- Is STC about to make a new, lower offer for Vodafone Egypt? (Speed Round)

- FX reserves rise in August for third month running. (Speed Round)

- Egypt’s credit rating vulnerable to water stress –Fitch. (Speed Round)

- SFE in talks with investors, traders to develop EuroAfrica electricity link. (Speed Round)

- United Bank sale on ice until covid has passed. (Speed Round)

- Who gets what as OIH splits in two? (Speed Round)

- Premium Card closes EGP 182 mn securitized bond issuance. (Speed Round)

- Nilex companies could get a hand from the EBRD in move designed to draw interest to the small-cap exchange. (Speed Round)

- Egypt covid cases pass 100k mark. (What We’re Tracking Today)

- Will last week’s Wall Street sell-off continue after the US holiday weekend? Futures right now say, “No.” (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 8 September 2020

Is STC about to lower its offer for Vodafone Egypt?

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to hump day — get through today and we’re one day closer to the weekend.

We’ve always thought of fall as a season of new beginnings. A new school year for the kids — and for our readers who themselves are heading back to college or starting an MBA or other graduate degree. The early days of budget season, when we spend long chunks of time not crunching the numbers backing 2021, but dreaming of what might be and where we want to take our businesses.

It’s also a great season to take stock of life. If you’re in a similarly pensive mood, there are much worse places to start this morning than with the final column of Guardian health and wellbeing writer Oliver Burkeman. He has eight tips for you, among them:

- There will always be too much to do – and this realisation is liberating;

- When stumped by a life choice, choose “enlargement” over happiness;

- The advice you don’t want to hear is usually the advice you need;

- The future will never provide the reassurance you seek from it.

And perhaps best: Embrace imposter syndrome, because you know what? Everyone else is winging it, too. The column is well worth reading in full.

SIGN OF THE TIMES- Our time online has basically doubled. Home internet usage has gone up 92% y-o-y between June and August, while mobile internet usage was up 12% y-o-y over the same period last year, according to a National Telecom Regulatory Authority (NTRA) report. Peak internet usage hours this year expanded by some four more hours, which means people are most actively using the interwebs between 3:00pm to 4:00am, up from the 9 hour peak hours window between 5:00pm to 2:00am recorded last year.

Meanwhile: All eyes will be in Wall Street later today at the opening bell as US markets come back from a long weekend for their first trading session since throwing a temper tantrum last Thursday and Friday. European markets shrugged off the faint whiff of panic across the Atlantic when they opened yesterday, the Financial Times tells us.

Here at home, the EGX 30 was up 0.6% at the close yesterday, ending a week of back-to-back losses that saw the bourse lose 3.3% since 27 August amid a wider global slump and last week’s US tech selloff. Trading was moderate, with EGP 1.1 bn-worth of shares changing hands — or just about on par with the trailing 90-day average. Other regional markets ended the day flat or little changed.

Futures suggest both Europe and Wall Street will open in the green later today.

Notably, the benchmark MSCI emerging markets index was down by 0.5% yesterday, and the currency gauge was little changed. Europe, Middle East and Africa have reversed their slump against their Asian counterparts since last week’s selloff in the US, rising for the past three sessions after hitting record lows on Wednesday, Bloomberg suggests. Commodity stocks have also surged, with a measure of EM raw material stocks vs. consumer discretionary stocks seeing its biggest three-day increase since November 2016.

We should hear more today about what the coming school year will look like for private and public K-12 schools. The announcement is expected to cover safety requirements, how tuition will be handled, private tutoring, and use of online platforms.

Health Minister Hala Zayed is in Sudan today to see the relief efforts underway following the worst flooding to hit the country in over a century, according to a report from the state-run MENA news agency. Sudan has declared a national state of emergency after torrential rains resulted in the deaths of 99 people and the damage of more than 100k homes.

