- Egypt’s reforms could shield the economy from covid-19 shocks -Moody’s. (Speed Round)

- Gov’t revises downward to 3.5% its GDP growth target for next fiscal year. (Speed Round)

- Covid-19 case tally rises to 3,490 (+157). (What We’re Tracking Today)

- Railway projects could be placed on ice as disbursal of USD 1.8 bn in international funds are delayed. (Speed Round)

- Pharos Energy bails on consortium eyeing Shell Egypt assets (Speed Round)

- Cement looks set for another tough year in 2020 as industry asks government for a hand. (Hardhat)

- The Market Yesterday

Wednesday, 22 April 2020

Expect news today on Ramadan + curfew. Plus: Reforms should shield Egypt from covid shock, Moody’s says.

TL;DR

What We’re Tracking Today

Good morning, friends. We hope this shortened workweek is treating you well as we hurtle along this news rollercoaster known as 2020. We’re really starting to wish we had sided with the people who argued 2020 was the last year of the previous decade, not the first year of a new one. If we change our answer to 2021, does that mean we get a do-over?

It’s (probably) three days until Ramadan. Dar El Ifta will meet this evening to determine whether the holy month will begin tomorrow or on Friday based on its sighting of the moon. Lunar calendar calculations suggest Friday is the most likely first day of Ramadan. We were wrong yesterday in saying there would be no moon sighting: The sighting is still happening, but the traditional celebration that follows has been canceled due to covid-19.

We should also know today whether the duration of the nighttime curfew will be extended, curtailed or left unchanged. Government officials have warned in the past two days that while they may make changes to curfew for Ramadan, it is not a given and claims on social media that it would run from 4pm through 6am were untrue.

We should also know by tomorrow where we stand measures to contain the spread of covid-19, including the suspension of schools and flights.

Markets today: The EGX30 ended Tuesday’s session down 2.8% as indexes across the region fell slumped with the spreading oil crisis. Turnover was 36% above the 90-day trailing average, with EGP 864 mn-worth of shares changing hands during trading. Asian stocks are in the read across the board as we neared dispatch time this morning, though not sharply. Futures point to a mixed open in Europe and show US markets opening tepidly upward.

It’s the 50th annual Earth Day today, and we’re not alone in wondering why we can take action against a pandemic, but not against the destruction of our planet. Earth Day was first marked on 22 April 1970, when mns across the globe took to the streets demanding governments take legislative action against toxic waste, pollution and a commitment to environmental protection, according to the United Nations. Earthday.org will be hosting live panel discussions and performances all day to help mark the event and provide concrete steps to take for more sustainable living.

COVID-19 IN EGYPT-

Egypt now has 3,490 confirmed cases of covid-19 after the Health Ministry reported 157 new infections yesterday. The ministry also said that another 14 people had died from the virus, taking the death toll to 264. We now have a total of 1,181 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 870 have fully recovered.

EgyptAir may be about to get an EGP 2-3 bn bailout to help shield the national flag carrier from the economic impact of covid-19, Al Masdar reports, citing unnamed government officials. The funding could take the form of a loan at a preferential interest rate of 8%, the site claims.

Domestic private airlines have also asked for government support and are waiting for news on hints that a package of measures might be in the works. In the meantime, private operators are switching to cargo to help offset their losses after passenger planes were grounded last month, according to Al Mal. The airlines are awaiting approvals from the Egyptian Civil Aviation Authority and aircraft manufacturers to repurpose their aircraft to haul goods. The International Air Transport Association had warned that Egypt’s airlines could lose as much as USD 1.6 bn in revenues, threatening up to 205k direct and indirect industry jobs in Egypt.

NBE, Banque Misr want the EBRD to help shore up liquidity: The National Bank of Egypt and Banque Misr have submitted requests for credit from the European Bank for Reconstruction and Development (EBRD) to help shore up their liquidity positions, Al Mal reported yesterday, citing informed sources. The two state-owned banks want to access the development bank’s EUR 1 bn relief fund which would allow them to access up to EUR 100 mn each in emergency funds.

