- The House is back in session today — is the cabinet shuffle on its agenda this week? (What We're Tracking Today)

- FinMin says it’s looking to cut spending by 6.5% in FY2020-21 budget. (Speed Round)

- Is the capital gains tax on EGX trades back in play? (Speed Round)

- Gov't's EGP 150 bn industry, mortgage support initiatives are positive for EGP stability + real estate sector, says Beltone. (Speed Round)

- Samih Sawiris acquires Thomas Cook’s German business. (Speed Round)

- Egyptian expat remittances forecast to be among fifth-highest in the world in 2019. (Speed Round)

- It looks like the IMF is shifting away from a “one size fits all” prescription for distressed emerging economies. (The Macro Picture)

- Egypt's coral reef tourism is one of the potential victims of climate change. (What We're Tracking Today)

- The Market Yesterday

Sunday, 8 December 2019

The House is back in session — is a cabinet shuffle the first thing on its agenda?

TL;DR

What We’re Tracking Today

The House of Representatives is back from recess today, and the big question isn’t what’s next on the legislative agenda, but when is that long-expected cabinet shuffle coming? MPs could be asked to approve President Abdel Fattah El Sisi’s new cabinet lineup as early as tomorrow, Masrawy reports, citing an unnamed source in the House. According to the source, the agenda MPs received for the week does not include the shuffle, but the Support Egypt coalition (parliament’s majority bloc) has urged MPs to ensure they attend this week’s sessions. Speculation in the domestic press over who’s in and who’s out was rampant this weekend. The only exit of which we’re certain right now is that of Social Solidarity Minister Ghada Waly, who is heading to Vienna for a new post as the executive director of the UNODC.

Also on parliament’s docket over the next few days: The House general assembly is scheduled to take a final vote on amendments to the Public Enterprises Act and will review several oil and gas agreements.

The Pitch by the Pyramids competition takes place today: The event will see startups from across the MENA region pitch their business plan in front of the Great Pyramids of Giza.

The Central Bank of Egypt will on Monday sell USD 1 bn in 1-year USD-denominated t-bills, it announced last week. The bills will be issued on Tuesday, 10 December and will mature on 8 December 2020.

The three-day Food Africa expo kicks off tomorrow at the Egypt International Convention Center. More than 400 local and international agro-food companies will participate in the exhibition.

Inflation figures for November are out this Tuesday, 10 December. Headline inflation fell to new multi-year lows of 2.4% in October due to cooling food and beverage inflation and a favorable base effect.

Rameda Pharma shares start trading on Wednesday under the ticker RMDA and bankers will be allocating today in both the institutional and retail offerings. The retail offering, which accounts for 5% of the shares offered in the IPO, was more than 36x oversubscribed as of the last day for orders last week.

The Egypt-UAE Business Council will hold its first investment forum in Cairo on Wednesday. The event aims to increase trade and investment between the two countries and promote the private sector as an engine of economic growth, according to Masrawy.

Global warming is poised to wreak havoc on Egypt’s tourism industry if emissions continue to rise, says a new study released at the UN climate negotiations in Madrid. Egypt could lose 95% of its income from coral reef tourism by the turn of the century, the study warns, as could impact other countries equally dependent on the sector, such as Indonesia, Mexico, Thailand and Australia. And the global USD 36 bn-a-year reef tourism industry could see losses of more than 90% by 2100.

Meanwhile, 30 mn people directly employed in ocean fishing each year will be impacted as oceans continue to warm and become more acidic. West African nations in particular are likely to suffer significant losses as fish move to cooler waters or die. The report follows recent findings from the Intergovernmental Panel on Climate Change that climate-driven damage to oceans is likely to cost the global economy some USD 430 bn by 2050 and almost USD 2 tn by 2100.

