- Covid infections surge to 1,070; gov’t says “more stringent” measures in the works, but stops short of lockdown. (What We’re Tracking Today)

- CBE leaves rates on hold in first meeting after record cut. (Speed Round)

- STC postpones talks to raise debt to finance Vodafone Egypt takeover. (Speed Round)

- Egypt’s airlines could forego USD 1.6 bn this year from covid-19 traffic suspension. (Speed Round)

- Dana Gas delays its decision on selling its Egypt assets. (Speed Round)

- Government’s move to the new capital, GEM opening postponed as El Sisi pushes national projects to 2021. (Speed Round)

- An emerging market credit crisis is looming in spite of the Fed’s repo facility. (The Macro Picture)

- Egyptians are starting to pay attention to social distancing. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 5 April 2020

Covid infections surge to 1,070; gov’t says “more stringent” measures in the works, but stops short of lockdown

TL;DR

What We’re Tracking Today

The Central Bank of Egypt left interest rates unchanged on Thursday after delivering an emergency 300 bps cut last month to contain the fallout from the covid-19 pandemic. The Monetary Policy Committee’s Thursday decision was in line with expectations from our poll last week, in which 10 of 11 analysts expected the committee to pause and assess the effect of its dramatic cut before using up more of its arsenal. We have chapter and verse in this morning’s Speed Round, below.

It’s PMI day — buckle up, folks, as March’s PMI figures for Egypt, Saudi Arabia and the UAE drop (literally and figuratively) this morning at 06:15 CLT. You can find it here when it’s out.

Foreign reserve figures for March should also be out today, while inflation figures for March land on Thursday, 9 April.

A couple of things before we get underway this morning. People smarter than us (such as this guy) have thoughts about how bad the economy is now, how bad it could get, and what governments around the world should do now. But a couple of us were talking it through recently and we are — so far — very cautiously optimistic that the recovery on the other side, while painful, could be faster than many think right now. Unlike in past crises, there has not yet been destruction of capital. There’s been no destruction of financial intermediaries. And no destruction of the labor force.

THINGS TO READ while you guzzle enough coffee to trudge to your home office:

- CIB’s Hisham Ezz Al-Arab reminds us that many Egyptian businesses already have the crisis management skills they need to weather this storm — lessons we all learned in 2011. (Euromoney)

- The US has called for everyone to wear cloth face masks in public. Here’s why that’s a good idea (pdf), and here are two masks you can easily make at home — one super-quick, the other that will take only a bit more time, but that offers more complete protection.

- Remember the immunity passports we suggested might become a thing? The Italians are well ahead of the Germans, it turns out. (New York Times)

- We’ve said it before, we’ll say it again: Stop trying to be productive when you’re not on the clock. Don’t believe the New York Times? Try this tweet, which spoke for us this weekend.

- Thoughts on why it feels like time is dragging, making weeks feel like months. (Toronto Star)

COVID-19 IN EGYPT-

Egypt’s total number of covid-19 cases officially broke the 1,000 barrier over the weekend. The country recorded 291 new cases and 19 deaths between Thursday and Saturday, bringing our total tally to 1,070 as of last night, the Health Ministry said. Friday alone saw 120 new recorded cases — the biggest one-day leap since the beginning of the outbreak. We now have a total of 306 people who have tested negative for the virus, of whom 241 have fully recovered.

The new milestone is expected to make it significantly more difficult to contain the outbreak and the number of infections is expected to increase exponentially from this point through community spread, Cabinet’s crisis management head Mohamed Abdel Maksoud said in an interview with Al Hayah Al Youm (watch, runtime: 15:33).

A hard lockdown isn’t in the works yet: The government is prepared to impose more stringent measures to flatten the curve if the situation continues to deteriorate, Information Minister Osama Heikal said on Sada Al Balad on Friday (watch, runtime: 04:48). The minister said yesterday that a hard lockdown will only come into effect if we reach the point of 1,000 new infections per day. We have more on this in Last Night’s Talk Shows, below.

