- Investor appetite will guide how the Sovereign Fund of Egypt builds its portfolio, says Soliman. (Speed Round)

- The UAE plans to double its investments in Egypt over the next five years. (Speed Round)

- EBRD, Green Climate Fund to extend USD 100 mn green loan to Egyptian SMEs. (Speed Round)

- How do analysts feel about emerging markets going into 2020? (The Macro Picture)

- US Fed unanimously decides to keep rates on hold — and signals it won’t cut rates in 2020. (What We’re Tracking Today)

- Don’t give up so quickly on climate funds, JPMorgan tells investors. (What We’re Tracking Today)

- My Morning Routine: Ahmed Issa, chief executive officer of retail banking at CIB.

- The Market Yesterday

Thursday, 12 December 2019

How the Sovereign Fund of Egypt is building its portfolio

TL;DR

What We’re Tracking Today

It’s a relatively quiet morning heading into the weekend. It is also a little early for the holiday-season news slowdown, so don’t get your hopes up quite yet, ladies and gentlemen.

Perhaps the biggest news of the day: You may want to bring an umbrella with you this morning. The Egyptian Meteorological Authority is forecasting a daytime high of 20°C and a chance of showers before overnight lows of 12°C.

CBE board shakeup soon? We could be seeing new faces on the Central Bank of Egypt’s board of directors’ table soon as Governor Tarek Amer, who was reappointed by the president last month, begins his second term in office, senior banking sources were quoted by Al Masry Al Youm as saying.

Election news is everywhere in the international press this morning:

- The UK goes to the polls today in what the two largest parties are calling the “most important election in a generation.” Pundits are predicting that Prime Minister Boris Johnson will be re-elected, but the size of his majority is in question. (Reuters)

- Algeria’s presidential elections will see mns go to the polls tomorrow amid opposition from the anti-government protest movement which has denounced the election as neither free nor fair. (The Guardian)

- Israel is on its way to its third election in nearly a year, after a deadline passed yesterday for caretaker PM Benjamin Netanyahu and his centrist rival Benny Gantz to resolve the deadlock that followed votes in April and September. (NYT)

Saudi Aramco shares rose 10% yesterday in their trading debut, closing at SAR 35.20, with the rise capped by an upward limit set by the Tadawul, the Wall Street Journal reports. The listing, which raised USD 25.6 bn, primarily from Saudi investors, is the world’s largest, even if it did not meet Crown Prince Mohammed bin Salman’s original goals to raise USD 100 bn. Aramco’s underwriters could make use of an option to sell up to 15% more shares in the first 30 days of trading if demand proves higher than expected, which would increase the money raised to nearly USD 30 bn.

Fed keeps rates on hold, signals easing will be on pause next year: In line with market expectations, the US Federal Reserve’s Open Market Committee unanimously decided yesterday to keep rates on hold after three cuts this year. The Fed said in a statement that the “strong” labor market and moderately rising economic activity, coupled with increased household spending led policymakers to maintain rates to support economic activity and keep inflation “near the Committee’s symmetric 2 percent objective.”

The Fed also signaled that it will pause easing next year. Yesterday’s statement did not allude to the “uncertainties” the Fed had cited at its last meeting, the Financial Times notes, which NatWest Markets’ head of strategy John Briggs suggests is “a signal that they feel pretty confident about what they have achieved and where they are with rates.”

US equities’ winning streak to continue into 2020 -investment banks: Lower interest rates and strong fundamentals will lead US stocks to fresh record highs in the new year, US investment banks have predicted. Optimism surrounding US-China trade and the Fed’s three consecutive rate cuts have pushed the S&P 500 to all-time highs in recent weeks, keeping it on track to finish the year up 25% — its third-best annual performance since 2000. This has led to investment banks forecasting a continued, albeit weaker, market rally in 2020, with eight banks projecting average growth of 4.6% over the 12 months. Morgan Stanley is the only outlier, with analysts predicting the market to finish 4% in the red on anemic earnings growth. The Financial Times has the story.

Don’t give up on climate funds, JPMorgan says: Investors should look past the meager returns delivered by climate change-linked funds and wait it out to see long-term gains, JPMorgan strategists say, according to Bloomberg. High fund fees, low profits, and the slow pace at which society is responding to climate change have all prevented these products paying out higher returns. But increasing public demands for stricter emissions targets and the increasing popularity of climate funds will boost their performance over the coming years, they say.