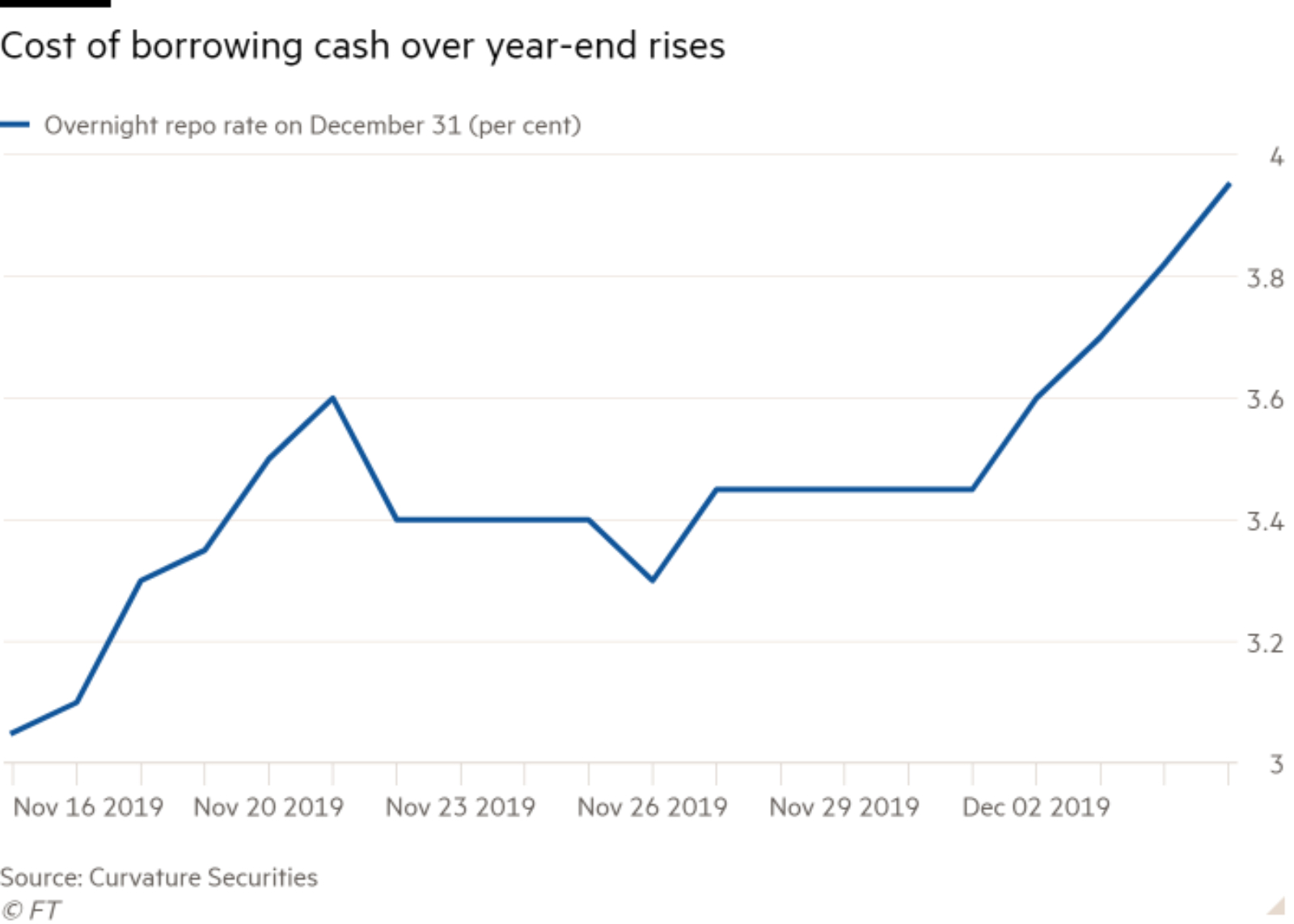

US repo market set for bumpy finish to 2019: The US repo rate — the interest rate at which financial institutions borrow overnight — rose to 3.95% on Thursday for contracts starting 31 December, raising fears of an uptick in volatility during the final weeks of the year, the Financial Times reports. This is up from 3% a month ago and far higher than the 1.6% rate for current contracts. The Federal Reserve has injected USD 50 bn in emergency funding into the market this year after the rate surged to almost 10% in September. Need more info on the repo rate? Read our primer.

Bitcoin isn’t being traded much these days: Trading of the digital currency has plummeted over the past year, with just 14% of the 18 mn bitcoins trading hands in the last week of November, down from 50% in October 2018, Paul Vigna write in the Wall Street Journal. “The energy that drove bitcoin and the cryptocurrency industry through much of the early years has been replaced by the sobering reality that creating new global monetary standards requires more than computer code,” he writes.

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths.

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths.

Oil exporters extend production cuts: Opec and the Russian-led group of allied oil producers have agreed to lower production by another 500k bbl/d until the end of March in an effort to prop up prices, the Wall Street Journal reports. The agreement means that around 1.7 mn bbl/d will be held back from the market, up from 1.2 mn bbl/d currently. Oil prices rose on the news, with Brent up 1.6% to USD 64.39 / bbl.

Saudi Arabia said it would voluntarily enact even deeper supply cuts as the kingdom appears to still be holding on to its hopes for a USD 2 tn valuation for Aramco, Bloomberg says.

More signs of detente in the Gulf: Qatari Foreign Minister Mohammed bin Abdulrahman al-Thani confirmed ongoing talks with Saudi Arabia and voiced hopes that the two countries could reach an agreement to end the two-and-a-half year blockade, Reuters reports.

The CEO of EFG Hermes — which cracked the top 20 in Bloomberg’s Europe, Middle East, and Africa IPO league table — is our guest on the latest episode of Making It : The firm has transformed under group CEO Karim Awad from a home-grown champion into a true multinational — without destroying the culture that made it special in the first place. Karim joined us in the studio to talk culture, growth and parking your ego at the door.

