- HHD to pause share sale plans after finding no bidders for 10% stake + management rights. (Speed Round)

- Your smoking habit is about to get more expensive. (Speed Round)

- Global stocks had their worst day in two years as covid-19 outbreak fuels worries over economic growth. (What We’re Tracking Today)

- House approves data protection, consumer credit acts + amendments to anti-terrorism act. (Speed Round)

- UAE’s FAB to decide on Bank Audi Egypt purchase in 2Q2020. (Speed Round)

- Investors want the gov’t to liberalize the energy market for manufacturers. (Speed Round)

- A locust swarm is slowly brewing on the Southeastern Red Sea coast. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 25 February 2020

It’s a packed news day no matter how you cut it

TL;DR

What We’re Tracking Today

We have a packed issue for you this morning thanks to a busy news day both here at home and abroad.

But first, a PSA- You’ll want to check the roads and for an email from your kids’ school before setting out on your morning commute. Education Minister Tarek Shawki has canceled classes today for schools and universities as cities including Cairo bail out from the torrential downpour, according to a cabinet statement. Some major arteries and many side streets in the capital city remain flooded this morning. Footage circulating on social media yesterday also showed cars struggling to make their way through the floods in some areas of the city. If it were up to us, external meetings would be cancelled today, too.

We usually laugh when the meteorologists refer to the weather as “unstable,” but that’s what it’s going to be today: A chance of rain early this morning giving way to cloudy with sunny periods, then sunny skies, then another chance of rain. Look for a high today of 18°C.

LOCAL STORY OF THE DAY #1- State-owned Heliopolis Housing announced yesterday it received zero offers in its tender for a private investor to buy a 10% stake with management rights, dragging down the company’s share price and that of several other real estate companies.

LOCAL STORY OF THE DAY # 2- Your smoking habit is about to get more expensive (yes, again) thanks to newly-approved hikes in sin tax. We have the full breakdown in this morning’s Speed Round. With the self-righteousness that only former smokers who are simultaneously econ nerds can muster, we agree wholeheartedly.

MPs also passed a number of key business-related laws yesterday into which many of you will want to dig deeper. We have chapter and verse on all of this and more in this morning’s Speed Round.

Oh, and for once we find ourselves in agreement with Amr Adib after the voluble talkshow host and lesser half of the Lamees-and-Amr duo suggested last night that he couldn’t quite figure out why Egypt is resuming flights to China in the midst of the covid-19 outbreak, which has led most other major airlines suspending flights there (watch, runtime: 2:13). We have more on El Corona just below:

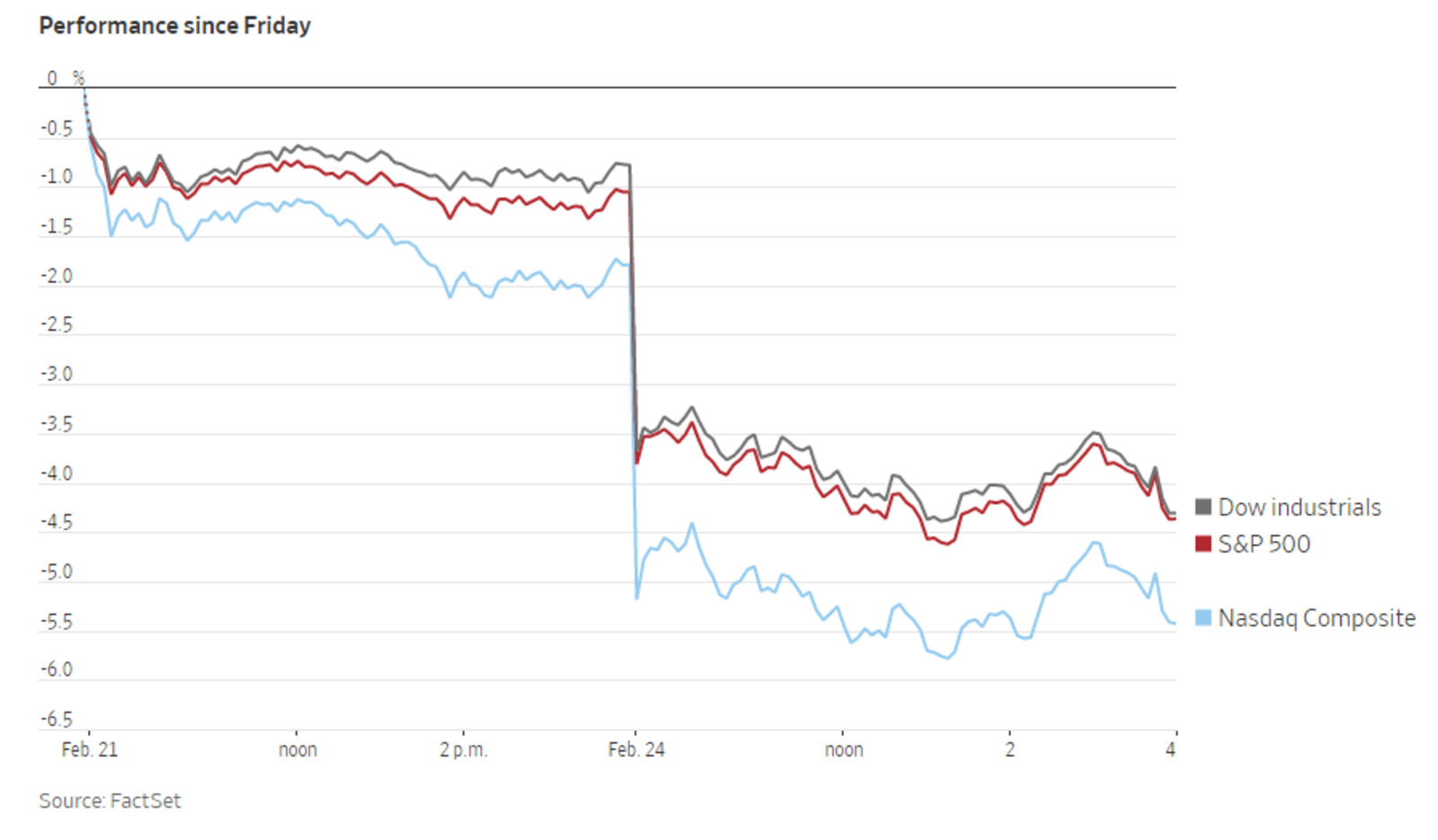

GLOBAL STORY OF THE DAY #1- Global stocks had their worst day in two years. The covid-19 outbreak sent markets into a tailspin yesterday as investor concerns the virus will hit global growth escalated. Investors everywhere turned away from equities and oil and toward safe haven gold and bonds as the rising number of covid-19 cases beyond China and the Italy lockdown are raising alarms, says the Financial Times.

Asian markets are down again this morning and the S&P 500 closed down 3.4% yesterday, its biggest one-day fall since 2018, and led the FTSE All-World index to lose 3.3%. Europe’s continent-wide Stoxx 600 also plummeted 4,2%, and the UK’s FTSE 100 3.3% at session close. Gold gained 1.7% to reach a seven-year high, but erased gains to close in the red.

Energy stocks were the biggest losers as they suffered from a ripple effect caused by weakening oil prices. Oil slid into bear territory ever since the outbreak intensified earlier this month. Tech stocks weren’t much better off, with semiconductor giant AMD’s shares ending 7.8% in the red.

Egypt has no new cases, but the global total now exceeds 80k, with epidemiologists now worrying that Iran presents a global threat and a “recipe for a massive viral outbreak.” New cases in the UAE, Bahrain, Kuwait, Oman, Lebanon and Canada have been linked to Iran.

The World Health Organization said yesterday that it is unsure whether the virus’ spread to new countries can be stopped at this point, but still refuses to call it a global pandemic, according to the WSJ.

One thing to keep in mind: Nobody really knows how bad it could get for the global economy. As the Journal reminds us: “estimates of the epidemic’s impact on the global economy are largely educated guesses.”

Other covid-19 developments:

- Chinese imports still held up in Egypt: Chinese household appliance prices have inched up 5-10% over the past few weeks as imported goods from Beijing are piling up at Egypt’s ports, according to the vice president of the household appliances division at the Cairo Chambers of Commerce, Fathi El Tahawy. The government is still reviewing requests from last week to release the imports being held up due to paperwork delays from China caused by the outbreak of coronavirus.

- Kuwait, Bahrain, and Iraq have each confirmed cases of covid-19, linking the infections to people associated with Iran, such as those returning from visiting Mashhad, a Muslim pilgrimage site in northeastern Iran, according to Bloomberg. Kuwait has confirmed three cases, while Bahrain and Iraq each have one case of the virus.

- Iran has denied allegations from a lawmaker on Monday that 50 people have died in the city of Qom from the covid-19 virus this month, according to the Associated Press. The government says that a total of 12 people have died and 60 cases have been reported.

