid Al Futtaim Properties CEO Ahmed Galal Ismail told us in our latest episode of Making It. We discuss the role of malls and their impact on communities, as well as the company’s future investment plans in the country. Majid Al Futtaim have invested over EGP 40 bn in Egypt since launching operations in 2002.

Tap or click here to listen to the episode on our website | Apple Podcasts | Google Podcasts | Anghami | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

Coverage of the opening of King Salman University and Sharm El Sheikh Museum was the only thing of note in what was a fairly tedious night on the airwaves.

El Sisi inaugurates national projects in Sharm El Sheikh: Al Hayah Al Youm’s Lobna Assal and Masaa DMC’s Eman El Hosary covered President Abdel Fattah El Sisi’s visit to Sharm El Sheikh for the opening of King Salman University and Sharm El Sheikh Museum. The museum houses just over 6k antiques displayed both inside and outside the exhibition halls (watch, runtime: 1:42), (watch, runtime: 9:08). Kelma Akhira’s Lamees El Hadidi mentioned that the cost of all national projects in Sinai during the last six years ranges between EGP 600-700 bn (watch, runtime: 0:45). El Hekaya’s Amr Adib phoned Tourism and Antiquities Minister Khaled El Enany, who said that the Royal Vehicles Museum and Kafr El Sheikh Museum were also inaugurated yesterday (watch, runtime: 3:05).

Sharm’s King Salman University a regional first: Adib phoned Osama Naqli, the Saudi ambassador in Egypt, who said that the newly-inaugurated university is the first institution in the region to offer a program in desert agriculture. He added that it is a growth sector given the vast deserts in Saudi Arabia and the Arab world (watch, runtime: 6:04). Adib phoned Higher Education Minister Khaled Abd El Ghaffar, who said that the university is not for profit, and aims to fight extremist ideologies with scientific teaching. The university cost EGP 14 bn, has a student capacity of 30k, and has two other branches at Al Tur and Ras Sidr (watch, runtime: 5:45). Ala Mas’ouleety’s Ahmed Moussa also spoke with Abd El Ghaffar, who said that the university has accepted 1k students for the first term of its first academic year (watch, runtime: 50: 35).

Sinai tourism in covid times: Moussa also spoke with South Sinai Governor Khaled Fouda who commented on covid precautions for tourists. Fouda said that they’re checked upon their arrival at the airports, and isolated immediately if they test positive, as with some Ukrainian tourists who were recently returned home to recover (watch, runtime: 27:00).

Speed Round

M&A WATCH- First Abu Dhabi Bank (FAB) has resumed talks with Bank Audi to acquire the Lebanese lender’s Egypt unit, according to a bank disclosure (pdf) to the Abu Dhabi stock exchange. The potential acquisition, which could be worth c.USD 700 mn, “is in line with FAB’s long-term growth strategy and expansion plans in targeted markets,” the statement said, stressing that any transaction would follow due diligence, the signing of an agreement, and regulatory approvals.

Background: We had heard whispers of FAB resuming negotiations in September after they were put on hold in May due to covid-19. The potential sale comes as Gulf banks look to acquire the Egypt units of Lebanese banks facing tough times due to the financial crisis in their home country. Acquisitions are currently the only way into Egypt’s banking sector as the CBE has not granted new licenses for years.

Car sales continued to tick upwards in September as the sector continued its recovery from the drop in sales during the second-quarter covid-19 lockdown, according to industry data released yesterday. Figures from the Automotive Information Council (AMIC) show that vehicle sales rose 11.25% y-o-y to 22.9k in September, up from 20.6k sold in the same period last year. The sales come on the heels of a 13% rise to 20.8k in August.

Passenger cars lead the recovery: Sales of passenger cars surged more than 24% y-o-y last month to around 17.5k vehicles, up from 13.7k in September 2019 and 16k in August. Sales volumes of passenger cars fell by as much as 26% during the government’s partial lockdown of the economy earlier this year, which caused dealerships to close and consumers to defer purchases.

Truck sales up, buses down: Truck sales increased slightly to 3.3k vehicles from 3.2k in August, up 9.6% from September of last year when around 3.1k units were sold. While bus sales were up to 2.5k units from 1.6k sold in August, they were down 34.1% on an annual basis from 3.8k units sold in September 2019.

Egypt’s remittance inflows could take a hit next year if GCC economies feel the crunch: Remittances from Egyptians working abroad “are likely to eventually decline” as slower economic growth in Gulf countries and lower oil prices take a toll on workers’ ability to send money home, the World Bank said.

We’re getting deja vu here: The consensus of economic experts only six months ago was that Egypt’s remittance inflows were going to be clobbered this year as lockdowns in the Gulf and the collapse of oil prices threatened to plunge governments and companies into financial crisis. So far though, inflows have remained unscathed, rising 11% in July to USD 2.9 bn as workers upped one-off payments to family members in Egypt. Preliminary figures also indicate that remittances rose around 10.4% in FY2019-2020 to USD 25.2 bn.