*** Listen to the episode on: Our website | Apple Podcast | Google Podcast.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag of nuts on the airwaves last night, with the talking heads keeping busy with an assortment of topics.

The most interesting business-relevant topic last night was Samih Sawiris’ acquisition of defunct tour operator Thomas Cook’s German franchise (we cover the story in detail in this morning’s Speed Round, below). Sawiris downplayed the magnitude of the acquisition, telling El Hekaya’s Amr Adib that this is a tiny acquisition in the context of his track record (watch, runtime: 7:34).

The anticipated cabinet shuffle was the subject of a phone-in from Rep. Ahmed El Segini, who explained to Masaa DMC’s Eman El Hosary the House of Representatives’ process for reviewing and ratifying a ministerial change-up. El Segini didn’t indulge in gossip over who’s in and who’s out, but did say the government needs to see a few new faces. The MP also didn’t provide any clarity on when we should expect the shakeup to be announced (watch, runtime: 4:55).

Education development plans: The Education Ministry is pushing through its plans to overhaul the country’s education system to focus on developing children’s skills, ministry official Reda Hegazy told Lobna Assal, who is now flying solo on Al Hayah Al Youm. Hegazy stressed that the development plan is part of the state’s overall policy and its continuity is not contingent on a specific minister (watch, runtime: 6:01).

Government-owned cars and taxis could be switched out for electric vehicles in the near future, once the infrastructure for EVs is put in place, Public Enterprises Minister Hisham Tawfik told Adib on Friday evening. Tawfik noted that, theoretically, Egypt could see 10k taxis turned into electric models per year, but with 380k cabs driving around the country right now, we’re not sure if the plan is to spend 38 years making the transition for all taxis on the road. Tawfik also briefed Adib on last week’s visit from Chinese auto company Dongfeng, with which Egypt is set to sign an EV manufacturing agreement next month (watch, runtime: 7:55).

Meetings on new capital preparations: President Abdel Fattah El Sisi, Prime Minister Moustafa Madbouly, and Planning Minister Hala El Said met yesterday to look into the process of moving ministries and other government bodies to the new administrative capital, Reham Ibrahim and Amr Khalil reported on Min Masr, which replaces Hona Al Asema (watch, runtime: 1:01).

Speed Round

Speed Round is presented in association with

BUDGET WATCH- FinMin aims to cut government spending by 6.5% next fiscal year: The Finance Ministry is projecting a 6.5% y-o-y reduction in government spending in the FY2020-2021 budget, according to a ministry statement. The ministry was mute on where the cuts to spending could come, and the expected trimming of subsidy spending next year is unlikely to account for the full 6.5% reduction.

What we already know about how the budget is shaping up: The ministry had indicated it is eyeing 6.4% GDP growth in FY2020-2021, up from a targeted 6% for the current fiscal year. The ministry is also planning to narrow the overall budget deficit to 6.2%, from an expected 7.2% in FY2019-2020. The budget will also look to lower Egypt’s debt-to-GDP ratio to 80%. The ministry is set to release its preliminary budget for the upcoming fiscal year in 3Q2019-2020.

Is the capital gains tax on EGX trades back in play? We suspect so, given a recent media report on a proposal by a finance industry association that comes across as a bid to shape the debate over the reintroduction of the measure.

So, what’s the issue? The government said in 2017 it was shelving for three years a proposed capital gains tax on stock market investments after a revolt by investors. Instead, the Finance Ministry imposed a 0.125% stamp tax that would rise to 0.15% and then 0.175%. The IMF, as part of the conditions for the USD 12 bn extended fund facility, recommended the government fully introduce the capital gains tax, but reports back in May citing unnamed government sources suggested the tax would not be brought into effect “anytime soon”; the stamp tax on EGX trades, meanwhile, remains at 0.15% this year.

What’s happening now? The Finance Ministry is apparently studying EGX data to gauge how a capital gains tax (CGT) might impact activity, the domestic press reported last week.

What to expect: Sources with whom we spoke over the weekend said the Madbouly government is keen to avoid spooking non-resident investors with a new tax and so would restrict CGT to resident investors (Egyptians or foreigners living in Egypt).

If this sounds familiar, it’s because it is: Finance Ministry officials told us earlier this year that one proposal in the works was to bring in a 10% CGT for resident investors, who would be exempt from stamp tax on trades. Non-resident investors would pay the stamp tax of 0.1% to 0.15% on trades, but be exempt from the CGT. We had reported again in September that the changes would be enacted as part of a basket of tax incentives designed to encourage new listings on Egypt’s bourse.

Enter ECMA, the finance industry lobby association: In a proposal that was in a number of reports mischaracterized last week, the Egyptian Capital Markets Association floated the idea of imposing a 0.1% withholding tax on transactions involving resident investors. Proceeds would then be deposited in a capital gains tax account at the Tax Authority, which would then refund the amount to any resident investor that makes a loss on an investment in any one publicly traded company in a given tax year. Misr for Central Clearing, Depository & Registry would then walk back through transactions each year and refund investors found to have paid more than 10% of their realized profits for the year.