You’ll find plenty of coverage here: Reuters | Financial Times | Wall Street Journal | New York Times | CNBC | Bloomberg

GLOBAL STORY OF THE DAY #2 — A New York court found producer Harvey Weinstein guilty on two charges — including [redacted] intercourse without consent — but acquitted him of more severe charges, which would have potentially earned him a life sentence in prison, Reuters reports. Weinstein also faces dozens of civil lawsuits from women accusing him of assault.

El Molla to announce Eastern Desert gold exploration tender details today: Oil Minister Tarek El Molla is set to announce the details of the upcoming international gold exploration and mining tender and Egypt’s mining strategy at a presser today, Youm7 reports, citing sources from the Egyptian Mineral Resources Authority (EMRA).

The government will start accepting bids for the tender during the first half of March, an official at EMRA said earlier this week. The tender has drawn interest from industry players Centamin and Sawiris’ La Mancha following the amendments made to the Mineral Resources Act that has drawn praise for being positive for investors.

News of a GERD agreement this weekend? Delegations from Egypt, Ethiopia, and Sudan will be in Washington on Thursday and Friday for what is hoped to be a final round of Grand Ethiopian Renaissance Dam (GERD) talks, cabinet said yesterday. A draft agreement on the rules for the filling and operation of the dam prepared by the US and the World Bank, who are mediating the dispute, reportedly made its way to the three countries’ top officials. The agreement has been expected to be sealed by the end of the month, but US Secretary of State Mike Pompeo suggested last week that it could take more time as a “great amount of work remains.”

International Cooperation Minister Rania Al Mashat is in Washington, DC, today to meet with World Bank officials and members of the US administration. Al Mashat will hold talks with World Bank President David Malpass, head of the Egyptian American Enterprise Fund James Harmon, and US Development Finance Corporation President Adam Boehler to discuss the activities of US companies operating in Egypt, reports Al Mal.

Defense Minister Mohamed Zaky is in Pakistan for several days, where he is set to meet with government and defense officials to talk military cooperation, according to Al Shorouk.

Egypt to host Arab Forum for Tourism Media: Some 40 journalists from 14 Arab countries will be in town from tomorrow to promote tourism in Egypt, according to Al Shorouk. Awards will also be granted to top Egyptian journalists.

Former President Hosni Mubarak is in the ICU after undergoing surgery last month, his son Alaa said on Twitter. The Mubarak family lawyer Farid El Deeb said on Sunday that the former president is in stable condition (watch, runtime: 7:34).

FinMin scraps auction as treasury yields climb after MPC decision to hold rates: The Finance Ministry has called off a treasury bill auction after investors asked for high yields on 91-day treasuries in the first sale after the decision by the central bank’s Monetary Policy Committee to hold interest rates last week, according to a local press report. The ministry accepted only 17% of bids it received in a separate auction for 265-day bills.

Average yields on 91-day treasuries climbed by 0.29% to 14.142% from last week’s auction. The lowest accepted yield in yesterday’s sale was 13.5%, up from 13% in an auction held right before the interest rate decision.

Coming up next week:

- Our friends at EFG Hermes are holding their annual One on One conference on 2-5 March at Atlantis, Dubai. The gathering is the world’s largest frontier- and emerging-market-focused investor conference.

- Business Today’s bt100 awards ceremony (pdf) takes place on Tuesday 3 March.

- The two-day Women Economic Forum (pdf) gets underway on Wednesday, 4 March in Cairo.

- The Union of Arab Banks will hold a three-day forum for risk officers on 6-8 March in Hurghada.

- A one-day investment conference for the Suez Canal Economic Zone will take place on Saturday, 7 March.

Located on the North West Corner of Somabay, lies Mesca Beach, stretched out onto 1.5km of silky sand. Mesca Beach is best known for its big tidal changes, shallow sandy waters and mounds of mangroves, in addition to the 7Bft Kite House, famously known as one of the best surfing spots on the planet. Combining luxury and adventure, the beach will be welcoming its very own Mesca Hotel, making its debut later this year.

Located on the North West Corner of Somabay, lies Mesca Beach, stretched out onto 1.5km of silky sand. Mesca Beach is best known for its big tidal changes, shallow sandy waters and mounds of mangroves, in addition to the 7Bft Kite House, famously known as one of the best surfing spots on the planet. Combining luxury and adventure, the beach will be welcoming its very own Mesca Hotel, making its debut later this year.

Private equity returns struggle to keep up with US bull market: Returns on US equities have topped those of PE funds over the past 10 years, the first time this has happened over a decade-long period. A study from Harvard economist Josh Lerner and consultancy firm Bain & Co. shows that S&P 500 investors have made a 15.5% return over the 10 years to June 2019, compared to 15.3% for private equity. The Financial Times has more.