We’re heading back to the polls tomorrow: The remaining seats in the newly-constituted Senate will be decided in run-off elections taking place tomorrow and Wednesday. The results will be announced on Wednesday, 16 September. The first-round of voting last month saw 174 representatives elected to the 300-seat upper chamber, leaving 26 to be decided by this week’s runoff. The president will appoint the remaining 100 members after the results of the run-off are announced.

EgyptAir is resuming direct flights from Cairo to Lagos, Abuja and Accra this week: Flights between Cairo and the Nigerian cities of Lagos and Abuja will run twice a week from today while twice-weekly trips to the Ghanaian capital will begin on 10 September, according to an EgyptAir statement.

Other key news triggers coming up this month:

- Inflation data for August will be out on or around Thursday, 10 September;

- Interest rate day falls on Thursday, 24 September when the central bank meets to discuss policy rates.

Conferences taking place this month:

- An Egyptian Businessmen Association online meeting with its Bahraini counterpart will discuss mutual trade and investment opportunities on 8 September.

- The Chemical Industries Export Council and Expolink will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda from 14-15 September.

- Talents Arena will host Egypt’s first tech job fair which will be held online on 19 September under the banner JobStack.

- GAFI is hosting a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt sometime this month.

Energy nerds may want to tune into the online-only BP Week, wherein top global officials at the global energy giant will talk about their new strategy, energy market trends and sustainability.

The Health Ministry reported 178 new covid-19 infections yesterday, up from 151 the day before. Egypt has now disclosed a total of 100,041 confirmed cases of covid-19. The ministry also reported 11 new deaths, bringing the country’s total death toll to 5,541. We now have a total of 79,008 confirmed cases that have fully recovered.

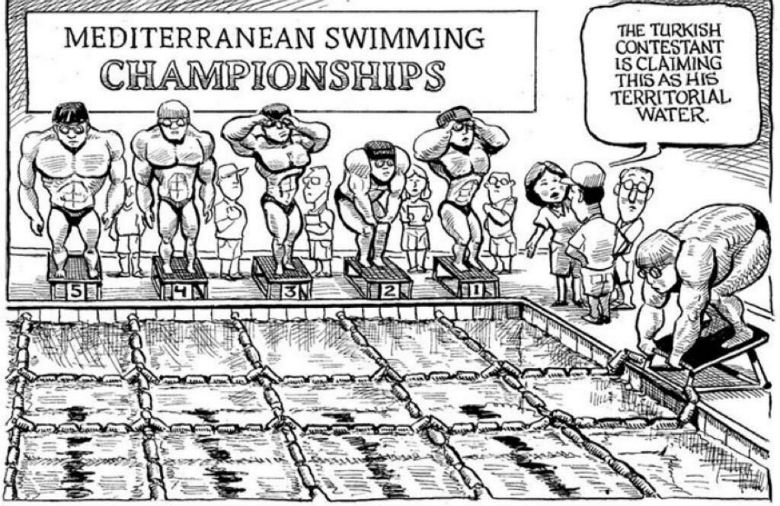

Greece is bolstering its army as tensions with Turkey grow: Greece is planning to acquire new weapons and revamp its armed forces amid escalating tensions with neighbouring Turkey over conflicting territorial claims in the EastMed, a government spokesman told reporters yesterday, according to Reuters. An official told the newswire last week that the government is in talks with France and others to purchase fighter jets. The maritime dispute between the two NATO members has intensified in recent weeks after Greece and Egypt established a joint economic zone in the EastMed covering territory staked out by Turkey and Libya in a similar agreement last year.

EU gets selective amnesia and forgets what happened with appeasement: The EU is prepared to offer Turkey incentives to resolve the dispute and avoid confrontation, but could also impose sanctions on if mediation fails, a senior official in Brussels said, describing this as a “carrot and stick” approach, according to Bloomberg. EU leaders are set to discuss the plan in a summit on 24-25 September.

Other international news worth knowing about this morning:

- An official delegation from the UAE will visit Israel for the first time on 22 September, a little more than a month after the two countries normalized ties, Reuters reports, citing unnamed official sources.