The final word of warning: We expect the issue to be in the press a fair bit in the coming period given how messy the “investor revolt” was the last time the CGT was mooted. In any event, we have a while to go yet: The measure, if it is to see the light of day, needs to go from the Finance Ministry to cabinet in its final form before being referred to the House of Representatives for debate and, eventually, back to FinMin for the drafting of executive regulations if the bill is enacted by Ittihadiya.

Gov’t’s EGP 150 bn industry, mortgage support initiatives positive for EGP stability + real estate sector -Beltone: The government and the central bank’s EGP 100 subsidized initiative to provide subsidized loans for mid-sized manufacturers and a EGP 50 bn middle-income mortgage program are expected to be a boon for the private sector as a whole and real estate developers in particular, Beltone Financial said in a research note out overnight.

Refresher on the initiatives: The government and the Central Bank of Egypt (CBE) announced last Wednesday a EGP 100 bn initiative to boost manufacturing by allowing medium-sized factories with annual sales revenues of less than EGP 1 bn to access subsidized loans at a declining 10% interest rate. The initiative will be extended to all types of factories, but import-reliant industries the government is looking to stimulate or introduce to the market will receive priority treatment. A separate initiative will allow middle-income homeowners access to EGP 50 bn-worth of subsidized mortgages at preferential interest rates of 10%.

It’s too early to gauge how the initiatives will affect the country’s banks, but Beltone expects they will eat into margins despite boosting the overall volume of their business and creating an abundance of liquidity in the banking system. Notably, the CBE hasn’t made clear how it and the Finance Ministry will make the funding available to participating banks, suggesting some may see pressure on their net interest margins as they participate. Beltone stresses that participation in the activity is in no way compulsory for private banks: CBE Governor Tarek Amer had said the funds will be channeled through state-affiliated banks which the government either fully owns or in which it holds shares, and left the door open for private-sector banks to participate should they wish to do so.

Meanwhile: EGP expected to see limited volatility next year: The research house says the EGP should remain relatively stable in 2020, anticipating “limited volatility” within the EGP 15.9-16 / USD 1 range. This forecast is underpinned by expectations that consumer spending will recover, while CAPEX borrowing will see a “mild recovery” and Egypt’s oil trade balance will improve next year. An uptick in private sector investment coupled with better consumer confidence should also drive down demand for foreign currency, which will help support longer-term currency stability, Beltone says.

M&A WATCH- Samih Sawiris acquires Thomas Cook’s German business: The Samih Sawiris majority-owned Raiffeisen Touristik Group (RT) has acquired the German subsidiary of now-bankrupt British travel giant Thomas Cook, Sawiris’ Orascom Development Egypt (ODE) said in a press release (pdf). The acquisition, for which no value was disclosed, will bring 280 of Thomas Cook-affiliated agencies under RT, a company based in Burghausen, Germany, with annual revenues of EUR 3.5 bn. It also establishes Sawiris as “the most powerful travel contractor in German tourism,” and RT as the third-largest German travel company by sales, Germany’s Handelsblatt newspaper said. Thomas Cook went into liquidation last September after it failed to reach an agreement with its creditors.

PRIVATIZATION WATCH- HSBC and Citibank are competing to act as financial advisor on combined-cycle plant stake sale: Egypt’s sovereign wealth fund is mulling offers from HSBC and Citibank to advise on the sale of a 70% stake in the first of three Siemens / Elsewedy Electric / Orascom Construction combined-cycle power plants, according to a domestic press report citing what it said were government sources. The report did not specify whether HSBC and Citibank have been shortlisted or if they were the only two banks to throw their hats in the ring. Fund CEO Ayman Soliman had said that the role should be filled this week. Six investors have already expressed interest in the acquisition, which is expected to be finalized in 2020, including Actis, Blackstone Group’s Zarou, France’s Engie, China Datang Overseas, and Edra Holdings.

M&A WATCH- Endeavour isn’t giving up on Centamin merger plans: Endeavour Mining is “reaching out to Centamin shareholders” in an attempt to bring them around to the all-share merger Endeavour had proposed last week, CEO Sébastian de Montessus told Reuters. Endeavour had offered to exchange 0.0846 of its shares for every Centamin share, valuing the company’s share capital at around USD 1.9 bn, but Centamin shareholders had indicated they are looking for a better offer. de Montessus declined to say whether Endeavour would come back to the negotiating table with a higher valuation. Naguib Sawiris’ La Mancha, the largest shareholder in Endeavour, had “strongly urged” the Centamin board to open merger talks following the company’s initial rejection. Centamin, which is listed on the London Stock Exchange, operates the Sukari gold mine in Egypt.

