- 45 Nile cruise passengers test positive for covid-19; total of 48 cases now confirmed. (Speed Round)

- It was a wild end to a wild week in the global equity markets. (What We’re Tracking Today)

- EBRD interested in Banque du Caire stake. (Speed Round)

- A major international bank wants to set up shop in Egypt. (Speed Round)

- European Union imposes tariffs on Egyptian glass fiber reinforcement exports to counter China subsidies. (Speed Round)

- MNHD sells land plot in Taj City to Minka for EGP 1.15 bn. (Speed Round)

- MM Group looks to take Ebtikar, e-payments company public on EGX next year. (Speed Round)

- Global growth could fall to 1% this year -IIF. (The Macro Picture)

- Egypt, Ethiopia continue war of words over GERD. (Speed Round)

- The Market Yesterday

Sunday, 8 March 2020

Egypt has 45 new covid-19 cases

TL;DR

What We’re Tracking Today

Egypt has 48 confirmed covid-19 cases, the Health Ministry confirmed over the weekend, 45 of them passengers and crew on a Nile cruise. Hotels nationwide have been briefed on procedures for staff and guests in the event they think they have a case on their hands. The Minister of Religious Endowments, meanwhile, has said that although cancellation of communal Friday prayers is an option, he’s not yet ready to go down that route. Meanwhile, Egypt and Kuwait have each suspended flights to the other country in a bid to contain the virus.

Government sets up hotline, website: Citizens can dial 105 to report suspected cases of covid-19 or can visit Care.gov.eg for more information on prevention, the virus in Egypt and the government’s response.

The responsible thing to do if you have a cough, runny nose or fever is to quarantine yourself. The New York Times has helpful instructions on that front.

The best thing you can read this morning: What we can learn from the 20th century’s deadliest pandemic by the very smart Dr. Jonathan D. Quick.

SCZone investment conference postponed: The Suez Canal Economic Zone has postponed the investment conference due to take place later this month due to the covid-19 outbreak, it said in a statement yesterday. The event — scheduled for 21-22 March — looked to promote the zone as an investment destination for foreign investors.

We have chapter and verse on the virus’ slow-burn spread in Egypt in this morning’s Speed Round, below.

Globally, we breached 100k cases at the weekend, with 3.4k people now having died as a result of covid-19. The tally on coronavirus cases continues ticking as the virus marked its imprint on at least 90 countries, seven of which have just seen their first cases reported on Friday, Reuters reports.

Containment of the epidemic should be made every country’s top priority, the World Health Organization warned, singling out Iran’s efforts (aka concealment) as an example of exactly what not to do. But the WHO is still holding back from officially declaring a pandemic: “Unless we’re convinced it’s uncontrollable, why [would] we call it a pandemic?” said WHO director-general Tedros Adhanom Ghebreyesus, according to the AP.

Iran has threatened to use force to suspend domestic travel, the Sydney Morning Herald reported. This came after an Iranian health expert warned that up to 40% of Tehran’s 9 mn population could become infected by the end of the Persian month and an advisor to the foreign minister died from the virus.

Italy just locked-down an entire province: Italians living in the populous northern province of Lombardy will not be allowed to enter or exit as the government takes increasingly drastic steps to contain the outbreak, which has so far infected 5,883 people and killed 233, the Guardian reports. All public events will be banned, and people caught trying to enter or exit the province will be fined. The government last week announced that schools and universities across the country will be closed until 15 March and that all Serie A football matches will be closed to the public.