Despite the growth in cases, Egypt is still faring well in the face of the outbreak in comparison to other countries, Ittihadiya spokesman Bassam Rady said yesterday (watch, runtime: 2:44). Rady attributed the relatively contained situation to preemptive measures the government implemented before the virus spread rapidly in the country.

Seventeen doctors and nurses at the National Cancer Institute have tested positive for covid-19, Masrawy reports. Those who tested positive have since been quarantined, the Doctors’ Syndicate , and the institute will be sanitized before being reopened to patients. The Associated Press also had the story, and we have more in Last Night’s Talk Shows, below.

No “mercy tables” this year: The Religious Endowments Ministry has banned privately produced “mercy tables” that feed the nation’s poor during this year’s Ramadan and has asked charity organizations and private citizens alike to instead distribute food packages or cash donations to the poor, according to a cabinet statement.

No pre-Easter services in church: The Coptic Orthodox Church will not be holding masses preceding Easter celebrations this month, El Watan reports. The Church had suspended masses and other activities in churches across the country last month. AFP also has the story.

Court hearings have been suspended until 16 April in another effort to minimize crowding in a single place, Justice Minister Omar Marwan said on Egypt’s Channel One (watch, runtime: 05:55). All scheduled court sessions will be postponed to a later date. The suspension excludes administrative work but courts have reduced the number of employees as a precaution.

Gov’t pulling together state healthcare system ahead of infection peak: The government is working on a plan to make full use of its healthcare infrastructure by relying on teaching hospitals under the Higher Education Ministry’s purview and other hospitals under the Health Ministry’s jurisdiction, Prime Minister Moustafa Madbouly said on Thursday. The plan would give all governorates across the country enough hospitals to handle covid-19 cases as they come, Madbouly said.