INVESTMENT WATCH- Majid Al Futtaim to invest EGP 44 bn in Egypt in the coming years: Dubai-based real estate developer and retail giant Majid Al Futtaim (MAF) will invest EGP 44 bn in Egypt in the coming years, CEO Alain Bejjani said, according to a cabinet statement. Bejjani had told Reuters last week that MAF plans to invest EGP 16 bn in Egypt in the next 2-3 years. Bejjani made the announcement during the official opening of MAF’s USD 580 mn City Center Almaza shopping mall in Heliopolis on Thursday, which was inaugurated by Investment Minister Sahar Nasr and Emirati Environment Minister Thani Al Zeyoudi.

Bejjani and an MAF delegation also met with Prime Minister Moustafa Madbouly on the day of the inauguration, according to a cabinet statement.

Egyptian expats are projected to send home the fifth highest value of remittances in the world by the end of year, World Bank data shows. Remittances to the country are expected to hit USD 26.4 bn this year, down slightly from USD 29 bn last year. Globally, remittance inflows to low- and middle-income countries are forecast to rise to USD 551 bn in 2019, up 4.7% y-o-y from USD 529 bn in 2018, before edging up again in 2021 to reach USD 597 bn.

Elsewhere: Large population countries India (2019 forecast: USD 82.2 bn), China (USD 70.3 bn), Mexico (USD 38.7 bn), and the Philippines (USD 35.1 bn) round out the top five remittances markets. Average y-o-y growth in MENA is expected to remain weak (3%) compared to Latin America and the Caribbean’s 7.8%, South Asia’s 5.3%, Sub-Saharan Africa’s 5.1%, and East Asia and the Pacific’s 3.8%. This is due primarily to labor market reforms and the introduction of value-added tax in Gulf countries. Europe and Central Asia, however, are projected to see the slowest growth rate at 1.8%, driven by lower oil prices and ruble depreciation.

STARTUP WATCH- Tribal Credit raises USD 5.5 mn seed round: Tribal Credit, a Silicon Valley-based fintech startup co-founded by Egyptian entrepreneurs Amr Shady and Mohamed Elkasstawi, has raised USD 5.5 mn in a seed funding round led by BECO Capital and Global Ventures, according to an emailed statement (pdf). The startup, which has yet to launch, will use “a proprietary AI-driven approval process and blockchain technology” to provide startups in emerging markets with instant access to credit and help remove financing hurdles. Other investors in Tribal Credit include Endure Capital, 500 Startups, Valve VC, AR Ventures, Off The Grid Ventures, Rising Tide Fund, RiseUp, and Tribe Capital.

CORRECTION- We incorrectly stated in an article last week that Trella had raised USD 600 mn in seed funding earlier this year, rather than USD 600k. The story has since been corrected on our website.

The Macro Picture

Is the IMF rethinking the shock therapy formula? Comments made recently by IMF bigwigs suggest that the fund may be relenting on its neoliberal formula as a one-size-fits-all prescription for distressed emerging economies, Steve Johnson writes in the Financial Times.

Why the shift in thinking? There’s a growing recognition within the IMF that the unrestricted movement of capital across borders brings with it its own deleterious effects. The fund is currently concerned capital inflows into emerging economies are putting them at risk of inflation contagion from developed countries, which have seen low price inflation become a permanent feature of their economies. Low inflation spreading to the developing world, in the words of Deputy Managing Director David Lipton, will “cause them to stagnate.” On top of this, the lower borrowing costs that accompany inflows have the capacity to significantly increase the debt burden of emerging economies

Is “capital account fundamentalism” ending? In a departure from IMF orthodoxy, both Lipton and IMF chief economist Gita Gopinath have suggested that governments in developing economies can use FX intervention and capital controls to mitigate the impact of excessive capital flows. Rather than insisting on maintaining a liberalized currency regime, Gopinath says that currency intervention can be a “desirable part of the policy mix in stressed times.” And to limit the problem of excessive borrowing, she recommends that governments preemptively impose capital controls “in normal times” — a particularly surprising corrective that implies that the fund may now endorse state intervention not just in emergencies but as a regular policy tool.

Egypt in the News

Topping coverage of Egypt in the foreign press today: The prevalence of tattoos in Ancient Egypt. Researchers who used infrared photography to examine seven mummified women in Deir el Medina found tattoos of motifs that were sacred in ancient Egyptian culture, as well as what looked like hieroglyphs, according to a study whose findings were presented at the American Schools of Oriental Research in San Diego in November. Previously, tattoos had only been found on six other Egyptian mummies, suggesting that it was the infrared photography that allowed the researchers to spot what was previously invisible to the eye. Science Alert | ZME Science | Smithsonian Magazine.

Other headlines worth a skim:

- Not everyone wants to see the back of Egypt’s tuk-tuks: Egypt’s plan to replace tuk-tuks with small minivans could devastate the informal economy and create resentment among drivers who cannot afford to buy the new minibuses, which could be running on Egypt’s streets within a year, Citizen Truth reports.

- GERD talks are stalling because Ethiopia wants single-handed control over operating, filling and managing the dam, an official involved with technical talks tells Al Monitor.