But there may be significant headwinds ahead: A frothy global bond market has so far helped GCC countries to stave off a fiscal crisis, but the outlook for oil prices and the trajectory of the pandemic is as uncertain as ever. As we head into the new year there remains a significant risk of financial distress in the Gulf, potentially with big implications for remittance flows into Egypt.

The World Bank is expecting next year to be worse for global remittance flows: Global remittances to low- and middle-income countries are expected to drop a combined 14.5% by next year compared to pre-pandemic levels, including 7% in 2020 and another 7.5% in 2021, with the Middle East and North Africa expected to be among the most affected regions.

DEBT WATCH- BdC could be getting USD 50 mn EBRD loan to on-lend to small businesses: The European Bank for Reconstruction and Development (EBRD) could provide Banque du Caire with a loan of up to USD 50 mn to on-lend to private sector MSMEs, according to the bank’s website. The loan would increase the availability of finance to MSMEs and allow for greater access to finance for the “largely underserved segment.” The EBRD has ramped up its SME financing operations through Egyptian banks since the beginning of the pandemic, which managing director for the SEMED region Heike Harmgart told us was key to channelling liquidity to cash-starved firms. The bank has already invested some EUR 1.15 bn in Egypt in 9M2020, Egypt Deputy Director Khaled Hamza told Masrawy.

LEGISLATION WATCH- House planning committee approves harsher penalties for late tax filing: The House Planning and Budgeting Committee has approved amendments to the Unified Tax Act that would impose fines of EGP 50k to EGP 2 mn on those who fail to submit their tax returns within 60 days of the deadline, Al Shorouk reports. Repeat offenders who fail to file returns within the 60-day period more than three times could also face jail time ranging between six months and three years. The Unified Tax Act was passed by the House earlier this year and allows for the creation of a single tax platform through which to file income tax, VAT, stamp tax, and real estate tax returns.

Overseas tax engineering is gonna get a little bit more difficult: Another amendment to the legislation clarifies the penalties handed to companies that fail to disclose transactions of more than EGP 8 mn made with a related overseas entity. Under the proposals, companies will:

- Pay a fine equivalent to 1% of the transaction for failing to disclose the transaction in the tax return

- Pay a 3% fine for failing to disclose local transactions

- Pay a 3% fine for failing to disclose overseas transactions

- Pay a 2% fine for failing to report on its overseas activities on a country-by-country basis.

CABINET WATCH- The Unified Budget Act earned a seal of approval from the Madbouly Cabinet in its weekly meeting last Wednesday, according to a statement. The legislation stipulates the procedures for formulating the state budget, outlines the distribution of resources to different sectors, and details the mechanisms for regulation and internal compliance. The law would combine the General Budget Law and the Government Accounting Act into a single piece of legislation, which the government says would make financial planning easier. Last we heard, the bill was scheduled to be reviewed by the House Planning and Budget Committee in June.

Also approved in the meeting:

- A new EGP 16.5 mn project to introduce a smart transport card and unified ticketing system covering all public transportation;

- Settling debts owed to the Oil Ministry by some public sector companies by transferring ownership of some of their real estate assets;

- The establishment specialized plasma collection centers to help Egypt become self-sufficient in the production of plasma and its derivatives to treat disease, according to another statement.

Egypt has submitted its ratification of an international agreement to crack down on tax avoidance to the Organization for Economic Cooperation and Development, a Finance Ministry statement said on Saturday. The agreement comes into effect in Egypt in January and helps to prevent companies from using loopholes in double taxation agreements to avoid tax. These treaties have cost the government tens of EGP bns, the ministry said. Egypt signed the agreement in June 2017 and submitted its initial ratification in September following parliamentary approval in the summer.

STARTUP WATCH- 21-year-old Egyptian businesswoman takes home African innovation award: Alaa Moatamed has been awarded the grand Anzisha prize of USD 25k for her work co-founding delivery management service Presto, according to an announcement by the prize committee. Presto aims to help small business owners overcome operational hassles by providing fast and flexible delivery services. The Anzisha prize was created in partnership between the African Leadership Academy and Mastercard and recognizes innovation by Africa’s youngest entrepreneurs.

King Salman International University was officially inaugurated by President Abdel Fattah El Sisi yesterday, an Ittihadiya statement said. He was accompanied by Prince Fahd bin Sultan Al Saud, the governor of Saudi Arabia’s Tabuk province, an Extranews video report showed (watch, runtime: 4:50). “The university is an example of the friendship and cooperation between Egypt and Saudi Arabia to develop the Sinai Peninsula,” Higher Education Minister Khaled Abdel Ghaffar said in a promotional video played during the ceremony (watch, runtime: 29:34). The university has 15 faculties across its three branches in Sharm El Sheikh, Al Tur and Ras Sidr.