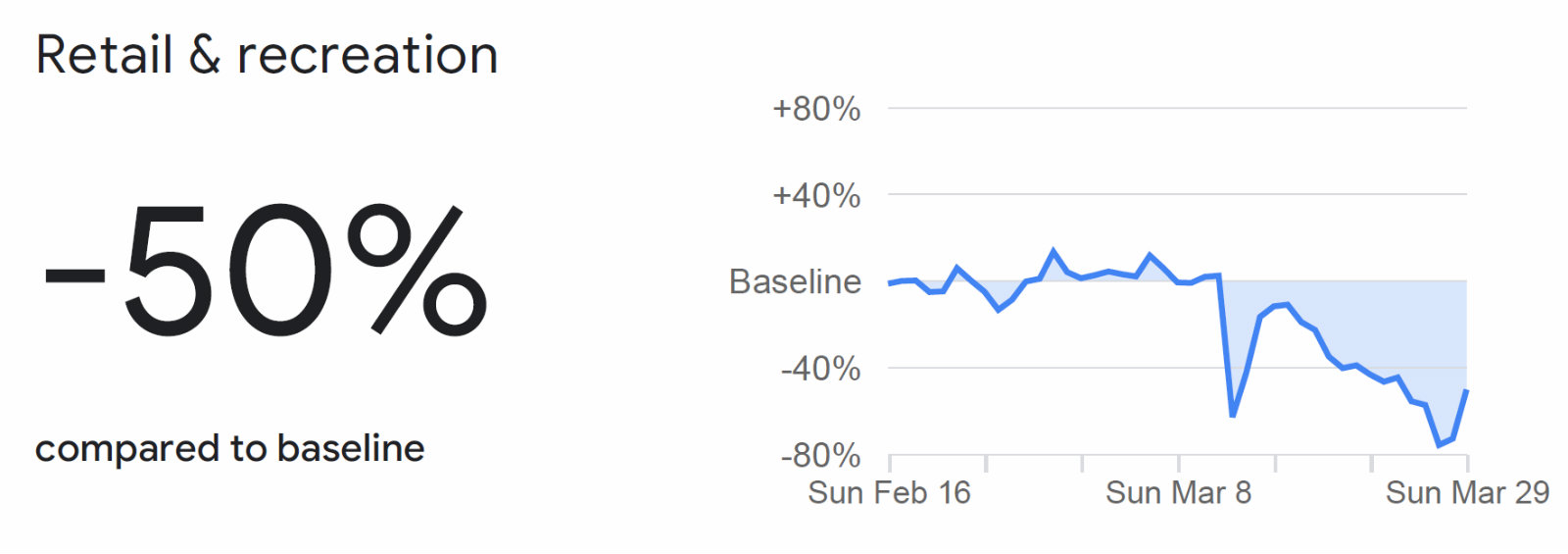

Egyptians are starting to pay attention to social distancing: Data released by Google over the weekend (pdf) suggests an increasing number of Egyptians are taking social distancing measures seriously. The data, based on Google’s tracking of the location of many who use its services, found:

- Time spent at home is up 15% nationwide;

- The number of people traveling to work dropped 35%;

- Footfall in Egypt’s retail and recreational outlets is down 50% since the middle of March;

- Use of transportation hubs is down 52%;

- Footfall in grocery stores and pharmacies is down 24%.

You can play with Google’s gadget here to see how other countries are doing.

Marsa Alam hotels are serving as quarantine centers for Egyptians returning home from the United States, according to Youm7. 310 returnees are already in quarantine there, and another flight is due to land today from Washington.

GOOD POLICY: We heard on Thursday and over the weekend from a number of members of the community who agree with Hassan Allam co-CEO Hassan Allam that the government should postpone tax filing and payment deadlines for businesses of all sizes to later this year. The suggestion mirrors moves in countries including the United States and Canada.

GOOD POLICY: Saudi Arabia is going to subsidize salaries for struggling companies to avert layoffs under a package that would benefit 1.2 mn Saudi nationals, according to Bloomberg, which notes that “business owners can request monthly compensation amounting to 60% of the employee’s salary for the next three months.”

BAD POLICY: The latest bright idea from our illustrious representatives: Legally enforced donations. Al Wafd Party leader and House Legislative Committee head Bahaa Abou Shoka plans to draft a bill that would require all citizens who earn more than EGP 5k per month to donate a portion of their monthly income to the Tahya Misr Fund, according to Al Shourouk. Abou Shoka’s plan would impose a tiered system where those earning EGP 5k per month would donate 5% of their income, those earning EGP 10k would donate 10%, those earning EGP 15k would donate 15%, and those earning over EGP 20k would be required to contribute 20% of their monthly earnings.

Gov’t to add to stockpiles of staple goods: The government is looking to increase the country’s strategic commodity reserves to be sufficient for a six-month period to protect against possible food supply shortages, Prime Minister Moustafa Madbouly said in a televised address on Thursday, according to a cabinet statement. Egypt currently has at least three months’ worth of staple goods in reserve, he said. The announcement came a few days after President Abdel Fattah El Sisi urged ministers to add to the country’s existing reserves.

Is the virus beginning to weigh on Egypt’s wheat tenders? In an unusual move, Egypt canceled a wheat tender within hours of announcing it late last week without giving a reason, Bloomberg reports. State grain buyer GASC reportedly included a new clause requiring suppliers to replace any shipments impacted by covid-19 transport restrictions with wheat from elsewhere, and to bear the cost. This in turn reportedly prompted concerns from some suppliers, which could have led to a lower turnout or offers at higher prices, traders said.

Health Minister Hala Zayed landed in Italy yesterday with a donation of medical supplies as a gesture of goodwill, Masrawy reports. The minister had similarly traveled to China with medical supplies last month.

The World Bank is releasing USD 7.9 mn in emergency funds to Egypt to help it battle covid-19, as part of a USD 14 bn in immediate funds it is disbursing to combat the spread of the virus in developing countries, the bank said in a statement. The funds will be issued under a larger USD 160 bn support package to vulnerable communities and businesses impacted by the crisis.