- Egypt has sold almost half of the land in the first phase of the new administrative capital, said Magdy Amin, head of real estate at the New Administrative Capital for Urban Development, according to Reuters.

- Arrest of Christian rights advocate: A Coptic Christian civil rights advocate was arrested in late November, and has since been charged with joining and financing a terrorist group, RNS reports.

- More Mohamed Ali: In a profile of the controversial actor turned public figure the Independent’s Robert Fisk (yes, he’s still writing…) attempts to understand what motivates him and how he became so popular.

- Remains of ancient temple of Ptah discovered: Archaeologists have discovered 19 blocks of pink granite and limestone that formed part of the ancient temple of Ptah, close to the Giza pyramids, Xinhua reports.

- Egypt serving Uber South Africa: Business Insider gives an inside look at Uber’s Cairo “Centre of Excellence" with customer service agents who work with South Africa.

Worth Reading

AI amplifies human biases, and only human problem-solving can help to change this. Algorithms have a powerful ability to mine data to find correlations at scale, but without the careful application of human insights as part of a continued process of learning, they will continue to reflect and amplify structural biases, theoretical neuroscientist Vivienne Ming writes in the Financial Times. Ming cites Amazon’s attempts to design an algorithm to promote fairer hiring as an example of this. The model was scrapped in 2015 because it was found to have embedded gender bias into its rating of candidates for technical positions, having been trained to observe and promote candidates based on patterns in resumes submitted to the company over a 10 year period — most of which came from men. Even when the company aimed to “de-bias” its data, the AI still discovered subtle patterns that distinguished male candidates from female, and overwhelmingly dismissed women applicants.

The problem is not biased data, but believing that an abundance of data can remove implicit biases. In fact, it is only by learning how to ask the right questions and applying human problem-solving skills (like the ability to observe and learn from failed solutions) to thorny issues like gender bias in hiring, that real progress can be made. A major trend in machine learning is training AI systems to focus on causal inference (asking “why”), and reinforcement-learning algorithms are an important move in that direction. But for now, Ming argues, the most effective way of using algorithms as helpful tools is by recognizing their limitations and focusing on training human problem solvers to ask the right questions in the first place.