A locust swarm is slowly brewing on the Southeastern Red Sea coast. A small cluster of adult locusts have been coalescing along the Southernmost coastal regions in Egypt that the FAO warns might pose great risk in the near future if left uncontrolled. Massive swarms of locusts have already been making their way through Kenya since December threatening mns, as they descend upon villages threatening food safety, agriculture and the region’s economy at large, the New York Times reports. The locusts can travel more than 80 miles a day and consume the equivalent of what 35,000 people do in a single day, currently threatening the livelihoods of 20 mn people across Ethiopia, Kenya, and Somalia with the risk to surrounding nations growing as the swarms reproduce. In addition to food supply, tourism to national parks and protected zones — for which other communities rely on as their main source of income — is also coming under threat.

Enterprise+: Last Night’s Talk Shows

Yesterday’s torrential downpour pushed other news stories to the sidelines last night. Television power couple Lamees Al Hadidi (Al Kahera Al Aan, watch, runtime: 10:26) and Amr Adib (El Hekaya, runtime: 7:26) both took note of the Zamalek FC not making it to the Cairo derby as a result of the rain.

Another topic of interest was the Grand Ethiopian Renaissance Dam as Egypt, Ethiopia and Sudan are expected to sign an agreement by the end of the month after taking off to Washington on Thursday to hash out the final sticking points. Al Hayah Al Youm’s Lobna Assal (watch, runtime: 0:40) and Adib (runtime: 3:45) both took note.

New tobacco taxes will not increase prices, MP claims: Amendment to the VAT Tax Act that raised taxes on cigarettes by between EGP 1-3 per pack are unlikely to lead to any increase in prices as vendors have already been charging higher prices, House Budgeting Committee deputy chair Rep. Yasser Omar told El Hadidi (watch, runtime: 4:01). The result of such “retail greed” was EGP 6 bn going into the pockets of merchants instead of to the state, Omar added. We have chapter and verse on the new taxes in Speed Round, below.

Is it a good idea to postpone your next car purchase? That’s what the self-appointed Let It Rust campaign is claiming (not that they have any interest in the question…). A new wave of car price drops is expected within the next three months as a result of the EGP appreciation, Let it Rust campaign spokesperson Mohamed Shetta tells Adib (watch, runtime: 4:49). (We suggest you not try holding your breath waiting for that to happen.)

Speed Round

Speed Round is presented in association with

PRIVATIZATION WATCH- HHD to pause share sale plans after finding no bidders for 10% stake + management rights: State-owned Heliopolis for Housing and Development (HHD) is preparing an “alternative plan” to offer a 10% stake and management rights to a private investor, saying it didn’t receive any offers on Sunday, the deadline for any interested parties, according to a regulatory filing (pdf). HHD has a contingency plan for this scenario, Managing Director Sahar El Damaty told Enterprise without elaborating.

What went wrong? The apparent lack of interest could be an indication that there’s a lack of liquidity among real estate players, real estate analyst Ahmed Ezzeldin told Enterprise, or that some parties had been interested, but ultimately decided they couldn’t deliver on HHD’s requirements.

There are conflicting accounts of whether or not anybody bid on the tender: HHD said in its filing that it didn’t receive any offers, but sources in the investment banking community with whom Enterprise spoke said it is widely believed that SODIC, BPE Partners and Palm Hills actually did submit offers. The three companies, along with Saudi’s Dar Al Arkan, had widely been expected to make bids in the tender after purchasing the conditions booklet, El Damaty told Enterprise previously. The contradicting accounts have sown confusion in the market, Pioneers Holding analyst Mohamed Gaballah told us.

The news hit real estate shares on the EGX yesterday. HHD plunged 9.7% to close at EGP 17.01, according to EGX data. The company’s share price could drop to as low as EGP 14.70 if it breaks the EGP 17 barrier, Naeem Securities’ head of technical analysis Ibrahim El Nemr tells Reuters. SODIC’s shares dropped 4.7% to close at EGP 12.34, and Palm Hills shares were trading at EGP 1.41 apiece by market close, down 5.2%. The debacle also dragged down other real estate shares, including Talaat Moustafa Group (-2.9%), Orascom Development (-6.8%), and MNHD (-3.76%).

So, what’s next? Analysts suggest that HHD could move ahead with a secondary offering on the EGX. The company had been planning to sell a 25% stake — including 10% to a strategic investor and 15% on the bourse — and could simply scrap the strategic investor part of that plan, Naeem Holdings analyst Mohamed Nabil tells Masrawy. Nabil says it’s unlikely that HHD will re-issue the tender under different terms, but could simply decide to increase its joint projects with private sector players.