Also opened yesterday: three new museums and a raft of infrastructure projects. The Sharm El Sheikh Museum, the Royal Vehicles Museum and the Kafr El Sheikh Museum were also inaugurated during the ceremony alongside other projects in the Sinai Peninsula, including new roads, residential complexes, potable water stations and sea water desalination plants. The projects include El Bardawil Airport in North Sinai, a 231-km road connecting the Ahmed Hamdy tunnel with the ports of Taba and Nuweiba, and a new sea water desalination plant in Sinai’s El Arish.

The world’s largest wastewater treatment plant in the world will be inaugurated within eight months, El Sisi announced during the ceremony, Extranews reports (watch, runtime: 4:17). The Bahr El Baqar water station in Sharqiyah governorate is valued at around EGP 18 bn, with supporting infrastructure bringing its total cost to EGP 25 bn.

MOVES- Amr Mohamed Mahfouz (LinkedIn) has been appointed CEO of the Information Technology Industry Development Authority (better known as ITIDA) on a one-year contract, following a decree by Prime Minister Mostafa Madbouly, Al Shorouk reports. Communications Minister Amr Talaat had appointed Mahfouz to the role, as well as deputy minister for IT development last July. Mahfouz has over 33 years of experience in the field, holding several positions including comms sector leader at IBM MENA.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

- A full-time copy editor to enforce house style, police facts and generally make us sound smarter than we really are.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

Egypt in the News

Reactions from President Abdel Fattah El Sisi and Al Azhar to French magazine Charlie Hebdo republishing its controversial comics of Prophet Mohamed earned some digital ink in the foreign press over the weekend. El Sisi said that freedom of expression should not offend over 1.5 bn people, reports Reuters, while Al Azhar called on the international community to criminalize “anti-Muslim” actions. Bloomberg also has the story.

Also getting attention in the foreign press this morning:

- Egypt is looking to edge Turkish products out of Saudi Arabia and take over the market as a rising campaign in the kingdom calls for the boycott of Turkish products, Al Monitor says.

- The New York Times spoke to the TikTok star known as Mena AbdelAziz about her [redacted] assault case and the subsequent debate it ignited on social mores and social media. The trial of her accused attacker is set to begin in December.

- The Guardian is out with a review of the newly-released Netflix documentary Secrets of the Saqqara Tomb, which it says “asserts Egyptian ownership of the country’s heritage and history.”

- Reuters profiles an Egyptian who has collected vintage cars for over 50 years.

Diplomacy + Foreign Trade

Topping diplomatic coverage this morning: Our campaign to deepen ties with Iraq. Prime Minister Moustafa Madbouly met with Iraq’s president and signed 15 MoUs with his Iraqi counterpart Mustafa Al Kadhimi during a visit to Baghdad yesterday, a cabinet statement said. The agreements cover everything from oil and water resources to construction, transportation, environmental protection, as well an exchange of expertise in the stock market and judiciary, the statement said.

The two countries also agreed to establish an “oil-for-reconstruction” mechanism that could see Egyptian companies work on development projects in Iraq in return for importing Iraqi oil, the local press reports, citing statements made by the prime minister during the committee’s meeting, without providing additional detail.

Other takeaways from the meeting:

- Egypt is looking to increase exports to the Iraqi market;

- Potential links of our electricity, oil and gas distribution networks are on the table;

- Cooperation on water security;

- The two chambers of commerce want to do more together.

Egypt, Iraq eye joint logistics + energy projects with Jordan: Egypt is looking at setting up a logistics zone to store Egyptian goods on the Jordanian-Iraqi border, as well as a separate commercial center for Egyptian wares in Baghdad, International Cooperation Minister Rania Al Mashat said on Friday at preparatory meetings ahead of the committee meeting, according to a ministry statement. A shared electricity grid between Egypt and Iraq and a trilateral oil and gas pipeline between the three countries was also on the agenda for a separate meeting Al Mashat had with Iraqi Planning Minister Khaled Battal, according to a statement.

Foreign Minister Sameh Shoukry met with the Russian deputy foreign minister, Mikhail Bogdanov, on Friday in Moscow, a Foreign Ministry statement said. Topping the agenda were discussions of the Russian industrial zone project in the Suez Canal Economic Zone, the construction of the Dabaa nuclear station, and the political settlement for the Libyan crisis. Bogdanov also expressed his country's hope that Egypt, Ethiopia and Sudan will reach an agreement over the Grand Ethiopian Renaissance Dam.