Worth Watching

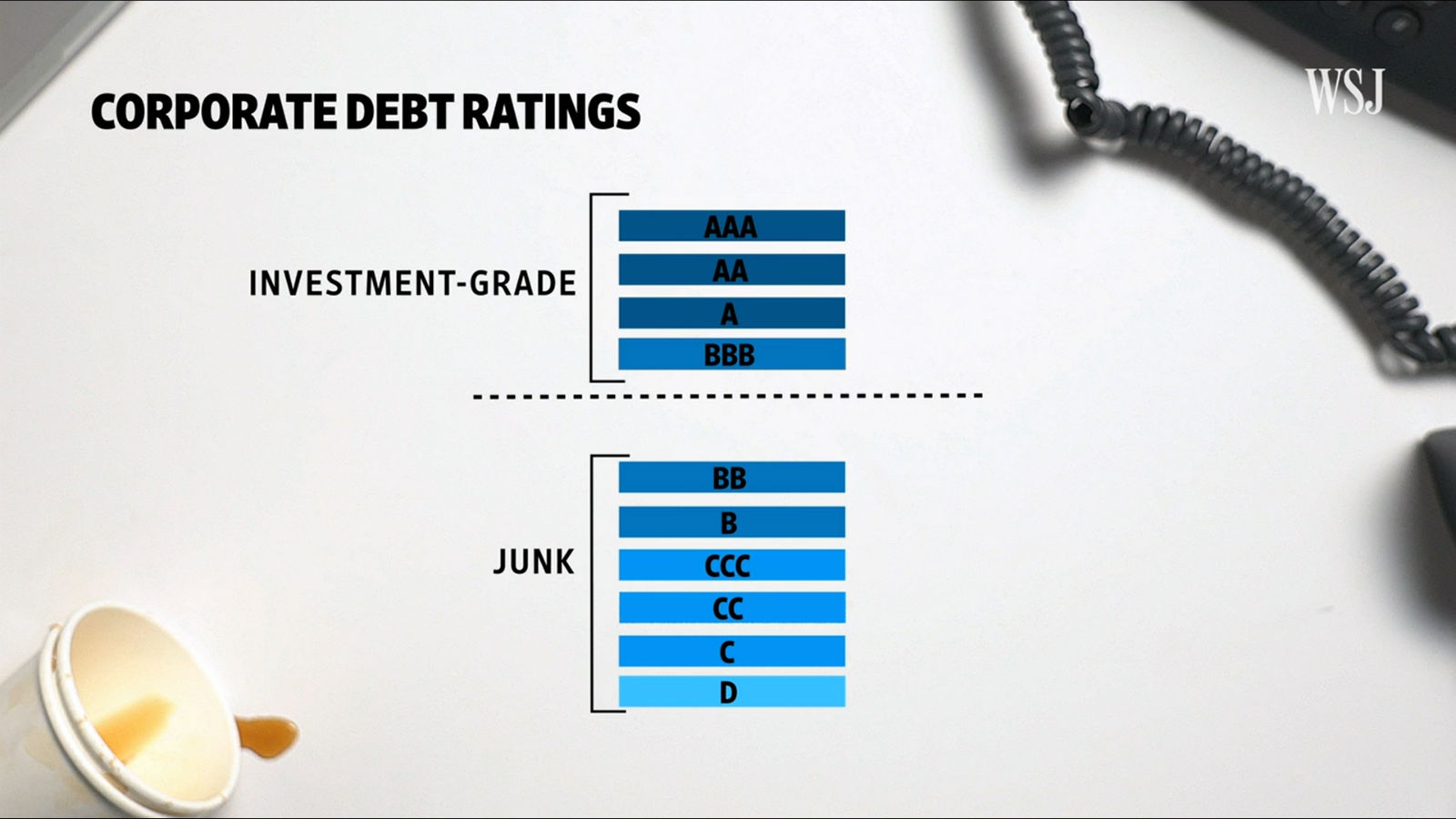

Growing level of low-ranking investment-grade corporate debt threatens deeper recessions: Nearly half of US investment-grade corporate debt is currently rated ‘BBB,’ which has investors worried that many companies could see their debt enter ‘junk’ territory when the next recession hits, says the Wall Street Journal (watch, runtime: 5:37). Companies rated BBB are currently leveraged close to 3.5x their annual earnings, and with around USD 3.7 tn in BBB-rated corporate debt, a large chunk of the corporate bond market could plunge in value in the event of a recession. Some analysts are skeptical that some of these BBB-rated companies should even be given an investment-grade rating given their high debt-to-earnings ratios, making holding their bonds that much riskier.

Diplomacy + Foreign Trade

Egypt, UAE sign first joint environmental agreement: Environment Minister Yasmine Fouad and her Emirati counterpart signed the first environmental protection agreement between Egypt and the United Arab Emirates, according to a cabinet statement. The agreement covers a number of areas including solid waste management, environmental tourism, natural reserve management,and climate change as well as assessing the environmental impact of national projects.

Libya and Turkey’s recently-signed border demarcation agreements will hinder efforts to resolve the Libyan crisis and negatively affect the Berlin political process, Foreign Ministry at the Rome Med 2019 – Mediterranean Dialogue on Friday. Shoukry also highlighted the establishment of the Eastern Mediterranean Gas Forum, which does not include Turkey nor Libya, as a model for constructive cooperation among Mediterranean countries to serve the objectives of sustainable development. The agreements signed between Turkey and Libya could potentially infringe upon territorial waters claimed by Egypt, Cyprus, and Greece.

French FM backs Egypt: French Foreign Minister Jean-Yves Le Drian separately called the agreements “illegal” under international law during a phone call with Shoukry, according to a ministry statement.

Energy

OC, Engie, Toyota inaugurate 262.5 MW Ras Ghareb wind farm

Orascom Construction, Engie and Toyota have inaugurated their 262.5 MW Ras Ghareb wind farm after beginning commercial operations in October, Engie said in a press release. Ras Ghareb is Egypt’s first private wind farm and is the first in the country to run under a build-own-operate (BOO) framework. Total investment in the project is approximately USD 380 mn, with Engie and Toyota each taking a 40% stake and Orascom Construction holding the remainder. The consortium has secured a 20-year power purchase agreement (PPA) under which it will supply power to the Egyptian Electricity Transmission Company.

Health + Education

USAID inaugurates energy research center in Egypt’s Ain Shams University

The US Agency for International Development (USAID) has inaugurated an energy research center at Ain Shams University, cabinet said in a statement. The center will be run in cooperation with the Massachusetts Institute of Technology (MIT), which will collaborate with Ain Shams on energy research. USAID announced earlier this year a USD 90 mn plan to establish energy, agriculture, and water centers at leading local universities in partnership with MIT, Cornell, and the American University in Cairo.

Tourism

Sharm El Sheikh- Hurghada ferry route is now open

Transport Minister Kamel El Wazir inaugurated on Thursday the Sharm El Sheikh-Hurghada ferry line on Thursday, which will link tourist areas in Sharm El Sheikh, St Catherine, Taba, Hurghada, and Luxor, according to a ministry statement. The Arab Bridge Maritime Company will be running the 2.5-hour journey on a schedule that runs three round trips per week.

Automotive + Transportation

France’s Alstom withdraws from EUR 380 mn metro contract

France’s Alstom has walked away from a EUR 380 mn contract it was due to sign with the Transport Ministry within days to manufacture and supply 32 metro cars for the third and fourth phases of Cairo Metro Line 3, ministry sources told Al Mal. The government will hold on to insurance payments made by Alstom earlier in the tender process, but will not take any legal action due to the lack of a binding contract, the sources said. The contract was part of a tender launched in 2014 for 64 metro cars. The first half was awarded to Hyundai Rotem, which will begin deliveries in May 2020. It remains unclear whether the ministry will launch another tender.