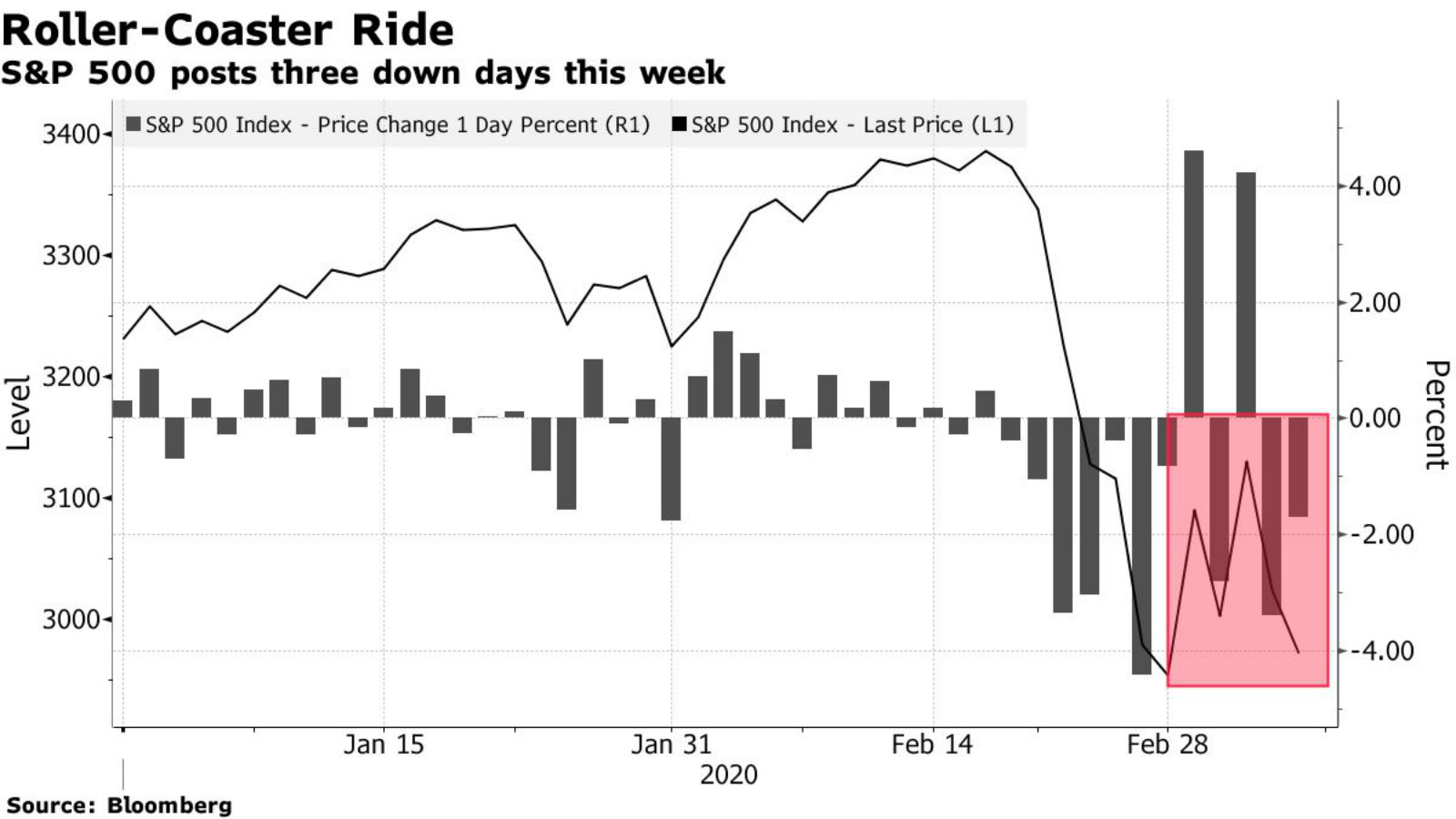

Friday trading was wild as fears of covid-19 again pushed stocks into the red: A last minute rally helped US stocks to claw back some of the losses sustained early on Friday to end a wild week of trading on Wall Street. The S&P 500 finished the day 1.7% in the red having fallen as much as 4% earlier in the day, with 2.4% being added in the final minutes of trading, according to the Financial Times. The late surge was caused by investors not wanting to be out of the market in case there was some good news about containing the covid-19 outbreak, said Max Gokhman, head of asset allocation for Pacific Life Fund Advisors. This drove the VIX index — a measure of share market volatility — to a new nine-year high.

The US bond market continued to make history as yields fell through the floor: The yield on the benchmark US 10-year bond collapsed to as low as 0.66%, having fallen past the 1% handle for the first time in history just two days before. “These low yields are no badge of honor for the bond market,” said Mark Spindel, chief executive officer of Potomac River Capital. “They are indicative of a very downbeat, if not dire, view of the economic outlook.”

We have more figures revealing just how much covid-19 is affecting the Chinese economy: Chinese exports plunged 17.2% in the first two months of the year as the virus outbreak disrupted global supply chains and economic activity, Reuters reports. This compares to a 14% drop predicted by a Reuters poll of analysts.

The virus could cost the global economy USD 2.7 tn in lost output: Drawing on both plummeting consumer sales and slowing industrial operations in China and taking into account disruptions in global trade, supply chains and tourism, the worst of four doom and gloom scenarios conjured up by Bloomberg Economics suggests a USD 2.7 tn loss to the global economy in 2020 if the virus remains on its current trajectory. Losses could potentially be curbed and even recouped in 2Q2020 if rapid containment becomes a reality but given the virus’ spread to less authoritarian countries which would find it harder to shut down an 11 mn person city, that outcome looks unlikely.

Commodities also continue to feel sting as crude takes massive one day hit: Oil prices dropped more than 9% to their lowest level in three years on Friday after Opec and Russia failed to reach an agreement to cut production in response to covid-19, the Financial Times reports. The Russian-led group that has coordinated with the cartel to support oil prices since 2016 dismissed calls by Saudi Arabia to make another 1.5 mn bbl/d in supply curbs in addition to the existing cuts of 2.1 mn bbl/d.