- Khashoggi killers escape death penalty: A Saudi court has handed the men found guilty of dismembering journalist Jamal Khashoggi sentences ranging from 7-20 years in prison, Bloomberg reports.

- UK Prime Minister Boris Johnson revived the possibility of a hard Brexit yesterday, saying he’s prepared to do away with a trade agreement if the UK’s demands aren’t met. This came after he gave EU negotiators a 15 October ultimatum to reach a post-Brexit agreement, according to Sky News.

US ELECTION WATCH- The US is scrambling to ramp up in-person voting while also taking into consideration covid-19 precautions with less than 60 days until election day, according to the New York Times. The preparations include integrating malls and arenas as voting options and contingency plans in case the pandemic gets worse. While mail-in voting seems like a safe alternative, Republicans — fueled by President Donald Trump’s conspiracy theory that postal ballots lead to voting fraud — are planning on physically visiting the polls. Trump’s claims were accompanied by cutting additional post office funding to derail mail-in voting, angering Democrats who are leaning towards the alternative to avoid a spike in cases at the voting booths.

Meanwhile, both Democratic nominee Joe Biden and President Donald Trump are zippingto key states to rally last-minute voters, according to Reuters. Yesterday, Biden sat down with union workers in Pennsylvania during the US’s Labor Day holiday.

MARK YOUR CALENDARS- The first of three US presidential election debates is on 29 September, with the others following on 15 and 22 October. Americans vote on 3 November.

Enterprise+: Last Night’s Talk Shows

We were finally treated to some econ news last night, as former IMF advisor Fakhry El Fiqi discussed yesterday’s foreign reserves figures. Also getting attention: the new “smart system” for Egypt’s roads, new facilities on offer through the government spending program, and flooding in Beheira Governorate.

Economy’s resilience amid covid-19: Salat Al Tahrir’s Azza Moustafa spoke with former advisor to the International Monetary Fund Fakhry El Fiqi, who said that the uptick in Egypt’s foreign exchange reserves confirmed the resilience of the the country’s economy in the face of the pandemic. He noted that reserves have been steadily increasing for three consecutive months. Meanwhile, gold reserves have reached 79.5 tonnes, giving Egypt the sixth-largest gold reserves in the Arab world, he said (watch, runtime: 10:19).

El Sisi calls for “smart” road system: Ala Mas’ouleety’s Ahmed Moussa covered President Abdel Fattah El-Sisi’s Ittihadiya meeting to review the implementation of the new “smart transportation” system, which aims to improve traffic flow and the movement of goods. The new system will rely on advanced communications systems to monitor roads, collect information, identify places of congestion, monitor accidents and guide drivers. The first phase of the project will include busy arteries such as the Cairo-Alexandria Desert Road, Cairo-Ismailia Desert Road, and the Shubra-Banha El Hurr road (watch, runtime: 7:24). Al Hayah Al Youm’s Lobna Assal also covered the news (watch, runtime: 5:22).

Flooding in Beheira: El Hekaya’s Amr Adib spoke with Beheira governor Hisham Amna, who discussed the flooding of farming lands in the governorate, which happened as the result of overflows from the flooding that occurred in Sudan. He said that the flooding covered some 17 feddans and there were no homes on flooded lands. Amna added that the governorate had addressed some 2k violations in the area along the Nile before the flooding broke out (watch, runtime: 4:14).

Speed Round

M&A WATCH- Is STC about to make a new, lower offer for Vodafone Egypt? Saudi Telecom (STC) is in talks with Vodafone to lower its non-binding USD 2.39 bn offer for a 55% stake in Vodafone Egypt, Bloomberg reports, citing unnamed sources familiar with the matter. It remains unclear how STC values the stake, but an offer will need to be placed on the table before the deadline for negotiations passes at the end of this week. The Saudi firm extended the MoU for an additional 60 days in mid-July due to “logistical challenges” resulting from the covid-19 pandemic. It extended the original agreement in April for the same reason.