Banking + Finance

AfDB allocates USD 1.5 bn to four Egyptian companies

The African Development Bank Group (AfDB) has agreed to provide USD 1.5 bn in financing to four Egyptian companies to implement projects in Africa, Director of AfDB's Country Office Malinne Blomberg told reporters last week at the African Economic Conference at Sharm El Sheikh. The four unnamed companies operate in new and renewable energy, agriculture, and industry.

Other Business News of Note

Investment Ministry delivers first units in Mit Ghamr industrial zone

The Investment Ministry has delivered the first batch of 30 industrial facilities in the Mit Ghamr industrial zone, the ministry said in a statement. This represents a third of the units to be established in the zone, which will house 225 new projects and create 3,500 new jobs.

Palm Hills joins the race for HHD 10% stake + management contract

Palm Hills Developments has joined the list of companies competing to snag management rights for Heliopolis Housing & Development (HHD) along with a 10% stake in the company, sources told the local press. The real estate developer purchased the prospectus that went on sale last month, according to the sources. SODIC and BPE Partners had also purchased the prospectus. Interested bidders have until 1pm on 14 January to throw their hats into the ring and must submit any enquiries by 18 December. State-owned investment bank NI Capital will announce the winning bid by the end of January, Public Enterprises Minister Hisham Tawfik told us last week.

National Security

Egypt and Russia conclude joint naval drill in Mediterranean

Egyptian and Russian naval forces concluded the “Friendship Bridge 2019” military drills, one of the largest drills in the Mediterranean Sea, the Armed Forces said in a statement.

On Your Way Out

The good news: Our railways are becoming safer. The bad news: Our roads are becoming less so. Road accidents increased in Egypt 17.9% in 1H2019 compared to 1H2018, according to Capmas findings (pdf). Road accidents reportedly 5,220 in the first six months of the year, causing 1,567 casualties and 6,046 injuries. Railway accidents, however, apparently saw a 14.7% decrease y-o-y, with more than half of these accidents being in the Delta region, the report said.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.19

EGP / USD at CIB: Buy 16.07 | Sell 16.17

EGP / USD at NBE: Buy 16.06 | Sell 16.16

EGX30 (Thursday): 13,622 (-0.1%)

Turnover: EGP 537 mn (26% below the 90-day average)

EGX 30 year-to-date: +4.5%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.1%. CIB, the index’s heaviest constituent, ended down 0.04%. EGX30’s top performing constituents were CIRA up 1.7%, Orascom Construction up 1.5%, and AMOC up 1.3%. Thursday’s worst performing stocks were Cleopatra Hospitals down 4.1%, Egyptian Resorts down 3.8% and Sidi Kerir Petrochemicals down 3.1%. The market turnover was EGP 537 mn, and foreigners investors were the sole net buyers.

Foreigners: Net Long | EGP +69.8 mn

Regional: Net Short | EGP -38.0 mn

Domestic: Net Short | EGP -31.7 mn

Retail: 59.4% of total trades | 56.1% of buyers | 62.7% of sellers

Institutions: 40.6% of total trades | 43.9% of buyers | 37.3% of sellers

WTI: USD 59.20 (+1.32%)

Brent: USD 64.39 (+1.58%)

Natural Gas (Nymex, futures prices) USD 2.33 MMBtu (-3.83%, January 2020 contract)

Gold: USD 1,465.10 / troy ounce (-1.21%)

TASI: 7,905.51 (+0.44%) (YTD: +1.01%)

ADX: 5,046.61 (-0.03%) (YTD: +2.68%)

DFM: 2,694.71 (-0.03%) (YTD: +6.52%)

KSE Premier Market: 6,655.71 (+0.17%)

QE: 10,358.35 (+0.84%) (YTD: +0.58%)

MSM: 4,028.89 (-0.28%) (YTD: -6.82%)

BB: 1,547.31 (+0.21%) (YTD: +15.71%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids.

8-9 December (Sunday-Monday): The 6th CEOs Thoughts 2019.

9 December (Monday): Officials from Egypt, Sudan and Ethiopia will convene in Washington to assess progress made during two subsequent round of technical talks on the rules of filling and operating the Grand Ethiopian Renaissance Dam.

9 December (Monday): Egypt’s exports councils will be sitting down with Export Subsidy Fund boss Amany El Wassal to discuss the fine points of implementing the new export subsidies framework, and the fund’s plans to settle away bns in accrued overdues.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected).

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” venue TBD, Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

12-14 December (Thursday-Saturday): AEEDC Education Cairo dentistry conference and exhibition, Royal Maxim Palace Kempinski Cairo.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.