Cue an “all-out oil war”: Saudi Arabia has made the deepest price cuts to its main grades in at least 20 years, launching what Bloomberg is calling an “all-out oil war” in response to Russia’s refusal to play ball. Saudi Aramco slashed its April pricing by USD 4-6/bbl for Asia and USD 7/bbl for the US. Moscow’s refusal to cut its output is being motivated by a desire to wipe out the burgeoning US shale oil industry, Alexander Dynkin, president of the state-run Institute of World Economy and International Relations in Moscow, told Bloomberg.

IN NON-COVID-19 NEWS: Foreign Minister Sameh Shoukry is on a regional tour that see him visit Jordan before heading to Saudi Arabia, Iraq, Kuwait, Oman, Bahrain and the UAE, The ministry said in a statement yesterday. Though the statement is light on details, you can expect the latest developments in our dispute with Ethiopia over the Grand Ethiopian Renaissance Dam to be on the agenda (more on this in this morning’s Speed Round below).

Inflation figures for February will be released on Tuesday, 10 March. Price growth accelerated for the third consecutive month in January, rising slightly to 7.2% from 7.1% in December.

Events coming up this month:

- Our friends at AmCham will host Planning and Economic Development Minister Hala El Said for its monthly luncheon on Thursday, 12 March. El Said will discuss the future of Egypt’s economic development agenda. Members can register for the event here.

- The Annual Export Summit will be held on 24 March at the Nile Ritz Carlton.

Lebanon is set to default on USD 1.2 bn debt: Lebanon will default on its USD 1.2 bn eurobond payment due Monday and will negotiate new payment terms with its creditors, Prime Minister Hassan Diab said yesterday, according to the New York Times. “The reserves of hard currency have reached a critical and dangerous level…It is necessary to use these funds to secure the basic needs of the Lebanese people,” he said in a televised statement, adding that the government will hold talks with its creditors to restructure the rest of its USD 31 bn debt, without providing details. (New York Times | Bloomberg | BBC | FT | The Guardian)

Two prominent Saudi royal family members were detained on Friday for an alleged coup attempt, the Wall Street Journal reports. Prince Ahmed bin Abdulaziz al Saud, brother of Saudi King Salman, and Prince Mohammed bin Nayef bin Abdulaziz al Saud, Salman’s nephew, now face lifetime imprisonment or execution on charges of treason. Both princes have held senior positions in the Saudi royal court and were at one time in line for the throne.

Two people blew themselves up near the US Embassy in Tunisia on Friday in what local authorities are recognizing as a targeted attack on an embassy security patrol, Bloomberg reports.

Egypt’s Amina Ismail wins Reuters Reporter of the Year award: Amina Ismail (LinkedIn) was named reporter of the year 2019 for her work covering Egypt and the wider region.

PSA #1- Clocks spring forward in much of the United States and Canada today as daylight savings time ends. Egypt did away with the spring forward / fall back ritual after a year in which the time changed four times.

PSA #2- If you think it’s hot today, wait for tomorrow. The mercury is set to peak today at 27°C before spiking to 32°C tomorrow — corona killing weather, we’re hoping. Our favourite weather app cautions that we’re looking at cool weather by the weekend with a chance of rain and highs of 18-20°C Friday and Saturday.

PSA# 3- That plastic EGP 10 note isn’t a fake. The Central Bank of Egypt will start rolling out EGP 10 notes made of plastic (much like Canada and Australia). Look for the notes to hit the streets later this year, the CBE Deputy Governor Gamal Negm said.

Enterprise+: Last Night’s Talk Shows

Covid-19 and GERD continued to fill the nation’s airwaves last night: Al Hayah Al Youm’s Lobna Assal reported on the 12 cases that were first tested positive for the covid-19 virus after having been on board a Luxor Nile cruise boat. The number of positive cases had increased to 44 after persons they had come into contact with were also tested, the report noted. They were airlifted to a quarantine facility in a Marsa Matrouh hospital (watch, runtime: 3:07), (watch, runtime: 2:27). Min Masr’s Amr Khalil aired the same report (watch, runtime: 4:48).

Travel to Kuwait on hold: Assal also reported on EgyptAir’s cancellation of flights to Kuwait. The decision comes on the heels of Kuwait’s decision to suspend travel from several countries, including Egypt, for a week starting on 9 March over covid-19 fears (watch, runtime: 0:30). Khalil carried the same report (watch, runtime: 0:59).

GERD talks still contentious: Assal also again reviewed the joint statement by Arab foreign ministers presented at the Arab League to condemn Ethiopia’s latest position over the Grand Ethiopian Renaissance Dam. Sudanese officials had also expressed their “reservations” that Ethiopia’s resolution does not serve their interests and might lead to confrontation (watch, runtime: 4:45). Masaa DMC’s Eman El Hosary also carried the report (watch, runtime: 4:51).