ON THE GLOBAL FRONT-

The global tally of covid-19 cases has surpassed 1 mn, while the death toll is currently at around 53k, BBC reports, citing official figures from Johns Hopkins University. Over 210k have recovered, the university’s figures show. The US has now become the epicenter of the pandemic, reporting over 1k new cases on Thursday alone. New York, Detroit, and New Orleans are still expected to peak in about a week, President Donald Trump said yesterday.

Dubai has moved to a hard lockdown for two weeks, the emirate’s media office tweeted. The UAE also indefinitely extended its curfew, which was set to expire today, Reuters reported. Only one member of each household will be allowed to leave their homes at a time, and then only to buy food or seek medical attention. You can read the full details of Dubai’s lockdown here.

Fresh Saudi-Russia rift may dash prospects for oil market recovery: An Opec+ meeting that was scheduled to take place tomorrow was pushed by “at least” a few days as Saudi and Russia continue to butt heads over who’s to blame for the oil market crash, reports Bloomberg, quoting an anonymous delegate familiar with the matter. Oil prices surged towards the end of last week, gaining nearly 50% on Thursday and at least 12% on Friday after The Donald took to Twitter to hint at a Saudi-Russia agreement and optimistically forecast production cuts of up to 15 mn bbl / d — a claim later denied by the Kremlin — and the Saudi government called for the now-postponed Monday meeting to negotiate the way forward.

‘Great Depression’ is starting to appear in headlines with alarming regularity: IMF head Kristina Georgieva was back to sounding the alarm on the trajectory of the current economic upheaval, calling it “worse than the global financial crisis,” and a situation unlike anything seen in the financial institution’s history. While economies have come to a virtual standstill on lockdown orders from governments looking to control the spread of covid-19, mns of jobs have been lost and capital has evaporated from emerging markets. The FT and CNBC have more on Georgieva’s comments.

Zoom is under fire over privacy and security concerns after users reported several incidents of hackers hijacking video conferences, according to the Wall Street Journal. The app, whose popularity has soared to 200 mn meetings after the covid-19 outbreak from 10 mn meetings last year, has pledged to enforce better end-to-end encryption, but says the feature “won’t be ready for a few months.”

*** PSA: Flat6Labs will this Tuesday hold a StartSmart webinar featuring global investor Chris Schroeder and Sawari and Flat6Labs co-founder Hany Al Sonbaty to discuss how startups can survive and thrive during the covid-19 pandemic. You can register for the session here.

Enterprise+: Last Night’s Talk Shows

Daily case rundown from the Health Ministry: Masaa DMC’s Eman El Hosary and Min Masr’s Amr Khalil recapped the Health Ministry’s daily covid-19 update, which reported 85 new cases and five new deaths yesterday. A total of 25 individuals have been released from the hospital, pushing up the number of recoveries to 241 (watch, runtime: 1:34 and runtime: 2:14).

Full lockdown will only be imposed once we hit 1k cases per day, Heikal says: With more than 1,000 cases within 48 days, the trajectory of covid-19 infections is still a relatively muted curve, and hasn’t seen any sudden or major spikes, Information Minister Osama Heikal told Al Kahera Alaan’s Lamees El Hadidi. The government is ready to impose a hard lockdown if the infection rate reaches 1,000 per day — which he noted would effectively grind the economy to a complete halt — but that we’re not at that point yet (watch, runtime: 10:13).

Investigation into cancer institute outbreak: Authorities are investigating the infection of 17 members of the National Cancer Institute’s medical staff members, and have so far tested 413 individuals who were in contact with the infected cases, Higher Education Minister Khaled Abdel Ghaffar told El Hekaya’s Amr Adib. A total of 500 people will be tested. The vast majority of those infected were asymptomatic, making it difficult to determine where the outbreak originated, Abdel Ghaffar said (watch, runtime: 2:11 and runtime: 3:03).