[CORRECTION- 23 April: An earlier version of this story incorrectly said the EBRD’s relief fund holds EUR 1 tn]

South African insurance company Sanlam has pressed pause on plans to expand into Egypt following sales slumps in African markets, according to AfricaReport. The company will be focused on maintaining current clients for the time being but Egypt, along with Ethiopia, remain “countries of interest,” said Sanalam’s CEO Heinie Werth.

Egypt’s electricity interconnection project with Saudi Arabia is on hold for now, with the Egyptian Electricity Transmission Company postponing for 60 days a tender for the construction of the interconnection power line, which was originally expected to be signed in May, Afrik 21 reports, without citing a source.

Prime Minister Mostafa Madbouly is fast-tracking the release of overdue payments to contractors to help them pay their workers and spur construction work on national projects, according to a cabinet statement.

DONATIONS-

- PepsiCo has donated USD 1 mn to provide 2 mn meals for day laborers impacted by covid-19 measures. (Statement, pdf)

- The Armed Forces have donated EGP 100 mn to the Tahya Misr Fund. (Statement)

- Novartis Egypt is donating EGP 6.5 mn for personal protective equipment and will help the Health Ministry acquire PCR test kits. (local press).

- Hyde Park Developments donated 2k covid-19 antibody test kits to a number of hospitals. (Hapi Journal).

- Uber and AXA Egypt will provide 20k trips and meals without charge to healthcare workers. (Press release, pdf).

ON THE GLOBAL FRONT-

There are now more than 230k cases of covid-19 in the Middle East, the Jerusalem Post reports. Turkey is the region’s worst affected country with over 90k recorded cases, followed by Iran with nearly 85k confirmed cases. The next worst-hit country is Israel with more than 13k cases, followed by Saudi Arabia with more than 10k cases, and the UAE with almost 7.5k.

Countries are struggling to keep an accurate count of the dead: At least 25k people in 11 countries have probably died of covid-19 without being included in the official count of deaths, the New York Times reports. Deaths related to the novel coronavirus as of 10 April were 41% higher in England and Wales than official figures provided by the government, Sky News suggests, just days after the total count in New York soard when “thousands of deaths that previously went uncounted were added to the city’s statistics,” Politico notes.

Agriculture and food ministers from G20 countries pledged to avoid disrupting food supply chains amid the pandemic, saying they would not enact measures that would drive food price volatility, Reuters reported.

The UK will also begin testing a covid-19 vaccine tomorrow, Health Secretary Matt Hancock said, according to Bloomberg.

New data lays bare corona’s impact on the global airline industry: Capacity on international flights has collapsed to just half a mn seats a week, a 90% plunge from an average 5.9 mn prior to covid-19, according to OAG Aviation Worldwide. Total capacity (accounting for domestic flights) has plunged by 70% to 29.8 mn and could fall still further next week as carriers continue to cut back, the travel data firm said.

Italy will begin easing its lockdown restrictions on 4 May, with Prime Minister Giuseppe Conte expected to announce later this week how the government will go about loosening controls on business and movement imposed in March, according to Reuters.

The list of delayed and cancelled events now stretches into fall:

- A one-year delay of Dubai Expo 2020 will be put to a vote at the Bureau International des Expositions. (Bloomberg)

- Germany has officially canceled this year’s Oktoberfest, which was set to begin on 19 September. (Deutsche Welle)

- Spain is canceling its iconic running of the bulls, also known as the festival of San Fermin. (The Guardian)

^^Get a load of that oil VIX: As this analyst pointed out on Twitter, 30-day volatility in the oil market usually fluctuates around the 30 pt handle. Yesterday it hit 1,100. Yes, you read that correctly.

Oil prices took another hit yesterday, with WTI June futures dropping 43% to USD 11.57 / bbl after holding above USD 20 / bbl even when oil contracts for May delivery fell into negative territory. The fall in June contracts indicates “the blowout in the May contract was more than just a technical blip,” the Financial Times says. Brent crude, the international benchmark, also tumbled yesterday, ending the day down 24% to USD 19.33 / bbl.