Speed Round

Speed Round is presented in association with

CORONA WATCH- 45 people linked to a Nile cruise test positive for covid-19: Thirty-three passengers and 12 crew members on a Nile cruise ship in Luxor tested positive for covid-19 at the weekend, Health Minister Hala Zayed said at a press conference yesterday. Twelve people from the ship had already been confirmed as infected with the virus, but Zayed said that another 33 had picked it up, bringing the total number of cases to 45. None of the patients displayed symptoms of the virus. A Taiwanese American on board who tested positive on returning home was identified as the original carrier of the virus, she said. There were 171 people on board the vessel, including 101 tourists and 70 Egyptian workers. All positive cases were airlifted to a quarantine facility at a hospital in Marsa Matrouh, Al Masry Al Youm reports.

There are three other cases that have tested positive in Egypt, the minister noted. The first, a Chinese national, was discovered on 13 February and tested negative after 48 hours. Five co-workers and 308 others that had made indirect contact with him were held for 14 days and tested negative. A Canadian oil engineer in the Western Desert tested positive on 2 March. Some 2,555 co-workers and 3,875 direct contacts were held and tested for 14 days, and another 890 possible contacts self-isolated for the same period, all testing negative, the minister said. The third patient is a 44-year-old Egyptian who had returned from Serbia on 5 March, after transiting in Paris for 12 hours. Some 42 potential contacts cases that have come into contact with him have all tested negative.

Some 250k thermal scanners have been purchased for deployment at ports nationwide by Tuesday 9 March, Prime Minister Moustafa Madbouly said at the press conference. There are now eight laboratories across Egypt capable of diagnosing the virus, he said, adding that the state “will not hesitate to take any measures necessary to protect Egyptian citizens.” He said the health, tourism, and aviation ministers will be traveling to Luxor today to assure tourists and citizens alike. He added that Egypt will deal with cases with transparency, following the guidelines of international organizations including the WHO.

We understand that only government labs are going to be doing PCR testing for the virus that causes covid-19 (in keeping with practices in most other countries) despite Speed Medical saying in February that it was importing PCR test kits.

The government is rolling out measures within a week to help mitigate the economic impact on Egypt of the global covid-19 outbreak, Planning Minister Hala Al Said said on the sidelines of the “She Can” conference at the American University in Cairo. She added that it is difficult to estimate the scale of the impact the virus will have on the economy but it is likely to be significant given the volume of trade relations between Egypt and China, and the size of the latter’s output in the global economy.

Greece has reported 14 new cases in the country, 11 of which have links to Egypt and Israel on a religious pilgrimage to holy sites in both countries, Reuters reports. At least five cases in Houston also have links to Egypt, according to local media reports.

Kuwait calls on nationals to evacuate Egypt, suspends flights: The Kuwaiti Health Ministry is calling on Kuwaiti nationals living in Egypt to return home, Al Masry Al Youm reports. The Kuwaiti Cabinet decided in an emergency meeting to suspend flights to Egypt and six other countries for a week, the state news agency KUNA reported. The list comes in addition to a prior suspension placed on flights from China, Hong Kong, Iran, South Korea, Thailand, Italy, Singapore, Japan and Iraq.

Saudi Arabia has called on those traveling to the kingdom from Egypt to self-quarantine for 14 days, the New York Times reports on Saturday, citing the country’s Health Ministry. The request was also made to travelers coming from Italy, Lebanon and South Korea. Saudi Arabia had suspended the Umrah pilgrimage for locals and residents over covid-19 on Thursday.

Hotels will be ramping up preventative measures in response to the most recently detected outbreak aboard the Nile cruise, Ahram Online reports. Abdel Fattah El Assi, head of the Tourism Ministry department responsible for hotels and resorts, said the government has made sure to distribute World Health Organization leaflets on the virus which include precautionary measures to help prevent spread.

The story is leading the conversation on Egypt in the foreign press this morning: AP | Reuters | Bloomberg | NYT | Washington Post | The Guardian | Russia Today.

PRIVATIZATION WATCH- EBRD still interested in Banque du Caire stake: The European Bank for Reconstruction and Development has joined the Sovereign Fund of Egypt and Abu Dhabi Development Holding as the latest to show interest in Banque du Caire’s planned IPO on the EGX, Bloomberg reports, quoting unnamed sources. Janet Heckman, former managing director for the Southern and Eastern Mediterranean at the development bank, told Enterprise back in 2018 that among companies listed in the state privatization program BdC was of particular interest to the bank. The EBRD declined to comment on the latest story. Informed sources told local media last week that the SFE and ADDH are looking to acquire a stake in the company during the IPO.