Construction work is resuming, but not without precautions: Construction workers are getting back to work at lower capacities than usual to prevent an outbreak of covid-19, Palm Hills Developments Chairman Yassin Mansour said in a phone-in with El Hadidi. He slammed previous calls to resume work as normal across all industries, saying that such a move would actually bring greater disruption to the economy with a spike in deaths. Mansour also called on the government to provide companies with test kits to use at their own expense (watch, runtime: 6:23).

Egypt could follow Germany’s model of mass testing to minimize the death rate from the virus by allowing for early intervention, businessman Tamer Wagih told Adib. Wagih pointed to testing kits that produce results within five minutes and with 90% accuracy as a feasible option for Egypt to use on a large scale (watch, runtime: 7:32).

In (kind of) non-covid news: Min Masr’s Amr Khalil took note of the Central Bank of Egypt’s decision to expand its EGP 100 bn industry initiative. We have the full story in this morning’s Speed Round, below (watch, runtime: 0:43).

Speed Round

Speed Round is presented in association with

CBE leaves rates on hold in first meeting after record cut: The Central Bank of Egypt left rates on hold on Thursday, less than three weeks after it made a dramatic 300 bps rate cut to shore up the economy amid widespread disruption caused by the covid-19 pandemic. The central bank left the overnight deposit rate at 9.25% and the lending rate at 10.25%, while the main operation and discount rates remain at 9.75%, the bank said in a statement (pdf).

This is what analysts had predicted: Ten of 11 analysts we surveyed ahead of the meeting expected the central bank to hold off on further easing for the time being, citing uncertainty over the trajectory of inflation and a deterioration of the carry trade amid accelerating capital flight from emerging markets.

What the CBE said: “The MPC decided that keeping key policy rates unchanged remains consistent with achieving the inflation target of 9% (+/-3%) in 4Q2020 and price stability over the medium term,” the bank said. Reuters and Bloomberg also had the story.

The door is still open for further cuts: The CBE reiterated that it “will not hesitate to utilize all available tools” to support the economy.

“The MPC’s decision, which was in line with our expectations, came on the back of supportive inflation rate readings that allowed for an exceptional 300 bps rate cut,” said Beltone’s Alia Mamdouh. “We maintain our average inflation expectations of 6.5%, which should keep headline inflation rates within the CBE’s target range.”

Inflation likely to tick up on covid and Ramadan spending: Mohamed Saad, equity analyst at Shuaa Securities, forecasts inflation to rise marginally to 5-7% over the coming months as consumers hoard goods and spend big for Ramadan. Expectations that the government will provide further relief to businesses and consumers by lowering fuel costs will help to keep prices within the CBE’s target range, he said.

Falling EGP will give the central bank more room for manoeuvre -Capital Economics: James Swanston, MENA economist at Capital Economics, warned that Egypt’s current account deficit will begin to widen if the EGP maintains its current rate and urged the central bank to let the currency slide against the greenback. “We expect the central bank will loosen its grip on the EGP and, if this is done soon, there is unlikely to be a sharp fall in the currency and inflation should remain in check. This would allow interest rates to be cut further to support activity.”

Enter Sigma’s Abou Bakr Imam with the counterpoint, who said that it is unlikely that the central bank is actively propping up the EGP, saying he thinks demand for hard currency has fallen as imports have slowed.

The EGP remained steady at 15.68 against the greenback on Thursday. The currency has fallen only 21 piasters since its peak in late February, and has fluctuated between 15.68-15.69 for the past two weeks.

Make a long-term policy prediction at your peril: Pharos’ head of research Radwa El Swaify, who has the central bank maintaining rates through to the end of the year as a base case, said that it is becoming more difficult to predict how policymakers will act as the known unknowns continue to swirl. “So many changes can happen in nine months, especially with growth and inflation, you cannot judge it now. There are so many unknowns at this point,” she said.

M&A WATCH- STC postpones talks for loan to finance Vodafone takeover: Saudi Telecom Company (STC) has delayed talks to raise debt finance for its acquisition of Vodafone Group's 55% stake in Vodafone Egypt due to the covid-19 outbreak, Bloomberg reports, quoting sources in the know.