But one company is setting out its case for the status quo: Natural resources giant BHP is advising investors to pile into hydrocarbons, claiming that a supply gap over the coming 15 years will deliver huge returns, the Financial Times says.

Mubadala sets USD 40 bn AUM target: The Abu Dhabi sovereign wealth fund’s investment arm Mubadala Capital intends to increase its assets under management to USD 40 bn “over the medium-term horizon” from USD 25 bn currently, Deputy CEO Waleed Al Muhairi said. Around USD 6 bn of this is expected to come from institutional investors, almost twice the USD 3.4 bn currently managed by the fund. Bloomberg had more.

Volcker takes parting shot at Trump in posthumous letter: Recently deceased former Fed chairman Paul Volcker slammed US President Donald Trump’s attempts to meddle with central bank policy in an afterword to his forthcoming autobiography written three months ago, the FT reports. “Not since just after the second world war have we seen a president so openly seek to dictate policy to the Fed. That is a matter of great concern, given that the central bank is one of our key governmental institutions, carefully designed to be [devoid] of purely partisan attacks,” he wrote.

US democracy is under serious threat, Volcker writes, in a somber warning of the challenges facing the country’s political system. “Nihilistic forces are dismantling policies to protect our air, water, and climate. And they seek to discredit the pillars of our democracy: voting rights and fair elections, the rule of law, the free press, the separation of powers, the belief in science, and the concept of truth itself,” he said.

Will The Donald and Xi announce an agreement this weekend? The US and China could announce an “eleventh hour” trade agreement and put the brakes on the 15% tariff on USD 160 bn in Chinese goods that are set to take hold on Sunday, Slatestone Wealth strategist Kenny Polcari tells CNBC.