Background: BdC is targeting to raise some USD 500 mn from an offering that is planned to hit the market in April, although guidance on timing emerged before the covid-19 market meltdown began in earnest. Unnamed sources had said a decision on the timing would be reached in two weeks. The offering will see 20-30% of the banks’ total shares sold on the exchange, the majority of which will be earmarked for so-called ‘anchor investors.’ A single investor will not be permitted to own more than 5% of the bank, Chairman Tarek Fayed said in a recent interview cited by Bloomberg.

Major international bank seeks entry into Egypt: An unnamed “major” international bank has approached the Central Bank of Egypt (CBE) to acquire a banking license, Deputy Governor Gamal Negm said on the sidelines of an ongoing forum held by the Union of Arab Banks in Hurghada, according to Al Masry Al Youm. Negm provided no further details.

Why we’re keeping a close eye on this: The CBE has since the late 1990s and early-to-mid 2000s refused to issue new licenses, pointing potential market entrants — foreign and domestic — to acquisition targets from among Egypt’s nearly 40 licensed banks. This could change — central bank governor Tarek Amer said in 2018 that the CBE is considering a rule change that could see it offer a limited numnber of new licenses to international banks wanting to enter the Egyptian market.

Could the new entrant be “a specialized bank”? The CBE will likely only grant new licenses to so-called “specialized banks,” says Fitch Ratings’ Zeinab Abdalla. This is because out of the 39 banking licenses in the country, only three are for bankers who work with certain subsets of clients, including SME owners, creating a larger market need for those types of dedicated services. The commercial space is also dominated by giants including National Bank of Egypt, Banque Misr, and CIB, Abdalla added.

Background: The CBE is currently studying new licenses for SME-focused lenders and digital banks, both of which will be exempted from the new capital requirements in the proposed Banking Act, a senior official told us last month. The capital requirements for those banks would be set on a case-by-case basis, but will not be subject to the EGP 5 bn floor applied to commercial banks.

Banks are now required to set up departments to oversee financial inclusion strategies and advise the Central Bank of Egypt’s (CBE) own financial inclusion unit, the CBE said on Thursday (pdf). State-owned and private banks, as well as branches of foreign banks, will get those departments to lay down three- to five-year strategies to bring more people to the banking sector, increase outreach, tweak products to meet the needs of unbanked segments of the population (with a focus on women and youth), and increase financial literacy.

European Union imposes tariffs on Egyptian exports to counter China subsidies: An EU tariff of 8.7% on Egyptian glass fiber reinforcements took effect yesterday as part of an attempt by the bloc to crack down on government-supported Chinese manufacturers, according to Bloomberg. The move is meant to counter alleged subsidies to Jushi Egypt for Fiberglass Industry, a subsidiary of Chinese giant Jushi Group that had set up shop in the Suez Canal Economic Zone in 2012.

Background: European glass-fiber manufacturers have claimed to have suffered “material injury” due to what they described as trade-distorting Egyptian government incentives for Jushi Egypt, including an exemption from value-added tax and import tariffs. Egypt’s share of the European market for glass fiber reinforcements almost tripled to 14% between 2016 and 2018 while China’s share fell to 5% from 8%.

MNHD sells land plot in Taj City to Minka for EGP 1.15 bn: Madinet Nasr Housing and Development (MNHD) has sold a 114.5k sqm land plot in its Taj City project to Sallam family-owned Minka Real Estate Investment for EGP 1.15 bn, according to a regulatory filing (pdf). Minka will develop fully finished residential units, which MNHD does not currently offer in Taj City. MNHD said that the move is part of plan to “faster monetize its land bank.” “Our partnership with MNHD through our land acquisitions in Taj City’s CBD has proven very successful with the launch of The Hoft,” Minka CEO Abdalla Sallam said. “The superb location of Taj City along with the help of MNHD’s management team has encouraged us to establish yet another development inside Taj City.”

IPO WATCH- MM Group looks to take Ebtikar, e-payments company public on EGX in 2021: Industry and trade group MM Group is considering launching its non-banking financial services company Ebtikar and an undisclosed e-payment company it recently established on the the EGX in 2021, the local press reports. Ashraf Al Ghannam, the director of investor relations at MM Group, said their smart payments providers Bee and Masary will be merged and brought under the fold of the unnamed e-payments company, which will act as the company’s e-finance investment arm, according to the report, which provided no further details.

Egypt is falling behind when it comes to using fintech apps and mobile service payments: Egypt ranked 45 out of 46 countries in the use of banking and financial service apps, placing us above last-place Morocco, in We Are Social’s 2020 Digital report. Only 17% of internet users between the age of 16 and 64 in Egypt reported using these apps on a monthly basis, compared to 65% in Thailand — the highest-ranking country in this category. A meagre 11% of Egyptians in the same age bracket use mobile payment services, and our credit card penetration rate is only 3%.