Background: STC began due diligence in March after signing a non-binding MoU with Vodafone Group in January to purchase its stake in Vodafone Egypt in a sale that would value the company at USD 4.4 bn. Telecom Egypt, which owns the remaining 45% of Vodafone Egypt, maintains the right of first refusal on the transaction, but it’s still unclear how it plans to proceed should STC move ahead with the purchase. The Financial Regulatory Authority said after the initial acquisition agreement that the Saudi company may be required to make a mandatory tender offer for 100% of the company if it goes ahead with the transaction.

Advisers: Barclays is working with STC on the transaction, Goldman Sachs is advising Vodafone and EFG Hermes and Citibank are advising Telecom Egypt.

FX reserves rise slightly in August: Foreign reserves rose in August for the third month running, coming in at USD 38.37 bn from USD 38.31 in July, according to central bank figures released yesterday. The country has added a little over USD 2 bn to its stockpiles over the past three months after reserves fell by about USD 10 bn at the height of the covid crisis. Reserves fell from USD 45.5 bn in February to USD 36 bn in May as CBE stepped in to cover portfolio outflows, debt repayments and imports of commodities. Reuters also has the story.

The rebuild is likely to continue at a snail’s pace in the months ahead: The IMF is projecting reserves to continue a slow recovery this year, reaching USD 40.1 bn by the end of FY2020-21, and USD 51 bn by the middle of the decade.

Egypt’s sovereign credit rating is “particularly” exposed to water stress and drought risks, Fitch Ratings suggests. This comes as water security could soon weigh more in ratings decisions, Fitch’s Mahmoud Harb and Kathleen Chen said in a recent research note. “Water risks are likely to become a more important sovereign rating driver over the medium to long term, particularly in the event of severe climate change,” said the analysts. Egypt’s sovereign rating could be impacted, as the country got a score of “3” on “water resources and management.” Fitch assigns an environmental, social and corporate governance (ESG) score for multiple environmental factors on a scale of 1-5, based on the level of their impact on their credit rating.

Everyone in our neighborhood faces similar challenges: Fitch notes that Israel, Jordan, Kuwait, Morocco, Saudi Arabia and Tunisia are particularly exposed to drought and water stress risks.

Fitch isn’t the only ratings agency sounding the alarm on our water risk. Moody’s recently listed long-term water challenges (from a growing population and exacerbated by the filling of the Grand Ethiopian Renaissance Dam) as factors that could lead to a downgrade of our sovereign credit rating. To mitigate risks of water stress, authorities recently said they’re investing some EGP 134.2 bn through 2050 to build seawater desalination plants that would give us 6.4 mn cbm/d of potable water.

You can catch the full Fitch report (paywall) on the impact of water on sovereign ratings here.

SFE in talks with investors, energy traders to develop EuroAfrica electricity link: The Sovereign Fund of Egypt (SFE) has opened talks with European infrastructure investors and energy traders to join it in investing in the EuroAfrica transmission link and import electricity from Egypt, CEO Ayman Soliman tells Bloomberg. Egypt signed on to the USD 4 bn EuroAfrica Interconnector with Greece and Cyprus last year, and the fund is now in discussions with infrastructure investors and traders to “to find counterparts who can invest alongside the fund and develop the transmission line,” Soliman said.

What is EuroAfrica? The 2-GW transmission link will connect Egypt’s electricity grid to mainland Europe via Cyprus, making it the longest interconnector cable in the world. The first, EUR 2.5 bn phase of the project will connect Egypt, Cyprus, Crete and Greece and is set for commissioning by December 2023 with an initial capacity of 1 GW. The link “will position Egypt as a long-term renewable supply hub for Europe,” Soliman said.

The SFE is also in talks to export electricity to Africa: “We are identifying the relevant players in Africa to partner or work with and we are in talks with some sovereign funds,” Soliman said, without naming specific countries or institutions.

Read our three-part Hardhat series on the current state of the electricity sector: Part 1 | Part 2 | Part 3.