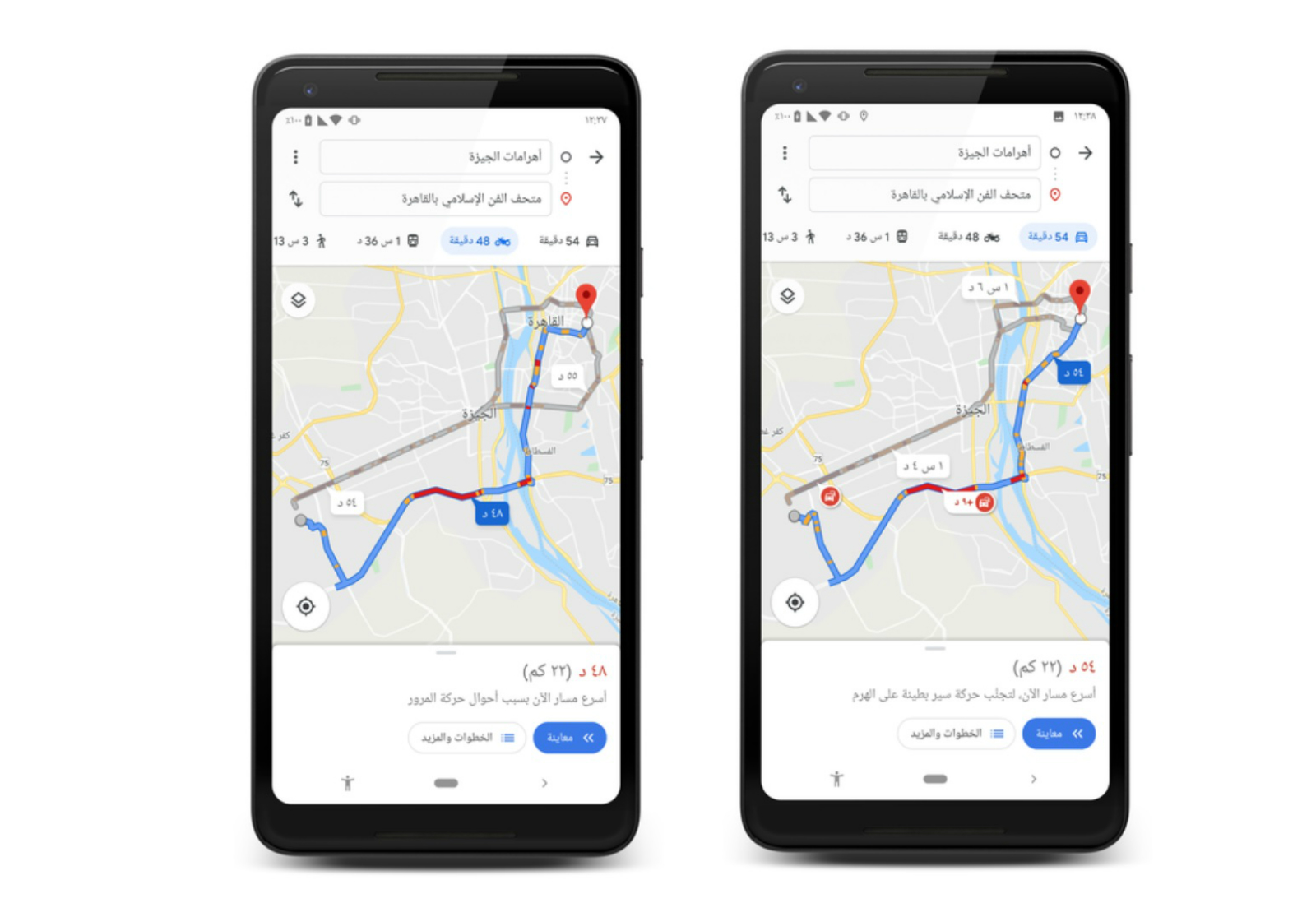

Google Maps launched a new motorcycle mode in Egypt to guide the country’s >4 mn motorbikes through “congestion on Egypt’s busiest highways by following shortcuts and local roads,” Google said earlier this week. The feature will next be rolled out in Algeria and Tunisia before being introduced to other countries.

Make your weekend listening the fourth episode of Making It, our podcast on how to build a great business here in Egypt. It will be in podcast feeds this afternoon. Our guest talks fashion, design, the business of creativity — and generational change in a family business.

Did you miss last week’s episode with EFG Hermes’ Karim Awad? You can listen to it on our website | Apple Podcast | Google Podcast.

Enterprise+: Last Night’s Talk Shows

Talking point of the day: The Aswan Forum for Sustainable Peace and Development, which got underway yesterday, was unsurprisingly the talk of the town on the airwaves last night.

El Sisi addresses terrorism, importance of working for African stability in opening speech: President Abdel Fattah El Sisi used his opening speech at the forum to call on the international community to take a stand against terrorism-sponsoring countries and work towards eradicating terrorism, which gives rise to other issues such as organized crime, illegal immigration, and human trafficking. The president also stressed the need to ensure sustainable development across Africa, Al Hayah Al Youm’s Lobna Assal noted in her recap of the opening address (watch, runtime: 6:27). The Associated Press also took note of El Sisi’s speech.

Benban steals the spotlight: The official inauguration of the 1.5 GW Benban Solar Power Park in Aswan also earned plenty of attention from the talking heads. Assal gave viewers a refresher on the solar park and its contributions to the economy and reduction of annual carbon emissions (watch, runtime: 3:55). New and Renewable Energy Authority head Mohamed El Khayat phoned in to Al Hayah Al Youm to brief Assal on the project, which he noted has been fully operational since the end of October (watch, runtime: 4:49). Min Masr's Amr Khalil also took note of the park’s inauguration as part of a rundown of El Sisi’s agenda at the forum (watch, runtime: 2:30).

Also from the forum:

- El Sisi met with the presidents of Niger, Senegal, and Chad on the sidelines of the forum to talk cooperation on infrastructure and other areas of development, Khalil noted on Min Masr (watch, runtime: 1:10).

- African Development Bank President told Masaa DMC’s Ramy Radwan that Africa is ripe for investment, particularly as the continent holds vast natural resources, including fertile land for agriculture (watch, runtime: 16:10).

- United Nations Secretary-General António Guterres called for governments to encourage the participation of women and youth to spur sustainable and comprehensive development in Africa, Masaa DMC reported (watch, runtime: 1:12).

Speed Round

Speed Round is presented in association with

Investor appetite will determine the assets the Sovereign Fund of Egypt chooses to acquire for its investment portfolio, the fund’s CEO Ayman Soliman tells Reuters' Patrick Werr. The ongoing sale of a 70% stake in the first of three Siemens / Elsewedy Electric / Orascom Construction combined-cycle power plants is the first example of how the fund will be managing its assets. By keeping the remaining 30% stake for itself, the fund is also signaling that it is “aligned with the investors who come along,” Soliman says. So far, six or seven buyers have already expressed interest in the transaction, which is expected to be finalized in 2020.