SOMETHING GOOD OUT OF COVID? If there’s one phrase we now despise, it’s “We’re all in this together.” Sure. But at least that means that the “influencer economy” is facing its first recession, too, the good people at Wired write.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: The cement industry looks set for another hard year in 2020, with many of the problems of the previous years festering and covid-19 weakening demand. And while all the players want government action to rescue the sector, opinions are divided over which direction to take, with some wanting it to address the oversupply problem directly, and others advocating export quotas and even price controls.

Enterprise+: Last Night’s Talk Shows

On a relatively quiet night on the airwaves, the Supreme Media Council’s decision to fine Al Masry Al Youm over an op-ed reportedly penned by founder Salah Diab earned some attention. Al Hayah Al Youm’s Lobna Assal (watch, runtime: 2:53) and Masaa DMC’s Ramy Radwan (watch, runtime: 2:12) took note of the story, without providing additional commentary. We have the story in this morning’s Speed Round, below.

The House of Representatives had a busy first day back in session after a 42-day recess, Assal noted. The Al Hayah Al Youm host recapped the bills passed yesterday, including amendments to the Emergency Law giving the president the authority to take measures to address the covid-19 crisis (watch, runtime: 2:26). Again, we have the full story in this morning’s Speed Round, below.

The Health Ministry’s report on Egypt’s covid-19 case tally also got its daily coverage on Al Hayah Al Youm (watch, runtime: 1:34), Masaa DMC (watch, runtime: 2:22) and Yahduth fi Misr (watch, runtime: 1:05).

Speed Round

Speed Round is presented in association with

Egypt’s reforms could shield the economy from covid-19 shocks -Moody’s: Egypt’s track record of economic reform commitment and strong FX reserves are expected to shield its credit rating from shocks caused by the covid-19 pandemic, Moody’s said in a credit opinion last week (pdf). The ratings agency says remaining committed to reform measures moving forward could help Egypt achieve “higher sustained growth” levels down the road. By continuing to narrow its current account deficit, the country “may also reduce the economy’s borrowing needs and shore up resilience to changing financing conditions,” Moody’s says.

FX reserves act as a bulwark against EM outflows: Meanwhile, a “broad domestic funding base” and the country’s strong FX reserves, which can cover six months’ worth of imports “provide buffers against significant capital outflows from emerging markets in the wake of the coronavirus pandemic,” the ratings agency said. Moody’s notes that Egypt’s banking sector is also acting as “a deep and stable domestic funding base” that will further support the country’s external liquidity.

On the flipside, Moody’s points to Egypt’s debt affordability as a major point of weakness that leaves the country’s credit profile “vulnerable to a sharp and sustained tightening in financing conditions.” Based on this weakness, Moody’s has scored Egypt’s fiscal strength at “ca” — the lowest score on its overall scorecard.

That said, the ratings agency expects our debt-to-GDP ratio to continue declining this fiscal year, even when accounting for the expected shock impact covid-19 will have on our growth and fiscal position. Moody’s forecasts general government debt as a percentage of GDP dipping to 82.6% in FY2019-2020, down from 84.2% in FY2018-2019, before rising again during the upcoming fiscal year to 83%.

Unemployment, inflation could drive down credit rating: The ratings agency says “social pressures” resulting from youth unemployment, inflation, and “lingering susceptibility to political event risks” continue to pose credit challenges, particularly as inflation would drive up the cost of government debt.