There could be another route toward private-sector involvement: Amendments to the Public Enterprises Act, which cabinet is currently preparing, would remove listed companies in which the government owns a 75% stake from the legislation and would bring them within the scope of the Companies Act instead. The law in its current form only applies that stipulation to companies the government holds a 50% stake in. “The whole point of the secondary offering was to cut the government’s current 72% stake in HHD to below 50%” so that the company would be governed by the Companies Act, El Damaty said.

Why does the legislation matter? If the amendments are passed by cabinet and the House of Representatives, HHD would be considered a private corporation, thus giving its general assembly more flexibility to deliver results.

Where the legislation currently stands: The government was split on expanding the purview of general assemblies, Public Enterprises Minister Hisham Tawfik had said. Tawfik has lobbied for the legislation to be approved, saying that it’s necessary to be able to “change incompetent management.”

LEGISLATION WATCH- Amendments to VAT Tax Act raises sin tax on tobacco products, imposes brand new taxes on e-cigs: Official tobacco prices will climb by varying rates on the back of amendments to the VAT Tax Act given a final nod by the House of Representatives yesterday, reports Masrawy. The end price of cigarettes and shisha tobacco, as well as e-liquids and heated tobacco used in vapes, have all increased, according to an official House report obtained by Enterprise (pdf).

Cigarettes: The changes changes tax bands for pre-rolled cigarettes — and tack additional flat taxes for all three bands. In addition to fixed tax rate hikes, cigarettes will still be subject to a 50% “schedule tax” stipulated by the VAT law and calculated on the final price. That will see cigarette prices EGP 1-3 as a result of the base hikes alone. The new fixed tax rates will be as follows:

- The fixed rate for the first bracket will rise to EGP 4 from EGP 3.50 for cigarette brands sold in shops at less than EGP 24, up from a previous ceiling of EGP 18;

- The rate for the second bracket will increase to EGP 6.50 from EGP 5.50 for brands prices EGP 24-35, up from EGP 18-30;

- The rate on third bracket brands will climb to EGP 7 from EGP 6.50 for brands sold at more than EGP 35, up from EGP 30.

By way of background: We noted the amendments in an exclusive we ran back in July, with only minor changes made in the final tax rates passed yesterday. At the time, the changes were already approved by the cabinet economic group and were set to pass the House in October. They were stalled to contain inflation, government sources told us then.

Higher shisha, new e-liquid, Heets taxes: A new tax of EGP 2 per ml will be applied to e-liquids (which are used for vapes), regardless of nicotine content. Burned tobacco, such as the Heets brand used for devices such as tobacco heating system IQOS, will meanwhile incur a new tax of EGP 1.4k per kg. A 165% schedule tax will also be applied to locally produced shisha tobacco, up from 150%, while imported varieties will be taxed at 200%, up from 175%.

State coffers to bring in an additional EGP 9 bn: The increased rates will help the government increase sin tax revenues by up to EGP 9 bn in FY2019-2020, the parliament report notes. Tobacco taxes came in at EGP 58.6 bn in FY2018-2019.

Shops can no longer set their own prices for smokes: Tobacco stores and kiosks are now required by the Tax Authority to post a standardized price list, according to a statement by the authority. Vendors have been illegally overcharging consumers since the government last hiked the sin tax in 2018, the authority said.

But expect prices to increase further as companies factor in new costs: Cigarette makers should be out with statements starting today raising prices by more than the base tax rate hikes, as companies gauge the added costs, state-owned Eastern Company said, according to Al Mal.

The story is making international headlines thanks to the folks at Reuters and Bloomberg.

LEGISLATION WATCH- Lawmakers had a busy day yesterday, giving final votes of approval to several key pieces of legislation. Among the bills that will now be signed into law by the president include:

The Data Protection Act, which lays out the ground rules for how businesses use personal information collected online, reports Ahram Gate. We noted yesterday that the bill already earned majority approval in a plenary session on Sunday.

The Consumer Credit Act, which will introduce a complete legislative framework regulating consumer finance companies, outline the requirements necessary for their establishment, and set “detailed” regulations for those in the market. Before receiving a final vote, the House of Representatives prepared a report rounding up the law’s touted benefits, which include giving companies that finance purchases of consumer durables, more clarity and stability to expand their businesses, reports Al Shorouk.

Extension to Tax Dispute Act: The Tax Dispute Act, which will extend a recently expired legislation by mandating newly-established dispute settlement committees to handle tax disputes until 30 June this year, has also received a final approval, according to Masrawy. Cabinet had approved the bill in December.