The fund plans to take some of its “cherry-picked” assets to the EGX, which it hopes will give the exchange a boost. “Our three-to-four year plan is to create multiple asset classes that are offloaded to the market. We will enrich the [stock] exchange. We can tag along with a stake, but we will have to list those entities,” Soliman tells the newswire. According to the CEO, the fund is looking to secure a 6-7% yield on the investments it will offer through its portfolio.

By straddling the line between government and the private sector, the fund will be able to “do things differently, unshackled from all those bureaucracies, and improve the way of doing business itself and work with the checks and balances within the government management that investors cannot navigate,” Soliman says.

What’s in the fund’s portfolio so far? The Supply Ministry, for one, has identified 6 mn sqm of unexploited assets owned directly by the ministry or through its affiliated bodies. The Sovereign Fund of Egypt, which currently has a paid-in capital of EGP 1 bn, is also eyeing potential real estate assets, including government-owned buildings in downtown Cairo that will be vacated once the move to the new administrative capital, as well as other options in mining, petrochems, and SME finance. The fund has received seven offers from investors for potential partnerships in healthcare, pharma, and agricultural manufacturing ventures. The fund is also working on drumming up investor interest in the Gulf, and is currently in talks with Oman for cooperation, having already sealed a USD 20 bn investment platform with Abu Dhabi Holding Company.

INVESTMENT WATCH- The UAE plans to double investment in Egypt over the next five years: Jamal Al-Jarwan, secretary general of the UAE International Investors Council, said that the country aims to double its investments in Egypt from USD 7.2 bn currently to USD 14 bn over the next five years, according to a cabinet statement.

More Emirati companies eyeing Egypt? This comes as Emirati companies have previously announced USD 2.5 bn of investments, including USD 1 bn Al Khaleej Sugar Company will plough into its Al Canal sugar factory and Lulu Market Group’s USD 500 mn planned investment in the retail sector, UAE Undersecretary for Foreign Trade Abdullah Al Saleh said during an Egyptian-Emirati investment forum in the new capital yesterday, according to the local press. The Sisi administration and the Emirates also recently announced a framework agreement for a USD 20 bn joint investment platform that will see Egypt’s sovereign wealth fund partner with the Abu Dhabi Development Corporation on high-impact opportunities.

Al Saleh also said Majid Al Futtaim is planning to invest an additional USD 1 bn in Egypt, but did not specify a timeline. CEO Alain Bejjani previously said that the company planned to invest EGP 16 bn over the next 2-3 years, which would bring the company’s total investments in Egypt to EGP 44 bn.

Rameda Pharma dip in EGX debut: Rameda Pharma shares edged down 4.7% in light trading on the EGX debut yesterday. Rameda, which trades under the ticker RMDA, started trading on poor day for the EGX, with the benchmark EGX30 closing down 0.6%. It is only the second IPO the EGX has seen this year, after e-payments firm Fawry floated in August.

Also yesterday: Rameda plans to launch 12-15 new products next year, and increase exports to 15% of total production, up from 8% today, CEO Amr Morsy said at a press conference. Rameda is the industry’s fastest-growing generic manufacturer and is coming off a shutdown for a factory upgrade, but management has guided for a significant pickup in business activity going forward. The company reported 3Q19 revenue growth of just over 19% despite the shutdown, which now sees it with a 60% increase in production capacity.

Rameda has said it will invest proceeds of the IPO in expansion, including the acquisition of new molecules and to engage in opportunistic acquisitions. More on the company’s IR microsite.

EBRD, Green Climate Fund to extend USD 100 mn green loan to Egyptian SMEs: The European Bank for Reconstruction and Development and the Green Climate Fund are planning to extend a USD 100 mn credit line to help Egyptian SMEs participate in energy efficiency and climate projects, according to the local press. The funds will be channeled through a private finance initiative (PFI) that would lend to private sector SMEs looking to invest in sustainable energy sources and effective use of resources. The finance is expected to begin in 1Q2020 and last for 36 months.

STARTUP WATCH- Roadside assistance app Mayday raises six-figure investment: Egyptian roadside assistance app Mayday has secured a six-figure investment led by Vflock Angel Network, Alex Angels, and Falak Startups, according to Menabytes. The exact amount of funding was not disclosed. The company will use the investments to fund a solid marketing plan, improve their technology, and work on enhancing the service with a focus on its B2B mode, founding partner Mohamed Aboelfotouh said. The mobile app provides a range of rescue services from towing trucks, through fuel delivery, and battery jump start across 24 cities.