But we’re nearing the top when it comes to e-commerce and ride-hailing apps — and we love Facebook comments. The report estimated that 3.8% of GDP per capita was used on e-commerce platforms, ranking Egypt 3 out of 44 countries, following China at 10.4% and South Korea at 4.6%. As for the use of ride-hailing apps, Egypt and South Africa both came in at 11 out of 45 countries, with 23% of internet subscribers using these apps. Indonesia came in first, followed by Singapore and Brazil. And of course, our love of El Face shines through, with the median monthly number of Facebook comments per user placing us at the second highest spot in the ranking.

Egypt reviews customs controls to aid SMEs: The Finance Ministry is reviewing Authorised Economic Operator Program conditions to allow for more SMEs to enjoy the benefits of the Green Path System in ports and customs outlets, according to a ministry statement. It is also considering providing whitelisted importers with field logistics coordinators, available outside of office hours, to assist with completing customs release procedures. The Green Path System was implemented in November to reduce time and cost of customs releases, and improve Egypt’s ranking in the World Bank’s trading across borders ranking.

The gov’t is also seeking to implement ACI pre-registration systems at Egypt’s ports to facilitate customs procedures, it said in a cabinet statement last week, as Chinese goods with incomplete paperwork have been piling up at Egypt’s ports as a result of the covid-19 outbreak. The newly revised Customs Act, which would expedite clearance through a white list of importers, among other things, is currently with the House of Representatives and expected to come into effect in 1H2020.

Four more foreign companies want to participate in Egypt’s upcoming gold mining tender, according to an Oil Ministry statement. The leaders of Canada’s Forbes & Manhattan Group and Franco-Nevada Corporation, as well as US-based giants Newmont Corporation and Barrick Gold, have shown enthusiasm in meetings last week with Oil Minister Tarek El Molla, who was at the PDAC mining conference in Toronto earlier this month drumming up interest. The companies join a growing list of potential investors including Centamin, US-based Sprott and Canada’s Kinross Gold. The ministry plans to launch on 15 March gold exploration tender covering 56 sqm of the Eastern Desert.

Egypt, Ethiopia continue war of words over GERD: Egypt has lashed out at a statement issued by Ethiopia’s Foreign Ministry that criticized the Arab League for backing Cairo in the dispute over the Grand Ethiopian Renaissance Dam (GERD). In a resolution last week, Arab foreign ministers rejected any unilateral moves taken by Ethiopia, calling Egypt’s access to water “an integral part of the Arab national security,” a stance that was denounced by the Ethiopia, which expressed “dismay” at what it described as the Arab League’s “blind support” for Egypt’s “hegemonic posturing.” In response, the Egyptian Foreign Ministry yesterday accused Ethiopia of levelling an “unacceptable insult” against the league’s member states and said that its decision to start unilaterally filling the dam “proves beyond doubt Ethiopia’s bad faith and lack of political will to reach a just and balanced agreement.”

Sudan is not on board with the Arab League declaration: Sudanese officials expressed “reservations” that the resolution does not serve its interests and might lead to an Arab-Ethiopian confrontation, sources told state-run news agency MENA, according to Ahram Online. Two days after the resolution, Ittihadiya announced that President Abdel Fattah El Sisi had exchanged words with the head of Sudan’s governing council Abdel Fattah Al Burhan, but gave away little in its statement.

Ethiopia has recalled its ambassadors from Egypt and Sudan but insisted that move was unrelated to the GERD dispute, it said in a statement picked up by Al Masry Al Youm.

Tensions have risen over Ethiopia’s megaproject in recent days after Ethiopia skipped talks in Washington at the end of last month, saying that it needed more time to consider the agreement. Egypt, which initialled the accord in Ethiopia’s absence, expressed “deep dissatisfaction and rejection” with Addis Ababa’s position on the talks after the meeting, and warned that it would use “all available means” to defend its interests if the talks fell through.

MOVES- Trade Minister Nevine Gamea has tapped Roba Galal as the acting head of the Export Development Authority, reports Youm7. Galal currently heads the Egypt Expo and Convention Authority’s (EECA) finance and administration department.