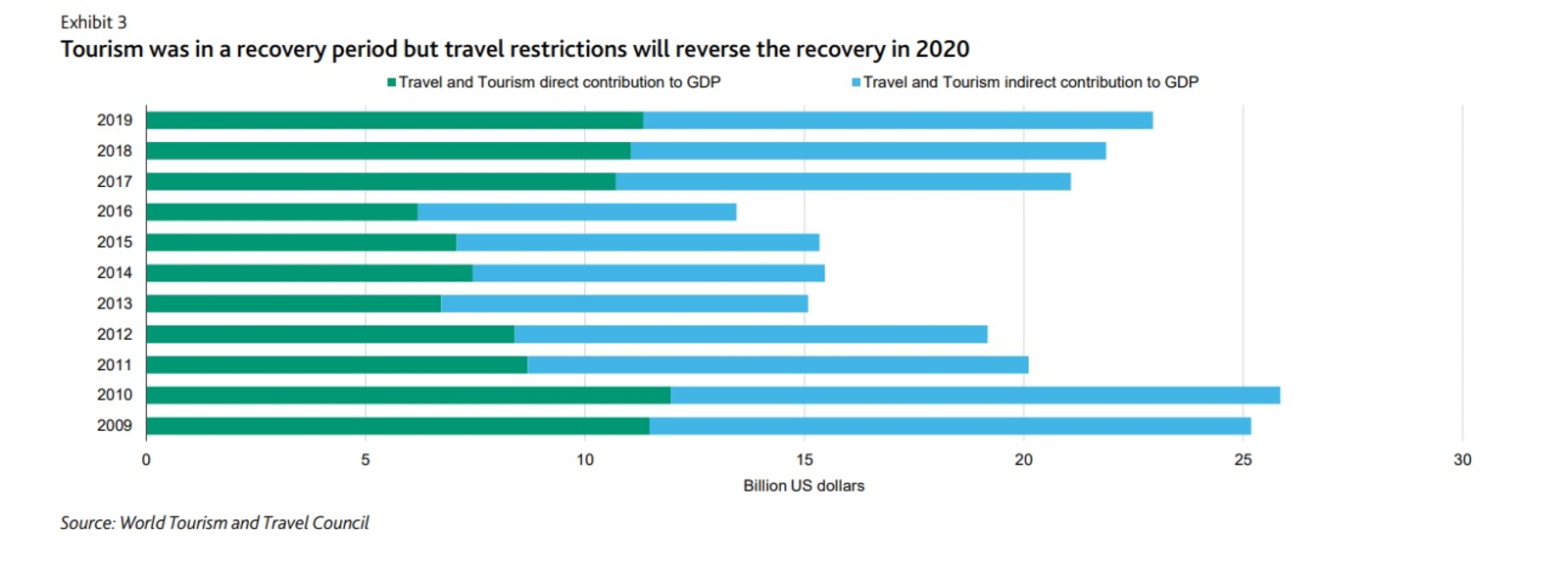

Egypt’s current account deficit is seen widening by the end of the current fiscal year on the back of tourism revenues and remittances falling sharply, which the agency says would “more than offset” the lower expenditure on oil as prices drop. Moody’s sees the current account deficit coming in at 4.5% in FY2019-2020 before narrowing again to 3.6% in FY2020-2021.

The impact of covid-19 will be most pronounced in the next fiscal year: The fall in tourism, coupled with disruptions in investment and trade, will drive down growth to 4.4% in FY2019-2020 and 2.7% in FY2020-2021, Moody’s says.

The government has revised downward its target GDP growth for FY2020-2021 to 3.5% from 4.5%, said Planning Minister Hala El Said, according to a cabinet statement. Projections for the current fiscal year have also been amended to 4.2%, down from 5.1% as the pandemic continues to weigh on the economy. The revised figures assume the worst will be over by June, but will be slashed another 30% if the crisis continues past that point, El Said noted.

Background: The Finance Ministry had said last week it would leave its projections for FY2020-2021 GDP growth unchanged from the assumptions it made when preparing the state budget before the covid-19 outbreak. According to the draft budget released at the time, the ministry said it would revisit the anticipated growth figures once the economic impact of the pandemic becomes clearer.

Railway projects could be placed on ice as disbursal of USD 1.8 bn in international funds are delayed: Some USD 1.8 bn in international loans earmarked for railway projects will not be disbursed until the middle of 2021 as lenders reprioritize financing in response to the covid-19 pandemic, Al Mal reports, citing informed sources. The Transport Ministry was hoping to access USD 1.5 bn in funding for the project to convert the 22-km Abu Qir-Alexandria railway into a subway before the end of 2020, and a further USD 300 mn to add additional tracks to several passenger lines. Lenders for the projects include the European Investment Bank, European Bank for Reconstruction and Development, the Asian Infrastructure Investment Bank and the French Development Agency.