MOVES- Hassan Ghanem (LinkedIn) has been appointed board chairman of City Edge, a week after being named chairman of the Housing and Development Bank, according to a company statement (pdf). Ghanem has 33 years of experience in the banking sector and succeeds Mohamed Al Alfy, who resigned several days ago.

Amjad Hassanein has also been appointed as City Edge’s CEO, according to the local press. He was formerly the CEO of Capital Group Properties and the undersecretary of the Real Estate Development Chamber in the Federation of Egyptian Industries, as well as a board member of the Real Estate Investment Chamber in the Trade and Industry Ministry.

CORRECTION- In yesterday’s ‘Coffee With’ featuring Majid Al Futtaim’s Ahmed Ismail we incorrectly stated that the company has invested EGP 24 bn in Egypt, rather than EGP 26 bn. The article has since been updated on our website.

The Macro Picture

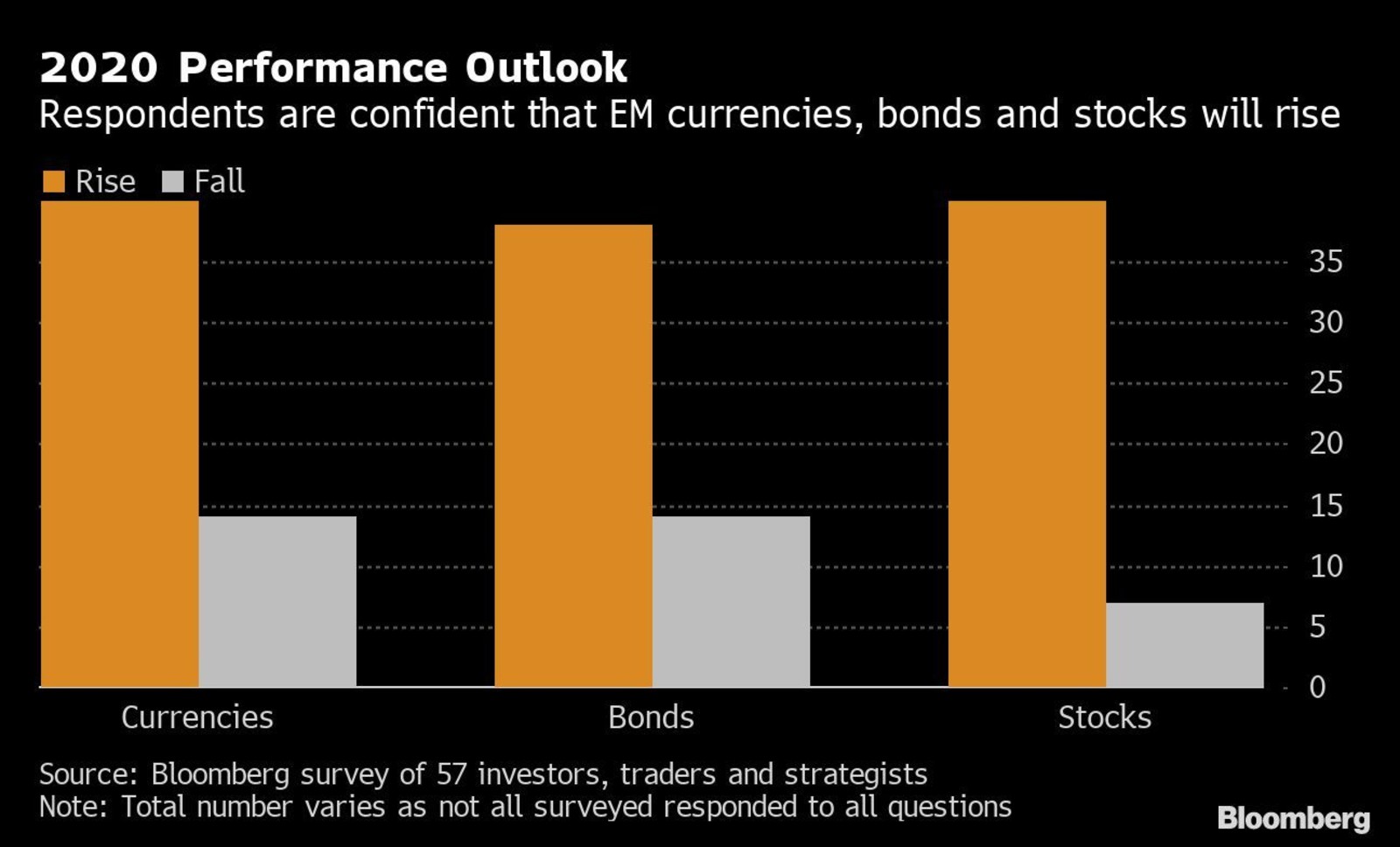

How do analysts feel about emerging markets going into 2020? Emerging markets are set to outperform developed markets in 2020, predict 57 global investors, traders and strategists in a Bloomberg survey, with all assets — currencies, stocks, and bonds — having rallied this year after 2018’s EM Zombie Apocalypse.