The Macro Picture

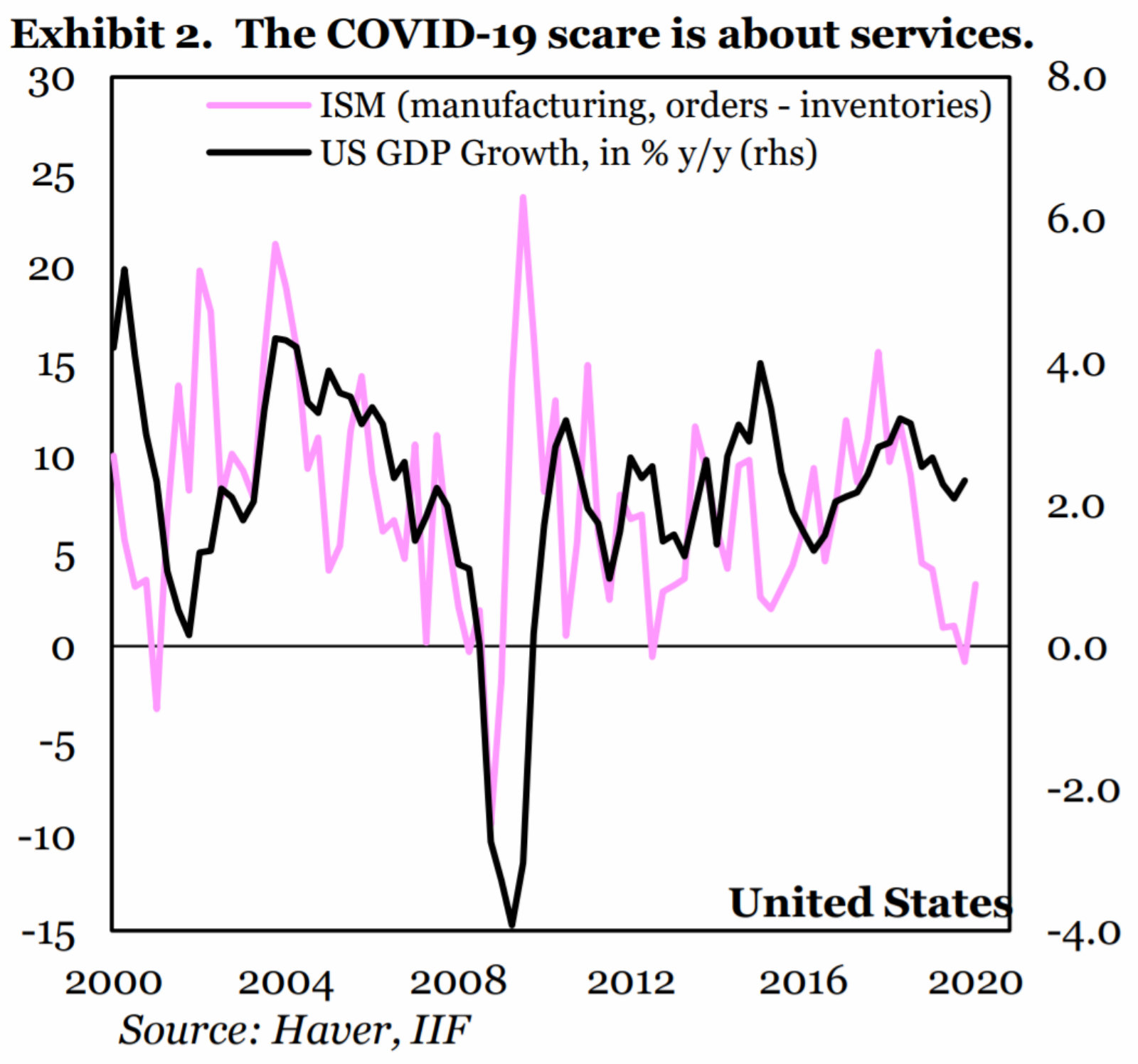

Global growth could fall to 1% this year -IIF: Global economic growth could fall to just 1% this year due to the impact of the covid-19 outbreak on the services and manufacturing sectors, the International Institute of Finance (IIF) has said. In a report published on Thursday, the financial association said it has lowered growth forecasts for the US economy to 1.3% in 2020 (down from 2% previously) and to less than 4% for the Chinese economy (from 5.9% previously). This could result in global growth of just 1% through the rest of the year, more than two times lower than the 2.6% achieved in 2019 and the lowest since the financial crisis.

Manufacturing clearly hit, effect on services still unclear: The IIF is reconsidering its ‘no recession’ prediction made last year when it became clear that the cause of the manufacturing slowdown was rooted in inventory overhang rather than supply chain disruptions. The virus has radically changed the outlook for the sector which is now suffering from a serious supply shock. But the true extent of the fallout will depend on the services sector, “where the severity of effects depends on the scale of contagion and resulting containment measures,” the IIF wrote.

The pressure on emerging markets is increasing, but Fed emergency cut provides cover for further easing: Emerging markets central banks taking cues from the US Federal Reserve could cut rates without risking devalued currencies, the IIF says. This is important in “high carry, low growth” countries such as Mexico and South Africa, but also holds true in other places. After the Fed’s dramatic 50 bps emergency cut last week, coordinated easing could prove a key tool to maintain EM growth and support the global economy.

The situation is still highly uncertain: “The range of potential outcomes is large and depends on the spread of the virus and resulting economic fall-out, all of which are highly uncertain at this stage,” the IIF wrote. “ The range of possible outcomes is large and uncertainty around any

forecast bigger than under normal circumstances.”