This doesn’t mean that the acquisition has been put on ice: The company is continuing to work on the acquisition and may restart negotiations for a USD 2 bn+ loan after the crisis abates, the sources said. STC is also considering other options to finance the purchase, which the Saudi giant agreed on in January before the outbreak went global, one of the people said without giving further details. We noted last month that STC had already begun doing duty diligence on Vodafone Egypt.

A refresher on the M&A: STC signed a non-binding agreement with UK-based Vodafone Group to buy its stake in Vodafone Egypt for USD 2.4 bn in January. Telecom Egypt, which owns the remaining 45%, has a right of first refusal on the transaction and will reportedly decide this month how it plans to proceed. Another complication for STC was presented by the Financial Regulatory Authority, which said after the initial acquisition agreement that the Saudi company may be required to make a mandatory tender offer for 100% of the company if it goes ahead with the Vodafone Group buyout.

Advisers: Barclays is working with STC on the transaction, Goldman Sachs is advising Vodafone and EFG Hermes and Citibank are advising Telecom Egypt.

Egypt’s airlines will see their revenues contract USD 1.6 bn and passenger volumes dip by 9.5 mn in 2020, which could result in lost GDP of USD 2.4 bn — equivalent to around 0.85% of GDP, according to a statement by the International Air Transport Association (IATA). The association, which warned the contraction threatens more than 205k direct and indirect jobs in Egypt, called on MENA governments to provide financial relief to their carriers, largely grounded amid the global covid-19 outbreak, and said the region will likely lose USD 23 bn in potential revenues this year, a 39% drop compared to last year.

Egyptian airlines would get off fairly lightly compared to other countries in the region: Saudi Arabia could forgo some USD 5.61 bn in revenues and the UAE USD 5.36 bn, according to the IATA’s findings.

Background: Egypt’s private-sector airlines appealed to the civil aviation minister last Tuesday to help “stop the bleeding” from the suspension of Egypt’s air traffic, soon after it was extended for another two weeks from 1 April. IATA has been repeatedly warning of revenue losses to the global air transport industry this year amid the covid-19 pandemic, estimating near the end of last month that it could lose up to USD 252 bn, or 44% below 2019’s figure. The association recommends that governments financially support their carriers directly with loans or through tax relief, as well as exempting flight crews from 14-day quarantines, fast-tracking permits, and speedily publishing flight data.

Dana Gas has postponed its decision on whether it will sell its Egypt assets because of the global covid-induced market turmoil, Reuters reports, citing two unnamed sources close to the talks. Plunging oil prices probably haven’t helped matters. The Emirati energy company is still in talks and the valuation process is still ongoing, the sources said, without saying when they would be completed.

Background: Dana Gas had said in February that it would make a decision by the end of March on the sale, saying it had received several bids for its onshore and offshore assets and was finalizing its technical and commercial evaluation. The company had issued a tender for its 14 development leases which cover three concessions in the Nile Delta region and a 26.4% stake in a gas liquids extraction plant in the Gulf of Suez.

Dana was planning to use the proceeds to cover USD 397 mn in outstanding sukuk due at the end of October. Egypt also still owes Dana EGP 111 mn in outstanding payments, and CEO Patrick Allman had previously suggested that the company could offload the outstanding arrears to the eventual buyer of its Egypt portfolio.

El Sisi postpones government’s move to new capital, GEM opening to 2021: President Abdel Fattah El Sisi has postponed to 2021 the inauguration of all national projects due this year, including the planned relocation of government offices to the new administrative capital and the opening of the Grand Egyptian Museum (GEM) due to the covid-19 outbreak, Ittihadiya said. The move to the new capital was scheduled to happen in June and the inauguration of GEM, which the government hopes would help tourism rebound following the outbreak, was expected shortly thereafter. Reuters and the National also had the story.