Total wealth in EM stocks and bonds now exceeds USD 25 tn, while data shows that EM investors have seen returns of USD 11 tn in the last decade. The combined equity value of the 26 markets on the MSCI EM Index has increased by USD 6.6 tn since 2010, while local currency bonds added USD 2.9 tn, USD bonds 1.7 tn, and EUR-denominated securities USD 237 bn during this time period. MSCI’s equities gauge is up 9.6% and its currency gauge rose 1.4% this year.

Hard currency bonds have performed particularly well, but while three-quarters of investor inflows into EM government bonds have gone into those held in hard currency in the last few years, a very recent shift may indicate increased investor appetite for local currency bonds, said Liam Spillane, head of EM debt at Aviva.

EM corporate bonds still don’t have the same pull, but awareness of their benefits as an asset class is increasing. Their risk-return profile has become more attractive, and there are indications that structural demand for them will continue to grow, a number of analysts say.

Not everyone’s so optimistic: EM equities have yet to resume their 1998-2008 bull market performance, says Philip Lawlor, managing director for global markets research at FTSE Russell, who sees concerns about the vulnerability of EM corporate profits and the impact of an appreciating USD on USD-denominated debt exposure as impeding growth.

But overall, sentiment is good. “I’m still quite bullish on emerging markets heading into 2020,” said Takeshi Yokouchi, a senior fund manager at Sumitomo Mitsui DS Asset Management. “Underlying supporting factors for EM still remain, with very low rates globally, and that will encourage investors to look at higher-yielding assets.”

Egypt in the News

Egypt is tied with Saudi Arabia for having the world’s third-highest number of jailed journalists, according to the Committee to Protect Journalists’ (CPJ) latest survey. Both Egypt and Saudi Arabia currently hold 26 reporters behind bars, compared to 48 in China and 47 in Turkey. The report is getting widespread attention in the foreign press: New York Times | Reuters | CNN | Voice of America | Forbes | Deutsche Welle | Vice.

Worth Reading

AI is accelerating concentration in capital markets — and regulators are worried: AI is starting to make inroads into capital markets, with computer-driven funds now constituting a fifth of US equity assets under management. But regulators fear that the machine-learning models able to process more data will result in potentially destabilizing market concentration. New firms will find it increasingly difficult to enter the markets, ultimately making them more vulnerable to unexpected shocks as they become ever more dependent on a limited number of entities and data-based relationships. The Financial Times has more.

Diplomacy + Foreign Trade

Foreign Ministry hosts political talks with Cypriot officials: The Foreign Ministry held a round of political discussions with the secretary of the Cyprus Ministry of Foreign Affairs, Tasos Tzionis on mutual cooperation, energy, and illegal immigration, according to a ministry statement.

Real Estate + Housing

Bonyan’s Walk of Cairo to open in 1H2020

Compass Capital-backed Bonyan for Development and Trade will open its ‘Walk of Cairo’ project in 1H2020, Compass Managing Partner Tarek Abdel Rahman told Al Mal. The Sheikh Zayed complex will include shopping outlets, a wellness center, food shops, and family entertainment facilities.

HHD plans EGP 4 bn residential project in New Heliopolis

Heliopolis Housing and Development (HHD) is planning a 75-feddan EGP 4 bn residential project in New Heliopolis, an unnamed source told Mubasher. The project, which will feature residential buildings and a shopping mall, will be built in three phases, the source added.

Tourism

Rare King Ramses II statue unearthed in Mit Rahina

A team of archaeologists unearthed a rare statue of King Ramses II yesterday in Giza’s Mit Rahina, according to an Antiquities Ministry statement. The team discovered the upper part of the statue, made of rare pink granite, with the Ka symbol (Egyptian soul form). This marks the second over Ka statue to be found, and the first granite Ka statue discovery.