M&A WATCH- United Bank sale on ice until we fully emerge from pandemic: The sale of state-owned United Bank to a strategic investor has been postponed until the covid-19 pandemic has abated and a vaccine is found, Masrawy reports, citing unnamed banking sources. More than one investor had submitted offers, but the process was postponed after the cancellation of flights prevented financial advisors from completing the due diligence, the sources said.

Background: CBE Governor Tarek Amer last year said the sale had been moving forward, shortly before tapping EFG Hermes and New York-based Evercore to act as advisors. The central bank owns 99.9% of United Bank’s shares, having created the institution through the merger of a number of smaller institutions.

DEMERGER WATCH- Who gets what as OIH splits in two? The Financial Regulatory Authority (FRA) has approved Orascom Investment Holding’s (OIH) plan to implement a “horizontal demerger,” it said in an EGX filing (pdf) yesterday. OIH has now officially split into two companies — OIH and Orascom Financial Holding (OFH). The move aims to clearly distinguish between the company’s operations in the financial services industry, which will be handled by OFH, and other sectors, managed by OIH, the company said in July. OIH will remain listed on the EGX with an authorized capital of EGP 2.5 bn, the regulator said in a separate filing (pdf).

Who gets what? OIH retains all of its investments in its eight subsidiaries, including Orascom Telecom Ventures, O Capital, and Orascom Pyramids, along with its sister Cheo Joint Venture Technology company. Meanwhile, OFH will get OIH’s investments in Beltone Financial (74.5%) and Sarwa Capital (28.8%).

DEBT WATCH- Premium Card closes EGP 182 mn securitized bond issuance: Premium Card has closed the third issuance of its EGP 2 bn securitized bond program with a single-tranche, 10-month bond worth EGP 182 mn, a company statement (pdf) said on Monday. EFG Hermes, the Arab African International Bank and EG Bank all participated in the issuance, which received a “Prime 1” rating from the Middle East Rating Bureau and Investor Services (MERIS), the highest credit rating in the Egyptian bond market.

Egypt’s new commodity exchange just got a new chairman as we inch closer to launch: Internal Trade Development Authority Chairman Ibrahim Ashmawy has been selected to lead Egycomex, the new commodity exchange, according to Hapi Journal. Ashmawy told the newspaper that the structural and administrative frameworks for the exchange are ready and that a draft law governing the exchange has been submitted to the prime minister. Supply Minister Aly El Moselhy was supposed to have revealed the timeline for the launch last Thursday, along with details on the exchange. Lingering questions that remain include:

- When trading will begin: It is unclear yet whether trading in the exchange will start in September as sources revealed to the local press back in January.

- Ownership of the exchange: 49% of the exchange will be held by a combination of private, state and quasi-state entities, according to past statements by Moselhy. The EGX has staked its claim on 30% of the exchange, according to EGX Chairman Mohamed Farid.

- What commodities will be traded: The exchange was expected to initially trade in six commodities: wheat, rice, corn, potatoes, onions, and oranges.

- Relation to the futures exchange: Will the commodities traded on the exchange underpin the prices on the upcoming futures exchange.

Nilex companies could get a hand from the EBRD in move designed to draw interest to the small-cap exchange: The European Bank for Reconstruction and Development (EBRD) offered to cover 50-70% of the costs paid by Nilex-listed SMEs for financial sponsors, in a meeting between EGX management and 15 of the sponsors on Monday, Youm7 reports. The financial assistance will provide relief to small-cap firms, which are now required by the Financial Regulatory Authority (FRA) to contract with sponsors when they list their shares on the Nilex.