Railway Authority land up for grabs: The National Railway Authority is hoping get a cash infusion to keep some projects on track through an estimated EGP 15 bn land offering for residential and commercial development, according to Al Mal. The offering from MOT for Investment and Projects, the authority’s investment arm, has received ministry approval to offer a mixed-use complex in in Mansoura, as well as land on Al-Tayaran street, in Dakahlia’s Talkha, and in Ramlet Boulaq, adjacent to the Nile City Towers.

Pharos Energy bails on consortium eyeing Shell Egypt assets: Pharos Energy has withdrawn from a consortium in the running to acquire Shell’s onshore assets in Egypt due to the collapse in oil prices, it said in a statement yesterday. Pharos was part of a consortium with Cheiron and Cairn Energy, which had moved to a second round of bidding to acquire Shell’s assets in the Western Desert. Egypt’s East Gas was invited to the next round of bidding which remains open.

The sale is unfortunately coinciding with one of the biggest oil crashes in history: Bidders are likely to reduce the value of their offers in light of the crash in oil prices which earlier this week saw US crude fall into negative territory for the first time in history.

Background: The Dutch oil giant had been looking to sell the assets for as much as USD 1 bn, a figure that now looks increasingly out of reach as the sector comes under increasing pressure from an unprecedented demand slump and a supply glut.

LEGISLATION WATCH- House approves EGP 10 bn additional provision for FY2019-2020 budget: The House of Representatives’ general assembly has approved the government’s request to allocate an additional EGP 10 bn in the FY2019-2020 budget to help the state fight the covid-19 pandemic, according to Al Mal. The proposal was approved by the cabinet and the House Planning and Budgeting Committee earlier this week.

Cabinet and the House appear to have reached a middle ground on the tax exemption threshold under the Income Tax Act, setting it at EGP 8k, up from EGP 7k proposed by the government and EGP 9k suggested by the committee, according to Al Shorouk. The tax bands have also been changed from the last draft we saw to be as follows:

- Those earning between EGP 8-30k would be taxed 10%;

- Those earning between EGP 30-45k would be taxed 15%;

- Those earning between EGP 45-200k would be taxed 20%;

- Those earning more than EGP 200k would be taxed at 22.5%.

Parliament’s general assembly will take a final vote on the bill today.

Also approved in principle yesterday:

- An amendment to the Real Estate Tax Act to exempt unused land from being taxed and give cabinet the power to issue exemptions for some buildings;

- Amendments to the Emergency Law to give the presidency increased powers. The amendments earned committee-level approval earlier this week;

- A bill allowing the government to move ahead with its tax relief package to help companies cope with covid-19 repercussions if they commit to keeping all employees

- An amendment to the Pensions Act to include special bonuses as part of a variable salary, effectively raising the value of pensions.

- The new SMEs Act, which will include tax and non-tax incentives to support SMEs to go legit. The details of the final bill have not yet been made available but last we heard, there were debates on exempting all SMEs from all taxes for five years.

The Supreme Media Council has fined private daily newspaper Al Masry Al Youm EGP 250k over an op-ed penned by founder Salah Diab under the pseudonym Newton, the newspaper said. Diab had suggested in the column that Sinai should be assigned a governor with expanded powers to better govern the peninsula. The council has ordered the paper to remove the piece from its website and issue an apology. AMAY is also required to suspend publishing Newton’s opinion pieces for one month. The council has also referred the case to the prosecutor general to decide whether further action is warranted.