IN OTHER NEWS: Egypt’s fiscal response to covid-19 earned praise from newly-appointed IMF executive board member Mahmoud Mohieldin in a meeting with Prime Minister Moustafa Madbouly, according to a cabinet statement, and Armed Forces Chief of Staff Lt-Gen. Mohamed Farid met with Sudan’s defence minister and chief of staff in Khartoum on Saturday to discuss security cooperation, an armed forces statement said on Saturday.

Basic Materials + Commodities

Suez Canal Authority signs MoU with Sterner to establish fish farming factories

The Suez Canal Authority signed an MoU with Norwegien water treatment company Sterner to set up a complex of fish farms, the authority said in a statement. The farms will have a total production rate of 25k tonnes of fish annually; the farms are going to take 12-18 months to build.

Real Estate + Housing

Cleopatra Urban Development signs pact with JZMK to develop north coast’s Esmerelda

The Cleopatra Urban Development Company has signed a partnership agreement with the US architects JZMK Partners to develop its Esmerelda residential and hotel project on the north coast, Al Mal reports. Chairman Mohamed Abu El Enein said the project will be inaugurated in Sidi Henish next year. The report did not note the value of the development.

Other Business News of Note

Porto Group is rebranding to Porto Developments and restructuring operations

Porto Group is rebranding as Porto Developments and plans to launch three new projects in the coming period as the company restructures its administrative and executive roles, Hapi Journal reports. Porto Group used to be part of Amer Group before the company was spun-off in 2014.

Sports

Egypt’s Mohamed El Kashashy set to take over Premier League club Burnley

Egyptian businessman Mohamed El Kashashy (LinkedIn) and British sports lawyer Chris Farnell are set to take over Premier League club Burnley in a GBP 200 mn agreement, according to the Mirror. The Egyptian-British duo have signed sale and purchase agreements with Burnley Chairman Mike Garlick and are waiting to pass the Premier League’s owners and directors test.

On Your Way Out

Egyptian director Sameh Alaa became the first Egyptian to earn the prestigious Palme d’Or award at the Cannes Film Festival after walking away with the award in the Short Film category for his film “I’m Afraid to Forget Your Face,” the festival announced. The film was produced by Mark Lotfy and Mohamed Taymour and written by Mohamed Fawzy. The 15-minute short follows Adam, who attempts to return to his girlfriend after an 82-day separation.

Mohamed Diab is on board to direct the Disney+ Marvel series Moon Knight, according to Deadline. Diab, famous for directing Cannes favorite Eshtebak, will helm the series about a comic book vigilante who assumes multiple alter egos to do battle with the criminal underworld.

The Market Yesterday

EGP / USD CBE market average: Buy 15.65 | Sell 15.75

EGP / USD at CIB: Buy 15.65 | Sell 15.75

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Wednesday): 10,515 (-0.4%)

Turnover: EGP 1.2 bn (7% above the 90-day average)

EGX 30 year-to-date: -24.7%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.4%. CIB, the index’s heaviest constituent, ended up 0.6%. EGX30’s top performing constituents were Egyptian Iron & Steel up 7.2%, Export Development Bank up 4.8%, and Dice up 1.6%. Wednesday's worst performing stocks were Heliopolis Housing down 3.2%, Madinet Nasr Housing down 2.9% and Telecom Egypt down 2.9%. The market turnover was EGP 1.2 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -136.5 mn

Regional: Net long | EGP +22.1 mn

Domestic: Net long | EGP +114.4 mn

Retail: 73.6% of total trades | 73.2% of buyers | 73.9% of sellers

Institutions: 26.4% of total trades | 26.8% of buyers | 26.1% of sellers

WTI: USD 35.79 (-1.05%)

Brent: USD 37.94 (-0.84%)

Natural Gas: (Nymex, futures prices) USD 3.35 MMBtu, (+1.61%, December 2020 contract)

Gold: USD 1,879.90/ troy ounce (+0.64%)

TASI: 7,907 (-2.65%) (YTD: -5.74%)

ADX: 4,660 (-0.49%) (YTD: -8.19%)

DFM: 2,187 (-0.15%) (YTD: -20.87%)

KSE Premier Market: 6,003 (+0.41%)

QE: 9,691 (-1.35%) (YTD: -7.05%)

MSM: 3,557 (+0.06%) (YTD: -10.64%)

BB: 1,427 (-0.02%) (YTD: -11.37%)

Calendar

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo.

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

7-9 November (Saturday-Monday): Techne Summit 2020, Bibliotheca Alexandrina, Alexandria.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The African Private Equity and Venture Capital Association (AVCA) is organizing an online conference titled “State of African Private Equity & Venture Capital: Regional Perspectives.” You can sign up here.

13-15 November (Friday-Sunday): A conference on banking in the time of covid by the Union of Arab Banks, Sharm El Sheikh, Egypt.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December (date TBC): Egypt Economic Summit, Cairo, Egypt, venue TBD.

December: Fifth round of Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.