Number of Russian tourists visiting Egyptian resorts remains unchanged y-o-y

The number of Russian tourists who visited Egyptian resorts in 2019 remained stable y-o-y at 120k, Association of Russian Tour Operators (EC) President Maya Lomidze said at a presser, according to Sputnik Arabic. Lomidze noted that the ban on direct flights from Russia to Egypt’s Red Sea resorts means that tourists essentially come in through the back door by flying in from other countries. A delegation of Russian officials visited Egypt last month to look into resuming flights from Moscow to Egypt’s Red Sea resorts again since they were banned in October 2015. Russia has been cagey for over four years about restoring charter flights to Egypt.

Automotive + Transportation

El Nasr preparing feasibility study for Dongfeng EV manufacturing project

El Nasr Automotive is preparing a feasibility study to manufacture 25k electric cars in partnership with China's Dongfeng ahead of an agreement expected to be signed in 2Q2020, a government source told the local press. Public Enterprises Minister said last week that the two companies would sign the agreement in January prior to the feasibility study. The Military Production Ministry is talking to companies from India, Russia, and China to manufacture electric cars in Egypt, a ministry adviser told the local press at the Egypt Automotive summit yesterday. The government aims to produce 2k electric cars during the coming four years, he said.

Sports

Egyptian weightlifting officials referred to prosecution over doping scandal

The Sports Ministry has referred to prosecution the Egyptian Weightlifting Federation’s board, management, and medical staff over the recent doping scandal that resulted in the national team’s suspension for two years, according to Ahram Online. Egypt had been banned from the 2019 World Championships and Tokyo Olympics 2020 by the Independent Member Federation Sanctions Panel (IMFSP), in response to a 2016 scandal in which seven members of the Egyptian weightlifting team were found to be doping. The Court of Arbitration for Sport, an international quasi-judicial body, has also endorsed the ban.

My Morning Routine

Ahmed Issa, chief executive officer of retail banking at CIB: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Ahmed Issa, who leads retail banking at CIB.

My name is Ahmed Issa, and I’m a grateful son, a loving husband, and the proud father of three children, as well as a dedicated Egyptian banker. I live in Cairo with my family, and I’m the chief executive officer for retail banking and a member of the board’s executive committee at CIB, the country’s largest private sector bank and the EGX’s largest listed company.

I’m fortunate enough to regard what I do as a vocation. Bankers go to work to collect the savings of the nation and choose who should areceive them. We also facilitate payment and trade by assuming risk. These are very important goals. Banks now intermediate about EGP 4 tn of the savings of Egyptians. There might be a quarter of a mn bankers currently working in Egypt, and they go to work every day to collect these savings and deploy them. That’s a great purpose in life, and it fills me with a huge amount of energy and drive.

At CIB, I’m in charge of business activities within consumer and business banking and distribution networks. This means that my team and I are in charge of all the bank’s relationships with consumers and small and medium-sized businesses that have a revenue of less than EGP 200 mn. Our customer base is growing rapidly: We currently serve 1.7 mn and I believe this number will grow to 2 mn in 2020 on the consumer side. On the business banking side, we currently serve some 50,000 business customers, and we hope to double this figure by the end of 2023. I’m also part of the team (with four others) that runs the bank on a day-to-day basis.

I have a couple of other affiliations: I chair the Banking Committee at the American Chamber of Commerce, and I sit on the boards of the EgyptAir holding company and the Egypt Trade Development Authority.

My retail banking team is the best, without question. In 2015, when I assumed my current role, we were only serving 700k customers. We’ve managed to increase the number of customers we serve to 1.7 mn, while only growing our branches by 16-17% and our workforce by 15%. So everyone’s productivity has grown quickly in a very short period of time.

Friday mornings are my favorite mornings. I wake early, go to the gym, and prepare breakfast for my family and, often, some close friends. Then the extended family will join us for lunch and we might gather as a group of 20 between 2pm and 5 or 6pm. I really enjoy this time a lot. The day is always busy, but it’s important to break from work and spend quality time with the people in my life. On weekdays and Saturdays, I typically wake at 6am. I check my emails, and read Enterprise, Bloomberg and the FT before usually leaving home within the hour. I commute an hour each way to the office, and like to use this time for reading or making personal calls. I still enjoy reading print newspapers, so usually have Al Ahram and Al Masry Al Youm in the car, and will read a couple of pages from the Qur’an there as well.