Amendments to Anti-Terrorism Act: Changes to the Anti-Terrorism Act will enact sharper penalties (up to the death penalty) for funding terrorist groups, as well as broaden the definition of what counts as funding terrorist. The changes, which come at a time when Egypt’s legal framework against money laundering and funding terrorism is subject to a review by the the Middle East and North Africa Financial Action Task Force, should now be with the president to be ratified and signed into law, says Masrawy.

Unified Building Code to get a final nod soon: The Unified Building Code, which would streamline procedures and cut red tape to obtain building permits, meanwhile received early approval in yesterday's plenary session, reports Al Mal. Discussion of the proposed law should continue in another general assembly session today. The long-awaited amendments would extend the validity of building permits to three year from one, and impose harsher penalties on violators and state officials found guilty of not acting to penalize building code violations, especially for building on agricultural land.

Also making its way through parliament — USD 6 mn USAID agreement for North Sinai development: The Constitutional and Legislative Affairs committee has given a nod to a recent agreement with the United States Agency for International Development (USAID) to provide an additional USD 6 mn grant for development projects in North Sinai, reports the local press.

M&A WATCH- FAB to decide on fate of its bid to acquire Bank Audi in 2Q2020: First Abu Dhabi Bank (FAB) will decide in the second quarter of the year whether it wishes to move ahead in its bid to acquire Bank Audi’s Egypt arm, Reuters reports, quoting an unnamed senior executive. FAB is currently in the due diligence process after it received a go-ahead from the Central Bank of Egypt last month. A final decision will be made after FAB completes the study, the banking group’s head of subsidiaries, strategy & transformation, Karim Karoui, said.

FAB eyes Egypt, Saudi expansion: The largest lender in the UAE sees Egypt and Saudi Arabia as its go-to markets for expansion, CFO James Burdett, told reporters. “Both [countries] have a very close relationship with the UAE, both have very big GDPs and we believe there are good [prospects] there,” Burdet said.

Background: FAB was one of three banks that expressed interest in buying the unit, after it emerged that Bank Audi was looking to exit the country amid the ongoing banking crisis in Lebanon. This came just a few months after the Lebanese bank looked close to acquiring the National Bank of Greece’s (NBG) Egypt arm.

ADIB Egypt to exit 34 legacy NBFS subsidiaries: Abu Dhabi Islamic Bank (ADIB) Egypt is liquidating 28 of its subsidiaries’ loss-making non-banking financial service activities and is restructuring six others as a prelude to exiting them, Chairman Mohamed Ali tells Hapi Journal. The bank had inherited the activities when it acquired the National Bank for Development in 2007 and have been making losses since. ADIB expects to recoup these losses — which hit EGP 1.4 bn — in 1Q2020, according to Al Mal.

Profit-making subsidiaries aren’t on the chopping board: ADIB will be keeping two companies it had established, namely ADIB Capital and Adilease, since the two are turning profits, Ali said. The bank has also received offers for the National Company for Glass & Crystal, which ADIB restructured and has since turned profitable, but no decisions have been made as of yet to offload the company. The bank also plans to begin offering microfinance services by establishing an internal department or a new subsidiary. The bank reported a 37% increase in annual net profits, rising to EGP 1.1 bn in 2019.

Taxes undermine stock funds as a channel for savings -EIMA: The Egyptian Investment Management Association (EIMA) has sent a memo urging the Finance Ministry to exempt stock funds from taxes on dividends, reports the local press. EIMA is essentially arguing that taxes are making stock funds a much less attractive channel for saving, as opposed to tax-exempt bank deposits and funds that invest in fixed-income securities.

REGULATION WATCH- Regulator working on amending reinsurance activity rules: The Financial Regulatory Authority (FRA) is working on amendments to the regulations governing reinsurance activity under the Insurance Act, FRA deputy head Reda Abdel Moaty said, according to Hapi Journal. The planned changes are meant to close regulatory loopholes that have left room for exploitation and illicit gains by some reinsurers in the market, according to Abdel Moaty. He did not specify an expected timeline for the market regulator to finalize drafting the amendments. The Insurance Act is currently in the final stages of review in the House of Representatives.

Investors lobby gov’t to liberalize energy market for manufacturers: Industry is looking to push the government to liberalize the energy market for factories, head of the Egyptian Businessmen’s Association’s (EBA) energy division Osama Guindy tells the local press. The division has sent formal requests to the energy and oil ministries to impose an automatic pricing mechanism for natural gas that would peg the cost to global prices. Factory owners have been complaining for months of high prices, which the EBA says could be resolved with an open energy market and increased competition. This system would allow factories to select energy suppliers based on competitive pricing, rather than being tied to a single source, Guindy says.