Apicorp to increase callable capital eightfold: Arab Petroleum Investments Corporation (Apicorp) shareholders have given the go-ahead to increase the development bank’s callable capital to USD 8.5 bn from USD 1 bn to support investments in the energy sector, it announced in a statement (pdf). The lender will also bump up its authorized capital to USD 20 bn and subscribed capital to USD 10 bn. “The capital increase will enable Apicorp to fulfil its policy mandate by continuing to deliver sustainable impact-driven development projects and supporting investment activities,” CEO Ahmed Ali Attiga said. This comes a week after the bank reported a 17% increase in net profits to USD 112 mn in 2019.

STARTUP WATCH- Disruptech makes its first investment in two Egyptian companies: Disruptech, a USD 25 mn fintech fund recently set up by Mohamed Okasha, a former top exec at fintech player Fawry, has made its first investment in two Egyptian startups, Khazna and Brimore, according to Menabytes. The fund is investing a six-figure USD sum, Okasha said, without disclosing the exact amount. Khazna will provide mobile financial services to Egyptians who do not have bank accounts, including a salary cash advance app, while Brimore serves local manufacturers and suppliers to access individual sales agents to market their products directly to consumers using mobile apps.

Image of the Day

Sham El Nessim blues: We don’t think we’ve ever seen the streets of our beloved downtown Cairo this empty — particularly not during our annual stinky-fish celebrations. Credit: Sayed Hassan.

Egypt in the News

Leading coverage of Egypt in the foreign press: Egypt’s shipment of medical supplies to the US yesterday as a gesture of goodwill and solidarity. The Washington Post notes that naysayers wonder whether Egypt can afford such gestures without depleting its own essential supplies. Local news outlets in the US including ABC7 News and WJZ also had the story.

Elsewhere, AFP looks at how some of the country’s healthcare workers are being shunned by their own communities over fears they might transmit covid-19 after battling it on the front lines.

Diplomacy + Foreign Trade

Al Mashat urges multilaterals to expand debt relief to middle-income countries: International Cooperation Minister Rania Al Mashat called on multilateral lenders to include middle-income countries in their debt relief initiatives to soften the covid-19 blow, the minister said in a meeting with ministers and senior officials hosted by the International Fund For Agricultural Development (IFAD), a UN development lender. Al Mashat’s call comes amid increasing pressure on sovereign and multilateral lenders to suspend debt payments for poor countries.

Cement looks set for another tough year in 2020: As covid-19 continues to ravage economies and pummels once-healthy sectors such as tourism, it’s hard not to wonder how it could hit Egypt’s cement market — a sector that was under pressure long before the virus entered the national lexicon. Industry players differ on the extent to which covid can impact the already-ailing sector, with some stating that it won’t have much of an impact and others suggesting that it could be devastating.

What ails the cement sector? A drawn out oversupply problem has continued to push companies deeper into the red, forcing them to slash prices and lay off workers in a bid to stay afloat. Some industry leaders we spoke with say that unless the underlying problems of oversupply and falling prices — which have driven plant shutdowns prior to the crisis — are dealt with, covid-19 is simply another nail in the coffin. Others want the state to bail the industry out with assigned export quotas and a floor on prices. And while the government has lowered natural gas prices, all agree that more needs to be done.

2019 was a rough year for the industry as the gap between supply and demand grew. Total sales volume (both for the local market and export) declined 0.8% y-o-y to 49.8 mn tonnes in FY2019, according to a research note by Pharos Holding (pdf). Local consumption alone was down 3.5% y-o-y to 48.7 mn tonnes, Arabian Cement CEO Sergio Alcantarilla tells us. This comes as the nation’s production capacity remains between 80-85 mn tonnes — a mismatch that sparked a price war as companies vied to hold on to market share. Ordinary portland cement saw prices fall from EGP 850 / tonne in January 2019, to EGP 800 / tonne by December 2019, according to data from Mubasher. Hikes in electricity prices from years of subsidy cuts added to the financial pressures on cement companies, causing production costs to rise 11%, Jose Maria Magrina, managing director of Suez Cement, told the local press last September.