There is no such thing as a typical day, but usually my days are filled with meetings and pre-arranged tasks, from 9am to 9pm. On some days, I might have huddle meetings with my team, committee meetings, or a board meeting. On others, I’ll be moderating a panel at AmCham or chairing the banking committee. I try to make Tuesdays an exception, keeping my schedule empty to leave some time for thinking or chances to communicate more personally with my team. The schedule usually ends up being filled at the last minute, but I aim to keep it available for that purpose.

I often visit CIB branches, especially when work is stressful. I find it gives me a lot of energy, and honestly I find the efforts that I see the tellers do on a daily basis very humbling. It also reminds me of how I started my CIB career: As a customer service clerk in our Mohandiseen branch, back in 1993.

I’m a strong believer that time is the most important resource anyone has, and the shape or design of my days regularly changes based on what I believe will generate the best return on my time, and in alignment with my priorities and objectives of the moment.

Recently, I found myself re-reading The Mystery Of Capital by Hernando de Soto, which examines why capitalism triumphs in the West and fails everywhere else. The book looks at how nations deploy their savings, which is a topic I’ve always been passionate about. I recommend it very highly, and believe it’s something that all emerging market policymakers should read, especially those that set policies on the ownership of real estate assets and the deployment of savings in their countries.

People often ask me why banks don’t build companies. I believe this reflects a fundamental misunderstanding of the value banks add to our stakeholders. We manage risks in the economy — so the key skill set of banks and bankers lies in estimating the creditworthiness of a borrower. Bankers typically don’t know how to manage a manufacturing facility or an agri-business, but we know if the company’s manager is capable of managing his or her own business, so as to eventually return the capital of the savings of Egyptian people. These are two different sets of skills.

Without a doubt, the banking industry will be impacted by digitization and the risk of disruption. When blockchain, AI, cloud computing and data analytics collide at a point in the future, banking will be changed irrevocably. And bankers who are not preparing for that day will face huge disruption. They may face the same fate as Kodak and Nokia.

Throughout my career, I’ve been very lucky to have been exposed to great business minds, from whom I’ve learned so much. From Hisham Ezz El Arab, I learned the importance of sharpening the saw and preparing. From Jawaid Mirza, I learned resilience: Failure is never eternal unless you want it to be, and the more resilient or buoyant you can be, the more you can advance. These two lessons are based on principles of humility coupled with strong resolve — and I believe these values are essential for any successful business and any successful businessperson, to sustain success over a long period of time.

The Market Yesterday

EGP / USD CBE market average: Buy 16.08 | Sell 16.20

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.07 | Sell 16.17

EGX30 (Wednesday): 13,427 (-0.6%)

Turnover: EGP 636 mn (13% below the 90-day average)

EGX 30 year-to-date: +3.0%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down -0.6%. CIB, the index’s heaviest constituent, ended up 0.1%. EGX30’s top performing constituents were Egyptian Resorts up 2.5%, Ibnsina Pharma up 0.1%, and CIB up 0.1%. Yesterday’s worst performing stocks were Sidi Kerir Petrochemicals down 8.1%, Madinet Nasr Housing down 3.2% and Orascom Development Egypt down 3.2%. The market turnover was EGP 636 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -70.9 mn

Regional: Net Short | EGP -6.4 mn

Domestic: Net Long | EGP +77.3 mn

Retail: 46.1% of total trades | 42.5% of buyers | 49.8% of sellers

Institutions: 53.9% of total trades | 57.5% of buyers | 50.2% of sellers

WTI: USD 58.76 (-0.81%)

Brent: USD 63.97 (-0.58%)

Natural Gas (Nymex, futures prices) USD 2.25 MMBtu (+0.27%, January 2020 contract)

Gold: USD 1,479.20 / troy ounce (+0.28%)

TASI: 8,133.72 (+0.83%) (YTD: +3.92%)

ADX: 5,040.23 (+0.40%) (YTD: +2.55%)

DFM: 2,713.57 (+0.97%) (YTD: +7.27%)

KSE Premier Market: 6,749.89 (+0.02%)

QE: 10,339.36 (+0.22%) (YTD: +0.39%)

MSM: 4,014.04 (-0.9%) (YTD: -7.16%)

BB: 1,555.16 (+0.35%) (YTD: +16.29%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

12-14 December (Thursday-Saturday): AEEDC Education Cairo dentistry conference and exhibition, Royal Maxim Palace Kempinski Cairo.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.