Energy prices have long been a concern for industry: The government said last year it would periodically review the price at which it sells energy to industry, following repeated requests from the Federation of Egyptian Industries for lower gas prices. The committee mandated with the review last met in October, when it lowered natgas prices by up to 25% for three types of factories.

IPO WATCH- Real estate player Emerald’s shares will officially begin trading on the EGX tomorrow, according to a regulatory filing. The retail component of the IPO was 17.7x oversubscribed, while the institutional component was 1.3x oversubscribed.

EARNINGS WATCH- Ibnsina Pharma posted annual net profits of EGP 328.77 bn in 2019, a 25.24% y-o-y increase from the same period in 2018, according to a regulatory filing (pdf). The profit increase was driven by revenues rising 24.6% y-o-y to reach EGP 16.6 bn during the year. The company’ said it grew its market share to 21.3% in 2019, up from 20.5% in 2018 on the back of growth of its client base. The company’s board of directors has proposed a cash dividend of EGP 0.07 per and the distribution of dividend shares of 0.17 new shares for every existing share held. Ibnsina’s plans going forward include the opening of new distribution centers.

CORRECTION- Yesterday we incorrectly stated that the Central Bank of Egypt’s Export Credit Guarantee Company is planning to help banks hedge against risks associated with PE and SME funds. The Credit Guarantee Company will assist the CBE with the program. The article has since been updated on our website.

CLARIFICATION- We picked up local press reports incorrectly suggesting that the Bank of Alexandria signed a USD 100 mn agreement with the European Bank for Reconstruction and Development (EBRD) to finance SMEs. The EBRD is only providing a smaller amount of financing for technical cooperation to provide training to SME owners. H/t Abdallah H.

Egypt in the News

Egypt’s furniture craftsmen aren’t all that keen on relocating to the Damietta Furniture City, which the government spent EGP 3.6 bn to develop with a goal of creating a hub for all furniture makers, Reuters says. The craftsmen, who already own workshops in Damietta, say they don’t have the money to relocate to the furniture city, and complain that it is far from their homes. The government has so far sold around 400 of the 1,400 workshops in the new city.

Diplomacy + Foreign Trade

Egypt has restored postal services to Qatar last week after a three-year halt due to the Qatar diplomatic row, Reuters reported, quoting a UN statement. Saudi Arabia and Bahrain are also expected to follow suit, along with the UAE, which brought back mail services to the Gulf state earlier this month. The move followed a UN Universal Postal Union meeting with postal representatives from the four countries late last month. It is still “not immediately clear why the service had been restored amid the wider, protracted row,” the newswire said.

Energy

Ganope to kick off plan to explore for natgas in Upper Egypt next month

State-owned South Valley Egyptian Petroleum Holding Company (Ganope) will begin next month conducting seismic scans in Upper Egypt, where it plans to explore for natural gas, according to an Oil Ministry statement. Ganope will also soon begin the second round of seismic scans in the Red Sea to gauge the probability of natural gas discoveries after it launched last March a tender for 10 oil and gas exploration blocks off the Red Sea coast, three of which were awarded to Chevron, Shell, and the UAE’s Mubadala in December.

The fifteenth Zohr well is expected to go online in March

Italy’s Eni will begin commercial operations on the Zohr natural gas field’s 15th well next month, Oil Minister Tarek El Molla said, according to the local press. The new well will put the field on track to reaching maximum production capacity this year. Production at the Zohr field inched up to 2.7 bcf/d last November with the connection of four wells in the field’s southern region.

Basic Materials + Commodities

Egypt’s wheat cultivation area hits 3.4 mn feddans

Egypt has cultivated 3.4 mn feddans of wheat this season, according to an Agriculture Ministry statement (pdf). A ministry official told Reuters earlier this month that Egypt cultivated 3.18 mn feddans in the 2019-2020 season.

Manufacturing

Egypt’s Kima to complete trial runs at Kima 2 fertilizers factory

State-owned Kima will complete today trial runs at its recently-inaugurated fertilizer factory Kima 2 in Aswan, Vice President Waleed Mohamed El Resheed tells Youm7. The project cost EGP 11.6 bn, with 62% of financing coming from a six-bank consortium.

Tourism

Egypt’s step pyramid of Djoser to be open for the public soon

The recently-restored step pyramid of Djoser will be open for the public soon, the Antiquities Ministry said in a statement. A team of British engineers completed work at the pyramid, which is Egypt’s oldest and still stands in the Saqqara necropolis, last April.