Local construction companies still went back to work yesterday, but will focus their energy on the new capital and New Alamein and put measures in place to curb the virus. Company representatives agreed to resume work at a meeting on Thursday with Housing Minister Assem El Gazzar, according to Hapi Journal and the local press. The preventive measures include having a Health Ministry official present at all sites and practicing social distancing in closed rooms.

Gov’t to speed up EGP 3.8 bn arrears to contractors to keep work going, but some workers are said to be reluctant: The ministry has promised to pay out EGP 3.8 bn-worth of arrears to contracts under an expedited schedule. There were few details on this, but a first tranche seems to have already been paid out and a second one is due this week, according to press reports. The 4 mn strong sector could face challenges as many workers are reluctant to man their posts, says Shams El Din Youssef, Egyptian Federation For Construction and Building Contractors board member, according to Al Mal.

Construction of phase 4 of Cairo Metro Line 3 is also resuming, Transport Minister Kamel El Wazir said yesterday. Work on the phase had been temporarily suspended for one week last month to deep clean workspaces.

CBE opens EGP 100 bn industry stimulus package to companies of all sizes. The Central Bank of Egypt (CBE) has expanded its EGP 100 bn industry stimulus initiative by scrapping the eligibility limit on a company’s annual revenues, according to a statement (pdf). The package was previously limited to companies with annual revenues between EGP 50k and EGP 1 bn. Companies with revenues of EGP 50k an above are now eligible to apply.

Background: The financing package was expanded recently to include agriculture and agricultural production, fish, poultry, and livestock companies. The package enables these companies to access soft loans, the terms of which the CBE had also updated last month to support the local industry against covid-19.

Cabinet greenlights investor protection fund intervention: The Madbouly Cabinet has approved a proposal from the Financial Regulatory Authority (FRA) to allow the Investor Protection Fund (IPF) to invest up to 10% of its EGP 4 bn funds to stimulate the stock market, according to a FRA official statement. The fund could decide to offload the 10% directly and buy equities, or decide to raise Misr Al Mostakbal Fund’s capital or buy up its securities, he fund's chairman Mamdouh Aboul Azm told Al Mal. The IPF still needs to draft the regulations for its investments and get FRA approval before moving ahead.

Separately, the IPF has allocated EGP 8 mn for brokerage companies and will disburse EGP 20k-100k in cash allowance for each company by mid-April to support their infrastructure costs and subsidize their membership fees.

MOVES- Hassan Ghanem (Linkedin) has been reappointed as chairman and managing director of the Housing and Development Bank for three years, according to Al Mal. He was first given the position of chairman last December, succeeding Mohamed El Sebai.

The Macro Picture

An emerging market credit crisis is looming as an increasing number of countries are struggling to repay their debts amid the economic fallout from covid-19, the Financial Times reports. The scale of the pandemic has triggered widespread funding pressures despite many countries now having more tools to withstand economic shocks than ever before, including heftier FX reserves and more local investors. EMs saw the biggest USD exodus since 2008 last month after investors pulled some USD 31 bn out of EM debt funds, while USD borrowing costs have risen to levels not seen since 2007-08 and the collapse in trade and commodity prices has shrunk USD supply.

EMs were already in a more precarious situation than anyone might have realized: Overall, EM overseas debt had already reached 35% of GDP (without counting China) at the end of 2018. And in frontier markets, the overall debt burden reached a record USD 3.2 tn last year. But a recently-published paper by US academics also indicates that the true ownership of EM bonds by overseas investors may be considerably greater than standard data shows. The paper questions the practice of allocating securities in national accounts based on the residency, rather than nationality, of their issuer. Using a specially-created algorithm, they calculated that US ownership of Brazilian bonds in 2017 amounted to USD 8 bn when based on residency, but USD 68 bn when based on nationality. For Chinese bonds, the increase went from USD 3 bn to USD 55 bn.