What is a sponsor, exactly? Similar to the nominated advisors (‘Nomad’) used in the UK’s small-cap market, sponsors are financial advisors that assess the suitability of SMEs for listing on the exchange and assist qualifying firms in both going public and meeting their responsibilities after listing. Following yesterday’s meeting — attended by EGX management, 15 sponsors and EBRD representatives and EGX board member Ahmed Bahaa Shalaby on behalf of the SMEs — the responsibilities of sponsors will be broadened beyond helping with registration to include issuing research reports on Nilex firms, a source that attended the meeting said. The idea is that, by providing additional expertise and support, small firms will see increased trading that could allow them eventually to upgrade to the main market.

More than half of Nilex firms aren’t too happy with the new rules though: Seventeen of the 26 Nilex-listed companies submitted a joint statement to the FRA demanding that it scrap its decision to allocate companies official corporate sponsors. The firms argue that requiring a sponsor throughout the registration period is a needless financial burden on SMEs whose returns are already limited, especially during the poor business environment caused by the pandemic.

FinMin ups discounts on consumer goods to boost spending: Ration card holders will receive a 14% discount on goods covered by the government’s consumer spending initiative, up from 10% currently, Masrawy reports, citing Finance Minister Mohamed Maait. The additional price cut only applies to goods which merchants and manufacturers have already discounted by at least 15%, Maait said.

Card holders can now also carry over unused sums from their monthly subsidy for food commodities, following a coordinated effort between the finance and supply ministries. Merchants and manufacturers will also be paid any dues owed to them from the treasury within four working days.

The initiative’s website has seen some 65k durable and non-durable goods sold from 1,631 outlets nationwide since the program’s launch in July, according to Deputy Minister of Treasury Affairs Ehab Abu Eish.

Background: The government launched the consumer spending program in July to stimulate some EGP 125 bn-worth of consumer spending. Egyptian and foreign consumers can buy select goods including electronics, appliances, clothes, leather products, and furniture through a dedicated website set up by the government. The same products will be available on sale in stores at the same time. Nearly 1.2k manufacturers and merchants have reportedly signed up to offer discounts on some 4.2k products.

In a related program, families on ration cards will get up to EGP 1k in additional spending power under the program. The government has earmarked as much as EGP 12.25 bn, providing an additional EGP 200 per family member to a maximum of EGP 1k per qualifying family for spending under the program.

The program looks set to last until at least January 2021, and could be extended further into 2021 if it proves successful.

The initiative came up on the airwaves last night, when Al Hayah Al Youm’s Lobna Assal spoke to Assistant Finance Minister Mohamed Abd El-Fattah (watch, runtime: 9:15).

REGULATION WATCH- Government to establish vocational schools accreditation authority: The ministers of education and manpower met yesterday to discuss legislation that would establish a vocational schools accreditation authority, according to a cabinet statement. The new authority would work to develop and apply accreditation policies for vocational schools and training academies in Egypt across for both government schools and private institutions, Deputy Education Minister Mohamed Megahed told Enterprise. The two ministries will be meeting with stakeholders in the coming few days to put the final touches on the structure of the organization and its role in developing vocational schools in Egypt, the statement noted.

A strategy to overhaul vocational education, build PPP schools: Once established, the new authority will work on a plan through 2030 to improve the quality of vocational education in all Egyptian schools. The authority will also focus on developing schools in collaboration with the private sector, with some 15 private-public vocational schools being planned for the first phase of the plan.

Legislation establishing the new authority has already won cabinet’s preliminary blessing. The final draft will be announced next week then sent to the House of Representatives’ agenda when they reconvene in October, Megahed says.

Background: The Education Ministry has been pursuing a long term strategy to develop the vocational training sector in Egypt, spanning through 2030, Megahed said. The government sought the help of the private sector and started a program that would see 100 vocational schools be established by 2030, ministry officials had told us in April.

LEGISLATION WATCH- President Abdel Fattah El Sisi ratified on Monday a bill redrawing Egypt’s electoral districts into 143 single-member constituencies across Egypt’s 27 governorates, and four in which MPs are elected through party lists, Al Masry Al Youm reports, carrying a copy of the bill as published in the Official Gazette on Thursday. The party list constituencies will include Cairo and the Middle and South Nile Delta, the North and Middle and South of Upper Egypt; the Eastern Nile Delta, and the Western Nile Delta and Alexandria. The draft law was approved by the House of Representatives in August. House elections are set to be held in November.