Automotive + Transportation

Egypt to roll out the first of 2k domestically made electric buses in November

Egypt is planning to produce its first electric bus in November in partnership with Foton Motor, Military Production Minister Mohamed El Assar said, according to Al Mal. Under an agreement signed with the Chinese manufacturer last year, 2k electric buses will be manufactured domestically by 2023. The ministry has also reached a separate agreement with China’s Geely to manufacture electric cars, El Assar said, without providing details, or a timeframe.

Other Business News of Note

EgyptAir consortium tapped by Nigeria to help overhaul aviation industry

Nigeria has selected an EgyptAir-led consortium to set up an aircraft leasing company as part of a plan by the African country’s government to develop its neglected aviation sector, reports Reuters. The new company will start with leasing planes from international lessors, and then leasing them on domestic flight operators.

Egypt Politics + Economics

Court upholds prison sentence for former Egyptian Customs Authority head

The Court of Cassation upheld yesterday a 10-year prison sentence for former Customs Authority Gamal Abdel Azim, who was arrested in 2018 on charges of corruption, the Associated Press reports. Abdel Azim was tried and convicted in Port Said for squandering public funds and profiteering.

On Your Way Out

French Institute inaugurates Sodic West branch: The French Institute in Egypt inaugurated this week its new branch at Sodic West’s Tanweer Cultural Center, according to an emailed statement (pdf). The branch is the institute’s first location in West Cairo.

The Market Yesterday

EGP / USD CBE market average: Buy 15.49 | Sell 15.62

EGP / USD at CIB: Buy 15.50 | Sell 15.60

EGP / USD at NBE: Buy 15.51 | Sell 15.61

EGX30 (Monday): 13,442 (-1.8%)

Turnover: EGP 687 mn (19% above the 90-day average)

EGX 30 year-to-date: -3.7%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.8%. CIB, the index’s heaviest constituent, ended down 0.9%. EGX30’s top performing constituent was CIRA up 1.8%. Yesterday’s worst performing stocks were Heliopolis Housing down 9.7%, Orascom Development Egypt down 6.8% and Palm Hills down 5.2%. The market turnover was EGP 687 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -14.7 mn

Regional: Net Long | EGP +49.7 mn

Domestic: Net Short | EGP -35.0 mn

Retail: 48.7% of total trades | 50.7% of buyers | 46.8% of sellers

Institutions: 51.3% of total trades | 49.3% of buyers | 53.2% of sellers

WTI: USD 51.58 (+0.29%)

Brent: USD 56.54 (+0.43%)

Natural Gas (Nymex, futures prices) USD 1.84 MMBtu, (+0.77%, March 2020 contract)

Gold: USD 1,650.90 / troy ounce (-1.53%)

TASI: 7,747.10 (-2.95%) (YTD: -7.65%)

ADX: 4,931.04 (-2.20%) (YTD: -2.85%)

DFM: 2,696.23 (-0.79%) (YTD: -2.48%)

KSE Premier Market: 6,730.18 (-1.73%)

QE: 9,770.04 (-1.30%) (YTD: -6.29%)

MSM: 4,156.33 (-0.98%) (YTD: +4.40%)

BB: 1,660.35 (-0.50%) (YTD: +3.12%)

Calendar

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

23-29 February (Sunday-Saturday): 20 Egyptian companies will participate in the “Egyptian Trade Week” in Kampala, Uganda.

28-29 February (Friday-Saturday): Egypt Career Summit, The Greek Campus, Cairo, Egypt.

March: An international conference to market investment prospects in the Suez Canal Economic Zone.

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March (Sunday): Egyptian Mining Day, Prospectors & Developers Association of Canada Convention, Toronto, Canada.

1 March (Sunday): A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

2-5 March (Monday-Thursday): EFG Hermes’ 16th annual One on One conference, Atlantis, The Palm, Dubai.

3 March (Tuesday): Business Today’s bt100 awards ceremony, Cairo.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

5-8 March (Wednesday-Saturday): 25 Egyptian companies will participate in a forum on investment in startups in Saudi’s King Abdullah Economic City.

6-8 March (Friday-Sunday): Arab Banking Forum, for heads of risk management in Arab banks, organized by the Union of Arab Banks,with the Central Bank of Egypt and the Federation of Egyptian Banks.

7 March (Saturday): International Investment Conference for the Suez Canal Economic Zone, Al Galala City, Egypt

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 March (Tuesday): The Annual Export Summit, Cairo, Egypt

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.