Egypt in the News

The discovery of 45 cases of covid-19 on a Nile cruise ship in Luxor at the weekend is leading the conversation in the foreign press. We have chapter and verse on this in this morning’s Speed Round, above.

Diplomacy + Foreign Trade

Prime Minister Moustafa Madbouly met on Thursday with Hamid Mamdouh to discuss his campaign to run for the director-general of the World Trade Organization (WTO), according to a statement. Mamdouh (LinkedIn) is aiming to get the support of African and Arab countries to back his position for the role. He has 27 years of experience in the field and is now the senior council for US law firm King and Spalding after previously being the director of the WTO’s Trade in Services and Investment Division.

Energy

Pharos Energy confirms interest in Shell’s Egypt assets

Pharos Energy has confirmed its interest in purchasing Shell’s onshore oil and gas assets in Egypt’s Western Desert as part of a consortium, and has said in a filing to the London Stock Exchange it is in the initial stages of evaluation. The interest doesn’t necessarily guarantee that a proposal will be made to Shell or that a transaction will take place, the company said. We took note of the story late last month.

Infrastructure

Korea’s CGN tapped to manage Borg El Arab port

Korean infrastructure company CGN is being considered to manage the dry port at Borg El Arab, the local press reports. Chairman of the Commission for Dry Ports Amro Ismail said that the company has submitted a proposal to manage the dry port, constructing railway links to distribution routes. The report did not provide a value or timeline for the transaction, except to say it was targeting completion this year.

Banking + Finance

Legislation + Policy

New Retail Stores Bill comes into effect, shop owners told to comply

The recently ratified Retail Stores Bill, which imposes new licensing rules on the retail sector, took effect over the weekend after Prime Minister Moustafa Madbouly issued a decree, according to a cabinet statement. The decree allows shops to continue operating under valid licenses and grants them two years to comply with the new rules. The law passed the House of Representatives last summer.

On Your Way Out

Djoser pyramid reopened to public after restoration: Egypt reopened the 4,700-year-old step pyramid of Djoser to the public on Thursday following years of restoration work, AFP reports. The pyramid is believed to be Egypt’s oldest, and dominates the Saqqara necropolis. Work to restore the pyramid, which suffered from interior damage during a 1992 earthquake, began in 2006, but was interrupted in 2011 and 2012 before resuming in 2013, the Antiquities Ministry said. The work covered the pyramid’s outer facades, internal corridors, and a stone sarcophagus and stairs at two entrances, the Guardian reports.

The Market Yesterday

EGP / USD CBE market average: Buy 15.56 | Sell 15.69

EGP / USD at CIB: Buy 15.59 | Sell 15.69

EGP / USD at NBE: Buy 15.58 | Sell 15.68

EGX30 (Thursday): 12,348 (+1.4%)

Turnover: EGP 618 mn (5% above the 90-day average)

EGX 30 year-to-date: -11.6%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.4%. CIB, the index’s heaviest constituent, ended up 1.3%. EGX30’s top performing constituents were Heliopolis Housing up 4.1%, Orascom Investment Holding up 4.0%, and Palm Hills up 3.3%. Thursday’s worst performing stocks were Juhayna down 3.9%, Orascom Development Egypt down 1.0% and Orascom Construction down 0.8%. The market turnover was EGP 618 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -65.8 mn

Regional: Net long | EGP +4.4 mn

Domestic: Net long | EGP +61.5 mn

Retail: 50.1% of total trades | 51.8% of buyers | 48.4% of sellers

Institutions: 49.9% of total trades | 48.2% of buyers | 51.6% of sellers

WTI: USD 41.28 (-10.07%)

Brent: USD 45.27 (-9.44%)

Natural Gas (Nymex, futures prices) USD 1.71 MMBtu, (-3.16%, April 2020 contract)

Gold: USD 1,672.40 / troy ounce (+0.26%)

TASI: 7,467 (-0.76%) (YTD: -10.99%)

ADX: 4,646 (-0.57%) (YTD: -8.52%)

DFM: 2,460 (-0.76%) (YTD: -11.01%)

KSE Premier Market: 6,390 (-0.95%)

QE: 9,309 (+0.68%) (YTD: -10.71%)

MSM: 4,107 (+0.15%) (YTD: +3.18%)

BB: 1,617 (-0.72%) (YTD: +0.47%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit

5-8 March (Wednesday-Saturday): 25 Egyptian companies will participate in a forum on investment in startups in Saudi’s King Abdullah Economic City.

6-8 March (Friday-Sunday): Arab Banking Forum, for heads of risk management in Arab banks, organized by the Union of Arab Banks,with the Central Bank of Egypt and the Federation of Egyptian Banks.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21-22 March (Saturday-Sunday): An international conference to market investment prospects in the Suez Canal Economic Zone, Al Galala City, Egypt

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.