As a result, private sector earnings nosedived last year. Suez Cement — the largest private sector producer with a 13% market share — saw net losses fall (pdf) 10% y-o-y to EGP 1.2 bn in FY2019. Meanwhile, Misr Beni Suef Cement — which is 20% state-owned — saw its net income falling (pdf) 66.8% y-o-y to EGP 80 mn.

Some companies simply haven’t been able to cope, with National Cement, Tourah Cement, and El Nahda Cement all shutting down operations, either temporarily or permanently, last year.

What’s the outlook for the sector 2020? More of the same — if not worse, industry leaders tell us. The outlook for 2020 will be worse than 2019 as we expect more production shutdowns and revenues will continue to decline, Alcantarilla tells us. He expects to see more plants being idled, telling us that he sees around three or four companies will not be operational by the end of the year. Meanwhile, the stronger companies will continue to hemorrhage funds and revenues will continue to decline, he added. He expects Arabian Cement’s 1Q2020 revenues to be consistent with the last four quarters, which saw declines.

Suez Cement’s Magrina sees 2020 as turning out worse than 2019, as the sector continues to slide downwards. He concurs with Alcantarilla that the shutdowns will continue and will hurt employment in the sector. Magrina had reportedly told the local press last year that, in addition to temporarily shuttering Tourah Cement, his company has had to cut around 2,300 jobs over the past two years. Whatever factors came into play last year, expect more of the same in 2020.

Both also agree that consolidation will not save the sector in 2020, as no one is buying. There are no investments coming into the sector, says Alcantarilla. Why would any investor buy into a sector whose decline looks set to continue without any tangible government support, he added. This was evident in 2019, where we saw no mergers take place due to the uncertainty in the sector, Magrina tells us. Any merged entity would lose more out of the transaction, he added.

Could cement prices fall even lower? The fair price of ordinary cement in this market should be around EGP 700-750 per tonne, says Ahmed El Zinny, who heads the construction materials division of the Federation of Egyptian Chambers of Commerce. Currently, a tonne of cement is being sold for EGP 780, he adds.

And all before covid-19 comes to play: Both El Zinny and Medhat Stefanous, vice chairman of the construction materials division of the Federation of Egyptian Industries, tell us that the impact of the covid-19 crisis could potentially be “devastating” for the sector as building projects and construction slow down due to the curfew and lockdown. While neither wanted to speculate on the extent of the damage, El Zinny does expect companies to continue operating in the red. The situation has become so bad that the state’s national projects are absorbing 60% of the nation’s total cement production, he tells us. Cement distributors have also been forced to buy cement at cost from producers, forgoing their profit margins, said El Zinny.

Thus far, the government has reacted by lowering natural gas prices for industries to USD 4.5/mmbtu from USD 6/mmbtu last month. But cement players tell us this has not been enough to make a significant impact. Pharos argues (pdf) that while this may offer some respite for industries during covid-19, it will not prevent losses.

While everybody we’ve spoken to want government intervention, they differ on what course of action to take. For Magrina and Alcantarilla, the solution is clear: the government needs to address the supply glut. “The problem is oversupply and a fragmented market as there are currently too many companies operating,” says Magrina. While there is an acknowledgement that demand is falling due to market conditions, the other side of the coin is the massive growth in supply over the past five years, when the government was issuing licenses as the oversupply was becoming clear, says Alcantarilla. In 2016, the Industrial Development Authority (IDA) awarded three cement licenses, despite an estimated oversupply of about 18 mn tonnes. The problem was made worse when the state entered with full force on the supply side by inaugurating the 13 mn tonnes/year cement plant in Beni Suef in 2018. When running at full capacity, this one plant alone holds a 26% market share.

El Zinny sees exports as the solution, and is calling on the government to impose a minimum export quota of 5% of total production to funnel out some of the excess supply. He pointed to similar actions taken by the Trade and Industry Ministry back in 2008 as having helped out the cement industry during the global financial crisis.