Businessman Salah Diab is facing fresh charges that he acquired the EGP 70 mn Queen Wooden Products Factory in 2013 in collusion with officials at the Suez Canal Bank for just EGP 12.8 mn, Youm7 reports. The founder of Pico Group and Al Masry Al Youm newspaper was detained for 15 days last Wednesday pending investigation of allegations of misuse of public land, building without licenses and tax evasion.

Egypt in the News

Topping coverage in the foreign press this morning: Authorities have arrested six witnesses as part of the investigation into the 2014 [redacted] assault case at the Fairmont Hotel — including three women who have provided witness testimony in the case, the Guardian reports. The people arrested face charges of “debauchery and “violating Egyptian family values.”

Energy

Total Egypt, Ola Energy to construct petroleum storage facility in Alexandria

Total Egypt and Ola Energy have agreed to a joint venture that will see the two oil companies build a petroleum storage warehouse in Alexandria, Hapi Journal reports. The 23k sqm warehouse will be built in the El Max oil district in Alexandria and is expected to maintain a total holding capacity of 10k cbm upon completion in 2022.

CIB teams up with Delta Payments to facilitate app-based electricity bill payments

CIB has signed an agreement with Delta Payments company to enable its smart wallet customers to charge prepaid electricity meters and pay electricity bills through a mobile phone application, Al Mal reports. The electricity meters can be recharged by any mobile phone that supports near-field communications (NFC) technology.

Basic Materials + Commodities

Private sector makes bids in government auction of 2020 cotton crop

The private sector has for the first time in the modern era participated in the state’s cotton crop auction sale on Sunday organized by state-owned Cotton and Textile Industries Holding Company, according to a cabinet statement. Opening bids for the first auction-based pricing scheme for this year’s cotton harvest started at EGP 1.79k per quintar and closed at a final sale price of EGP 1.8k per quintar. This comes after last year’s auction saw private sector companies refusing to participate in the new bidding system after complaints that the opening auction price of EGP 2.1 k per quintar started too high.

Health + Education

El Sewedy Education invests EGP 1 bn in first two phases of Administrative Capital university

El Sewedy Education has invested EGP 1 bn to complete the first two phases of its International Knowledge University project in the new administrative capital. CEO Ehab Salama said in a statement to Hapi Journal that the entire project will be completed over 10 years at a total cost of EGP 7 bn. Construction work is being carried out by the Al Rowad Contracting company according to a schedule set by the Armed Forces’ engineering department, Salama added.

Telecoms + ICT

TPay partners with Huawei to enable app store users to pay with mobile number

Egyptian fintech company TPay signed a cooperation agreement with Huawei to provide direct consumer billing (DCB) services in 10 MEA countries to help developers monetize their applications on the Huawei and Honor app store, according to a press release picked up by Zawya. TPay’s DCB service offers all Huawei app store customers the ability to pay for their apps and services by registering their mobile number from which TPay would draw the money from their phone’s credit balance.

Banking + Finance

NBE, BdC arrange EGP 3 bn to EgyptAir

The National Bank of Egypt (NBE) will provide EGP 1.8 bn of a 10-year, EGP 3 bn loan to EgyptAir being arranged by Banque du Caire, with BdC covering the remainder, Al Mal reports. The national flag carrier had been seeking the loan earlier this year as it came under pressure from lower volumes during the covid-19 pandemic. EgyptAir has sustained losses of some EGP 3 bn since covid-19 grounded global travel and the company’s foreign debt currently stands at EGP 13 bn, said EgyptAir holding company president Mohamed Zakria. EgyptAir earlier this year received a EGP 2 bn loan from the Finance Ministry that will see the government service the carrier’s debt until its operating capacity reaches 80% of levels achieved in 2019. The EGP 3 bn loan brings the total amount of pandemic financing obtained by the airline to EGP 5 bn.