The Fed’s repo facility may bring some relief, but it’s no magic bullet: Starting tomorrow, foreign central banks will be allowed to exchange government bonds for overnight USD loans, a move designed to provide countries that don’t have swap lines with the Fed with USD liquidity. This will only provide limited relief though, according to Commerzbank EM analyst Antje Praefcke, who says that not every EM central bank will be in a position to make use of this, and those who can are under too much stress for it to make a tangible difference. Furthermore, although central banks with large FX reserves and Treasury holdings may see real benefits from the repo facility, it won’t do much to alleviate currency pressures because unlike swaps it won’t bolster central bank reserves.

Diplomacy + Foreign Trade

El Sisi talks covid updates with Macron, African leaders: President Abdel Fattah El Sisi joined French President Emmanuel Macron and a number of African leaders in a video conference with the World Health Organization to follow up on the latest covid-19 developments throughout the continent and set priorities for facing the virus, according to an Ittihadiya statement. El Sisi renewed his calls to seek help from international partners and global financial institutions to set effective priorities to fast-track the help needed for African countries through the African Union.

Energy

Egypt and Sudan link energy grids

Egypt and Sudan have connected energy grids with an initial capacity of 60 MW, Reuters reports, citing a statement from Sudan’s Energy Ministry. The connection will be ramped up to 100 MW in a second phase before later reaching its maximum 300 MW capacity. The EGP 509 mn 1k km long electricity interconnection project has been in the works since the governments first agreed upon the network in 2018 but has seen continuous delays as political disputes over the Grand Ethipian Renaissance Dam (GERD) overshadowed its construction.

Scatec Solar secures guarantees for Benban project

Scatec Solar has secured guarantees with the Multilateral Investment Guarantee Agency (MIGA) covering its equity investments in the Benban project, the company said in a statement. The guarantees cover 90% of investments by Scatec Solar for up to 15 years against the risks that it will be unable to legally convert EGP into hard currency and transfer it out of the country. MIGA, a World Bank member, provides guarantees to investors in emerging-market and developing countries to help them protect against political and non-commercial risk.

Manufacturing

EIPICO to begin running its EGP 1 bn third plant in May

The Egyptan International Company for Pharma Industries (EIPICO) will start production on its third plant in May, the local press reports. The factory, based in the Tenth of Ramadan City, cost EIPICO EGP 1 bn and is expected to contribute to the government’s fight against the covid-19 outbreak by producing genetically modified proteins.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Thursday): 9,455 (+0.3%)

Turnover: EGP 926 mn (53% above the 90-day average)

EGX 30 year-to-date: -32.3%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.3%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were El Sewedy Electric up 8.4%, EFG Hermes up 4.5%, and Juhayna up 2.3%. Thursday’s worst performing stocks were Cleopatra Hospital down 4.0%, Kima down 1.8% and Credit Agricole down 1.1%. The market turnover was EGP 926 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -322.6 mn

Regional: Net Short | EGP -13.5 mn

Domestic: Net Long | EGP +336.1 mn

Retail: 37.8% of total trades | 43.4% of buyers | 32.3% of sellers

Institutions: 62.2% of total trades | 56.6% of buyers | 67.7% of sellers

WTI: USD 28.34 (+11.93%)

Brent: USD 34.11 (+13.94%)

Natural Gas (Nymex, futures prices) USD 1.62 MMBtu, (+4.45%, May 2020 contract)

Gold: USD 1,645.70 / troy ounce (+0.49%)

TASI: 6,749.69 (+2.74%) (YTD: -19.54%)

ADX: 3,758.35 (+0.35%) (YTD: -25.96%)

DFM: 1,722.87 (+0.12%) (YTD: -37.69%)

KSE Premier Market: 5,043.20 (-1.28%)

QE: 8,458.32 (+3.21%) (YTD: -18.87%)

MSM: 3,383.45 (-1.21%) (YTD: -15.01%)

BB: 1,329.78 (-0.86%) (YTD: -17.41%)

Calendar

12 April (Sunday): House of Representatives covid-19 recess ends.

12 April (Sunday): Western Easter Sunday.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

13 April (Monday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

15 April (Wednesday): Suspension of international flights to / from Egypt expires.

15 April (Wednesday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.