The problem with exports is that this isn’t 2008. Energy was subsidized, hence production costs were cheaper. In those years, Egypt was exporting around 6-8 mn tonnes of clinker to regional markets. Industry insiders tell us that as the local market was reaching equilibrium and plants began suffering from stagnant utilization, Egypt’s exports markets began building up their own capacities, while other traditional export markets (including Libya and Yemen) are not longer buyers thanks to ongoing instability. That said, the government itself appears to favor exports, and has suggested it could be considering more subsidies for exporters, Magrina revealed to us.

Unfair playing field in global export market: And while El Zinny counters that Egypt can make inroads to Europe and other African export markets, Magrina says it will be difficult, if not near impossible, to compete with regional players such as Algeria and Saudi Arabia exporting cement at cheaper prices. Fuel makes up 50-60% of all costs, so subsidies make a difference. Regional competitors are selling cement USD 12 / tonne cheaper than Egypt’s, say Magrina and the FEI’s Stefanos. Egypt does not have a competitive edge in cement, so either the domestic market must increase its demand, or some factories must cease production, Stefanos told Ahram Online last year.

The FEI is also planning on lobbying the Finance Ministry for tax relief, and is proposing an amendment to the income tax of cement companies, which are taxed using a different formula than other companies, El Zinny tells us.

Even analysts are calling for radical solutions, with Pharos stating that the government will need to either set a minimum threshold for how low cement could get — or inefficient players need to exit.

in a research note headlined “Bankruptcies are the Name of the Game,” Pharos Holdings estimated that demand for cement has to grow by roughly 47% pushing utilization rates to 85% for sector dynamics to materially improve. Otherwise, “inefficient and highly leveraged players” will be pushed out of the market.

Either way, it’s a dynamic on which everyone from real estate companies to would-be home-owners should be keeping a watchful eye.

Your top infrastructure news of the week:

- Renewables: The Electricity Ministry has brought Egypt’s largest wind farm online.

- More renewables: General Electric has completed the EGP 100 mn control and monitoring center at Benban solar facility.

- Elsewedy goes to Dubai: Elsewedy Electric has signed a AED 124.5 mn contract with the Dubai electricity authority to install 22.5 km of cables.

- Polymers: Saipem and Petrojet will construct Egypt’s first polybutadiene plant after being awarded the contract by state-owned Ethydco.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Tuesday): 9,875 (-2.8%)

Turnover: EGP 864 mn (36% above the 90-day average)

EGX 30 year-to-date: -29.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 2.8%. CIB, the index’s heaviest constituent, ended down 3.8%. EGX30’s top performing constituents were Dice up 9.5%, Orascom Investment Holding up 4.7%, and Heliopolis Housing up 3.0%. Yesterday’s worst performing stocks were Egypt Kuwait Holding down 6.5%, Sidi Kerir Petrochemicals down 5.2% and AMOC down 4.2%. The market turnover was EGP 864 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -225.6 mn

Regional: Net Long | EGP +15.7 mn

Domestic: Net Long | EGP +209.9 mn

Retail: 52.1% of total trades | 75.9% of buyers | 28.4% of sellers

Institutions: 47.9% of total trades | 24.1% of buyers | 71.6% of sellers

WTI: USD 13.17 (+13.18%)

Brent: USD 19.17 (-0.83%)

Natural Gas (Nymex, futures prices) USD 1.83 MMBtu, (+0.71%, May 2020 contract)

Gold: USD 1,709.70 / troy ounce (+1.30%)

TASI: 6,496.72 (-1.58%) (YTD: -22.56%)

ADX: 3,860.46 (-2.74%) (YTD: -23.94%)

DFM: 1,825.63 (-3.28%) (YTD: -33.97%)

KSE Premier Market: 5,055.41 (-2.62%)

QE: 8,325.85 (-1.41%) (YTD: -20.14%)

MSM: 3,442.34 (-1.19%) (YTD: -13.53%)

BB: 1,312.78 (-0.47%) (YTD: -18.47%)

Calendar

24 April (Friday): First day of Ramadan. (TBC)

23 April (Thursday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

23 April (Thursday): Suspension of international flights to / from Egypt expires.

23 April (Thursday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29 April (Sunday): House of Representatives covid-19 recess ends.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.