On Your Way Out

Qubix has brought a handy, innovative marriage of shipping container architecture and medical utility to Cairo. The startup, which converts 20-foot-long metal containers into pop-up restaurants and makeshift offices, has turned its focus to setting up portable medical centers, dubbed Q-MED, amid the covid-19 pandemic. The new structures are “fully furnished, turnkey space(s) already packed and set up with the medical equipment needed to provide any medical service, from dentistry to general practitioners,” said co-founder Youssef Farag to Arab News. The company is in talks with healthcare providers and equipment suppliers to deploy Q-MED facilities across Egypt.

Not quite the space race: Egyptian swimmers will try to beat Turkey’s obscure world record on International Peace Day: A cohort of 550 swimmers will try to break the Guinness World Record for the largest peace emblem during International Peace Day on 21 September, Ahram Gate reports. The current record was set by Turkey, which previously used 460 swimmers to form the symbol.

The Market Yesterday

EGP / USD CBE market average: Buy 15.74 | Sell 15.84

EGP / USD at CIB: Buy 15.74 | Sell 15.84

EGP / USD at NBE: Buy 15.75 | Sell 15.85

EGX30 (Monday): 11,136 (+0.6%)

Turnover: EGP 1.1 bn (equal to the 90-day average)

EGX 30 year-to-date: -20.2%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.6%. CIB, the index’s heaviest constituent, ended up 1.0%. EGX30’s top performing constituents were Telecom Egypt up 2.3%, Ezz Steel up 1.7%, and Orascom Investment Holding up 1.6%. Yesterday’s worst performing stocks were AMOC down 1.5%, Qalaa Holdings down 1.1% and Pioneers Holding down 1.0%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -109.7 mn

Regional: Net long | EGP +10.1 mn

Domestic: Net long | EGP +99.6 mn

Retail: 72.3% of total trades | 71.5% of buyers | 73.0% of sellers

Institutions: 27.7% of total trades | 28.5% of buyers | 27.0% of sellers

WTI: USD 39.19 (-1.46%)

Brent: USD 42.01 (-1.52%)

Natural Gas: (Nymex, futures prices) USD 2.54 MMBtu, (-1.89%, October 2020 contract)

Gold: USD 1,936.10 / troy ounce (+0.09%)

TASI: 8,050 (+0.32%) (YTD: -4.04%)

ADX: 4,507 (-0.33%) (YTD: -11.19%)

DFM: 2,271 (+0.56%) (YTD: -17.85%)

KSE Premier Market: 5,807 (-0.13%)

QE: 9,725 (+0.02%) (YTD: -6.72%)

MSM: 3,706 (-0.01%) (YTD: -6.90%)

BB: 1,404 (+0.15%) (YTD: -12.75%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

September: The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

5-9 September (Saturday-Wednesday): China International Fair for Trade-In Services (CIFTIS), Beijing National Convention Center, China. Registration can be found here.

8 September (Tuesday): The Education Ministry will announce what the school year will look like for both private and public schools.

8 September (Tuesday): Online Egyptian-Bahraini Businessmen Association meeting to discuss mutual trade and investment opportunities.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

9 September-25 October: KLM to run passenger flights to Cairo for the first time since 2017.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against the Tourism Development Authority.

14 September (Monday): Postponed EU-China summit in Leipzig to be held as a video conference, focus on trade.

14-15 September (Monday-Tuesday): The Chemical Industries Export Council will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda.

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

Mid-September: Proposed time slot for UAE-Israel normalization agreement signing ceremony which will be held in Washington, US.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24-25 September (Thursday-Friday): The European Union will discuss imposing sanctions on Turkey to limit the country’s ability to expand its search for oil and gas in contested eastern Mediterranean waters.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

End of September: Last chance to settle building code violations for illegal buildings.

Late October or November: Voters head to the polls to elect a new House of Representatives. Election dates still TBD.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.